aa0ef06cbf87d55aa42448019d0dee9f.ppt

- Количество слайдов: 28

Credit Fin 254 f: Spring 2010 1. 3 Kindleberger/Aliber (4) Reinhart/Rogoff(2)

Credit Fin 254 f: Spring 2010 1. 3 Kindleberger/Aliber (4) Reinhart/Rogoff(2)

Outline à Credit n n n and money Money mechanisms Currency Schools Types of credit à Credit collapse in great depression à Sovereign debt and serial defaults

Outline à Credit n n n and money Money mechanisms Currency Schools Types of credit à Credit collapse in great depression à Sovereign debt and serial defaults

Money Supply à What is it? à Is it exogenous or endogenous? à How is it connected to credit/collateral? n n M 1 = demand deposits M 2 = M 1 + time deposits M 3 = M 2 + government securities Mi etc. , etc à How do you measure?

Money Supply à What is it? à Is it exogenous or endogenous? à How is it connected to credit/collateral? n n M 1 = demand deposits M 2 = M 1 + time deposits M 3 = M 2 + government securities Mi etc. , etc à How do you measure?

Creating Money à Investor buys a $1000 AAA MBS (mortgage backed security à Use as collateral to borrow $900 à Buy $900 AAA MBS à Use as collateral to borrow $810 à …. .

Creating Money à Investor buys a $1000 AAA MBS (mortgage backed security à Use as collateral to borrow $900 à Buy $900 AAA MBS à Use as collateral to borrow $810 à …. .

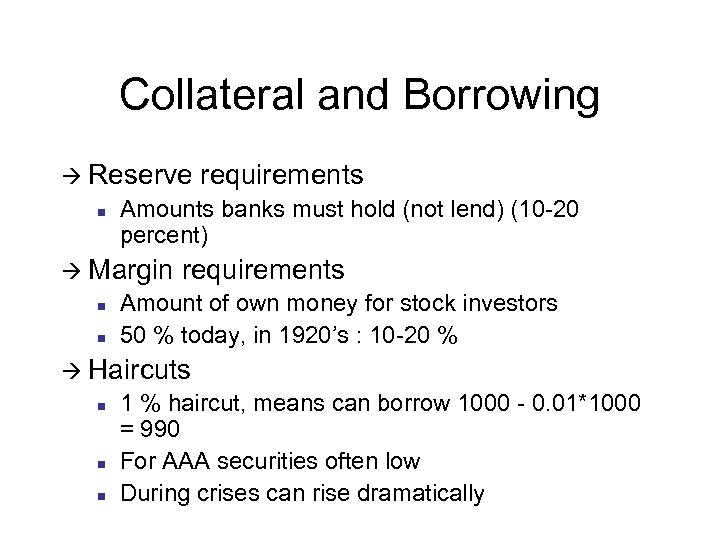

Collateral and Borrowing à Reserve n Amounts banks must hold (not lend) (10 -20 percent) à Margin n n requirements Amount of own money for stock investors 50 % today, in 1920’s : 10 -20 % à Haircuts n n n 1 % haircut, means can borrow 1000 - 0. 01*1000 = 990 For AAA securities often low During crises can rise dramatically

Collateral and Borrowing à Reserve n Amounts banks must hold (not lend) (10 -20 percent) à Margin n n requirements Amount of own money for stock investors 50 % today, in 1920’s : 10 -20 % à Haircuts n n n 1 % haircut, means can borrow 1000 - 0. 01*1000 = 990 For AAA securities often low During crises can rise dramatically

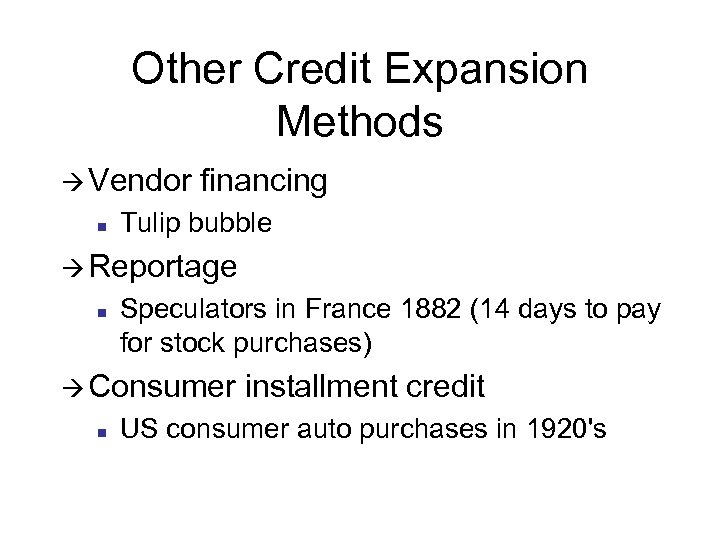

Other Credit Expansion Methods à Vendor n financing Tulip bubble à Reportage n Speculators in France 1882 (14 days to pay for stock purchases) à Consumer n installment credit US consumer auto purchases in 1920's

Other Credit Expansion Methods à Vendor n financing Tulip bubble à Reportage n Speculators in France 1882 (14 days to pay for stock purchases) à Consumer n installment credit US consumer auto purchases in 1920's

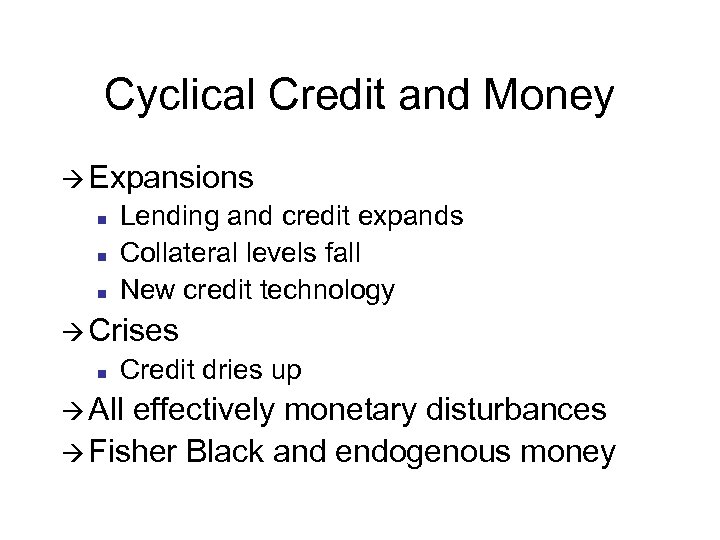

Cyclical Credit and Money à Expansions n n n Lending and credit expands Collateral levels fall New credit technology à Crises n Credit dries up à All effectively monetary disturbances à Fisher Black and endogenous money

Cyclical Credit and Money à Expansions n n n Lending and credit expands Collateral levels fall New credit technology à Crises n Credit dries up à All effectively monetary disturbances à Fisher Black and endogenous money

Schools of Monetary Thought à Currency School à Banking School

Schools of Monetary Thought à Currency School à Banking School

Currency School à Hard n restrictions on monetary growth Like 2% à Eventually became monetarists (Friedman) à Inflation and monetary growth locked to this policy à No big role for "endogenous money" and credit à Hesitant about banking/financial restrictions

Currency School à Hard n restrictions on monetary growth Like 2% à Eventually became monetarists (Friedman) à Inflation and monetary growth locked to this policy à No big role for "endogenous money" and credit à Hesitant about banking/financial restrictions

Banking School à Increases in money and credit natural in expansion à Will generally not overheat à Driven by increases in business activity

Banking School à Increases in money and credit natural in expansion à Will generally not overheat à Driven by increases in business activity

Monetary Difficulties à Too n much credit Inflation and instability (Currency school!) à During early growth periods expansion of credit necessary n Banking school! à How do we balance this? à How do you eventually shut down credit growth as bubbles take off?

Monetary Difficulties à Too n much credit Inflation and instability (Currency school!) à During early growth periods expansion of credit necessary n Banking school! à How do we balance this? à How do you eventually shut down credit growth as bubbles take off?

Defining Money Again à Problematic à Cash + Deposits + short term assets + long term assets + real estate +. . . à What about "total credit"? à Can you measure this?

Defining Money Again à Problematic à Cash + Deposits + short term assets + long term assets + real estate +. . . à What about "total credit"? à Can you measure this?

Debt Quality à Periods n n of euophoria Quantity of debt increases Quality falls à Quality and Minsky (Hedge, Speculative, Ponzi)

Debt Quality à Periods n n of euophoria Quantity of debt increases Quality falls à Quality and Minsky (Hedge, Speculative, Ponzi)

Debt Instruments à Bills n n n of exchange Vendor finance (seller extends credit to buyer) Initially directly tied to goods and shipments Later more general Were they money? Occasionally periods when debts of firms far exceeded their net worth à LTCM = $5 billion in capital -> 125 billion assets, 25 -1 à Similar ratios in early booms

Debt Instruments à Bills n n n of exchange Vendor finance (seller extends credit to buyer) Initially directly tied to goods and shipments Later more general Were they money? Occasionally periods when debts of firms far exceeded their net worth à LTCM = $5 billion in capital -> 125 billion assets, 25 -1 à Similar ratios in early booms

Call Money à One day loan (origins France 1882) à Used by security traders for short term liquidity à France(1882) and US(1920’s) n n n Supports speculative stock buying Increased demands for credit as market rises Massive defaults on loans as market falls à Curbed in 1930’s (margin requirements to 50 percent), but n Is this different from S&P futures traders (10 percent margin requirement)

Call Money à One day loan (origins France 1882) à Used by security traders for short term liquidity à France(1882) and US(1920’s) n n n Supports speculative stock buying Increased demands for credit as market rises Massive defaults on loans as market falls à Curbed in 1930’s (margin requirements to 50 percent), but n Is this different from S&P futures traders (10 percent margin requirement)

Gold Exchange Standard à Central bank holdings of British Pound based securities à Early 1900's à Country borrows in pounds à Adds to reserves à Increases global credit and money supply

Gold Exchange Standard à Central bank holdings of British Pound based securities à Early 1900's à Country borrows in pounds à Adds to reserves à Increases global credit and money supply

The Great Depression and Credit à Competing theories à Monetary n Friedman/Schwartz u Decline in money supply from 29 -33 à Keynesian n Peter Temin Consumption and normal consumption Real money (M/P) increases, 29 -33

The Great Depression and Credit à Competing theories à Monetary n Friedman/Schwartz u Decline in money supply from 29 -33 à Keynesian n Peter Temin Consumption and normal consumption Real money (M/P) increases, 29 -33

The Great Depression and Credit à Industrial n n n production June 29: 127 Sept 29: 122 Oct 29: 117 Nov 29: 106 Dec 29: 99 à Credit drawn to stock market as rises to peaks in October 29 à Credit freezes after stock market crash à Auto production: 660 K (March) - 92. 5 K (December)

The Great Depression and Credit à Industrial n n n production June 29: 127 Sept 29: 122 Oct 29: 117 Nov 29: 106 Dec 29: 99 à Credit drawn to stock market as rises to peaks in October 29 à Credit freezes after stock market crash à Auto production: 660 K (March) - 92. 5 K (December)

The Great Depression and Credit à Trade also collapses à Loans to finance trade credits drop n (Classic explanations are protectionism) à Minsky and Henry Simmons only proponents of credit mechanisms à Simmons policy reco's n n n 100 percent currency reserves for banks Ban most other forms of lending All financial wealth to be equity based

The Great Depression and Credit à Trade also collapses à Loans to finance trade credits drop n (Classic explanations are protectionism) à Minsky and Henry Simmons only proponents of credit mechanisms à Simmons policy reco's n n n 100 percent currency reserves for banks Ban most other forms of lending All financial wealth to be equity based

Austrians and Money à Private money issuance à "Good money drives out bad" à Several historical experiences suggest otherwise

Austrians and Money à Private money issuance à "Good money drives out bad" à Several historical experiences suggest otherwise

Central Banks and Money/credit à Can they influence? à Can they restrain when credit begins to blow up? à Can they expand credit during a crisis?

Central Banks and Money/credit à Can they influence? à Can they restrain when credit begins to blow up? à Can they expand credit during a crisis?

Sovereign Debt Levels Reinhart and Rogoff (2) à Troubling debt levels à Lower for emerging economies à Recurrent defaults à Some developed countries high n Japan 170 % of GDP à Much crises start at lower levels for developing countries

Sovereign Debt Levels Reinhart and Rogoff (2) à Troubling debt levels à Lower for emerging economies à Recurrent defaults à Some developed countries high n Japan 170 % of GDP à Much crises start at lower levels for developing countries

Developing Examples 1970 -2008: Extern. Debt/GDP à Mexico, n 1982 (47) à Chile, n 1972 (31), 1983, (96) à Ecuador, n 1984 (68. 2), 2000(106), 2008(20) à Russia n 1998 (59) à Turkey n 1978(21) à Average 69. 3 (>100% in only 16%)

Developing Examples 1970 -2008: Extern. Debt/GDP à Mexico, n 1982 (47) à Chile, n 1972 (31), 1983, (96) à Ecuador, n 1984 (68. 2), 2000(106), 2008(20) à Russia n 1998 (59) à Turkey n 1978(21) à Average 69. 3 (>100% in only 16%)

Debt Distributions à Larger for defaulters à Trouble thresholds depend on many variables à Troubled history (inflation/repayment) matters a lot à Worse, this is lower is the "debt threshold"

Debt Distributions à Larger for defaulters à Trouble thresholds depend on many variables à Troubled history (inflation/repayment) matters a lot à Worse, this is lower is the "debt threshold"

Debt and Risk à Correlations of External Debt/ GDP and Institutional Investor ratings à Generally large and positive n (Table 2. 3, 0. 3 -0. 5, except Middle East = 0. 14)

Debt and Risk à Correlations of External Debt/ GDP and Institutional Investor ratings à Generally large and positive n (Table 2. 3, 0. 3 -0. 5, except Middle East = 0. 14)

Debtors Clubs (groups) à Low n Type I à Low n risk, low debt Type 3 à High n risk, high debt Type 2 à High n risk, low debt risk, high debt Type 4

Debtors Clubs (groups) à Low n Type I à Low n risk, low debt Type 3 à High n risk, high debt Type 2 à High n risk, low debt risk, high debt Type 4

Debt Intolerance à How can countries become debt intolerant? à Institutions, government, other soft factors matter à Risk sharing by open capital markets may be small à Capital flows may be procyclical and destabilizing (Iceland)

Debt Intolerance à How can countries become debt intolerant? à Institutions, government, other soft factors matter à Risk sharing by open capital markets may be small à Capital flows may be procyclical and destabilizing (Iceland)

Summary à Crises seem tied to increases in debt à Public debt and private debt à Related to monetary control too à Continue to analyze

Summary à Crises seem tied to increases in debt à Public debt and private debt à Related to monetary control too à Continue to analyze