a27541afe9c3b976c58f4cc860b51537.ppt

- Количество слайдов: 16

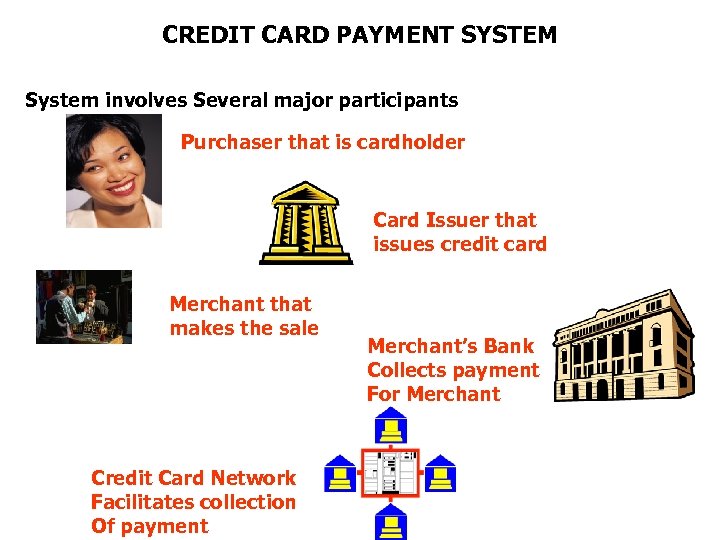

CREDIT CARD PAYMENT SYSTEM System involves Several major participants Purchaser that is cardholder Card Issuer that issues credit card Merchant that makes the sale Credit Card Network Facilitates collection Of payment Merchant’s Bank Collects payment For Merchant

CREDIT CARD PAYMENT SYSTEM System involves Several major participants Purchaser that is cardholder Card Issuer that issues credit card Merchant that makes the sale Credit Card Network Facilitates collection Of payment Merchant’s Bank Collects payment For Merchant

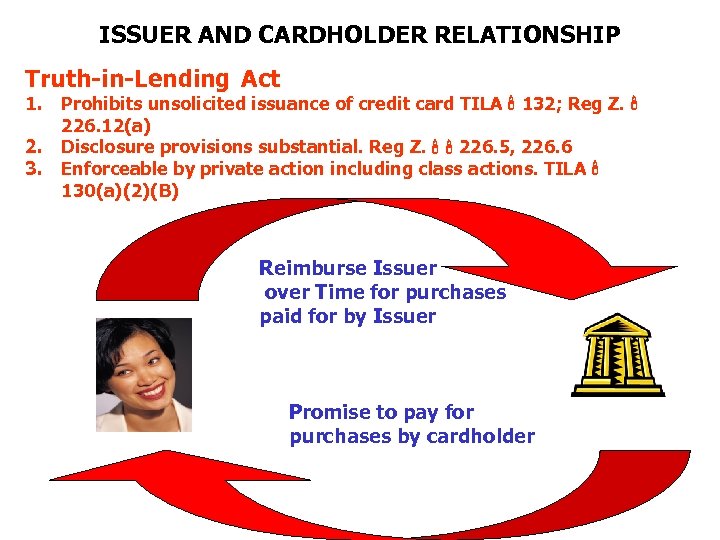

ISSUER AND CARDHOLDER RELATIONSHIP Truth-in-Lending Act 1. Prohibits unsolicited issuance of credit card TILA 132; Reg Z. 226. 12(a) 2. Disclosure provisions substantial. Reg Z. 226. 5, 226. 6 3. Enforceable by private action including class actions. TILA 130(a)(2)(B) Reimburse Issuer over Time for purchases paid for by Issuer Promise to pay for purchases by cardholder

ISSUER AND CARDHOLDER RELATIONSHIP Truth-in-Lending Act 1. Prohibits unsolicited issuance of credit card TILA 132; Reg Z. 226. 12(a) 2. Disclosure provisions substantial. Reg Z. 226. 5, 226. 6 3. Enforceable by private action including class actions. TILA 130(a)(2)(B) Reimburse Issuer over Time for purchases paid for by Issuer Promise to pay for purchases by cardholder

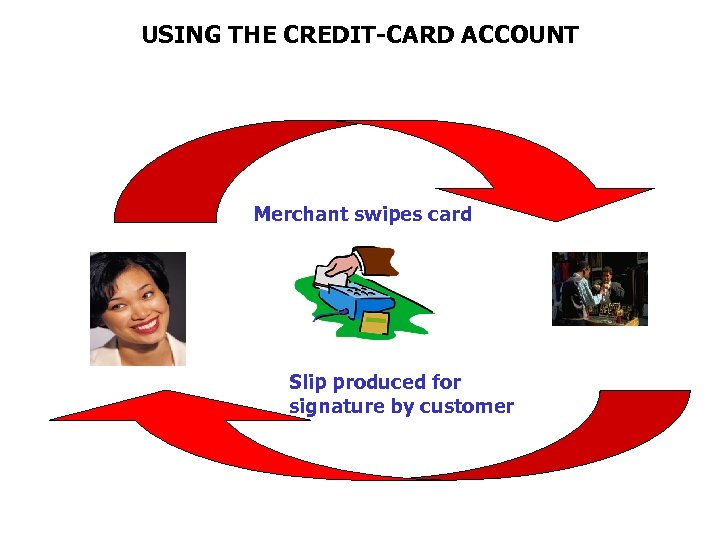

USING THE CREDIT-CARD ACCOUNT Merchant swipes card Slip produced for signature by customer

USING THE CREDIT-CARD ACCOUNT Merchant swipes card Slip produced for signature by customer

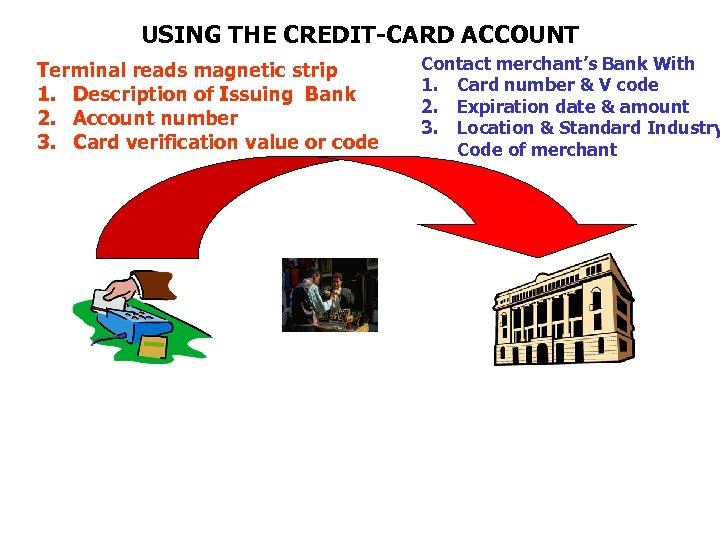

USING THE CREDIT-CARD ACCOUNT Terminal reads magnetic strip 1. Description of Issuing Bank 2. Account number 3. Card verification value or code Contact merchant’s Bank With 1. Card number & V code 2. Expiration date & amount 3. Location & Standard Industry Code of merchant

USING THE CREDIT-CARD ACCOUNT Terminal reads magnetic strip 1. Description of Issuing Bank 2. Account number 3. Card verification value or code Contact merchant’s Bank With 1. Card number & V code 2. Expiration date & amount 3. Location & Standard Industry Code of merchant

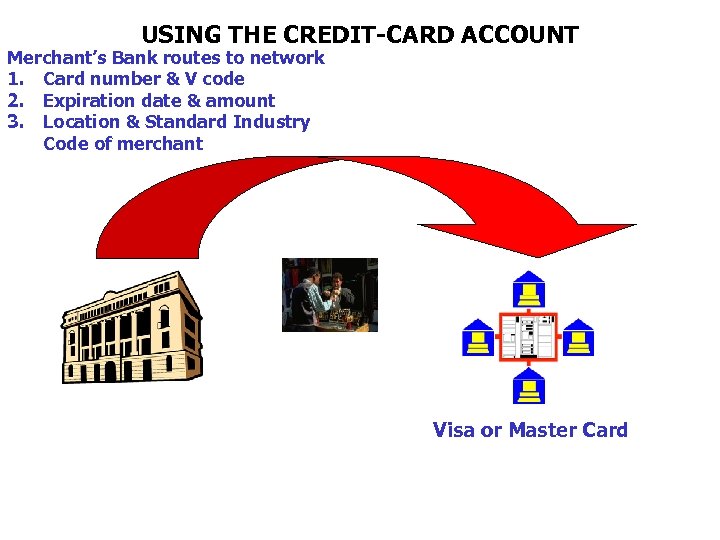

USING THE CREDIT-CARD ACCOUNT Merchant’s Bank routes to network 1. Card number & V code 2. Expiration date & amount 3. Location & Standard Industry Code of merchant Visa or Master Card

USING THE CREDIT-CARD ACCOUNT Merchant’s Bank routes to network 1. Card number & V code 2. Expiration date & amount 3. Location & Standard Industry Code of merchant Visa or Master Card

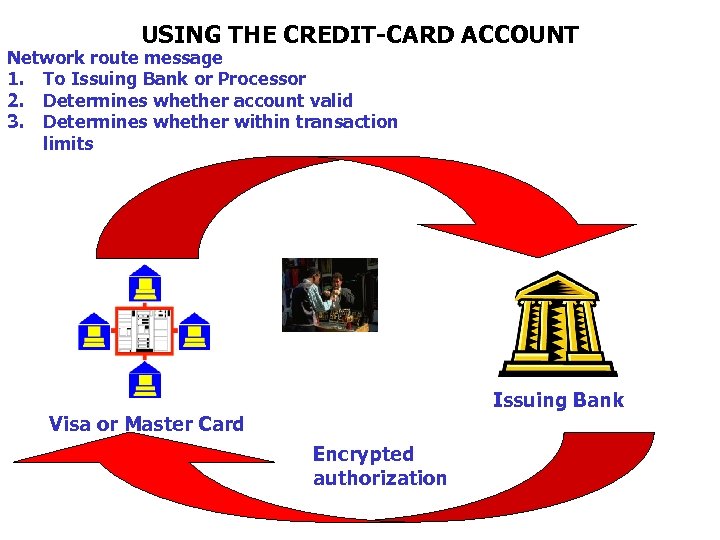

USING THE CREDIT-CARD ACCOUNT Network route message 1. To Issuing Bank or Processor 2. Determines whether account valid 3. Determines whether within transaction limits Issuing Bank Visa or Master Card Encrypted authorization

USING THE CREDIT-CARD ACCOUNT Network route message 1. To Issuing Bank or Processor 2. Determines whether account valid 3. Determines whether within transaction limits Issuing Bank Visa or Master Card Encrypted authorization

USING THE CREDIT-CARD ACCOUNT Merchant swipes card After authorization Slip produced for signature by customer

USING THE CREDIT-CARD ACCOUNT Merchant swipes card After authorization Slip produced for signature by customer

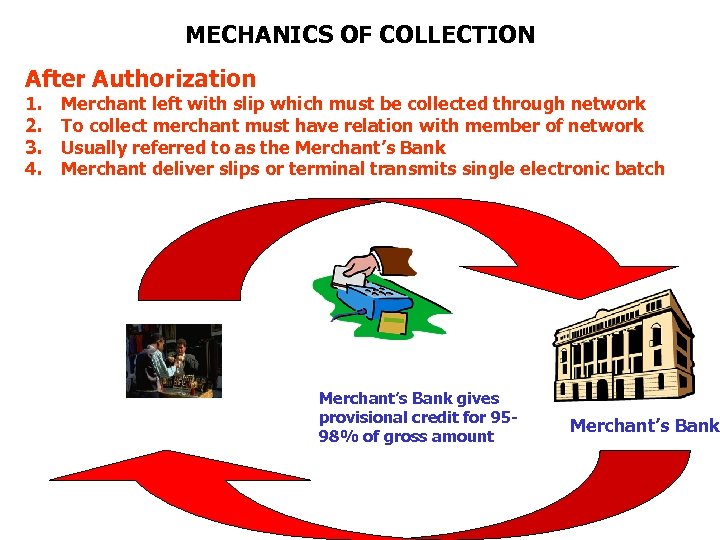

MECHANICS OF COLLECTION After Authorization 1. 2. 3. 4. Merchant left with slip which must be collected through network To collect merchant must have relation with member of network Usually referred to as the Merchant’s Bank Merchant deliver slips or terminal transmits single electronic batch Merchant’s Bank gives provisional credit for 9598% of gross amount Merchant’s Bank

MECHANICS OF COLLECTION After Authorization 1. 2. 3. 4. Merchant left with slip which must be collected through network To collect merchant must have relation with member of network Usually referred to as the Merchant’s Bank Merchant deliver slips or terminal transmits single electronic batch Merchant’s Bank gives provisional credit for 9598% of gross amount Merchant’s Bank

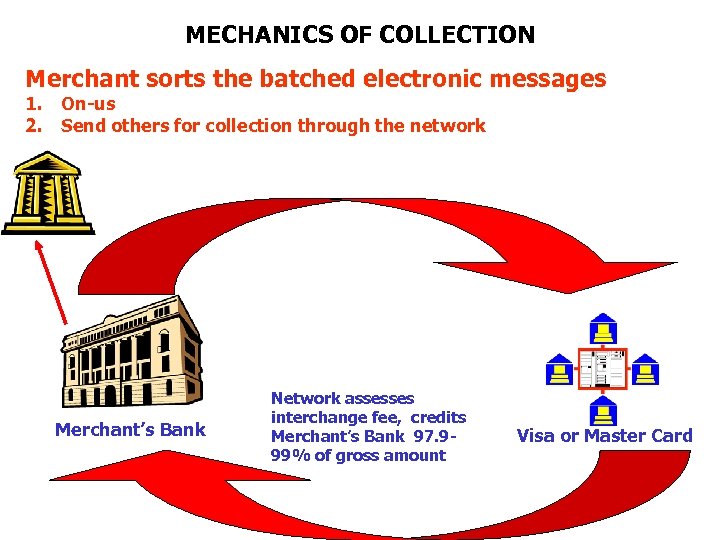

MECHANICS OF COLLECTION Merchant sorts the batched electronic messages 1. On-us 2. Send others for collection through the network Merchant’s Bank Network assesses interchange fee, credits Merchant’s Bank 97. 999% of gross amount Visa or Master Card

MECHANICS OF COLLECTION Merchant sorts the batched electronic messages 1. On-us 2. Send others for collection through the network Merchant’s Bank Network assesses interchange fee, credits Merchant’s Bank 97. 999% of gross amount Visa or Master Card

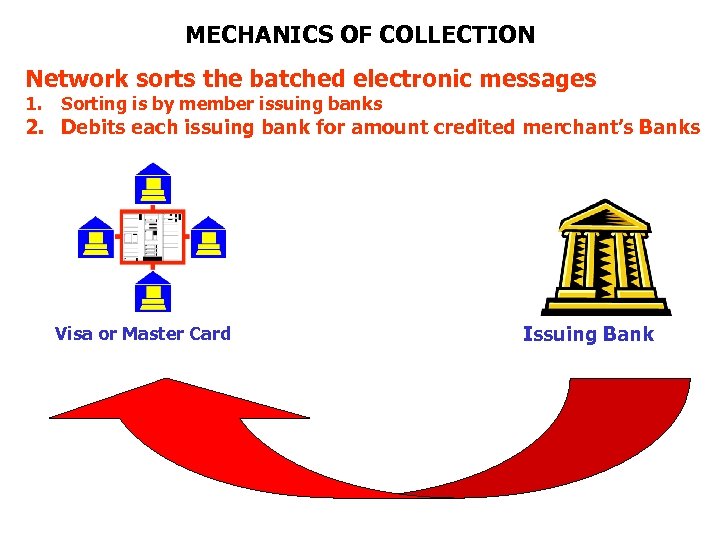

MECHANICS OF COLLECTION Network sorts the batched electronic messages 1. Sorting is by member issuing banks 2. Debits each issuing bank for amount credited merchant’s Banks Visa or Master Card Issuing Bank

MECHANICS OF COLLECTION Network sorts the batched electronic messages 1. Sorting is by member issuing banks 2. Debits each issuing bank for amount credited merchant’s Banks Visa or Master Card Issuing Bank

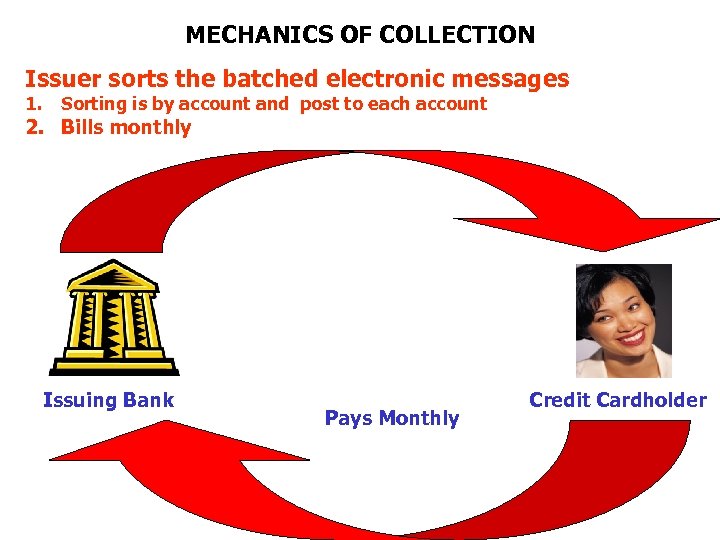

MECHANICS OF COLLECTION Issuer sorts the batched electronic messages 1. Sorting is by account and post to each account 2. Bills monthly Issuing Bank Pays Monthly Credit Cardholder

MECHANICS OF COLLECTION Issuer sorts the batched electronic messages 1. Sorting is by account and post to each account 2. Bills monthly Issuing Bank Pays Monthly Credit Cardholder

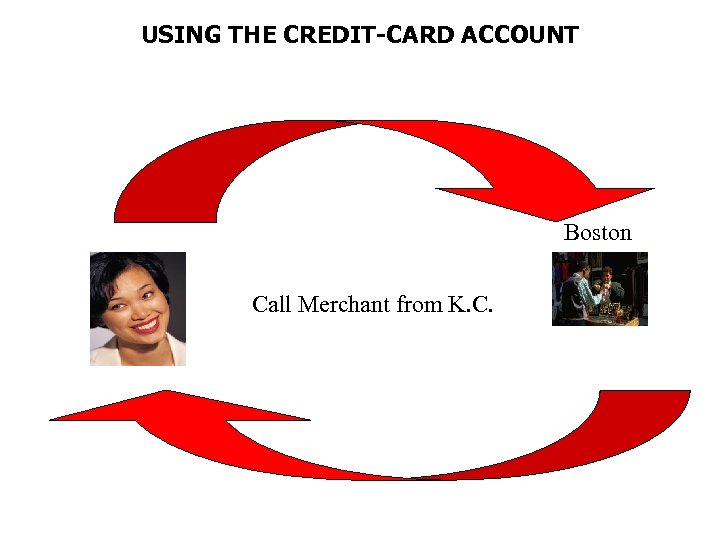

USING THE CREDIT-CARD ACCOUNT Boston Call Merchant from K. C.

USING THE CREDIT-CARD ACCOUNT Boston Call Merchant from K. C.

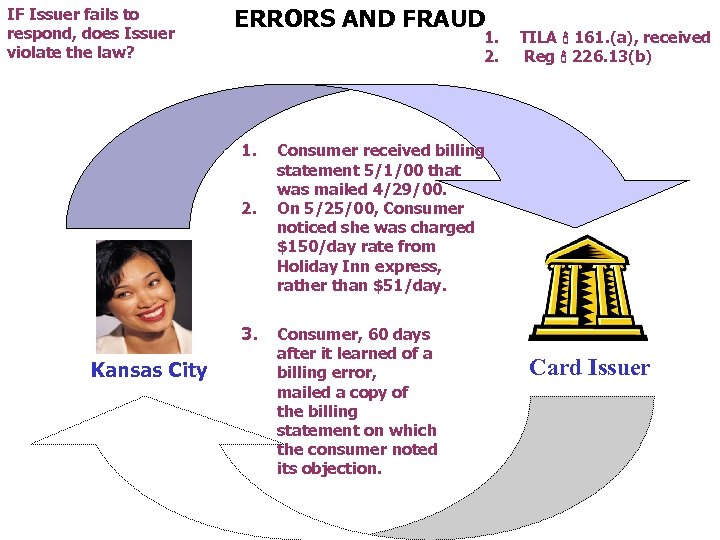

IF Issuer fails to respond, does Issuer violate the law? ERRORS AND FRAUD 1. 2. 3. Kansas City TILA 161. (a), received Reg 226. 13(b) Consumer received billing statement 5/1/00 that was mailed 4/29/00. On 5/25/00, Consumer noticed she was charged $150/day rate from Holiday Inn express, rather than $51/day. Consumer, 60 days after it learned of a billing error, mailed a copy of the billing statement on which the consumer noted its objection. Card Issuer

IF Issuer fails to respond, does Issuer violate the law? ERRORS AND FRAUD 1. 2. 3. Kansas City TILA 161. (a), received Reg 226. 13(b) Consumer received billing statement 5/1/00 that was mailed 4/29/00. On 5/25/00, Consumer noticed she was charged $150/day rate from Holiday Inn express, rather than $51/day. Consumer, 60 days after it learned of a billing error, mailed a copy of the billing statement on which the consumer noted its objection. Card Issuer

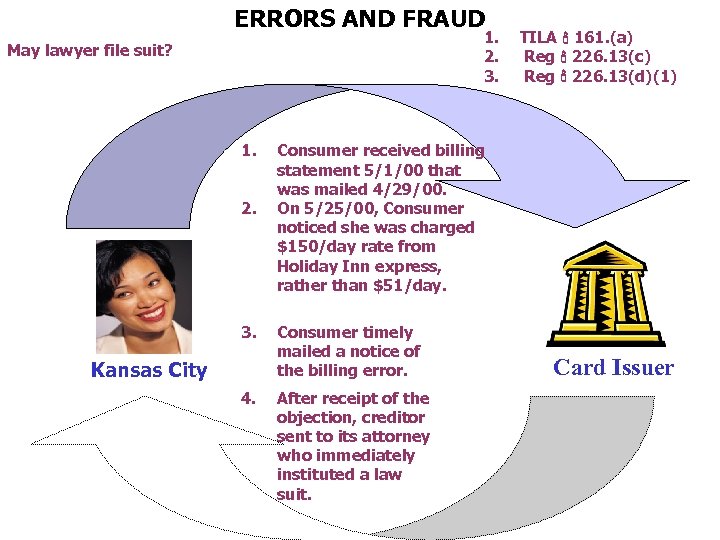

ERRORS AND FRAUD 1. 2. 3. May lawyer file suit? 1. 2. 3. Kansas City 4. TILA 161. (a) Reg 226. 13(c) Reg 226. 13(d)(1) Consumer received billing statement 5/1/00 that was mailed 4/29/00. On 5/25/00, Consumer noticed she was charged $150/day rate from Holiday Inn express, rather than $51/day. Consumer timely mailed a notice of the billing error. After receipt of the objection, creditor sent to its attorney who immediately instituted a law suit. Card Issuer

ERRORS AND FRAUD 1. 2. 3. May lawyer file suit? 1. 2. 3. Kansas City 4. TILA 161. (a) Reg 226. 13(c) Reg 226. 13(d)(1) Consumer received billing statement 5/1/00 that was mailed 4/29/00. On 5/25/00, Consumer noticed she was charged $150/day rate from Holiday Inn express, rather than $51/day. Consumer timely mailed a notice of the billing error. After receipt of the objection, creditor sent to its attorney who immediately instituted a law suit. Card Issuer

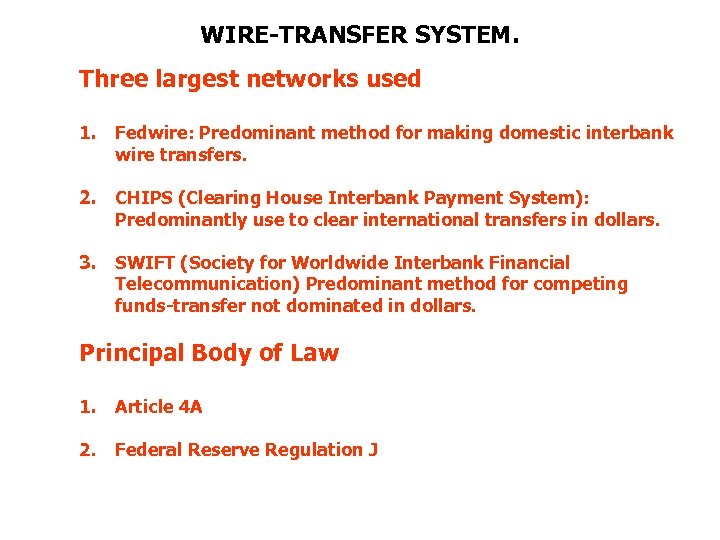

WIRE-TRANSFER SYSTEM. Three largest networks used 1. Fedwire: Predominant method for making domestic interbank wire transfers. 2. CHIPS (Clearing House Interbank Payment System): Predominantly use to clear international transfers in dollars. 3. SWIFT (Society for Worldwide Interbank Financial Telecommunication) Predominant method for competing funds-transfer not dominated in dollars. Principal Body of Law 1. Article 4 A 2. Federal Reserve Regulation J

WIRE-TRANSFER SYSTEM. Three largest networks used 1. Fedwire: Predominant method for making domestic interbank wire transfers. 2. CHIPS (Clearing House Interbank Payment System): Predominantly use to clear international transfers in dollars. 3. SWIFT (Society for Worldwide Interbank Financial Telecommunication) Predominant method for competing funds-transfer not dominated in dollars. Principal Body of Law 1. Article 4 A 2. Federal Reserve Regulation J

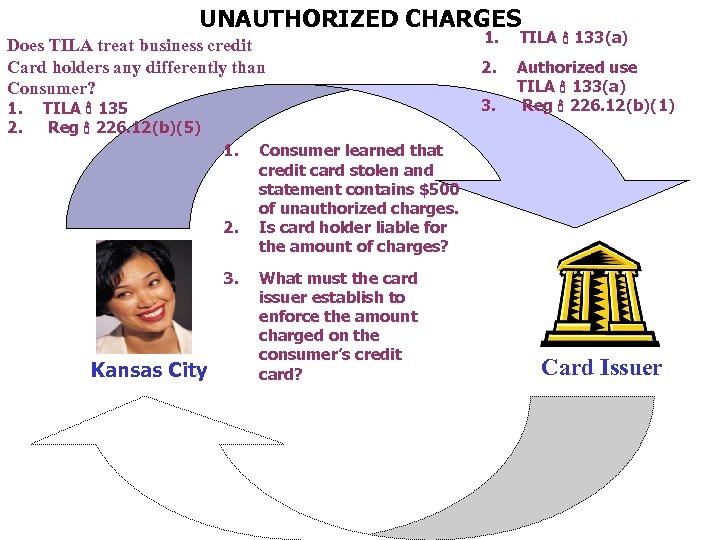

UNAUTHORIZED CHARGES Does TILA treat business credit Card holders any differently than Consumer? 1. 2. TILA 135 Reg 226. 12(b)(5) 1. 2. 3. Kansas City 1. TILA 133(a) 2. Authorized use TILA 133(a) Reg 226. 12(b)(1) 3. Consumer learned that credit card stolen and statement contains $500 of unauthorized charges. Is card holder liable for the amount of charges? What must the card issuer establish to enforce the amount charged on the consumer’s credit card? Card Issuer

UNAUTHORIZED CHARGES Does TILA treat business credit Card holders any differently than Consumer? 1. 2. TILA 135 Reg 226. 12(b)(5) 1. 2. 3. Kansas City 1. TILA 133(a) 2. Authorized use TILA 133(a) Reg 226. 12(b)(1) 3. Consumer learned that credit card stolen and statement contains $500 of unauthorized charges. Is card holder liable for the amount of charges? What must the card issuer establish to enforce the amount charged on the consumer’s credit card? Card Issuer