6c6f0848d205a2a7bfd4bb64c9beb999.ppt

- Количество слайдов: 11

Cost & Management Accounting Lecturer-45

Cost & Management Accounting Lecturer-45

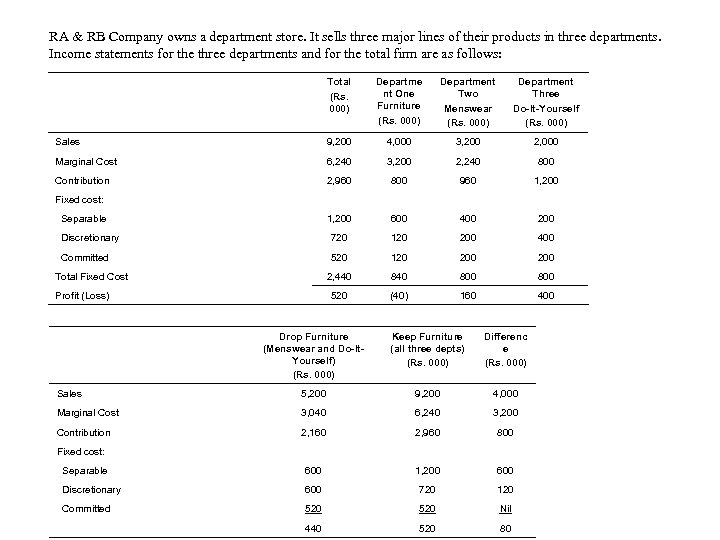

RA & RB Company owns a department store. It sells three major lines of their products in three departments. Income statements for the three departments and for the total firm are as follows: Total (Rs. 000) Departme nt One Furniture (Rs. 000) Department Two Menswear (Rs. 000) Department Three Do-It-Yourself (Rs. 000) Sales 9, 200 4, 000 3, 200 2, 000 Marginal Cost 6, 240 3, 200 2, 240 800 Contribution 2, 960 800 960 1, 200 600 400 200 Discretionary 720 120 200 400 Committed 520 120 200 2, 440 800 800 520 (40) 160 400 Fixed cost: Separable Total Fixed Cost Profit (Loss) Drop Furniture (Menswear and Do-It. Yourself) (Rs. 000) Keep Furniture (all three depts) (Rs. 000) Differenc e (Rs. 000) Sales 5, 200 9, 200 4, 000 Marginal Cost 3, 040 6, 240 3, 200 Contribution 2, 160 2, 960 800 Separable 600 1, 200 600 Discretionary 600 720 120 Committed 520 Nil 440 520 80 Fixed cost:

RA & RB Company owns a department store. It sells three major lines of their products in three departments. Income statements for the three departments and for the total firm are as follows: Total (Rs. 000) Departme nt One Furniture (Rs. 000) Department Two Menswear (Rs. 000) Department Three Do-It-Yourself (Rs. 000) Sales 9, 200 4, 000 3, 200 2, 000 Marginal Cost 6, 240 3, 200 2, 240 800 Contribution 2, 960 800 960 1, 200 600 400 200 Discretionary 720 120 200 400 Committed 520 120 200 2, 440 800 800 520 (40) 160 400 Fixed cost: Separable Total Fixed Cost Profit (Loss) Drop Furniture (Menswear and Do-It. Yourself) (Rs. 000) Keep Furniture (all three depts) (Rs. 000) Differenc e (Rs. 000) Sales 5, 200 9, 200 4, 000 Marginal Cost 3, 040 6, 240 3, 200 Contribution 2, 160 2, 960 800 Separable 600 1, 200 600 Discretionary 600 720 120 Committed 520 Nil 440 520 80 Fixed cost:

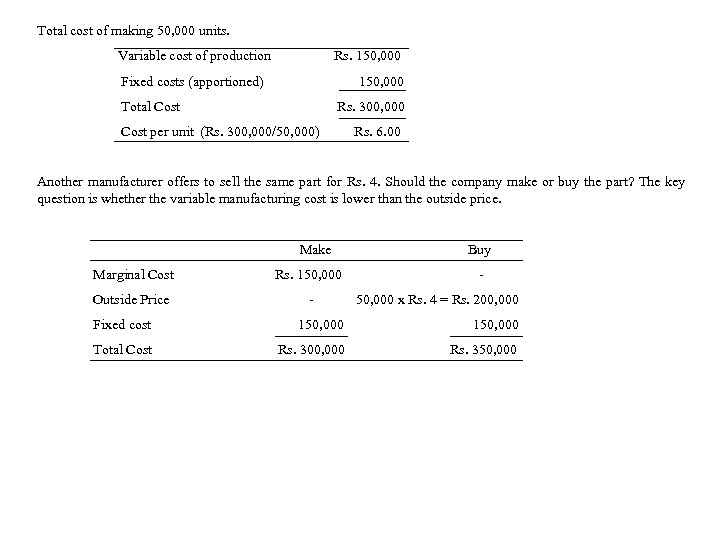

Total cost of making 50, 000 units. Variable cost of production Rs. 150, 000 Fixed costs (apportioned) 150, 000 Total Cost Rs. 300, 000 Cost per unit (Rs. 300, 000/50, 000) Rs. 6. 00 Another manufacturer offers to sell the same part for Rs. 4. Should the company make or buy the part? The key question is whether the variable manufacturing cost is lower than the outside price. Make Marginal Cost Rs. 150, 000 Outside Price - Buy 50, 000 x Rs. 4 = Rs. 200, 000 Fixed cost 150, 000 Total Cost Rs. 300, 000 Rs. 350, 000

Total cost of making 50, 000 units. Variable cost of production Rs. 150, 000 Fixed costs (apportioned) 150, 000 Total Cost Rs. 300, 000 Cost per unit (Rs. 300, 000/50, 000) Rs. 6. 00 Another manufacturer offers to sell the same part for Rs. 4. Should the company make or buy the part? The key question is whether the variable manufacturing cost is lower than the outside price. Make Marginal Cost Rs. 150, 000 Outside Price - Buy 50, 000 x Rs. 4 = Rs. 200, 000 Fixed cost 150, 000 Total Cost Rs. 300, 000 Rs. 350, 000

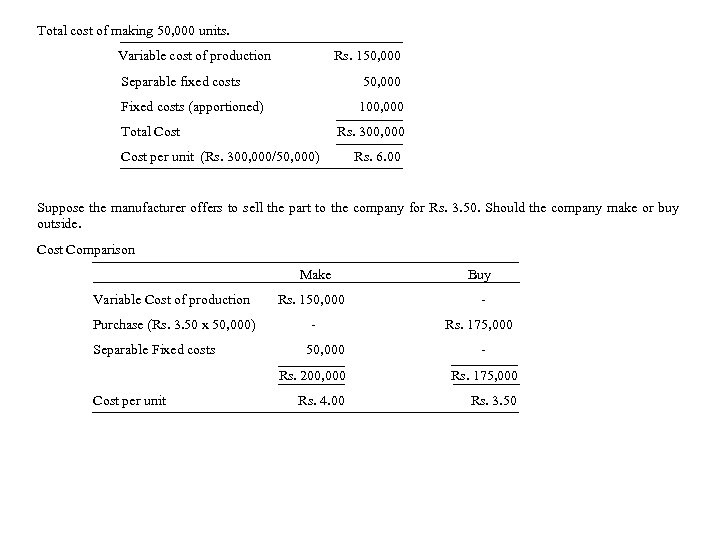

Total cost of making 50, 000 units. Variable cost of production Rs. 150, 000 Separable fixed costs 50, 000 Fixed costs (apportioned) 100, 000 Total Cost Rs. 300, 000 Cost per unit (Rs. 300, 000/50, 000) Rs. 6. 00 Suppose the manufacturer offers to sell the part to the company for Rs. 3. 50. Should the company make or buy outside. Cost Comparison Make Variable Cost of production Rs. 150, 000 Purchase (Rs. 3. 50 x 50, 000) - Separable Fixed costs 50, 000 Buy Rs. 175, 000 - Rs. 200, 000 Cost per unit Rs. 175, 000 Rs. 4. 00 Rs. 3. 50

Total cost of making 50, 000 units. Variable cost of production Rs. 150, 000 Separable fixed costs 50, 000 Fixed costs (apportioned) 100, 000 Total Cost Rs. 300, 000 Cost per unit (Rs. 300, 000/50, 000) Rs. 6. 00 Suppose the manufacturer offers to sell the part to the company for Rs. 3. 50. Should the company make or buy outside. Cost Comparison Make Variable Cost of production Rs. 150, 000 Purchase (Rs. 3. 50 x 50, 000) - Separable Fixed costs 50, 000 Buy Rs. 175, 000 - Rs. 200, 000 Cost per unit Rs. 175, 000 Rs. 4. 00 Rs. 3. 50

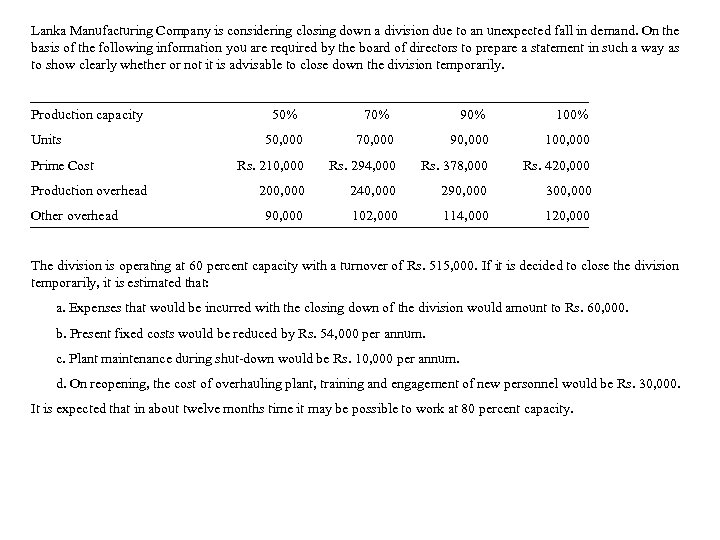

Lanka Manufacturing Company is considering closing down a division due to an unexpected fall in demand. On the basis of the following information you are required by the board of directors to prepare a statement in such a way as to show clearly whether or not it is advisable to close down the division temporarily. Production capacity Units Prime Cost Production overhead Other overhead 50% 70% 90% 100% 50, 000 70, 000 90, 000 100, 000 Rs. 210, 000 Rs. 294, 000 Rs. 378, 000 Rs. 420, 000 200, 000 240, 000 290, 000 300, 000 90, 000 102, 000 114, 000 120, 000 The division is operating at 60 percent capacity with a turnover of Rs. 515, 000. If it is decided to close the division temporarily, it is estimated that: a. Expenses that would be incurred with the closing down of the division would amount to Rs. 60, 000. b. Present fixed costs would be reduced by Rs. 54, 000 per annum. c. Plant maintenance during shut-down would be Rs. 10, 000 per annum. d. On reopening, the cost of overhauling plant, training and engagement of new personnel would be Rs. 30, 000. It is expected that in about twelve months time it may be possible to work at 80 percent capacity.

Lanka Manufacturing Company is considering closing down a division due to an unexpected fall in demand. On the basis of the following information you are required by the board of directors to prepare a statement in such a way as to show clearly whether or not it is advisable to close down the division temporarily. Production capacity Units Prime Cost Production overhead Other overhead 50% 70% 90% 100% 50, 000 70, 000 90, 000 100, 000 Rs. 210, 000 Rs. 294, 000 Rs. 378, 000 Rs. 420, 000 200, 000 240, 000 290, 000 300, 000 90, 000 102, 000 114, 000 120, 000 The division is operating at 60 percent capacity with a turnover of Rs. 515, 000. If it is decided to close the division temporarily, it is estimated that: a. Expenses that would be incurred with the closing down of the division would amount to Rs. 60, 000. b. Present fixed costs would be reduced by Rs. 54, 000 per annum. c. Plant maintenance during shut-down would be Rs. 10, 000 per annum. d. On reopening, the cost of overhauling plant, training and engagement of new personnel would be Rs. 30, 000. It is expected that in about twelve months time it may be possible to work at 80 percent capacity.

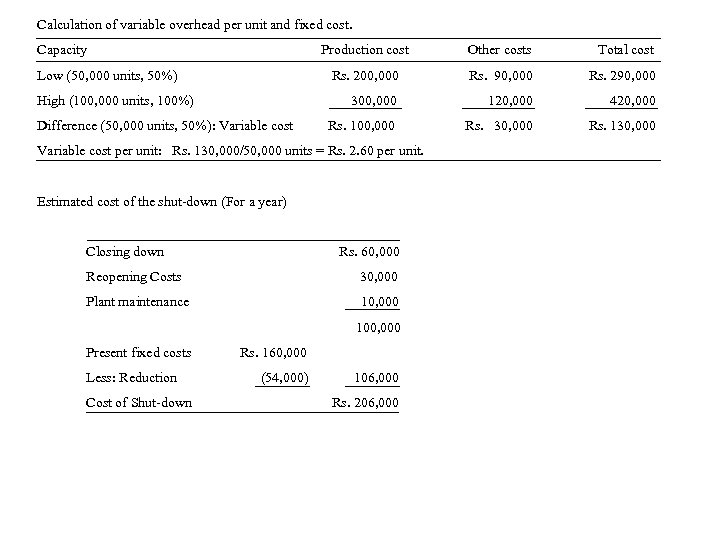

Calculation of variable overhead per unit and fixed cost. Capacity Production cost Difference (50, 000 units, 50%): Variable cost Rs. 90, 000 Rs. 290, 000 300, 000 High (100, 000 units, 100%) Total cost Rs. 200, 000 Low (50, 000 units, 50%) Other costs 120, 000 420, 000 Rs. 100, 000 Rs. 30, 000 Rs. 130, 000 Variable cost per unit: Rs. 130, 000/50, 000 units = Rs. 2. 60 per unit. Estimated cost of the shut-down (For a year) Closing down Rs. 60, 000 Reopening Costs 30, 000 Plant maintenance 10, 000 100, 000 Present fixed costs Less: Reduction Cost of Shut-down Rs. 160, 000 (54, 000) 106, 000 Rs. 206, 000

Calculation of variable overhead per unit and fixed cost. Capacity Production cost Difference (50, 000 units, 50%): Variable cost Rs. 90, 000 Rs. 290, 000 300, 000 High (100, 000 units, 100%) Total cost Rs. 200, 000 Low (50, 000 units, 50%) Other costs 120, 000 420, 000 Rs. 100, 000 Rs. 30, 000 Rs. 130, 000 Variable cost per unit: Rs. 130, 000/50, 000 units = Rs. 2. 60 per unit. Estimated cost of the shut-down (For a year) Closing down Rs. 60, 000 Reopening Costs 30, 000 Plant maintenance 10, 000 100, 000 Present fixed costs Less: Reduction Cost of Shut-down Rs. 160, 000 (54, 000) 106, 000 Rs. 206, 000

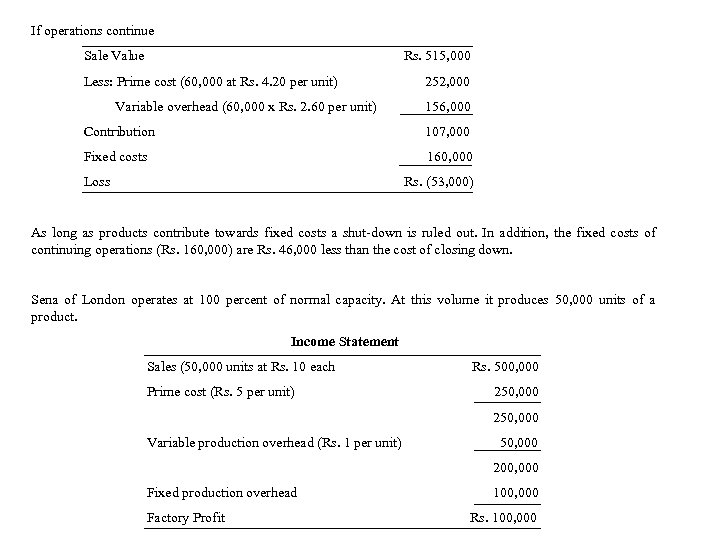

If operations continue Sale Value Rs. 515, 000 Less: Prime cost (60, 000 at Rs. 4. 20 per unit) Variable overhead (60, 000 x Rs. 2. 60 per unit) 252, 000 156, 000 Contribution 107, 000 Fixed costs 160, 000 Loss Rs. (53, 000) As long as products contribute towards fixed costs a shut-down is ruled out. In addition, the fixed costs of continuing operations (Rs. 160, 000) are Rs. 46, 000 less than the cost of closing down. Sena of London operates at 100 percent of normal capacity. At this volume it produces 50, 000 units of a product. Income Statement Sales (50, 000 units at Rs. 10 each Prime cost (Rs. 5 per unit) Rs. 500, 000 250, 000 Variable production overhead (Rs. 1 per unit) 50, 000 200, 000 Fixed production overhead Factory Profit 100, 000 Rs. 100, 000

If operations continue Sale Value Rs. 515, 000 Less: Prime cost (60, 000 at Rs. 4. 20 per unit) Variable overhead (60, 000 x Rs. 2. 60 per unit) 252, 000 156, 000 Contribution 107, 000 Fixed costs 160, 000 Loss Rs. (53, 000) As long as products contribute towards fixed costs a shut-down is ruled out. In addition, the fixed costs of continuing operations (Rs. 160, 000) are Rs. 46, 000 less than the cost of closing down. Sena of London operates at 100 percent of normal capacity. At this volume it produces 50, 000 units of a product. Income Statement Sales (50, 000 units at Rs. 10 each Prime cost (Rs. 5 per unit) Rs. 500, 000 250, 000 Variable production overhead (Rs. 1 per unit) 50, 000 200, 000 Fixed production overhead Factory Profit 100, 000 Rs. 100, 000

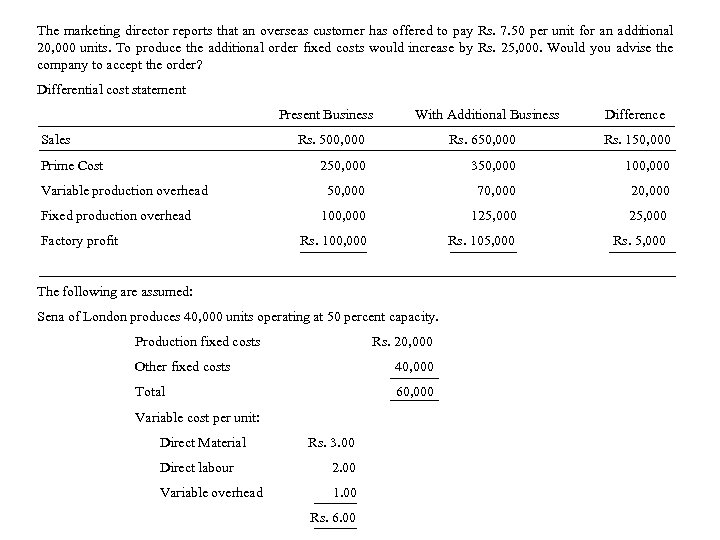

The marketing director reports that an overseas customer has offered to pay Rs. 7. 50 per unit for an additional 20, 000 units. To produce the additional order fixed costs would increase by Rs. 25, 000. Would you advise the company to accept the order? Differential cost statement Present Business Sales With Additional Business Difference Rs. 500, 000 Fixed production overhead Factory profit 350, 000 100, 000 50, 000 70, 000 20, 000 100, 000 125, 000 Rs. 100, 000 Variable production overhead Rs. 150, 000 250, 000 Prime Cost Rs. 650, 000 Rs. 105, 000 Rs. 5, 000 The following are assumed: Sena of London produces 40, 000 units operating at 50 percent capacity. Production fixed costs Rs. 20, 000 Other fixed costs 40, 000 Total 60, 000 Variable cost per unit: Direct Material Rs. 3. 00 Direct labour 2. 00 Variable overhead 1. 00 Rs. 6. 00

The marketing director reports that an overseas customer has offered to pay Rs. 7. 50 per unit for an additional 20, 000 units. To produce the additional order fixed costs would increase by Rs. 25, 000. Would you advise the company to accept the order? Differential cost statement Present Business Sales With Additional Business Difference Rs. 500, 000 Fixed production overhead Factory profit 350, 000 100, 000 50, 000 70, 000 20, 000 100, 000 125, 000 Rs. 100, 000 Variable production overhead Rs. 150, 000 250, 000 Prime Cost Rs. 650, 000 Rs. 105, 000 Rs. 5, 000 The following are assumed: Sena of London produces 40, 000 units operating at 50 percent capacity. Production fixed costs Rs. 20, 000 Other fixed costs 40, 000 Total 60, 000 Variable cost per unit: Direct Material Rs. 3. 00 Direct labour 2. 00 Variable overhead 1. 00 Rs. 6. 00

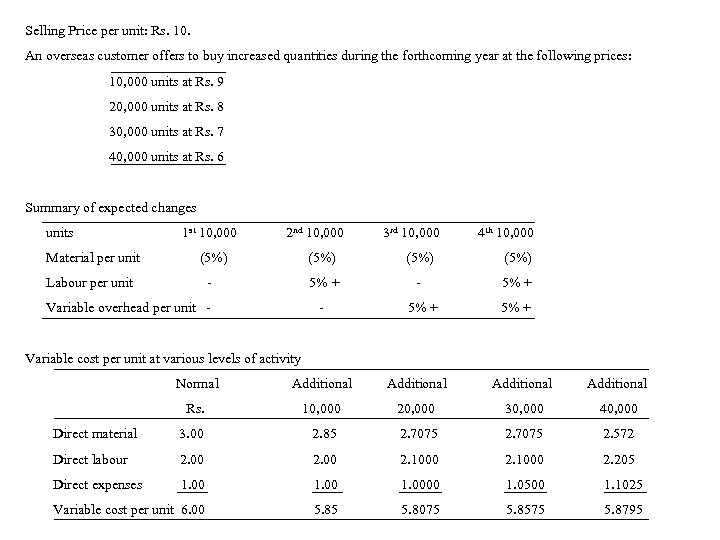

Selling Price per unit: Rs. 10. An overseas customer offers to buy increased quantities during the forthcoming year at the following prices: 10, 000 units at Rs. 9 20, 000 units at Rs. 8 30, 000 units at Rs. 7 40, 000 units at Rs. 6 Summary of expected changes units Material per unit 1 st 10, 000 2 nd 10, 000 (5%) Labour per unit 3 rd 10, 000 4 th 10, 000 (5%) Variable overhead per unit - (5%) 5% + - (5%) - 5% + Variable cost per unit at various levels of activity Normal Additional Rs. 10, 000 20, 000 30, 000 40, 000 Direct material 3. 00 2. 85 2. 7075 2. 572 Direct labour 2. 00 2. 1000 2. 205 Direct expenses 1. 0000 1. 0500 1. 1025 Variable cost per unit 6. 00 5. 85 5. 8075 5. 8575 5. 8795

Selling Price per unit: Rs. 10. An overseas customer offers to buy increased quantities during the forthcoming year at the following prices: 10, 000 units at Rs. 9 20, 000 units at Rs. 8 30, 000 units at Rs. 7 40, 000 units at Rs. 6 Summary of expected changes units Material per unit 1 st 10, 000 2 nd 10, 000 (5%) Labour per unit 3 rd 10, 000 4 th 10, 000 (5%) Variable overhead per unit - (5%) 5% + - (5%) - 5% + Variable cost per unit at various levels of activity Normal Additional Rs. 10, 000 20, 000 30, 000 40, 000 Direct material 3. 00 2. 85 2. 7075 2. 572 Direct labour 2. 00 2. 1000 2. 205 Direct expenses 1. 0000 1. 0500 1. 1025 Variable cost per unit 6. 00 5. 85 5. 8075 5. 8575 5. 8795

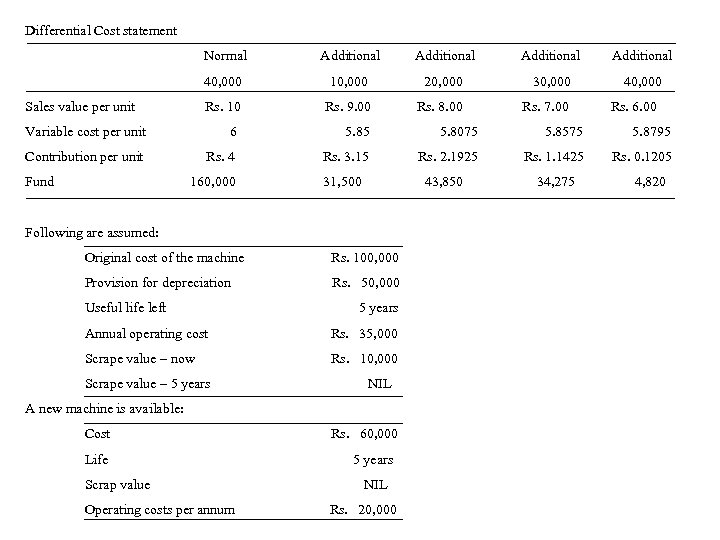

Differential Cost statement Normal Additional 40, 000 10, 000 20, 000 30, 000 40, 000 Rs. 10 Rs. 9. 00 Rs. 8. 00 Rs. 7. 00 Variable cost per unit 6 5. 85 5. 8075 5. 8575 5. 8795 Contribution per unit Rs. 4 Rs. 3. 15 Rs. 2. 1925 Rs. 1. 1425 Rs. 0. 1205 31, 500 43, 850 34, 275 Sales value per unit Fund 160, 000 Following are assumed: Original cost of the machine Rs. 100, 000 Provision for depreciation Rs. 50, 000 Useful life left 5 years Annual operating cost Rs. 35, 000 Scrape value – now Rs. 10, 000 Scrape value – 5 years NIL A new machine is available: Cost Life Scrap value Operating costs per annum Rs. 60, 000 5 years NIL Rs. 20, 000 Rs. 6. 00 4, 820

Differential Cost statement Normal Additional 40, 000 10, 000 20, 000 30, 000 40, 000 Rs. 10 Rs. 9. 00 Rs. 8. 00 Rs. 7. 00 Variable cost per unit 6 5. 85 5. 8075 5. 8575 5. 8795 Contribution per unit Rs. 4 Rs. 3. 15 Rs. 2. 1925 Rs. 1. 1425 Rs. 0. 1205 31, 500 43, 850 34, 275 Sales value per unit Fund 160, 000 Following are assumed: Original cost of the machine Rs. 100, 000 Provision for depreciation Rs. 50, 000 Useful life left 5 years Annual operating cost Rs. 35, 000 Scrape value – now Rs. 10, 000 Scrape value – 5 years NIL A new machine is available: Cost Life Scrap value Operating costs per annum Rs. 60, 000 5 years NIL Rs. 20, 000 Rs. 6. 00 4, 820

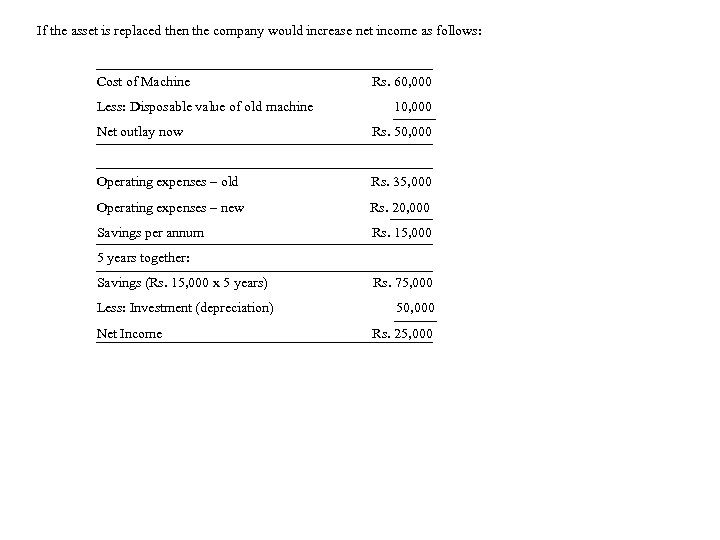

If the asset is replaced then the company would increase net income as follows: Cost of Machine Less: Disposable value of old machine Rs. 60, 000 10, 000 Net outlay now Rs. 50, 000 Operating expenses – old Rs. 35, 000 Operating expenses – new Rs. 20, 000 Savings per annum Rs. 15, 000 5 years together: Savings (Rs. 15, 000 x 5 years) Less: Investment (depreciation) Net Income Rs. 75, 000 50, 000 Rs. 25, 000

If the asset is replaced then the company would increase net income as follows: Cost of Machine Less: Disposable value of old machine Rs. 60, 000 10, 000 Net outlay now Rs. 50, 000 Operating expenses – old Rs. 35, 000 Operating expenses – new Rs. 20, 000 Savings per annum Rs. 15, 000 5 years together: Savings (Rs. 15, 000 x 5 years) Less: Investment (depreciation) Net Income Rs. 75, 000 50, 000 Rs. 25, 000