72ff49a6029c7bdfc25360fb93f183ad.ppt

- Количество слайдов: 31

Coupon Trends and Takeaways for 2013 Devora Rogers Senior Director, Retail Marketing Insights

Coupon Trends and Takeaways for 2013 Devora Rogers Senior Director, Retail Marketing Insights

Devora Rogers • Senior Director, Retail Marketing Insights • New to Inmar (and North Carolina) • Previously with IPG Media Lab and Shopper Sciences • devora. rogers@inmar. com • 336. 770. 3495 • Twitter: @devoraerogers

Devora Rogers • Senior Director, Retail Marketing Insights • New to Inmar (and North Carolina) • Previously with IPG Media Lab and Shopper Sciences • devora. rogers@inmar. com • 336. 770. 3495 • Twitter: @devoraerogers

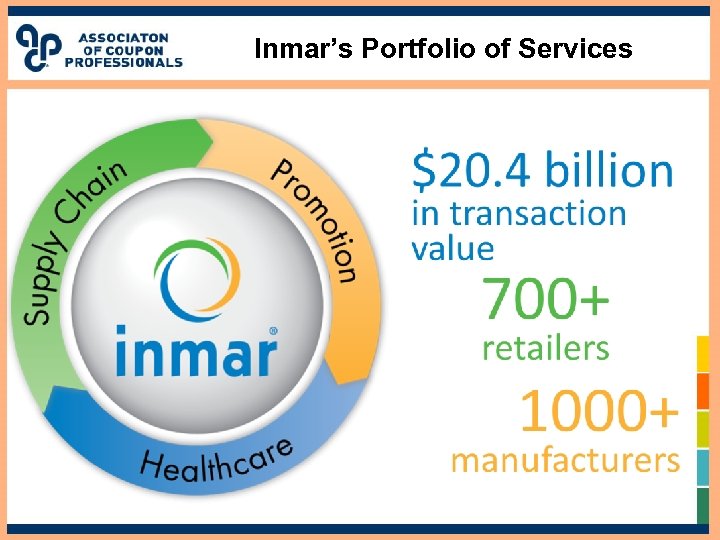

Inmar’s Portfolio of Services

Inmar’s Portfolio of Services

Key Findings 2012 COUPON TRENDS

Key Findings 2012 COUPON TRENDS

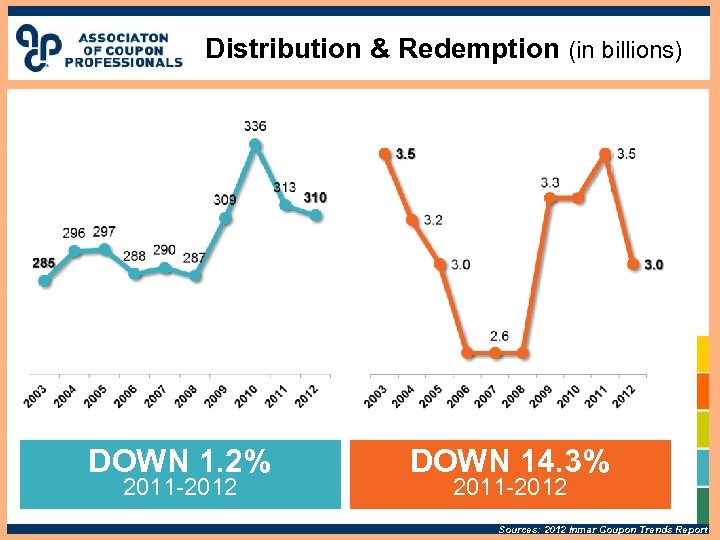

Distribution & Redemption (in billions) DOWN 1. 2% 2011 -2012 DOWN 14. 3% 2011 -2012 Sources: 2012 Inmar Coupon Trends Report

Distribution & Redemption (in billions) DOWN 1. 2% 2011 -2012 DOWN 14. 3% 2011 -2012 Sources: 2012 Inmar Coupon Trends Report

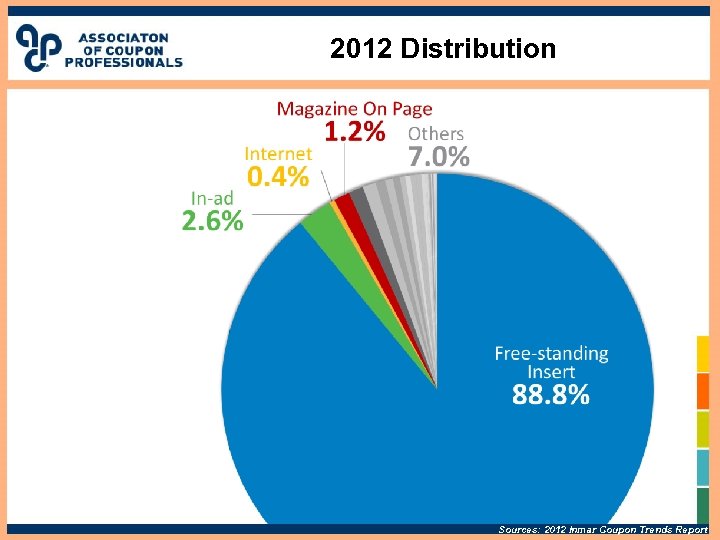

2012 Distribution Sources: 2012 Inmar Coupon Trends Report

2012 Distribution Sources: 2012 Inmar Coupon Trends Report

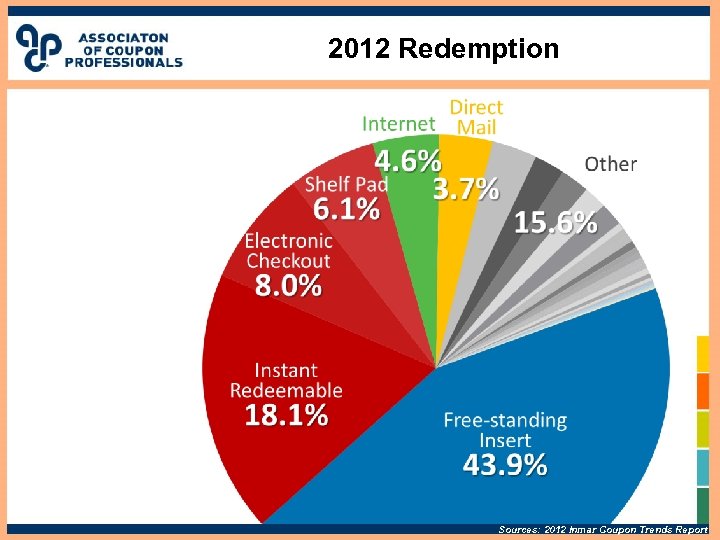

2012 Redemption Sources: 2012 Inmar Coupon Trends Report

2012 Redemption Sources: 2012 Inmar Coupon Trends Report

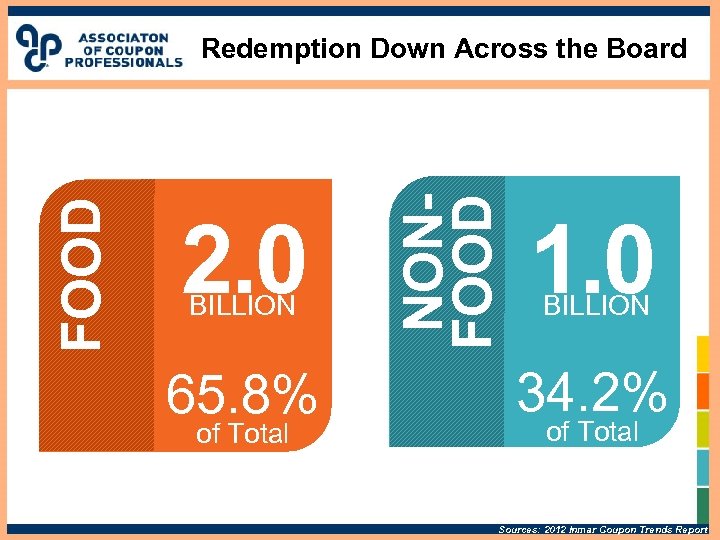

2. 0 BILLION 65. 8% of Total NONFOOD Redemption Down Across the Board 1. 0 BILLION 34. 2% of Total Sources: 2012 Inmar Coupon Trends Report

2. 0 BILLION 65. 8% of Total NONFOOD Redemption Down Across the Board 1. 0 BILLION 34. 2% of Total Sources: 2012 Inmar Coupon Trends Report

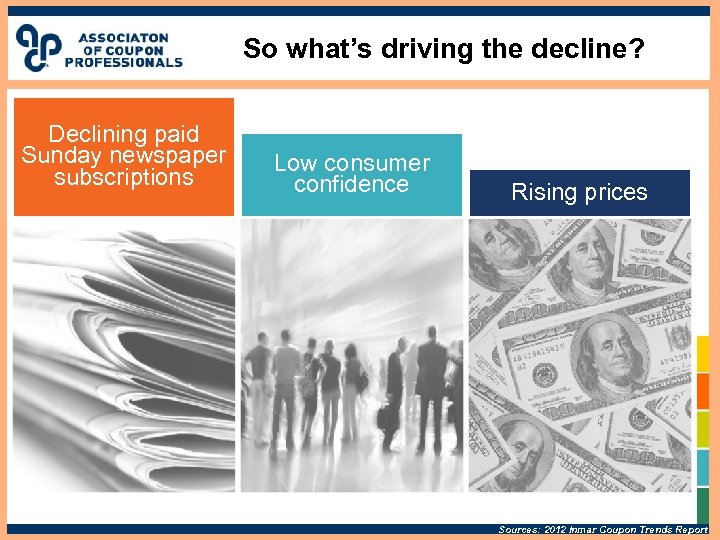

So what’s driving the decline? Declining paid Sunday newspaper subscriptions Low consumer confidence Rising prices Sources: 2012 Inmar Coupon Trends Report

So what’s driving the decline? Declining paid Sunday newspaper subscriptions Low consumer confidence Rising prices Sources: 2012 Inmar Coupon Trends Report

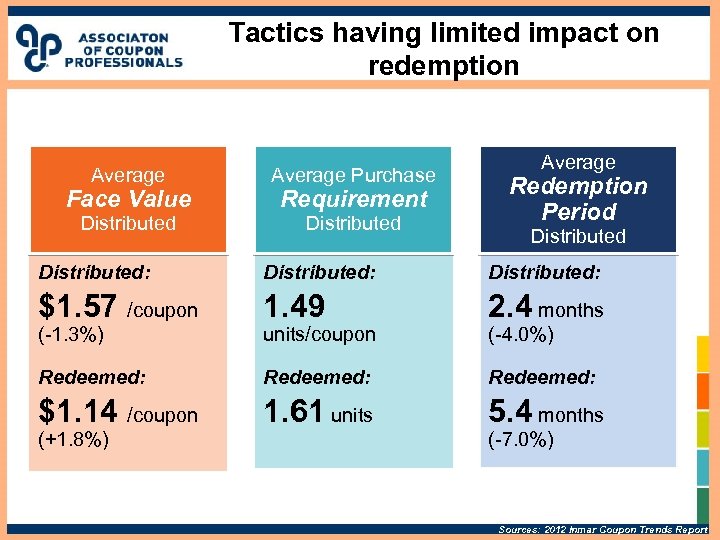

Tactics having limited impact on redemption Average Purchase Distributed Face Value Requirement Average Redemption Period Distributed: $1. 57 /coupon 1. 49 2. 4 months Redeemed: $1. 14 /coupon 1. 61 units 5. 4 months (-1. 3%) (+1. 8%) units/coupon (-4. 0%) (-7. 0%) Sources: 2012 Inmar Coupon Trends Report

Tactics having limited impact on redemption Average Purchase Distributed Face Value Requirement Average Redemption Period Distributed: $1. 57 /coupon 1. 49 2. 4 months Redeemed: $1. 14 /coupon 1. 61 units 5. 4 months (-1. 3%) (+1. 8%) units/coupon (-4. 0%) (-7. 0%) Sources: 2012 Inmar Coupon Trends Report

Tactics having limited impact on redemption 34. 36% 37. 64% “I usually won’t use a coupon if I have to purchase multiple items” “There are too many rules/exclusions for using coupons” Sources: 2012 Inmar Coupon Trends Report

Tactics having limited impact on redemption 34. 36% 37. 64% “I usually won’t use a coupon if I have to purchase multiple items” “There are too many rules/exclusions for using coupons” Sources: 2012 Inmar Coupon Trends Report

New Product Trial Dampening Redemption 190 727 93 Manufacturers Promoting New Products via FSI in 2012 New Product Event Dates in 2012 Categories Featuring New Product Events in 2012 +9. 9% +23. 2% +13. 4% over 2011 52. 83% “I can’t find coupons for the products I want to buy” Sources: , Marx and 2012 Inmar Shopper Survey

New Product Trial Dampening Redemption 190 727 93 Manufacturers Promoting New Products via FSI in 2012 New Product Event Dates in 2012 Categories Featuring New Product Events in 2012 +9. 9% +23. 2% +13. 4% over 2011 52. 83% “I can’t find coupons for the products I want to buy” Sources: , Marx and 2012 Inmar Shopper Survey

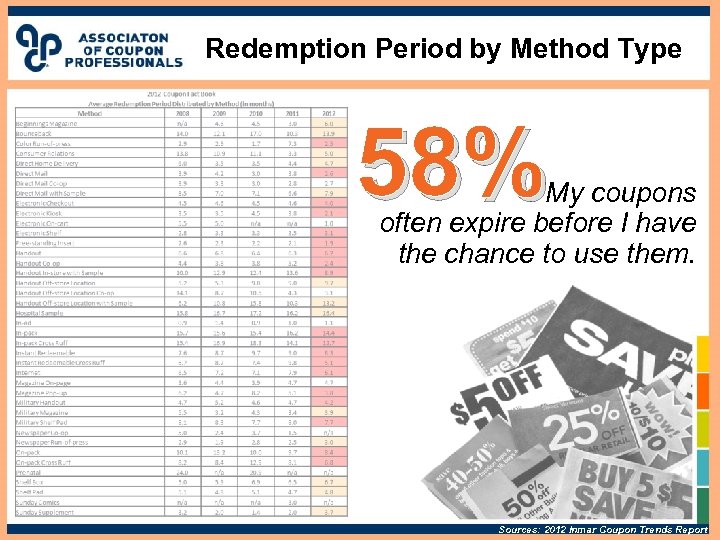

Redemption Period by Method Type 58% My coupons often expire before I have the chance to use them. Sources: 2012 Inmar Coupon Trends Report

Redemption Period by Method Type 58% My coupons often expire before I have the chance to use them. Sources: 2012 Inmar Coupon Trends Report

SHOPPER BEHAVIOR

SHOPPER BEHAVIOR

“New Couponer” The ENTITLED ENABLED ENGAGED 15

“New Couponer” The ENTITLED ENABLED ENGAGED 15

Changing Shopper Sentiment From effort to entitlement “If I put in the effort, I can get deals on the brands I buy. ” “If I shop a store a lot, I shouldn’t have to work for deals I deserve. ”

Changing Shopper Sentiment From effort to entitlement “If I put in the effort, I can get deals on the brands I buy. ” “If I shop a store a lot, I shouldn’t have to work for deals I deserve. ”

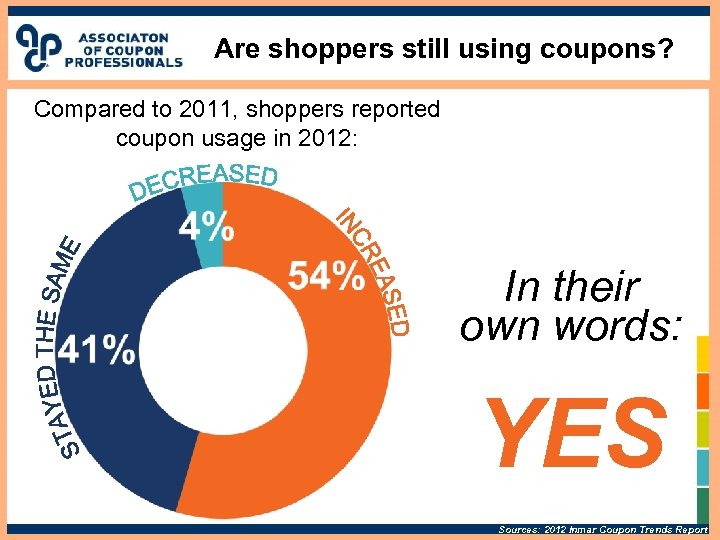

Are shoppers still using coupons? Compared to 2011, shoppers reported coupon usage in 2012: In their own words: YES Sources: 2012 Inmar Coupon Trends Report

Are shoppers still using coupons? Compared to 2011, shoppers reported coupon usage in 2012: In their own words: YES Sources: 2012 Inmar Coupon Trends Report

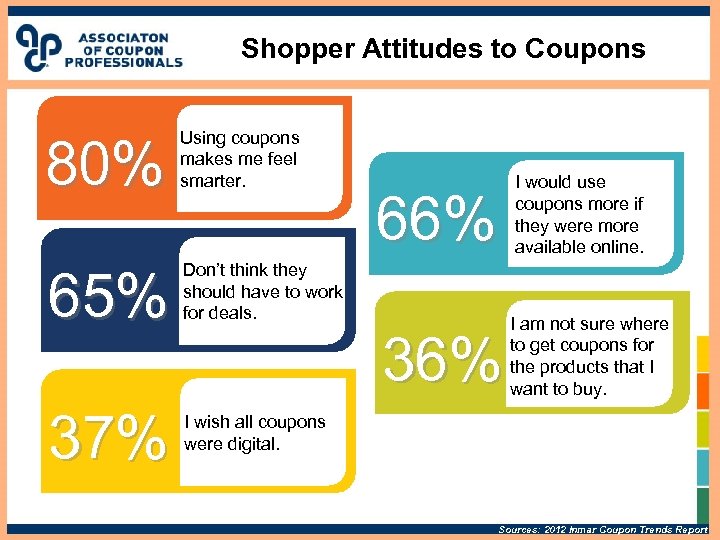

Shopper Attitudes to Coupons 80% Using coupons makes me feel smarter. 65% Don’t think they should have to work for deals. 37% I wish all coupons were digital. 66% 36% I would use coupons more if they were more available online. I am not sure where to get coupons for the products that I want to buy. Sources: 2012 Inmar Coupon Trends Report

Shopper Attitudes to Coupons 80% Using coupons makes me feel smarter. 65% Don’t think they should have to work for deals. 37% I wish all coupons were digital. 66% 36% I would use coupons more if they were more available online. I am not sure where to get coupons for the products that I want to buy. Sources: 2012 Inmar Coupon Trends Report

Hispanic Shopper Attitudes 44% Hispanic 35% Non. Hispanic “I wish all coupons were digital” 19

Hispanic Shopper Attitudes 44% Hispanic 35% Non. Hispanic “I wish all coupons were digital” 19

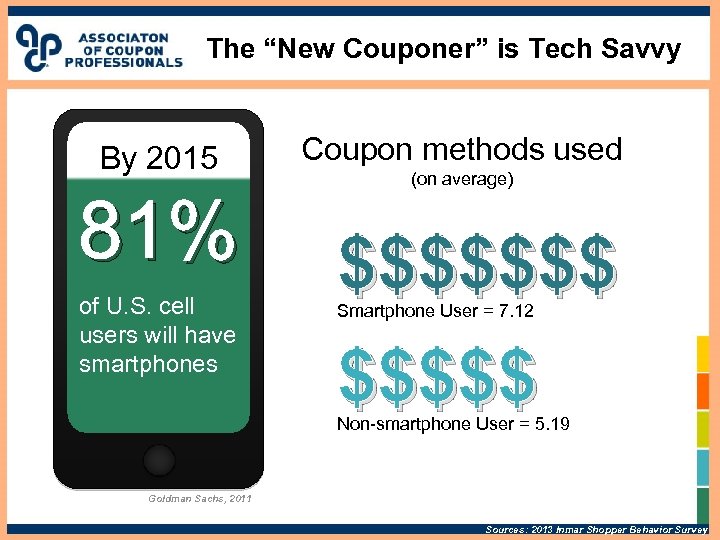

The “New Couponer” is Tech Savvy By 2015 81% of U. S. cell users will have smartphones Coupon methods used (on average) $$$$$$$ Smartphone User = 7. 12 $$$$$ Non-smartphone User = 5. 19 Goldman Sachs, 2011 Sources: 2013 Inmar Shopper Behavior Survey

The “New Couponer” is Tech Savvy By 2015 81% of U. S. cell users will have smartphones Coupon methods used (on average) $$$$$$$ Smartphone User = 7. 12 $$$$$ Non-smartphone User = 5. 19 Goldman Sachs, 2011 Sources: 2013 Inmar Shopper Behavior Survey

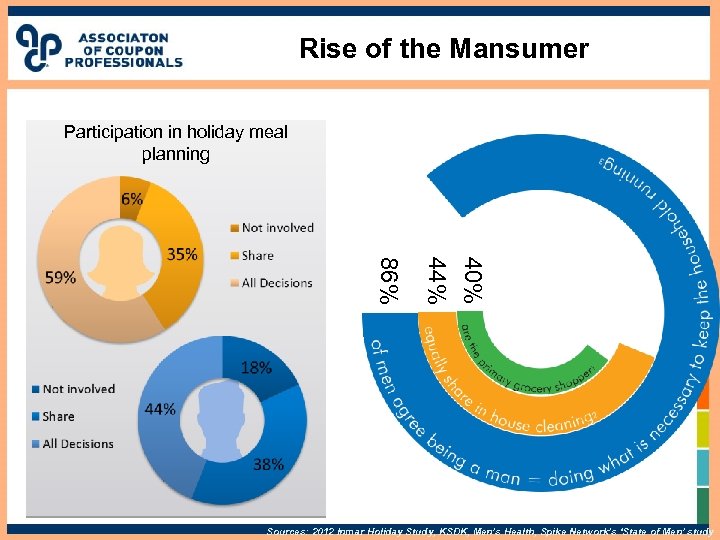

Rise of the Mansumer Participation in holiday meal planning 40% 44% 86% Sources: 2012 Inmar Holiday Study, KSDK, Men’s Health, Spike Network’s ‘State of Men’ study

Rise of the Mansumer Participation in holiday meal planning 40% 44% 86% Sources: 2012 Inmar Holiday Study, KSDK, Men’s Health, Spike Network’s ‘State of Men’ study

Average Number of Coupon Methods Used 7. 49 Kids 7. 32 Hispanic 6. 12 Non. Hispanic 5. 47 6. 43 6. 76 7. 11 35+ Female Overall 5. 68 6. 00 Under 35 Male No kids 22

Average Number of Coupon Methods Used 7. 49 Kids 7. 32 Hispanic 6. 12 Non. Hispanic 5. 47 6. 43 6. 76 7. 11 35+ Female Overall 5. 68 6. 00 Under 35 Male No kids 22

THE DISH ON DIGITAL

THE DISH ON DIGITAL

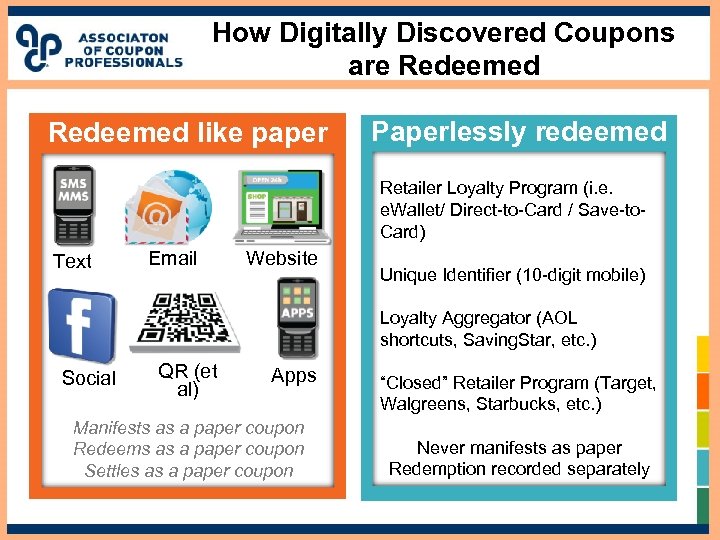

How Digitally Discovered Coupons are Redeemed like paper Paperlessly redeemed Retailer Loyalty Program (i. e. Wallet/ Direct-to-Card / Save-to. Card) Text Email Website Unique Identifier (10 -digit mobile) Loyalty Aggregator (AOL shortcuts, Saving. Star, etc. ) Social QR (et al) Apps Manifests as a paper coupon Redeems as a paper coupon Settles as a paper coupon “Closed” Retailer Program (Target, Walgreens, Starbucks, etc. ) Never manifests as paper Redemption recorded separately

How Digitally Discovered Coupons are Redeemed like paper Paperlessly redeemed Retailer Loyalty Program (i. e. Wallet/ Direct-to-Card / Save-to. Card) Text Email Website Unique Identifier (10 -digit mobile) Loyalty Aggregator (AOL shortcuts, Saving. Star, etc. ) Social QR (et al) Apps Manifests as a paper coupon Redeems as a paper coupon Settles as a paper coupon “Closed” Retailer Program (Target, Walgreens, Starbucks, etc. ) Never manifests as paper Redemption recorded separately

Digital Stats for 2012 250 M CLIPPED 27. 5 M REDEEMED $0. 91 AVERAGE FACE VALUE 11% AVERAGE REDEMPTION RATE In 2013, the number of retailer storefronts which accept paperless coupons is expected to grow 50% or more depending on channel. Sources: 2012 Inmar Coupon Trends Report

Digital Stats for 2012 250 M CLIPPED 27. 5 M REDEEMED $0. 91 AVERAGE FACE VALUE 11% AVERAGE REDEMPTION RATE In 2013, the number of retailer storefronts which accept paperless coupons is expected to grow 50% or more depending on channel. Sources: 2012 Inmar Coupon Trends Report

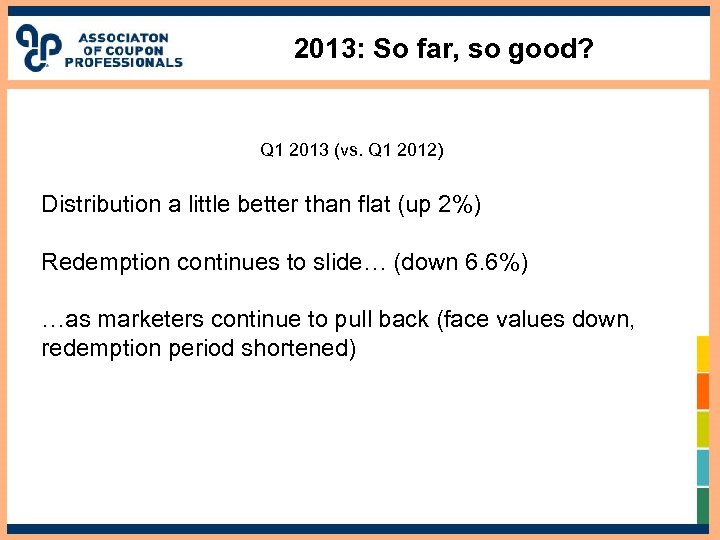

2013: So far, so good? Q 1 2013 (vs. Q 1 2012) Distribution a little better than flat (up 2%) Redemption continues to slide… (down 6. 6%) …as marketers continue to pull back (face values down, redemption period shortened)

2013: So far, so good? Q 1 2013 (vs. Q 1 2012) Distribution a little better than flat (up 2%) Redemption continues to slide… (down 6. 6%) …as marketers continue to pull back (face values down, redemption period shortened)

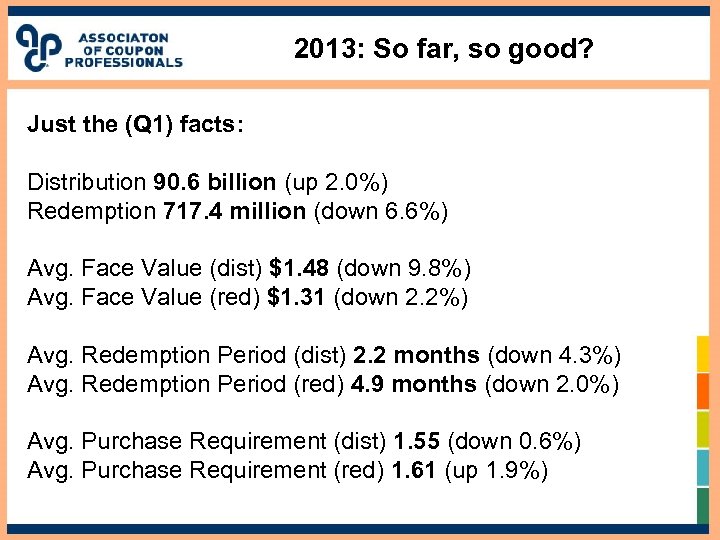

2013: So far, so good? Just the (Q 1) facts: Distribution 90. 6 billion (up 2. 0%) Redemption 717. 4 million (down 6. 6%) Avg. Face Value (dist) $1. 48 (down 9. 8%) Avg. Face Value (red) $1. 31 (down 2. 2%) Avg. Redemption Period (dist) 2. 2 months (down 4. 3%) Avg. Redemption Period (red) 4. 9 months (down 2. 0%) Avg. Purchase Requirement (dist) 1. 55 (down 0. 6%) Avg. Purchase Requirement (red) 1. 61 (up 1. 9%)

2013: So far, so good? Just the (Q 1) facts: Distribution 90. 6 billion (up 2. 0%) Redemption 717. 4 million (down 6. 6%) Avg. Face Value (dist) $1. 48 (down 9. 8%) Avg. Face Value (red) $1. 31 (down 2. 2%) Avg. Redemption Period (dist) 2. 2 months (down 4. 3%) Avg. Redemption Period (red) 4. 9 months (down 2. 0%) Avg. Purchase Requirement (dist) 1. 55 (down 0. 6%) Avg. Purchase Requirement (red) 1. 61 (up 1. 9%)

Plus ca change… Q 1 2013 (vs. Q 1 2012) Distribution a little better than flat (up 2%) Redemption continues to slide… (down 6. 6%) …as marketers continue to pull back (face values down, redemption period shortened)

Plus ca change… Q 1 2013 (vs. Q 1 2012) Distribution a little better than flat (up 2%) Redemption continues to slide… (down 6. 6%) …as marketers continue to pull back (face values down, redemption period shortened)

…plus c’est la meme chose Q 1 2013 (vs. Q 1 2012) FSI remains dominant for distribution (91. 2%) “Big 3” redemption methods (FSI, Instant Redeemable, Electronic Checkout) account for 75% of all coupons redeemed Print at Home / Internet Printable next with 5. 8% share

…plus c’est la meme chose Q 1 2013 (vs. Q 1 2012) FSI remains dominant for distribution (91. 2%) “Big 3” redemption methods (FSI, Instant Redeemable, Electronic Checkout) account for 75% of all coupons redeemed Print at Home / Internet Printable next with 5. 8% share

Thank you. QUESTIONS?

Thank you. QUESTIONS?