cecb48da91ed8ea927c5302e053aa8bf.ppt

- Количество слайдов: 29

Creating a Compelling and Persuasive Series A Investor Presentation Jaine Lucas Ellen Weber 1

Creating a Compelling and Persuasive Series A Investor Presentation Jaine Lucas Ellen Weber 1

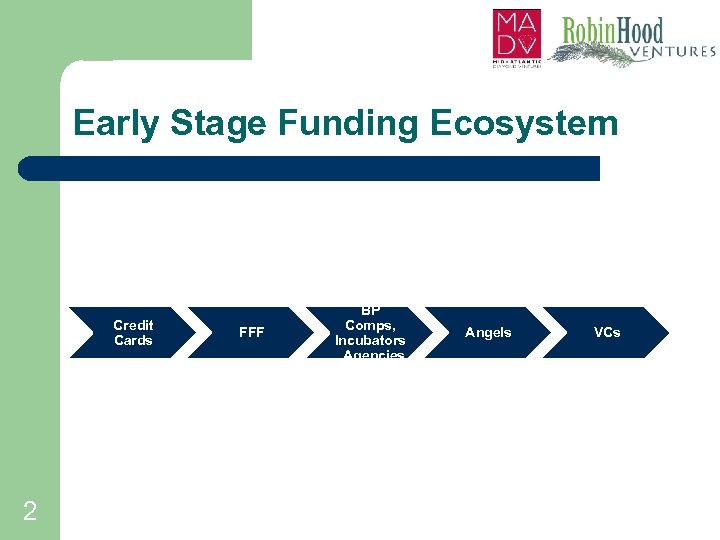

Early Stage Funding Ecosystem Credit Cards 2 FFF BP Comps, Incubators , Agencies Angels VCs

Early Stage Funding Ecosystem Credit Cards 2 FFF BP Comps, Incubators , Agencies Angels VCs

Angel Investors Angel investors are: • • • 3 Individuals who invest his or her own money in an entrepreneurial firm Usually located within 150 -mile radius of metropolitan areas Motivated by more than profit

Angel Investors Angel investors are: • • • 3 Individuals who invest his or her own money in an entrepreneurial firm Usually located within 150 -mile radius of metropolitan areas Motivated by more than profit

Angel Investors – Where to find them • • • 4 Networking (events sponsored by MAC Alliance, AWE, MADV, EFGP, PSL etc. ) Universities with strong entrepreneurship programs Business incubators IP attorneys, SBA, venture capitalists, big four accounting firms and more Advisory and consulting firms Angel. Soft. net

Angel Investors – Where to find them • • • 4 Networking (events sponsored by MAC Alliance, AWE, MADV, EFGP, PSL etc. ) Universities with strong entrepreneurship programs Business incubators IP attorneys, SBA, venture capitalists, big four accounting firms and more Advisory and consulting firms Angel. Soft. net

Philadelphia Angel Groups 5

Philadelphia Angel Groups 5

Other Early Funders • Ben Franklin Technology Partners • • Bioadvance • • 6 #3 & #5 on Entrepreneur magazine’s list of top early-stage funders: 15 deals for SEP, 13 deals for NEP Life science start-ups via a $20 MM greenhouse fund Therapeutics, devices, diagnostics and platform technologies focused on human health

Other Early Funders • Ben Franklin Technology Partners • • Bioadvance • • 6 #3 & #5 on Entrepreneur magazine’s list of top early-stage funders: 15 deals for SEP, 13 deals for NEP Life science start-ups via a $20 MM greenhouse fund Therapeutics, devices, diagnostics and platform technologies focused on human health

Other Early Funders • • First Round Capital Originate Ventures Osage Ventures Dream. It Ventures • • First State Innovation • • Privately held initiative with a network of 230 accredited, high net worth investors (85% in Delaware, 15% in Delaware Valley) Mentor. Tech Ventures • • 7 Seed funding, collaborative work space, mentors/advisors Companies originating at University of Pennsylvania Medical devices, IT, marketing technology

Other Early Funders • • First Round Capital Originate Ventures Osage Ventures Dream. It Ventures • • First State Innovation • • Privately held initiative with a network of 230 accredited, high net worth investors (85% in Delaware, 15% in Delaware Valley) Mentor. Tech Ventures • • 7 Seed funding, collaborative work space, mentors/advisors Companies originating at University of Pennsylvania Medical devices, IT, marketing technology

Before getting involved with angels: • • • 8 Ensure you want a “partner” Be sure you’re ready to have a Board of Directors Understand that involving angels means giving up equity Know that your forecasts will be dramatically reforecasted (as will your valuation) Be prepared to deliver monthly financials and strategic updates

Before getting involved with angels: • • • 8 Ensure you want a “partner” Be sure you’re ready to have a Board of Directors Understand that involving angels means giving up equity Know that your forecasts will be dramatically reforecasted (as will your valuation) Be prepared to deliver monthly financials and strategic updates

An Investor Pitch • What it is • • What it isn’t • • 9 An eight to 12 -minute presentation with an investor focus Grabs attention early and keeps it by hitting highlights Leaves the investor eager to know more • A technology presentation A sales presentation An opportunity to “get in the weeds”

An Investor Pitch • What it is • • What it isn’t • • 9 An eight to 12 -minute presentation with an investor focus Grabs attention early and keeps it by hitting highlights Leaves the investor eager to know more • A technology presentation A sales presentation An opportunity to “get in the weeds”

What We’ll Want to Know • • How do you make money? • Do you have proof that customers will buy? Is it essential or a nice-to-have? • Can you defend it in the market? What’s the secret sauce? • 10 What is the opportunity? How big is it? Can you execute? Can you prove it with the management team’s track record? • What will you do with our money?

What We’ll Want to Know • • How do you make money? • Do you have proof that customers will buy? Is it essential or a nice-to-have? • Can you defend it in the market? What’s the secret sauce? • 10 What is the opportunity? How big is it? Can you execute? Can you prove it with the management team’s track record? • What will you do with our money?

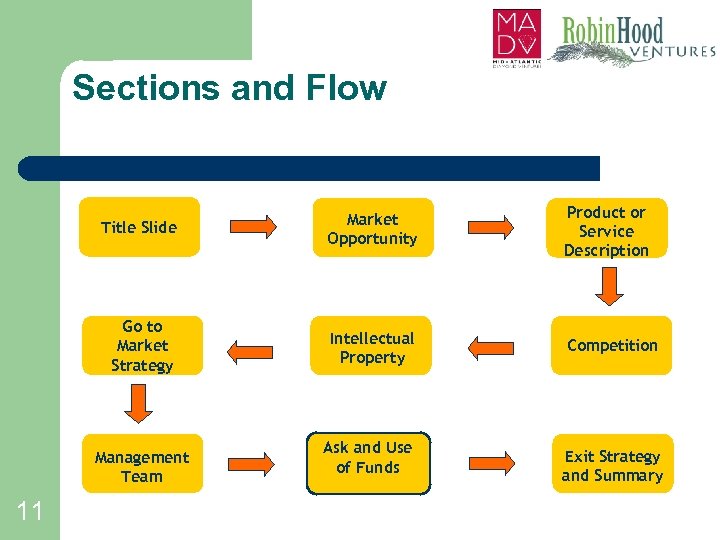

Sections and Flow Title Slide Market Opportunity Product or Service Description Go to Market Strategy Intellectual Property Competition Management Team 11 Ask and Use of Funds Exit Strategy and Summary

Sections and Flow Title Slide Market Opportunity Product or Service Description Go to Market Strategy Intellectual Property Competition Management Team 11 Ask and Use of Funds Exit Strategy and Summary

Executive Summary 12

Executive Summary 12

Connecting to RHV • • Check in periodically for updates • Find a referral or sponsor– look at our bios to see who we are and who we might know …multiple referrals are even better • 13 Go to our website, follow our process Have a clear value proposition (and “secret sauce”)

Connecting to RHV • • Check in periodically for updates • Find a referral or sponsor– look at our bios to see who we are and who we might know …multiple referrals are even better • 13 Go to our website, follow our process Have a clear value proposition (and “secret sauce”)

We’re investing in you • • 14 Be passionate Be entrepreneurial Be honest Be coachable Do your homework Listen and accept negative feedback Be a (or find a) business person managing a technology-based company

We’re investing in you • • 14 Be passionate Be entrepreneurial Be honest Be coachable Do your homework Listen and accept negative feedback Be a (or find a) business person managing a technology-based company

Good Luck! www. robinhoodventures. com Ellen Weber, Executive Director 3711 Market Street, 8 th Floor Philadelphia, PA 19104 15

Good Luck! www. robinhoodventures. com Ellen Weber, Executive Director 3711 Market Street, 8 th Floor Philadelphia, PA 19104 15

Title Slide • Include on the slide • • • Talk about… • • 16 Company name, logo and date of presentation Ensure a highly professional image – get help if you need it What your company does (high level) Open with a “wow statement” that commands attention

Title Slide • Include on the slide • • • Talk about… • • 16 Company name, logo and date of presentation Ensure a highly professional image – get help if you need it What your company does (high level) Open with a “wow statement” that commands attention

Market/Opportunity • • • What is the problem your product or service solves? How is the market solving the problem currently? Why is your solution superior? • • • What is the target market and size? • • • 17 What is your value proposition Must be compelling and believable What segments are you addressing? What are the size of each? Prioritize segments; provide justification

Market/Opportunity • • • What is the problem your product or service solves? How is the market solving the problem currently? Why is your solution superior? • • • What is the target market and size? • • • 17 What is your value proposition Must be compelling and believable What segments are you addressing? What are the size of each? Prioritize segments; provide justification

Product/Service Description • • 18 Briefly explain your product or service Why and how does it solve the defined problem? Provide diagrams, photos, videos Avoid appearing too “emotionally attached” to the product Don’t get in the weeds: this is not a sales presentation!

Product/Service Description • • 18 Briefly explain your product or service Why and how does it solve the defined problem? Provide diagrams, photos, videos Avoid appearing too “emotionally attached” to the product Don’t get in the weeds: this is not a sales presentation!

Competitive Landscape • • • What are firms and products are providing solutions to the problem? Use pie charts to show market share of competitors What differentiates your product or service? • • 19 • Superior performance, lower cost alternative, lower side effects, etc. How entrenched is the competition? What are their weaknesses? Perceptual maps can help in some cases What are the “barriers to entry” for others?

Competitive Landscape • • • What are firms and products are providing solutions to the problem? Use pie charts to show market share of competitors What differentiates your product or service? • • 19 • Superior performance, lower cost alternative, lower side effects, etc. How entrenched is the competition? What are their weaknesses? Perceptual maps can help in some cases What are the “barriers to entry” for others?

Intellectual Property • What intellectual property do you have? • • • Do you have a proprietary and defensible position? Mention licensing arrangements, patents filed and what type Trade secrets, copyrights, trademarks, etc. IP is an additional security blanket for investors 20

Intellectual Property • What intellectual property do you have? • • • Do you have a proprietary and defensible position? Mention licensing arrangements, patents filed and what type Trade secrets, copyrights, trademarks, etc. IP is an additional security blanket for investors 20

Go to Market Strategy • • How will you reach target customers and drive revenues? How will you make money (revenue model)? • • • 21 • Sell product or service direct to customer License technology Develop product then sell to competitor Merger-acquisition What are the key messages for your target market segments? Describe marketing and sales plan What partnerships or alliances are necessary? Taking it from idea to market success

Go to Market Strategy • • How will you reach target customers and drive revenues? How will you make money (revenue model)? • • • 21 • Sell product or service direct to customer License technology Develop product then sell to competitor Merger-acquisition What are the key messages for your target market segments? Describe marketing and sales plan What partnerships or alliances are necessary? Taking it from idea to market success

People • Management Team • • Advisory Board • • • 22 List two or three key players: CEO is the focus List successful exits, impressive affiliations, inventions, discoveries, degrees, etc. Acknowledge additional key players needed List three or four highly impressive members Round out deficiencies or weaknesses of management team Notable industry experts, key executives or former key executives in your field/industry Demonstrate you have the right team to execute!

People • Management Team • • Advisory Board • • • 22 List two or three key players: CEO is the focus List successful exits, impressive affiliations, inventions, discoveries, degrees, etc. Acknowledge additional key players needed List three or four highly impressive members Round out deficiencies or weaknesses of management team Notable industry experts, key executives or former key executives in your field/industry Demonstrate you have the right team to execute!

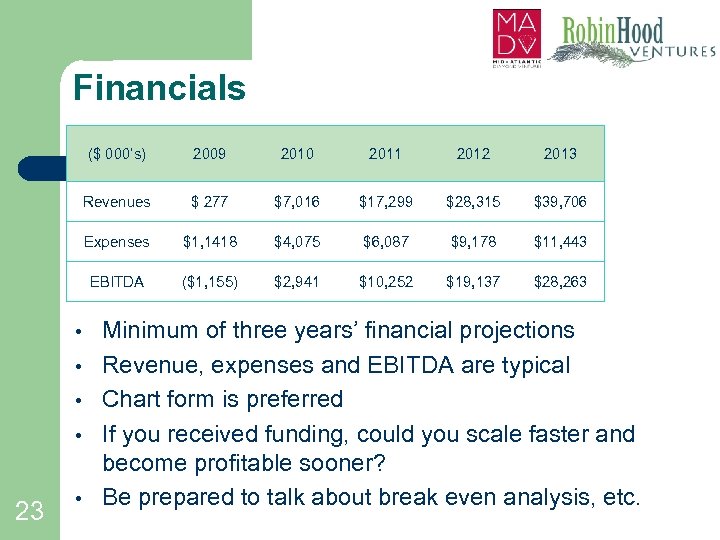

Financials ($ 000’s) • 23 • 2012 2013 $ 277 $7, 016 $17, 299 $28, 315 $39, 706 $1, 1418 $4, 075 $6, 087 $9, 178 $11, 443 EBITDA • 2011 Expenses • 2010 Revenues • 2009 ($1, 155) $2, 941 $10, 252 $19, 137 $28, 263 Minimum of three years’ financial projections Revenue, expenses and EBITDA are typical Chart form is preferred If you received funding, could you scale faster and become profitable sooner? Be prepared to talk about break even analysis, etc.

Financials ($ 000’s) • 23 • 2012 2013 $ 277 $7, 016 $17, 299 $28, 315 $39, 706 $1, 1418 $4, 075 $6, 087 $9, 178 $11, 443 EBITDA • 2011 Expenses • 2010 Revenues • 2009 ($1, 155) $2, 941 $10, 252 $19, 137 $28, 263 Minimum of three years’ financial projections Revenue, expenses and EBITDA are typical Chart form is preferred If you received funding, could you scale faster and become profitable sooner? Be prepared to talk about break even analysis, etc.

Funding and Uses • • • 24 How much have you raised to date and from whom? Show founders investment and/or “skin in the game” from management team List current and future asks How will the funds be used? For therapeutics and medical devices, show clinical trials milestone with needed funding

Funding and Uses • • • 24 How much have you raised to date and from whom? Show founders investment and/or “skin in the game” from management team List current and future asks How will the funds be used? For therapeutics and medical devices, show clinical trials milestone with needed funding

Exit Strategy • • When will investors receive back their money? What multiples are likely? Are there comparable exits? • • What will be the scenario? • • 25 Provide examples where possible Acquisition by competitor or market leader IPO (proceed w/ caution!)

Exit Strategy • • When will investors receive back their money? What multiples are likely? Are there comparable exits? • • What will be the scenario? • • 25 Provide examples where possible Acquisition by competitor or market leader IPO (proceed w/ caution!)

Special Issues for Therapeutics • • Revenue projections are often not relevant for therapeutics – that’s OK Long and expensive runways to commercialization • • • 26 Phase 1 -3 studies are time and cost intensive Milestone charts demonstrate an experienced and knowledgeable CEO Higher failure rate compared to other technology sectors Show you can mitigate risk Think out of the box for investment

Special Issues for Therapeutics • • Revenue projections are often not relevant for therapeutics – that’s OK Long and expensive runways to commercialization • • • 26 Phase 1 -3 studies are time and cost intensive Milestone charts demonstrate an experienced and knowledgeable CEO Higher failure rate compared to other technology sectors Show you can mitigate risk Think out of the box for investment

Summary • • 27 • Reiterate the market problem your product/service solves and why it represents a disruptive or superior approach State the large market potential and scalability of your business Emphasize you have the right team to turn idea into profits Thank the audience and solicit questions Put your logo and contact info on it.

Summary • • 27 • Reiterate the market problem your product/service solves and why it represents a disruptive or superior approach State the large market potential and scalability of your business Emphasize you have the right team to turn idea into profits Thank the audience and solicit questions Put your logo and contact info on it.

Valuation. . . • Delay talk about valuation until you’ve sold them on the idea • • An entrepreneur’s company is always worth less than he/she thinks Pre-money/early stage valuations are imprecise and difficult • • Few assets, little cash flow Valuations are complex • 28 And never in an investor forum! Make it a closed door discussion • Science (formulas, number crunching) Art (how do you apply the numbers? )

Valuation. . . • Delay talk about valuation until you’ve sold them on the idea • • An entrepreneur’s company is always worth less than he/she thinks Pre-money/early stage valuations are imprecise and difficult • • Few assets, little cash flow Valuations are complex • 28 And never in an investor forum! Make it a closed door discussion • Science (formulas, number crunching) Art (how do you apply the numbers? )

Factors Affecting Valuation • • • 29 Previous Investment Money required to achieve exit Time to achieve exit Market adoption and long-term market potential Competitive landscape Financials Value proposition Entrepreneurial ecosystem Investor comfort level

Factors Affecting Valuation • • • 29 Previous Investment Money required to achieve exit Time to achieve exit Market adoption and long-term market potential Competitive landscape Financials Value proposition Entrepreneurial ecosystem Investor comfort level