d5c1680aa357ca12336b1c5222d07ea9.ppt

- Количество слайдов: 20

Credit Card & Merchant Businesses Nicholas L. A. Kennett General Manager Cards & Financing Products November 2001

Disclaimer The material that follows is a presentation of general background information about the Bank’s activities current at the date of the presentation, 7 November 2001. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These should be considered, with or without professional advice when deciding if an investment is appropriate.

Outline • • • Credit card environment in Australia Regulatory environment Profitability drivers CBA Card - Strategy and Vision Delivering the vision The future

Cards Environment in Australia • • Highly competitive Significant growth Key players and market share Consumers seeking convenience and security Sophisticated payments environment Ansett collapse Re-regulation

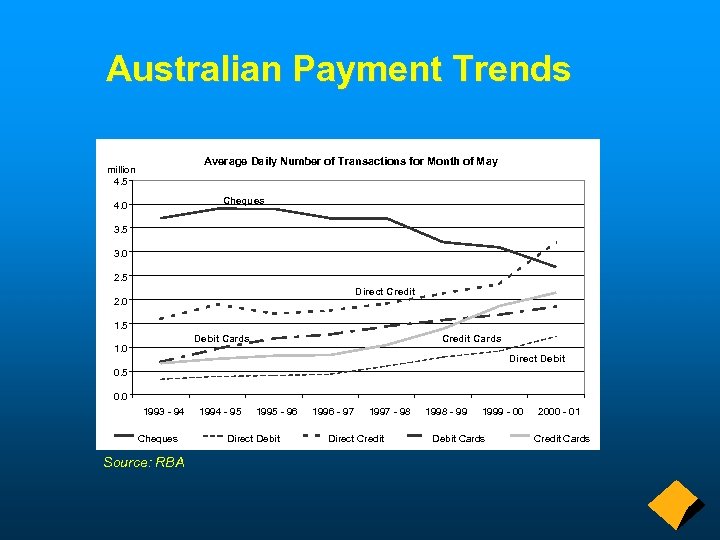

Australian Payment Trends Average Daily Number of Transactions for Month of May million 4. 5 Cheques 4. 0 3. 5 3. 0 2. 5 Direct Credit 2. 0 1. 5 Debit Cards 1. 0 Credit Cards Direct Debit 0. 5 0. 0 1993 - 94 Cheques Source: RBA 1994 - 95 1995 - 96 Direct Debit 1996 - 97 1997 - 98 Direct Credit 1998 - 99 1999 - 00 Debit Cards 2000 - 01 Credit Cards

Regulatory Environment • Worldwide focus • RBA designation of the ‘Schemes’ – developing standards • interchange fees • access regime to the credit card systems – review expected in November 2001 – consultation period – final decisions in early 2002

Possible Market Impact of Regulatory Changes • • Reduced interchange income to issuers Reduced interchange expense to acquirers Potential risk of ‘contamination’ of payments system Potential backlash to surcharging • • • Higher cardholder fees Unequal position with “closed” schemes Less funding for loyalty Pressure on commercial cards Less technology investment

Business Impact of Potential Regulatory Changes • Best placed institutions will have: – large portfolio – balanced issuing and acquiring profile – high ratio of interest/interchange income – low cost rewards programme – broad portfolio of merchants

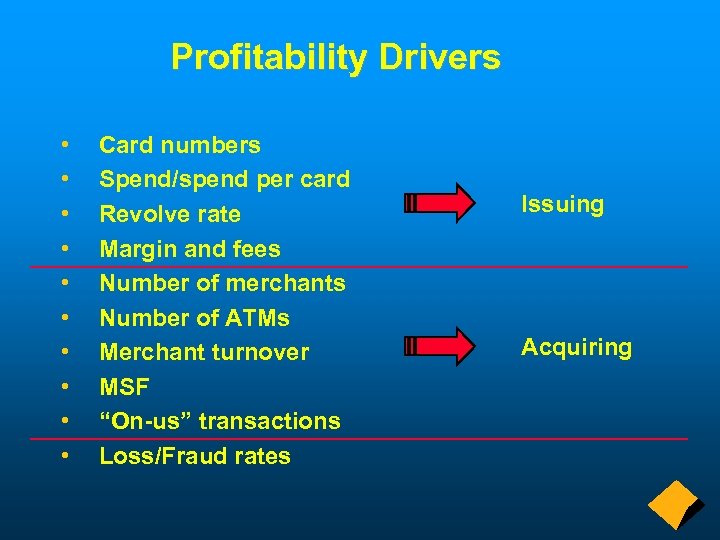

Profitability Drivers • • • Card numbers Spend/spend per card Revolve rate Margin and fees Number of merchants Number of ATMs Merchant turnover MSF “On-us” transactions Loss/Fraud rates Issuing Acquiring

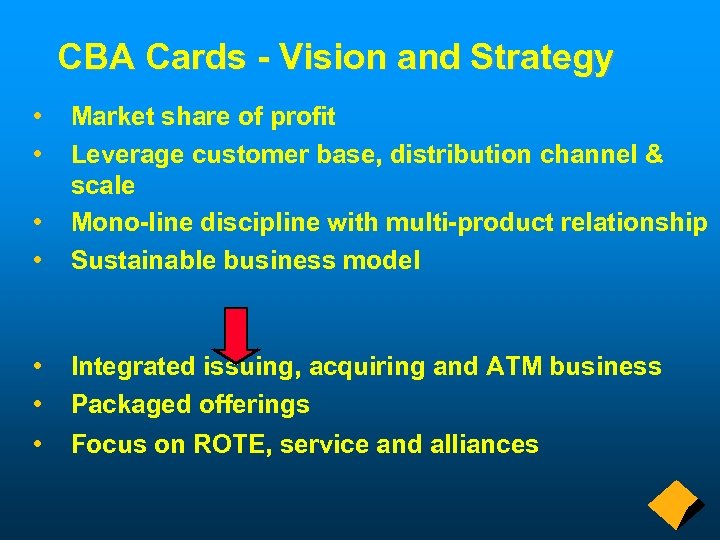

CBA Cards - Vision and Strategy • • Market share of profit Leverage customer base, distribution channel & scale Mono-line discipline with multi-product relationship Sustainable business model • • Integrated issuing, acquiring and ATM business Packaged offerings • Focus on ROTE, service and alliances

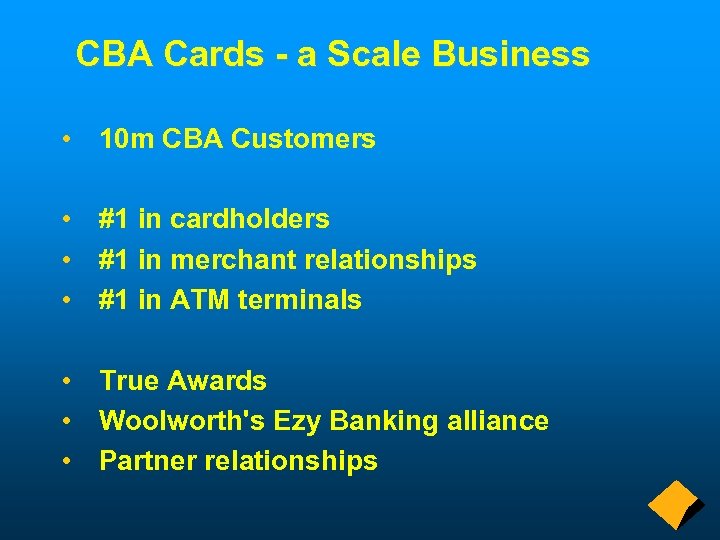

CBA Cards - a Scale Business • 10 m CBA Customers • #1 in cardholders • #1 in merchant relationships • #1 in ATM terminals • True Awards • Woolworth's Ezy Banking alliance • Partner relationships

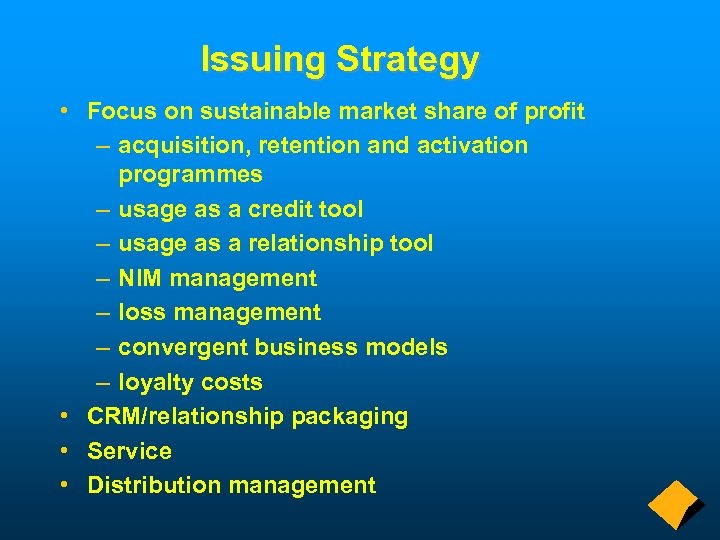

Issuing Strategy • Focus on sustainable market share of profit – acquisition, retention and activation programmes – usage as a credit tool – usage as a relationship tool – NIM management – loss management – convergent business models – loyalty costs • CRM/relationship packaging • Service • Distribution management

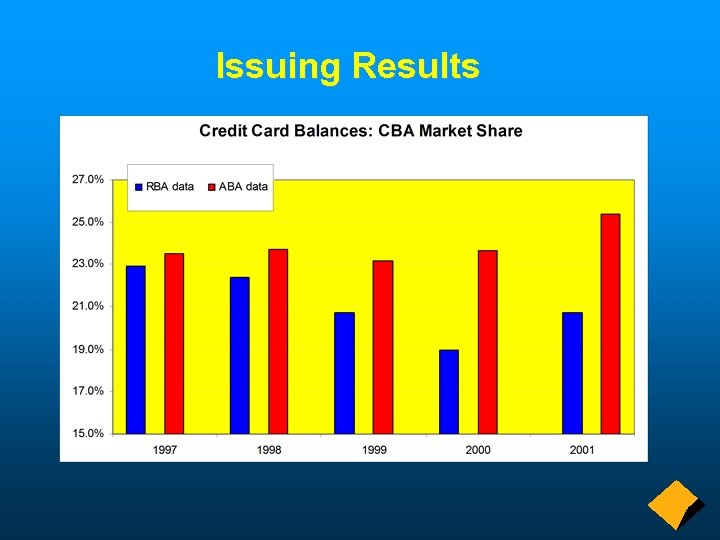

Issuing Results

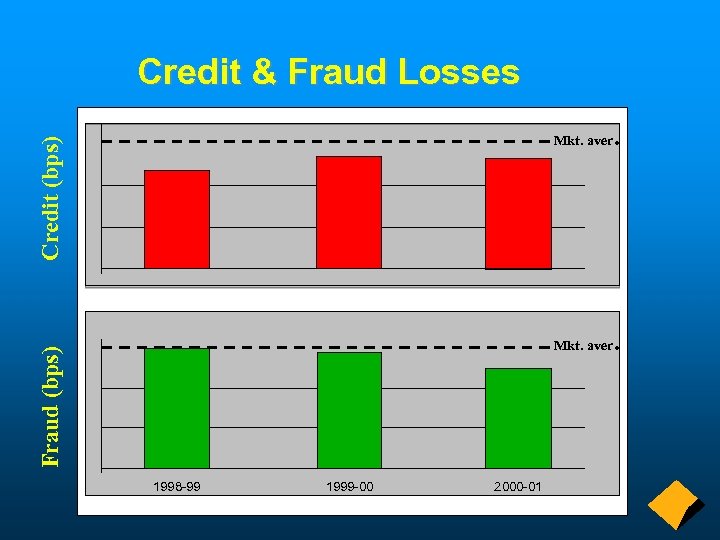

Credit & Fraud Losses Fraud (bps) 1998 -99 1999 -00 2000 -01 . Mkt. aver Credit (bps) Mkt. aver .

CBA Acquiring • #1 market share – 150, 000 Merchants – 4, 000 ATMs • 35% market share • Growing at 25 %+ pa • Key initiatives: – Mobile – E-commerce • Low capital requirement

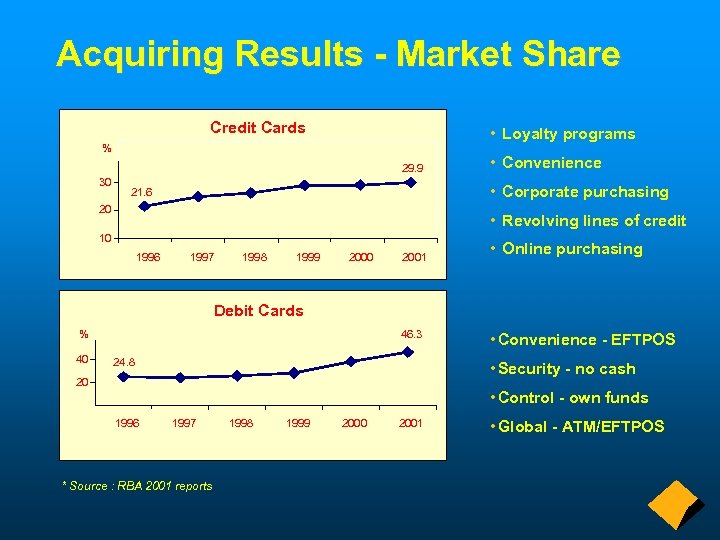

Acquiring Results - Market Share Credit Cards • Loyalty programs % 29. 9 30 • Convenience • Corporate purchasing 21. 6 20 • Revolving lines of credit 10 1996 1997 1998 1999 2000 2001 • Online purchasing Debit Cards % 40 46. 3 24. 8 • Convenience - EFTPOS • Security - no cash 20 • Control - own funds 1996 1997 * Source : RBA 2001 reports 1998 1999 2000 2001 • Global - ATM/EFTPOS

Acquiring Strategy • Leverage scale • Convergent opportunities • Leverage relationship with corporate relationships • New acquiring markets • Support customer move to online acquiring • Drive down losses

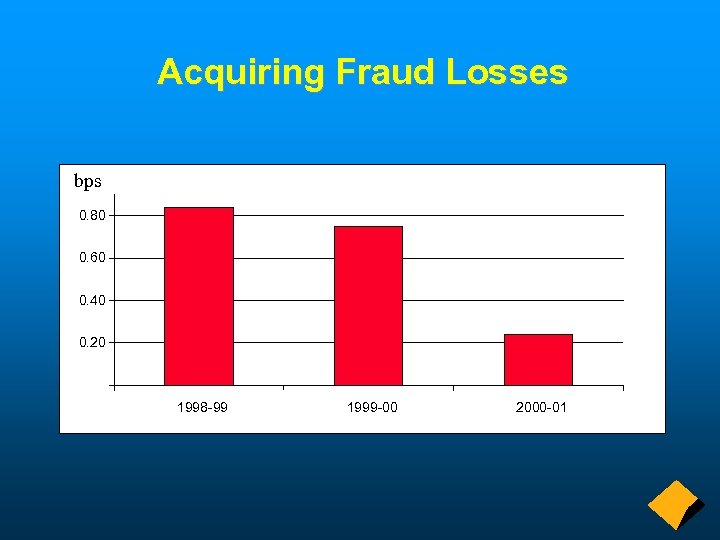

Acquiring Fraud Losses bps 0. 80 0. 60 0. 40 0. 20 1998 -99 1999 -00 2000 -01

The Future • Consumer • Merchant price • Regulation • Technology Chip convenience and security convenience, security and ongoing Pin@POS, 3 DES, 3 D Secure/SPA, The winner will have a sustainable business model, options, strong distribution and scale

Credit Card & Merchant Businesses Nicholas L. A. Kennett General Manager Cards & Financing Products November 2001

d5c1680aa357ca12336b1c5222d07ea9.ppt