BF1_Fall2014_Intro.ppt

- Количество слайдов: 36

COURSE OUTLINE: COURSE: BBA BF-I INSTRUCTOR: Andrei Zaporozhetz, MBA, CPA E-MAIL: az. invest@yahoo. com CLASS HOURS: WED, THR, SAT, 15: 20 - 17: 55 COURSE DESCRIPTION: (Pls see the Syllabus) PREREQUISITES: Accounting-I and -II TEXBOOK: RWJ “Corporate Finance” WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 1

RECOMMENDED RESOURCES: Company information, financial reports, stock screeners: http: //finance. yahoo. com www. marketwatch. com www. morningstar. com Company information, historical prices, ratios: http: //www. reuters. com Dictionaries and Tutorials: www. Investopedia. com/dictionary www. Investor. Words. com www. Accounting. Coach. com WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 2

CLASS RULES Ø No phone calls please Ø Q&A are a must Ø Group work and class discussions Ø WIUU BBA BF-I, Fall 2014, A. Zaporozhetz Sharing your work experience 3

Class 1 Introduction Finance - definitions. 2 core concepts of finance. Financial management: 3 approaches. Goals of a business company Study materials: RWJ: Ch. 1. 1. – 1. 4. Slides WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 4

FINANCE: is there a good definition? • Barron’s Dictionary of Finance and Investment Terms: none • Collins Dictionary of Business: none WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 5

FINANCE: is there a good definition? • Investopedia. com: “The science that describes the management of money, banking, credit, investments, and assets. ” • IMA SMA 1 B (1982): “…Financial information comprises…that information, monetary or non-monetary, necessary to interpret the cause and effect of actual or planned business activities, economic circumstances, and asset and liability valuations. ” • Investorwords. com: “A branch of economics concerned with resource allocation as well as resource management, acquisition and investment. Simply, finance deals with matters related to money and the markets. ” WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 6

MONEY FUNCTIONS IN THE ECONOMY ü Medium of Exchange ü Store of Value ü Unit of Account ü Standard of Deferred Payment “Money is a matter of functions four: a medium, a measure, a standard, a store. " Ex-Soviet function: “World Money” WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 7

FINANCE: Approaches to the Definition • Finance among other business disciplines • 2 core concepts of Finance • What do financial managers manage? (business finance) • Accounting vs. Financial markets WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 8

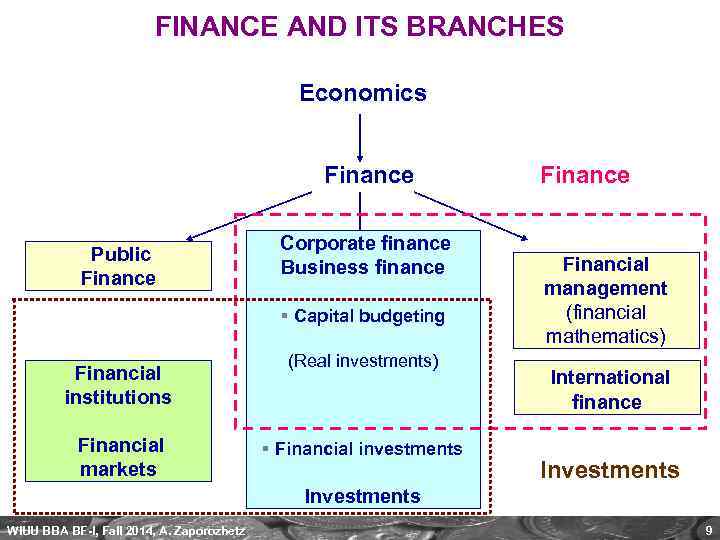

FINANCE AND ITS BRANCHES Economics Finance Public Finance Corporate finance Business finance § Capital budgeting Financial institutions Financial markets (Real investments) § Financial investments Finance Financial management (financial mathematics) International finance Investments WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 9

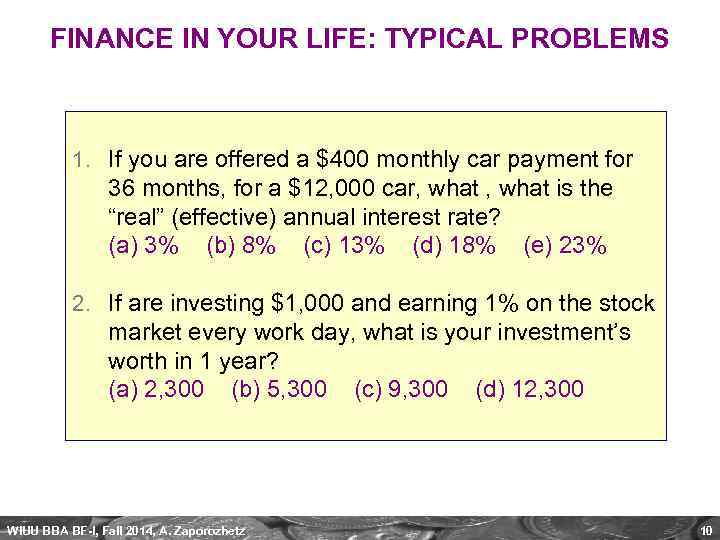

FINANCE IN YOUR LIFE: TYPICAL PROBLEMS 1. If you are offered a $400 monthly car payment for 36 months, for a $12, 000 car, what is the “real” (effective) annual interest rate? (а) 3% (b) 8% (c) 13% (d) 18% (e) 23% 2. If are investing $1, 000 and earning 1% on the stock market every work day, what is your investment’s worth in 1 year? (а) 2, 300 (b) 5, 300 (c) 9, 300 (d) 12, 300 WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 10

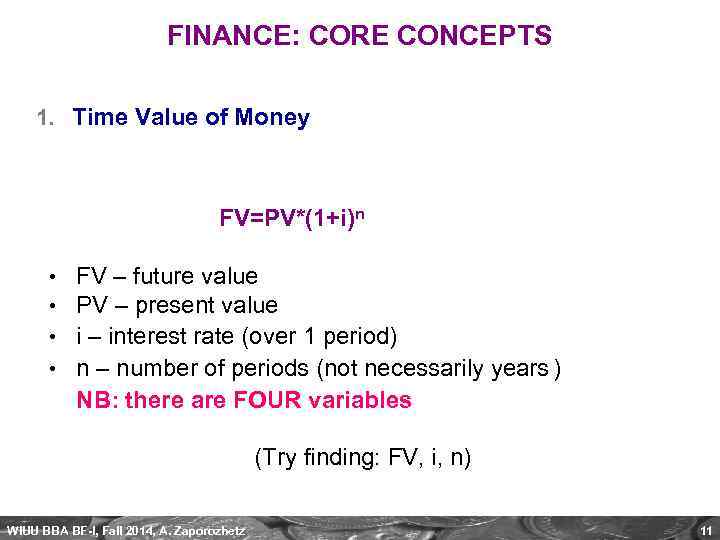

FINANCE: CORE CONCEPTS 1. Time Value of Money FV=PV*(1+i)n • • FV – future value PV – present value i – interest rate (over 1 period) n – number of periods (not necessarily years ) NB: there are FOUR variables (Try finding: FV, i, n) WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 11

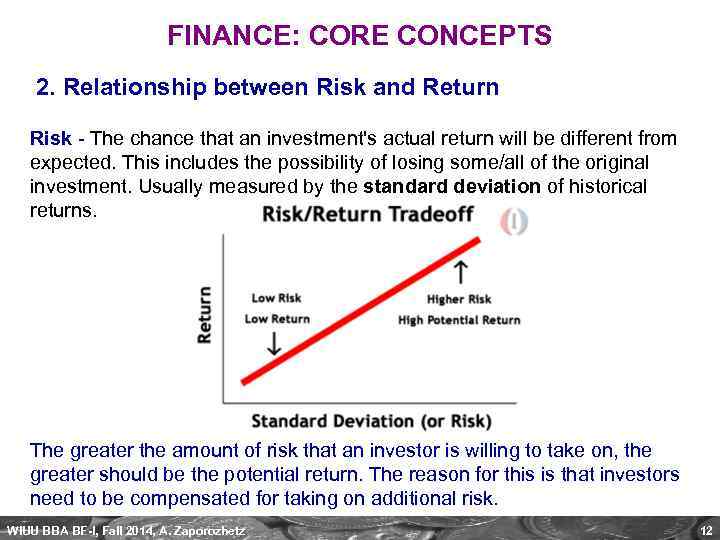

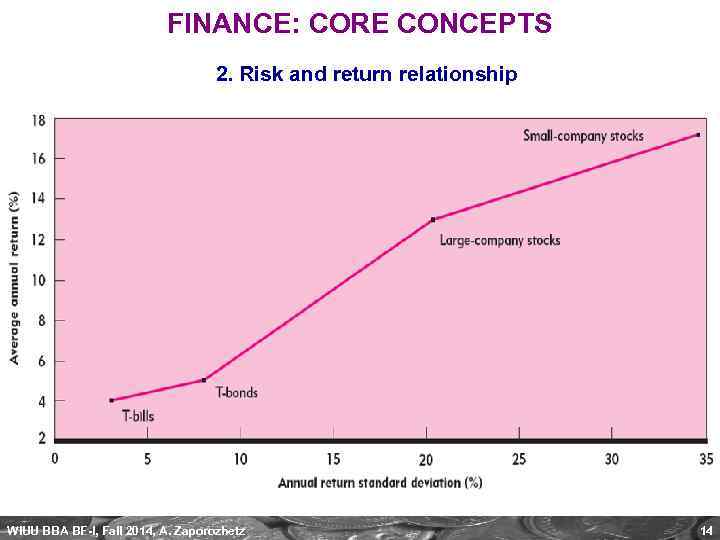

FINANCE: CORE CONCEPTS 2. Relationship between Risk and Return Risk - The chance that an investment's actual return will be different from expected. This includes the possibility of losing some/all of the original investment. Usually measured by the standard deviation of historical returns. The greater the amount of risk that an investor is willing to take on, the greater should be the potential return. The reason for this is that investors need to be compensated for taking on additional risk. WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 12

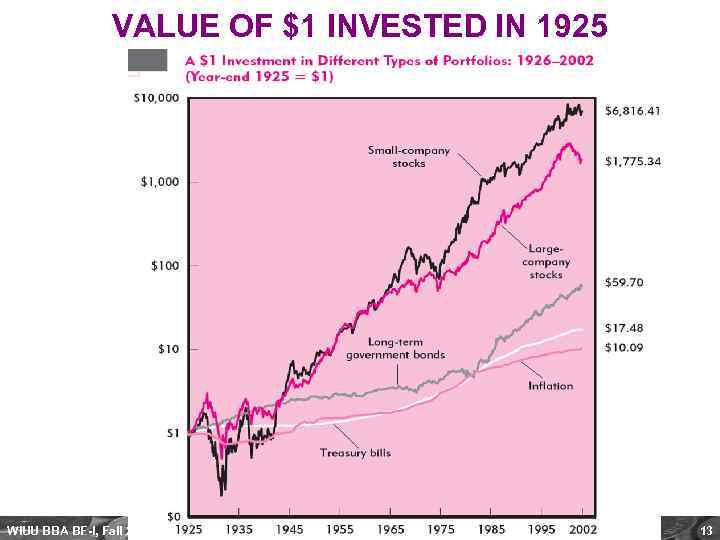

VALUE OF $1 INVESTED IN 1925 WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 13

FINANCE: CORE CONCEPTS 2. Risk and return relationship WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 14

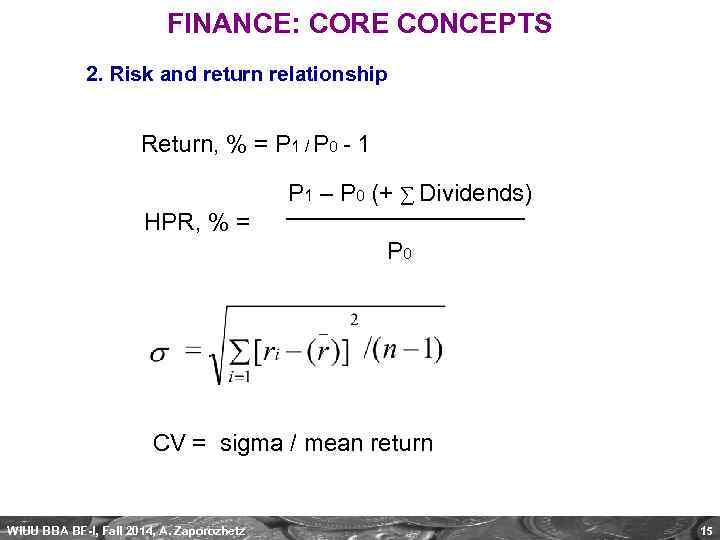

FINANCE: CORE CONCEPTS 2. Risk and return relationship Return, % = P 1 / P 0 - 1 P 1 – P 0 (+ ∑ Dividends) HPR, % = P 0 CV = sigma / mean return WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 15

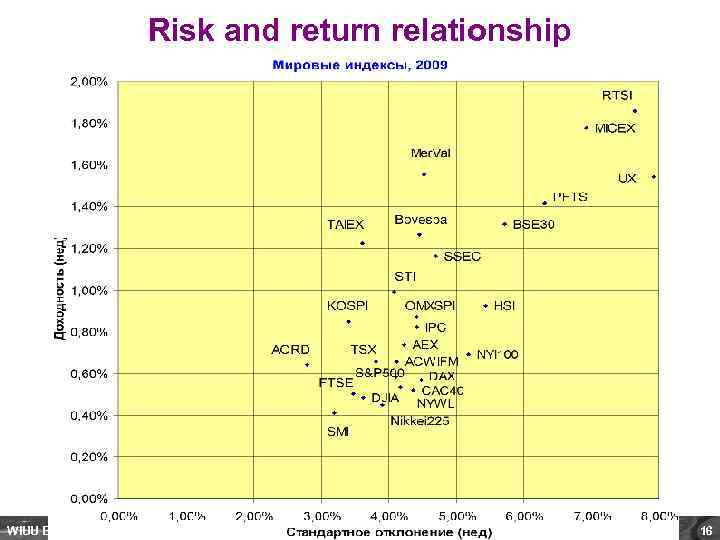

Risk and return relationship WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 16

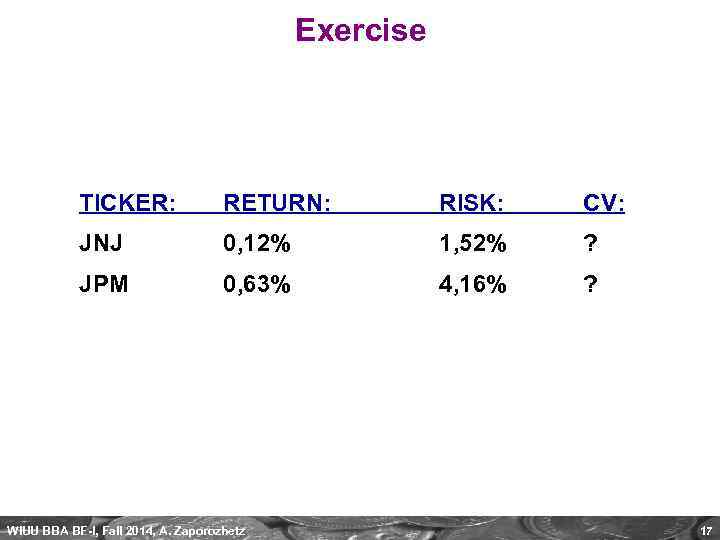

Exercise TICKER: RETURN: RISK: CV: JNJ 0, 12% 1, 52% ? JPM 0, 63% 4, 16% ? WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 17

What do financial managers manage? 1. Balance Sheet format approach 2. Cash Flow Statement approach 3. Performance management (KPI) approach WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 18

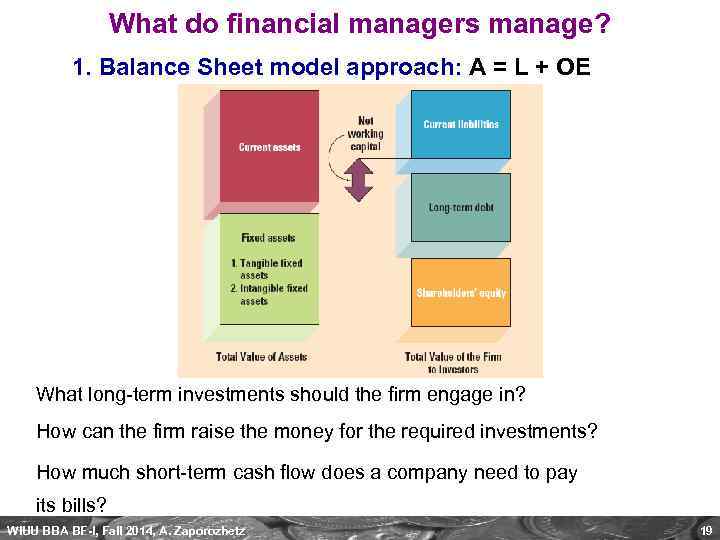

What do financial managers manage? 1. Balance Sheet model approach: A = L + OE What long-term investments should the firm engage in? How can the firm raise the money for the required investments? How much short-term cash flow does a company need to pay its bills? WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 19

2. Cash Flow Statement approach: Cash (Bo. Y) = + CF from Operating activities + CF from Investing activities + CF from Financing activities = Cash (Eo. Y) WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 20

2. Cash Flow Statement approach: “To create value, the financial manager should: - make smart investment decisions, - make smart financing decisions. ” (S. Ross) П(С)БО 4: “Финансовая деятельность – приводящая к изменениям размера и состава собственного и заемного капитала. Инвестиционная деятельность – приобретение и реализация необоротных активов, и финансовых инвестиций, которые не являются денежными средствами. ” WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 21

3. Performance management approach: Maximizing (optimizing) financial results and financial position… Key performance indicators (KPI) Financial ratios BSC Controlling (variance analysis, etc) WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 22

GOALS OF A BUSINESS COMPANY The traditional answer is that the managers of the corporation are obliged to make efforts to maximize shareholder wealth. Maximizing size ü Maximizing Accounting Profits ü Maximizing Stock Price ü (Kolb, Rodriguez, 1992) “Business value to shareholders, as reflected in the value of the… common stock, depends fundamentally on the expected size, timing, and risk (variability) associated with the firm’s future net cash flows… Unexpected changes in… future net cash flows are a major source of fluctuations in business value. ” (Harrington, Niehaus, RM, p. 4) WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 23

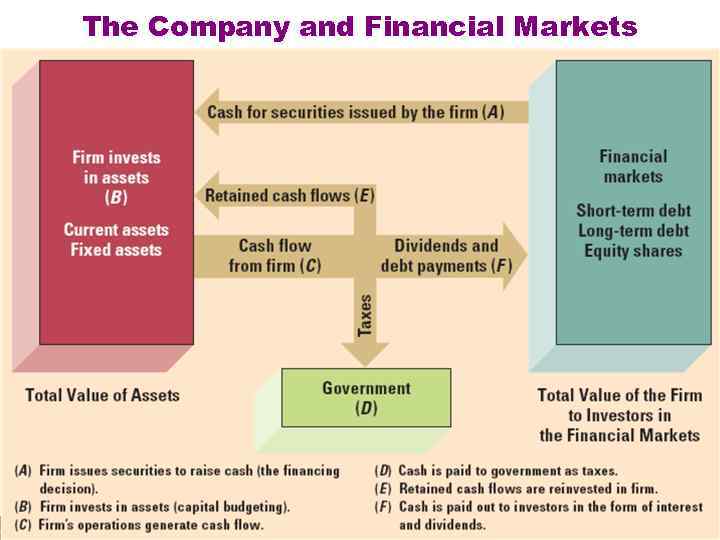

The Company and Financial Markets WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 24

FINANCIAL MARKETS WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 25

FINANCIAL MARKETS Financial markets: - Money markets - Capital markets - Stock markets - Bond markets - Derivative markets - Commodity markets - Real Estate markets - Other WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 26

Class 1 Additional info WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 27

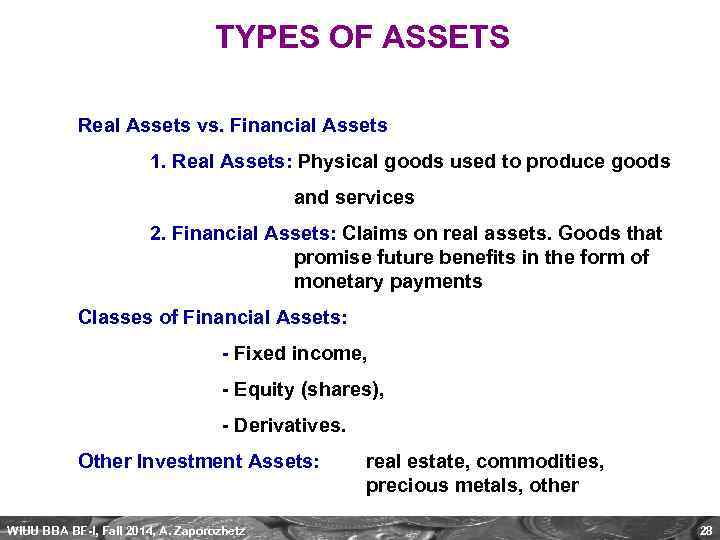

TYPES OF ASSETS Real Assets vs. Financial Assets 1. Real Assets: Physical goods used to produce goods and services 2. Financial Assets: Claims on real assets. Goods that promise future benefits in the form of monetary payments Classes of Financial Assets: - Fixed income, - Equity (shares), - Derivatives. Other Investment Assets: WIUU BBA BF-I, Fall 2014, A. Zaporozhetz real estate, commodities, precious metals, other 28

FINANCIAL MARKETS The major players in the financial markets: 1. Corporations 2. Households 3. Governments (4. ) Financial Intermediaries: investment companies, pension funds, asset management companies (mutual funds), credit unions, insurance companies, banks Exchanges, brokerage companies WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 29

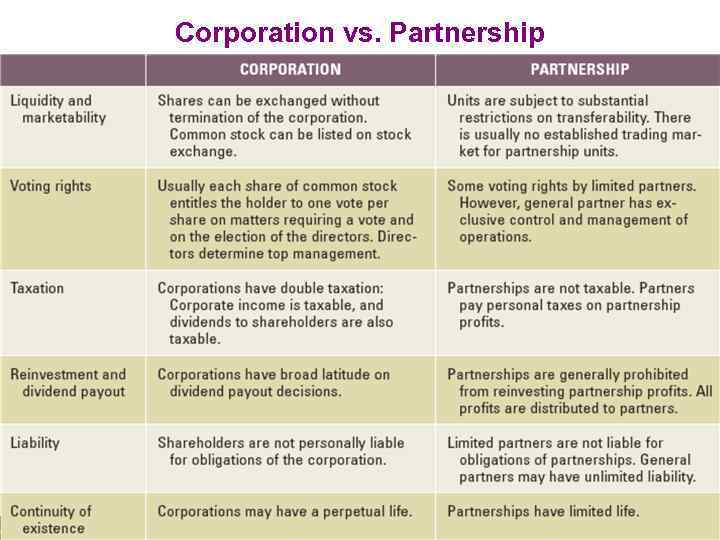

Corporation vs. Partnership WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 30

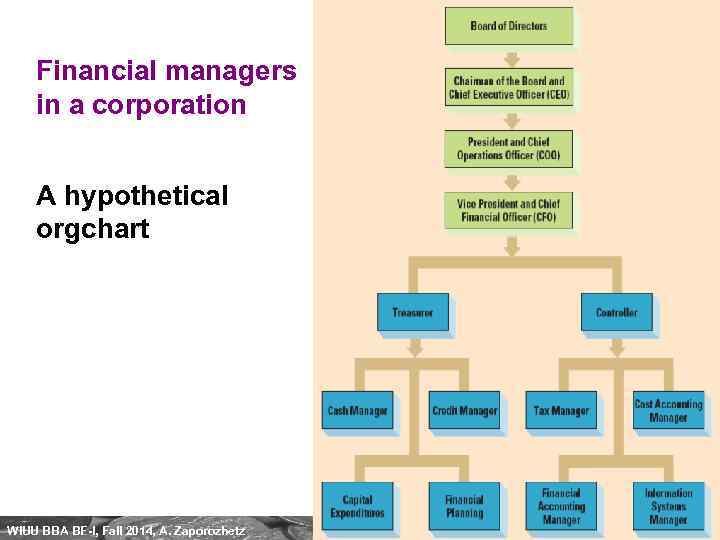

Financial managers in a corporation A hypothetical orgchart WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 31

What do financial managers manage? What is management? What are the 4 functions of management? What are the 2 linking processes in management? What are the 10 managerial roles of a manager? WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 32

10 managerial roles described by H. Mintzberg (“The Nature of Managerial Work” 1973) A role is a set of specific tasks a person performs because of the position they hold. • Roles are directed inside as well as outside the organization • There are 3 role categories: 1. Interpersonal 2. Informational 3. Decisional WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 33

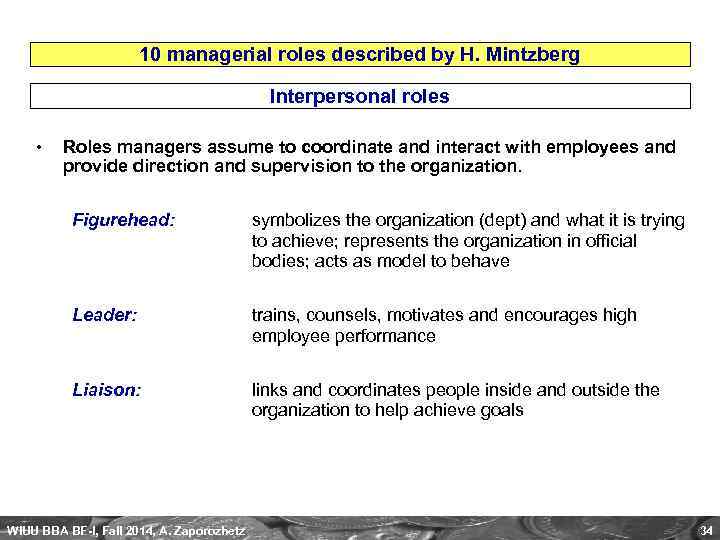

10 managerial roles described by H. Mintzberg Interpersonal roles • Roles managers assume to coordinate and interact with employees and provide direction and supervision to the organization. Figurehead: symbolizes the organization (dept) and what it is trying to achieve; represents the organization in official bodies; acts as model to behave Leader: trains, counsels, motivates and encourages high employee performance Liaison: links and coordinates people inside and outside the organization to help achieve goals WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 34

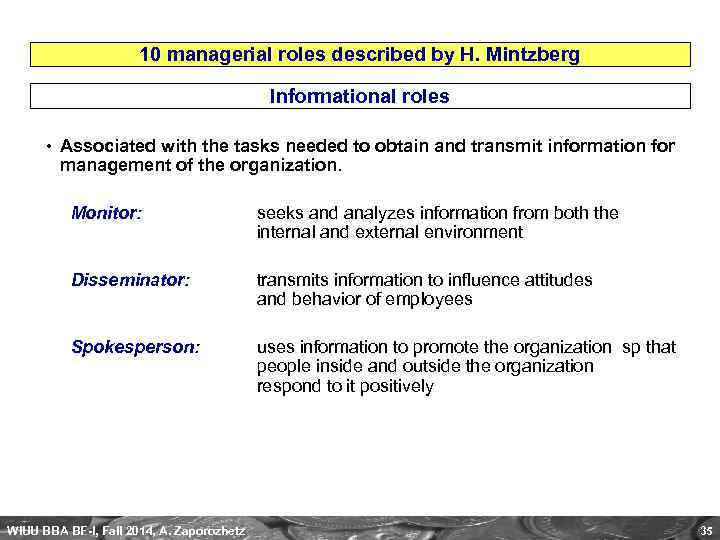

10 managerial roles described by H. Mintzberg Informational roles • Associated with the tasks needed to obtain and transmit information for management of the organization. Monitor: seeks and analyzes information from both the internal and external environment Disseminator: transmits information to influence attitudes and behavior of employees Spokesperson: uses information to promote the organization sp that people inside and outside the organization respond to it positively WIUU BBA BF-I, Fall 2014, A. Zaporozhetz 35

10 managerial roles described by H. Mintzberg Decisional roles • Associated with the methods managers use to plan and utilize resources to achieve goals. Entrepreneur: decides upon new projects / programs to initiate and invest in. Disturbance handler: assumes responsibility for handling an unexpected event or crisis threatening the organization. Resource allocator: assigns resources between functions and divisions, sets budgets of lower managers. Negotiator: WIUU BBA BF-I, Fall 2014, A. Zaporozhetz seeks to negotiate an reach agreements solutions with other managers, unions, customers, or shareholders. 36

BF1_Fall2014_Intro.ppt