0521b750642e5db14f6090979a0db4a7.ppt

- Количество слайдов: 52

Creating Regional Wealth in the Innovation Economy American University – Kogod – Nov 2002 Jeff Saperstein and Daniel Rouach sapermktg@earthlink. net and drouach@escp-eap. net

Creating Regional Wealth in the Innovation Economy American University – Kogod – Nov 2002 Jeff Saperstein and Daniel Rouach sapermktg@earthlink. net and drouach@escp-eap. net

Creating Regional Wealth 3 Years of Research • Project teams in Regions : 12 teams • Bibliography : 150 key articles and 30 books • Face to face interviews as possible : 85 meetings with 115 persons in 15 countries • Format that enabled us to be consistent yet true to local flavor • Factors selected by region to highlight local dynamics yet eliminate redundancy • Emphasis on perspectives

Creating Regional Wealth 3 Years of Research • Project teams in Regions : 12 teams • Bibliography : 150 key articles and 30 books • Face to face interviews as possible : 85 meetings with 115 persons in 15 countries • Format that enabled us to be consistent yet true to local flavor • Factors selected by region to highlight local dynamics yet eliminate redundancy • Emphasis on perspectives

www. creatingregionalwealth. com Our Web Site

www. creatingregionalwealth. com Our Web Site

Part 1. Presentation 1. Introduction 2. Key Topics 3 Key Ingredients 4. Israel Wadi Valley 5. Grenoble & Sophia Antipolis

Part 1. Presentation 1. Introduction 2. Key Topics 3 Key Ingredients 4. Israel Wadi Valley 5. Grenoble & Sophia Antipolis

Part 2. Discussion Questions & Comments Kogod- Escp-Eap Cooperation Models Perspective Best practices

Part 2. Discussion Questions & Comments Kogod- Escp-Eap Cooperation Models Perspective Best practices

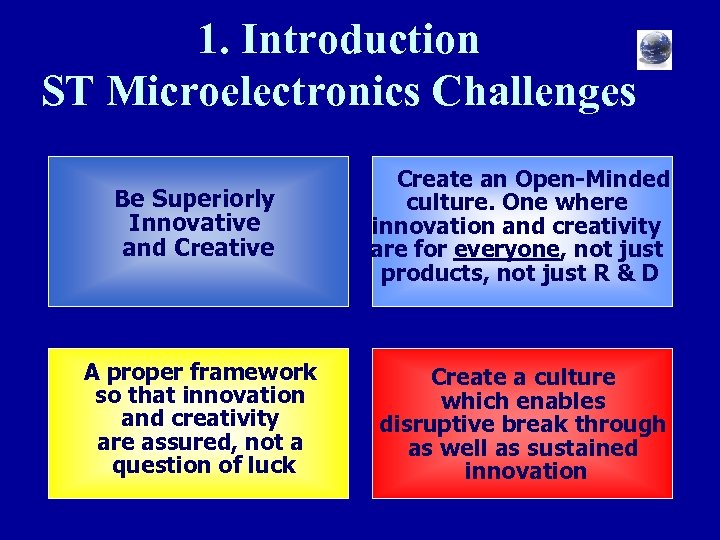

1. Introduction ST Microelectronics Challenges Be Superiorly Innovative and Creative Create an Open-Minded culture. One where innovation and creativity are for everyone, not just products, not just R & D A proper framework so that innovation and creativity are assured, not a question of luck Create a culture which enables disruptive break through as well as sustained innovation

1. Introduction ST Microelectronics Challenges Be Superiorly Innovative and Creative Create an Open-Minded culture. One where innovation and creativity are for everyone, not just products, not just R & D A proper framework so that innovation and creativity are assured, not a question of luck Create a culture which enables disruptive break through as well as sustained innovation

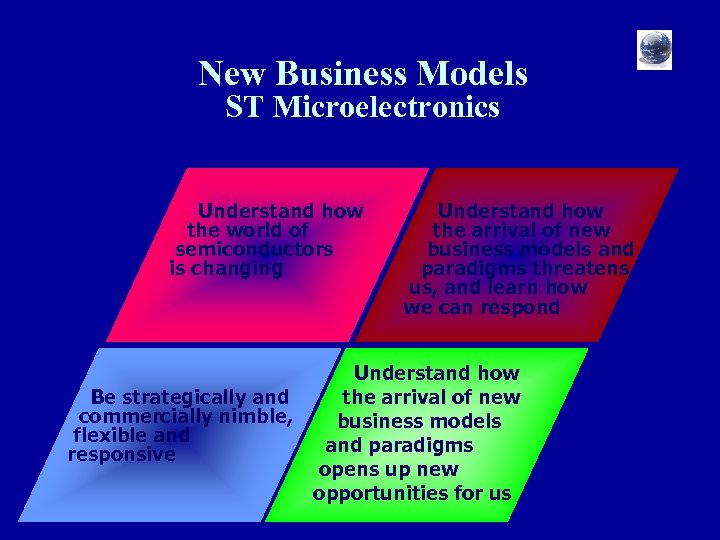

New Business Models ST Microelectronics Understand how the world of semiconductors is changing Understand how the arrival of new business models and paradigms threatens us, and learn how we can respond Understand how Be strategically and the arrival of new commercially nimble, business models flexible and paradigms responsive opens up new opportunities for us

New Business Models ST Microelectronics Understand how the world of semiconductors is changing Understand how the arrival of new business models and paradigms threatens us, and learn how we can respond Understand how Be strategically and the arrival of new commercially nimble, business models flexible and paradigms responsive opens up new opportunities for us

. Where is the RIGHT place to BE ? Intellectual Capital of Regions

. Where is the RIGHT place to BE ? Intellectual Capital of Regions

Clusters Michael Porter* “Clusters are a Driving Force in increasing exports and are Magnets for attracting Foreign Investment” Feb 2000 Economic development Quartely Vol 14 p. 15

Clusters Michael Porter* “Clusters are a Driving Force in increasing exports and are Magnets for attracting Foreign Investment” Feb 2000 Economic development Quartely Vol 14 p. 15

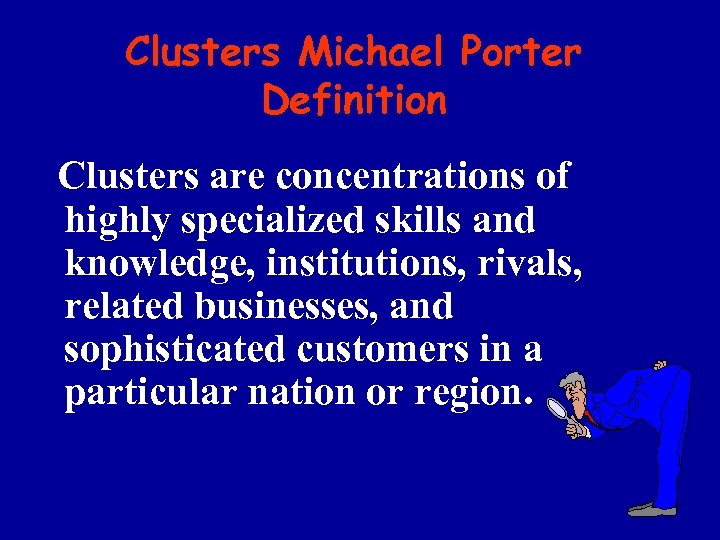

Clusters Michael Porter Definition Clusters are concentrations of highly specialized skills and knowledge, institutions, rivals, related businesses, and sophisticated customers in a particular nation or region.

Clusters Michael Porter Definition Clusters are concentrations of highly specialized skills and knowledge, institutions, rivals, related businesses, and sophisticated customers in a particular nation or region.

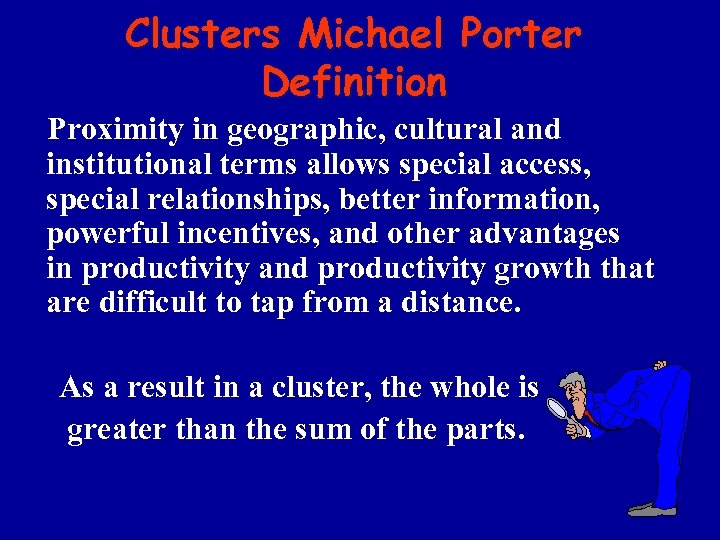

Clusters Michael Porter Definition Proximity in geographic, cultural and institutional terms allows special access, special relationships, better information, powerful incentives, and other advantages in productivity and productivity growth that are difficult to tap from a distance. As a result in a cluster, the whole is greater than the sum of the parts.

Clusters Michael Porter Definition Proximity in geographic, cultural and institutional terms allows special access, special relationships, better information, powerful incentives, and other advantages in productivity and productivity growth that are difficult to tap from a distance. As a result in a cluster, the whole is greater than the sum of the parts.

Were is the Right Place to be ? Silicon Valley or Death Valley ? • • • Baby Cluster : Atlas valley Babel Cluster : Sophia Antipolis Island Cluster : Wadi Valley (Israël) Magnet Cluster : Silicon Valley Network Cluster : Bengalore

Were is the Right Place to be ? Silicon Valley or Death Valley ? • • • Baby Cluster : Atlas valley Babel Cluster : Sophia Antipolis Island Cluster : Wadi Valley (Israël) Magnet Cluster : Silicon Valley Network Cluster : Bengalore

2. Creating Regional Wealth Key Topics • Principles and Practices enabling Regions to adapt to Innovation Economy • How can Regions Plug into Innovation Economy with their own particular Strengths ? • How can Foreign Investment be attracted and businesses plug into successful regions ?

2. Creating Regional Wealth Key Topics • Principles and Practices enabling Regions to adapt to Innovation Economy • How can Regions Plug into Innovation Economy with their own particular Strengths ? • How can Foreign Investment be attracted and businesses plug into successful regions ?

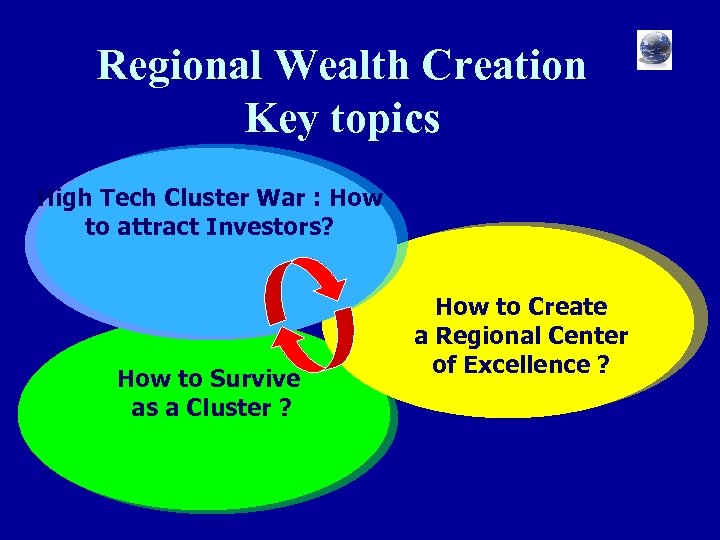

Regional Wealth Creation Key topics High Tech Cluster War : How to attract Investors? How to Survive as a Cluster ? How to Create a Regional Center of Excellence ?

Regional Wealth Creation Key topics High Tech Cluster War : How to attract Investors? How to Survive as a Cluster ? How to Create a Regional Center of Excellence ?

Regions Selected Gold Medalists and Others Silicon Valley Ireland Munich Cambridge Models Perspective Best practices Sophia Antipolis Taiwan Israël India

Regions Selected Gold Medalists and Others Silicon Valley Ireland Munich Cambridge Models Perspective Best practices Sophia Antipolis Taiwan Israël India

3. Creating or Destroying Value ? Key Ingredients For Success • #1 • #2 • #3 • #4 • #5 Cross Fertilisation Coopetition Pollinisation Innovation Incubation

3. Creating or Destroying Value ? Key Ingredients For Success • #1 • #2 • #3 • #4 • #5 Cross Fertilisation Coopetition Pollinisation Innovation Incubation

Creating Regional Value Key Ingredients for Success # 6. A Champion - Networker # 7. “Magic Atmosphere” # 8. No NIH “Not Invented Here” # 9. Knowledge Transfer # 10. Diasporas Culture

Creating Regional Value Key Ingredients for Success # 6. A Champion - Networker # 7. “Magic Atmosphere” # 8. No NIH “Not Invented Here” # 9. Knowledge Transfer # 10. Diasporas Culture

Key Ingredients # 11. Education Investment • Priority for Governments Major Universities Regional Technical Colleges Research Institutions Technology Parks

Key Ingredients # 11. Education Investment • Priority for Governments Major Universities Regional Technical Colleges Research Institutions Technology Parks

# 12. Convergence of Societal Institutions • Working Together for a Region to Succeed Government at all levels NGO’s and educational institutions Industry and labor Venture Capital and Markets Permeable collaboration has huge implications for individual career choices

# 12. Convergence of Societal Institutions • Working Together for a Region to Succeed Government at all levels NGO’s and educational institutions Industry and labor Venture Capital and Markets Permeable collaboration has huge implications for individual career choices

#13. Risk and Chutzpah ! • Entrepreneurial risk must be rewarded and encouraged for individuals Stock options and Open Capital Markets Environment that does not penalize failure

#13. Risk and Chutzpah ! • Entrepreneurial risk must be rewarded and encouraged for individuals Stock options and Open Capital Markets Environment that does not penalize failure

# 14. Branding & Distinctive Competencies • Successful Regions have staked out important distinctive competencies Leverage Regional Strengths Do not replicate Silicon Valley

# 14. Branding & Distinctive Competencies • Successful Regions have staked out important distinctive competencies Leverage Regional Strengths Do not replicate Silicon Valley

#15. Flexibilty & Regional Evolution • There is an evolution to regional success and working up the value chain Low-cost manufacturing and service centers evolve to high end sophisticated regions Regional integration between high end and low end is encouraging (Taiwan--China) Transnational diasporas are great catalysts for regional development

#15. Flexibilty & Regional Evolution • There is an evolution to regional success and working up the value chain Low-cost manufacturing and service centers evolve to high end sophisticated regions Regional integration between high end and low end is encouraging (Taiwan--China) Transnational diasporas are great catalysts for regional development

For much of the world, poverty, ignorance, and societal dysfunction has led many to despair, anger and fanaticism as the only way to attain human dignity. Perhaps the promise of Creating Regional Wealth in the Innovation Economy will provide another way for the benefit of all.

For much of the world, poverty, ignorance, and societal dysfunction has led many to despair, anger and fanaticism as the only way to attain human dignity. Perhaps the promise of Creating Regional Wealth in the Innovation Economy will provide another way for the benefit of all.

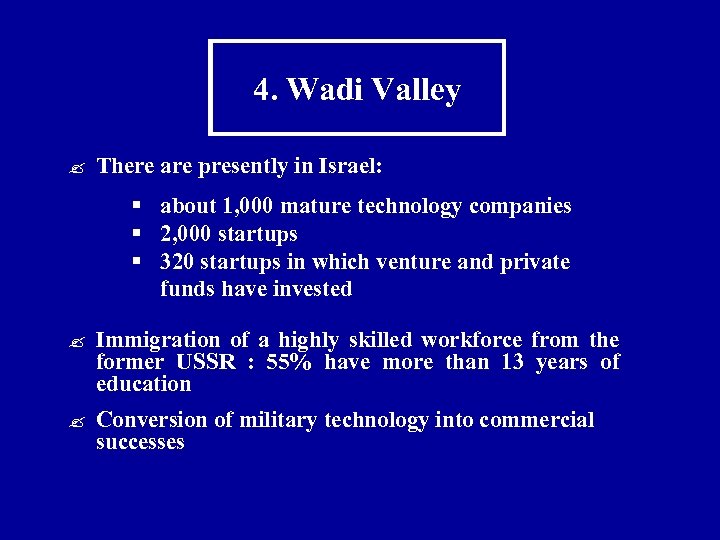

4. Wadi Valley ? There are presently in Israel: § about 1, 000 mature technology companies § 2, 000 startups § 320 startups in which venture and private funds have invested ? Immigration of a highly skilled workforce from the former USSR : 55% have more than 13 years of education ? Conversion of military technology into commercial successes

4. Wadi Valley ? There are presently in Israel: § about 1, 000 mature technology companies § 2, 000 startups § 320 startups in which venture and private funds have invested ? Immigration of a highly skilled workforce from the former USSR : 55% have more than 13 years of education ? Conversion of military technology into commercial successes

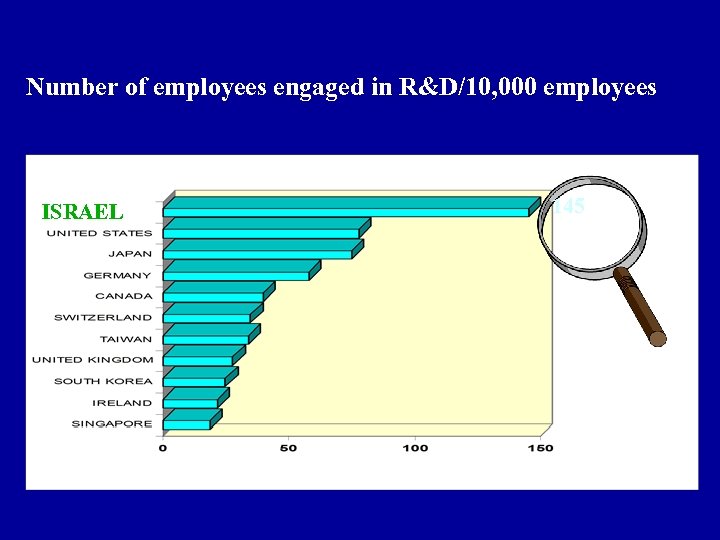

Number of employees engaged in R&D/10, 000 employees ISRAEL 145

Number of employees engaged in R&D/10, 000 employees ISRAEL 145

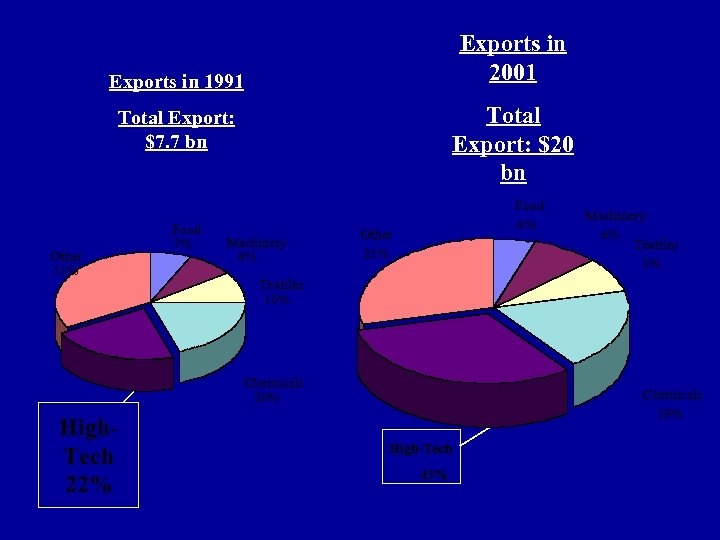

Exports in 2001 Exports in 1991 Total Export: $20 bn Total Export: $7. 7 bn Other 33% Food 7% Machinery 8% Food 4% Other 23% Textiles 10% Chemicals 20% High. Tech 22% Machinery 6% Textiles 5% Chemicals 19% High-Tech 43%

Exports in 2001 Exports in 1991 Total Export: $20 bn Total Export: $7. 7 bn Other 33% Food 7% Machinery 8% Food 4% Other 23% Textiles 10% Chemicals 20% High. Tech 22% Machinery 6% Textiles 5% Chemicals 19% High-Tech 43%

Israeli-based VCs and Startups § From 3 VC funds in 1993 to more than 100 funds (2002) § Over $5 billion invested in technology companies last 5 years

Israeli-based VCs and Startups § From 3 VC funds in 1993 to more than 100 funds (2002) § Over $5 billion invested in technology companies last 5 years

Interest from Multinational Players Multinational presence in Israel Through R&D and production facilities : m Intel, Microsoft (their only R&D center outside USA), IBM, Motorola, DEC(COMPAQ), Analog Devices, Rockwell, EMC, 3 M. ADC Telecom, AOL, BAAN, BMC, Broadcom, Cisco, Compaq, Conexant, Fujitsu, GE Medical, Intel, Johnson & Johnson, etc. Through investment in Israeli companies : m Daimler-Benz, Siemens, America On-line, US Robotics, Applied Material, Sumitomo, Boston Scientific, 3 COM, J&J, Terayon, Marconi, Motorola, Nortel Networks etc.

Interest from Multinational Players Multinational presence in Israel Through R&D and production facilities : m Intel, Microsoft (their only R&D center outside USA), IBM, Motorola, DEC(COMPAQ), Analog Devices, Rockwell, EMC, 3 M. ADC Telecom, AOL, BAAN, BMC, Broadcom, Cisco, Compaq, Conexant, Fujitsu, GE Medical, Intel, Johnson & Johnson, etc. Through investment in Israeli companies : m Daimler-Benz, Siemens, America On-line, US Robotics, Applied Material, Sumitomo, Boston Scientific, 3 COM, J&J, Terayon, Marconi, Motorola, Nortel Networks etc.

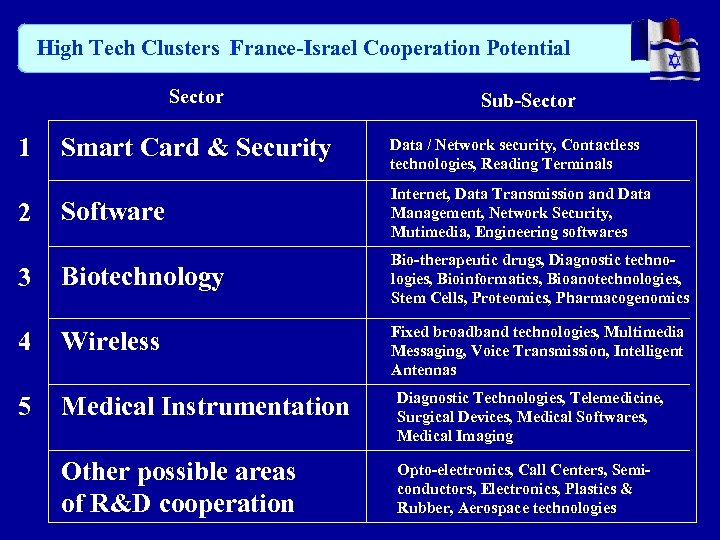

High Tech Clusters France-Israel Cooperation Potential Sector Sub-Sector Smart Card & Security Data / Network security, Contactless technologies, Reading Terminals Software Internet, Data Transmission and Data Management, Network Security, Mutimedia, Engineering softwares 3 Biotechnology Bio-therapeutic drugs, Diagnostic technologies, Bioinformatics, Bioanotechnologies, Stem Cells, Proteomics, Pharmacogenomics 4 Wireless 5 Medical Instrumentation Diagnostic Technologies, Telemedicine, Surgical Devices, Medical Softwares, Medical Imaging Other possible areas of R&D cooperation Opto-electronics, Call Centers, Semiconductors, Electronics, Plastics & Rubber, Aerospace technologies 1 2 Fixed broadband technologies, Multimedia Messaging, Voice Transmission, Intelligent Antennas

High Tech Clusters France-Israel Cooperation Potential Sector Sub-Sector Smart Card & Security Data / Network security, Contactless technologies, Reading Terminals Software Internet, Data Transmission and Data Management, Network Security, Mutimedia, Engineering softwares 3 Biotechnology Bio-therapeutic drugs, Diagnostic technologies, Bioinformatics, Bioanotechnologies, Stem Cells, Proteomics, Pharmacogenomics 4 Wireless 5 Medical Instrumentation Diagnostic Technologies, Telemedicine, Surgical Devices, Medical Softwares, Medical Imaging Other possible areas of R&D cooperation Opto-electronics, Call Centers, Semiconductors, Electronics, Plastics & Rubber, Aerospace technologies 1 2 Fixed broadband technologies, Multimedia Messaging, Voice Transmission, Intelligent Antennas

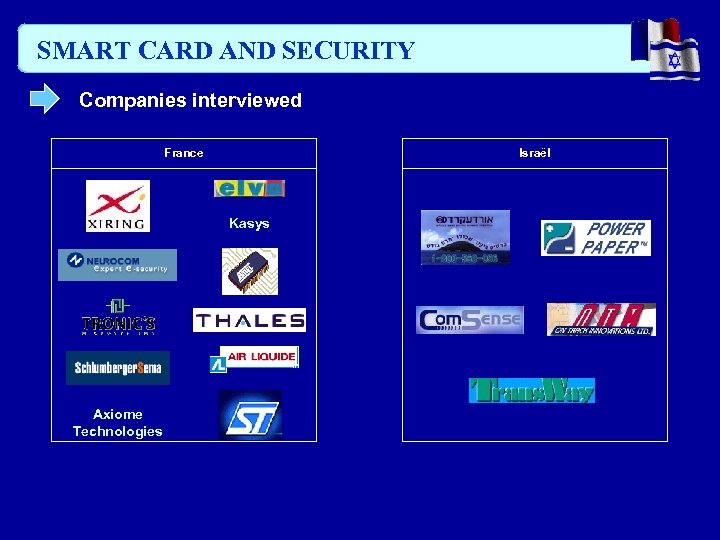

SMART CARD AND SECURITY Companies interviewed France Israël Kasys Axiome Technologies

SMART CARD AND SECURITY Companies interviewed France Israël Kasys Axiome Technologies

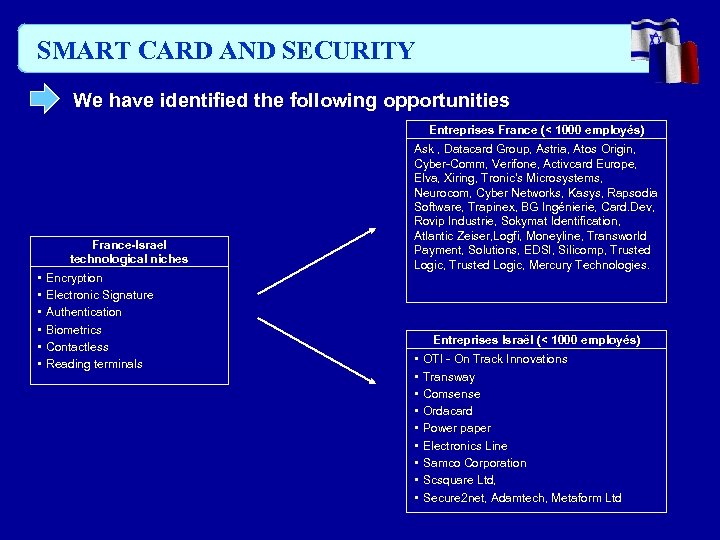

SMART CARD AND SECURITY We have identified the following opportunities Entreprises France (< 1000 employés) France-Israel technological niches • • • Encryption Electronic Signature Authentication Biometrics Contactless Reading terminals Ask , Datacard Group, Astria, Atos Origin, Cyber-Comm, Verifone, Activcard Europe, Elva, Xiring, Tronic’s Microsystems, Neurocom, Cyber Networks, Kasys, Rapsodia Software, Trapinex, BG Ingénierie, Card. Dev, Rovip Industrie, Sokymat Identification, Atlantic Zeiser, Logfi, Moneyline, Transworld Payment, Solutions, EDSI, Silicomp, Trusted Logic, Mercury Technologies. Entreprises Israël (< 1000 employés) • • • OTI - On Track Innovations Transway Comsense Ordacard Power paper Electronics Line Samco Corporation Scsquare Ltd, Secure 2 net, Adamtech, Metaform Ltd

SMART CARD AND SECURITY We have identified the following opportunities Entreprises France (< 1000 employés) France-Israel technological niches • • • Encryption Electronic Signature Authentication Biometrics Contactless Reading terminals Ask , Datacard Group, Astria, Atos Origin, Cyber-Comm, Verifone, Activcard Europe, Elva, Xiring, Tronic’s Microsystems, Neurocom, Cyber Networks, Kasys, Rapsodia Software, Trapinex, BG Ingénierie, Card. Dev, Rovip Industrie, Sokymat Identification, Atlantic Zeiser, Logfi, Moneyline, Transworld Payment, Solutions, EDSI, Silicomp, Trusted Logic, Mercury Technologies. Entreprises Israël (< 1000 employés) • • • OTI - On Track Innovations Transway Comsense Ordacard Power paper Electronics Line Samco Corporation Scsquare Ltd, Secure 2 net, Adamtech, Metaform Ltd

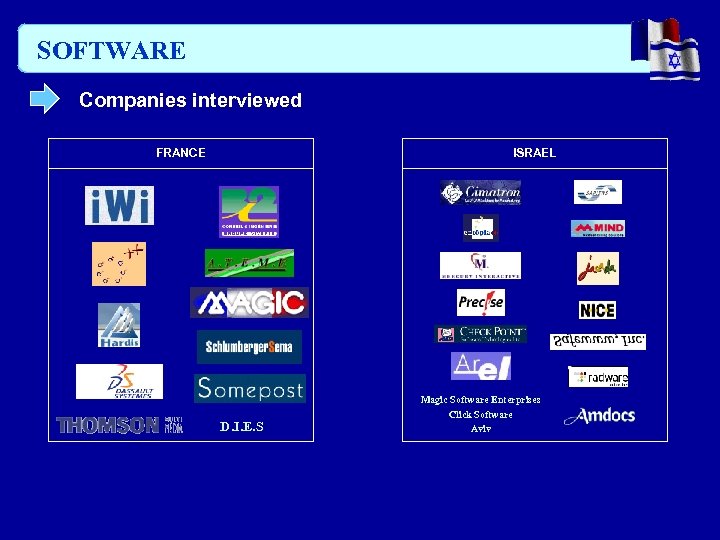

SOFTWARE Companies interviewed FRANCE ISRAEL D. I. E. S Magic Software Enterprises Click Software Aviv

SOFTWARE Companies interviewed FRANCE ISRAEL D. I. E. S Magic Software Enterprises Click Software Aviv

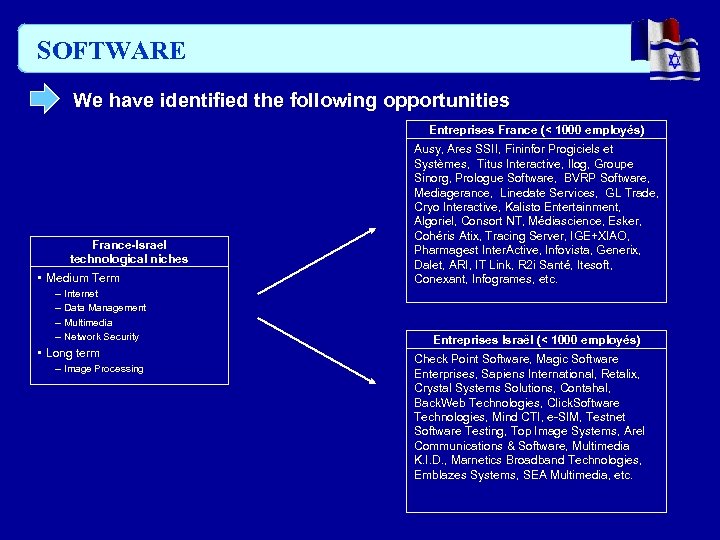

SOFTWARE We have identified the following opportunities Entreprises France (< 1000 employés) France-Israel technological niches • Medium Term – Internet – Data Management – Multimedia – Network Security • Long term – Image Processing Ausy, Ares SSII, Fininfor Progiciels et Systèmes, Titus Interactive, Ilog, Groupe Sinorg, Prologue Software, BVRP Software, Mediagerance, Linedate Services, GL Trade, Cryo Interactive, Kalisto Entertainment, Algoriel, Consort NT, Médiascience, Esker, Cohéris Atix, Tracing Server, IGE+XIAO, Pharmagest Inter. Active, Infovista, Generix, Dalet, ARI, IT Link, R 2 i Santé, Itesoft, Conexant, Infogrames, etc. Entreprises Israël (< 1000 employés) Check Point Software, Magic Software Enterprises, Sapiens International, Retalix, Crystal Systems Solutions, Contahal, Back. Web Technologies, Click. Software Technologies, Mind CTI, e-SIM, Testnet Software Testing, Top Image Systems, Arel Communications & Software, Multimedia K. I. D. , Marnetics Broadband Technologies, Emblazes Systems, SEA Multimedia, etc.

SOFTWARE We have identified the following opportunities Entreprises France (< 1000 employés) France-Israel technological niches • Medium Term – Internet – Data Management – Multimedia – Network Security • Long term – Image Processing Ausy, Ares SSII, Fininfor Progiciels et Systèmes, Titus Interactive, Ilog, Groupe Sinorg, Prologue Software, BVRP Software, Mediagerance, Linedate Services, GL Trade, Cryo Interactive, Kalisto Entertainment, Algoriel, Consort NT, Médiascience, Esker, Cohéris Atix, Tracing Server, IGE+XIAO, Pharmagest Inter. Active, Infovista, Generix, Dalet, ARI, IT Link, R 2 i Santé, Itesoft, Conexant, Infogrames, etc. Entreprises Israël (< 1000 employés) Check Point Software, Magic Software Enterprises, Sapiens International, Retalix, Crystal Systems Solutions, Contahal, Back. Web Technologies, Click. Software Technologies, Mind CTI, e-SIM, Testnet Software Testing, Top Image Systems, Arel Communications & Software, Multimedia K. I. D. , Marnetics Broadband Technologies, Emblazes Systems, SEA Multimedia, etc.

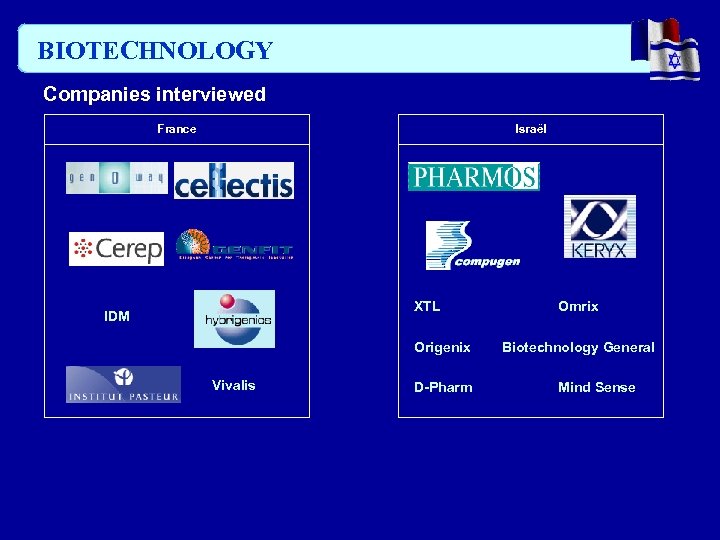

BIOTECHNOLOGY Companies interviewed France Israël XTL IDM Origenix Vivalis D-Pharm Omrix Biotechnology General Mind Sense

BIOTECHNOLOGY Companies interviewed France Israël XTL IDM Origenix Vivalis D-Pharm Omrix Biotechnology General Mind Sense

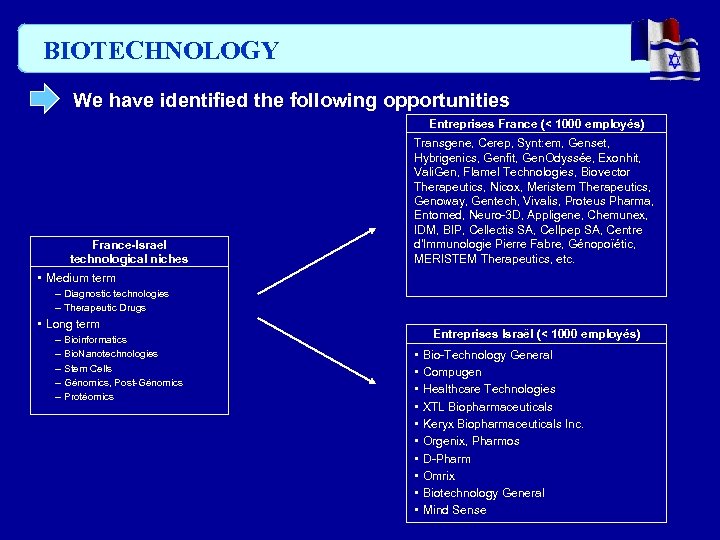

BIOTECHNOLOGY We have identified the following opportunities Entreprises France (< 1000 employés) France-Israel technological niches Transgene, Cerep, Synt: em, Genset, Hybrigenics, Genfit, Gen. Odyssée, Exonhit, Vali. Gen, Flamel Technologies, Biovector Therapeutics, Nicox, Meristem Therapeutics, Genoway, Gentech, Vivalis, Proteus Pharma, Entomed, Neuro-3 D, Appligene, Chemunex, IDM, BIP, Cellectis SA, Cellpep SA, Centre d'Immunologie Pierre Fabre, Génopoïétic, MERISTEM Therapeutics, etc. • Medium term – Diagnostic technologies – Therapeutic Drugs • Long term – Bioinformatics – Bio. Nanotechnologies – Stem Cells – Génomics, Post-Génomics – Protéomics Entreprises Israël (< 1000 employés) • • • Bio-Technology General Compugen Healthcare Technologies XTL Biopharmaceuticals Keryx Biopharmaceuticals Inc. Orgenix, Pharmos D-Pharm Omrix Biotechnology General Mind Sense

BIOTECHNOLOGY We have identified the following opportunities Entreprises France (< 1000 employés) France-Israel technological niches Transgene, Cerep, Synt: em, Genset, Hybrigenics, Genfit, Gen. Odyssée, Exonhit, Vali. Gen, Flamel Technologies, Biovector Therapeutics, Nicox, Meristem Therapeutics, Genoway, Gentech, Vivalis, Proteus Pharma, Entomed, Neuro-3 D, Appligene, Chemunex, IDM, BIP, Cellectis SA, Cellpep SA, Centre d'Immunologie Pierre Fabre, Génopoïétic, MERISTEM Therapeutics, etc. • Medium term – Diagnostic technologies – Therapeutic Drugs • Long term – Bioinformatics – Bio. Nanotechnologies – Stem Cells – Génomics, Post-Génomics – Protéomics Entreprises Israël (< 1000 employés) • • • Bio-Technology General Compugen Healthcare Technologies XTL Biopharmaceuticals Keryx Biopharmaceuticals Inc. Orgenix, Pharmos D-Pharm Omrix Biotechnology General Mind Sense

Biotechnology In this field, cooperation is vital. Companies have to cooperate with each other, with research institutions and with universities. They also have to cooperate with pharma companies. The time available for a biotech company to achieve critical mass is continually shortening and the definition of critical mass is continually increasing. Biotech companies need to run faster and jump higher than ever before.

Biotechnology In this field, cooperation is vital. Companies have to cooperate with each other, with research institutions and with universities. They also have to cooperate with pharma companies. The time available for a biotech company to achieve critical mass is continually shortening and the definition of critical mass is continually increasing. Biotech companies need to run faster and jump higher than ever before.

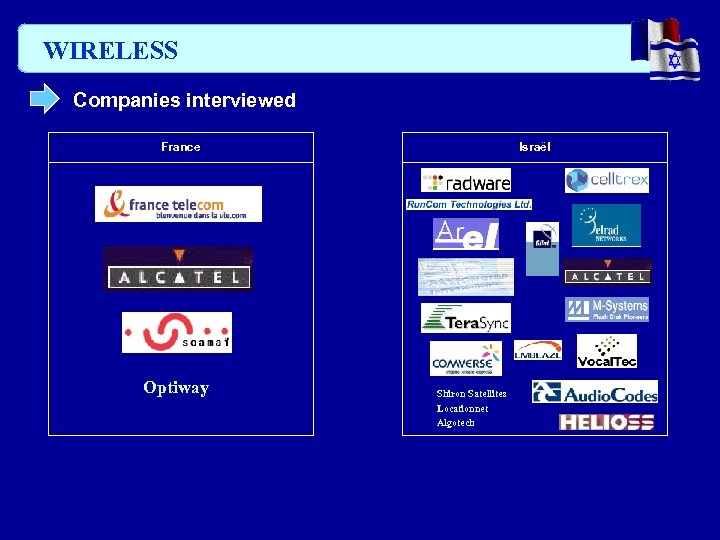

WIRELESS Companies interviewed France Optiway Israël Shiron Satellites Locationnet Algotech

WIRELESS Companies interviewed France Optiway Israël Shiron Satellites Locationnet Algotech

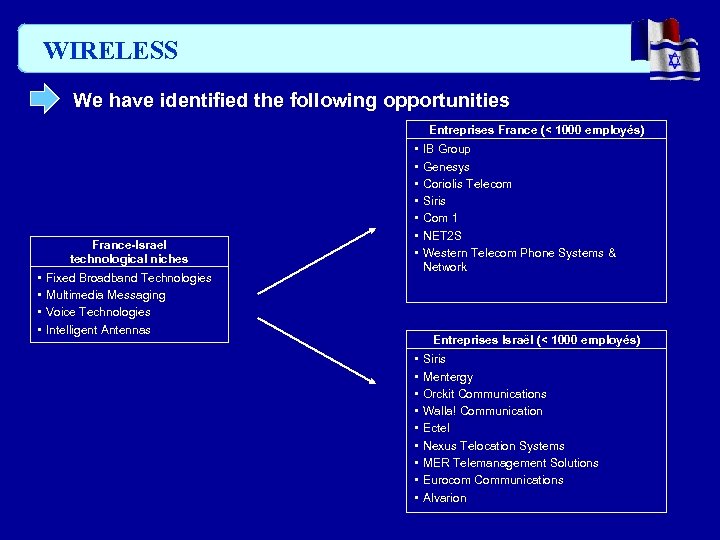

WIRELESS We have identified the following opportunities Entreprises France (< 1000 employés) France-Israel technological niches • • • Fixed Broadband Technologies Multimedia Messaging Voice Technologies Intelligent Antennas IB Group Genesys Coriolis Telecom Siris Com 1 NET 2 S Western Telecom Phone Systems & Network Entreprises Israël (< 1000 employés) • • • Siris Mentergy Orckit Communications Walla! Communication Ectel Nexus Telocation Systems MER Telemanagement Solutions Eurocom Communications Alvarion

WIRELESS We have identified the following opportunities Entreprises France (< 1000 employés) France-Israel technological niches • • • Fixed Broadband Technologies Multimedia Messaging Voice Technologies Intelligent Antennas IB Group Genesys Coriolis Telecom Siris Com 1 NET 2 S Western Telecom Phone Systems & Network Entreprises Israël (< 1000 employés) • • • Siris Mentergy Orckit Communications Walla! Communication Ectel Nexus Telocation Systems MER Telemanagement Solutions Eurocom Communications Alvarion

MEDICAL INSTRUMENTATION Companies interviewed France Laboratoire Aguettant Israël

MEDICAL INSTRUMENTATION Companies interviewed France Laboratoire Aguettant Israël

5. Grenoble • A high-tech hub: Digital, IT, micro&nanotechnologies • Mission: No 1 in Europe for micro&nanotechnologies • Influence by local environment and tradition • Entrepreneurial spirit: spin-offs, self-sufficiency Sophia Antipolis • Telecom Valley brand • « California in Europe » • R&D, inter-disciplinarity, cross-fertilization

5. Grenoble • A high-tech hub: Digital, IT, micro&nanotechnologies • Mission: No 1 in Europe for micro&nanotechnologies • Influence by local environment and tradition • Entrepreneurial spirit: spin-offs, self-sufficiency Sophia Antipolis • Telecom Valley brand • « California in Europe » • R&D, inter-disciplinarity, cross-fertilization

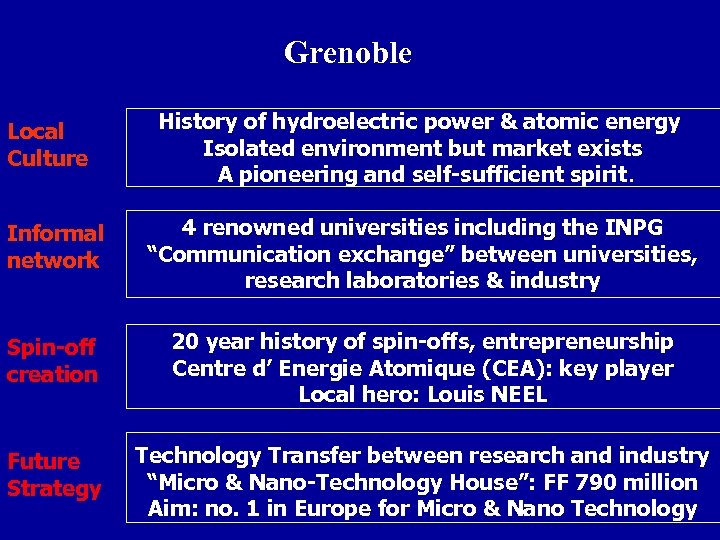

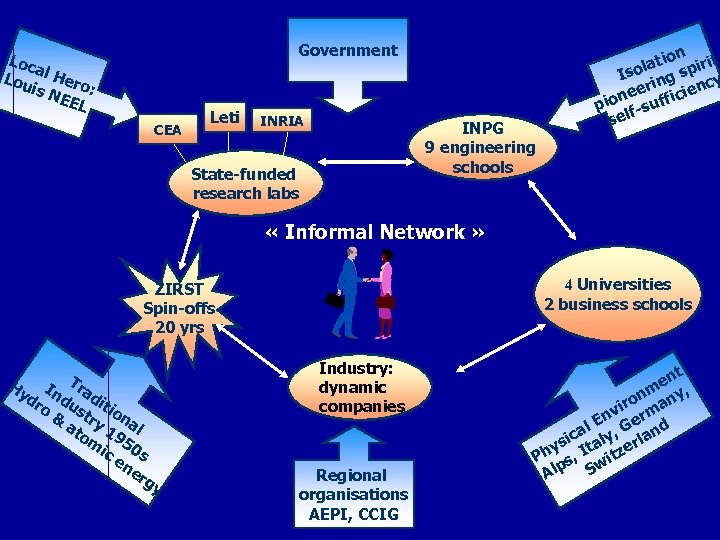

Grenoble Local Culture History of hydroelectric power & atomic energy Isolated environment but market exists A pioneering and self-sufficient spirit. Informal network 4 renowned universities including the INPG “Communication exchange” between universities, research laboratories & industry Spin-off creation 20 year history of spin-offs, entrepreneurship Centre d’ Energie Atomique (CEA): key player Local hero: Louis NEEL Future Strategy Technology Transfer between research and industry “Micro & Nano-Technology House”: FF 790 million Aim: no. 1 in Europe for Micro & Nano Technology

Grenoble Local Culture History of hydroelectric power & atomic energy Isolated environment but market exists A pioneering and self-sufficient spirit. Informal network 4 renowned universities including the INPG “Communication exchange” between universities, research laboratories & industry Spin-off creation 20 year history of spin-offs, entrepreneurship Centre d’ Energie Atomique (CEA): key player Local hero: Louis NEEL Future Strategy Technology Transfer between research and industry “Micro & Nano-Technology House”: FF 790 million Aim: no. 1 in Europe for Micro & Nano Technology

Challenges and problems for Grenoble “to stay competitive and to attract multinationals” • Regional Infrastructure factors: no TGV from Lyon, isolation. Competition: Lyon & Sophia-Antipolis are in the same region. • National Brittany, Lorraine, Paris and Sophia-Antipolis are national competitors for high-tech development. • International Grenoble is not a major European city. In competition with Munich, Dublin, Barcelona and Stockholm.

Challenges and problems for Grenoble “to stay competitive and to attract multinationals” • Regional Infrastructure factors: no TGV from Lyon, isolation. Competition: Lyon & Sophia-Antipolis are in the same region. • National Brittany, Lorraine, Paris and Sophia-Antipolis are national competitors for high-tech development. • International Grenoble is not a major European city. In competition with Munich, Dublin, Barcelona and Stockholm.

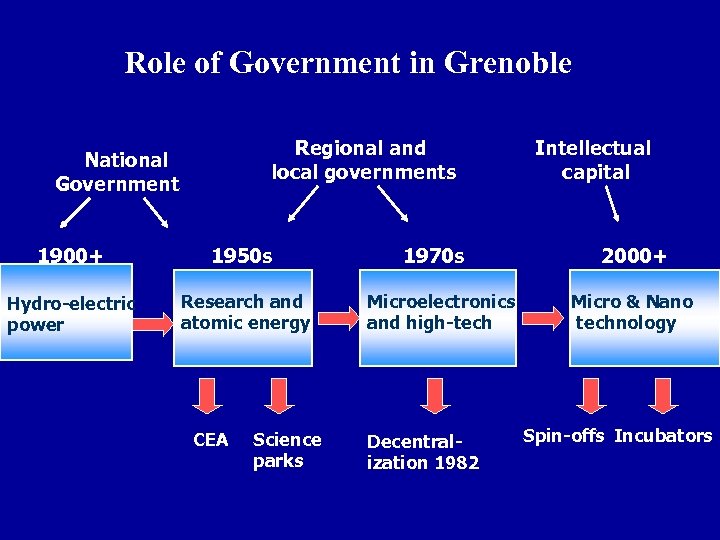

Role of Government in Grenoble Regional and local governments National Government 1900+ 1950 s Hydro-electric power Research and atomic energy CEA Science parks 1970 s Microelectronics and high-tech Decentralization 1982 Intellectual capital 2000+ Micro & Nano technology Spin-offs Incubators

Role of Government in Grenoble Regional and local governments National Government 1900+ 1950 s Hydro-electric power Research and atomic energy CEA Science parks 1970 s Microelectronics and high-tech Decentralization 1982 Intellectual capital 2000+ Micro & Nano technology Spin-offs Incubators

Government Loc a Lou l Hero is N : EEL CEA Leti INRIA INPG 9 engineering schools State-funded research labs n atio pirit l Iso ing s cy r n nee fficie io p su elfs « Informal Network » 4 Universities 2 business schools ZIRST Spin-offs 20 yrs Hy In Tra dr du dit o & stry iona at 1 l om 95 ic 0 s en er gy Industry: dynamic companies Regional organisations AEPI, CCIG t en , m on any ir nv erm E al y, G and ic ys Ital zerl Ph s, wit p S Al

Government Loc a Lou l Hero is N : EEL CEA Leti INRIA INPG 9 engineering schools State-funded research labs n atio pirit l Iso ing s cy r n nee fficie io p su elfs « Informal Network » 4 Universities 2 business schools ZIRST Spin-offs 20 yrs Hy In Tra dr du dit o & stry iona at 1 l om 95 ic 0 s en er gy Industry: dynamic companies Regional organisations AEPI, CCIG t en , m on any ir nv erm E al y, G and ic ys Ital zerl Ph s, wit p S Al

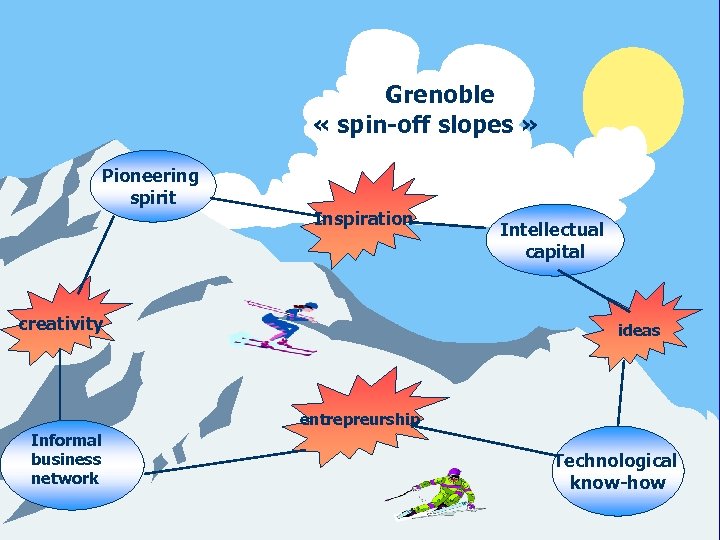

Grenoble « spin-off slopes » Pioneering spirit Inspiration creativity Intellectual capital ideas entrepreurship Informal business network Technological know-how

Grenoble « spin-off slopes » Pioneering spirit Inspiration creativity Intellectual capital ideas entrepreurship Informal business network Technological know-how

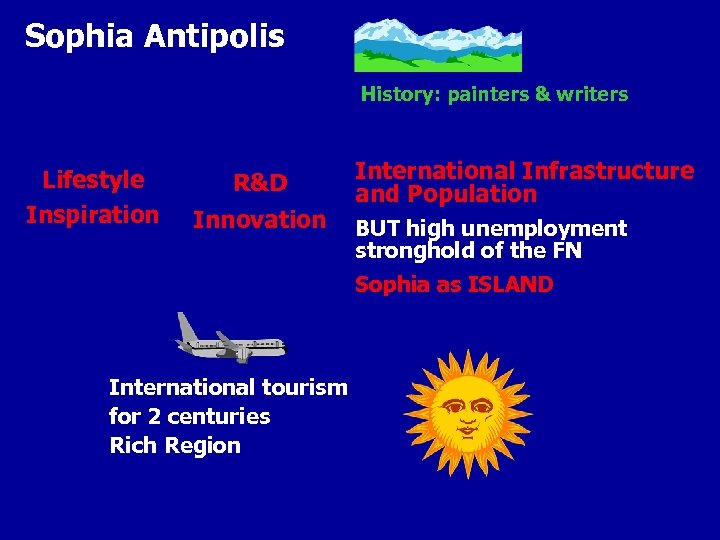

Sophia Antipolis History: painters & writers Lifestyle Inspiration R&D Innovation International Infrastructure and Population BUT high unemployment stronghold of the FN Sophia as ISLAND International tourism for 2 centuries Rich Region

Sophia Antipolis History: painters & writers Lifestyle Inspiration R&D Innovation International Infrastructure and Population BUT high unemployment stronghold of the FN Sophia as ISLAND International tourism for 2 centuries Rich Region

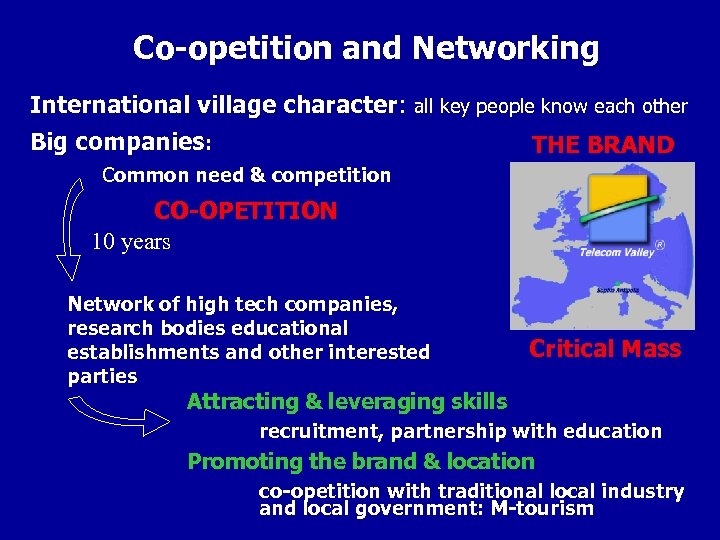

Co-opetition and Networking International village character: all key people know each other Big companies: THE BRAND Common need & competition CO-OPETITION 10 years Network of high tech companies, research bodies educational establishments and other interested parties Critical Mass Attracting & leveraging skills recruitment, partnership with education Promoting the brand & location co-opetition with traditional local industry and local government: M-tourism

Co-opetition and Networking International village character: all key people know each other Big companies: THE BRAND Common need & competition CO-OPETITION 10 years Network of high tech companies, research bodies educational establishments and other interested parties Critical Mass Attracting & leveraging skills recruitment, partnership with education Promoting the brand & location co-opetition with traditional local industry and local government: M-tourism

The Main Challenges Skills • Marketing, business, IT and engineering • Cross disciplinary Infrastructure • Growth in step with Sophia Antipolis expansion Government • appreciation and support of high-tech Co-opetition • ever closer co-opetition between all the parties on these issues CONFIDENCE SUCCESS EXPERIENCE SUCCESS

The Main Challenges Skills • Marketing, business, IT and engineering • Cross disciplinary Infrastructure • Growth in step with Sophia Antipolis expansion Government • appreciation and support of high-tech Co-opetition • ever closer co-opetition between all the parties on these issues CONFIDENCE SUCCESS EXPERIENCE SUCCESS

I CROSS FERTILIZATION ?

I CROSS FERTILIZATION ?

Entrepreneurial spirit INRIA: since 1983 in Sophia Antipolis • No entrepreneurial spirit at the time • « Learn through experience and a network » • Failure: researchers can return to their posts Motivation • «for the benefit of the French nation » • To defend the interests of France against those of competing countries such as US • Not so much personal wealth creation

Entrepreneurial spirit INRIA: since 1983 in Sophia Antipolis • No entrepreneurial spirit at the time • « Learn through experience and a network » • Failure: researchers can return to their posts Motivation • «for the benefit of the French nation » • To defend the interests of France against those of competing countries such as US • Not so much personal wealth creation

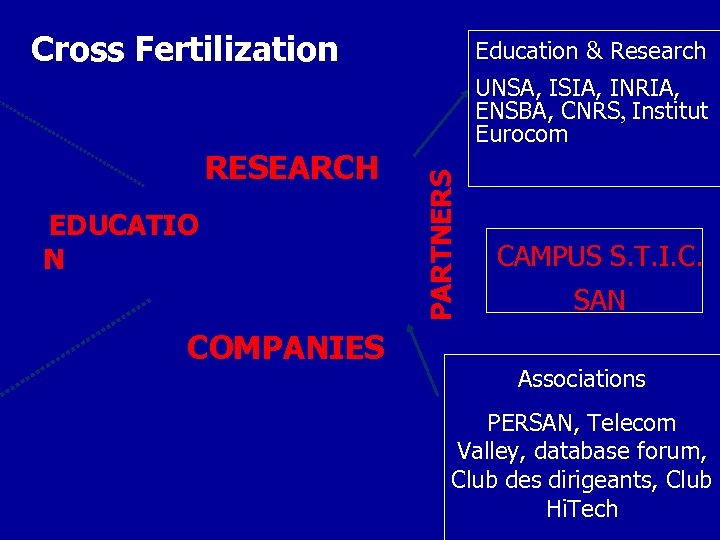

Cross Fertilization Education & Research RESEARCH EDUCATIO N COMPANIES PARTNERS UNSA, ISIA, INRIA, ENSBA, CNRS, Institut Eurocom CAMPUS S. T. I. C. SAN Associations PERSAN, Telecom Valley, database forum, Club des dirigeants, Club Hi. Tech

Cross Fertilization Education & Research RESEARCH EDUCATIO N COMPANIES PARTNERS UNSA, ISIA, INRIA, ENSBA, CNRS, Institut Eurocom CAMPUS S. T. I. C. SAN Associations PERSAN, Telecom Valley, database forum, Club des dirigeants, Club Hi. Tech

Part 2 : Q & A Write to: drouach@escp-eap. net

Part 2 : Q & A Write to: drouach@escp-eap. net