a2423ffb1d16687e3510cf62c92dc4a8.ppt

- Количество слайдов: 23

Cost Management in Challenging Times: The Tax Aspects 26 March 2009 The Tower Hotel, Waterford City Enterprise Board © M. K. Brazil

Cost Management in Challenging Times: The Tax Aspects 26 March 2009 The Tower Hotel, Waterford City Enterprise Board © M. K. Brazil

© M. K. Brazil

© M. K. Brazil

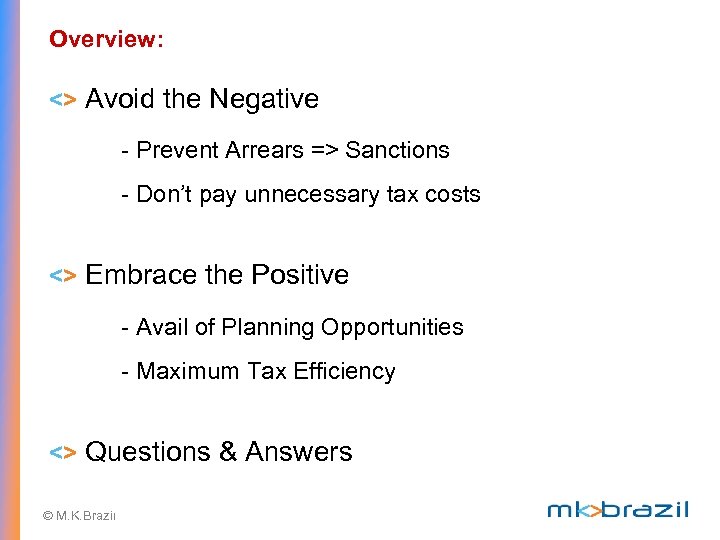

Overview: <> Avoid the Negative - Prevent Arrears => Sanctions - Don’t pay unnecessary tax costs <> Embrace the Positive - Avail of Planning Opportunities - Maximum Tax Efficiency <> Questions & Answers © M. K. Brazil

Overview: <> Avoid the Negative - Prevent Arrears => Sanctions - Don’t pay unnecessary tax costs <> Embrace the Positive - Avail of Planning Opportunities - Maximum Tax Efficiency <> Questions & Answers © M. K. Brazil

Prevention © M. K. Brazil

Prevention © M. K. Brazil

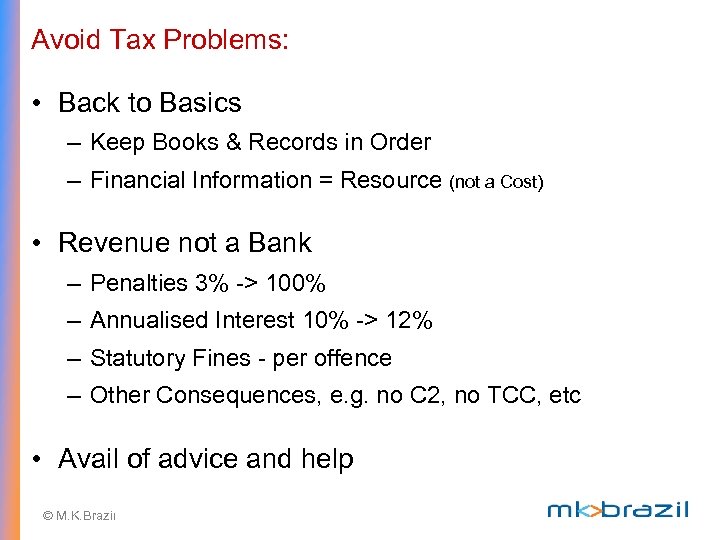

Avoid Tax Problems: • Back to Basics – Keep Books & Records in Order – Financial Information = Resource (not a Cost) • Revenue not a Bank – Penalties 3% -> 100% – Annualised Interest 10% -> 12% – Statutory Fines - per offence – Other Consequences, e. g. no C 2, no TCC, etc • Avail of advice and help © M. K. Brazil

Avoid Tax Problems: • Back to Basics – Keep Books & Records in Order – Financial Information = Resource (not a Cost) • Revenue not a Bank – Penalties 3% -> 100% – Annualised Interest 10% -> 12% – Statutory Fines - per offence – Other Consequences, e. g. no C 2, no TCC, etc • Avail of advice and help © M. K. Brazil

Costs & Cash-Flow © M. K. Brazil

Costs & Cash-Flow © M. K. Brazil

Costs & Cash-flow: • VAT – If Possible, Switch to Cash Receipts Basis – If Not - Payment Requests v Invoices – Monitor DD - Falling Sales / Permanent Refunds, etc – Switch back to Bi-Monthly if Refunds – W/O Bad Debts and seek Refund – Forfeited Deposits - Refund - Prior Years? – Monitor Supplier’s Invoices - Multiple v Composite – If Property Involved (e. g. lease) => Seek Advice © M. K. Brazil

Costs & Cash-flow: • VAT – If Possible, Switch to Cash Receipts Basis – If Not - Payment Requests v Invoices – Monitor DD - Falling Sales / Permanent Refunds, etc – Switch back to Bi-Monthly if Refunds – W/O Bad Debts and seek Refund – Forfeited Deposits - Refund - Prior Years? – Monitor Supplier’s Invoices - Multiple v Composite – If Property Involved (e. g. lease) => Seek Advice © M. K. Brazil

Costs & Cash-flow continued… • Payroll / Staff – Flexible Remuneration Packages • Job insecurity, Childcare Costs, etc => part-time, reduced hours, work from home, etc • 3 -day week => DSW for remaining days? – Exploit Anomalies in Payroll System e. g. < € 352 no Income Levy, no PRSI, < € 500 pw = no 2% Levies, etc, for example switch 10 Employees from € 505 pw to € 495 pw => No net loss for Employees, => Employer Saves € 5, 600+ © M. K. Brazil

Costs & Cash-flow continued… • Payroll / Staff – Flexible Remuneration Packages • Job insecurity, Childcare Costs, etc => part-time, reduced hours, work from home, etc • 3 -day week => DSW for remaining days? – Exploit Anomalies in Payroll System e. g. < € 352 no Income Levy, no PRSI, < € 500 pw = no 2% Levies, etc, for example switch 10 Employees from € 505 pw to € 495 pw => No net loss for Employees, => Employer Saves € 5, 600+ © M. K. Brazil

Costs & Cash-flow continued … Payroll / Staff cont. . . – Tax Efficient Remuneration Packages • Medical Insurance • Share Schemes • Travel Passes / Car Parking • Implement Expense Scheme • Training Courses / Exams • Phone / Lap-top • Pool Vehicles v BIK (Car v Van) • Exploit ‘Small BIK Exemption’ - € 250 • New BIK-Free Bike Scheme © M. K. Brazil

Costs & Cash-flow continued … Payroll / Staff cont. . . – Tax Efficient Remuneration Packages • Medical Insurance • Share Schemes • Travel Passes / Car Parking • Implement Expense Scheme • Training Courses / Exams • Phone / Lap-top • Pool Vehicles v BIK (Car v Van) • Exploit ‘Small BIK Exemption’ - € 250 • New BIK-Free Bike Scheme © M. K. Brazil

Costs & Cash-flow continued … Payroll / Staff cont. . . – Revenue Job Assist Scheme • New Employees only • May change in April Budget – Switch Bonuses from Turnover to Receipts – Temporary lay-off rather than Redundancy – If Redundancies - Get Advice and Do It Right – Employees can also provide funding - see below © M. K. Brazil

Costs & Cash-flow continued … Payroll / Staff cont. . . – Revenue Job Assist Scheme • New Employees only • May change in April Budget – Switch Bonuses from Turnover to Receipts – Temporary lay-off rather than Redundancy – If Redundancies - Get Advice and Do It Right – Employees can also provide funding - see below © M. K. Brazil

Costs & Cash-flow continued. . . • Owners - Directors – Director’s Loan v Repayment of Loan – Family Members • Must be Bona Fide • Use Tax Credits and/or SRCOP • Termination Payments – Mileage & Subsistence – Pension Position (payment without a plan) © M. K. Brazil

Costs & Cash-flow continued. . . • Owners - Directors – Director’s Loan v Repayment of Loan – Family Members • Must be Bona Fide • Use Tax Credits and/or SRCOP • Termination Payments – Mileage & Subsistence – Pension Position (payment without a plan) © M. K. Brazil

Costs & Cash-flow continued. . . • Various Other Considerations – Complete Structural Review • Sole-trade v Company etc – Adjusting Accounting Year End – Rental Income • Sub-letting of Office Space • Pre-Letting v Between Letting • VAT implications – Green Tax Incentives • e. g. Electric Car = Lower BIK = Increased Allowances, etc © M. K. Brazil

Costs & Cash-flow continued. . . • Various Other Considerations – Complete Structural Review • Sole-trade v Company etc – Adjusting Accounting Year End – Rental Income • Sub-letting of Office Space • Pre-Letting v Between Letting • VAT implications – Green Tax Incentives • e. g. Electric Car = Lower BIK = Increased Allowances, etc © M. K. Brazil

Cash Injection / Raising Funds © M. K. Brazil

Cash Injection / Raising Funds © M. K. Brazil

Cash Injection: • Traditional – BES - Seed Capital - Grants etc • Owner - Directors – Loan Interest Deduction • Private Investors – Share Option Agreements - Complicated but possible – Private Loan Agreements - Standard-Rated Income etc – Exempt Patent Dividends © M. K. Brazil

Cash Injection: • Traditional – BES - Seed Capital - Grants etc • Owner - Directors – Loan Interest Deduction • Private Investors – Share Option Agreements - Complicated but possible – Private Loan Agreements - Standard-Rated Income etc – Exempt Patent Dividends © M. K. Brazil

Cash Injection cont. . . • Employees – S. 479 - Once Off Investment • € 6, 350 per employee • Ord shares for minimum of 3 years – Loan Interest Deduction • Money to buy shares or to loan to employer company – Share Schemes - e. g. PSS in lieu of Bonus – BES - if Employer qualifies © M. K. Brazil

Cash Injection cont. . . • Employees – S. 479 - Once Off Investment • € 6, 350 per employee • Ord shares for minimum of 3 years – Loan Interest Deduction • Money to buy shares or to loan to employer company – Share Schemes - e. g. PSS in lieu of Bonus – BES - if Employer qualifies © M. K. Brazil

Tax Planning © M. K. Brazil

Tax Planning © M. K. Brazil

Tax Planning: • Restructuring – Expansion – Mergers – Rationalisation, etc – Tax Planning - Group – Trade Sale - etc • Retirement Planning – Fund Retirement – Facilitate Hand-over • Succession Planning – Family Company - Investment Assets – House – On-going financial assistance © M. K. Brazil

Tax Planning: • Restructuring – Expansion – Mergers – Rationalisation, etc – Tax Planning - Group – Trade Sale - etc • Retirement Planning – Fund Retirement – Facilitate Hand-over • Succession Planning – Family Company - Investment Assets – House – On-going financial assistance © M. K. Brazil

Tax Planning cont…: • Event / Transaction Planning – Purchase / Sale of Property or Assets – Purchase / Sale of Business – Whole or Part – Inheritance - Gift – MBO, Bonuses, Retirement, Termination etc • Routine / On-going Planning – Rental Income – S. 23, Loan Interest, etc – Property Development – BES, Remuneration Packages etc © M. K. Brazil

Tax Planning cont…: • Event / Transaction Planning – Purchase / Sale of Property or Assets – Purchase / Sale of Business – Whole or Part – Inheritance - Gift – MBO, Bonuses, Retirement, Termination etc • Routine / On-going Planning – Rental Income – S. 23, Loan Interest, etc – Property Development – BES, Remuneration Packages etc © M. K. Brazil

Miscellaneous & Summary © M. K. Brazil

Miscellaneous & Summary © M. K. Brazil

Sundry Other Considerations: • New Company Exemption – Restrictive Conditions, but. . . • R & D Credit – Complex but very valuable • Losses – Consider how best utilised – Cash Flow v Tax Efficiency – Patents - Significant Tax Breaks © M. K. Brazil

Sundry Other Considerations: • New Company Exemption – Restrictive Conditions, but. . . • R & D Credit – Complex but very valuable • Losses – Consider how best utilised – Cash Flow v Tax Efficiency – Patents - Significant Tax Breaks © M. K. Brazil

Sundry Considerations cont. . . • Class S v Class A – Take part-time role = PAYE Credit = Stamps • Rental Losses – Can they be utilised, e. g. Storage • Pre-Budget Planning – Income & Capital Taxes to Increase – Trigger Tax Charge pre-budget? – e. g. Director’s Bonus, CCS Dividends, Retirement Plan, Gifts to Children, Extracting Property, Liquidation © M. K. Brazil

Sundry Considerations cont. . . • Class S v Class A – Take part-time role = PAYE Credit = Stamps • Rental Losses – Can they be utilised, e. g. Storage • Pre-Budget Planning – Income & Capital Taxes to Increase – Trigger Tax Charge pre-budget? – e. g. Director’s Bonus, CCS Dividends, Retirement Plan, Gifts to Children, Extracting Property, Liquidation © M. K. Brazil

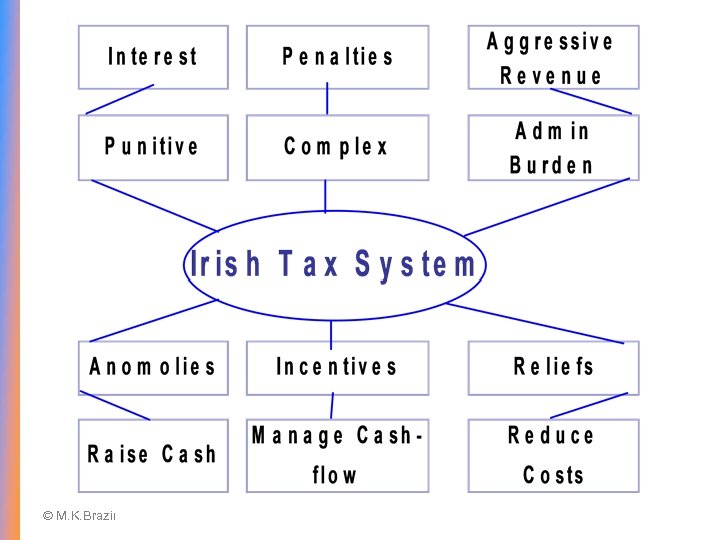

SUMMARY: • Irish Tax system can help businesses – Raise Funds, Cut Costs, etc • Watch Budget Changes • Tax Planning requires Time and Information – Tax is only part of the picture but often a critical part • Get Advice Regularly © M. K. Brazil

SUMMARY: • Irish Tax system can help businesses – Raise Funds, Cut Costs, etc • Watch Budget Changes • Tax Planning requires Time and Information – Tax is only part of the picture but often a critical part • Get Advice Regularly © M. K. Brazil

Thank you for your attention. QUESTIONS? O’Connell Court, 64 O’Connell Street, Waterford. Tel: 051 840800 / Fax: 051 - 874504 E-mail: brendantwohig@mkbrazil. com © M. K. Brazil

Thank you for your attention. QUESTIONS? O’Connell Court, 64 O’Connell Street, Waterford. Tel: 051 840800 / Fax: 051 - 874504 E-mail: brendantwohig@mkbrazil. com © M. K. Brazil