20c9f98ef7aacb8f1cc605703006c205.ppt

- Количество слайдов: 52

Cost-Volume-Profit Analysis Chapter 22 HORNGREN ♦ HARRISON ♦ BAMBER ♦ BEST ♦ FRASER ♦ WILLETT

Cost-Volume-Profit Analysis Chapter 22 HORNGREN ♦ HARRISON ♦ BAMBER ♦ BEST ♦ FRASER ♦ WILLETT

Objectives 1. Identify different cost behaviour patterns 2. Use a contribution margin statement of financial performance to make business decisions 3. Calculate breakeven sales 4. Calculate the sales level needed to earn a target profit Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 2

Objectives 1. Identify different cost behaviour patterns 2. Use a contribution margin statement of financial performance to make business decisions 3. Calculate breakeven sales 4. Calculate the sales level needed to earn a target profit Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 2

Objectives 5. Graph a set of cost-volume-profit relationships 6. Calculate a margin of safety 7. Use the sales mix in CVP analysis 8. Calculate profit using variable costing and absorption costing Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 3

Objectives 5. Graph a set of cost-volume-profit relationships 6. Calculate a margin of safety 7. Use the sales mix in CVP analysis 8. Calculate profit using variable costing and absorption costing Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 3

Objective 1 Identify different cost behavior patterns. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 4

Objective 1 Identify different cost behavior patterns. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 4

Types of Costs Variable Fixed Mixed Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 5

Types of Costs Variable Fixed Mixed Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 5

Variable Costs Example Consider the textbook example of North Coast Railway l Assume that breakfast costs the railway $3 person. l If the railway carries 2, 000 passengers, it will spend $6, 000 for breakfast. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 6

Variable Costs Example Consider the textbook example of North Coast Railway l Assume that breakfast costs the railway $3 person. l If the railway carries 2, 000 passengers, it will spend $6, 000 for breakfast. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 6

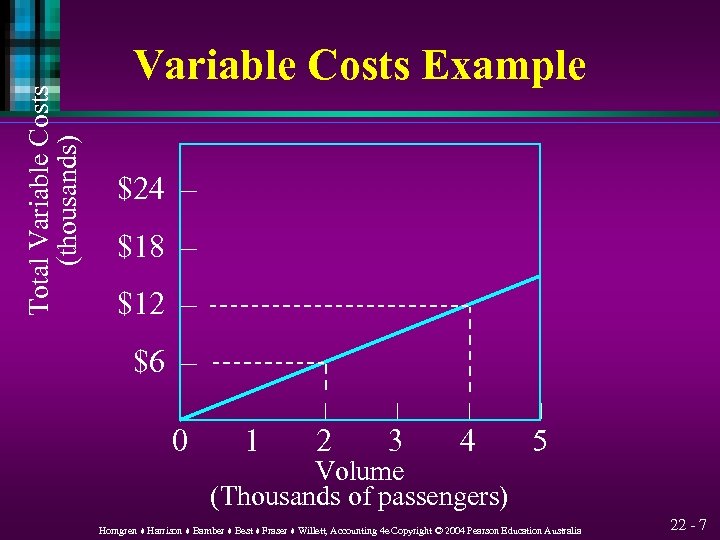

Total Variable Costs (thousands) Variable Costs Example $24 – $18 – $12 – $6 – – 1 – 0 2 3 4 5 Volume (Thousands of passengers) Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 7

Total Variable Costs (thousands) Variable Costs Example $24 – $18 – $12 – $6 – – 1 – 0 2 3 4 5 Volume (Thousands of passengers) Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 7

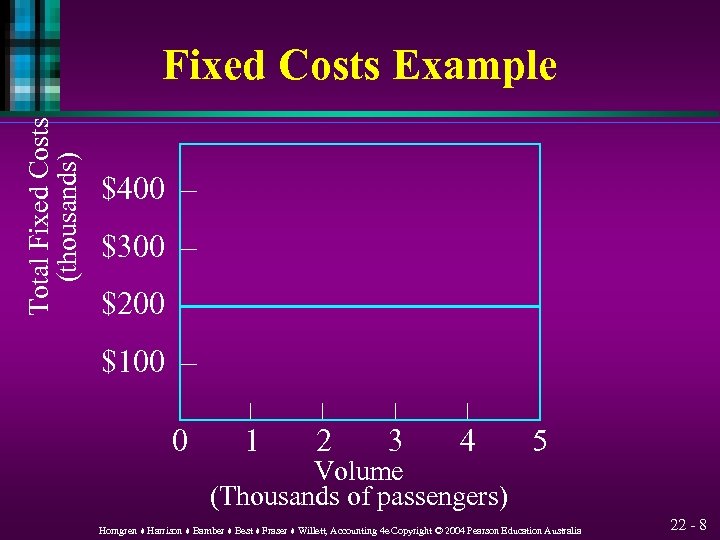

Total Fixed Costs (thousands) Fixed Costs Example $400 – $300 – $200 – $100 – – – 0 1 2 3 4 Volume (Thousands of passengers) 5 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 8

Total Fixed Costs (thousands) Fixed Costs Example $400 – $300 – $200 – $100 – – – 0 1 2 3 4 Volume (Thousands of passengers) 5 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 8

Mixed Costs Example A mixed cost is part variable and part fixed. l Assume the railway’s internet service has fixed costs of $50 per month ($600 per year) and there also variable costs of $3 per hour of use. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 9

Mixed Costs Example A mixed cost is part variable and part fixed. l Assume the railway’s internet service has fixed costs of $50 per month ($600 per year) and there also variable costs of $3 per hour of use. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 9

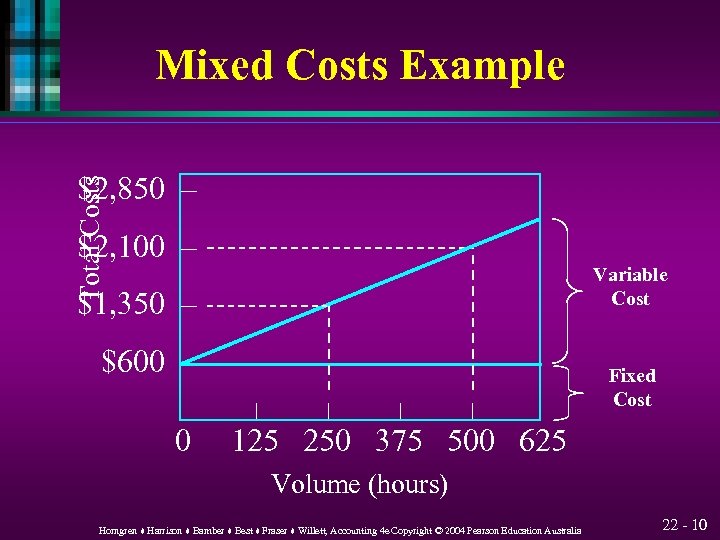

Mixed Costs Example Total Costs $2, 850 – $2, 100 – Variable Cost $1, 350 – $600 – – – 0 Fixed Cost 125 250 375 500 625 Volume (hours) Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 10

Mixed Costs Example Total Costs $2, 850 – $2, 100 – Variable Cost $1, 350 – $600 – – – 0 Fixed Cost 125 250 375 500 625 Volume (hours) Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 10

Relevant Range. . . – l l is a band of volume in which a specific relationship exists between cost and volume. Outside the relevant range, the cost may either increases or decreases. A fixed cost is fixed only within a given relevant range and a given time period. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 11

Relevant Range. . . – l l is a band of volume in which a specific relationship exists between cost and volume. Outside the relevant range, the cost may either increases or decreases. A fixed cost is fixed only within a given relevant range and a given time period. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 11

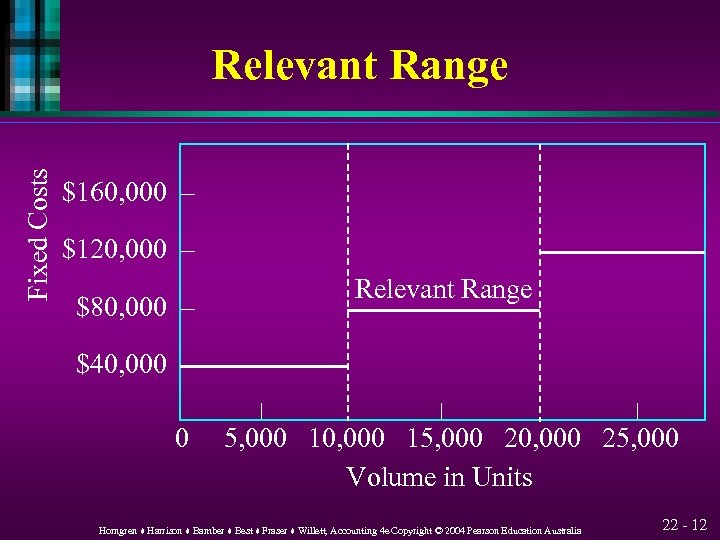

$160, 000 – $120, 000 – Relevant Range $80, 000 – – $40, 000 – Fixed Costs Relevant Range 5, 000 10, 000 15, 000 20, 000 25, 000 Volume in Units Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 12

$160, 000 – $120, 000 – Relevant Range $80, 000 – – $40, 000 – Fixed Costs Relevant Range 5, 000 10, 000 15, 000 20, 000 25, 000 Volume in Units Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 12

Objective 2 Use a contribution margin statement of financial performance to make business decisions. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 13

Objective 2 Use a contribution margin statement of financial performance to make business decisions. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 13

Two Approaches to Calculate Profits Conventional statement of financial performance Contribution margin statement of financial performance Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 14

Two Approaches to Calculate Profits Conventional statement of financial performance Contribution margin statement of financial performance Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 14

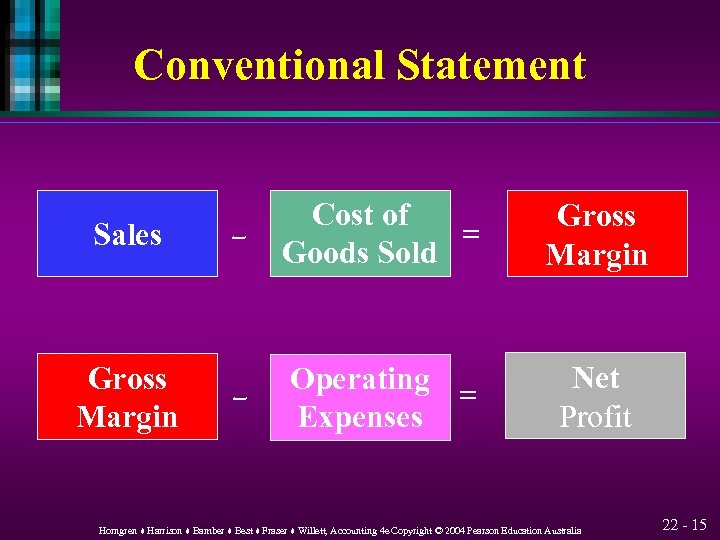

Conventional Statement Sales Gross Margin – Cost of = Goods Sold Gross Margin – Operating = Expenses Net Profit Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 15

Conventional Statement Sales Gross Margin – Cost of = Goods Sold Gross Margin – Operating = Expenses Net Profit Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 15

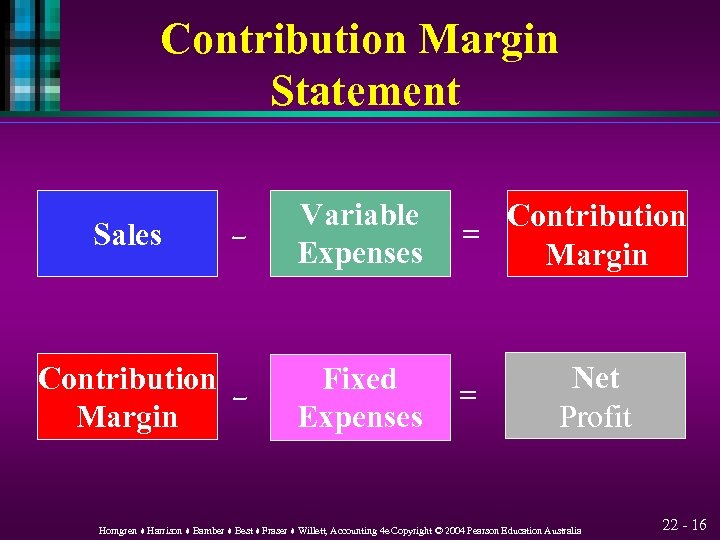

Contribution Margin Statement – Variable Expenses Contribution – Margin Fixed Expenses Sales Contribution = Margin = Net Profit Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 16

Contribution Margin Statement – Variable Expenses Contribution – Margin Fixed Expenses Sales Contribution = Margin = Net Profit Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 16

Contribution Margin Example Ly and Thu manufacture a device that allows users to download music from the internet more quickly. l The usual price for the device is $100. l Variable costs are $70. l They receive a proposal from a company in New Delhi to buy 20, 000 units at a price of $85 each. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 17

Contribution Margin Example Ly and Thu manufacture a device that allows users to download music from the internet more quickly. l The usual price for the device is $100. l Variable costs are $70. l They receive a proposal from a company in New Delhi to buy 20, 000 units at a price of $85 each. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 17

Contribution Margin Example There is sufficient capacity to produce the order. l How do we analyse this situation? l Selling price – variable cost = contribution margin l $85 – $70 = $15 contribution margin. l $15 × 20, 000 units = $300, 000 (total increase in contribution margin) l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 18

Contribution Margin Example There is sufficient capacity to produce the order. l How do we analyse this situation? l Selling price – variable cost = contribution margin l $85 – $70 = $15 contribution margin. l $15 × 20, 000 units = $300, 000 (total increase in contribution margin) l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 18

Assumptions of CVP Analysis 1 2 3 Expenses can be classified as either variable or fixed. CVP relationships are linear over a wide range of production and sales. Sales prices, unit variable cost, and total fixed expenses will not vary within the relevant range. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 19

Assumptions of CVP Analysis 1 2 3 Expenses can be classified as either variable or fixed. CVP relationships are linear over a wide range of production and sales. Sales prices, unit variable cost, and total fixed expenses will not vary within the relevant range. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 19

Assumptions of CVP Analysis 4 5 6 7 Volume is the only cost driver. The relevant range of volume is specified. Inventory levels will be unchanged. The sales mix remains unchanged during the period. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 20

Assumptions of CVP Analysis 4 5 6 7 Volume is the only cost driver. The relevant range of volume is specified. Inventory levels will be unchanged. The sales mix remains unchanged during the period. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 20

Objective 3 Calculate breakeven sales Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 21

Objective 3 Calculate breakeven sales Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 21

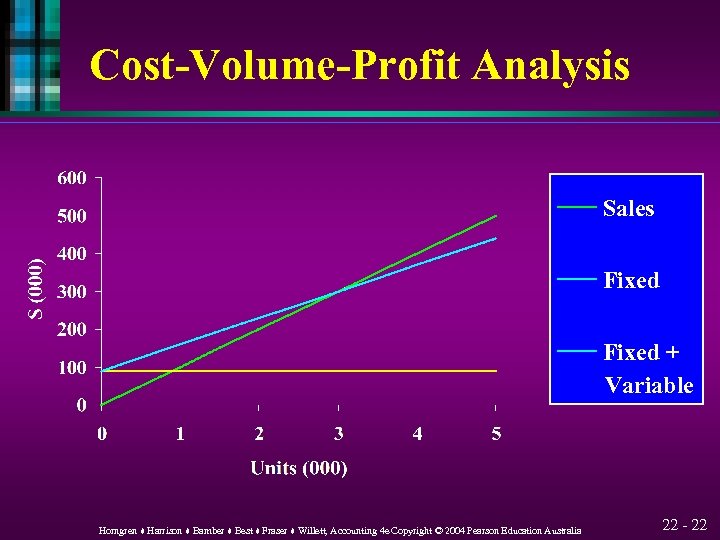

Cost-Volume-Profit Analysis — Sales — Fixed + Variable Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 22

Cost-Volume-Profit Analysis — Sales — Fixed + Variable Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 22

Cost-Volume-Profit Analysis Accountants use two methods to perform CVP analysis. l Both methods use an equation or formula derived from the contribution margin statement of Sx – Vx – F = 0 financial performance. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 23

Cost-Volume-Profit Analysis Accountants use two methods to perform CVP analysis. l Both methods use an equation or formula derived from the contribution margin statement of Sx – Vx – F = 0 financial performance. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 23

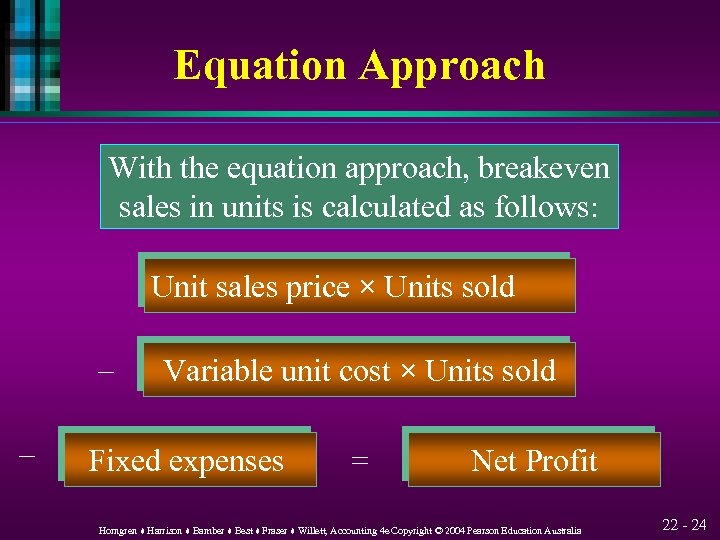

Equation Approach With the equation approach, breakeven sales in units is calculated as follows: Unit sales price × Units sold – – Variable unit cost × Units sold Fixed expenses = Net Profit Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 24

Equation Approach With the equation approach, breakeven sales in units is calculated as follows: Unit sales price × Units sold – – Variable unit cost × Units sold Fixed expenses = Net Profit Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 24

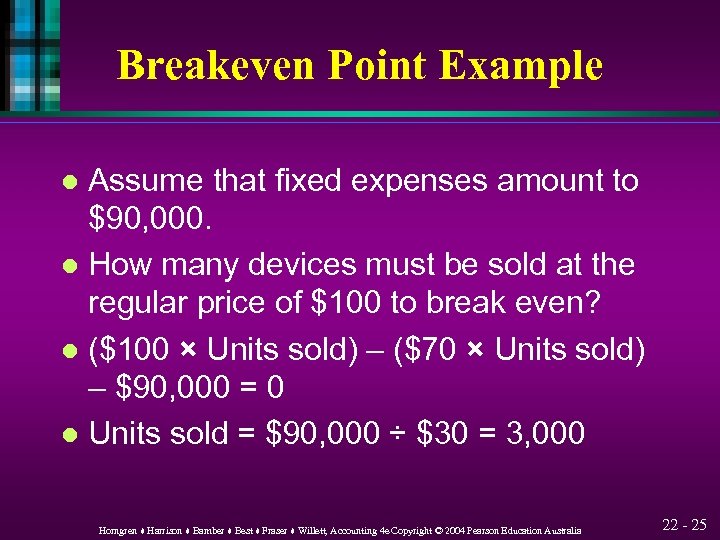

Breakeven Point Example Assume that fixed expenses amount to $90, 000. l How many devices must be sold at the regular price of $100 to break even? l ($100 × Units sold) – ($70 × Units sold) – $90, 000 = 0 l Units sold = $90, 000 ÷ $30 = 3, 000 l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 25

Breakeven Point Example Assume that fixed expenses amount to $90, 000. l How many devices must be sold at the regular price of $100 to break even? l ($100 × Units sold) – ($70 × Units sold) – $90, 000 = 0 l Units sold = $90, 000 ÷ $30 = 3, 000 l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 25

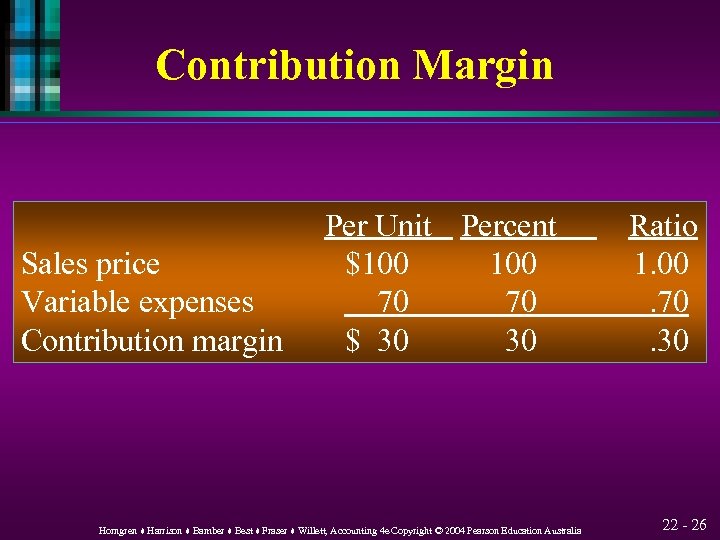

Contribution Margin Sales price Variable expenses Contribution margin Per Unit Percent $100 70 70 $ 30 30 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia Ratio 1. 00. 70. 30 22 - 26

Contribution Margin Sales price Variable expenses Contribution margin Per Unit Percent $100 70 70 $ 30 30 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia Ratio 1. 00. 70. 30 22 - 26

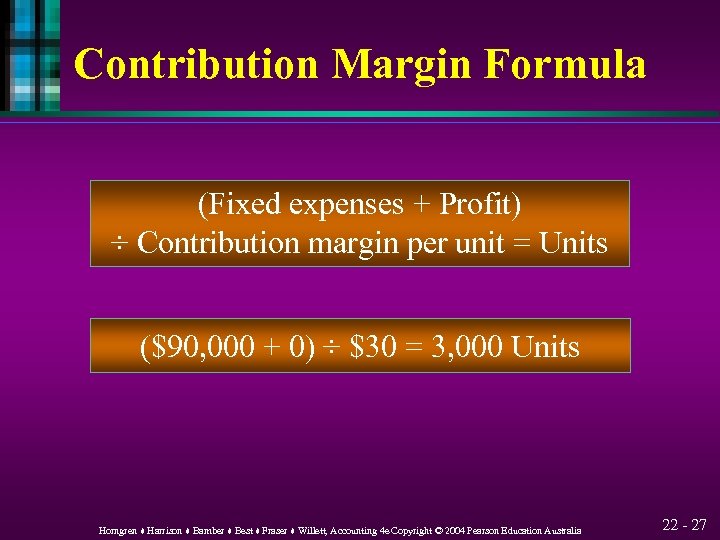

Contribution Margin Formula (Fixed expenses + Profit) ÷ Contribution margin per unit = Units ($90, 000 + 0) ÷ $30 = 3, 000 Units Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 27

Contribution Margin Formula (Fixed expenses + Profit) ÷ Contribution margin per unit = Units ($90, 000 + 0) ÷ $30 = 3, 000 Units Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 27

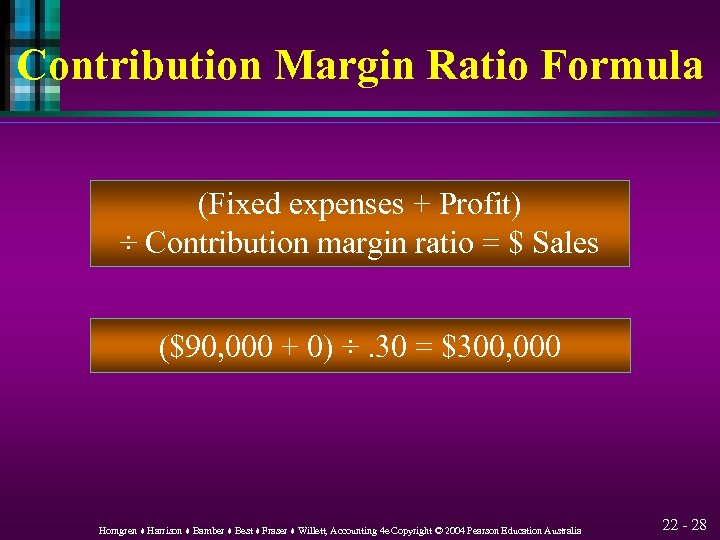

Contribution Margin Ratio Formula (Fixed expenses + Profit) ÷ Contribution margin ratio = $ Sales ($90, 000 + 0) ÷. 30 = $300, 000 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 28

Contribution Margin Ratio Formula (Fixed expenses + Profit) ÷ Contribution margin ratio = $ Sales ($90, 000 + 0) ÷. 30 = $300, 000 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 28

Change in Sales Price Example Suppose that the sales price per device is $106 rather than $100. l What is the revised breakeven sales in units? l New contribution margin: $106 – $70 = $36 l $90, 000 ÷ $36 = 2, 500 units l $106 x 2, 500 = $265, 000 Sales l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 29

Change in Sales Price Example Suppose that the sales price per device is $106 rather than $100. l What is the revised breakeven sales in units? l New contribution margin: $106 – $70 = $36 l $90, 000 ÷ $36 = 2, 500 units l $106 x 2, 500 = $265, 000 Sales l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 29

Change in Variable Costs Example Suppose that variable expenses per device are $75 instead of $70. l Other factors remain unchanged. l $90, 000 ÷ $25 = 3, 600 l $90, 000 ÷ 0. 25 = $360, 000 l (or $100 x 3, 600 = $360, 000 Sales) l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 30

Change in Variable Costs Example Suppose that variable expenses per device are $75 instead of $70. l Other factors remain unchanged. l $90, 000 ÷ $25 = 3, 600 l $90, 000 ÷ 0. 25 = $360, 000 l (or $100 x 3, 600 = $360, 000 Sales) l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 30

Change in Fixed Costs Example Suppose that rental costs increased by $30, 000. l What are the new fixed costs? l $90, 000 + $30, 000 = $120, 000 l What is the new breakeven point? l $120, 000 ÷ $30 = 4, 000 units l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 31

Change in Fixed Costs Example Suppose that rental costs increased by $30, 000. l What are the new fixed costs? l $90, 000 + $30, 000 = $120, 000 l What is the new breakeven point? l $120, 000 ÷ $30 = 4, 000 units l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 31

Objective 4 Calculate the sales level needed to earn a target net profit. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 32

Objective 4 Calculate the sales level needed to earn a target net profit. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 32

Target Profit Example Suppose that a business would be content with a $45, 000 profit. l Assuming $100 per unit selling price, variable expenses of $70 per unit, and fixed expenses of $90, 000, how many units must be sold? l ($90, 000 + $45, 000) ÷ $30 = 4, 500 l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 33

Target Profit Example Suppose that a business would be content with a $45, 000 profit. l Assuming $100 per unit selling price, variable expenses of $70 per unit, and fixed expenses of $90, 000, how many units must be sold? l ($90, 000 + $45, 000) ÷ $30 = 4, 500 l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 33

Objective 5 Graph a set of cost-volume-profit relationships. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 34

Objective 5 Graph a set of cost-volume-profit relationships. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 34

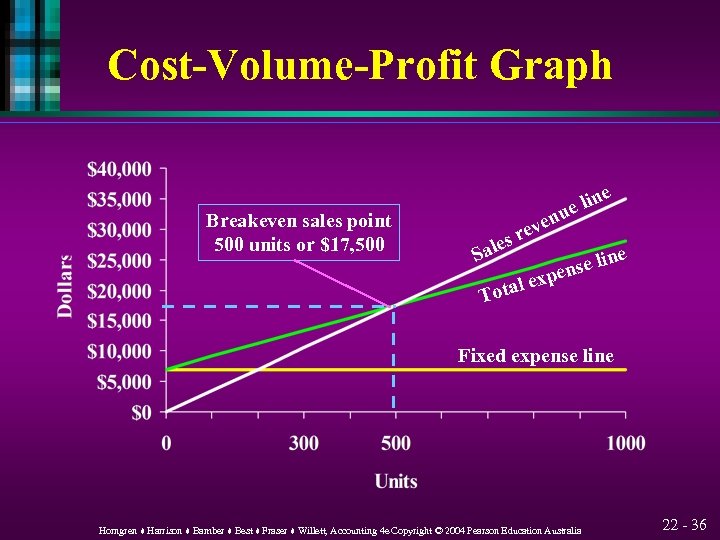

Various Sales Levels Example l A new example ä (compare to Kay Parker page 961 -70 text) Assume selling price is $35 per unit. l Variable expense is $21 per unit. l Fixed cost is $7, 000. l What is the breakeven point? l 500 units or $17, 500 Sales l [$7, 000 / ($35 - $21) = 500 units] l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 35

Various Sales Levels Example l A new example ä (compare to Kay Parker page 961 -70 text) Assume selling price is $35 per unit. l Variable expense is $21 per unit. l Fixed cost is $7, 000. l What is the breakeven point? l 500 units or $17, 500 Sales l [$7, 000 / ($35 - $21) = 500 units] l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 35

Cost-Volume-Profit Graph Breakeven sales point 500 units or $17, 500 line e s e Sal u ven re l Tota e se lin n expe Fixed expense line Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 36

Cost-Volume-Profit Graph Breakeven sales point 500 units or $17, 500 line e s e Sal u ven re l Tota e se lin n expe Fixed expense line Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 36

Various Sales Levels Example l l What profit is expected when sales are 300 units? (Contribution margin x Units sold) $14 × 300 = $4, 200 total contribution Total contribution – fixed costs = profit $4, 200 – $7, 000 = ($2, 800) Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 37

Various Sales Levels Example l l What profit is expected when sales are 300 units? (Contribution margin x Units sold) $14 × 300 = $4, 200 total contribution Total contribution – fixed costs = profit $4, 200 – $7, 000 = ($2, 800) Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 37

Various Sales Levels Example l l What profit is expected when sales are 1, 000 units? $14 × 1, 000 = $14, 000 – $7, 000 = $7, 000 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 38

Various Sales Levels Example l l What profit is expected when sales are 1, 000 units? $14 × 1, 000 = $14, 000 – $7, 000 = $7, 000 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 38

Objective 6 Calculate a margin of safety. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 39

Objective 6 Calculate a margin of safety. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 39

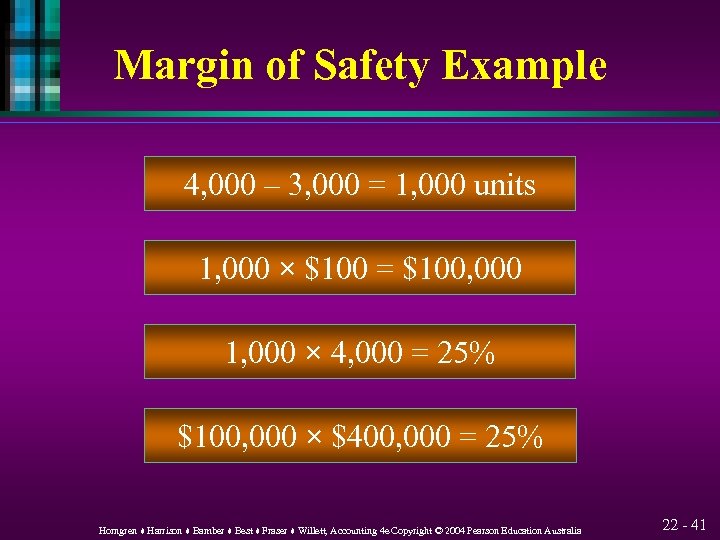

Margin of Safety Example l l Margin of safety is the excess of expected sales over breakeven sales. Returning to Ly and Thu’s (the previous internet music example) assume breakeven point is 3, 000 devices. Suppose they expect to sell 4, 000 during the period. What is the margin of safety? Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 40

Margin of Safety Example l l Margin of safety is the excess of expected sales over breakeven sales. Returning to Ly and Thu’s (the previous internet music example) assume breakeven point is 3, 000 devices. Suppose they expect to sell 4, 000 during the period. What is the margin of safety? Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 40

Margin of Safety Example 4, 000 – 3, 000 = 1, 000 units 1, 000 × $100 = $100, 000 1, 000 × 4, 000 = 25% $100, 000 × $400, 000 = 25% Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 41

Margin of Safety Example 4, 000 – 3, 000 = 1, 000 units 1, 000 × $100 = $100, 000 1, 000 × 4, 000 = 25% $100, 000 × $400, 000 = 25% Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 41

Objective 7 Use the sales mix in CVP analysis. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 42

Objective 7 Use the sales mix in CVP analysis. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 42

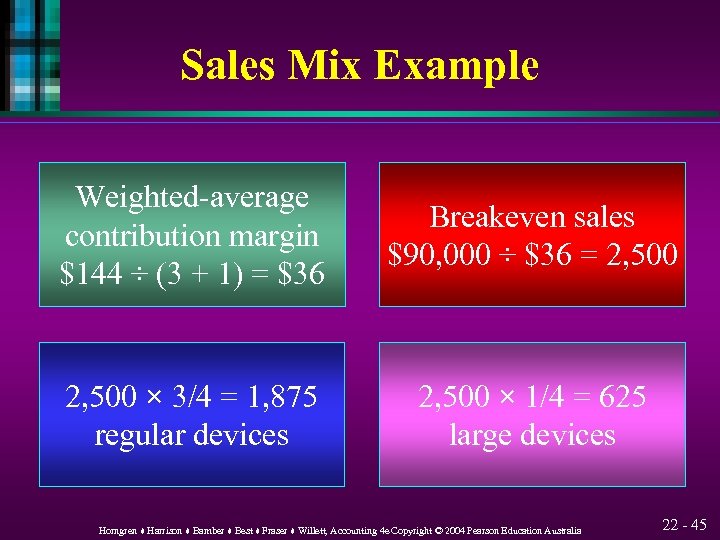

Sales Mix Example Suppose that Ly and Thu plan to sell two types of devices instead of one. l They estimate that sales will be 3, 000 regular devices and 1, 000 large devices. l This is a 3: 1 sales mix. l They expect 3/4 of the devices sold to be regular devices and 1/4 to be large devices. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 43

Sales Mix Example Suppose that Ly and Thu plan to sell two types of devices instead of one. l They estimate that sales will be 3, 000 regular devices and 1, 000 large devices. l This is a 3: 1 sales mix. l They expect 3/4 of the devices sold to be regular devices and 1/4 to be large devices. l Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 43

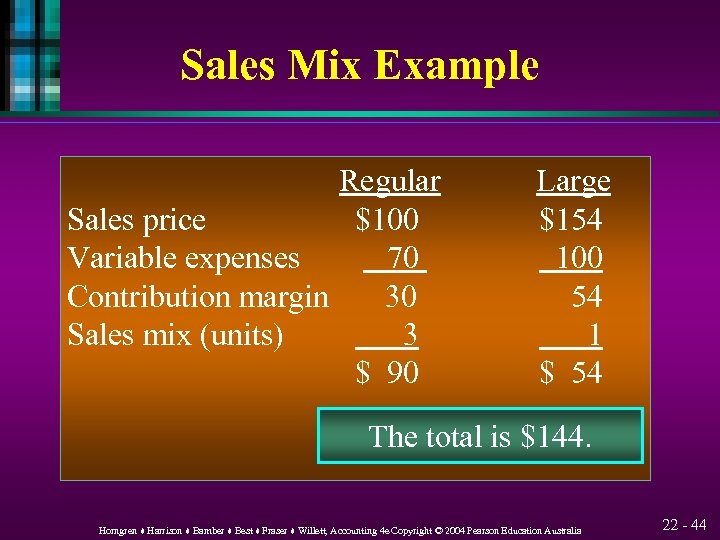

Sales Mix Example Regular Sales price $100 Variable expenses 70 Contribution margin 30 Sales mix (units) 3 $ 90 Large $154 100 54 1 $ 54 The total is $144. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 44

Sales Mix Example Regular Sales price $100 Variable expenses 70 Contribution margin 30 Sales mix (units) 3 $ 90 Large $154 100 54 1 $ 54 The total is $144. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 44

Sales Mix Example Weighted-average contribution margin $144 ÷ (3 + 1) = $36 Breakeven sales $90, 000 ÷ $36 = 2, 500 × 3/4 = 1, 875 regular devices 2, 500 × 1/4 = 625 large devices Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 45

Sales Mix Example Weighted-average contribution margin $144 ÷ (3 + 1) = $36 Breakeven sales $90, 000 ÷ $36 = 2, 500 × 3/4 = 1, 875 regular devices 2, 500 × 1/4 = 625 large devices Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 45

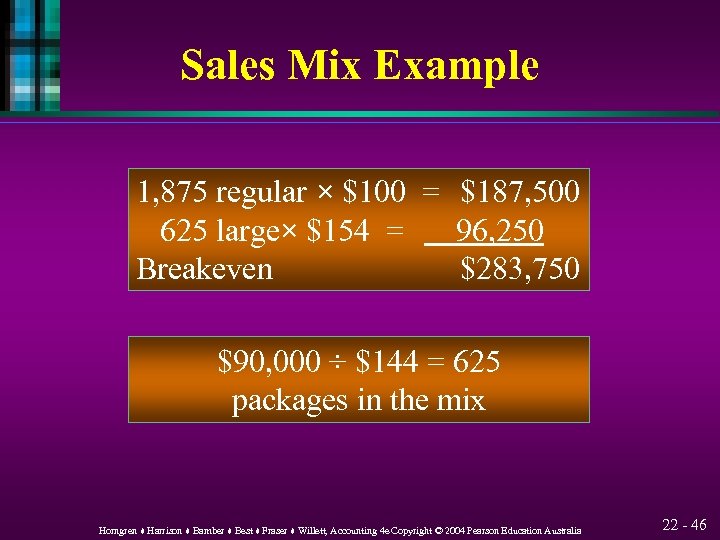

Sales Mix Example 1, 875 regular × $100 = $187, 500 625 large× $154 = 96, 250 Breakeven $283, 750 $90, 000 ÷ $144 = 625 packages in the mix Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 46

Sales Mix Example 1, 875 regular × $100 = $187, 500 625 large× $154 = 96, 250 Breakeven $283, 750 $90, 000 ÷ $144 = 625 packages in the mix Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 46

Objective 8 Calculate profit using variable costing and absorption costing. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 47

Objective 8 Calculate profit using variable costing and absorption costing. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 47

Product Costing Absorption costing assigns all manufacturing costs to products. Financial statements prepared under GAAP use absorption costing. Variable costing assigns only variable manufacturing costs to products. Variable costing is for internal use only. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 48

Product Costing Absorption costing assigns all manufacturing costs to products. Financial statements prepared under GAAP use absorption costing. Variable costing assigns only variable manufacturing costs to products. Variable costing is for internal use only. Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 48

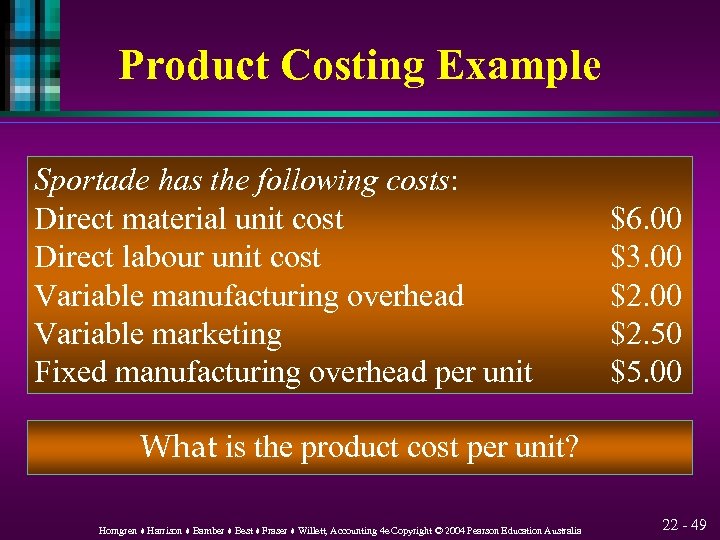

Product Costing Example Sportade has the following costs: Direct material unit cost Direct labour unit cost Variable manufacturing overhead Variable marketing Fixed manufacturing overhead per unit $6. 00 $3. 00 $2. 50 $5. 00 What is the product cost per unit? Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 49

Product Costing Example Sportade has the following costs: Direct material unit cost Direct labour unit cost Variable manufacturing overhead Variable marketing Fixed manufacturing overhead per unit $6. 00 $3. 00 $2. 50 $5. 00 What is the product cost per unit? Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 49

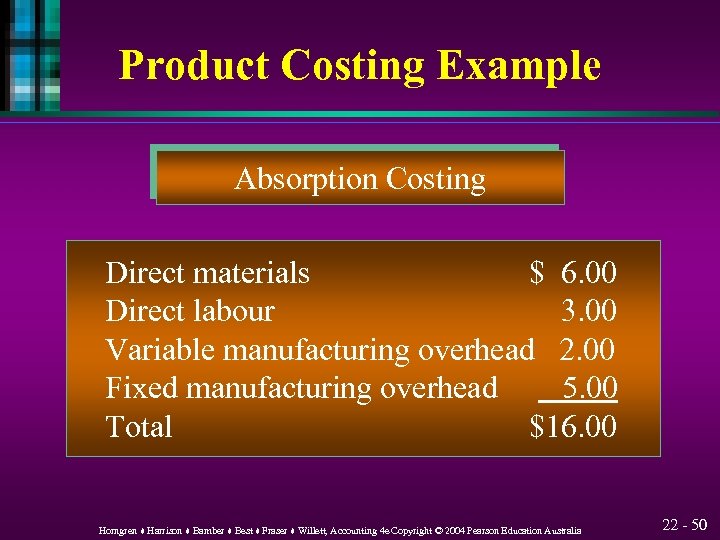

Product Costing Example Absorption Costing Direct materials $ 6. 00 Direct labour 3. 00 Variable manufacturing overhead 2. 00 Fixed manufacturing overhead 5. 00 Total $16. 00 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 50

Product Costing Example Absorption Costing Direct materials $ 6. 00 Direct labour 3. 00 Variable manufacturing overhead 2. 00 Fixed manufacturing overhead 5. 00 Total $16. 00 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 50

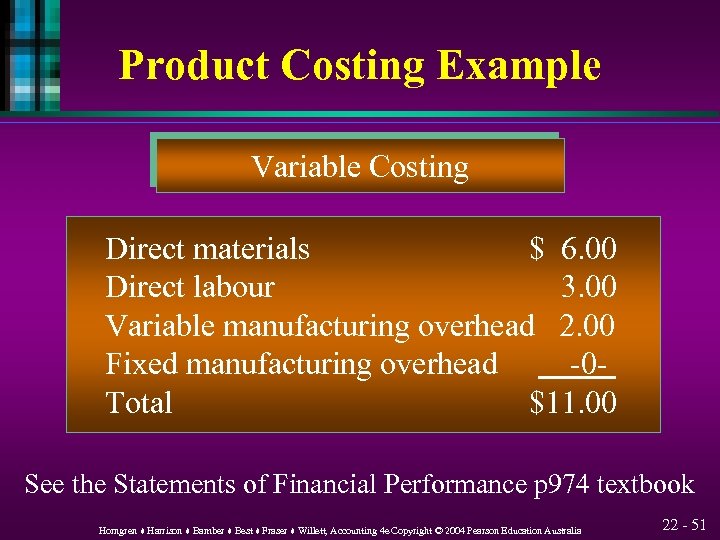

Product Costing Example Variable Costing Direct materials $ 6. 00 Direct labour 3. 00 Variable manufacturing overhead 2. 00 Fixed manufacturing overhead -0 Total $11. 00 See the Statements of Financial Performance p 974 textbook Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 51

Product Costing Example Variable Costing Direct materials $ 6. 00 Direct labour 3. 00 Variable manufacturing overhead 2. 00 Fixed manufacturing overhead -0 Total $11. 00 See the Statements of Financial Performance p 974 textbook Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 51

End of Chapter 22 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 52

End of Chapter 22 Horngren ♦ Harrison ♦ Bamber ♦ Best ♦ Fraser ♦ Willett, Accounting 4 e Copyright © 2004 Pearson Education Australia 22 - 52