Council Housing Finance The Government’s plans for reforming funding for council housing

Council Housing Finance The Government’s plans for reforming funding for council housing

The current system § The Housing Revenue Account accounts for income and expenditure associated with the Council’s housing stock § The Government uses a formula to decide how much the Council should spend on managing and maintaining its housing stock and how much rent should be charged § If the guideline rent is less than the amount which the Government says needs to be spent, then the council receives housing subsidy from the Government § If the guideline rent is more than the amount which the Government says needs to be spent, the Council is required to pay negative housing subsidy

The current system § The Housing Revenue Account accounts for income and expenditure associated with the Council’s housing stock § The Government uses a formula to decide how much the Council should spend on managing and maintaining its housing stock and how much rent should be charged § If the guideline rent is less than the amount which the Government says needs to be spent, then the council receives housing subsidy from the Government § If the guideline rent is more than the amount which the Government says needs to be spent, the Council is required to pay negative housing subsidy

The current system § Around 170 local authorities are in the HRA subsidy system § A quarter receive subsidy but most councils, including Kettering, pay negative housing subsidy § This year, Kettering will collect £ 13. 4 million in rent from tenants. § Negative housing subsidy payments will amount to £ 4. 5 million § £ 1 in every £ 3 that our tenants pay in rent goes straight to HM Treasury

The current system § Around 170 local authorities are in the HRA subsidy system § A quarter receive subsidy but most councils, including Kettering, pay negative housing subsidy § This year, Kettering will collect £ 13. 4 million in rent from tenants. § Negative housing subsidy payments will amount to £ 4. 5 million § £ 1 in every £ 3 that our tenants pay in rent goes straight to HM Treasury

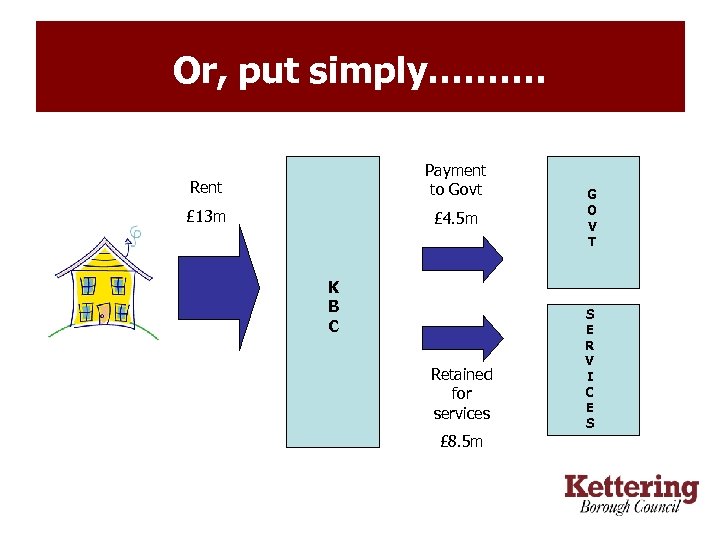

Or, put simply………. Rent Payment to Govt £ 13 m £ 4. 5 m K B C Retained for services £ 8. 5 m G O V T S E R V I C E S

Or, put simply………. Rent Payment to Govt £ 13 m £ 4. 5 m K B C Retained for services £ 8. 5 m G O V T S E R V I C E S

The problem with the HRA system § It’s complex § We can’t plan properly because HRA subsidy determinations can fluctuate considerably from year to year § There is no connection between the rent tenants pay and the service they receive from the Council § The system is acknowledged by the Government to be underfunded § There are year-on-year “real terms” decreases in funding

The problem with the HRA system § It’s complex § We can’t plan properly because HRA subsidy determinations can fluctuate considerably from year to year § There is no connection between the rent tenants pay and the service they receive from the Council § The system is acknowledged by the Government to be underfunded § There are year-on-year “real terms” decreases in funding

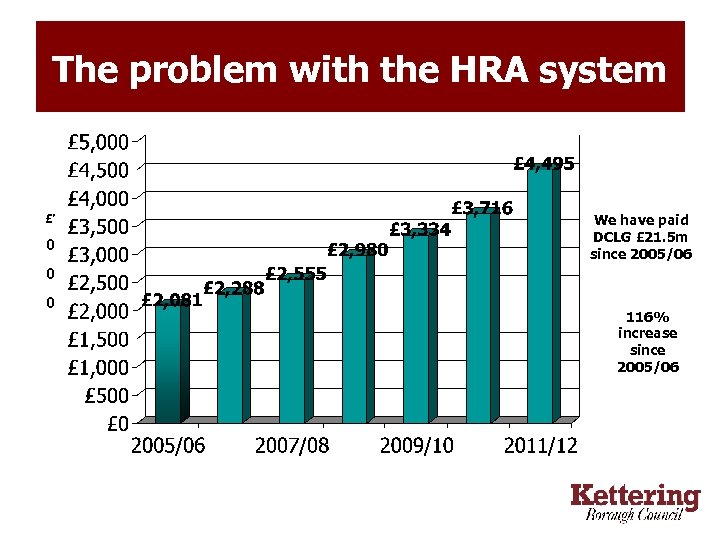

The problem with the HRA system £’ 0 We have paid DCLG £ 21. 5 m since 2005/06 0 0 116% increase since 2005/06

The problem with the HRA system £’ 0 We have paid DCLG £ 21. 5 m since 2005/06 0 0 116% increase since 2005/06

The problem with the HRA system In 2011/12, under the current housing finance system, § Rents went up by 6. 98% § We will collect £ 13. 4 million in rents and charges § We will pay the Government £ 4. 5 million (33%) § Only £ 8. 9 million will be available for services

The problem with the HRA system In 2011/12, under the current housing finance system, § Rents went up by 6. 98% § We will collect £ 13. 4 million in rents and charges § We will pay the Government £ 4. 5 million (33%) § Only £ 8. 9 million will be available for services

The new system § In April 2012, a new self-financing system will be introduced: § We will be able to keep all our rental income § We won’t have to pay the Government § Expenditure allowances will be increased by 13% and there will be a new allowance for disabled adaptations § But, we will have to take on additional debt of £ 68. 8 m § The Government will take 75% of future sale receipts § The Government will effectively continue to ‘set’ rents

The new system § In April 2012, a new self-financing system will be introduced: § We will be able to keep all our rental income § We won’t have to pay the Government § Expenditure allowances will be increased by 13% and there will be a new allowance for disabled adaptations § But, we will have to take on additional debt of £ 68. 8 m § The Government will take 75% of future sale receipts § The Government will effectively continue to ‘set’ rents

The pros and cons û System remains vulnerable to changes in national policy û Some key risks are outside council control – interest rates, house sales, bad debts, inflation û Not much change in early years ü Less volatility and uncertainty – will be able to plan with confidence over the long term ü Increase in management, maintenance and major repairs allowances and a new allowance for disabled adaptations ü More open and transparent – easier for tenants to hold the Council to account

The pros and cons û System remains vulnerable to changes in national policy û Some key risks are outside council control – interest rates, house sales, bad debts, inflation û Not much change in early years ü Less volatility and uncertainty – will be able to plan with confidence over the long term ü Increase in management, maintenance and major repairs allowances and a new allowance for disabled adaptations ü More open and transparent – easier for tenants to hold the Council to account

The main issues for KBC § The fairness of the debt settlement § Structuring the debt in a flexible manner § Significant work required over the coming months

The main issues for KBC § The fairness of the debt settlement § Structuring the debt in a flexible manner § Significant work required over the coming months

Council Housing Finance The Government’s plans for reforming funding for council housing

Council Housing Finance The Government’s plans for reforming funding for council housing