Credit Rating • The process of assigning a symbol with specific reference to the instrument being rated, that acts as an indicator of the current opinion on relative capability on the issuer to service its debt obligation in a timely fashion.

Credit Rating • The process of assigning a symbol with specific reference to the instrument being rated, that acts as an indicator of the current opinion on relative capability on the issuer to service its debt obligation in a timely fashion.

Credit Rating • Specificity: To a debt instruments • Relativity: Rating based on the capability & willingness of the issuer of the instrument to service debt obligations. • Guidance: To the investors/creditors • Not a Recommendation: No recommendation to buy, hold or sell an instrument

Credit Rating • Specificity: To a debt instruments • Relativity: Rating based on the capability & willingness of the issuer of the instrument to service debt obligations. • Guidance: To the investors/creditors • Not a Recommendation: No recommendation to buy, hold or sell an instrument

• Broad Parameters: Information supplied by the issuer & from other sources including personal interactions. • No guarantee • Quantitative & Qualitative Information

• Broad Parameters: Information supplied by the issuer & from other sources including personal interactions. • No guarantee • Quantitative & Qualitative Information

Credit Rating Process • • Contract Between Rater and Client Sending Expert Team to Client’s Place Data Collection Data Analysis Discussion Credit Report Preparation Submission to ‘Grading Committee’ Grade Communication to client

Credit Rating Process • • Contract Between Rater and Client Sending Expert Team to Client’s Place Data Collection Data Analysis Discussion Credit Report Preparation Submission to ‘Grading Committee’ Grade Communication to client

Credit Rating System – Growth Factors “Every Time a rating is assigned, the agency’s name, integrity and credibility are online and subject to inspection by the whole community” Factors Like: • Objectivity of opinions, Professionalism • Relevant Expertise, Strict rules of confidentiality

Credit Rating System – Growth Factors “Every Time a rating is assigned, the agency’s name, integrity and credibility are online and subject to inspection by the whole community” Factors Like: • Objectivity of opinions, Professionalism • Relevant Expertise, Strict rules of confidentiality

Growth Factors • • • Credibility and Independence Capital Market Mechanism Disclosure Requirements Credit Education Creation of Debt Market

Growth Factors • • • Credibility and Independence Capital Market Mechanism Disclosure Requirements Credit Education Creation of Debt Market

International Rating agencies • • Moody’s Investors Service (Moody’s) Standard & Poor’s corporation (S&P) Duff and Phelps Credit Rating Co. (DCR) Japan Credit Rating Agency (JCR)

International Rating agencies • • Moody’s Investors Service (Moody’s) Standard & Poor’s corporation (S&P) Duff and Phelps Credit Rating Co. (DCR) Japan Credit Rating Agency (JCR)

CRISIL • Credit Rating and Information Services of India Ltd. • Jointly promoted by ICICI, Nationalized and foreign banks, and Insurance Companies in 1987. • Services Offered are : Rating, Information Services, infrastructure and consultancy.

CRISIL • Credit Rating and Information Services of India Ltd. • Jointly promoted by ICICI, Nationalized and foreign banks, and Insurance Companies in 1987. • Services Offered are : Rating, Information Services, infrastructure and consultancy.

ICRA • Investment Information and Credit Rating Agency of India Ltd. • Promoted in 1991 by IFCI & 21 other shareholders comprising nationalized banks. • Services offered are: Rating Services, Advisory services and investment information services.

ICRA • Investment Information and Credit Rating Agency of India Ltd. • Promoted in 1991 by IFCI & 21 other shareholders comprising nationalized banks. • Services offered are: Rating Services, Advisory services and investment information services.

CARE • Credit Analysis & Research • Incorporated in 1992 with the combined efforts of IDBI, and several other banks & insurance companies.

CARE • Credit Analysis & Research • Incorporated in 1992 with the combined efforts of IDBI, and several other banks & insurance companies.

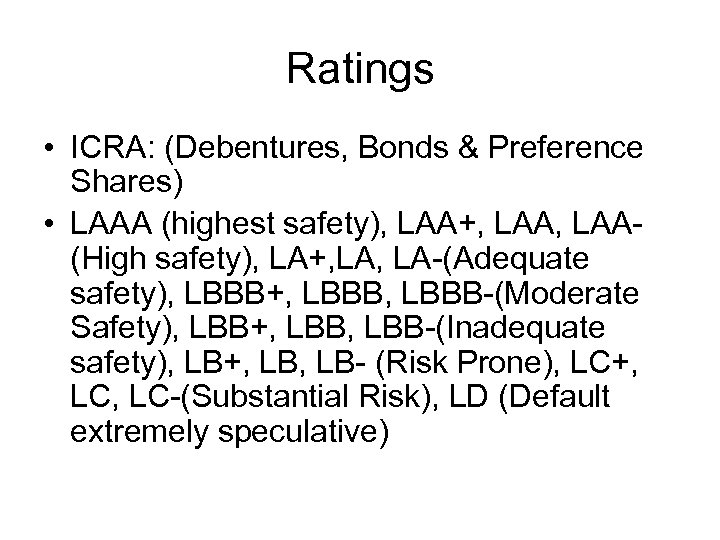

Ratings • ICRA: (Debentures, Bonds & Preference Shares) • LAAA (highest safety), LAA+, LAA(High safety), LA+, LA-(Adequate safety), LBBB+, LBBB-(Moderate Safety), LBB+, LBB-(Inadequate safety), LB+, LB- (Risk Prone), LC+, LC-(Substantial Risk), LD (Default extremely speculative)

Ratings • ICRA: (Debentures, Bonds & Preference Shares) • LAAA (highest safety), LAA+, LAA(High safety), LA+, LA-(Adequate safety), LBBB+, LBBB-(Moderate Safety), LBB+, LBB-(Inadequate safety), LB+, LB- (Risk Prone), LC+, LC-(Substantial Risk), LD (Default extremely speculative)

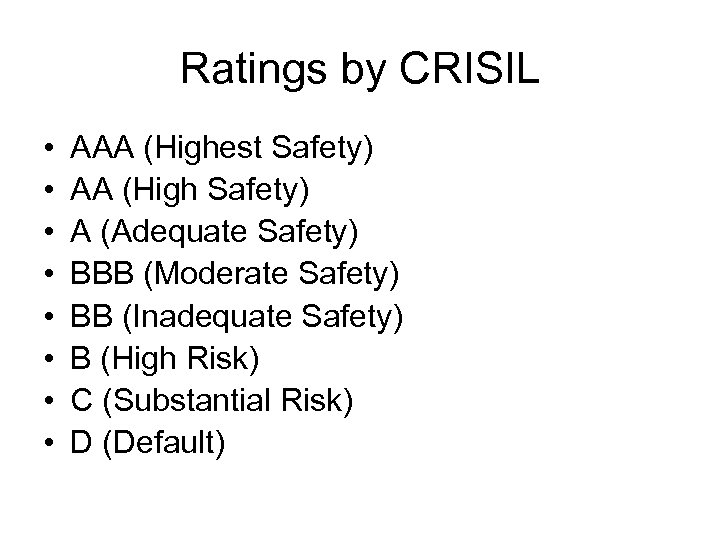

Ratings by CRISIL • • AAA (Highest Safety) AA (High Safety) A (Adequate Safety) BBB (Moderate Safety) BB (Inadequate Safety) B (High Risk) C (Substantial Risk) D (Default)

Ratings by CRISIL • • AAA (Highest Safety) AA (High Safety) A (Adequate Safety) BBB (Moderate Safety) BB (Inadequate Safety) B (High Risk) C (Substantial Risk) D (Default)