d2a43370e52aa6ab8fcc37ffd1fa52ea.ppt

- Количество слайдов: 9

Creating Superior Performance and Value for our Shareholders Peter Marriott Chief Financial Officer 18 July 2000

Creating Superior Performance and Value for our Shareholders Peter Marriott Chief Financial Officer 18 July 2000

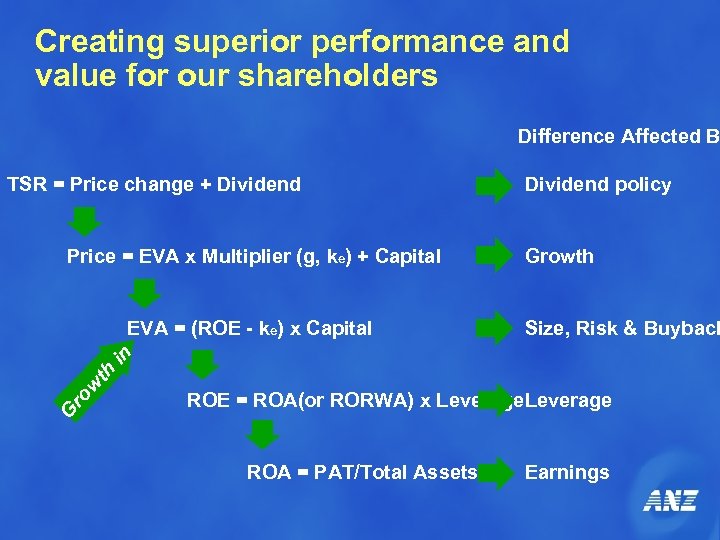

Creating superior performance and value for our shareholders Difference Affected B TSR = Price change + Dividend Price = EVA x Multiplier (g, ke) + Capital Growth Size, Risk & Buyback G ro w th in EVA = (ROE - ke) x Capital Dividend policy ROE = ROA(or RORWA) x Leverage ROA = PAT/Total Assets Earnings

Creating superior performance and value for our shareholders Difference Affected B TSR = Price change + Dividend Price = EVA x Multiplier (g, ke) + Capital Growth Size, Risk & Buyback G ro w th in EVA = (ROE - ke) x Capital Dividend policy ROE = ROA(or RORWA) x Leverage ROA = PAT/Total Assets Earnings

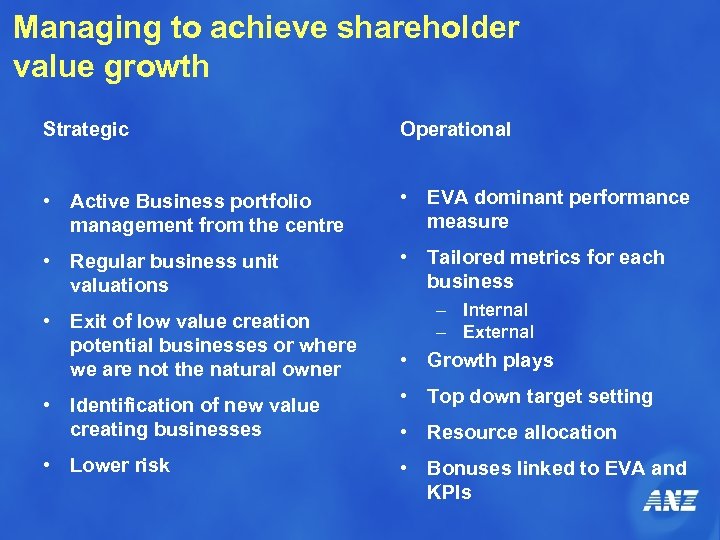

Managing to achieve shareholder value growth Strategic Operational • Active Business portfolio management from the centre • EVA dominant performance measure • Regular business unit valuations • Tailored metrics for each business • Exit of low value creation potential businesses or where we are not the natural owner – Internal – External • Growth plays • Identification of new value creating businesses • Top down target setting • Lower risk • Bonuses linked to EVA and KPIs • Resource allocation

Managing to achieve shareholder value growth Strategic Operational • Active Business portfolio management from the centre • EVA dominant performance measure • Regular business unit valuations • Tailored metrics for each business • Exit of low value creation potential businesses or where we are not the natural owner – Internal – External • Growth plays • Identification of new value creating businesses • Top down target setting • Lower risk • Bonuses linked to EVA and KPIs • Resource allocation

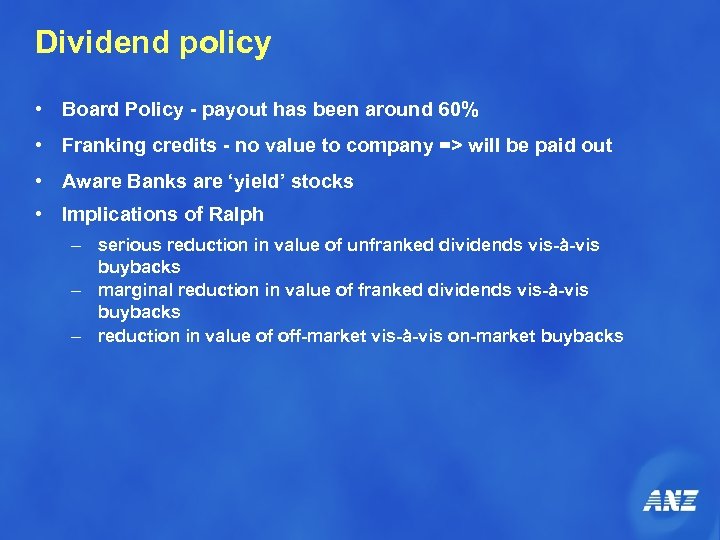

Dividend policy • Board Policy - payout has been around 60% • Franking credits - no value to company => will be paid out • Aware Banks are ‘yield’ stocks • Implications of Ralph – serious reduction in value of unfranked dividends vis-à-vis buybacks – marginal reduction in value of franked dividends vis-à-vis buybacks – reduction in value of off-market vis-à-vis on-market buybacks

Dividend policy • Board Policy - payout has been around 60% • Franking credits - no value to company => will be paid out • Aware Banks are ‘yield’ stocks • Implications of Ralph – serious reduction in value of unfranked dividends vis-à-vis buybacks – marginal reduction in value of franked dividends vis-à-vis buybacks – reduction in value of off-market vis-à-vis on-market buybacks

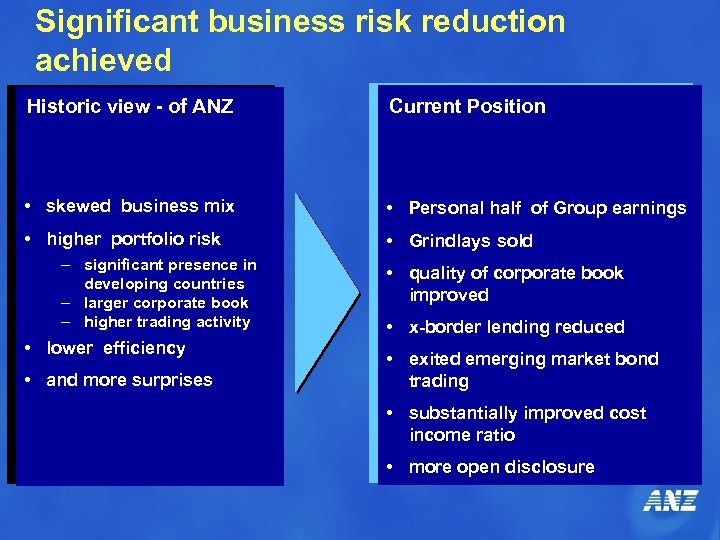

Significant business risk reduction achieved Historic view - of ANZ Current Position • skewed business mix • Personal half of Group earnings • higher portfolio risk • Grindlays sold – significant presence in developing countries – larger corporate book – higher trading activity • lower efficiency • and more surprises • quality of corporate book improved • x-border lending reduced • exited emerging market bond trading • substantially improved cost income ratio • more open disclosure

Significant business risk reduction achieved Historic view - of ANZ Current Position • skewed business mix • Personal half of Group earnings • higher portfolio risk • Grindlays sold – significant presence in developing countries – larger corporate book – higher trading activity • lower efficiency • and more surprises • quality of corporate book improved • x-border lending reduced • exited emerging market bond trading • substantially improved cost income ratio • more open disclosure

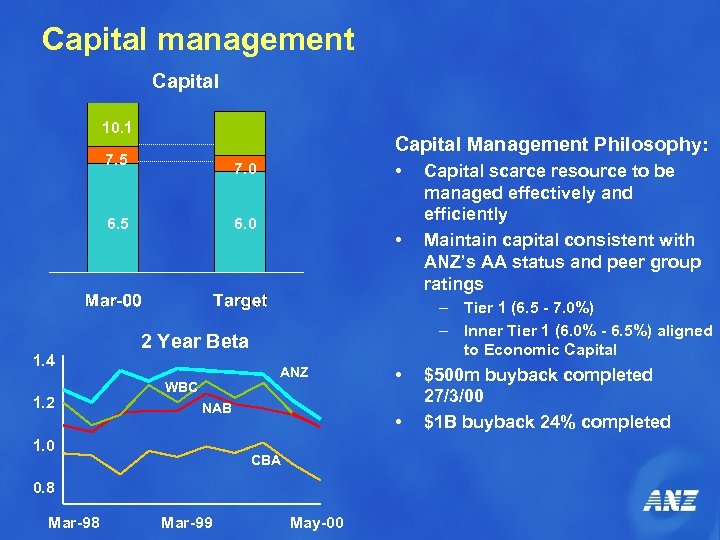

Capital management Capital 10. 1 Capital Management Philosophy: 7. 5 7. 0 6. 5 1. 4 1. 2 • 6. 0 • – Tier 1 (6. 5 - 7. 0%) – Inner Tier 1 (6. 0% - 6. 5%) aligned to Economic Capital 2 Year Beta ANZ WBC NAB 1. 0 CBA Mar-99 • • 0. 8 Mar-98 Capital scarce resource to be managed effectively and efficiently Maintain capital consistent with ANZ’s AA status and peer group ratings May-00 $500 m buyback completed 27/3/00 $1 B buyback 24% completed

Capital management Capital 10. 1 Capital Management Philosophy: 7. 5 7. 0 6. 5 1. 4 1. 2 • 6. 0 • – Tier 1 (6. 5 - 7. 0%) – Inner Tier 1 (6. 0% - 6. 5%) aligned to Economic Capital 2 Year Beta ANZ WBC NAB 1. 0 CBA Mar-99 • • 0. 8 Mar-98 Capital scarce resource to be managed effectively and efficiently Maintain capital consistent with ANZ’s AA status and peer group ratings May-00 $500 m buyback completed 27/3/00 $1 B buyback 24% completed

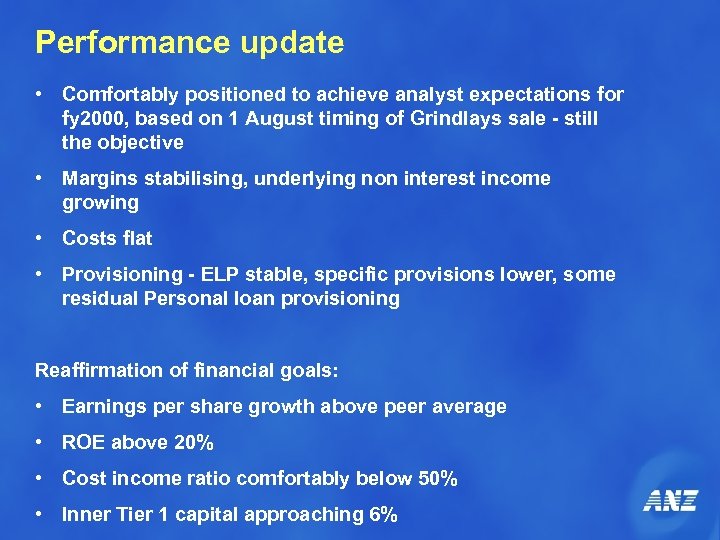

Performance update • Comfortably positioned to achieve analyst expectations for fy 2000, based on 1 August timing of Grindlays sale - still the objective • Margins stabilising, underlying non interest income growing • Costs flat • Provisioning - ELP stable, specific provisions lower, some residual Personal loan provisioning Reaffirmation of financial goals: • Earnings per share growth above peer average • ROE above 20% • Cost income ratio comfortably below 50% • Inner Tier 1 capital approaching 6%

Performance update • Comfortably positioned to achieve analyst expectations for fy 2000, based on 1 August timing of Grindlays sale - still the objective • Margins stabilising, underlying non interest income growing • Costs flat • Provisioning - ELP stable, specific provisions lower, some residual Personal loan provisioning Reaffirmation of financial goals: • Earnings per share growth above peer average • ROE above 20% • Cost income ratio comfortably below 50% • Inner Tier 1 capital approaching 6%

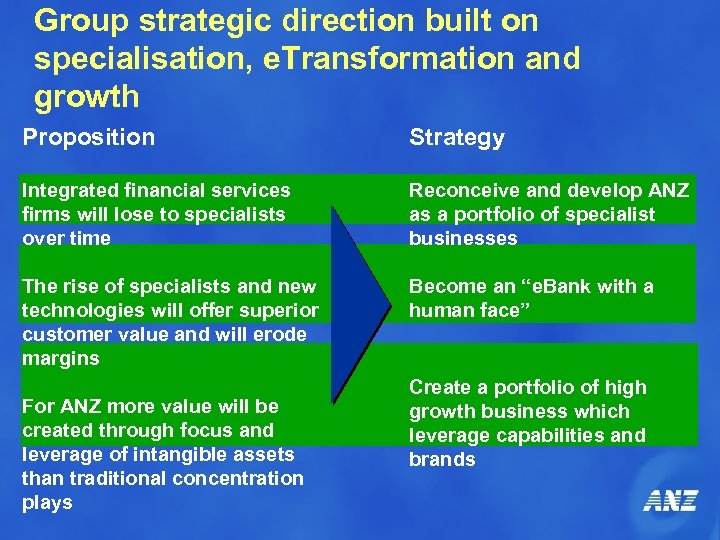

Group strategic direction built on specialisation, e. Transformation and growth Proposition Strategy Integrated financial services firms will lose to specialists over time Reconceive and develop ANZ as a portfolio of specialist businesses The rise of specialists and new technologies will offer superior customer value and will erode margins Become an “e. Bank with a human face” For ANZ more value will be created through focus and leverage of intangible assets than traditional concentration plays Create a portfolio of high growth business which leverage capabilities and brands

Group strategic direction built on specialisation, e. Transformation and growth Proposition Strategy Integrated financial services firms will lose to specialists over time Reconceive and develop ANZ as a portfolio of specialist businesses The rise of specialists and new technologies will offer superior customer value and will erode margins Become an “e. Bank with a human face” For ANZ more value will be created through focus and leverage of intangible assets than traditional concentration plays Create a portfolio of high growth business which leverage capabilities and brands

Copy of Presentation available on www. anz. com

Copy of Presentation available on www. anz. com