0bbeb3c09e01291592e530d29662e729.ppt

- Количество слайдов: 27

Creating Viable Export Agriculture Through Integrated Finance: Experience with Agri-Export Zones u Presented By: Mukul Sarkar, Exim Bank u Mumbai, March 16, 2007

Presentation Structure u India’s Exim India agri exports potential and constraints. u Brief background of AEZ. u How AEZ helps in establishing a value chain. u Financing needs in AEZ and Integrated Finance. u Performance u. A of AEZs. word on Exim Bank. 2

India’s Agri Exports: Potential Exim India u The size of the global food trade is about USD 650 bn. u Value of India’s agri exports is about USD 10 bn i. e. less than 1. 50%. u India has one tenth of world’s arable land (size is more than China’s). u It has rich and diverse agro climatic zones with more than 50 major crops. u One fifth of world’s irrigated land. u 2 nd largest producer of fruits and vegetables. u 3 rd largest producer of agri commodities (largest in food grains). 3

Agri Exports – India’s Potential Exim India u No. 1 Producer of Tea, Mango, Banana, Cashew, Cauliflower, Okra, Pulses, Milk etc. u Largest producer, consumer and exporter of spices. u The country is a treasure house of medicinal aromatic plant species. u Exports are mainly confined to commodities. Tremendous scope for value addition. u In horticulture products, India has certain competitive advantages. u WTO regime provides great opportunity for exports. u Farmers can benefit from exports of high value products. 4

Agri Exports: What Constrains Us? u u u u Exim India Low productivity due to inappropriate cultivation practices and improper harvest methods. This affects international competitiveness. Inadequate infrastructure. Too many middlemen in the procurement chain. Lack of contract farming practices. Quality problems due to poor post-harvest management. Inadequacy of domestic quality standards. Not able to meet stringent SPS/Codex requirements of developed countries. No clear focus on exports due to vast domestic market with low quality standards. 5

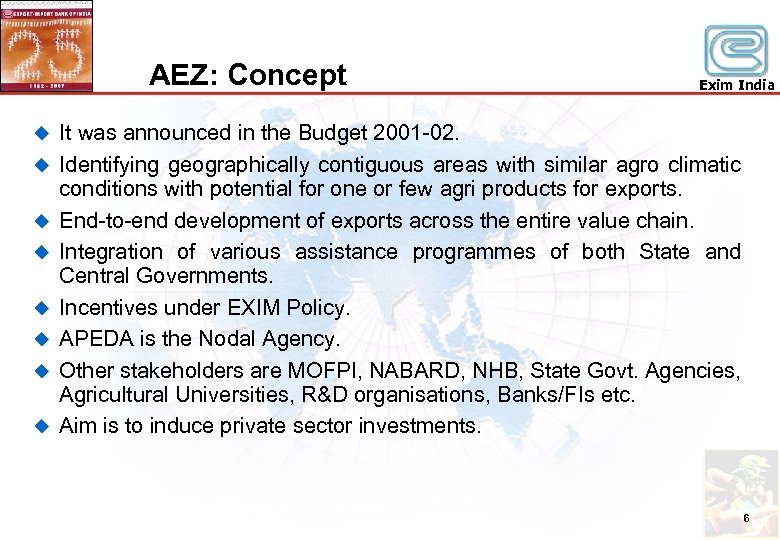

AEZ: Concept u u u u Exim India It was announced in the Budget 2001 -02. Identifying geographically contiguous areas with similar agro climatic conditions with potential for one or few agri products for exports. End-to-end development of exports across the entire value chain. Integration of various assistance programmes of both State and Central Governments. Incentives under EXIM Policy. APEDA is the Nodal Agency. Other stakeholders are MOFPI, NABARD, NHB, State Govt. Agencies, Agricultural Universities, R&D organisations, Banks/FIs etc. Aim is to induce private sector investments. 6

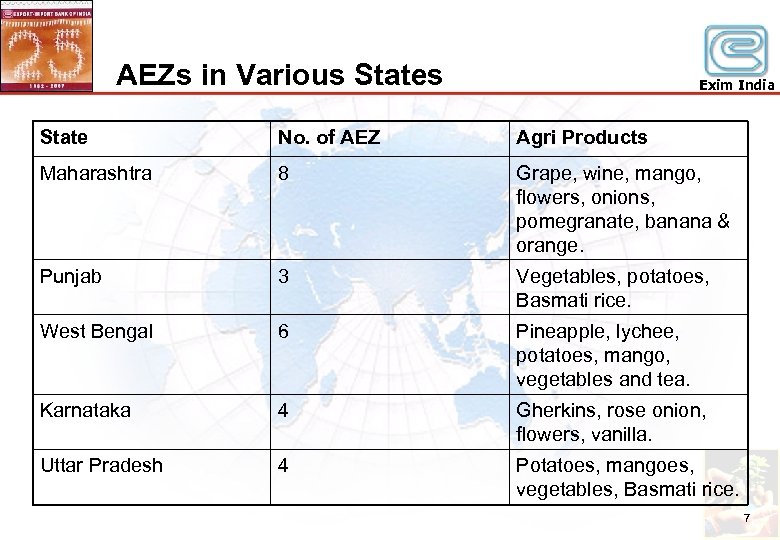

AEZs in Various States Exim India State No. of AEZ Agri Products Maharashtra 8 Grape, wine, mango, flowers, onions, pomegranate, banana & orange. Punjab 3 Vegetables, potatoes, Basmati rice. West Bengal 6 Pineapple, lychee, potatoes, mango, vegetables and tea. Karnataka 4 Gherkins, rose onion, flowers, vanilla. Uttar Pradesh 4 Potatoes, mangoes, vegetables, Basmati rice. 7

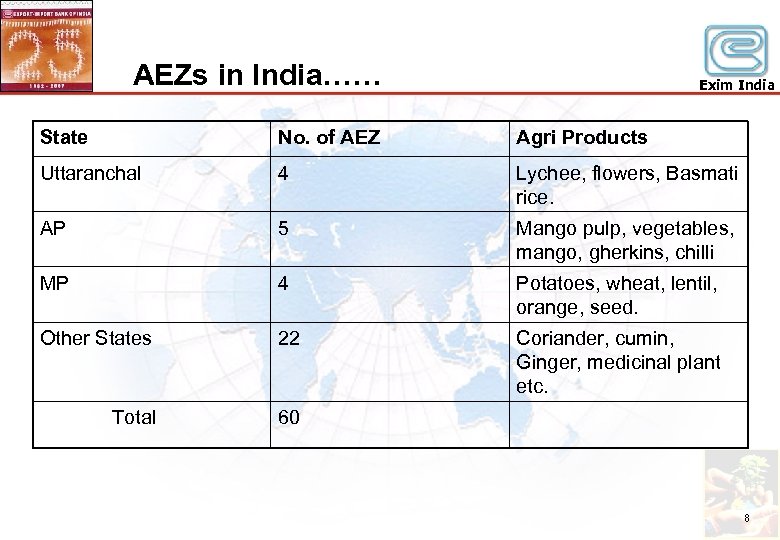

AEZs in India…… Exim India State No. of AEZ Agri Products Uttaranchal 4 Lychee, flowers, Basmati rice. AP 5 Mango pulp, vegetables, mango, gherkins, chilli MP 4 Potatoes, wheat, lentil, orange, seed. Other States 22 Coriander, cumin, Ginger, medicinal plant etc. Total 60 8

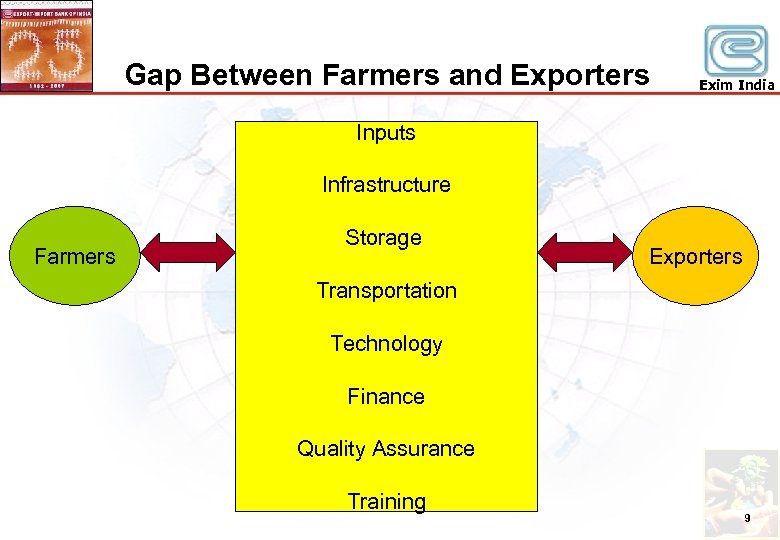

Gap Between Farmers and Exporters Exim India Inputs Infrastructure Farmers Storage Exporters Transportation Technology Finance Quality Assurance Training 9

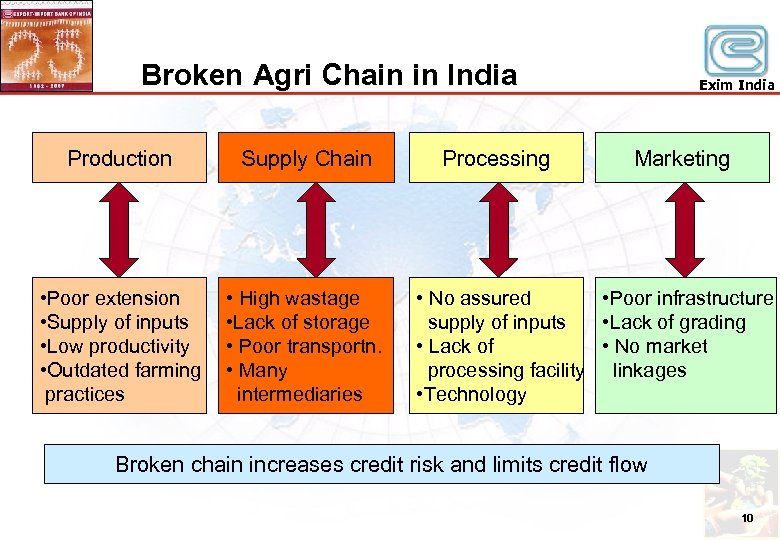

Broken Agri Chain in India Production Supply Chain • Poor extension • Supply of inputs • Low productivity • Outdated farming practices • High wastage • Lack of storage • Poor transportn. • Many intermediaries Processing Exim India Marketing • No assured • Poor infrastructure supply of inputs • Lack of grading • Lack of • No market processing facility linkages • Technology Broken chain increases credit risk and limits credit flow 10

What AEZ Offers to Improve Value Chain? u Training of farmers and strengthening of extension services. u Soil testing laboratories. u Supply of quality seeds/plants. u Setting up pack houses with sorting/ grading facilities. u Greenhouses u Pre-cooling units, cold storage. u Refrigerated vans u Irradiation units/ vapour and heat treatment units u Exim India Perishable cargo handling facilities at airports 11

What AEZ Offers to Improve Value Chain? u Waiver of electricity duties for processing units. u Transport subsidies. u Waiver of sales tax on packing materials. u International certifying agencies. u Encouraging private investments. u Exim India Promoting Contract Farming. 12

Financing Needs in AEZ Exim India u Farmers need finance for purchase of quality seeds, fertilizers, pesticides, harvesting equipment etc. u Service providers like cold storage, pack house, refrigerated vans, testing facilities need finance to create infrastructure. u Processors need finance to set up processing facilities and working capital. u Exporters will need trade finance for exports. 13

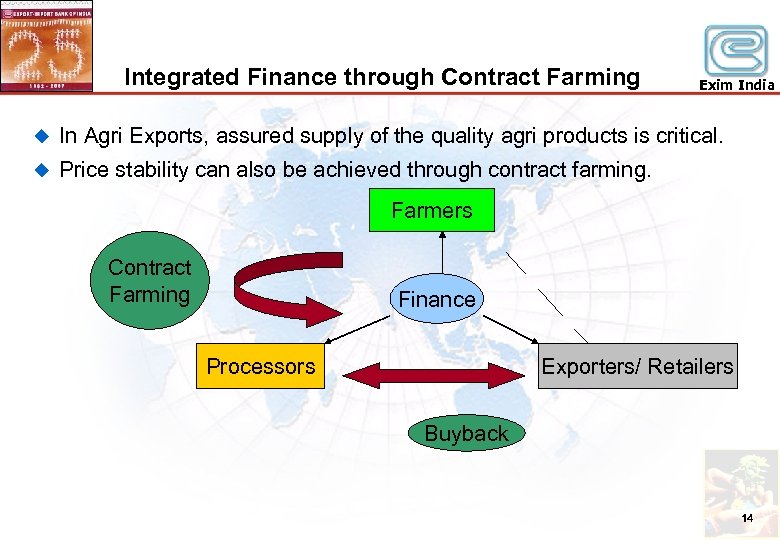

Integrated Finance through Contract Farming Exim India u In Agri Exports, assured supply of the quality agri products is critical. u Price stability can also be achieved through contract farming. Farmers Contract Farming Finance Processors Exporters/ Retailers Buyback 14

Advantages of Integrated Finance? u Risk to stakeholders is minimized. u Unknown risks to calculated risks. u Risks are shared among stakeholders. u Enhances credit flow to agri sector u Makes agriculture more sustainable. u Overall efficiency and productivity of the chain improves. u Reduction of losses and wastage. u Exim India Improves traceability and better control on quality. 15

PERFORMANCE OF AEZs u u u Exim India Total investments are about Rs. 810 crores in 60 AEZs. Exports of USD 1. 10 bn during the last 5 years. Both investments and exports are less than half of the originally projected levels. More needs to be done in the area of infrastructure. AEZs for gherkins, basmati rice, mango pulp, grape, walnuts, onions in different states have done well in terms of exports. Products with no ready local market have a better chance of success. 16

Exim Bank of India Exim India THE GENESIS q SET UP BY AN ACT OF PARLIAMENT IN SEPTEMBER 1981 q WHOLLY OWNED BY GOVERNMENT OF INDIA q COMMENCED OPERATIONS IN MARCH 1982 q APEX FINANCIAL INSTITUTION TO PROVIDE MEDIUM AND LONG TERM EXPORT FINANCE 17

Objectives Exim India Established “for providing financial assistance to exporters and importers, and for functioning as the principal financial institution for coordinating the working of institutions engaged in financing export and import of goods and services with a view to promoting the country’s international trade…” (Export-Import Bank of India Act, 1981) 18

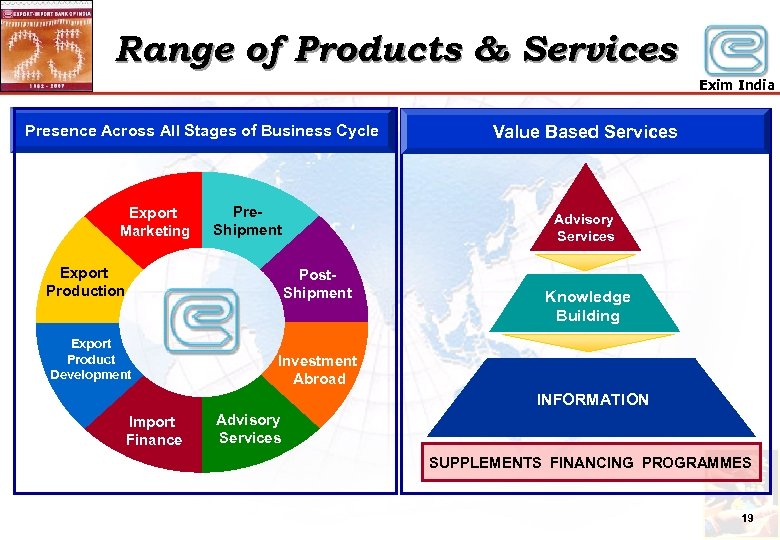

Range of Products & Services Exim India Presence Across All Stages of Business Cycle Export Marketing Pre. Shipment Export Production Advisory Services Post. Shipment Export Product Development Value Based Services Knowledge Building Investment Abroad INFORMATION Import Finance Advisory Services SUPPLEMENTS FINANCING PROGRAMMES 19

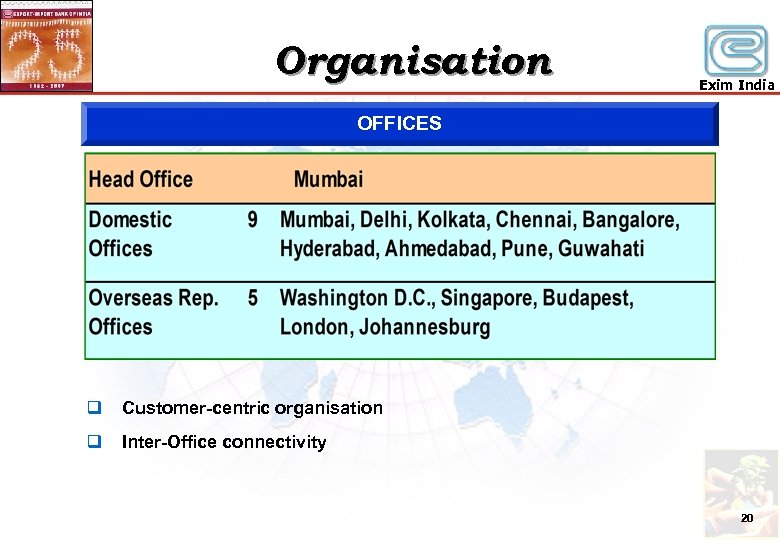

Organisation Exim India OFFICES q Customer-centric organisation q Inter-Office connectivity 20

Exim Bank’s Loan Products Exim India u Exim Bank finances only exporter or importer. u Term Loan for setting up new project, expansion, modernisation, import of machinery, technology. u Term loan for setting up JV/WOS abroad. u Financing overseas acquisition. u Pre-shipment/Post-shipment finance. u Working Capital Term Loan. u Buyer’s Credit. u Supplier’s Credit. u Equity investments in overseas ventures. u Factoring through Global Trade Finance 21

Exim Bank Lines of Credit ( ) LOCs Exim India A Catalyst for Trade Promotion q Enables import of Indian equipment and technology on deferred credit terms q Direct exposure on overseas borrowers q No recourse to Indian exporters q Exporters get payment on shipment q Particularly relevant for small and medium sectors q Extended to Overseas Governments, Government agencies overseas, National or regional development banks abroad, Commercial banks abroad q GOI Lines of Credit also extended through Exim Bank q More than 60 Operative LOCs amounting to approx. US$ 2 billion in over 60 countries in Asia, Africa, CIS and Latin America 22

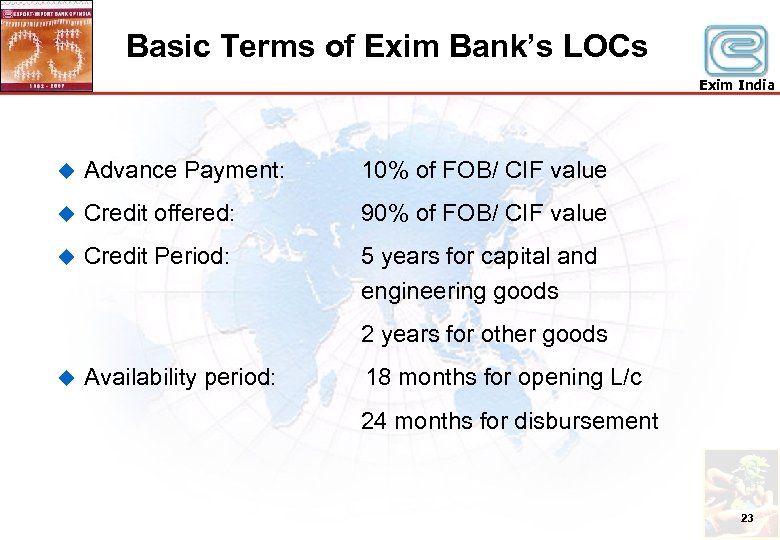

Basic Terms of Exim Bank’s LOCs Exim India u Advance Payment: 10% of FOB/ CIF value u Credit offered: 90% of FOB/ CIF value u Credit Period: 5 years for capital and engineering goods 2 years for other goods u Availability period: 18 months for opening L/c 24 months for disbursement 23

Benefits of LOCs Exim India Ø Developing countries who lack forex can buy Indian goods on credit. Ø Entry mechanism for new markets/development of new market. Ø Exporters receive cash payment for exports under LOC. Ø An arrangement for financing a number of export contracts under one umbrella. 24

Research Activities Exim India Occasional & Working Papers on Agri and Agro based sectors Floriculture Herbal medicinal plants Agro & Processed foods Fresh Fruits and Vegetables and Dairy Organic Products Biotechnology Vanilla 25

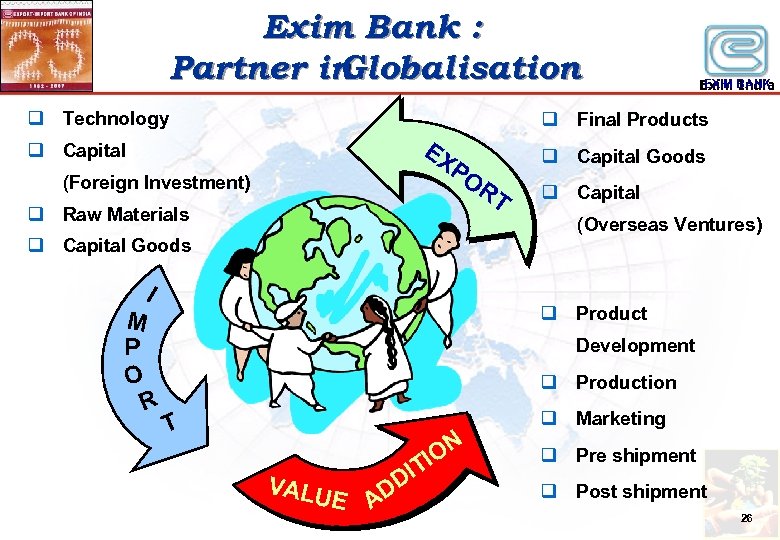

Exim Bank : Partner in Globalisation q Technology q Final Products EX q Capital Goods PO (Foreign Investment) RT q Raw Materials q Capital (Overseas Ventures) q Capital Goods I M P O R EXIM India Exim BANK q Product Development q Production q Marketing T VALU E AD ON I IT D q Pre shipment q Post shipment 26

EXIM BANK THANK YOU Visit us at www. eximbankindia. com www. eximbankagro. com

0bbeb3c09e01291592e530d29662e729.ppt