afe8672554dae8f844c683451dc601ea.ppt

- Количество слайдов: 55

Country Risk Analysis A presentation by ECGC

What is Risk? n n Uncertainty about the future outcome n Lack of knowledge n Imperfection in knowledge Possibility of Loss

Export Credit Risk n n n Exports n Goods n Services Credit n Extending supplier credit: DP, DA, OA Risk n Possibility of nonpayment of accounts receivables

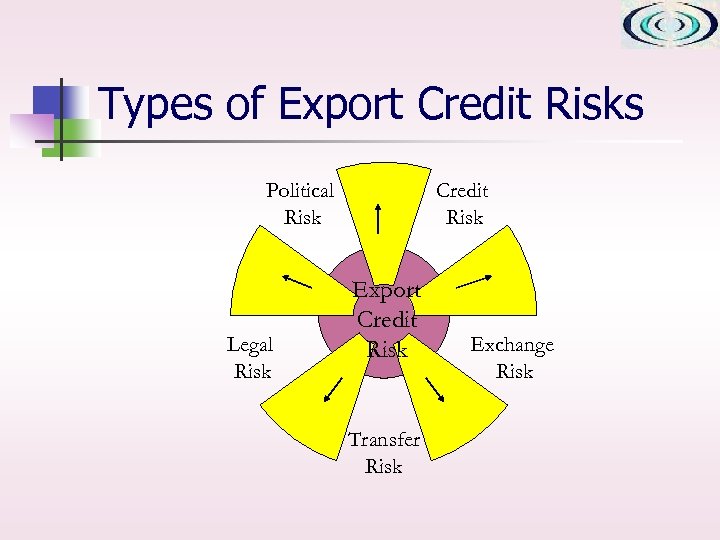

Types of Export Credit Risks Credit Risk Political Risk Legal Risk Export Credit Risk Transfer Risk Exchange Risk

Political Risk n Some countries may experience major political instability defaults on payments leading to… n exchange transfer blockages n nationalization n confiscation of property n

Credit Risk n The risk of n Insolvency n Default n Fraud n Unwillingness to accept the goods on the part of the buyer All resulting in…. . Credit risk

Exchange Risk n The possibility of variability in the exchange rate on account of the time lag between the date of contract and actual payment is referred to as 'Exchange Risk'

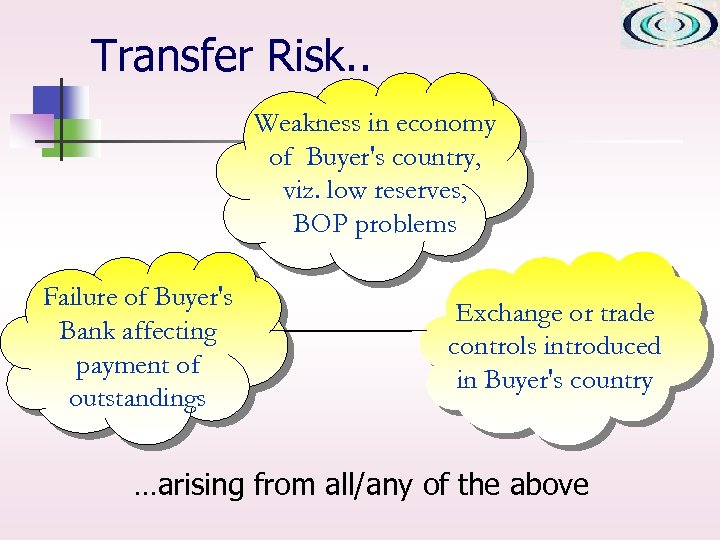

Transfer Risk. . Weakness in economy of Buyer's country, viz. low reserves, BOP problems Failure of Buyer's Bank affecting payment of outstandings Exchange or trade controls introduced in Buyer's country …arising from all/any of the above

Legal Risk n n Differences in law can be expected in overseas countries These may have an impact in such areas as: • • import procedures taxation employment practices currency dealings property rights the protection of intellectual property agency/distributorship arrangements

Export Credit Insurance n Export Credit insurance is cover offered by insurance companies which encompasses the risk of non-payment within export operations Risks covered by export credit insurers: Commercial Risk Political Risk

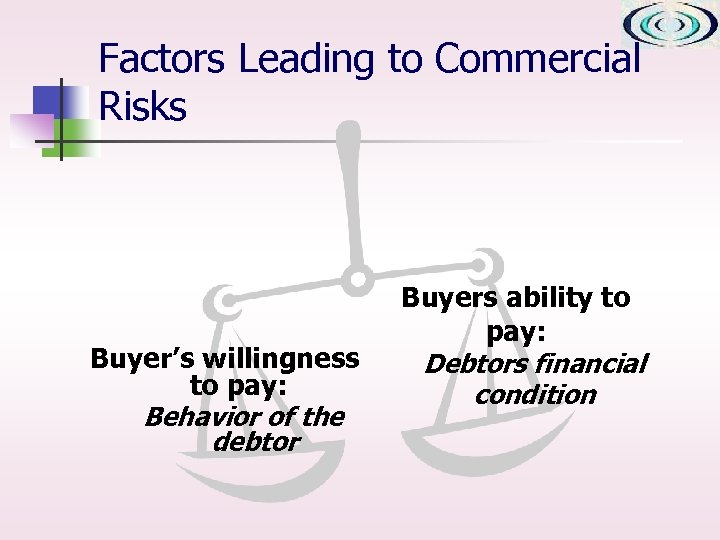

Factors Leading to Commercial Risks Buyer’s willingness to pay: Behavior of the debtor Buyers ability to pay: Debtors financial condition

Commercial Risks n n Insolvency/ Bankruptcy Breach of Contract n n Payment Default Refuse to take delivery of goods Ability or behavior?

Political Risks n Political risks cover events that occur abroad other than commercial risks such as: The general political risk The natural catastrophe risk The non-transfer risk

Methods of Political Risk Control by Credit Insurers n Country Risk Classification: The arrangement on Guidelines for Officially Supported Export Credits is a "Gentlemen's Agreement" among OECD Participants. The Arrangement, including the Knaepen Package, gives a seven fold classification of countries, which is used by many export credit insurers

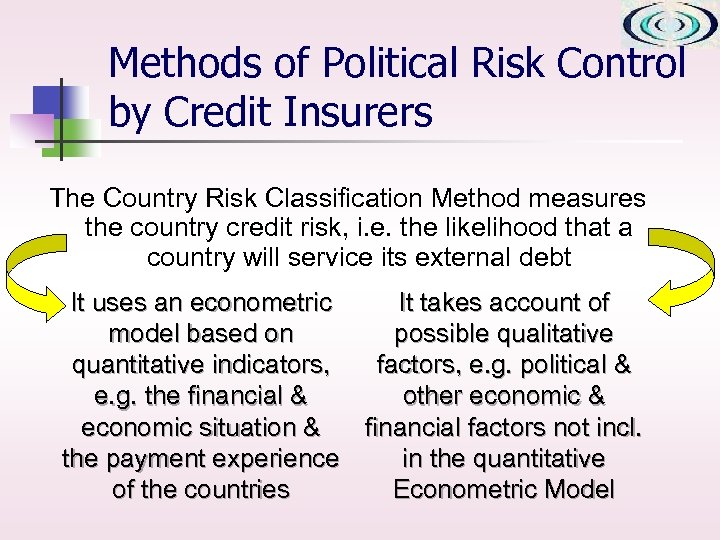

Methods of Political Risk Control by Credit Insurers The Country Risk Classification Method measures the country credit risk, i. e. the likelihood that a country will service its external debt It uses an econometric It takes account of model based on possible qualitative quantitative indicators, factors, e. g. political & e. g. the financial & other economic & economic situation & financial factors not incl. the payment experience in the quantitative of the countries Econometric Model

Methods of Political Risk Control by Credit Insurers The final classification, based only on valid country risk elements, is a consensus decision of the sub. Group of Country Risk Experts that involves the country risk experts of the participating Export Credit Agencies

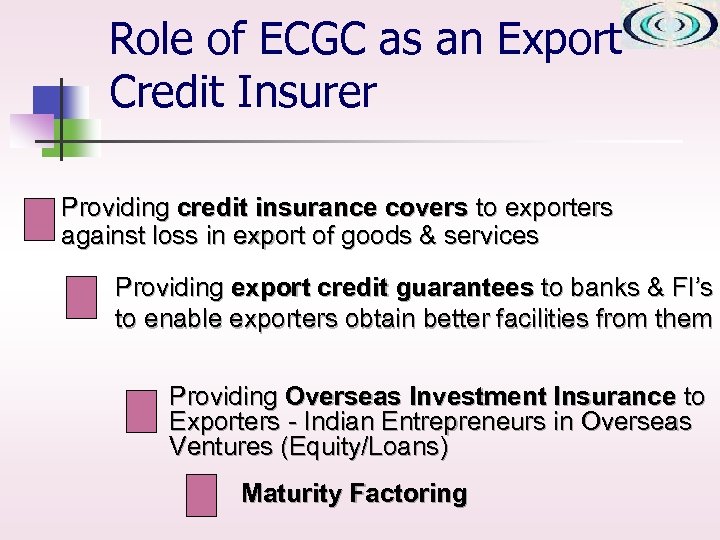

Role of ECGC as an Export Credit Insurer Providing credit insurance covers to exporters against loss in export of goods & services Providing export credit guarantees to banks & FI’s to enable exporters obtain better facilities from them Providing Overseas Investment Insurance to Exporters - Indian Entrepreneurs in Overseas Ventures (Equity/Loans) Maturity Factoring

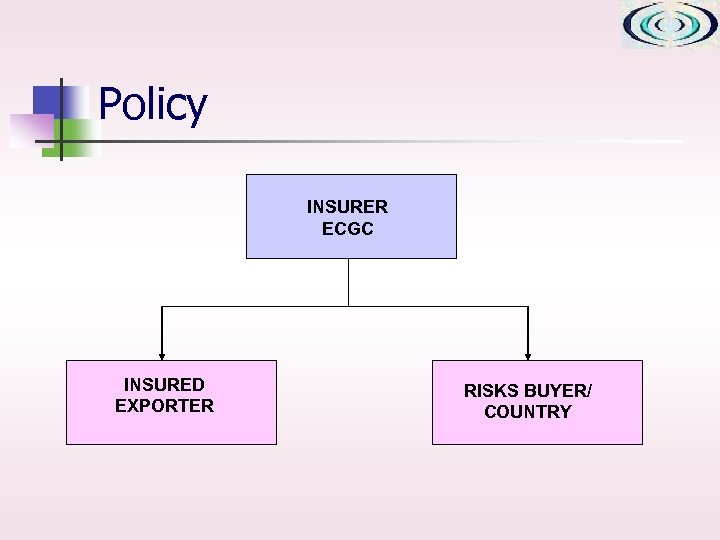

Policy INSURER ECGC INSURED EXPORTER RISKS BUYER/ COUNTRY

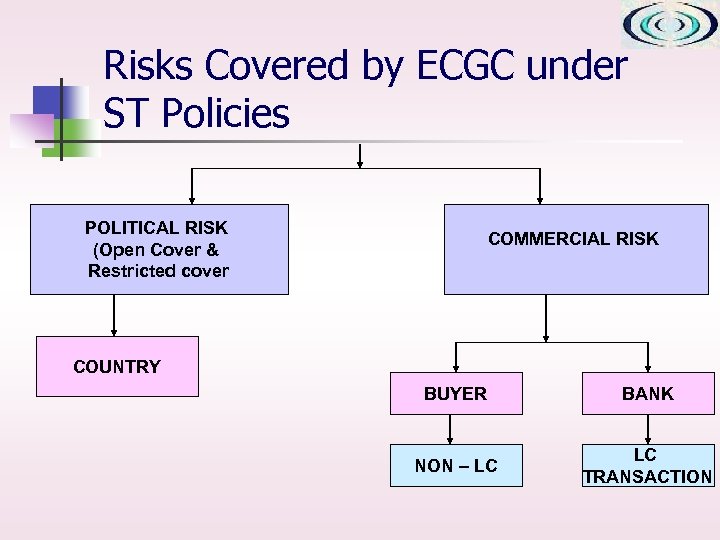

Risks Covered by ECGC under ST Policies POLITICAL RISK (Open Cover & Restricted cover COMMERCIAL RISK COUNTRY BUYER BANK NON – LC LC TRANSACTION

Risks Covered Under ST Policies COMMERCIAL RISKS n n n Insolvency of buyer/LC opening bank Default of buyer Repudiation by buyer POLITICAL RISKS n n War/civil war/revolutions Import restrictions Exchange transfer delay/embargo Diversion of Voyage Risk

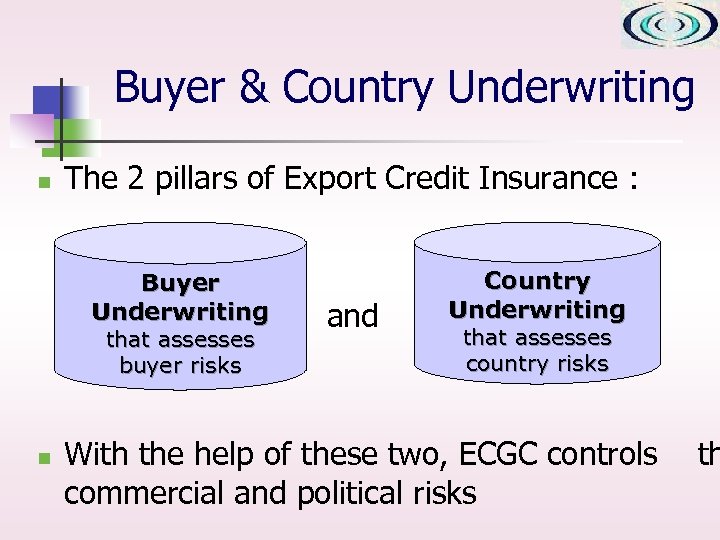

Buyer & Country Underwriting n The 2 pillars of Export Credit Insurance : Buyer Underwriting that assesses buyer risks n and Country Underwriting that assesses country risks With the help of these two, ECGC controls commercial and political risks th

Country Underwriting Evaluating a Country Reviewing a Country Assessment and evaluation of political risks associated with countries for the purpose of premium calculation, determining types of cover and terms of cover Country reviews are taken up on a regular basis for up/down grading

Evaluating a Country n n Country Underwriting involves assessment of a country’s ability and likelihood to honour its commitments undertaken both, as part of trade as well as sovereign debt The country risk is evaluated on the basis of the politico-economic situation prevailing in a country

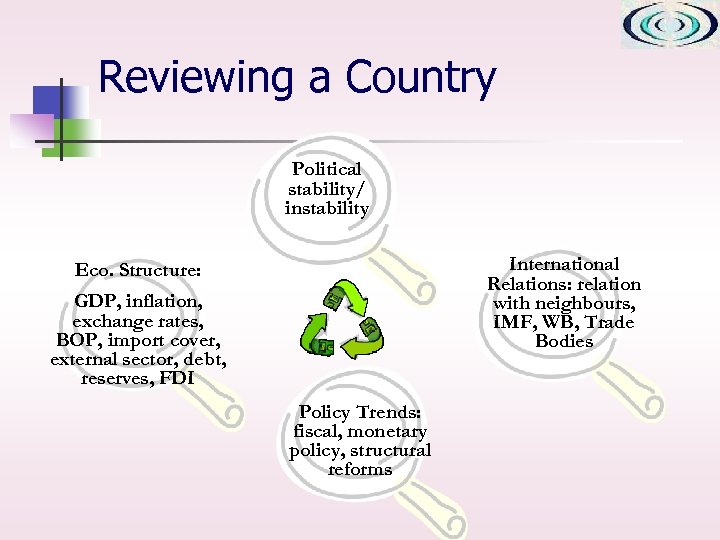

Reviewing a Country Political stability/ instability International Relations: relation with neighbours, IMF, WB, Trade Bodies Eco. Structure: GDP, inflation, exchange rates, BOP, import cover, external sector, debt, reserves, FDI Policy Trends: fiscal, monetary policy, structural reforms

Reviewing a Country Late Payment Experience ECGC Experience with other credit insurers International Rankings Trade Relations with India

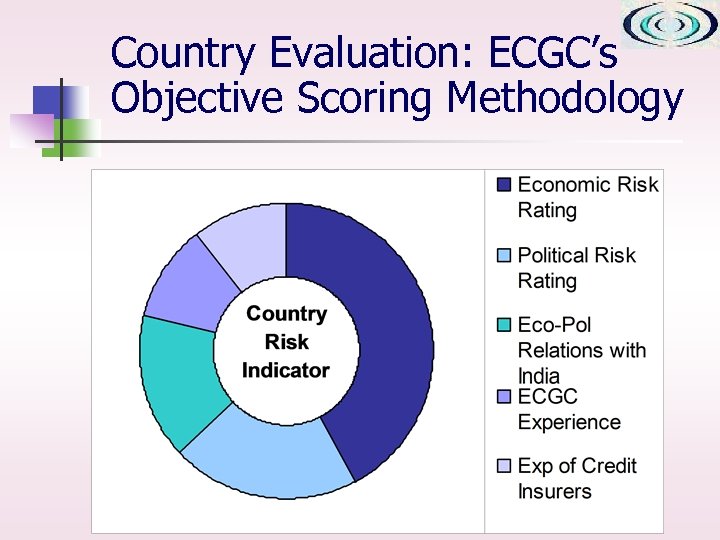

Country Evaluation: ECGC’s Objective Scoring Methodology n n ECGC classifies the countries with the help of an objective scoring methodology Under the rating system followed, the weighted averages of scores on economic risk rating, political risk rating, past experience of ECGC, trade relations with India and experience with other credit insurers are calculated to arrive at the Country Risk Indicator

Country Evaluation: ECGC’s Objective Scoring Methodology

Objective Scoring Methodology n The individual scores are added up as per pre-determined weights n Weightage scores are summed up to obtain a total final score on a base of 100 n This score is used to derive an overall rating for classifying the countries

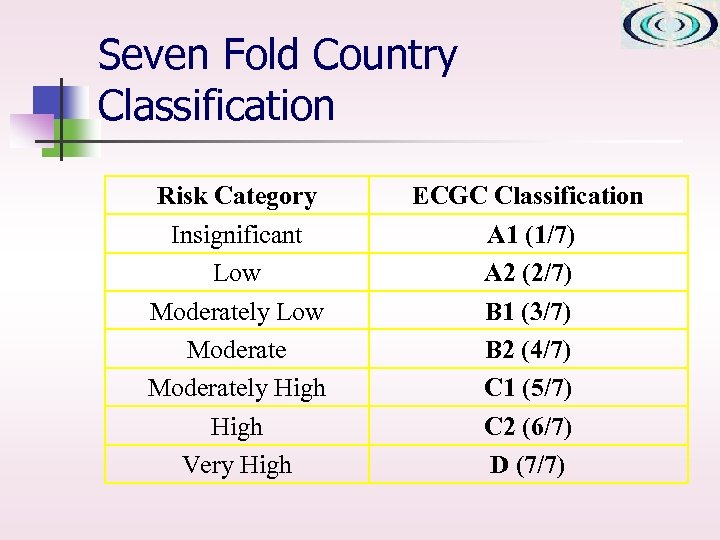

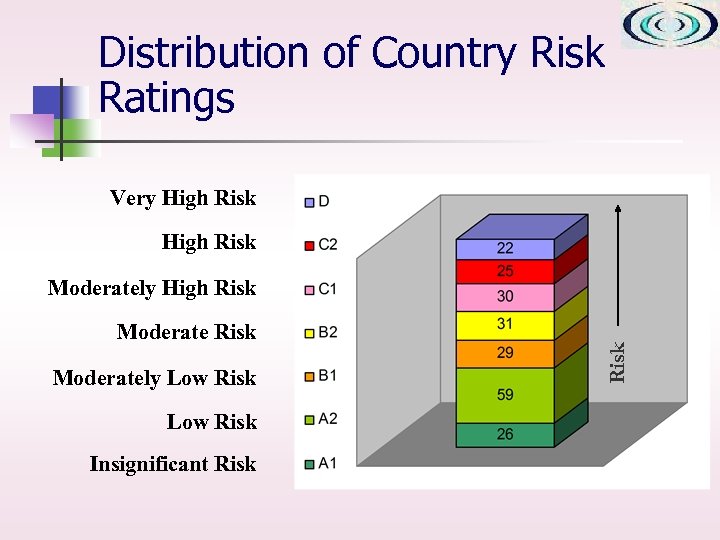

Seven Fold Country Classification Risk Category Insignificant Low Moderately High Very High ECGC Classification A 1 (1/7) A 2 (2/7) B 1 (3/7) B 2 (4/7) C 1 (5/7) C 2 (6/7) D (7/7)

Types of Cover n While underwriting the country risk, ECGC places the country either in Open Cover n OR Restricted Cover The basis for deciding on the type of cover and terms of cover is a host of economic and political factors

Open Cover Countries n n n Cover with No Restrictions Cover is offered usually on normal terms and conditions i. e. 90% cover, 4 months waiting period for ascertainment of loss and settlement of claims, etc. Currently ECGC places 195 countries under Open Cover

Restricted Cover Countries n n Usually those countries where the political and/or economic conditions are relatively deteriorating or have deteriorated and likelihood of payment delays or non-payment are imminent or have occurred Permits selection of risks ECGC wishes to underwrite

Restricted Cover Countries n n Divided into 2 Categories Category 1: Countries for which revolving limits are approved normally valid for one year n Basis of cover: n n n ILCs opened or confirmed by banks listed in Banker’s almanac or by local banks whose reports are satisfactory. Cover will be 90% Normal cover of 90% on DP/DA terms subject to satisfactory report on the buyer 20 countries under this category

Restricted Cover Countries n Category 2: Countries where Specific Approval will be given on case to case basis on merits n Valid for six months n Normal waiting Period of 4 months n Only 7 countries under this category: Afghanistan, Argentina, Cuba, East Timor, Iraq, North Korea, Somalia

Restricted Cover Countries

Underwriting Options for Restricted Cover Countries n Options exercised to control risk in Restricted Cover countries: n n n n Reduce percentage of cover Increase waiting period for the settlement of claim Provide cover against availability of government guarantee/confirmed ILCs Payment in convertible currency Fix country exposure limit Fix transaction limit per exporter per buyer Fix bank exposure limit

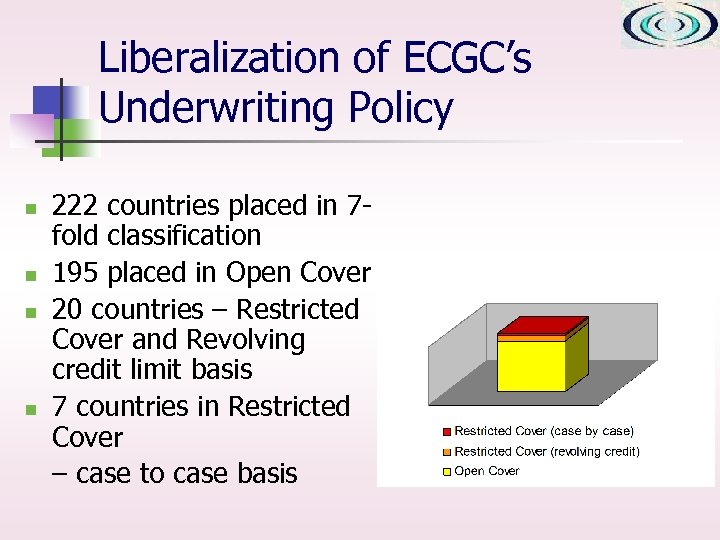

Liberalization of ECGC’s Underwriting Policy n n 222 countries placed in 7 fold classification 195 placed in Open Cover 20 countries – Restricted Cover and Revolving credit limit basis 7 countries in Restricted Cover – case to case basis

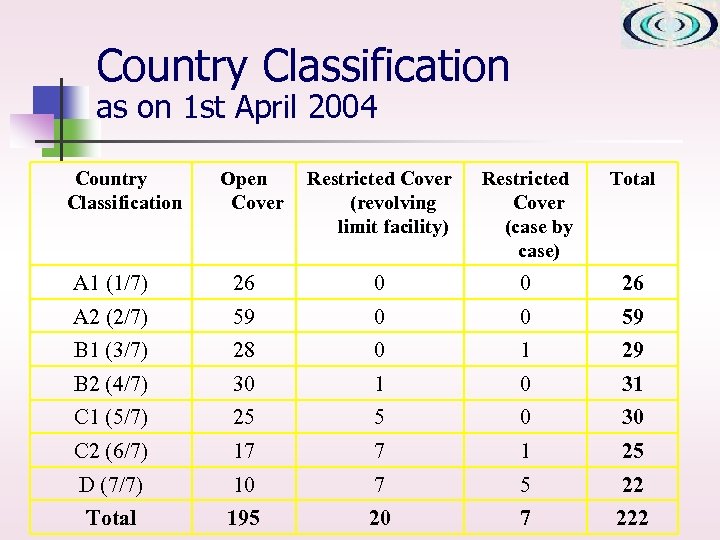

Country Classification as on 1 st April 2004 Country Classification Open Cover Restricted Cover (revolving limit facility) Restricted Cover (case by case) Total A 1 (1/7) 26 0 0 26 A 2 (2/7) 59 0 0 59 B 1 (3/7) 28 0 1 29 B 2 (4/7) 30 1 0 31 C 1 (5/7) 25 5 0 30 C 2 (6/7) 17 7 1 25 D (7/7) 10 7 5 22 Total 195 20 7 222

Distribution of Country Risk Ratings Very High Risk Moderately Low Risk Insignificant Risk Moderately High Risk

Case Study of Selected Countries n n n n A 1: USA (Open Cover) A 2: China (Open Cover) B 1: Russia (Open Cover) B 2: Kenya (Open Cover) C 1: Serbia & Montenegro (Open Cover) C 2: Uganda (Open Cover) D : Iraq (Restricted Cover)

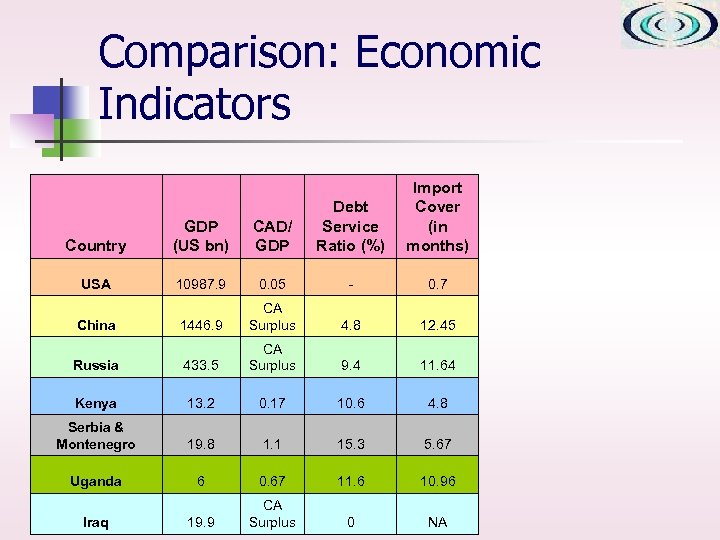

Comparison: Economic Indicators Import Cover (in months) Country GDP (US bn) CAD/ GDP Debt Service Ratio (%) USA 10987. 9 0. 05 - 0. 7 1446. 9 CA Surplus 4. 8 12. 45 Russia 433. 5 CA Surplus 9. 4 11. 64 Kenya 13. 2 0. 17 10. 6 4. 8 Serbia & Montenegro 19. 8 1. 1 15. 3 5. 67 Uganda 6 0. 67 11. 6 10. 96 19. 9 CA Surplus 0 NA China Iraq

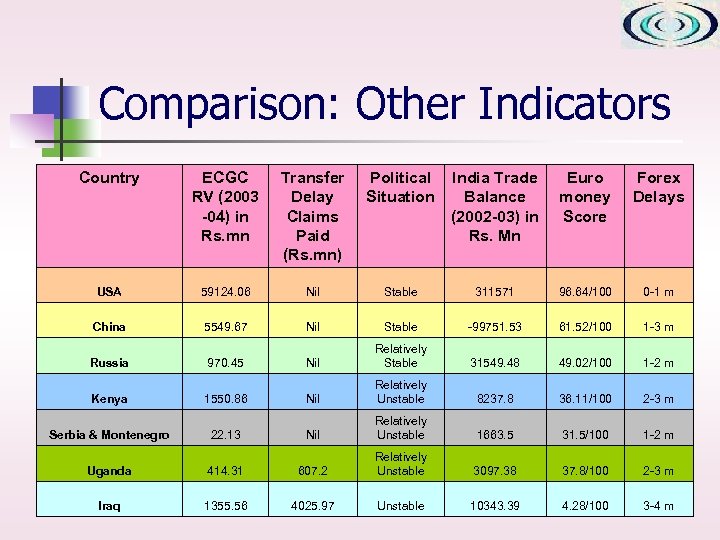

Comparison: Other Indicators Country ECGC RV (2003 -04) in Rs. mn Transfer Delay Claims Paid (Rs. mn) Political Situation India Trade Balance (2002 -03) in Rs. Mn Euro money Score Forex Delays USA 59124. 06 Nil Stable 311571 96. 64/100 0 -1 m China 5549. 67 Nil Stable -99751. 53 61. 52/100 1 -3 m Russia 970. 45 Nil Relatively Stable 31549. 48 49. 02/100 1 -2 m Kenya 1550. 86 Nil Relatively Unstable 8237. 8 36. 11/100 2 -3 m Serbia & Montenegro 22. 13 Nil Relatively Unstable 1663. 5 31. 5/100 1 -2 m Uganda 414. 31 607. 2 Relatively Unstable 3097. 38 37. 8/100 2 -3 m Iraq 1355. 56 4025. 97 Unstable 10343. 39 4. 28/100 3 -4 m

ECGC Initiatives for Mo. C Focus Regions n Focus LAC n n n Review of all countries carried out in June 2003. Mexico, Panama and Venezuela upgraded by 1 step, Brazil by 2 steps ECGC continues to closely monitor the situation in these countries and reviews the gradings as and when the opportunity arises Argentina is the only country placed in the RC; the Corporation is constantly monitoring the ecopolitical situation in the country

ECGC Initiatives for Mo. C Focus Regions n Focus Africa n n South Africa, Tanzania, Botswana & Mauritius upgraded. All countries under 1 st phase of Focus Africa Programme placed in Open Cover Revised and lower premium rates introduced from April 2003 ECGC ratings at par or better than OECD gradings and also grading given by other Berne Union members ECGC continues to closely monitor the situation in these countries and reviews the gradings as and when the opportunity arises

ECGC Initiatives for Mo. C Focus Regions n Focus CIS n n n Underwriting policy liberalized. Azerbaijan, Kazakhastan, Russia, Ukraine placed in Open Cover from Restricted Cover Georgia and Moldova upgraded Corporation is considering upgradation of Armenia and Belarus and placing them in the Open cover from Restricted Cover

ECGC Initiatives for Mo. C Focus Regions n Focus East Asia n n n All countries in ASEAN as well as Australia & New Zealand placed in Open Cover Revised and lower premium rates introduced from April 2003 ECGC ratings at par or better than OECD gradings and also grading given by other Berne Union members

ECGC Schemes n Schemes for Exporters n Maturity Factoring n Schemes for Banks/ Financial Instns n Special Schemes

Schemes for Exporters – Short Term Cover: Payment within 180 days n SCR or Standard Policy: To cover risks in respect of all shipments on short term credit by exporters with anticipated annual turnover of more than Rs. 50 lacs n Turnover Policy: A variation of SCR policy with additional discounts and incentives available to exporters who pay a premium of not less than Rs. 10 lacs per year.

Schemes for Exporters – Short Term Cover: Payment within 180 days n n Small Exporters Policy Similar to SCR Policy, but for exporters with anticipated annual turnover of Rs. 50 lacs or less Specific Shipment Policy (Short term) To cover risks in respect of a specific shipment or shipments against a specific contract n n n Commercial & Political Only LC Commercial and Political

Schemes for Exporters – Short Term Cover: Payment within 180 days n n n Exports (Specific Buyer Policy) To cover risks in respect of all shipment to one or a few buyers n Commercial & Political n Political Only n LC Commercial & Political Exports of Services Policy n To cover the risks of insolvency and default and political risks for services rendered Without Recourse Export maturity Factoring n Undertaking to pay the amount due for a shipment on the maturity of the credit period.

Products in the offing n Consignment policy : to cover consignment exports where goods are shipped and held in stocks overseas ready for sale to overseas buyers , as and when orders are received § § stockholding agent policy global entity policy

Products in the offing n Exposure policy where premium would be charged on the basis of the expected level of exposure n n single buyer policy: covering the risks on a specific buyer multi buyer policy : covering the risks on all buyers

Bancassurance n n ECGC has signed Corporate Agency Agreements with a number of banks so as to use the Banks network of branches to market its policies Under this arrangement, exporters can buy their policies and pay premium through various branches of these banks ECGC offers commission to the banks for the policies and premium secured ECGC has currently signed corporate agency agreements with 10 Banks

E-Connectivity n n n Re-designed portal www. ecgcindia. com Explanation of our schemes and Q&A by e-mail Online facilities to our exporters : - premium calculator, - online status of applications, - online premium adjustment status, - List of defaulted buyers, - downloading application forms - online submission of applications and decls. - payment of premium, fees through payment gateway

It is so easy with ECGC For more details Please visit www. ecgcindia. com

afe8672554dae8f844c683451dc601ea.ppt