fabdacd049b2a26a51ef1c92aa0945c3.ppt

- Количество слайдов: 14

Cost of Capital John H. Cochrane University of Chicago GSB

Cost of Capital John H. Cochrane University of Chicago GSB

Standard approach • Question: Should we invest, buy asset or company? • Standard answer: Value = Expected Profit / Expected Return (Really, multiperiod version) • ER? Use CAPM, ER = Rf + β E(Rm-Rf) • Spend a lot of time on β, use 6% for E(Rm-Rf)

Standard approach • Question: Should we invest, buy asset or company? • Standard answer: Value = Expected Profit / Expected Return (Really, multiperiod version) • ER? Use CAPM, ER = Rf + β E(Rm-Rf) • Spend a lot of time on β, use 6% for E(Rm-Rf)

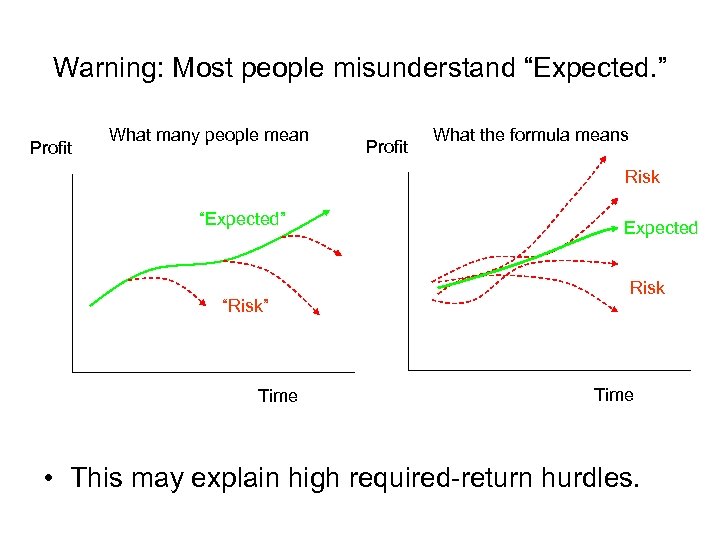

Warning: Most people misunderstand “Expected. ” Profit What many people mean Profit What the formula means Risk “Expected” “Risk” Time Expected Risk Time • This may explain high required-return hurdles.

Warning: Most people misunderstand “Expected. ” Profit What many people mean Profit What the formula means Risk “Expected” “Risk” Time Expected Risk Time • This may explain high required-return hurdles.

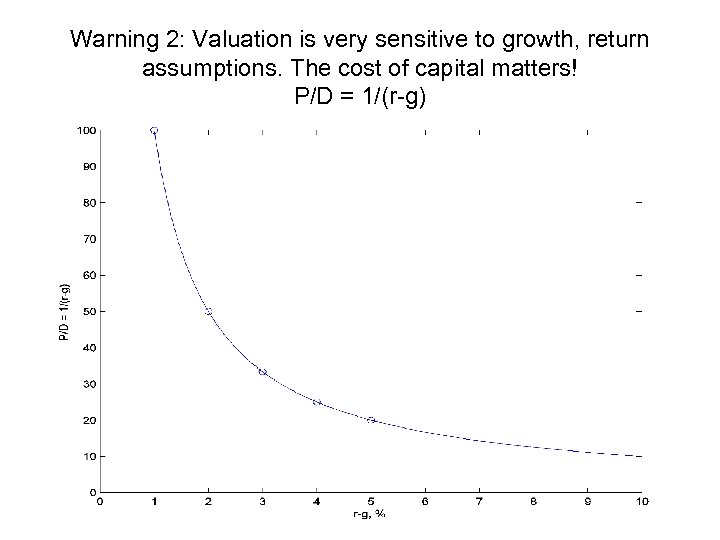

Warning 2: Valuation is very sensitive to growth, return assumptions. The cost of capital matters! P/D = 1/(r-g)

Warning 2: Valuation is very sensitive to growth, return assumptions. The cost of capital matters! P/D = 1/(r-g)

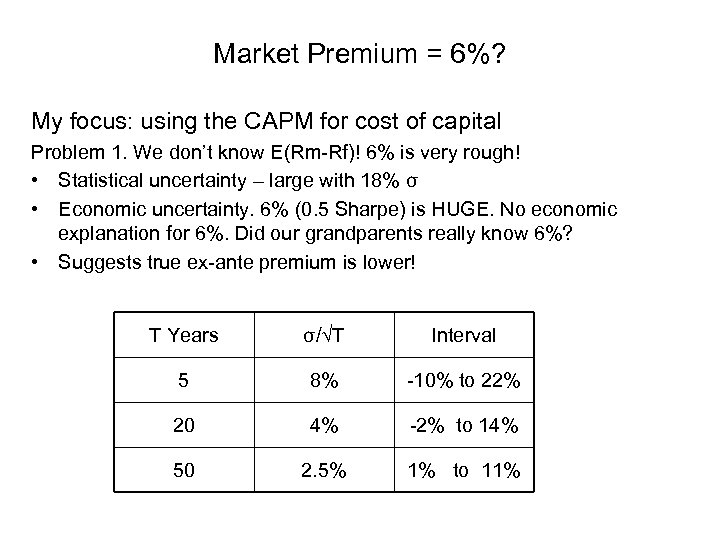

Market Premium = 6%? My focus: using the CAPM for cost of capital Problem 1. We don’t know E(Rm-Rf)! 6% is very rough! • Statistical uncertainty – large with 18% σ • Economic uncertainty. 6% (0. 5 Sharpe) is HUGE. No economic explanation for 6%. Did our grandparents really know 6%? • Suggests true ex-ante premium is lower! T Years σ/√T Interval 5 8% -10% to 22% 20 4% -2% to 14% 50 2. 5% 1% to 11%

Market Premium = 6%? My focus: using the CAPM for cost of capital Problem 1. We don’t know E(Rm-Rf)! 6% is very rough! • Statistical uncertainty – large with 18% σ • Economic uncertainty. 6% (0. 5 Sharpe) is HUGE. No economic explanation for 6%. Did our grandparents really know 6%? • Suggests true ex-ante premium is lower! T Years σ/√T Interval 5 8% -10% to 22% 20 4% -2% to 14% 50 2. 5% 1% to 11%

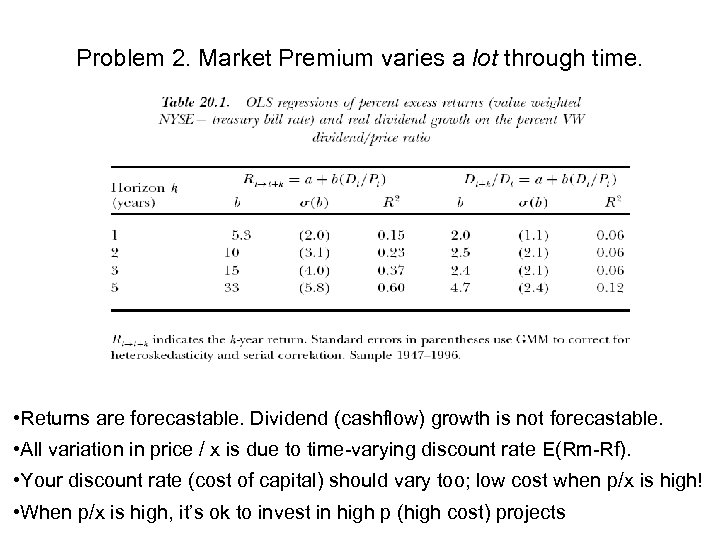

Problem 2. Market Premium varies a lot through time. • Returns are forecastable. Dividend (cashflow) growth is not forecastable. • All variation in price / x is due to time-varying discount rate E(Rm-Rf). • Your discount rate (cost of capital) should vary too; low cost when p/x is high! • When p/x is high, it’s ok to invest in high p (high cost) projects

Problem 2. Market Premium varies a lot through time. • Returns are forecastable. Dividend (cashflow) growth is not forecastable. • All variation in price / x is due to time-varying discount rate E(Rm-Rf). • Your discount rate (cost of capital) should vary too; low cost when p/x is high! • When p/x is high, it’s ok to invest in high p (high cost) projects

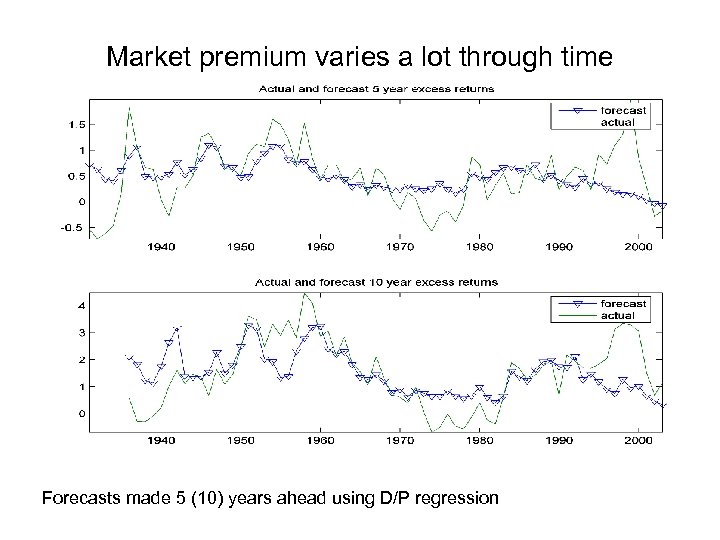

Market premium varies a lot through time Forecasts made 5 (10) years ahead using D/P regression

Market premium varies a lot through time Forecasts made 5 (10) years ahead using D/P regression

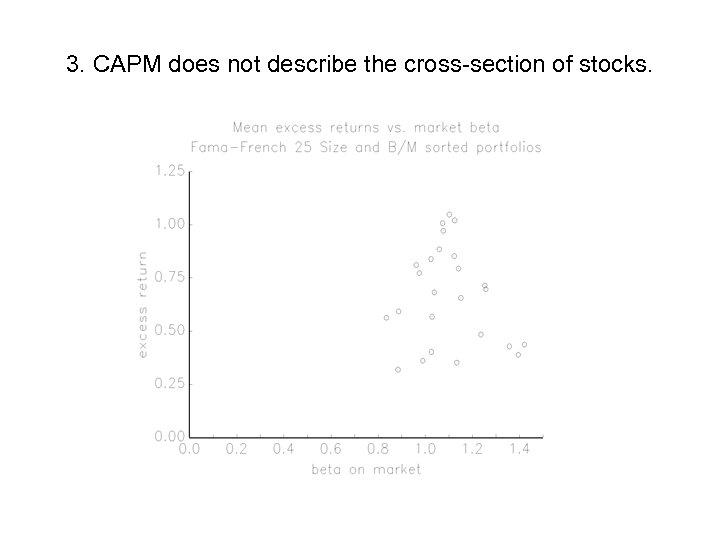

3. CAPM does not describe the cross-section of stocks.

3. CAPM does not describe the cross-section of stocks.

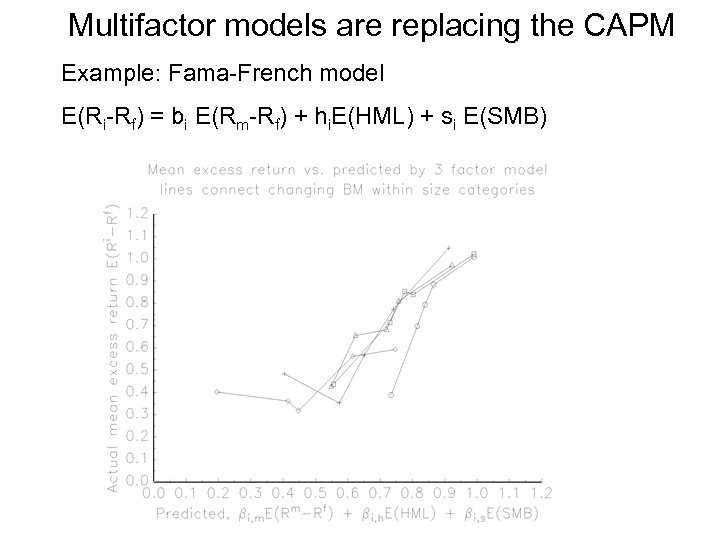

Multifactor models are replacing the CAPM Example: Fama-French model E(Ri-Rf) = bi E(Rm-Rf) + hi. E(HML) + si E(SMB)

Multifactor models are replacing the CAPM Example: Fama-French model E(Ri-Rf) = bi E(Rm-Rf) + hi. E(HML) + si E(SMB)

Use Dynamic Multifactor Models? • Use multifactor models (e. g. FF) with time-varying betas and time-varying premiums? • Note betas and premium vary over the life of the project as well as over time (when project is started). • Technically complex but straightforward. Much theoretical literature is headed this way. • Better answers? Problem 1: New premia just as uncertain and vary over time too! Et(Ri-Rf) = bi Et(Rm-Rf) + hi. Et (HML) + si. Et (SMB) What’s E(HML), E(SMB)? Same statistical problem. Even less economic understanding of value/size premium. Less still of how they vary over time. More of them!

Use Dynamic Multifactor Models? • Use multifactor models (e. g. FF) with time-varying betas and time-varying premiums? • Note betas and premium vary over the life of the project as well as over time (when project is started). • Technically complex but straightforward. Much theoretical literature is headed this way. • Better answers? Problem 1: New premia just as uncertain and vary over time too! Et(Ri-Rf) = bi Et(Rm-Rf) + hi. Et (HML) + si. Et (SMB) What’s E(HML), E(SMB)? Same statistical problem. Even less economic understanding of value/size premium. Less still of how they vary over time. More of them!

Use Dynamic Multifactor Models? • Problem 2: Lots of new “factors” and anomalies. • FF fails on momentum, small growth (especially important here!), other anomalies. • “Answer: ” Many more factors! Momentum, small-growth, currencies, term premium, default premium, option returns and up/down betas……

Use Dynamic Multifactor Models? • Problem 2: Lots of new “factors” and anomalies. • FF fails on momentum, small growth (especially important here!), other anomalies. • “Answer: ” Many more factors! Momentum, small-growth, currencies, term premium, default premium, option returns and up/down betas……

Answer guess 1: Comparables? • Renewed use of comparables. (Keeping fallacies and pitfalls in mind. ) • E(Ri) = Rf + β E (Rm-Rf) • Why not just measure the left hand side? Avg returns of similar firms? • Old answers: 1. CAPM gives better measure. σ is lower (1/2) so σ √T is better. (Industry return may have been luck. ) 2. Need to make β adjustments. This project may be low β though industry (comparable) is high β. 3. CAPM is “right” model.

Answer guess 1: Comparables? • Renewed use of comparables. (Keeping fallacies and pitfalls in mind. ) • E(Ri) = Rf + β E (Rm-Rf) • Why not just measure the left hand side? Avg returns of similar firms? • Old answers: 1. CAPM gives better measure. σ is lower (1/2) so σ √T is better. (Industry return may have been luck. ) 2. Need to make β adjustments. This project may be low β though industry (comparable) is high β. 3. CAPM is “right” model.

Comparables? • New answers: 1. We don’t know (yet) that multifactor models give better predictions for ER going forward. 2. Challenge for MF is now to explain patterns already well described by characteristics (size, book/market, momentum, industry etc. ) 3. Possible to be low β project with high ER characteristics, but how often does this really happen? 4. Much less confidence that MF models are “True” vs. “Descriptive. ” Who really cares about covariance with SMB?

Comparables? • New answers: 1. We don’t know (yet) that multifactor models give better predictions for ER going forward. 2. Challenge for MF is now to explain patterns already well described by characteristics (size, book/market, momentum, industry etc. ) 3. Possible to be low β project with high ER characteristics, but how often does this really happen? 4. Much less confidence that MF models are “True” vs. “Descriptive. ” Who really cares about covariance with SMB?

Answer guess 2: Prices • Why is the cost of capital different from the cost of tomatoes? • Real question: If we issue stock for new investment or acquisition, will money raised = cost of investment? • A: If new project is like your old projects, market / book ratio tells you the answer directly. • Q theory: Invest whenever market / book > 1.

Answer guess 2: Prices • Why is the cost of capital different from the cost of tomatoes? • Real question: If we issue stock for new investment or acquisition, will money raised = cost of investment? • A: If new project is like your old projects, market / book ratio tells you the answer directly. • Q theory: Invest whenever market / book > 1.