a7bcba823b6dda447c8e6e6ad3189d53.ppt

- Количество слайдов: 30

Credit management as a driver for business transformation It can happen – it is happening

Credit management as a driver for business transformation I believe this is the ultimate challenge for credit management – it is our future It is driven by the credit manager and enabled by technology It represents the step away from the “back office” perception It represents an opportunity for credit managers to grow as individuals and to operate at the next level up professionally There are fellow ICTF members in this audience who strongly agree and have started or are about to start the journey Some members may strongly disagree – let’s have a debate!

About Co-pilot We advise large corporates and multinationals on credit management software – – – We have been doing it for 8 years We know what works and what doesn’t work We advise on software, processes and best practice There are many different possible solutions - we help clients pull it all together We’re with the client from start to finish Typical client – – – Credit Director/Group Credit Manager An individual who wants to drive change and for whom the timing is right We are seeing an increasing focus on credit management driving sales growth This is a key step towards business transformation

Key learning for Co-pilot these past 8 years? “You don’t know what you don’t know” It’s not just about functionality: It’s about having the latest technology (must be future-proof) But it’s also about how you USE the technology The power of end-to-end data all in one place The power of operating in ONE system (Data integrity) It’s about what the software partners are like to work with

i. Phone syndrome Making the photo bigger with Click to edit the your fingers outline text format A Second fantastic idea Somebody thought of it Outline Level Third Outline Or maybe it was collaborative Level Fourth But afterwards it was obvious Outline Level And who do we all think had Fifth the idea? Outline Level

Not me

i. Phone syndrome So todayto edit the Click I’m going to talk about the principles, not outline text format individual ideas or solutions Second Outline The intellectual capital for Level those ideas belongs to clients, Co-pilot or competing suppliers and it Third unprofessional would be Outline of me to Level air it here Fourth But in any event, the principles are what we Outline Level should be discussing Fifth Outline Level

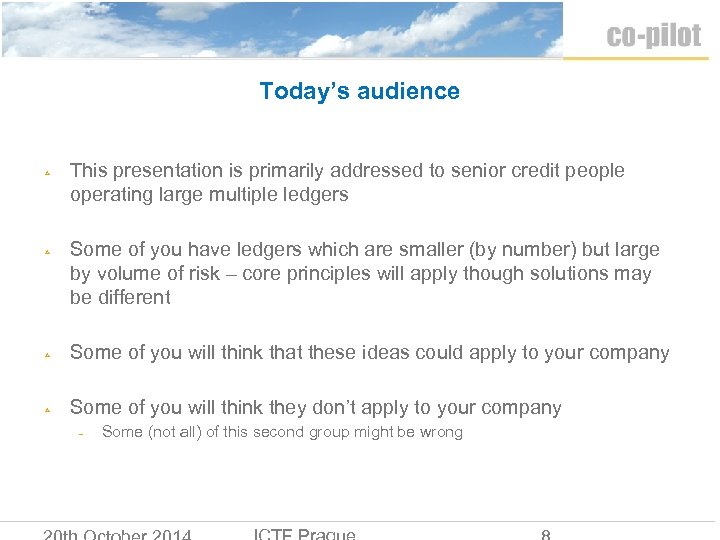

Today’s audience This presentation is primarily addressed to senior credit people operating large multiple ledgers Some of you have ledgers which are smaller (by number) but large by volume of risk – core principles will apply though solutions may be different Some of you will think that these ideas could apply to your company Some of you will think they don’t apply to your company – Some (not all) of this second group might be wrong

Credit management historically seen as “Back office” KPIs tended to be negative and after-the-event (the sale) – – Recent years have seen a focus on costs (eg: SSCs and BPOs) – Reduce DSO Reduce or avoid bad debt Reduce unallocated cash Deal with disputes Often driven by the same “back office” perception Good credit managers have always supported sales – – – Through good relationships and collaboration - often event-driven A strong belief that credit management is the “eyes and ears” of the business Many credit managers will feel that this support has not always been seen or valued by the board Probably the CFO just thinks you’re doing your job – “that’s what I expect you to do anyway” And that’s probably because credit management support has been “day-to-day”, rather than strategic, planned, implemented and reported

So what is credit management-driven business transformation? It is a credit management-initiated strategy and plan to support sales growth - more than a series of daily events or interventions The sales outputs are planned, significant and visible It positively enhances the customer experience It is “inclusive” – it impacts the sales role and the way that the company does business with its customers – these things change And, not to lose sight of things, all the traditional things are done better too Head in the clouds, feet on the ground

What has to be in place? A credit manager who sees the opportunity and wants to make it happen Credibility and trust – – – Ability to manage the change process The right team The right technology Internal support – – – Board Credit team Stakeholders The credit team Stakeholders Project management External support – the right partners

Don’t let anyone tell you it is easy Managing a change project is a significant challenge Issues, politics and all sorts of weird things are thrown at you from every angle As we learned at ICTF Barcelona, Nick King initiated and is implementing such a project He will tell you that it has given him a few grey hairs But it has also been a good learning experience – he is stronger and wiser for it. Scored under the “Hay model” he operates at a higher professional level And, don’t forget, the impact upon Travis Perkins’ business will be profound:

Travis Perkins business impact - recap Cost savings Significant improvements in all the traditional credit management metrics Strong sales growth – more new customers and more business with existing customers Significant improvements to the customer experience – TP will look like a different business to its customers A positive influence on customer payment behaviour Change to the sales process – 1, 900 Branch Directors embedded into the process Manual processes could not deliver these outcomes - the environment Nick has created operates in real time

Real time credit limit decisioning is essential The 80/20 rule: – – – Credit Policy should act like a valve that you can open or close – – – You should target automated decisioning and monitoring on >80% of the portfolio This frees up the credit team to focus on the risks where they add most value Which is supported by automated workflows for analysis and decisioning You need to be able to react to external changes and internal needs as business requirements change If Credit Policy is simply a document (PDF/Word) it will not deliver this Credit Policy needs to be embedded into daily workflows - and you need control over it Decisioning based upon real-time end-to-end data is stronger Ability to develop and adapt scorecards is essential – Can you “Champion Challenge” your scorecards? If you have got all this you can safely make portfolio-wide decisions in real-time

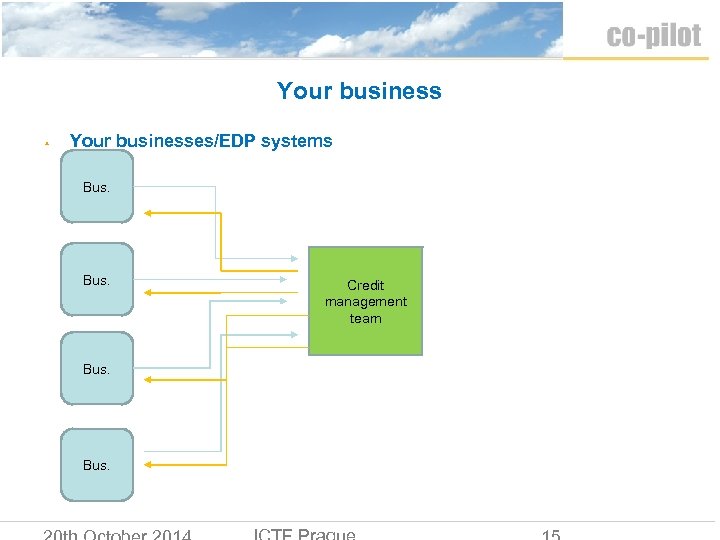

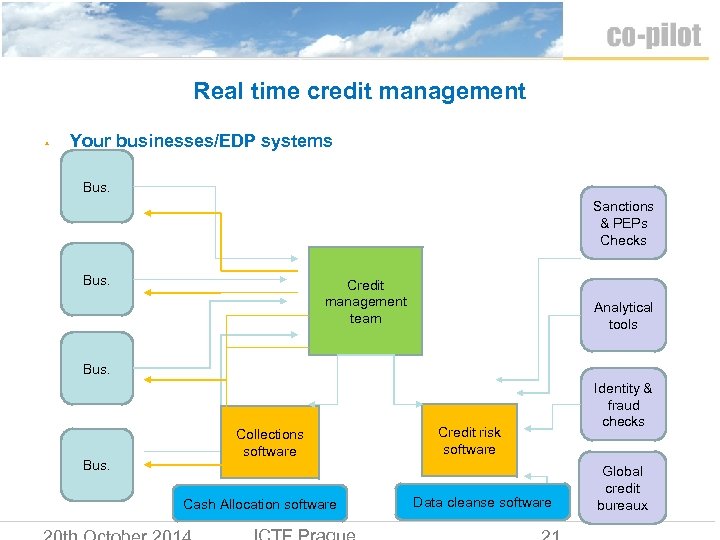

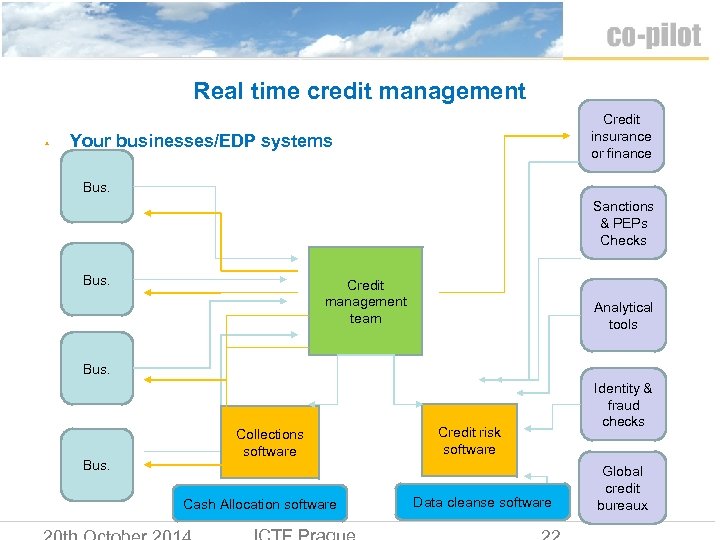

Your business Your businesses/EDP systems Bus. Credit management team

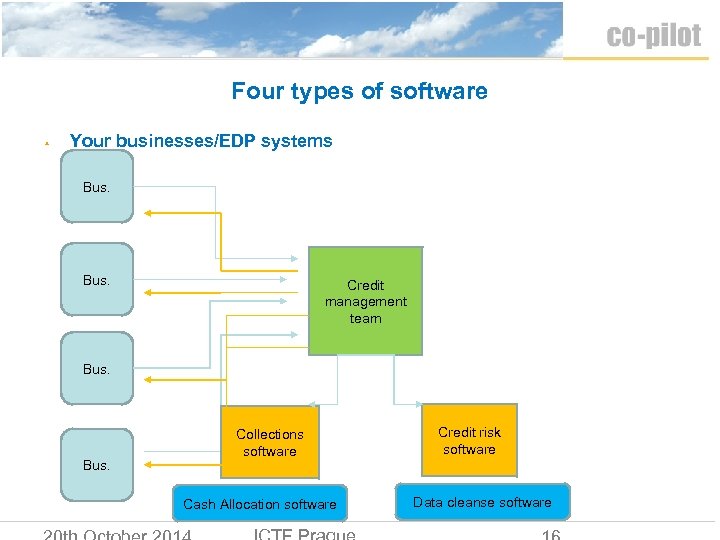

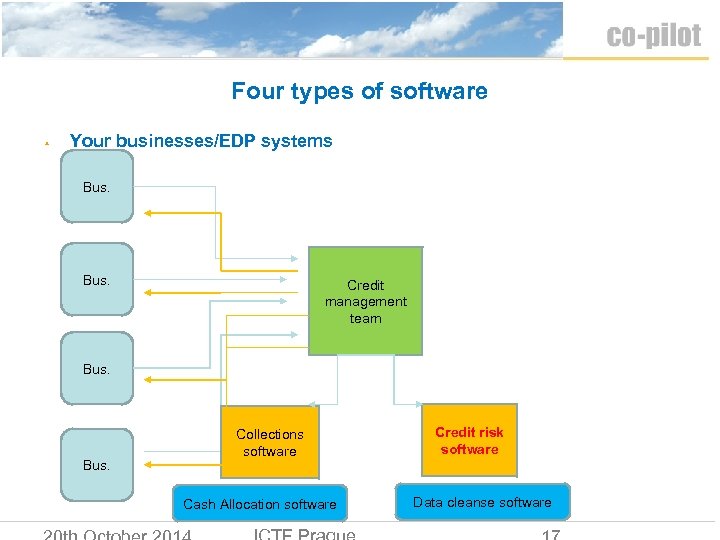

Four types of software Your businesses/EDP systems Bus. Credit management team Bus. Collections software Cash Allocation software Credit risk software Data cleanse software

Four types of software Your businesses/EDP systems Bus. Credit management team Bus. Collections software Cash Allocation software Credit risk software Data cleanse software

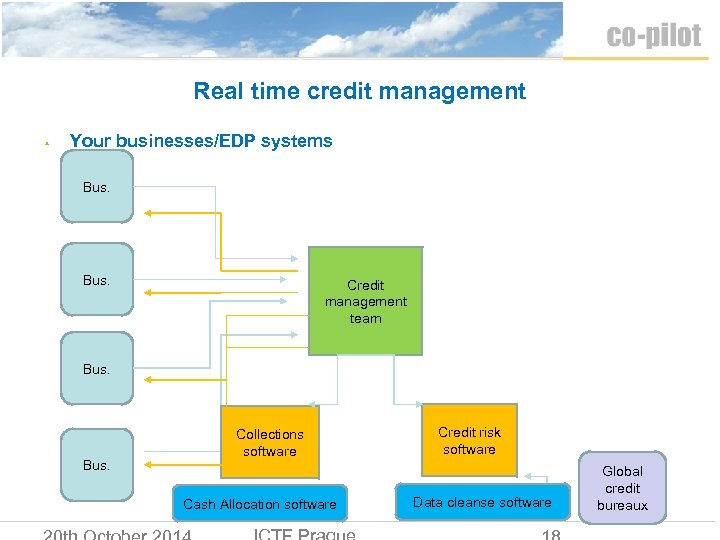

Real time credit management Your businesses/EDP systems Bus. Credit management team Bus. Collections software Cash Allocation software Credit risk software Data cleanse software Global credit bureaux

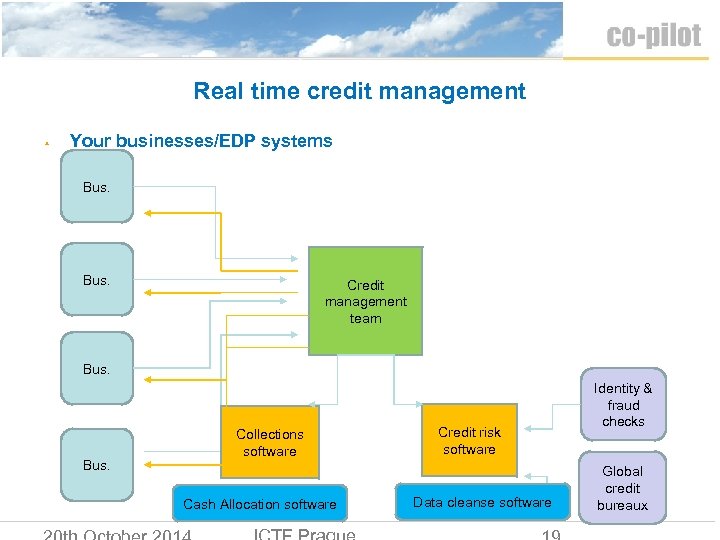

Real time credit management Your businesses/EDP systems Bus. Credit management team Bus. Collections software Cash Allocation software Credit risk software Data cleanse software Identity & fraud checks Global credit bureaux

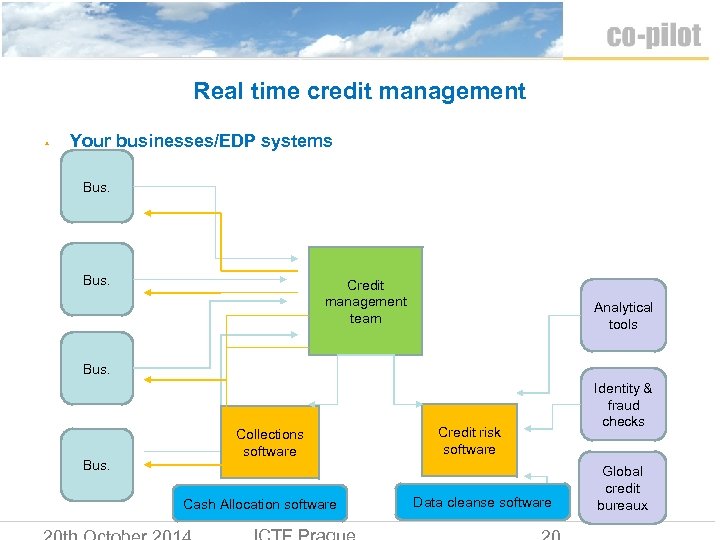

Real time credit management Your businesses/EDP systems Bus. Credit management team Analytical tools Bus. Collections software Cash Allocation software Credit risk software Data cleanse software Identity & fraud checks Global credit bureaux

Real time credit management Your businesses/EDP systems Bus. Sanctions & PEPs Checks Bus. Credit management team Analytical tools Bus. Collections software Cash Allocation software Credit risk software Data cleanse software Identity & fraud checks Global credit bureaux

Real time credit management Credit insurance or finance Your businesses/EDP systems Bus. Sanctions & PEPs Checks Bus. Credit management team Analytical tools Bus. Collections software Cash Allocation software Credit risk software Data cleanse software Identity & fraud checks Global credit bureaux

How you can support sales with real-time credit limit decisioning and monitoring New customers Better identification of good/bad new risks permits: – higher credit limits – better prospecting – point-of-sale decisioning Existing customers Ability systematically to pre-authorise increased credit limits for good/improving existing customers: – – Automated or manual Insured or house Essential for seasonal trade A better customer experience Competitive edge Ability to adapt risk strategies quickly

Credibility and professionalism

Credibility and professionalism Two examples:

The CFO phone call “Our Global Key Account, “Acme Distribution” has just issued a profits warning - sales are down 10%. What is the impact upon us? ” Four possible answers: I’ll get back to you 2. I’m sending you a pdf now – it shows you our global position at close of play last night All outstanding global balances, payment history, payment behaviour, risk profile and history, credit limit history, decisioning audit trail, etc 3. I’m sending you the pdf and, as we speak, I am running the new numbers through my risk analysis tool – it shows me that the impact upon Acme’s financial health is xxx 4. You have already sent the pdf, the analysis and your recommended action because your credit risk management software picked up the profits warning as it happened and actioned appropriate work flows. And this is what the CFO is phoning to consult you on How many credit managers were monitoring Tesco? 1.

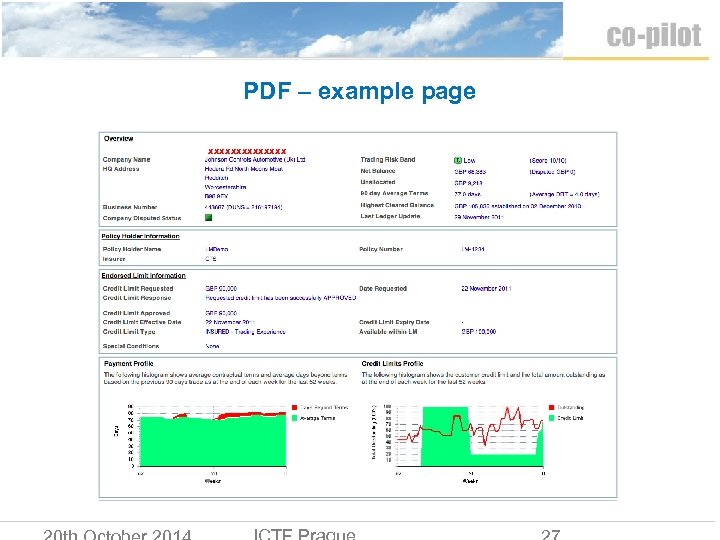

PDF – example page xxxxxxx

The Sales Director phone call “Why won’t you give me a bigger credit limit on International Widgets? ” Answer: I’m sending you a Delinquency Report now. It shows that they regularly pay 45 days beyond terms and it shows you how much this is costing us. Our margin on this business is x% If you want a bigger limit you need to negotiate a higher price, or get them to pay sooner The opportunity for risk/reward based limit capacity allocation?

Develop functionality within your ERP system? Don’t go there! – – – Credit people explaining what they want to IT people Things get missed or misunderstood Time-consuming internal project with other demands Huge costs Changes require another project – future-proofing is critical There will always be things you didn’t think of – because you didn’t know what you didn’t know Specialist credit management software is: – – – Able to work with multiple ERP systems Better Quicker to implement Cheaper Future-proof

In conclusion – – – Some credit managers will see and seize the opportunity In doing so they will grow as individuals and enhance their professional standing and their career prospects And, something I have not yet mentioned: They will enhance their team’s job satisfaction and better protect the team’s job security It’s a question of manage or be managed

a7bcba823b6dda447c8e6e6ad3189d53.ppt