ee183cd64253ee7b8ca949c63cafddfb.ppt

- Количество слайдов: 20

CREBs: Financing for Renewable Energy Projects Robinson & Cole LLP David M. Panico dpanico@rc. com (860) 275 -8390

What is a CREB? • CREB: “clean renewable energy bond” • Enacted as part of Energy Tax Incentive Act of 2005 • Section 54 of Internal Revenue Code • Expired December 31, 2008, but was extended by H. R. 1424 to December 31, 2009

Tax Credit Bond – Provides holder with a credit against tax, rather than tax exempt interest – Credit rate and term set by IRS – Level principal paid in each year of term – Taxable bond, but subject to some tax exempt provisions – Amount of credit included in gross income – Designed to provide issuers with 0% interest cost

Economics of Issue • $2. 5 million CREB sold April 2008 • 15 year maturity • $166, 666. 67 annual principal • Credit rates 3. 30% (2008) to 5. 73% (2022) • 0. 85% supplemental interest rate

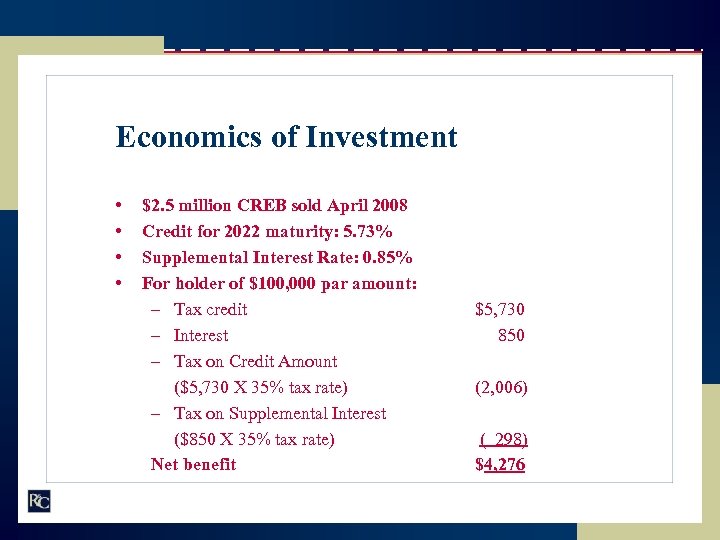

Economics of Investment • • $2. 5 million CREB sold April 2008 Credit for 2022 maturity: 5. 73% Supplemental Interest Rate: 0. 85% For holder of $100, 000 par amount: – Tax credit – Interest – Tax on Credit Amount ($5, 730 X 35% tax rate) – Tax on Supplemental Interest ($850 X 35% tax rate) Net benefit $5, 730 850 (2, 006) ( 298) $4, 276

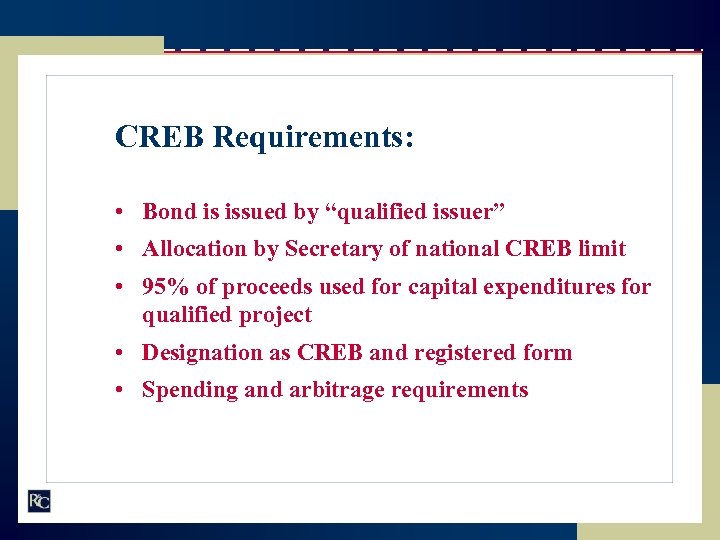

CREB Requirements: • Bond is issued by “qualified issuer” • Allocation by Secretary of national CREB limit • 95% of proceeds used for capital expenditures for qualified project • Designation as CREB and registered form • Spending and arbitrage requirements

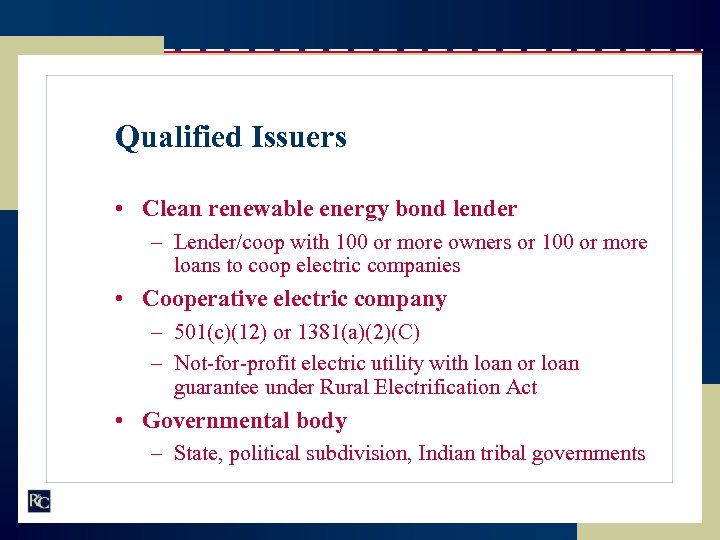

Qualified Issuers • Clean renewable energy bond lender – Lender/coop with 100 or more owners or 100 or more loans to coop electric companies • Cooperative electric company – 501(c)(12) or 1381(a)(2)(C) – Not-for-profit electric utility with loan or loan guarantee under Rural Electrification Act • Governmental body – State, political subdivision, Indian tribal governments

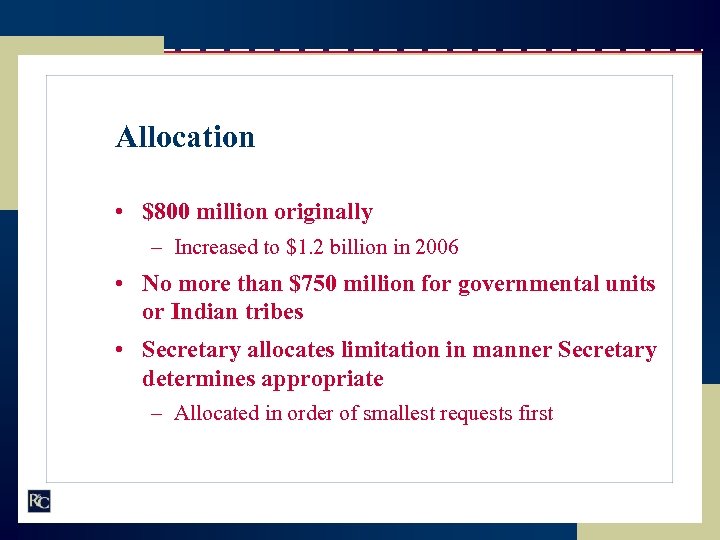

Allocation • $800 million originally – Increased to $1. 2 billion in 2006 • No more than $750 million for governmental units or Indian tribes • Secretary allocates limitation in manner Secretary determines appropriate – Allocated in order of smallest requests first

Qualified Projects • Qualified facilities under Code Section 45(d) • Wind facilities – facility using wind to produce electricity – turbine, blades, generator, tower, pad • Closed-loop biomass facilities – use organic material intended for use as fuel • Open-loop biomass facilities – use agricultural livestock waste, wood shavings, wood pallets and crates, crops and crop by-products

Qualified Projects • Geothermal or solar energy facilities – produce geothermal energy from natural heat stored in rocks, liquid or vapor • Small irrigation power facilities – use irrigation system canal or ditch • Landfill gas facilities – use methane from biodegradation of municipal solid waste

Qualified Projects • Trash combustion facilities – Burn municipal solid waste to produce steam to drive turbine • Refined coal production facilities – produce refined coal to be used to produce steam • Qualified hydropower facilities – produce hydroelectric power

Spending and Arbitrage Requirements • 95% or more of proceeds spent for qualified project within five years – can be extended for reasonable cause – if not met, nonqualified bonds must be redeemed within 90 days – commitment for 10% or more of proceeds within six months – projects completed and proceeds spent with due diligence

Spending and Arbitrage Requirements • Arbitrage Requirements of Section 148 – Yield limitations • five year temporary period • yield reduction payments available – Rebate requirement • regular rebate exceptions apply • small issuer exception includes CREB amount • yield would be 0% assuming no OID or supplemental interest payment

Spending and Arbitrage Requirements – Refinancing and Reimbursement • CREB proceeds can be used to refinance another obligation incurred after August 8, 2005 • CREB proceeds can be used for reimbursement of expenses after August 8, 2005 if: – prior to payment of expenditure, borrower declares intent to reimburse with proceeds of CREB – issuer adopts DOI not later than 60 days after expense – reimbursement occurs not later than 18 months after expenditure

Application Process • Applications for latest $400 million were due July 13, 2007 – Additional allocation would have new deadline • Application form included in IRS Notice 2007 -26 – Submitted by qualified issuer – Identifies qualified borrower – Detailed description of qualified project – Certification by independent engineer – Prior CREB allocations, if any – Location of project – Plan to obtain all federal, state and local approvals

New Legislation • H. R. 1424 (Passed by Senate 10/01/08 & House 10/03/08) – Extension to December 31, 2009 for issuance of CREBs – Creation of two new types of Tax Credit Bonds: • New Clean Renewable Energy Bonds • Qualified Energy Conservation Bonds

New Clean Renewable Energy Bonds “New CREBs” • Allocation by Secretary of the $800 M national New CREB limit • 1/3 of the allocation available to each of (i) Public Power Provider, (ii) Governmental Body and (iii) Cooperative Electric Company • 100% of proceeds used for capital expenditures for qualified project

New Clean Renewable Energy Bonds “New CREBs” • Designation of bond as New CREB • Qualified Issuers – same three as for CREBs with the addition of a Not-For-Profit Electric Utility • Qualified Projects are the same as for CREBs with the exception that New CREBs cannot finance a refined coal production facility • Annual credit for New CREBs is 70% of rate determined for tax credit bonds

Qualified Energy Conservation Bonds “QECBs” • Allocation by Secretary of the $800 M national QECB limit - allocations are in proportion to populations of States • Allocation available only to States and Large Local Governments (a municipality or county with a population of 100, 000 or more) • 100% of proceeds used for Qualified Conservation Purpose • QECB issued by State or local government

Qualified Energy Conservation Bonds “QECBs” • Designation of bond as QECB • Numerous Qualified Conservation Purposes • Annual credit for QECBs is 70% of rate determined for tax credit bonds • Allocation to Large Local Governments may be reallocated to State • Up to 30% of QECB may be used for private activity bonds

ee183cd64253ee7b8ca949c63cafddfb.ppt