7c87db70fe2021d6316e2a94aa557eb8.ppt

- Количество слайдов: 50

COURSE: GLOBAL BUSINESS MANAGEMENT MGT 610 DR. DIMITRIS STAVROULAKIS PROFESSOR OF HUMAN RESOURCE MANAGEMENT DEPT OF ACCOUNTING TEI OF PIRAEUS

Unit 7: Entry Modes & Foreign Direct Investment Training Material: -“FDI”, entry from: Wankel, C. (ed. ) (2009): Encyclopedia of Business in Today’s World. London: Sage, 695 -697. -Chapter 12 from: Hill, C. W. L. , (2008): Global Business Today. Irwin, Mc. Graw-Hill (5 th Edition).

Entry Modes Entry Mode: A critical strategic decision, affecting future decisions and operations of the MNC in a new market. Includes exporting, licensing, franchising, contract manufacturing, turnkey projects, and joint venturing. Exporting: Entails physical transfer of merchandise to a foreign market (with or without the mediation of an agent) for financial gain. Piggybackis the practice through which a manufacturer uses the sales & distribution network of another company in order to dispose products. A safe activity, however confronted with shortcomings such as high transportation costs, and tariffs/barriers. Other non-tariff restrictions to trade are: ü Quotas are restrictions on quantities of certain products that are allowed to be imported in certain countries. ü Discriminatory government procurements favor certain companies, thus establishing informal monopolies. Governments may also issue restrictive technical regulations and specifications, which exclude the mainstream of competitors. ü Customs proceduresmay be lengthy, costly, and complicated, therefore favoring bribery.

Licensing The licensor grants the rights to intangible property to another company (the licensee) for a specific period in return for a royalty fee. In countries where there are barriers to investment, licensing allows a foreign firm to exploit its know-how (intangible property). It is appropriate mostly to newborn MNCs that lack capabilities for international expansion. The licensor avoids barriers to trade and exploits best the local market through the infrastructure of the licensee. Disadvantages: ü Unrestricted dissemination of know-how and experience is likely to lead to imitation practices and to the transformation of licensees to potential competitors, particularly in countries where patent protection is weak. ü Passive presence in foreign countries implies limited opportunities for market learning. ü Investigating compliance of the licensee to the terms of agreement in certain countries might be costly, complicated, or even impossible. ü In case that the product performs better than expected, there are limited opportunities for the licensor to bargain for better terms.

Franchise Similar to license, but usually restricted to services. Also control is tighter and the franchisee has to comply with strict rules on how to conduct business. Extensive training of franchisees is required in order to ensure quality of services. Allows rapid expansion of MNC networks and fast cash through royalties. Disadvantages: ü In specific sectors (food), cultural patterns may dissuade consumers from adhering to foreign brand names. ü Unfavorable developments regarding a MNC in one country may affect its whole franchise chain in others. ü The process should be incremental. However, some MNCs are eager to pocket cash without questioning viability of franchisees, a fact resulting in the creation of a fragile infrastructure. A massive close-down of franchisees would be fatal. ü Infrequent inspections and inadequate control procedures lead to degradation of quality standards, eventually eroding the brand name.

Contract Manufacturing Many MNCs (IKEA, Nike etc) subcontract local manufacturers to produce items under the umbrella of their own brand name, according to the same technical standards as their subs. The contract is restricted solely to manufacturing. Products bear the MNC brand name, while marketing & sales are undertaken exclusively by the MNC. This entry mode may be selected either because MNCs wish to exploit local resources to avoid heavy , or taxation or to overcome tariffs, quotas and other entry barriers , , or because this is explicitly required the host country by government (China). Disadvantages: ü Difficulties in performing frequent inspections in local firms may result in the violation of the agreed technical standards. ü Relocation of production may cause labor unrest and trade union action due to the loss of employment positions in subs & HQ. ü Illicit labor practices of contractors (child labor, unsafe work conditions, environmental issues) will backfire on the MNC brand. ü Emergence of contractors to potential competitors is likely, due to their familiarization with the MNC practices and specifications.

Turnkey Projects The MNC agrees to deliver to the foreign client the whole project (design, construction, quality control, testing), ready to operate. The package includes all issues, from maintenance to personnel training. v Are applicable in heavy industries which require advanced knowhow (hydro-electric plants, oil refineries, steel factories). v Abound in oil-rich Middle East countries. Advantages: ü Important economic returns. ü Less tricky than FDI, since long-term engagement is avoided in high-risk countries. Disadvantages: ü Emergence of potential competitors, since the local recipients may eventually acquire the know-how ü Limited presence in strategic local markets. This problem may be compensated through the acquisition of a minority equity interest by the MNC.

Joint Venture A firm that has been created by two or more independent companies which pool resources in order to exploit assets of the host country. The foreign partners benefit from the local partner’s network and knowledge of the business environment. Development costs & risks are shared. Often JVs are temporary, formed in order to exploit specific assets (e. g. mines, oil deposits). In certain countries, a joint venture is the only feasible mode of entry (e. g. auto makers in China). Most common in Greek supermarkets and retail chains worldwide (Tesco in Hungary, Malaysia, China, Thailand). Advantages include high rates of return, direct control over operations, and contact with the market agents & government. Drawbacks: ü Disputes may arise concerning allocation of resources and ownership of patents & brand names. Caution is recommended with regard to the selection of partners and terms of agreement. ü Emergence of conflict pertaining to cultural distance. ü Lack of total control over the JV incurs less profits for individual participants.

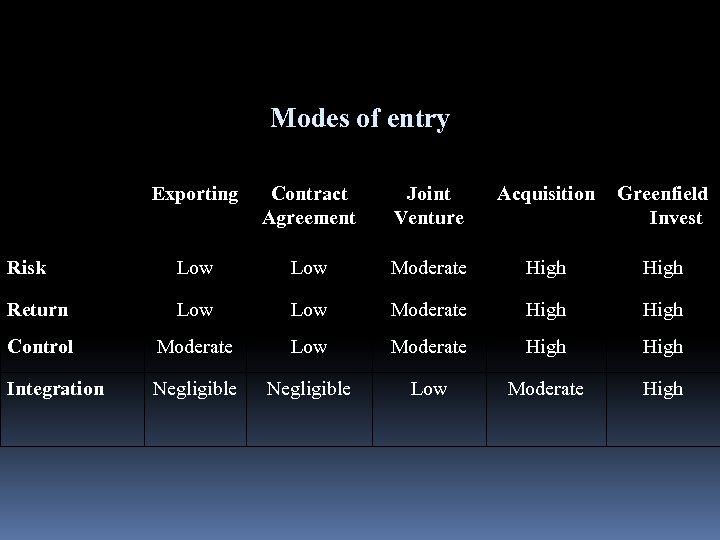

Modes of entry Exporting Contract Agreement Joint Venture Acquisition Greenfield Invest Risk Low Moderate High Return Low Moderate High Control Moderate Low Moderate High Integration Negligible Low Moderate High

FDI: Working Definitions Ø “A category of international investment that indicates an intention to acquire a lasting interest in an enterprise operating in another economy. It covers all financial transactions between the investing enterprise and its subsidiaries abroad”. (European Commission) Ø “An investment involving a long-term relationship and reflecting a lasting interest and control of a resident entity in one economy in an enterprise resident in an economy other than that of the investor”. (UN) 12

What is not FDI Non-equity investments. Portfolio investment: Investment that involves the exchange of equity with the aim of attaining a return on the invested capital, rather than achieve some form of control. Licensing production or technology rights to another company abroad. Strategic alliances. 13

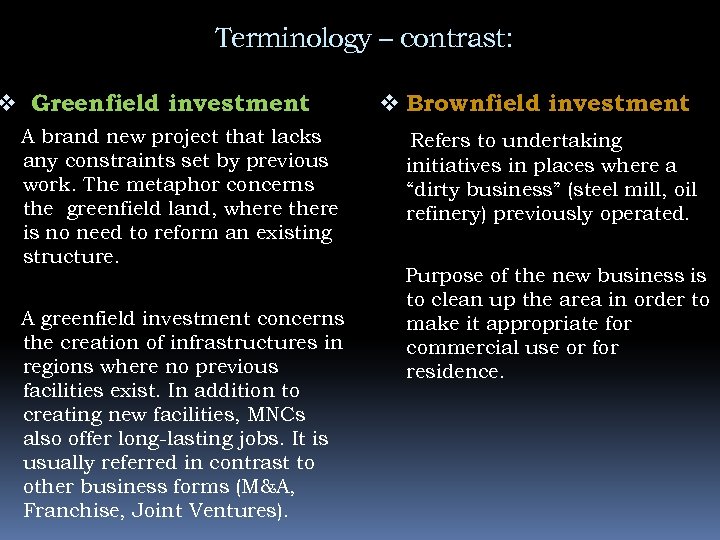

Terminology – contrast: v Greenfield investment A brand new project that lacks any constraints set by previous work. The metaphor concerns the greenfield land, where there is no need to reform an existing structure. A greenfield investment concerns the creation of infrastructures in regions where no previous facilities exist. In addition to creating new facilities, MNCs also offer long-lasting jobs. It is usually referred in contrast to other business forms (M&A, Franchise, Joint Ventures). v Brownfield investment Refers to undertaking initiatives in places where a “dirty business” (steel mill, oil refinery) previously operated. Purpose of the new business is to clean up the area in order to make it appropriate for commercial use or for residence.

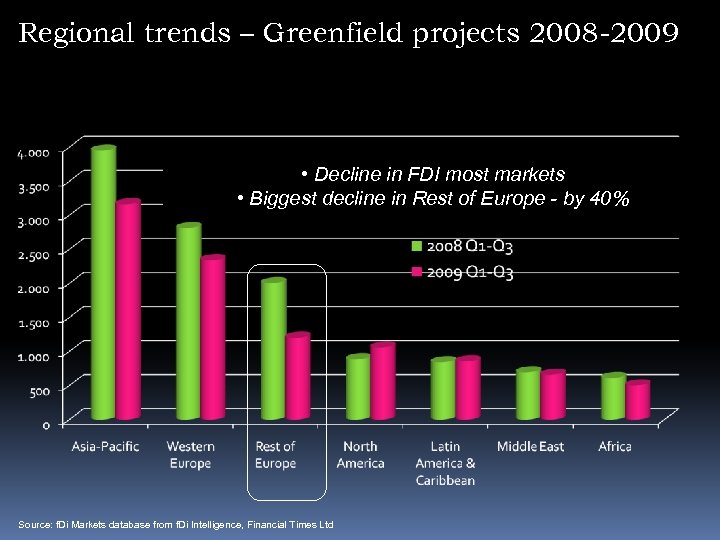

Regional trends – Greenfield projects 2008 -2009 • Decline in FDI most markets • Biggest decline in Rest of Europe - by 40% Source: f. Di Markets database from f. Di Intelligence, Financial Times Ltd

EC study: FDI attracted in regions that have: Access to a populous national market (national market size effect). Borders with the home country and/or language in common with home country (proximity and culture effect) A high level of business English language proficiency (internationalization effect) Low corporate taxes and business incentives (fiscal incentive effect) Many advanced consumers with high purchasing power (national GDP per capita) Low unemployment level (proxy for few rigidities on the labor market)

FDI attracted in regions that have (cont): A large share of other foreign investors (signal effect). Good infrastructure and accessibility (access effect). A highly educated regional workforce (skill effect). A high level of spending on R&D (innovation effect). Penetration of information & communication technologies (ICT effect). A large presence of competitors, clients and suppliers within the firm’s industry (agglomeration & clustering effect). Fame as prominent social milieus and commercial centers (fame effect). Low labor costs (labor effect).

Greek FDI - 2001 Source: Bank of Greece, 2007

Greek FDI - 2006 Source: Bank of Greece, 2007

Joint Ventures

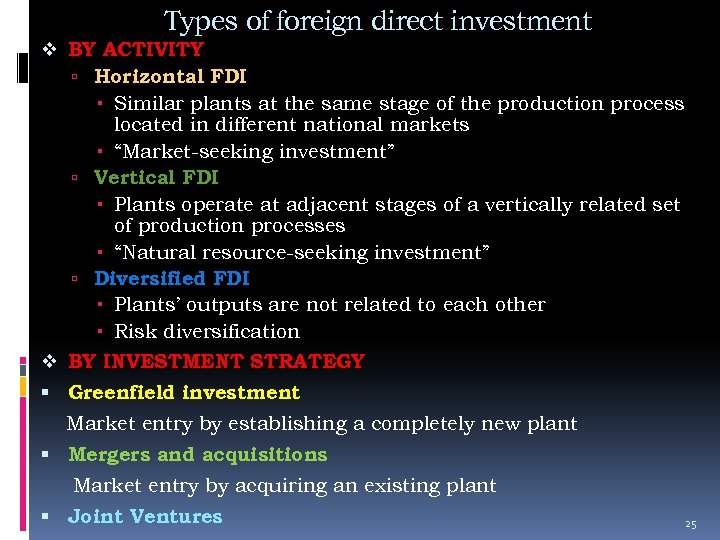

Types of foreign direct investment v BY ACTIVITY Horizontal FDI Similar plants at the same stage of the production process located in different national markets “Market-seeking investment” Vertical FDI Plants operate at adjacent stages of a vertically related set of production processes “Natural resource-seeking investment” Diversified FDI Plants’ outputs are not related to each other Risk diversification v BY INVESTMENT STRATEGY Greenfield investment Market entry by establishing a completely new plant Mergers and acquisitions Market entry by acquiring an existing plant Joint Ventures 25

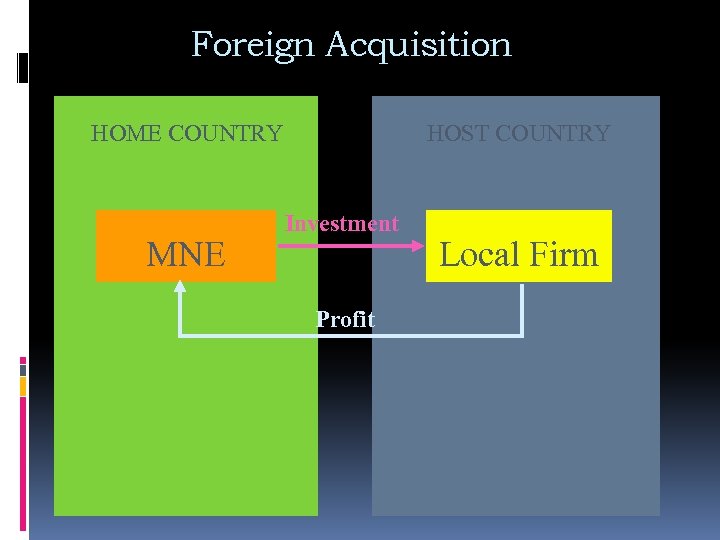

Foreign Acquisition HOME COUNTRY MNE HOST COUNTRY Investment Profit Local Firm

Foreign Acquisition Advantages Access to target’s local knowledge Control over foreign operations Control over target’s technology n n n Disadvantages Uncertainty about target’s value Difficulty in “absorbing” acquired assets Risky if corporate governance is underdeveloped in the foreign country When Is Acquisition Appropriate? Developed market for corporate governance & control Acquirer has high “absorptive” capacity High synergy between the two firms

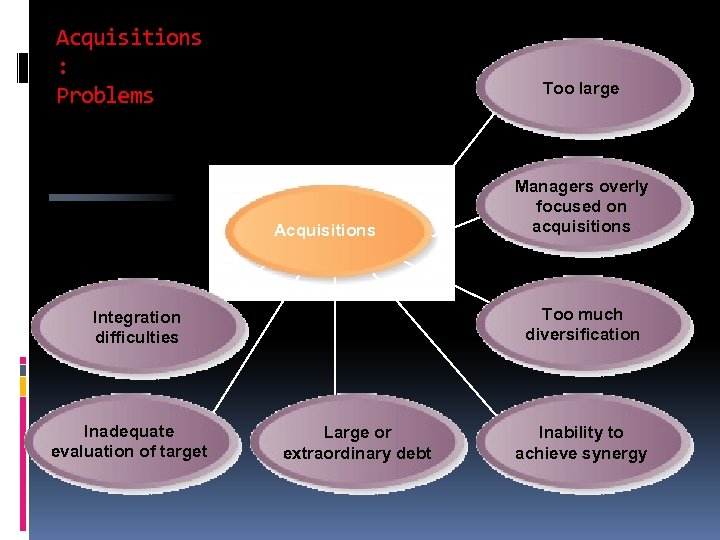

Acquisitions : Problems Too large Acquisitions Too much diversification Integration difficulties Inadequate evaluation of target Managers overly focused on acquisitions Large or extraordinary debt Inability to achieve synergy

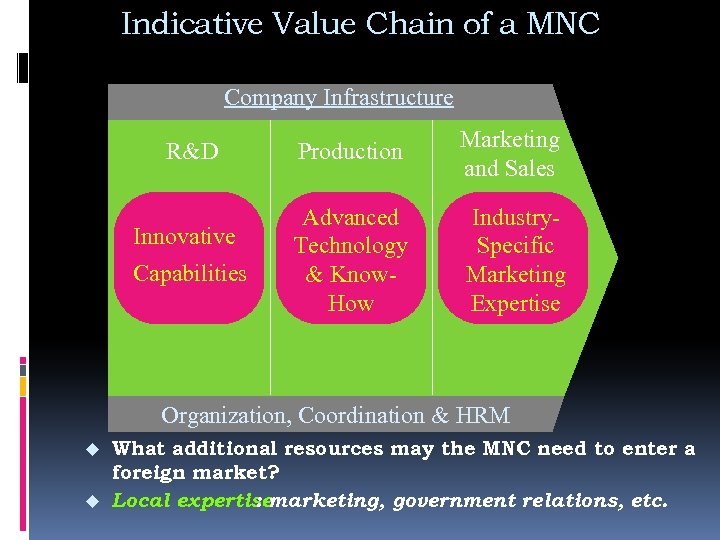

Indicative Value Chain of a MNC Company Infrastructure R&D Innovative Capabilities Production Marketing and Sales Advanced Technology & Know. How Industry. Specific Marketing Expertise Organization, Coordination & HRM u u What additional resources may the MNC need to enter a foreign market? Local expertise : marketing, government relations, etc.

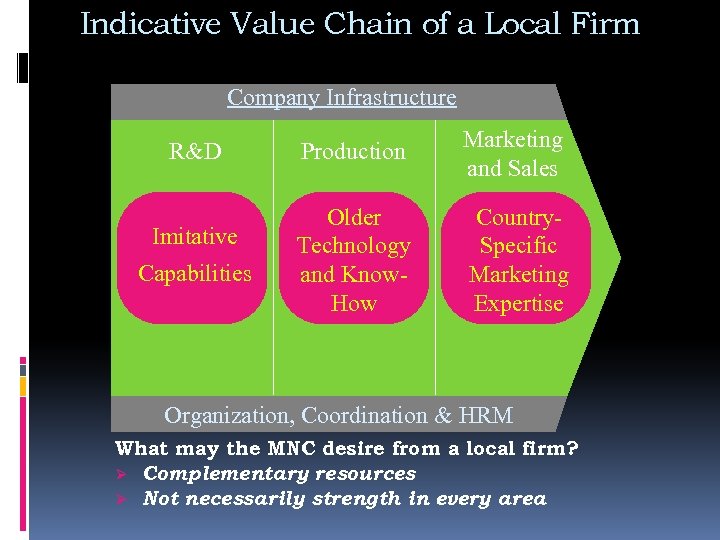

Indicative Value Chain of a Local Firm Company Infrastructure R&D Imitative Capabilities Production Marketing and Sales Older Technology and Know. How Country. Specific Marketing Expertise Organization, Coordination & HRM What may the MNC desire from a local firm? Ø Complementary resources Ø Not necessarily strength in every area

Complementarity of Resources MNE’s Resources Local Firm’s Resources Innovative capabilities Advanced technology and know-how Industry-specific marketing expertise Organization structure and systems Imitating capabilities Older technology and know-how Country-specific marketing expertise Country specific organization skills

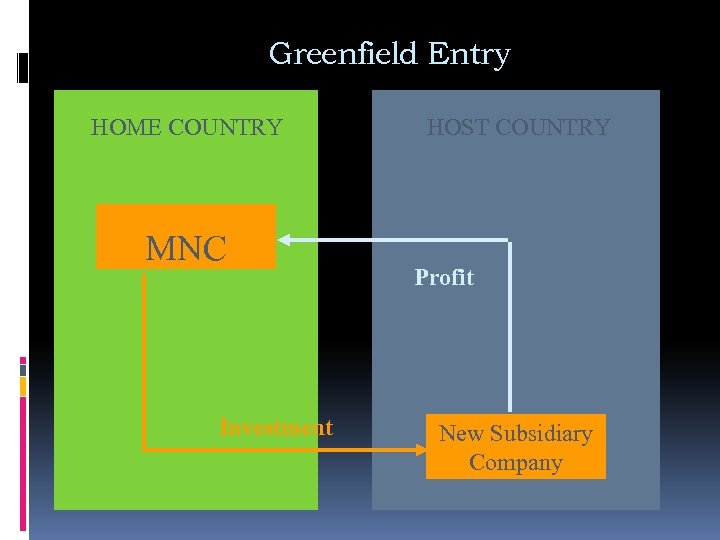

Greenfield Entry HOME COUNTRY MNC Investment HOST COUNTRY Profit New Subsidiary Company

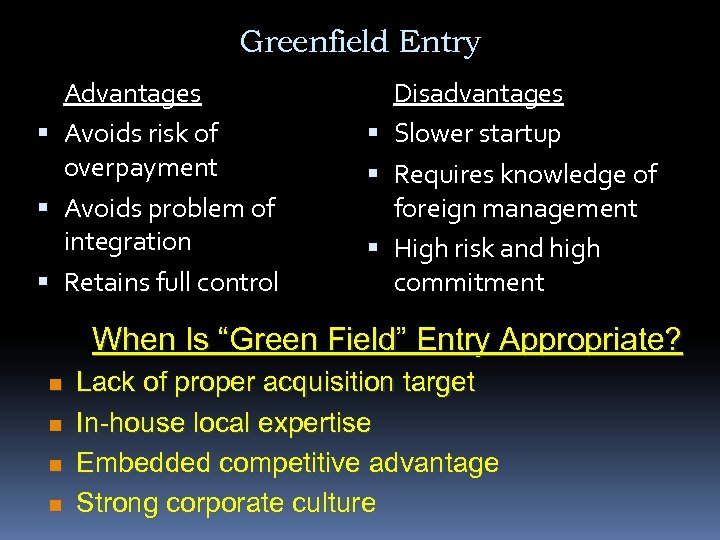

Greenfield Entry Advantages Avoids risk of overpayment Avoids problem of integration Retains full control Disadvantages Slower startup Requires knowledge of foreign management High risk and high commitment When Is “Green Field” Entry Appropriate? n n Lack of proper acquisition target In-house local expertise Embedded competitive advantage Strong corporate culture

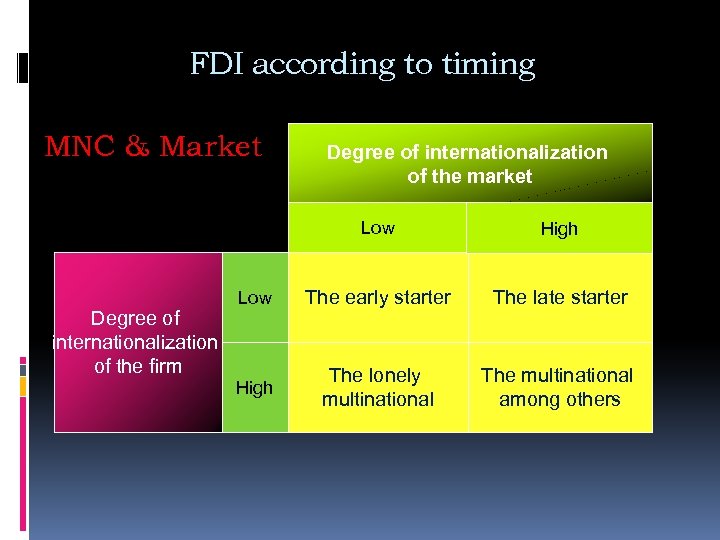

FDI according to timing MNC & Market Degree of internationalization of the market Low Degree of internationalization of the firm High Low The early starter The late starter High The lonely multinational The multinational among others

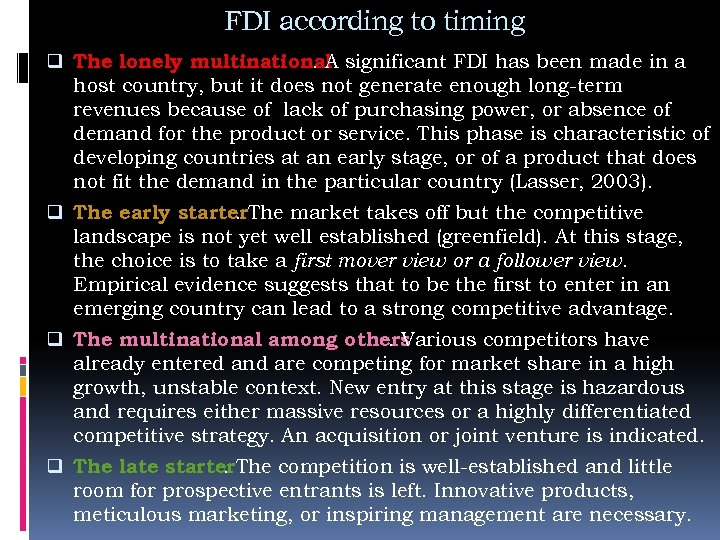

FDI according to timing q The lonely multinational significant FDI has been made in a. A host country, but it does not generate enough long-term revenues because of lack of purchasing power, or absence of demand for the product or service. This phase is characteristic of developing countries at an early stage, or of a product that does not fit the demand in the particular country (Lasser, 2003). q The early starter. The market takes off but the competitive. landscape is not yet well established (greenfield). At this stage, the choice is to take a first mover view or a follower view. Empirical evidence suggests that to be the first to enter in an emerging country can lead to a strong competitive advantage. q The multinational among others. Various competitors have already entered and are competing for market share in a high growth, unstable context. New entry at this stage is hazardous and requires either massive resources or a highly differentiated competitive strategy. An acquisition or joint venture is indicated. q The late starter. The competition is well-established and little. room for prospective entrants is left. Innovative products, meticulous marketing, or inspiring management are necessary.

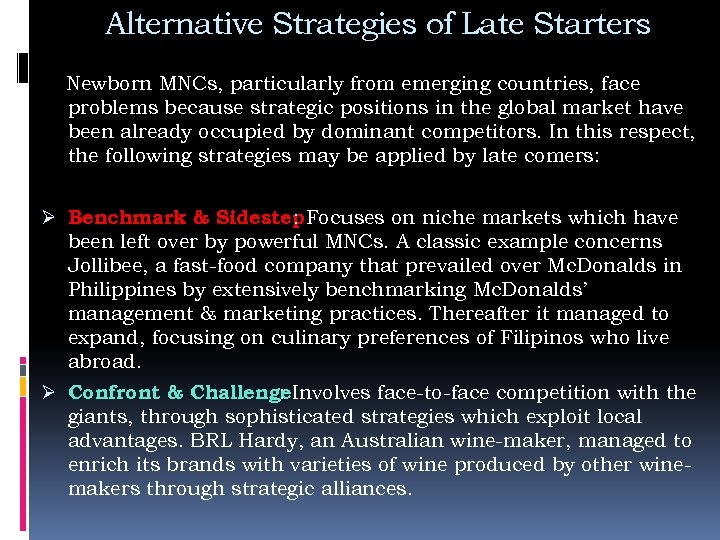

Alternative Strategies of Late Starters Newborn MNCs, particularly from emerging countries, face problems because strategic positions in the global market have been already occupied by dominant competitors. In this respect, the following strategies may be applied by late comers: Ø Benchmark & Sidestep Focuses on niche markets which have : been left over by powerful MNCs. A classic example concerns Jollibee, a fast-food company that prevailed over Mc. Donalds in Philippines by extensively benchmarking Mc. Donalds’ management & marketing practices. Thereafter it managed to expand, focusing on culinary preferences of Filipinos who live abroad. Ø Confront & Challenge. Involves face-to-face competition with the : giants, through sophisticated strategies which exploit local advantages. BRL Hardy, an Australian wine-maker, managed to enrich its brands with varieties of wine produced by other winemakers through strategic alliances.

Country Risk ü Besides advantages, foreign countries bear inherent risks for investors. ü Country risk results from a set of complex and interdependent socio-economic, financial and political factors. These factors are specific for a particular country, but they can spread fast due to global integration. ü On the other hand, a country can be easily contaminated by negative regional or global forces.

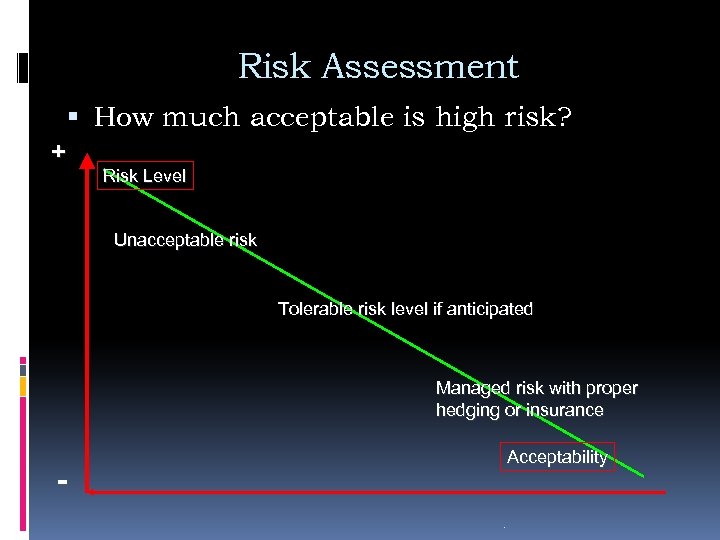

Risk Assessment How much acceptable is high risk? + Risk Level Unacceptable risk Tolerable risk level if anticipated Managed risk with proper hedging or insurance Acceptability .

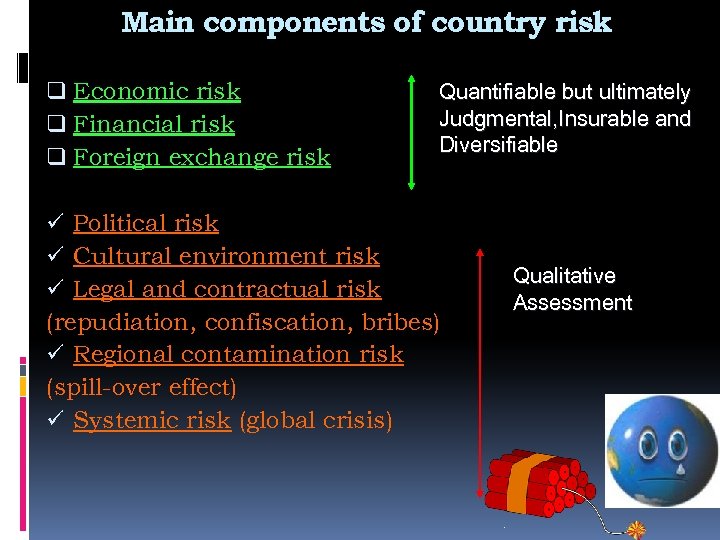

Main components of country risk q Economic risk q Financial risk q Foreign exchange risk Quantifiable but ultimately Judgmental, Insurable and Diversifiable ü Political risk ü Cultural environment risk ü Legal and contractual risk (repudiation, confiscation, bribes) ü Regional contamination risk (spill-over effect) ü Systemic risk (global crisis) Qualitative Assessment .

Country Risk Assessment Ø Economic risk Low growth, inflation, low or declining : investment and savings ratios, interest rate rise, structural weakness of the banking system, budget deficit, liquidity and solvency risk (when a nation’s capital assets are composed more of debt than of equity) etc. Ø Financial risk Credit crunch, banking crisis, current : account deficit. Ø Foreign Exchange risk. Drop in official international : reserves, devaluation, capital controls. .

Country Risk Assessment (cont) Ø Political Risk : (1)The risk incurred by lenders, exporters, or investors, when a payment or the repatriation of an investment is restricted afterwards by the arbitrary decisionof the host country government. This decision may be carried out through confiscation, repudiation (refusal to endorse an agreement), nationalization, default (breaking the promise of paying back) etc. (2)The risk owed to political turmoil, government change, or deteriorating governance: lack of transparency, political speculation, corruption, nepotism, bureaucracy.

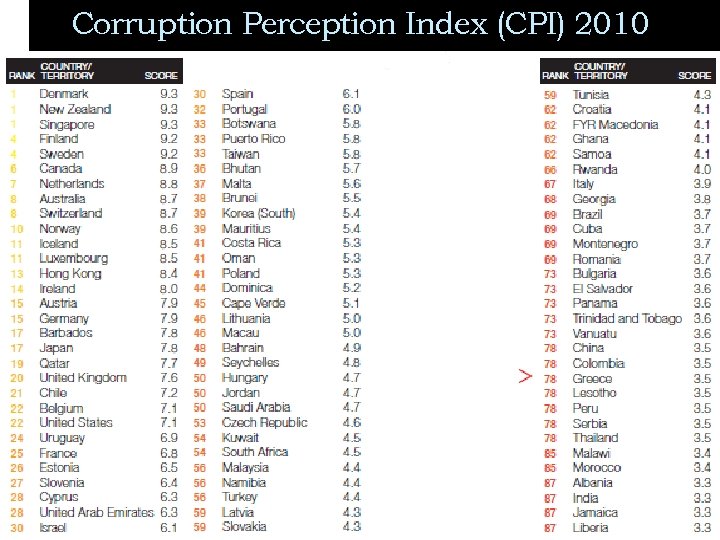

Corruption Perception Index (CPI) 2010

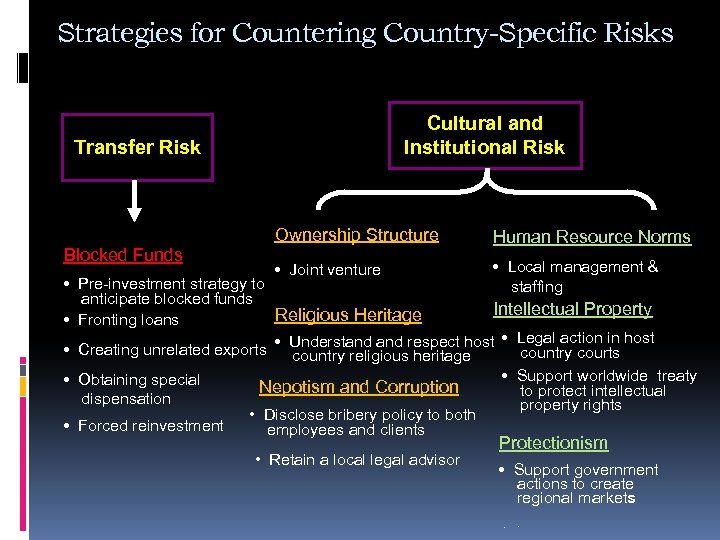

Strategies for Countering Country-Specific Risks Cultural and Institutional Risk Transfer Risk Ownership Structure Blocked Funds Human Resource Norms • Joint venture • Local management & staffing • Pre-investment strategy to anticipate blocked funds Intellectual Property Religious Heritage • Fronting loans • Understand respect host • Legal action in host • Creating unrelated exports country courts country religious heritage • Support worldwide treaty • Obtaining special Nepotism and Corruption to protect intellectual dispensation property rights • Disclose bribery policy to both • Forced reinvestment employees and clients • Retain a local legal advisor Protectionism • Support government actions to create regional markets. .

Country-Specific Risks Ø Transfer risks concern the limitations on the MNC’s ability to transfer funds into and out of a host country without restrictions. MNCs can react to potential transfer risk in 3 stages: Prior to making the investment, a firm can analyze the effect of blocked funds During operations a firm can attempt to move funds through a variety of repositioning techniques Funds that cannot be removed have to be reinvested in the local country to avoid deterioration in real value . .

Transfer Risk MNCs use mostly the following strategies for transferring funds under restrictions: Alternative conduits for repatriating funds Transfer pricing goods & services between subs Leading and lagging payments Using fronting loans Creating unrelated exports Obtaining special dispensation . .

Transfer Risk (cont) Fronting loans: Transferring funds from parent to host country. Certain countries (China) impose restrictions to the entrance of foreign capital. A fronting loan is a parent-to-sub loan channeled through a financial intermediary. The lending parent deposits the funds in an international bank, let’s say in London. That bank in turn “loans” this amount to the borrowing subsidiary. In essence, the bank “fronts” for the parent. . .

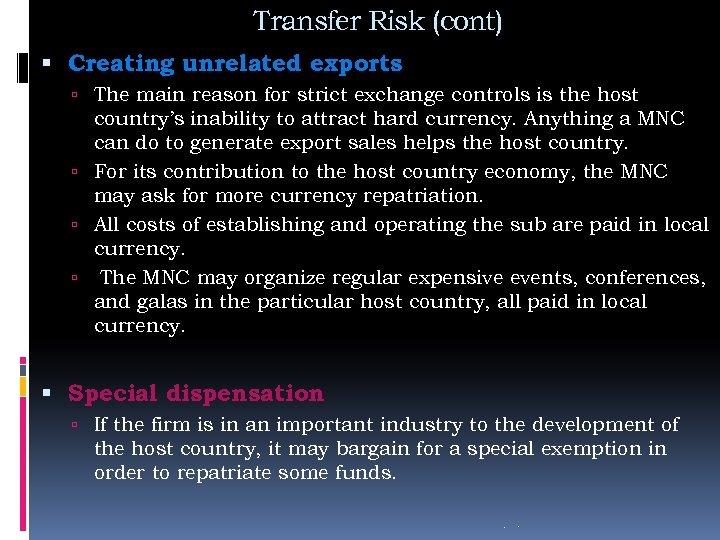

Transfer Risk (cont) Creating unrelated exports The main reason for strict exchange controls is the host country’s inability to attract hard currency. Anything a MNC can do to generate export sales helps the host country. For its contribution to the host country economy, the MNC may ask for more currency repatriation. All costs of establishing and operating the sub are paid in local currency. The MNC may organize regular expensive events, conferences, and galas in the particular host country, all paid in local currency. Special dispensation If the firm is in an important industry to the development of the host country, it may bargain for a special exemption in order to repatriate some funds. . .

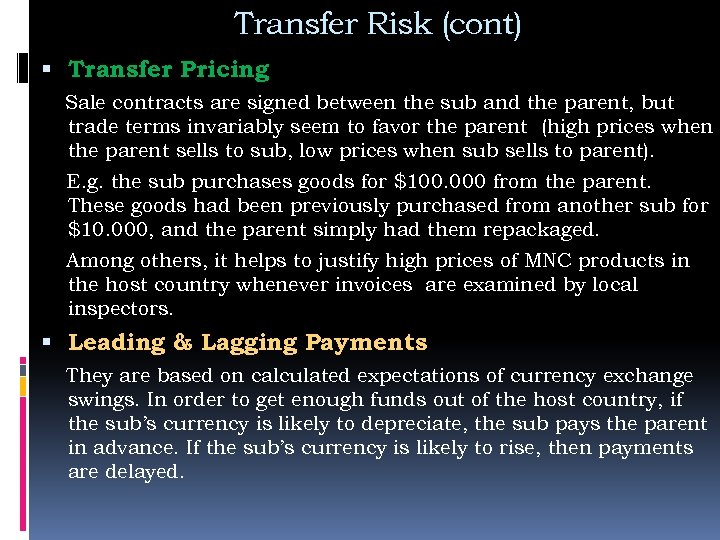

Transfer Risk (cont) Transfer Pricing. Sale contracts are signed between the sub and the parent, but trade terms invariably seem to favor the parent (high prices when the parent sells to sub, low prices when sub sells to parent). E. g. the sub purchases goods for $100. 000 from the parent. These goods had been previously purchased from another sub for $10. 000, and the parent simply had them repackaged. Among others, it helps to justify high prices of MNC products in the host country whenever invoices are examined by local inspectors. Leading & Lagging Payments They are based on calculated expectations of currency exchange swings. In order to get enough funds out of the host country, if the sub’s currency is likely to depreciate, the sub pays the parent in advance. If the sub’s currency is likely to rise, then payments are delayed.

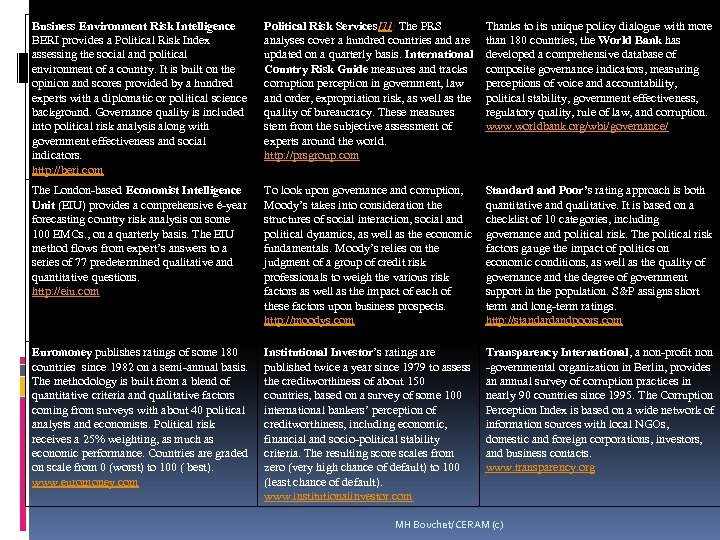

Business Environment Risk Intelligence BERI provides a Political Risk Index assessing the social and political environment of a country. It is built on the opinion and scores provided by a hundred experts with a diplomatic or political science background. Governance quality is included into political risk analysis along with government effectiveness and social indicators. http: //beri. com Political Risk Services[1]: The PRS analyses cover a hundred countries and are updated on a quarterly basis. International Country Risk Guide measures and tracks corruption perception in government, law and order, expropriation risk, as well as the quality of bureaucracy. These measures stem from the subjective assessment of experts around the world. http: //prsgroup. com Thanks to its unique policy dialogue with more than 180 countries, the World Bank has developed a comprehensive database of composite governance indicators, measuring perceptions of voice and accountability, political stability, government effectiveness, regulatory quality, rule of law, and corruption. www. worldbank. org/wbi/governance/ The London-based Economist Intelligence Unit (EIU) provides a comprehensive é-year forecasting country risk analysis on some 100 EMCs. , on a quarterly basis. The EIU method flows from expert’s answers to a series of 77 predetermined qualitative and quantitative questions. http: //eiu. com To look upon governance and corruption, Moody’s takes into consideration the structures of social interaction, social and political dynamics, as well as the economic fundamentals. Moody’s relies on the judgment of a group of credit risk professionals to weigh the various risk factors as well as the impact of each of these factors upon business prospects. http: //moodys. com Standard and Poor’s rating approach is both quantitative and qualitative. It is based on a checklist of 10 categories, including governance and political risk. The political risk factors gauge the impact of politics on economic conditions, as well as the quality of governance and the degree of government support in the population. S&P assigns short term and long-term ratings. http: //standardandpoors. com Euromoney publishes ratings of some 180 countries since 1982 on a semi-annual basis. The methodology is built from a blend of quantitative criteria and qualitative factors coming from surveys with about 40 political analysts and economists. Political risk receives a 25% weighting, as much as economic performance. Countries are graded on scale from 0 (worst) to 100 ( best). www. euromoney. com Institutional Investor’s ratings are published twice a year since 1979 to assess the creditworthiness of about 150 countries, based on a survey of some 100 international bankers’ perception of creditworthiness, including economic, financial and socio-political stability criteria. The resulting score scales from zero (very high chance of default) to 100 (least chance of default). www. institutionalinvestor. com Transparency International, a non-profit non -governmental organization in Berlin, provides an annual survey of corruption practices in nearly 90 countries since 1995. The Corruption Perception Index is based on a wide network of information sources with local NGOs, domestic and foreign corporations, investors, and business contacts. www. transparency. org MH Bouchet/CERAM (c)

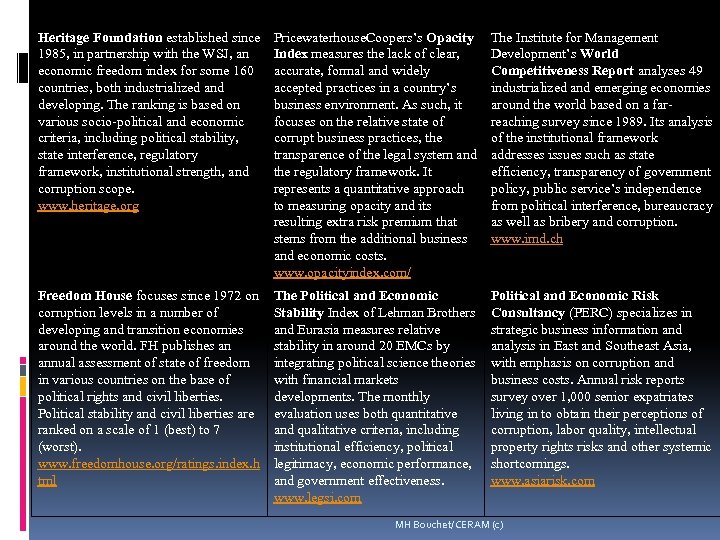

Heritage Foundation established since 1985, in partnership with the WSJ, an economic freedom index for some 160 countries, both industrialized and developing. The ranking is based on various socio-political and economic criteria, including political stability, state interference, regulatory framework, institutional strength, and corruption scope. www. heritage. org Pricewaterhouse. Coopers’s Opacity Index measures the lack of clear, accurate, formal and widely accepted practices in a country’s business environment. As such, it focuses on the relative state of corrupt business practices, the transparence of the legal system and the regulatory framework. It represents a quantitative approach to measuring opacity and its resulting extra risk premium that stems from the additional business and economic costs. www. opacityindex. com/ The Institute for Management Development’s World Competitiveness Report analyses 49 industrialized and emerging economies around the world based on a farreaching survey since 1989. Its analysis of the institutional framework addresses issues such as state efficiency, transparency of government policy, public service’s independence from political interference, bureaucracy as well as bribery and corruption. www. imd. ch Freedom House focuses since 1972 on corruption levels in a number of developing and transition economies around the world. FH publishes an annual assessment of state of freedom in various countries on the base of political rights and civil liberties. Political stability and civil liberties are ranked on a scale of 1 (best) to 7 (worst). www. freedomhouse. org/ratings. index. h tml The Political and Economic Stability Index of Lehman Brothers and Eurasia measures relative stability in around 20 EMCs by integrating political science theories with financial markets developments. The monthly evaluation uses both quantitative and qualitative criteria, including institutional efficiency, political legitimacy, economic performance, and government effectiveness. www. legsi. com Political and Economic Risk Consultancy (PERC) specializes in strategic business information and analysis in East and Southeast Asia, with emphasis on corruption and business costs. Annual risk reports survey over 1, 000 senior expatriates living in to obtain their perceptions of corruption, labor quality, intellectual property rights risks and other systemic shortcomings. www. asiarisk. com MH Bouchet/CERAM (c)

7c87db70fe2021d6316e2a94aa557eb8.ppt