e51f0f99cd331034b4f38adf343604f9.ppt

- Количество слайдов: 21

Creating new growth and Managing it more effectively Clayton Christensen Harvard Business School cchristensen@hbs. edu 3/16/2018 Copyright Clayton M. Christensen 1

Creating new growth and Managing it more effectively Clayton Christensen Harvard Business School cchristensen@hbs. edu 3/16/2018 Copyright Clayton M. Christensen 1

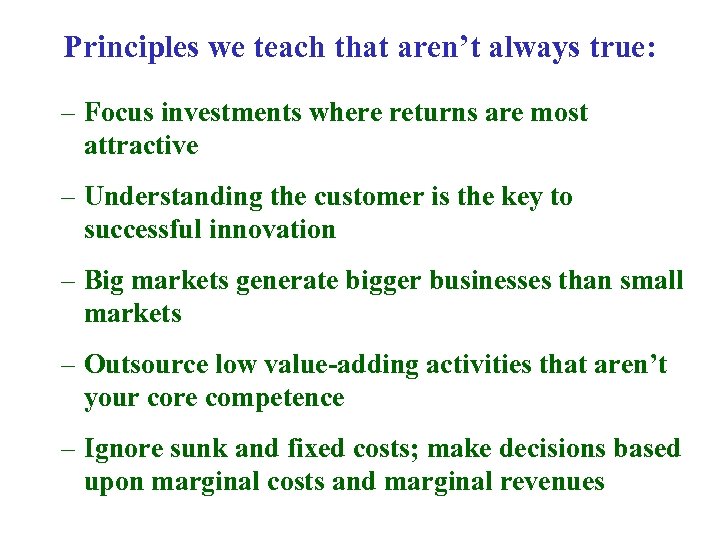

Principles we teach that aren’t always true: – Focus investments where returns are most attractive – Understanding the customer is the key to successful innovation – Big markets generate bigger businesses than small markets – Outsource low value-adding activities that aren’t your core competence – Ignore sunk and fixed costs; make decisions based upon marginal costs and marginal revenues

Principles we teach that aren’t always true: – Focus investments where returns are most attractive – Understanding the customer is the key to successful innovation – Big markets generate bigger businesses than small markets – Outsource low value-adding activities that aren’t your core competence – Ignore sunk and fixed costs; make decisions based upon marginal costs and marginal revenues

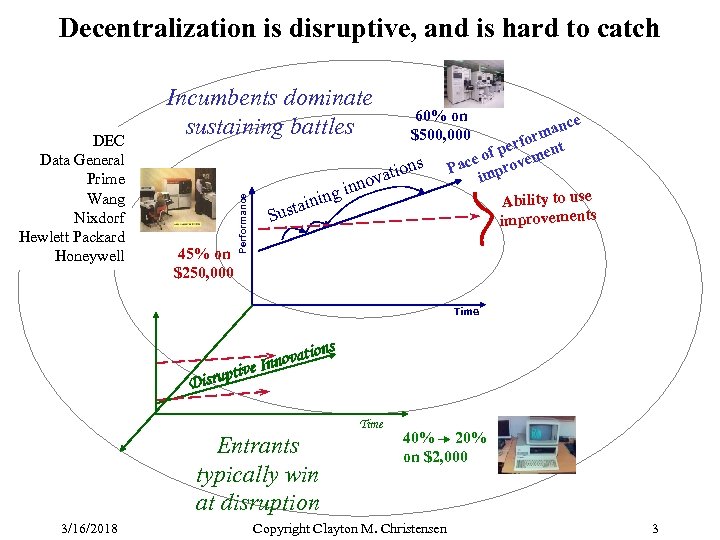

Decentralization is disruptive, and is hard to catch 45% on $250, 000 Performance DEC Data General Prime Wang Nixdorf Hewlett Packard Honeywell Incumbents dominate sustaining battles i ning i a Sust 60% on $500, 000 ns atio ov nn ce man for per ment of ace prove P im Ability to use improvements Time pti Disru ions at Innov ve Entrants typically win at disruption 3/16/2018 Time 40% 20% on $2, 000 Copyright Clayton M. Christensen 3

Decentralization is disruptive, and is hard to catch 45% on $250, 000 Performance DEC Data General Prime Wang Nixdorf Hewlett Packard Honeywell Incumbents dominate sustaining battles i ning i a Sust 60% on $500, 000 ns atio ov nn ce man for per ment of ace prove P im Ability to use improvements Time pti Disru ions at Innov ve Entrants typically win at disruption 3/16/2018 Time 40% 20% on $2, 000 Copyright Clayton M. Christensen 3

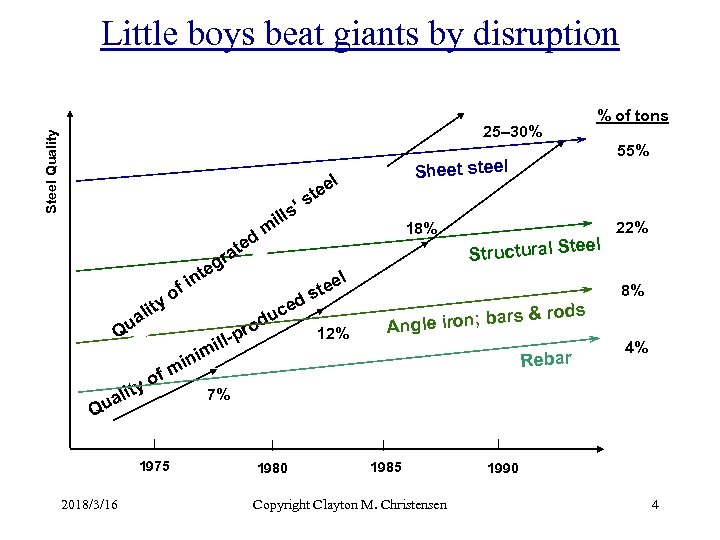

Little boys beat giants by disruption % of tons Steel Quality 25– 30% a gr e ed t m f yo m t li ua Q 1975 2018/3/16 18% eel Structural St l o ity l c u rod a Qu Sheet steel l ee t ’s ills t in f 55% p illm ed e ste 12% 22% 8% rs & rods a Angle iron; b ini Rebar 4% 7% 1980 1985 Copyright Clayton M. Christensen 1990 4

Little boys beat giants by disruption % of tons Steel Quality 25– 30% a gr e ed t m f yo m t li ua Q 1975 2018/3/16 18% eel Structural St l o ity l c u rod a Qu Sheet steel l ee t ’s ills t in f 55% p illm ed e ste 12% 22% 8% rs & rods a Angle iron; b ini Rebar 4% 7% 1980 1985 Copyright Clayton M. Christensen 1990 4

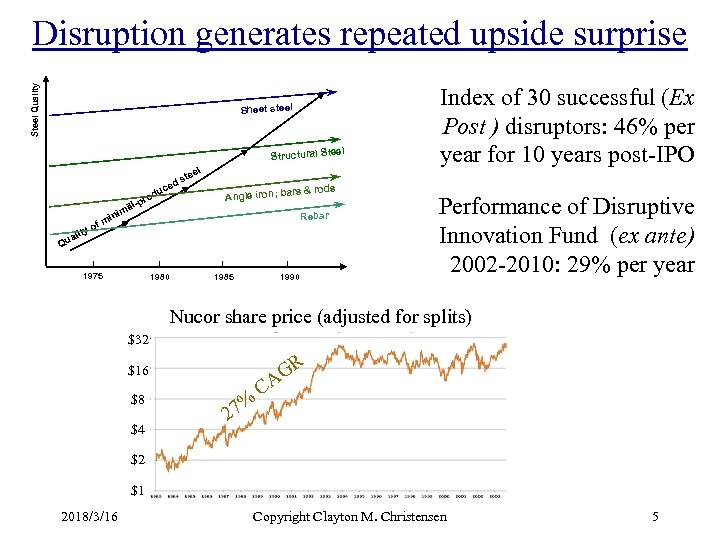

Steel Quality Disruption generates repeated upside surprise Sheet steel el Structural Ste e ste ed c du pro ali Qu ty m of illnim i 1975 l s & rods ar Angle iron; b Rebar 1980 1985 1990 Index of 30 successful (Ex Post ) disruptors: 46% per year for 10 years post-IPO Performance of Disruptive Innovation Fund (ex ante) 2002 -2010: 29% per year Nucor share price (adjusted for splits) $32 GR A $16 $8 $4 % 27 C $2 $1 2018/3/16 Copyright Clayton M. Christensen 5

Steel Quality Disruption generates repeated upside surprise Sheet steel el Structural Ste e ste ed c du pro ali Qu ty m of illnim i 1975 l s & rods ar Angle iron; b Rebar 1980 1985 1990 Index of 30 successful (Ex Post ) disruptors: 46% per year for 10 years post-IPO Performance of Disruptive Innovation Fund (ex ante) 2002 -2010: 29% per year Nucor share price (adjusted for splits) $32 GR A $16 $8 $4 % 27 C $2 $1 2018/3/16 Copyright Clayton M. Christensen 5

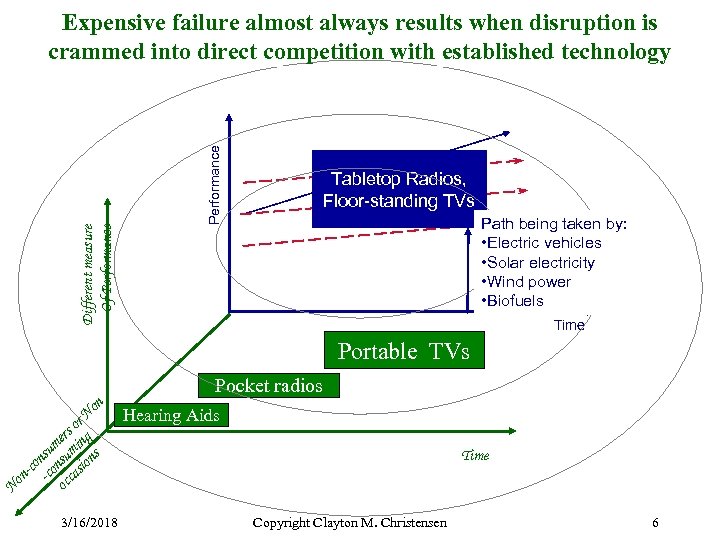

Performance Different measure Of Performance Expensive failure almost always results when disruption is crammed into direct competition with established technology Tabletop Radios, Floor-standing TVs Path being taken by: • Electric vehicles Path taken by • Solar electricity vacuum tube • Wind power manufacturers • Biofuels Time Portable TVs on N or rs g me min s u ns nsu ion co n- -co ccas o No 3/16/2018 Pocket radios Hearing Aids Time Copyright Clayton M. Christensen 6

Performance Different measure Of Performance Expensive failure almost always results when disruption is crammed into direct competition with established technology Tabletop Radios, Floor-standing TVs Path being taken by: • Electric vehicles Path taken by • Solar electricity vacuum tube • Wind power manufacturers • Biofuels Time Portable TVs on N or rs g me min s u ns nsu ion co n- -co ccas o No 3/16/2018 Pocket radios Hearing Aids Time Copyright Clayton M. Christensen 6

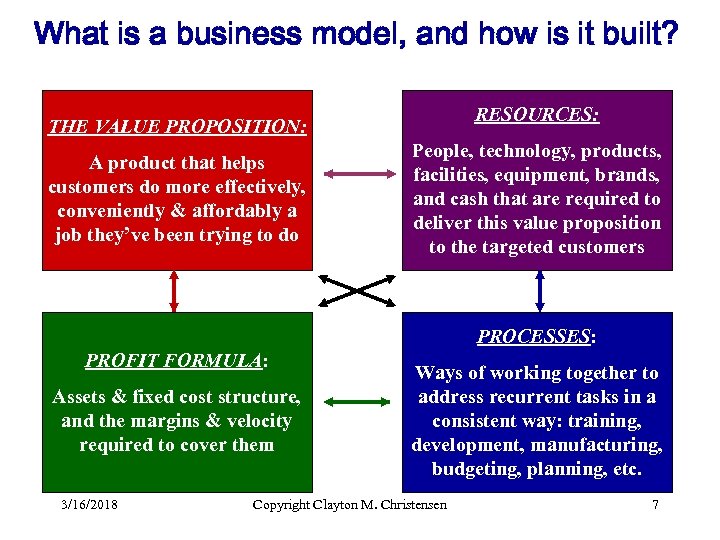

What is a business model, and how is it built? RESOURCES: THE VALUE PROPOSITION: A product that helps customers do more effectively, conveniently & affordably a job they’ve been trying to do People, technology, products, facilities, equipment, brands, and cash that are required to deliver this value proposition to the targeted customers PROCESSES: PROFIT FORMULA: Assets & fixed cost structure, and the margins & velocity required to cover them 3/16/2018 Ways of working together to address recurrent tasks in a consistent way: training, development, manufacturing, budgeting, planning, etc. Copyright Clayton M. Christensen 7

What is a business model, and how is it built? RESOURCES: THE VALUE PROPOSITION: A product that helps customers do more effectively, conveniently & affordably a job they’ve been trying to do People, technology, products, facilities, equipment, brands, and cash that are required to deliver this value proposition to the targeted customers PROCESSES: PROFIT FORMULA: Assets & fixed cost structure, and the margins & velocity required to cover them 3/16/2018 Ways of working together to address recurrent tasks in a consistent way: training, development, manufacturing, budgeting, planning, etc. Copyright Clayton M. Christensen 7

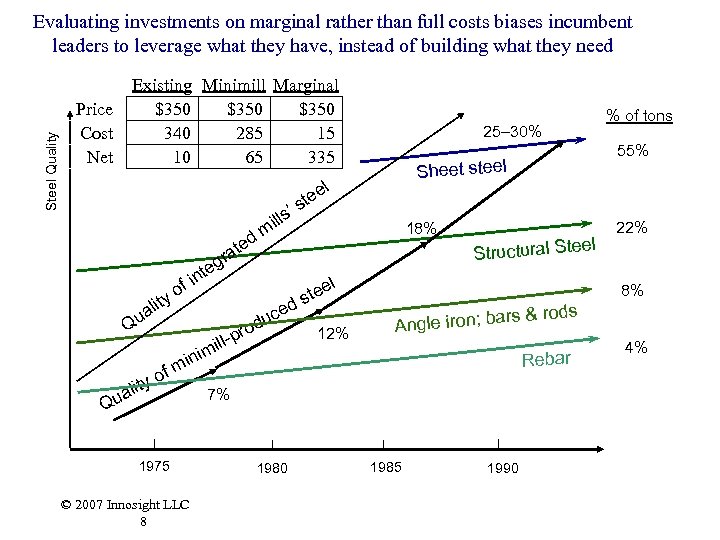

Steel Quality Evaluating investments on marginal rather than full costs biases incumbent leaders to leverage what they have, instead of building what they need Price Cost Net Existing Minimill Marginal $350 340 285 15 10 65 335 25– 30% a gr ted e yo t ali Qu t f in f ty o li ua Q ced ill-p im u rod e ste 18% e ste el Structural Ste l 12% s & rods ngle iron; bar A Rebar © 2007 Innosight LLC 8 7% 1980 22% 8% min 1975 55% Sheet steel l ’ ills m % of tons 1985 1990 4%

Steel Quality Evaluating investments on marginal rather than full costs biases incumbent leaders to leverage what they have, instead of building what they need Price Cost Net Existing Minimill Marginal $350 340 285 15 10 65 335 25– 30% a gr ted e yo t ali Qu t f in f ty o li ua Q ced ill-p im u rod e ste 18% e ste el Structural Ste l 12% s & rods ngle iron; bar A Rebar © 2007 Innosight LLC 8 7% 1980 22% 8% min 1975 55% Sheet steel l ’ ills m % of tons 1985 1990 4%

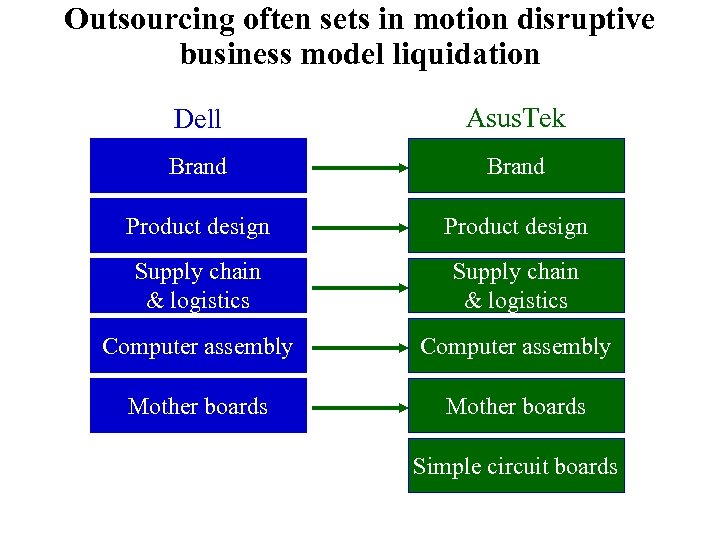

Outsourcing often sets in motion disruptive business model liquidation Dell Asus. Tek Brand Product design Supply chain & logistics Computer assembly Mother boards Simple circuit boards

Outsourcing often sets in motion disruptive business model liquidation Dell Asus. Tek Brand Product design Supply chain & logistics Computer assembly Mother boards Simple circuit boards

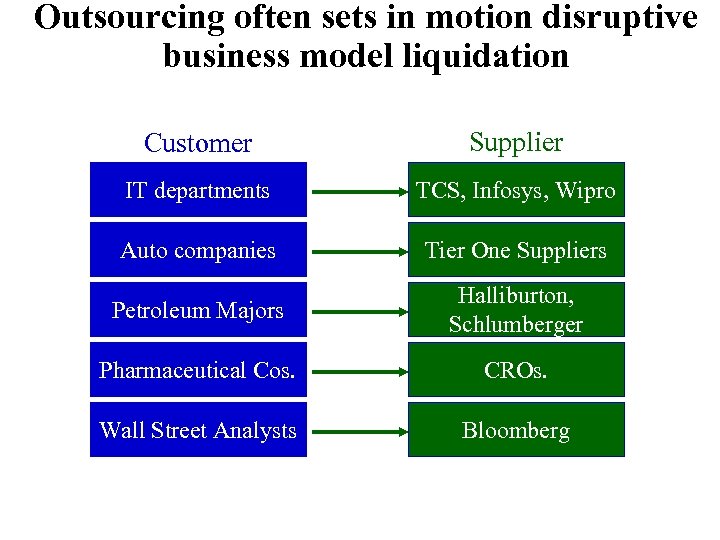

Outsourcing often sets in motion disruptive business model liquidation Customer Supplier IT departments TCS, Infosys, Wipro Auto companies Tier One Suppliers Petroleum Majors Halliburton, Schlumberger Pharmaceutical Cos. CROs. Wall Street Analysts Bloomberg

Outsourcing often sets in motion disruptive business model liquidation Customer Supplier IT departments TCS, Infosys, Wipro Auto companies Tier One Suppliers Petroleum Majors Halliburton, Schlumberger Pharmaceutical Cos. CROs. Wall Street Analysts Bloomberg

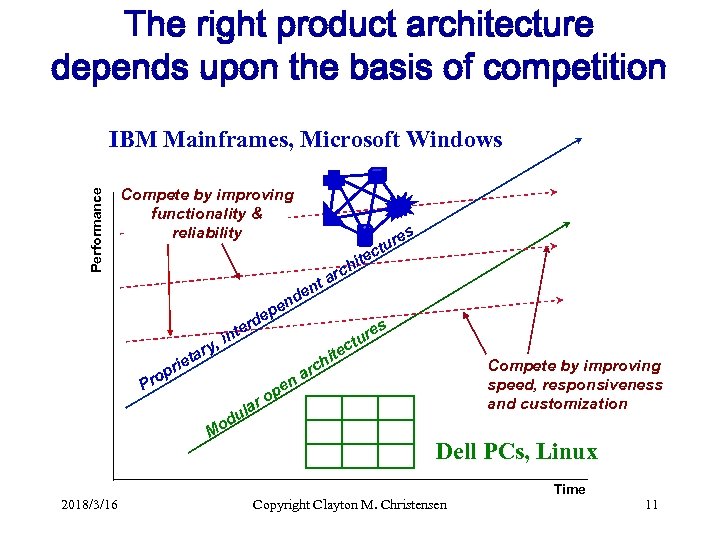

The right product architecture depends upon the basis of competition Performance IBM Mainframes, Microsoft Windows Compete by improving functionality & reliability e hit rc ta p rde e int y, tar e pri r la du Mo n de en s re tu tec hi o Pr 2018/3/16 s e tur c e op n c ar Compete by improving speed, responsiveness and customization Dell PCs, Linux Copyright Clayton M. Christensen Time 11

The right product architecture depends upon the basis of competition Performance IBM Mainframes, Microsoft Windows Compete by improving functionality & reliability e hit rc ta p rde e int y, tar e pri r la du Mo n de en s re tu tec hi o Pr 2018/3/16 s e tur c e op n c ar Compete by improving speed, responsiveness and customization Dell PCs, Linux Copyright Clayton M. Christensen Time 11

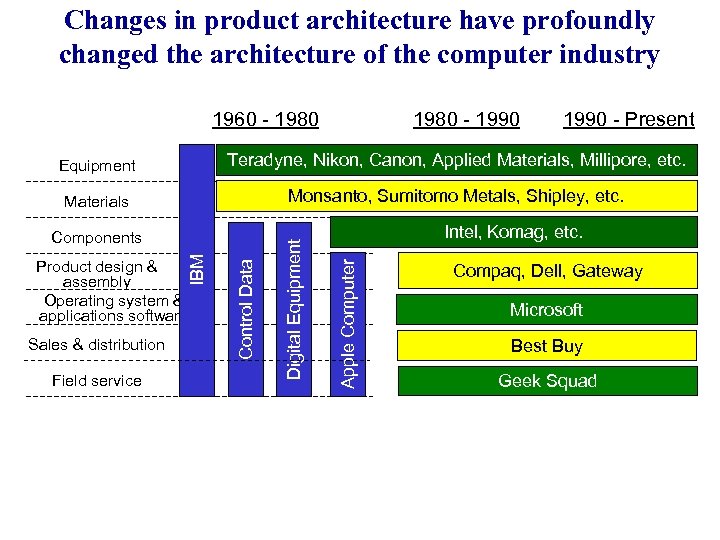

Changes in product architecture have profoundly changed the architecture of the computer industry 1960 - 1980 - 1990 - Present Teradyne, Nikon, Canon, Applied Materials, Millipore, etc. Materials Monsanto, Sumitomo Metals, Shipley, etc. Sales & distribution Field service Intel, Komag, etc. Apple Computer Product design & assembly Operating system & applications software Control Data IBM Components Digital Equipment Compaq, Dell, Gateway Microsoft Best Buy Geek Squad

Changes in product architecture have profoundly changed the architecture of the computer industry 1960 - 1980 - 1990 - Present Teradyne, Nikon, Canon, Applied Materials, Millipore, etc. Materials Monsanto, Sumitomo Metals, Shipley, etc. Sales & distribution Field service Intel, Komag, etc. Apple Computer Product design & assembly Operating system & applications software Control Data IBM Components Digital Equipment Compaq, Dell, Gateway Microsoft Best Buy Geek Squad

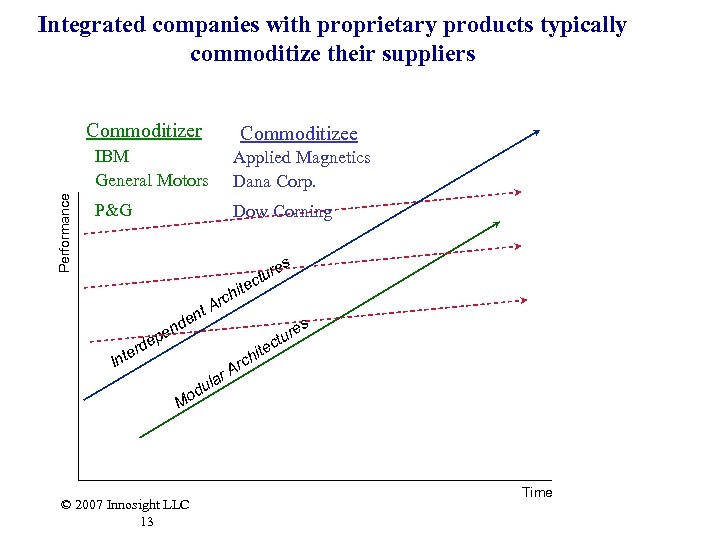

Integrated companies with proprietary products typically commoditize their suppliers Commoditizer Commoditizee Performance IBM General Motors Applied Magnetics Dana Corp. P&G Dow Corning s re ctu nt de en ep d ter n ite ch Ar s ite I ch Ar r la u od M © 2007 Innosight LLC 13 e tur c Time

Integrated companies with proprietary products typically commoditize their suppliers Commoditizer Commoditizee Performance IBM General Motors Applied Magnetics Dana Corp. P&G Dow Corning s re ctu nt de en ep d ter n ite ch Ar s ite I ch Ar r la u od M © 2007 Innosight LLC 13 e tur c Time

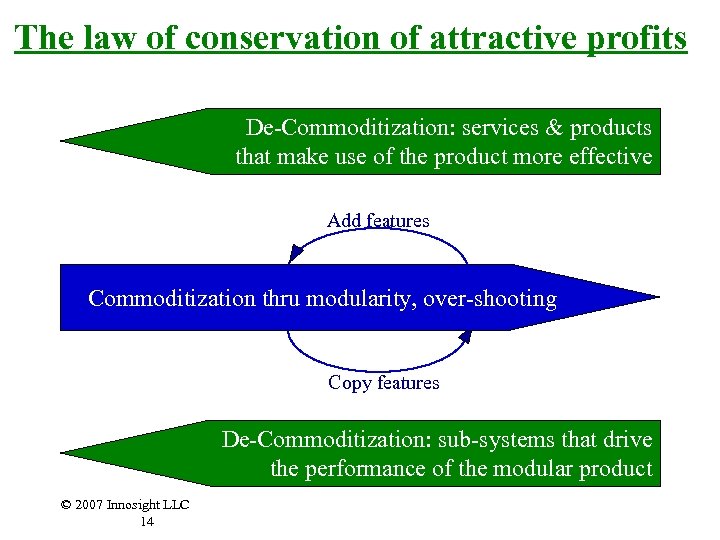

The law of conservation of attractive profits De-Commoditization: services & products that make use of the product more effective Add features Commoditization thru modularity, over-shooting Copy features De-Commoditization: sub-systems that drive the performance of the modular product © 2007 Innosight LLC 14

The law of conservation of attractive profits De-Commoditization: services & products that make use of the product more effective Add features Commoditization thru modularity, over-shooting Copy features De-Commoditization: sub-systems that drive the performance of the modular product © 2007 Innosight LLC 14

So what should the Harvard Business School Do? 2018/3/16 Copyright Clayton M. Christensen 15

So what should the Harvard Business School Do? 2018/3/16 Copyright Clayton M. Christensen 15

Market Understanding that Mirrors how Customers Experience Life “The customer rarely buys what the company thinks it is selling him” - Peter Drucker

Market Understanding that Mirrors how Customers Experience Life “The customer rarely buys what the company thinks it is selling him” - Peter Drucker

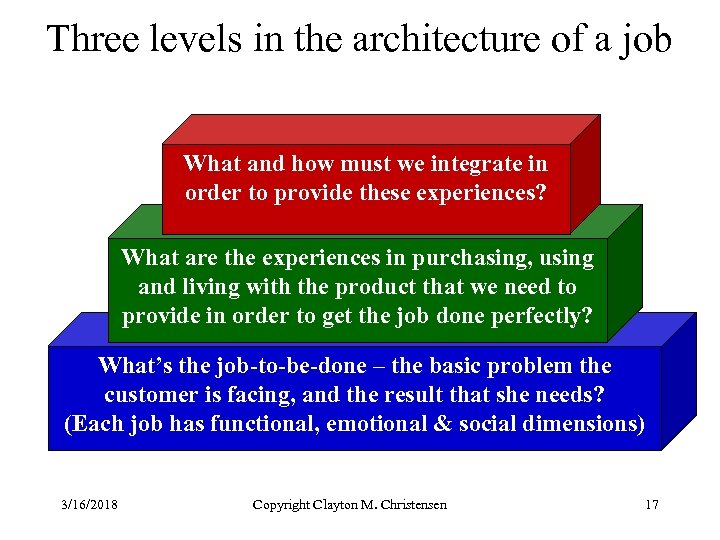

Three levels in the architecture of a job What and how must we integrate in order to provide these experiences? What are the experiences in purchasing, using and living with the product that we need to provide in order to get the job done perfectly? What’s the job-to-be-done – the basic problem the customer is facing, and the result that she needs? (Each job has functional, emotional & social dimensions) 3/16/2018 Copyright Clayton M. Christensen 17

Three levels in the architecture of a job What and how must we integrate in order to provide these experiences? What are the experiences in purchasing, using and living with the product that we need to provide in order to get the job done perfectly? What’s the job-to-be-done – the basic problem the customer is facing, and the result that she needs? (Each job has functional, emotional & social dimensions) 3/16/2018 Copyright Clayton M. Christensen 17

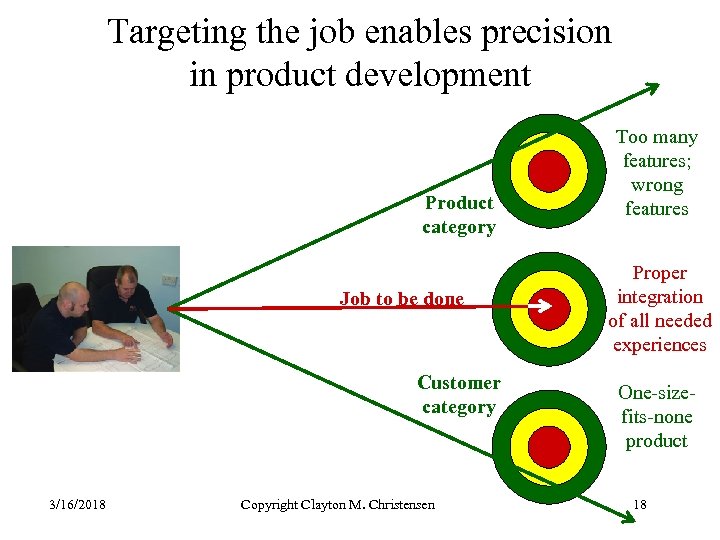

Targeting the job enables precision in product development Product category Job to be done Customer category 3/16/2018 Copyright Clayton M. Christensen Too many features; wrong features Proper integration of all needed experiences One-sizefits-none product 18

Targeting the job enables precision in product development Product category Job to be done Customer category 3/16/2018 Copyright Clayton M. Christensen Too many features; wrong features Proper integration of all needed experiences One-sizefits-none product 18

Companies that segment markets by job find: – The market is much larger – Their share is smaller – Their real competitors aren’t in their product category – Growth potential is greater, because nonconsumption is usually a major competitor – They can integrate properly – Building a valuable brand is straightforward

Companies that segment markets by job find: – The market is much larger – Their share is smaller – Their real competitors aren’t in their product category – Growth potential is greater, because nonconsumption is usually a major competitor – They can integrate properly – Building a valuable brand is straightforward

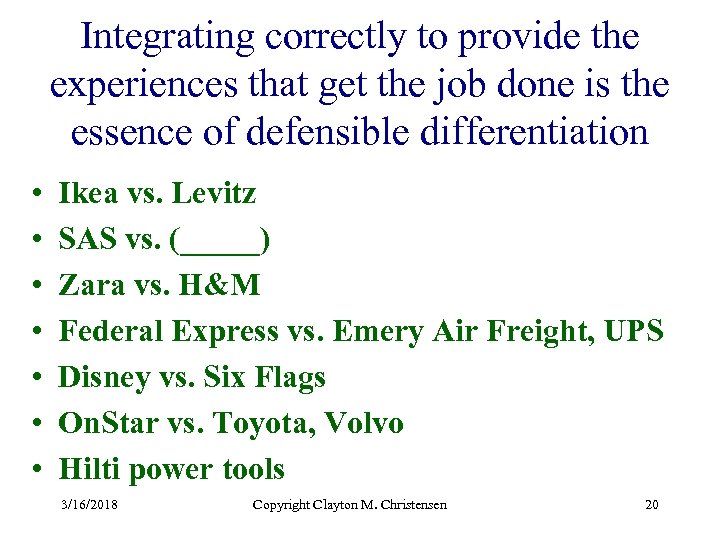

Integrating correctly to provide the experiences that get the job done is the essence of defensible differentiation • • Ikea vs. Levitz SAS vs. (_____) Zara vs. H&M Federal Express vs. Emery Air Freight, UPS Disney vs. Six Flags On. Star vs. Toyota, Volvo Hilti power tools 3/16/2018 Copyright Clayton M. Christensen 20

Integrating correctly to provide the experiences that get the job done is the essence of defensible differentiation • • Ikea vs. Levitz SAS vs. (_____) Zara vs. H&M Federal Express vs. Emery Air Freight, UPS Disney vs. Six Flags On. Star vs. Toyota, Volvo Hilti power tools 3/16/2018 Copyright Clayton M. Christensen 20

Principles we teach that aren’t always true: – Focus investments where returns are most attractive – Understanding the customer is the key to successful innovation – Big markets generate bigger businesses than small markets – Outsource low value-adding activities that aren’t your core competence – Ignore sunk and fixed costs; make decisions based upon marginal costs and marginal revenues

Principles we teach that aren’t always true: – Focus investments where returns are most attractive – Understanding the customer is the key to successful innovation – Big markets generate bigger businesses than small markets – Outsource low value-adding activities that aren’t your core competence – Ignore sunk and fixed costs; make decisions based upon marginal costs and marginal revenues