671fa93d066cac852015675b818b729e.ppt

- Количество слайдов: 37

Creating a Viable Denel Presentation to Parliament Joint Meeting of the Portfolio Committee on Public Enterprises and the Select Committee on Labour and Public Enterprises 18 October 2005

Agenda Group Overview • Situation/Business Analysis • Financial Update • Strategy Update 1

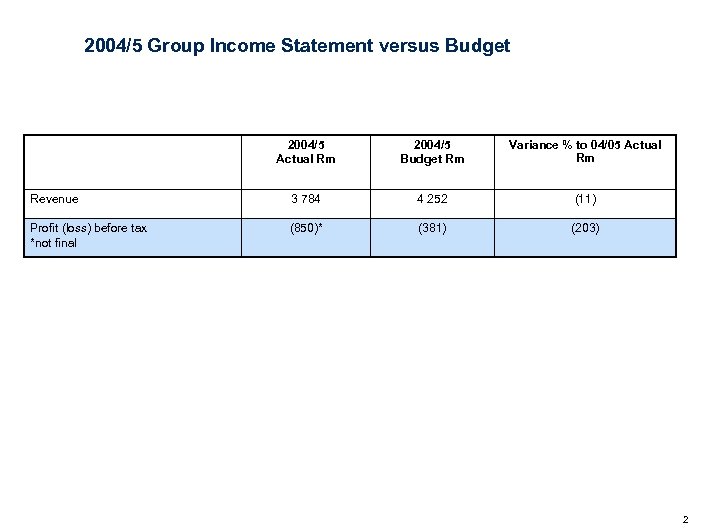

2004/5 Group Income Statement versus Budget 2004/5 Actual Rm 2004/5 Budget Rm Variance % to 04/05 Actual Rm Revenue 3 784 4 252 (11) Profit (loss) before tax *not final (850)* (381) (203) 2

OUR CHALLENGE ‘Fixing’ Denel means. . . • Becoming a profitable, commercially viable and dynamic entity • Delivering consistent, real growth • Attracting, developing, retaining and appropriately rewarding world class skills • Achieving world class productivity • Focusing on the areas where we can compete credibly • Partnering with the state agencies to meet the defence needs of the country • Developing partnerships/alliance ventures with true value add 3

‘Fixing’ Denel means. . . • If we want to compete in the open market, we must behave like the best in the open market (systems, processes, governance, marketing, equipment, commercial culture etc. ) • We cannot achieve world class results and delivery with a ‘subsidy mindset’ – this mindset, will continue to support mediocrity in everything we do and are. • Anything other than world class will not cut it! 4

WHO ARE WE ? • We need to decide who we are and stick to the game plan • This calls for a reality check, based on facts • The mind-shift required for this process will take ‘courage’ 5

SINGLE VISION – ANYTHING ELSE WILL NOT HELP From: Misalignment amongst stakeholders President and Cabinet To: Single vision and purpose Portfolio Ministers – DPE, DOD, Foreign Affairs, Finance One team • President and Cabinet • Portfolio Ministers Denel Board Denel Executive team • Denel Board • Denel Executive team 6

KEY MESSAGES 1. Much of the global defence spend is inaccessible to independent contractors, making players highly reliant on their domestic markets. Furthermore, changes in the industry are forcing players to consolidate, build alliances and carefully focus their businesses 7

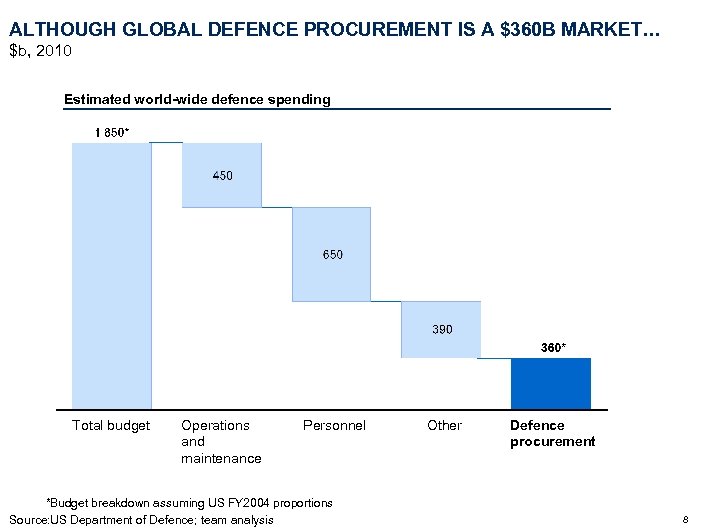

ALTHOUGH GLOBAL DEFENCE PROCUREMENT IS A $360 B MARKET… $b, 2010 Estimated world-wide defence spending Total budget Operations and maintenance Personnel *Budget breakdown assuming US FY 2004 proportions Source: US Department of Defence; team analysis Other Defence procurement 8

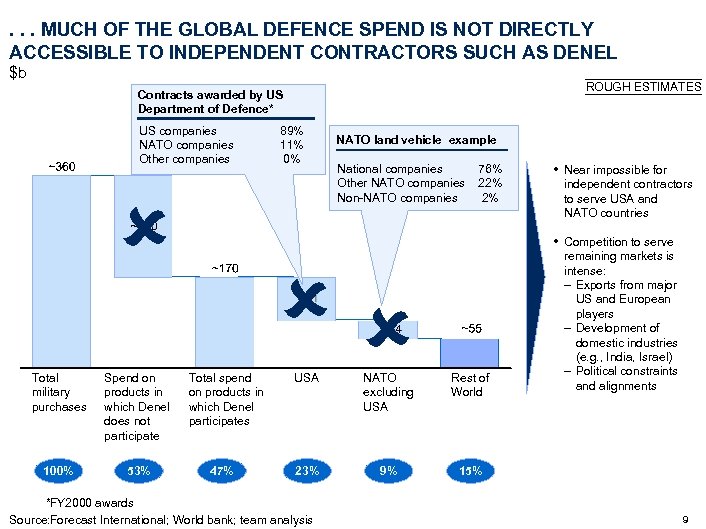

. . . MUCH OF THE GLOBAL DEFENCE SPEND IS NOT DIRECTLY ACCESSIBLE TO INDEPENDENT CONTRACTORS SUCH AS DENEL $b ROUGH ESTIMATES Contracts awarded by US Department of Defence* US companies NATO companies Other companies û Total military purchases Spend on products in which Denel does not participate 100% 53% 89% 11% 0% NATO land vehicle example National companies Other NATO companies Non-NATO companies 76% 22% 2% • Near impossible for independent contractors to serve USA and NATO countries • Competition to serve Total spend on products in which Denel participates 47% ûû USA NATO excluding USA Rest of World 23% 9% remaining markets is intense: – Exports from major US and European players – Development of domestic industries (e. g. , India, Israel) – Political constraints and alignments 15% *FY 2000 awards Source: Forecast International; World bank; team analysis 9

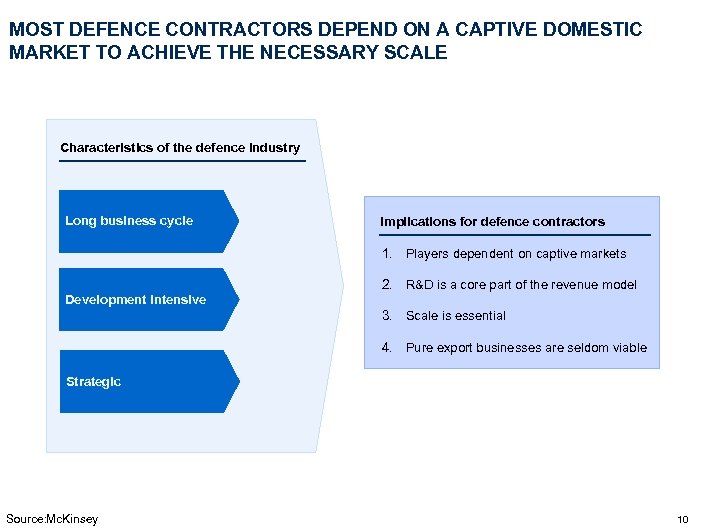

MOST DEFENCE CONTRACTORS DEPEND ON A CAPTIVE DOMESTIC MARKET TO ACHIEVE THE NECESSARY SCALE Characteristics of the defence industry Long business cycle Implications for defence contractors 1. Players dependent on captive markets Development intensive 2. R&D is a core part of the revenue model 3. Scale is essential 4. Pure export businesses are seldom viable Strategic Source: Mc. Kinsey 10

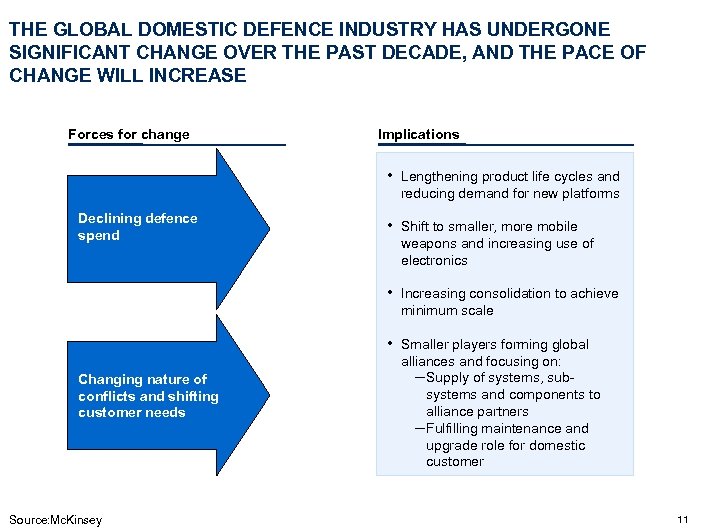

THE GLOBAL DOMESTIC DEFENCE INDUSTRY HAS UNDERGONE SIGNIFICANT CHANGE OVER THE PAST DECADE, AND THE PACE OF CHANGE WILL INCREASE Forces for change Implications • Lengthening product life cycles and reducing demand for new platforms Declining defence spend • Shift to smaller, more mobile weapons and increasing use of electronics • Increasing consolidation to achieve minimum scale • Smaller players forming global Changing nature of conflicts and shifting customer needs Source: Mc. Kinsey alliances and focusing on: – Supply of systems, subsystems and components to alliance partners – Fulfilling maintenance and upgrade role for domestic customer 11

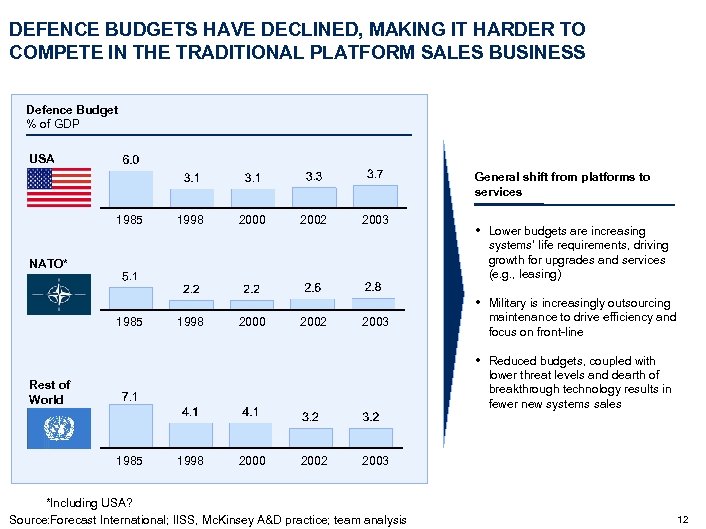

DEFENCE BUDGETS HAVE DECLINED, MAKING IT HARDER TO COMPETE IN THE TRADITIONAL PLATFORM SALES BUSINESS Defence Budget % of GDP USA General shift from platforms to services 1985 1998 2000 2002 2003 • Lower budgets are increasing systems’ life requirements, driving growth for upgrades and services (e. g. , leasing) NATO* • Military is increasingly outsourcing 1985 1998 2000 2002 2003 maintenance to drive efficiency and focus on front-line • Reduced budgets, coupled with lower threat levels and dearth of breakthrough technology results in fewer new systems sales Rest of World 1985 1998 2000 2002 2003 *Including USA? Source: Forecast International; IISS, Mc. Kinsey A&D practice; team analysis 12

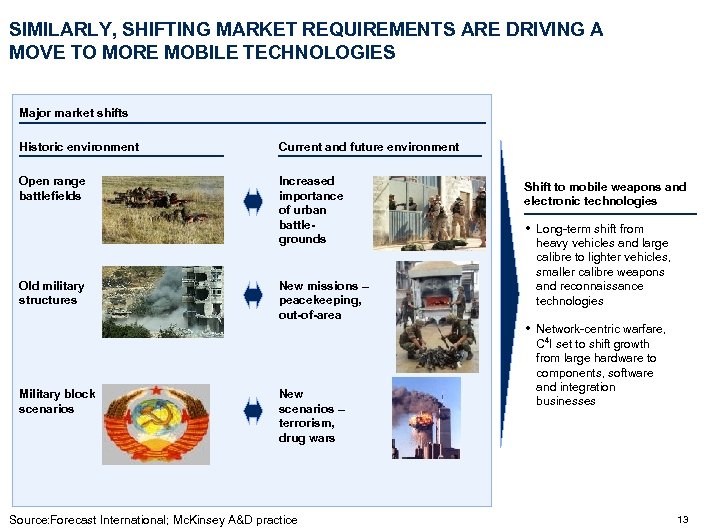

SIMILARLY, SHIFTING MARKET REQUIREMENTS ARE DRIVING A MOVE TO MORE MOBILE TECHNOLOGIES Major market shifts Historic environment Current and future environment Open range battlefields Increased importance of urban battlegrounds Old military structures Military block scenarios New missions – peacekeeping, out-of-area New scenarios – terrorism, drug wars Source: Forecast International; Mc. Kinsey A&D practice Shift to mobile weapons and electronic technologies • Long-term shift from heavy vehicles and large calibre to lighter vehicles, smaller calibre weapons and reconnaissance technologies • Network-centric warfare, C 4 I set to shift growth from large hardware to components, software and integration businesses 13

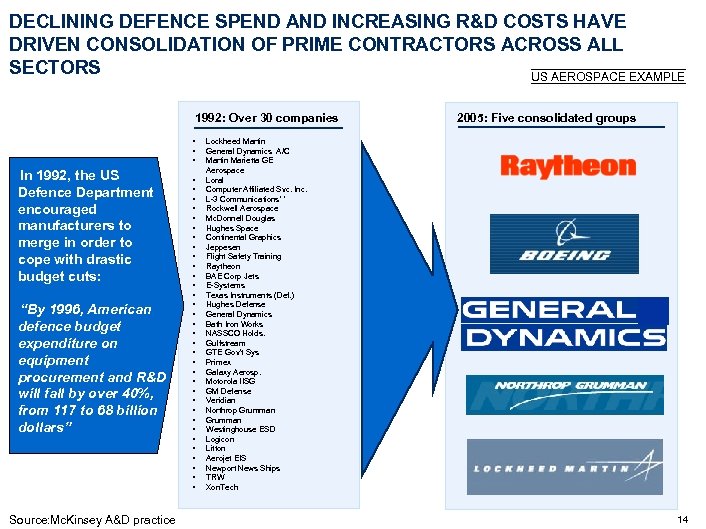

DECLINING DEFENCE SPEND AND INCREASING R&D COSTS HAVE DRIVEN CONSOLIDATION OF PRIME CONTRACTORS ACROSS ALL SECTORS US AEROSPACE EXAMPLE 1992: Over 30 companies • • • In 1992, the US Defence Department encouraged manufacturers to merge in order to cope with drastic budget cuts: “By 1996, American defence budget expenditure on equipment procurement and R&D will fall by over 40%, from 117 to 68 billion dollars” Source: Mc. Kinsey A&D practice • • • • • • • • • 2005: Five consolidated groups Lockheed Martin General Dynamics A/C Martin Marietta GE Aerospace Loral Computer Affiliated Svc. Inc. L-3 Communications** Rockwell Aerospace Mc. Donnell Douglas Hughes Space Continental Graphics Jeppesen Flight Safety Training Raytheon BAE Corp Jets E-Systems Texas Instruments (Def. ) Hughes Defense General Dynamics Bath Iron Works NASSCO Holds. Gulfstream GTE Gov't Sys Primex Galaxy Aerosp. Motorola IISG GM Defense Veridian Northrop Grumman Westinghouse ESD Logicon Litton Aerojet EIS Newport News Ships TRW Xon. Tech 14

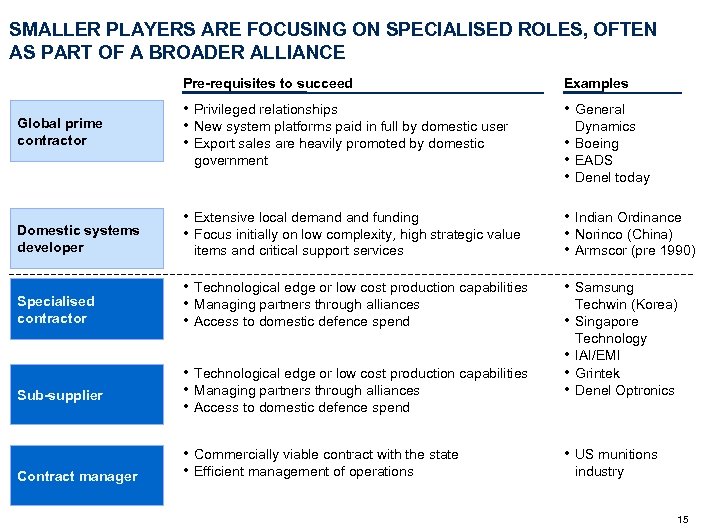

SMALLER PLAYERS ARE FOCUSING ON SPECIALISED ROLES, OFTEN AS PART OF A BROADER ALLIANCE Pre-requisites to succeed Global prime contractor Examples • Privileged relationships • New system platforms paid in full by domestic user • Export sales are heavily promoted by domestic • General government Domestic systems developer Specialised contractor Sub-supplier Contract manager • Extensive local demand funding • Focus initially on low complexity, high strategic value items and critical support services • Technological edge or low cost production capabilities • Managing partners through alliances • Access to domestic defence spend • Commercially viable contract with the state • Efficient management of operations • • • Dynamics Boeing EADS Denel today • Indian Ordinance • Norinco (China) • Armscor (pre 1990) • Samsung • • Techwin (Korea) Singapore Technology IAI/EMI Grintek Denel Optronics • US munitions industry 15

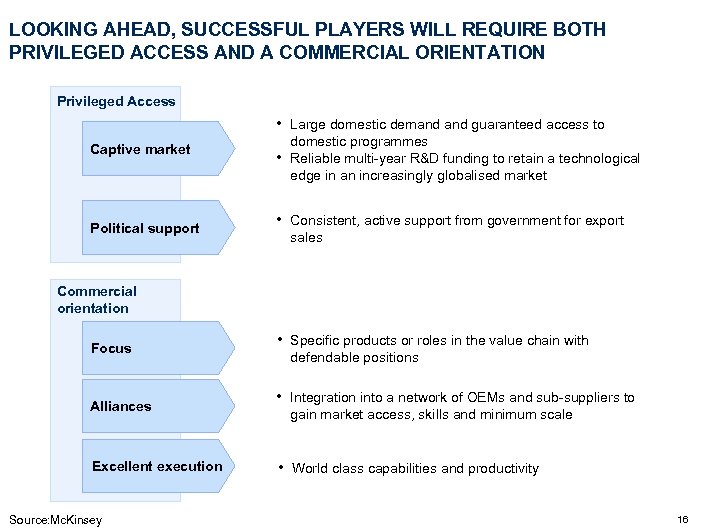

LOOKING AHEAD, SUCCESSFUL PLAYERS WILL REQUIRE BOTH PRIVILEGED ACCESS AND A COMMERCIAL ORIENTATION Privileged Access • Large domestic demand guaranteed access to Captive market Political support • domestic programmes Reliable multi-year R&D funding to retain a technological edge in an increasingly globalised market • Consistent, active support from government for export sales Commercial orientation Focus Alliances Excellent execution Source: Mc. Kinsey • Specific products or roles in the value chain with defendable positions • Integration into a network of OEMs and sub-suppliers to gain market access, skills and minimum scale • World class capabilities and productivity 16

KEY MESSAGES 1. Much of the global defence spend is inaccessible to independent contractors, making players highly reliant on their domestic markets. Furthermore, changes in the industry are forcing players to consolidate, build alliances and carefully focus their businesses 2. Denel is facing a funding crisis, and there is significant risk associated with the current financial projections 17

DENEL CURRENTLY OFFERS AN IMPRESSIVE PRODUCT AND SERVICE PORTFOLIO. . . Source: Denel; team analysis 18

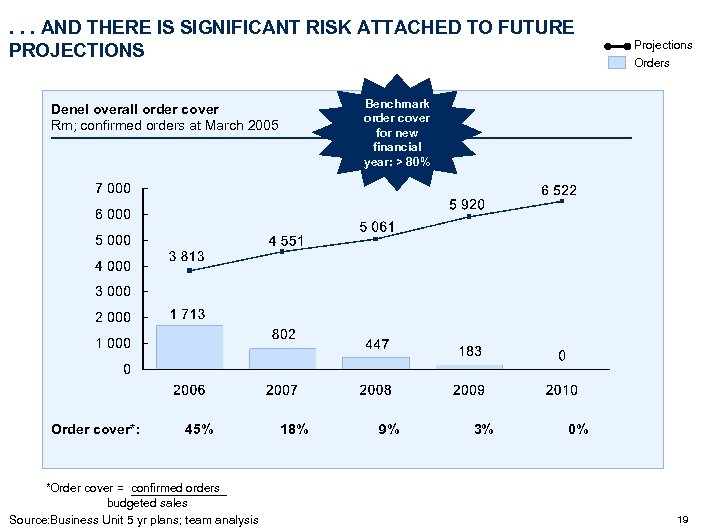

. . . AND THERE IS SIGNIFICANT RISK ATTACHED TO FUTURE PROJECTIONS Benchmark order cover for new financial year: > 80% Denel overall order cover Rm; confirmed orders at March 2005 Order cover*: 45% *Order cover = confirmed orders budgeted sales Source: Business Unit 5 yr plans; team analysis Projections Orders 18% 9% 3% 0% 19

KEY MESSAGES 1. Much of the global defence spend is inaccessible to independent contractors, making players highly reliant on their domestic markets. Furthermore, changes in the industry are forcing players to consolidate, build alliances and carefully focus their businesses 2. Denel is facing a funding crisis, and there is significant risk associated with the current financial projections 3. Denel is not viable under the current model. It no longer has the domestic market and scale to succeed as an independent systems integrator and exporter of a broad range of products 20

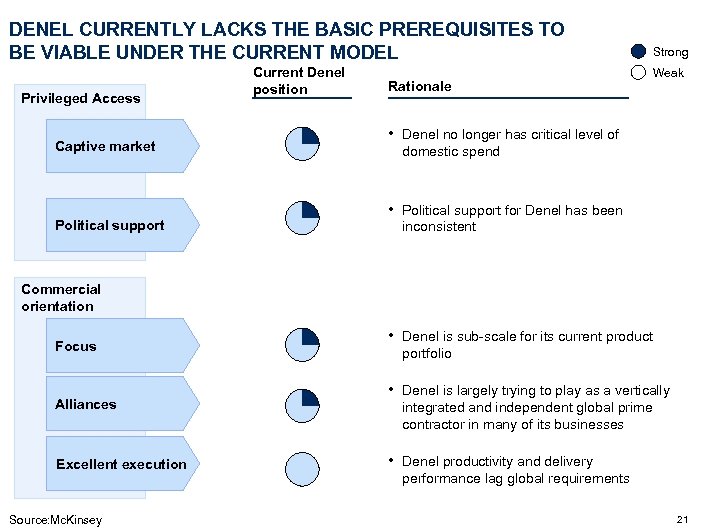

DENEL CURRENTLY LACKS THE BASIC PREREQUISITES TO BE VIABLE UNDER THE CURRENT MODEL Privileged Access Captive market Political support Current Denel position Rationale Strong Weak • Denel no longer has critical level of domestic spend • Political support for Denel has been inconsistent Commercial orientation Focus Alliances Excellent execution Source: Mc. Kinsey • Denel is sub-scale for its current product portfolio • Denel is largely trying to play as a vertically integrated and independent global prime contractor in many of its businesses • Denel productivity and delivery performance lag global requirements 21

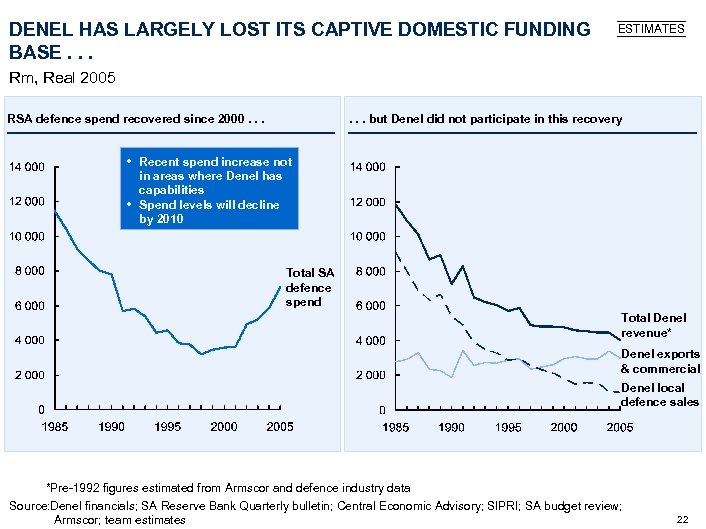

DENEL HAS LARGELY LOST ITS CAPTIVE DOMESTIC FUNDING BASE. . . ESTIMATES Rm, Real 2005 RSA defence spend recovered since 2000. . . but Denel did not participate in this recovery • Recent spend increase not • in areas where Denel has capabilities Spend levels will decline by 2010 Total SA defence spend Total Denel revenue* Denel exports & commercial Denel local defence sales *Pre-1992 figures estimated from Armscor and defence industry data Source: Denel financials; SA Reserve Bank Quarterly bulletin; Central Economic Advisory; SIPRI; SA budget review; Armscor; team estimates 22

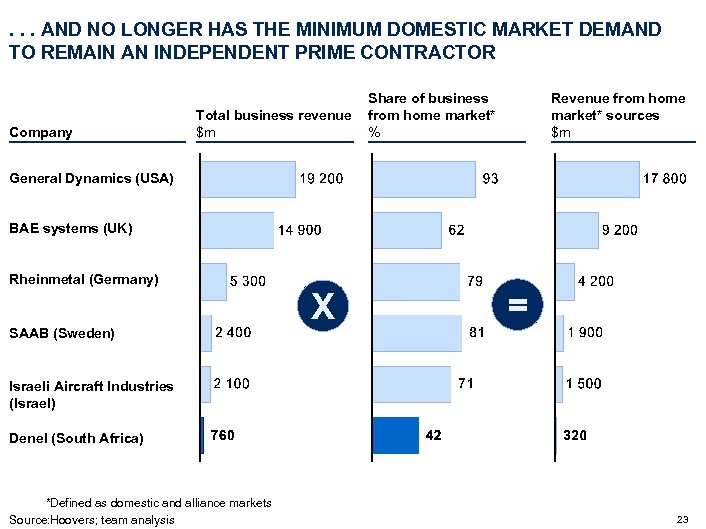

. . . AND NO LONGER HAS THE MINIMUM DOMESTIC MARKET DEMAND TO REMAIN AN INDEPENDENT PRIME CONTRACTOR Company Total business revenue $m Share of business from home market* % Revenue from home market* sources $m General Dynamics (USA) BAE systems (UK) Rheinmetal (Germany) SAAB (Sweden) X = Israeli Aircraft Industries (Israel) Denel (South Africa) *Defined as domestic and alliance markets Source: Hoovers; team analysis 23

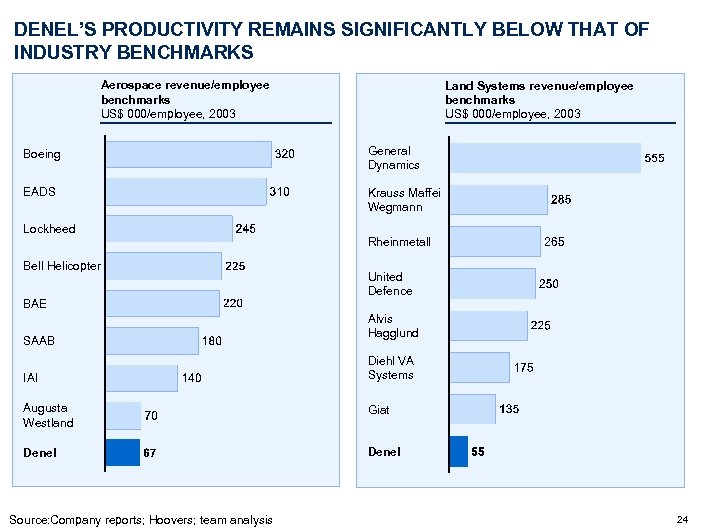

DENEL’S PRODUCTIVITY REMAINS SIGNIFICANTLY BELOW THAT OF INDUSTRY BENCHMARKS Aerospace revenue/employee benchmarks US$ 000/employee, 2003 Land Systems revenue/employee benchmarks US$ 000/employee, 2003 Boeing General Dynamics EADS Krauss Maffei Wegmann Lockheed Bell Helicopter BAE SAAB IAI Rheinmetall United Defence Alvis Hagglund Diehl VA Systems Augusta Westland Giat Denel Source: Company reports; Hoovers; team analysis 24

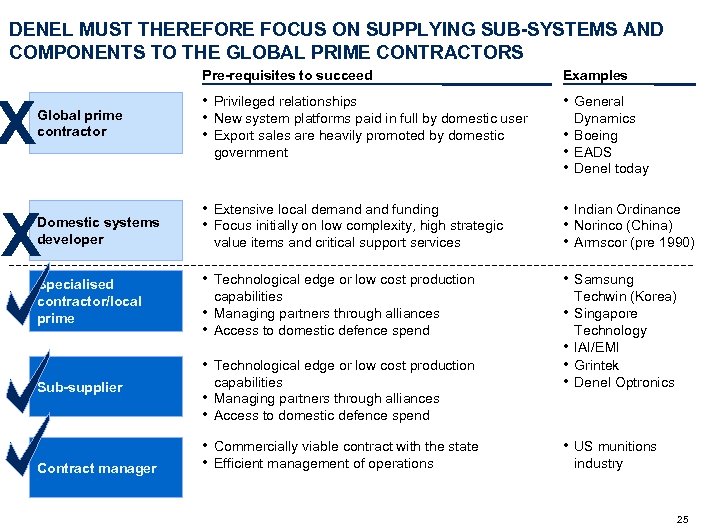

DENEL MUST THEREFORE FOCUS ON SUPPLYING SUB-SYSTEMS AND COMPONENTS TO THE GLOBAL PRIME CONTRACTORS Pre-requisites to succeed X Global prime contractor Examples • Privileged relationships • New system platforms paid in full by domestic user • Export sales are heavily promoted by domestic • General government X Domestic systems developer Specialised contractor/local prime • Extensive local demand funding • Focus initially on low complexity, high strategic value items and critical support services • Technological edge or low cost production • • capabilities Managing partners through alliances Access to domestic defence spend • Technological edge or low cost production Sub-supplier Contract manager • • capabilities Managing partners through alliances Access to domestic defence spend • Commercially viable contract with the state • Efficient management of operations • • • Dynamics Boeing EADS Denel today • Indian Ordinance • Norinco (China) • Armscor (pre 1990) • Samsung • • Techwin (Korea) Singapore Technology IAI/EMI Grintek Denel Optronics • US munitions industry 25

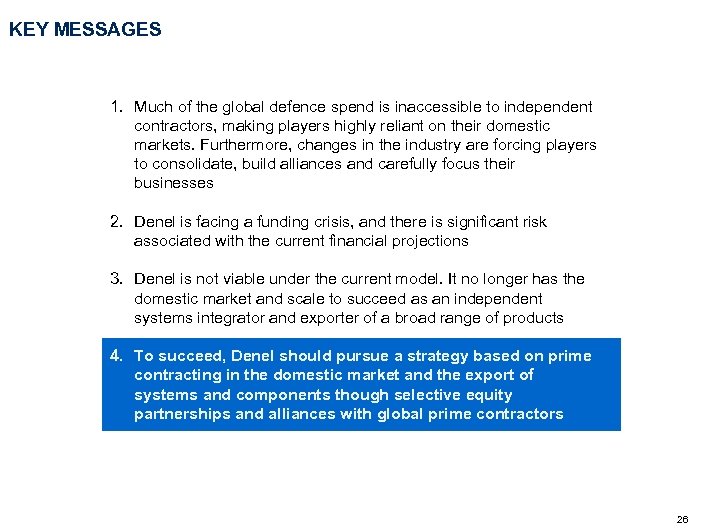

KEY MESSAGES 1. Much of the global defence spend is inaccessible to independent contractors, making players highly reliant on their domestic markets. Furthermore, changes in the industry are forcing players to consolidate, build alliances and carefully focus their businesses 2. Denel is facing a funding crisis, and there is significant risk associated with the current financial projections 3. Denel is not viable under the current model. It no longer has the domestic market and scale to succeed as an independent systems integrator and exporter of a broad range of products 4. To succeed, Denel should pursue a strategy based on prime contracting in the domestic market and the export of systems and components though selective equity partnerships and alliances with global prime contractors 26

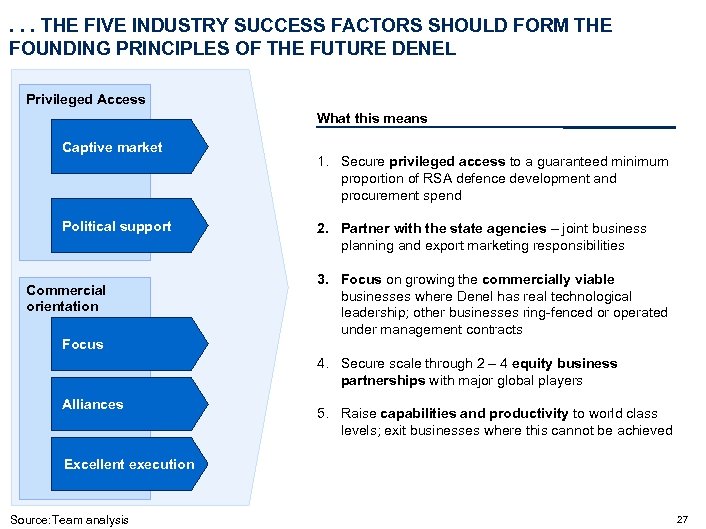

. . . THE FIVE INDUSTRY SUCCESS FACTORS SHOULD FORM THE FOUNDING PRINCIPLES OF THE FUTURE DENEL Privileged Access What this means Captive market Political support Commercial orientation Focus 1. Secure privileged access to a guaranteed minimum proportion of RSA defence development and procurement spend 2. Partner with the state agencies – joint business planning and export marketing responsibilities 3. Focus on growing the commercially viable businesses where Denel has real technological leadership; other businesses ring-fenced or operated under management contracts 4. Secure scale through 2 – 4 equity business partnerships with major global players Alliances 5. Raise capabilities and productivity to world class levels; exit businesses where this cannot be achieved Excellent execution Source: Team analysis 27

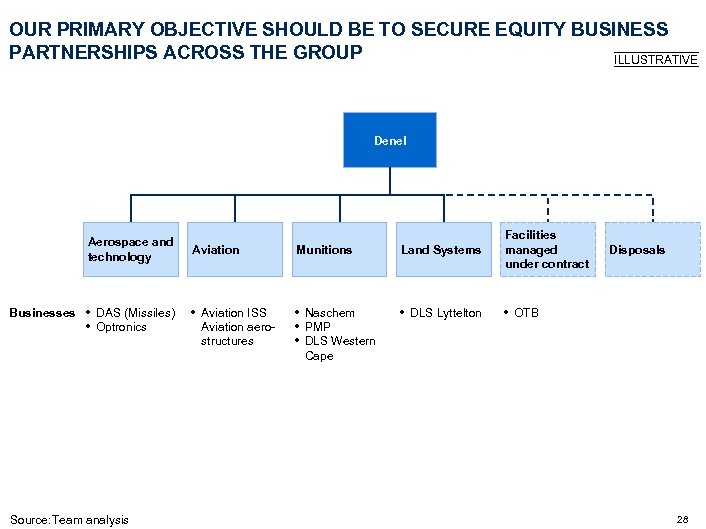

OUR PRIMARY OBJECTIVE SHOULD BE TO SECURE EQUITY BUSINESS PARTNERSHIPS ACROSS THE GROUP ILLUSTRATIVE Denel Aerospace and technology Businesses • DAS (Missiles) • Optronics Aviation Munitions Land Systems Facilities managed under contract • Aviation ISS • Naschem • PMP • DLS Western • DLS Lyttelton • OTB Aviation aerostructures Disposals Cape Source: Team analysis 28

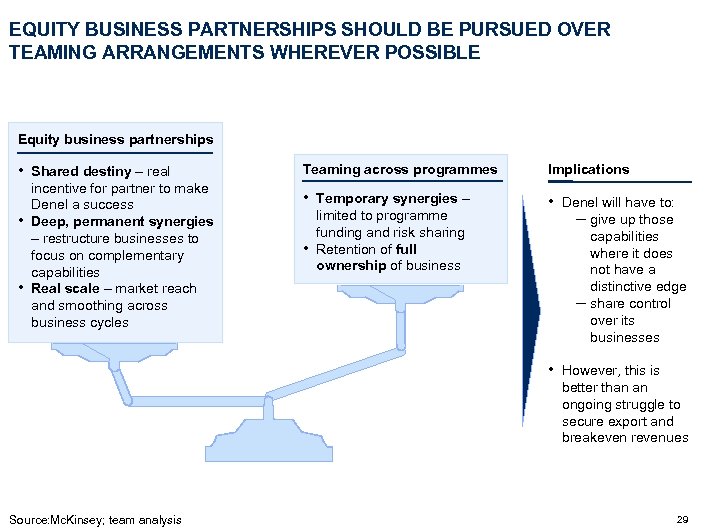

EQUITY BUSINESS PARTNERSHIPS SHOULD BE PURSUED OVER TEAMING ARRANGEMENTS WHEREVER POSSIBLE Equity business partnerships • Shared destiny – real • • incentive for partner to make Denel a success Deep, permanent synergies – restructure businesses to focus on complementary capabilities Real scale – market reach and smoothing across business cycles Teaming across programmes Implications • Temporary synergies – • Denel will have to: – give up those • limited to programme funding and risk sharing Retention of full ownership of business – capabilities where it does not have a distinctive edge share control over its businesses • However, this is better than an ongoing struggle to secure export and breakeven revenues Source: Mc. Kinsey; team analysis 29

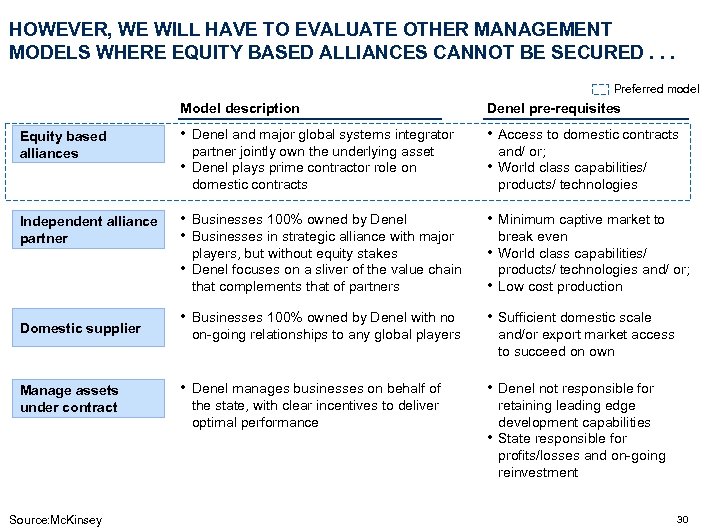

HOWEVER, WE WILL HAVE TO EVALUATE OTHER MANAGEMENT MODELS WHERE EQUITY BASED ALLIANCES CANNOT BE SECURED. . . Preferred model Model description Denel pre-requisites Equity based alliances • Denel and major global systems integrator • Access to domestic contracts Independent alliance partner • Businesses 100% owned by Denel • Businesses in strategic alliance with major • • Domestic supplier Manage assets under contract Source: Mc. Kinsey partner jointly own the underlying asset Denel plays prime contractor role on domestic contracts players, but without equity stakes Denel focuses on a sliver of the value chain that complements that of partners • Businesses 100% owned by Denel with no • • Minimum captive market to • • the state, with clear incentives to deliver optimal performance break even World class capabilities/ products/ technologies and/ or; Low cost production • Sufficient domestic scale on-going relationships to any global players • Denel manages businesses on behalf of and/ or; World class capabilities/ products/ technologies and/or export market access to succeed on own • Denel not responsible for • retaining leading edge development capabilities State responsible for profits/losses and on-going reinvestment 30

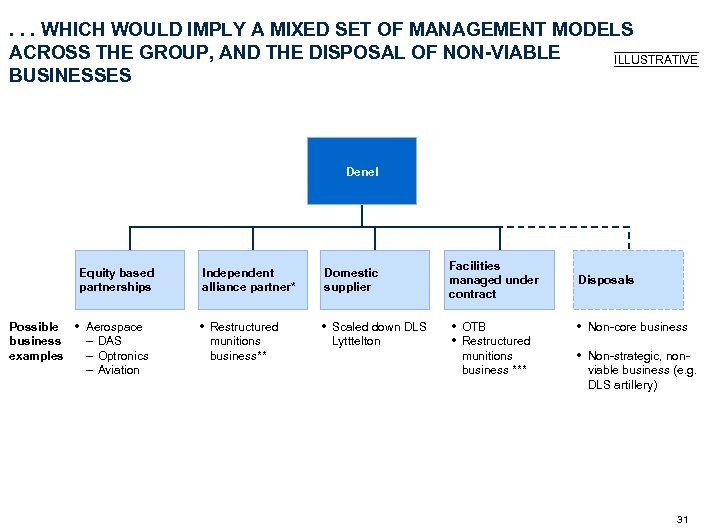

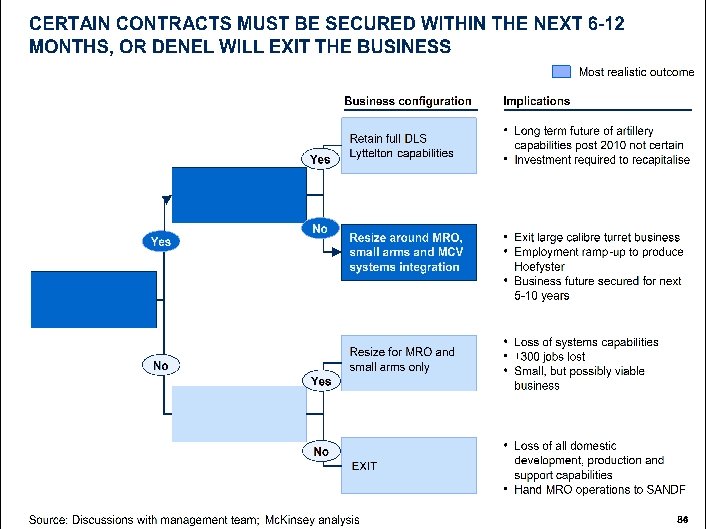

. . . WHICH WOULD IMPLY A MIXED SET OF MANAGEMENT MODELS ACROSS THE GROUP, AND THE DISPOSAL OF NON-VIABLE ILLUSTRATIVE BUSINESSES Denel Equity based partnerships Possible business examples • Aerospace – DAS – Optronics – Aviation Independent alliance partner* • Restructured munitions business** Domestic supplier • Scaled down DLS Lytttelton Facilities managed under contract • OTB • Restructured munitions business *** Disposals • Non-core business • Non-strategic, nonviable business (e. g. DLS artillery) 31

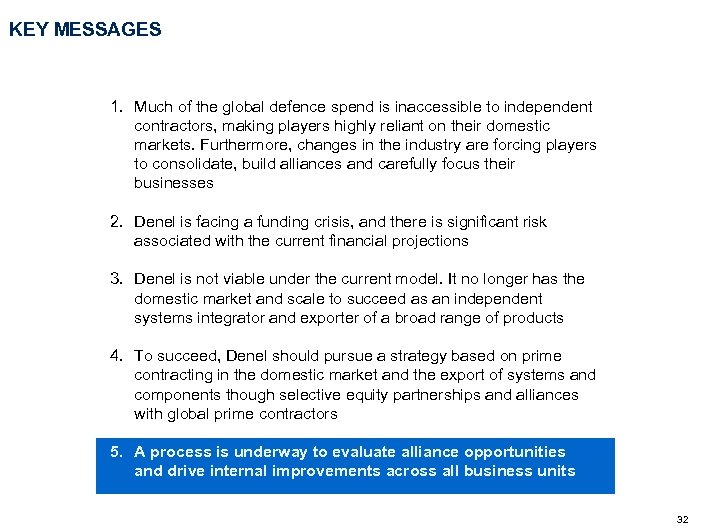

KEY MESSAGES 1. Much of the global defence spend is inaccessible to independent contractors, making players highly reliant on their domestic markets. Furthermore, changes in the industry are forcing players to consolidate, build alliances and carefully focus their businesses 2. Denel is facing a funding crisis, and there is significant risk associated with the current financial projections 3. Denel is not viable under the current model. It no longer has the domestic market and scale to succeed as an independent systems integrator and exporter of a broad range of products 4. To succeed, Denel should pursue a strategy based on prime contracting in the domestic market and the export of systems and components though selective equity partnerships and alliances with global prime contractors 5. A process is underway to evaluate alliance opportunities and drive internal improvements across all business units 32

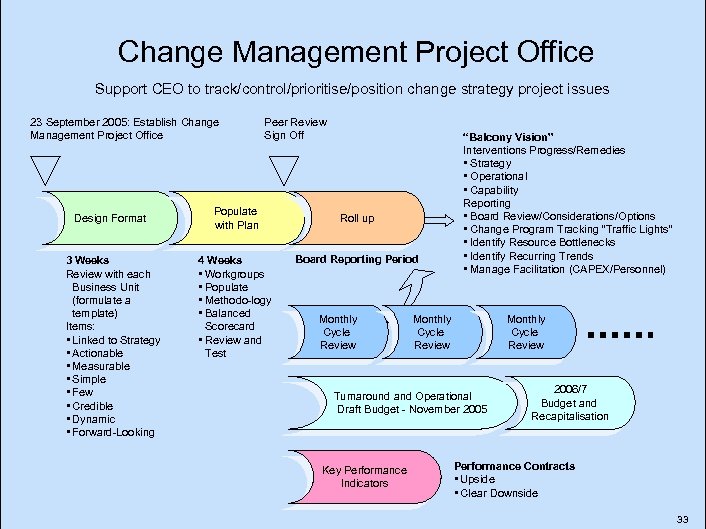

Change Management Project Office Support CEO to track/control/prioritise/position change strategy project issues 23 September 2005: Establish Change Management Project Office Design Format 3 Weeks Review with each Business Unit (formulate a template) Items: • Linked to Strategy • Actionable • Measurable • Simple • Few • Credible • Dynamic • Forward-Looking Peer Review Sign Off Populate with Plan 4 Weeks • Workgroups • Populate • Methodo-logy • Balanced Scorecard • Review and Test Roll up Board Reporting Period Monthly Cycle Review “Balcony Vision” Interventions Progress/Remedies • Strategy • Operational • Capability Reporting • Board Review/Considerations/Options • Change Program Tracking “Traffic Lights” • Identify Resource Bottlenecks • Identify Recurring Trends • Manage Facilitation (CAPEX/Personnel) Monthly Cycle Review Turnaround and Operational Draft Budget - November 2005 Key Performance Indicators 2006/7 Budget and Recapitalisation Performance Contracts • Upside • Clear Downside 33

34

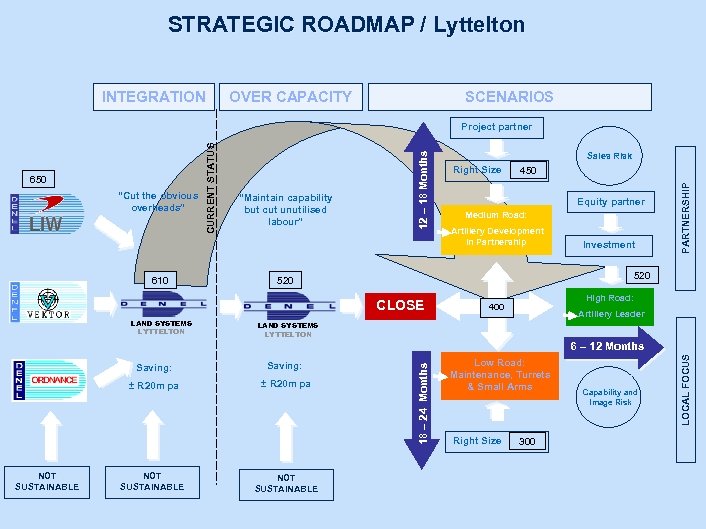

STRATEGIC ROADMAP / Lyttelton INTEGRATION OVER CAPACITY SCENARIOS 610 “Maintain capability but cut unutilised labour” Right Size 450 Equity partner Medium Road: Artillery Development in Partnership Investment 520 CLOSE LAND SYSTEMS LYTTELTON Sales Risk PARTNERSHIP “Cut the obvious overheads” 12 – 18 Months 650 CURRENT STATUS Project partner High Road: 400 Artillery Leader LAND SYSTEMS LYTTELTON ± R 20 m pa NOT SUSTAINABLE Saving: ± R 20 m pa NOT SUSTAINABLE Low Road: Maintenance, Turrets & Small Arms Right Size 300 Capability and Image Risk LOCAL FOCUS Saving: 18 – 24 Months 6 – 12 Months

Thank you

671fa93d066cac852015675b818b729e.ppt