8fe06e21eb5bb10b0cf1a53eeae2f6e2.ppt

- Количество слайдов: 24

Course Title

Planning for Profits – Budgeting Essentials Lori Supinie President Senseney Music, Inc.

Session Agenda • What is a budget? • Why prepare a budget? • Where do I start? • How do I carry out the process? • How do I use the budget?

What is a Budget? • A set of financial statements showing the expected results for a future period. • Expresses targets, goals, or limits. • Establishes control of operations. • Basis for evaluating performance.

What is a Budget? A PLAN FOR PROFITS “You can’t build a house without a blue print; similarly you can’t make a profit if you don’t plan for it. ” Alan Friedman “Hope is not a plan. ” Andy Supinie

Why Prepare a Budget? • Quantifies goals • Provides a yardstick for measuring success • Relieves lack of direction • Communicates priorities to personnel • Financing requirements • Credibility

Why Prepare a Budget? According to my banker: 50% of clients prepare a budget 75% of those who do actually use it “Those who do prepare a budget are the most successful companies. Benefits include input from all employees and more effective allocation of discretionary expenses, such as advertising. ”

Why Prepare a Budget? According to Alan Friedman, CPA: 30 -35% of clients prepare an annual budget 10% of music industry clients prepare an annual budget “There is ABSOLUTELY a correlation between those clients who prepare and use budgets and their success and stability. If nothing else, there are fewer surprises at year end. ”

Where do I start? Scope: What is the format of the budget? • Done on an annual basis. • Divide year into quarters, months even better. • Divide total store operations into departments or broad product categories.

Budgeted Income Statement Southwinds Music, Inc. Assume a Goal of $480, 000 Annual Accessories Sales

Budgeted Income Statement Estimate Sales: • Based on last year or prior years • Consider the effects of: – – Inflation / Deflation New products/markets or discontinued ones Marketing/promotional efforts Overall economic factors • Experience and best judgment

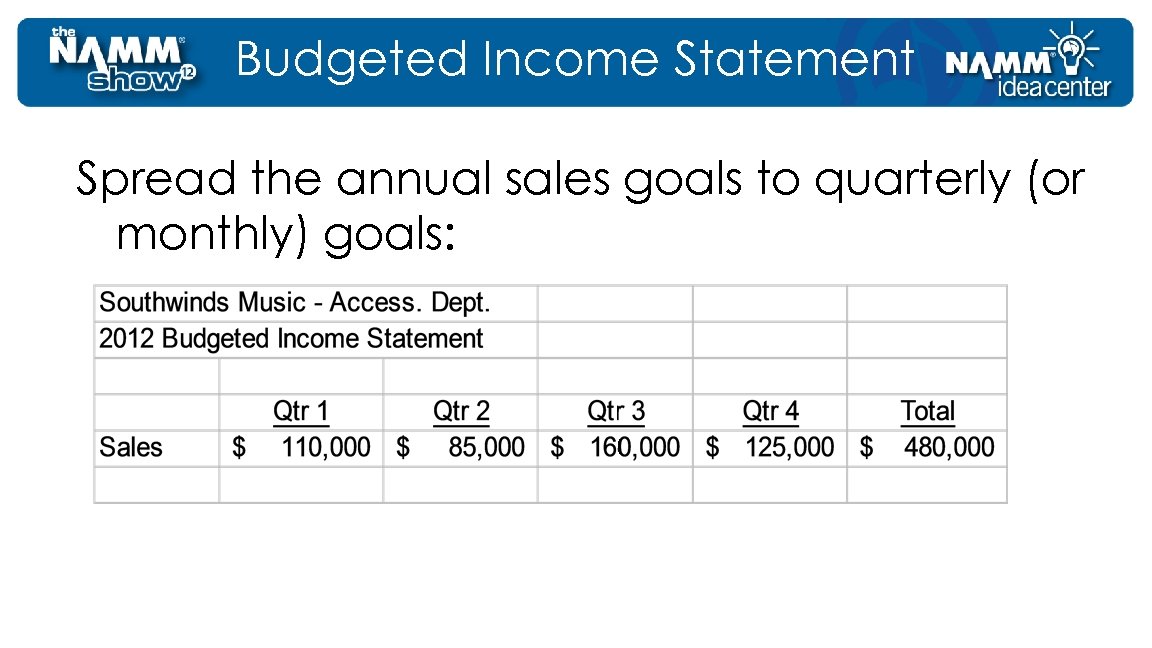

Budgeted Income Statement Spread the annual sales goals to quarterly (or monthly) goals:

Budgeted Income Statement Estimate Cost of Goods Sold: • Express as a percentage of sales • Consider effects of changes in: – – Vendors and vendor discounts Master orders Freight in Competitive pressures

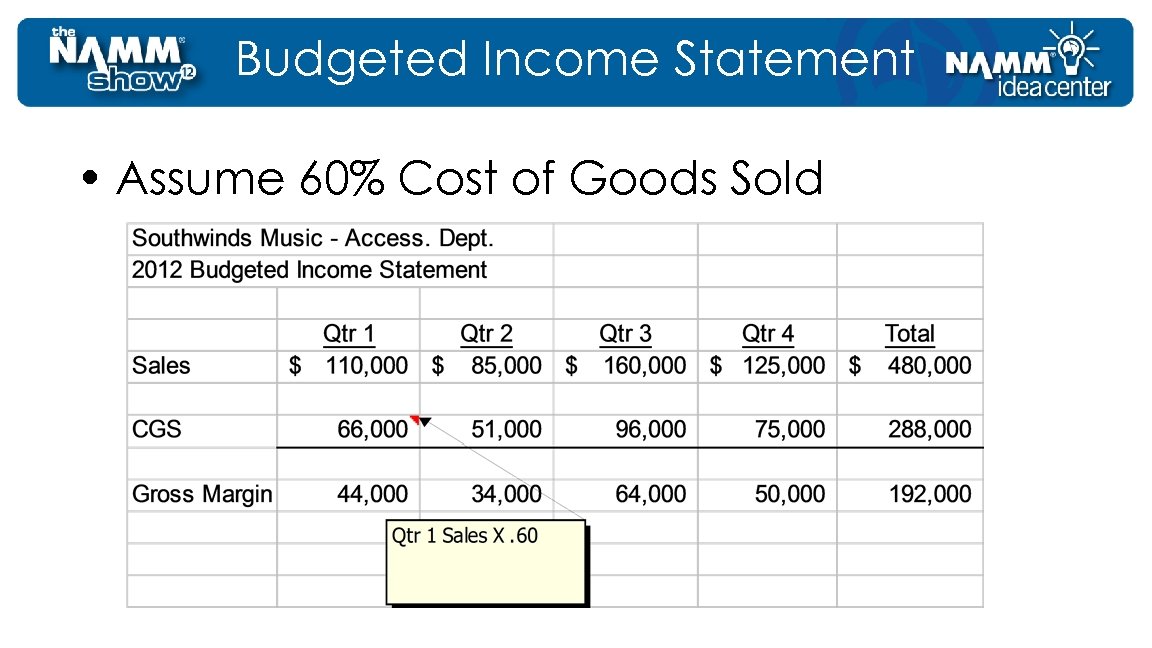

Budgeted Income Statement • Assume 60% Cost of Goods Sold

Budgeted Income Statement Estimate Other Revenues: • • • Lessons / Studio Rent Workshop Income Finance Charges Shipping & Handling Charges Repair

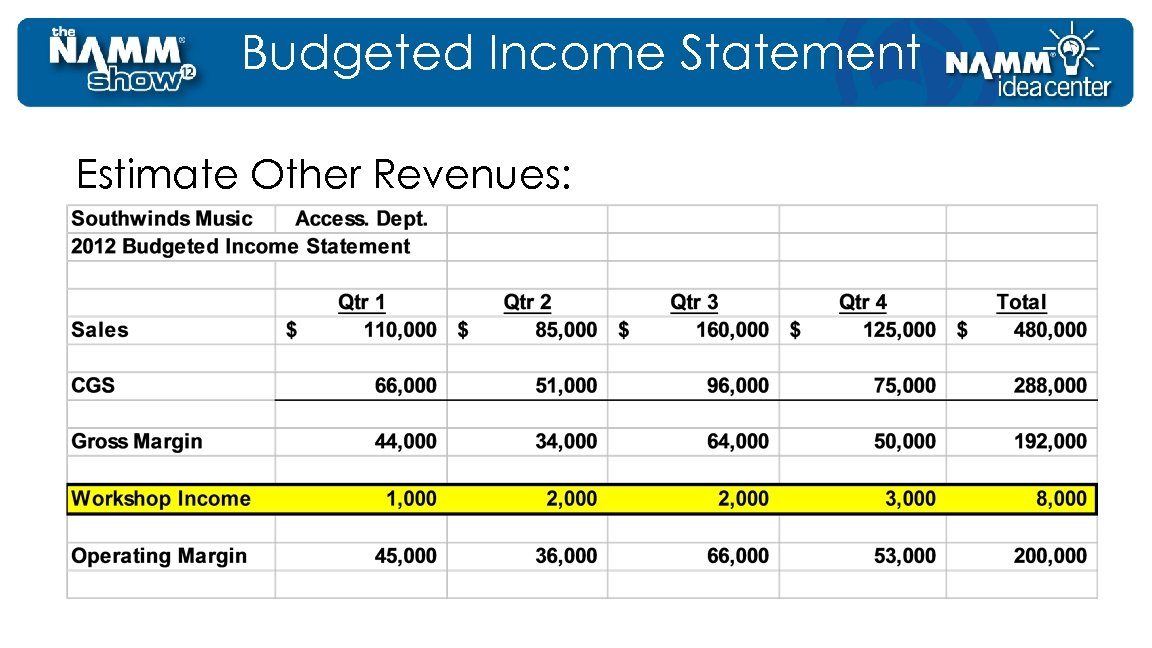

Budgeted Income Statement Estimate Other Revenues:

Budgeted Income Statement Estimate Expenses: Allocate expenses to departments or product categories according to some activity measure such as: – Square footage (occupancy) – # of employees / usage (communications) – Time (salaries) – Direct attribution (contract labor)

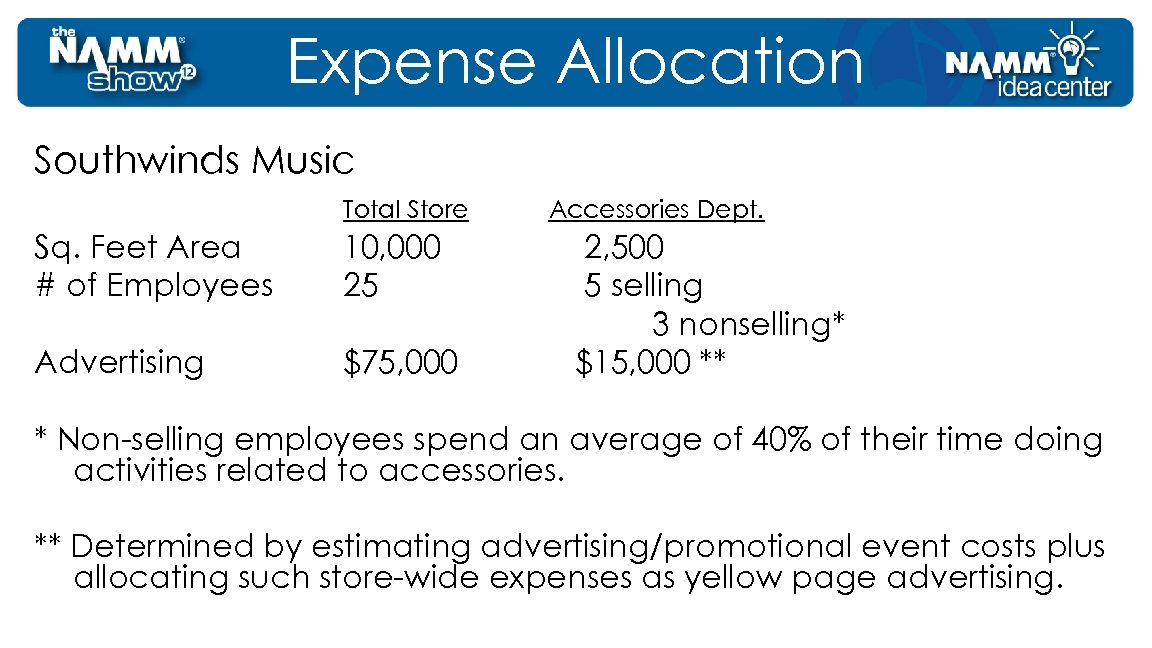

Expense Allocation Southwinds Music Total Store Sq. Feet Area # of Employees 10, 000 25 Advertising $75, 000 Accessories Dept. 2, 500 5 selling 3 nonselling* $15, 000 ** * Non-selling employees spend an average of 40% of their time doing activities related to accessories. ** Determined by estimating advertising/promotional event costs plus allocating such store-wide expenses as yellow page advertising.

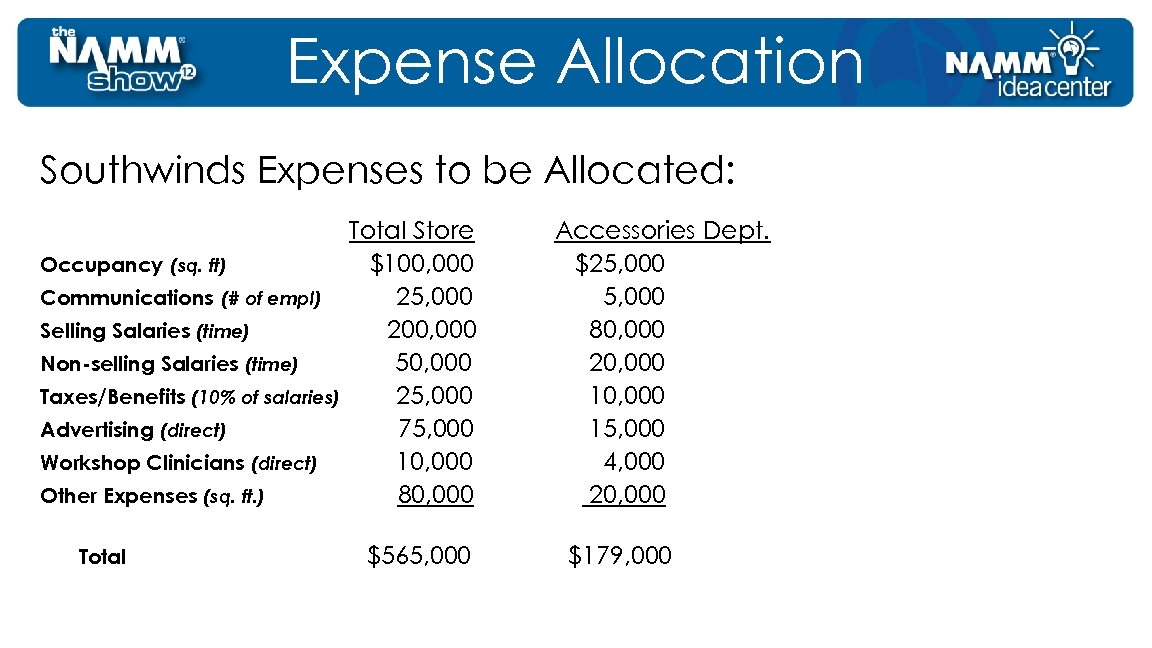

Expense Allocation Southwinds Expenses to be Allocated: Occupancy (sq. ft) Communications (# of empl) Selling Salaries (time) Non-selling Salaries (time) Taxes/Benefits (10% of salaries) Advertising (direct) Workshop Clinicians (direct) Other Expenses (sq. ft. ) Total Store $100, 000 25, 000 200, 000 50, 000 25, 000 75, 000 10, 000 80, 000 $565, 000 Accessories Dept. $25, 000 80, 000 20, 000 15, 000 4, 000 20, 000 $179, 000

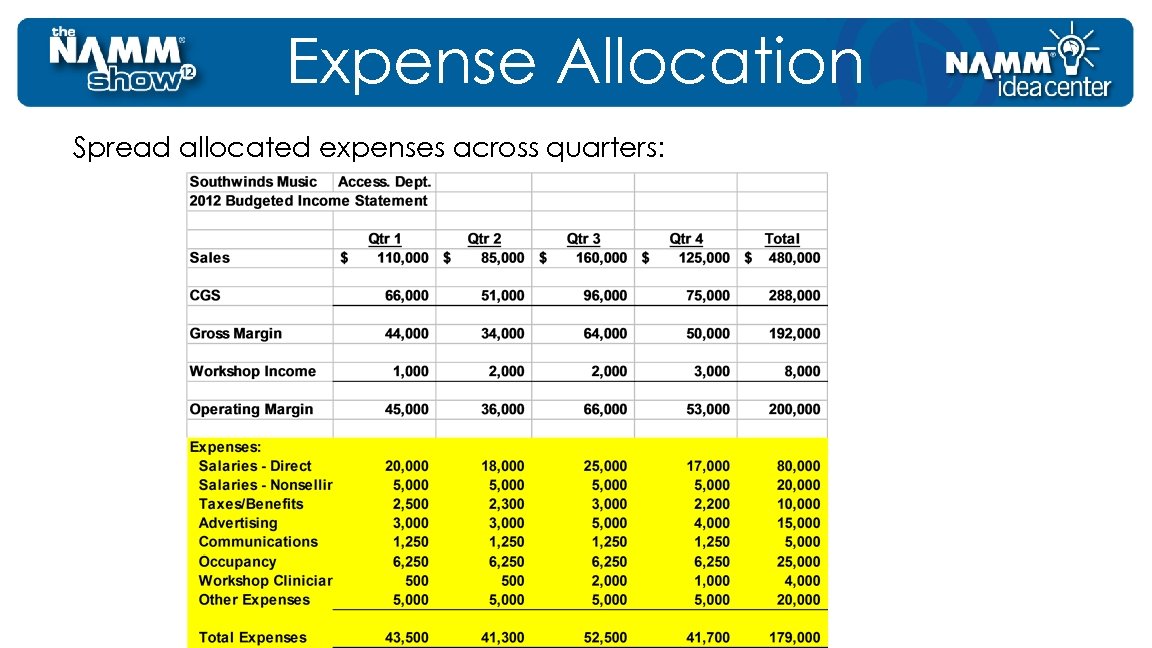

Expense Allocation Spread allocated expenses across quarters:

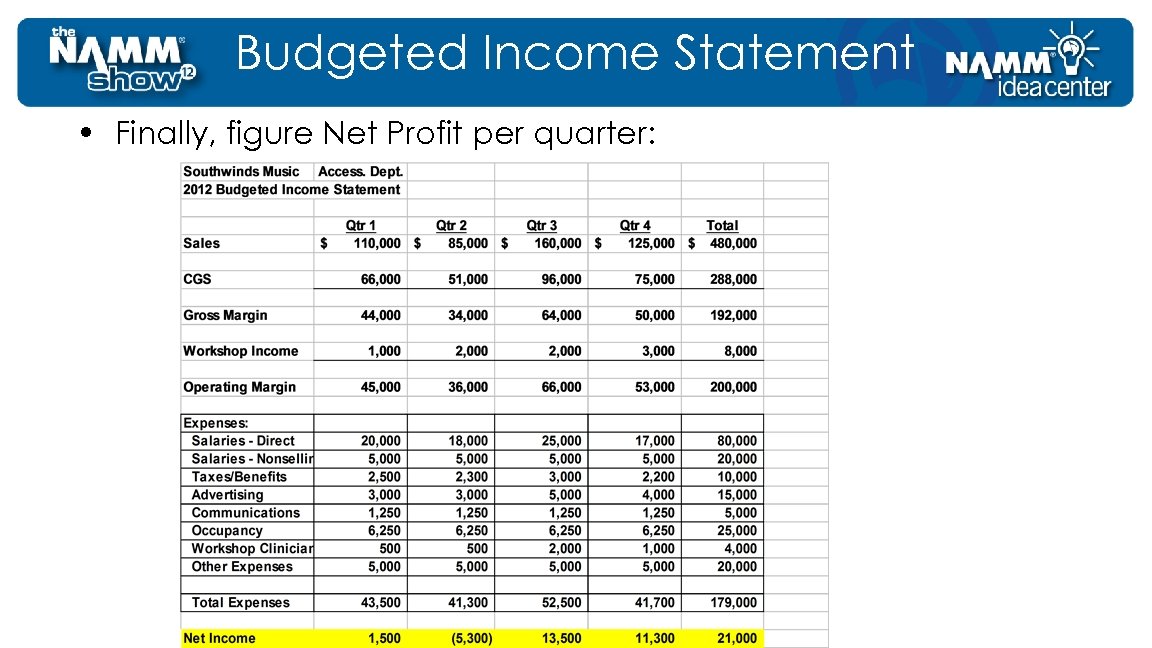

Budgeted Income Statement • Finally, figure Net Profit per quarter:

Now What? Sales Forecast Budgeted Income Statement • Can be used for “What if? ” analysis • Compare to Actual Performance on a regular basis – what caused the variances? • Maintains the focus on goals, not on past history • Controls expenses, especially salaries and advertising.

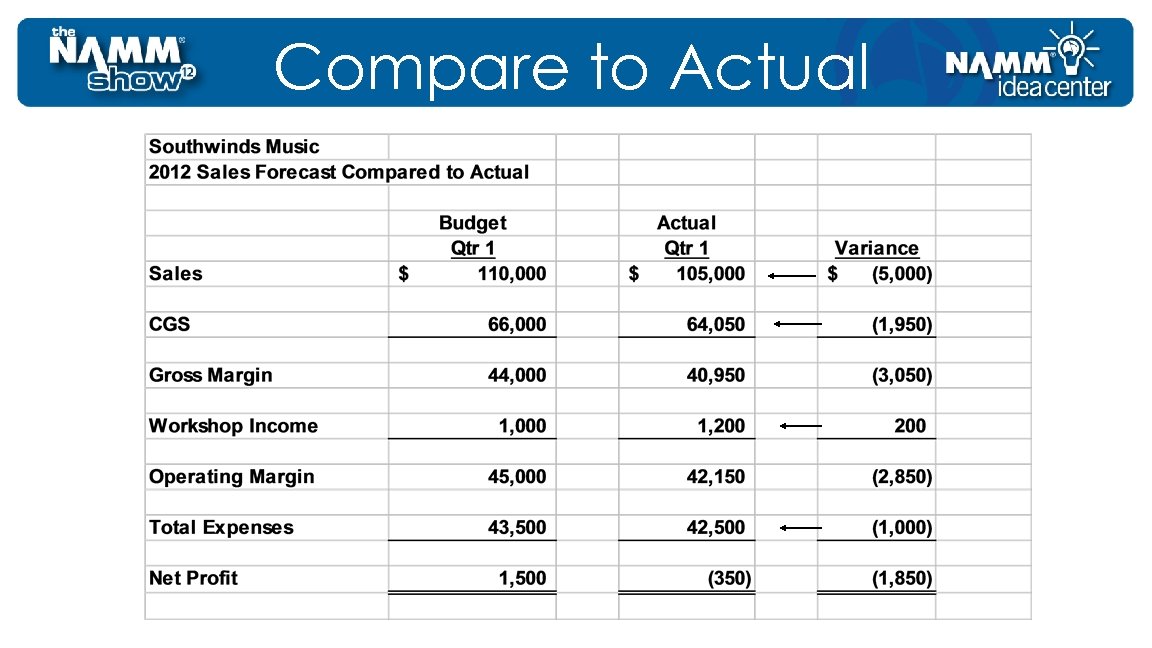

Compare to Actual

In Conclusion: Budgeting can provide you with: • • A yardstick for measuring success Control over expenses A sense of priorities, direction A quantifiable way to communicate your goals to your employees. • A plan for profits.

8fe06e21eb5bb10b0cf1a53eeae2f6e2.ppt