f4ee9a74cde166b7539da0d2e1ffb906.ppt

- Количество слайдов: 14

Cost & Management Accounting Job order & Process costing Main Ahmad Farhan (FCA)

Examples Software house Textile Unit Job order costing Process costing

Concept Job order costing Concentrate or focus on specific job. Process costing Out put units should be homogenous.

Job Order Costing Process 1. 2. 3. Related to a customer specific order Assigning a unique job code Cost accumulation and preparing job order cost sheet

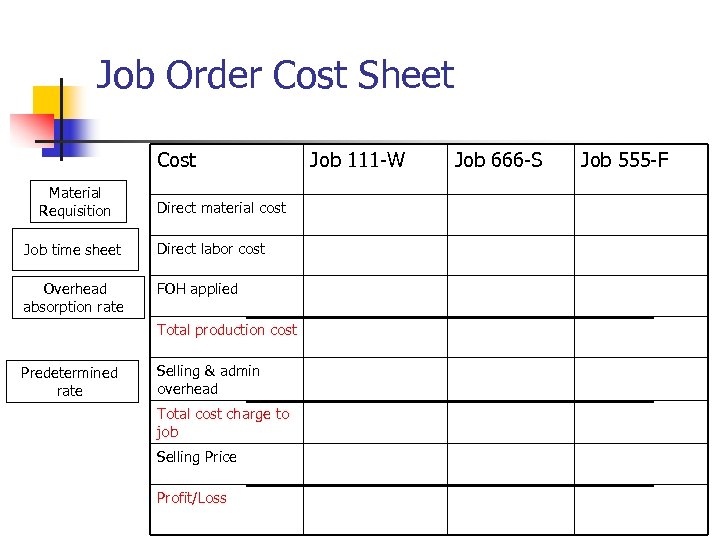

Job Order Cost Sheet Cost Material Requisition Direct material cost Job time sheet Direct labor cost Overhead absorption rate FOH applied Total production cost Predetermined rate Selling & admin overhead Total cost charge to job Selling Price Profit/Loss Job 111 -W Job 666 -S Job 555 -F

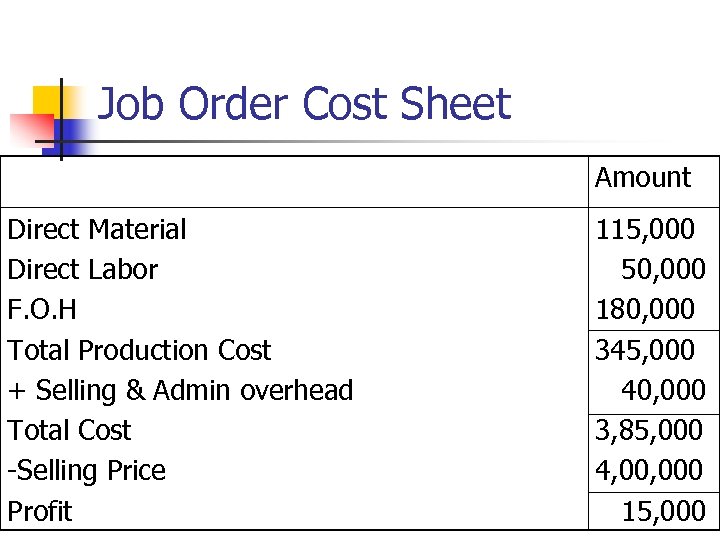

Example A furniture Mart received an order to manufacture furniture for a school the order was assigned a job code FS-6 Job was priced at Rs. 4, 000 and selling & Admin cost allocated to the FS-6 Job was 10% of selling price.

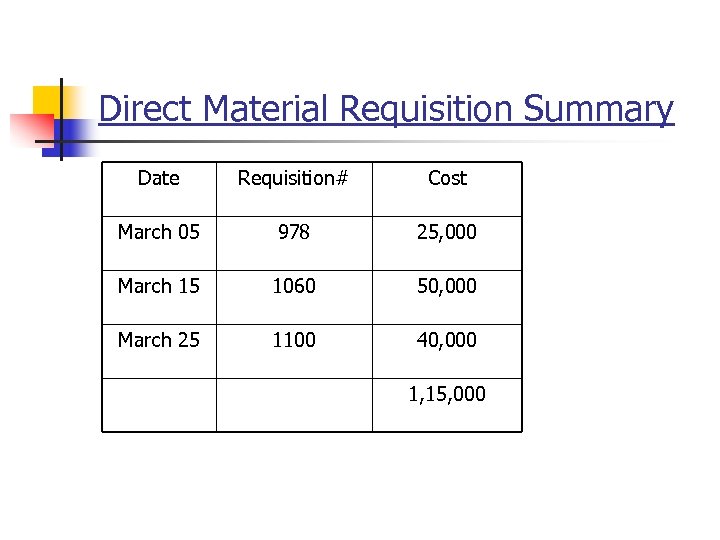

Direct Material Requisition Summary Date Requisition# Cost March 05 978 25, 000 March 15 1060 50, 000 March 25 1100 40, 000 1, 15, 000

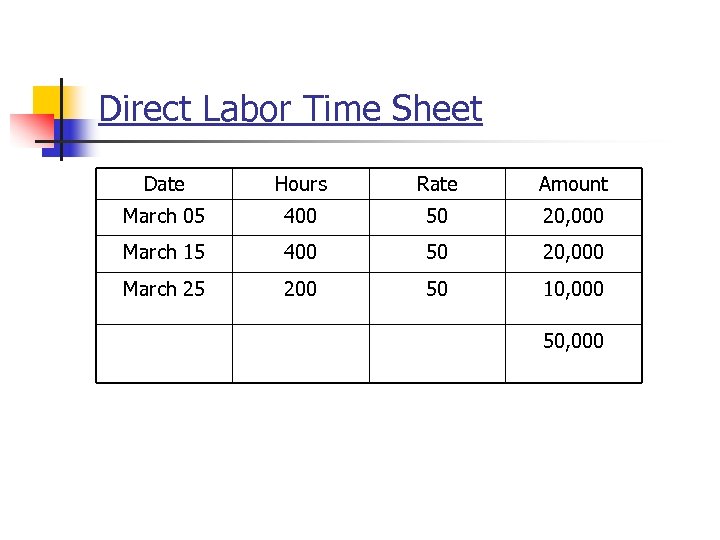

Direct Labor Time Sheet Date Hours Rate Amount March 05 400 50 20, 000 March 15 400 50 20, 000 March 25 200 50 10, 000 50, 000

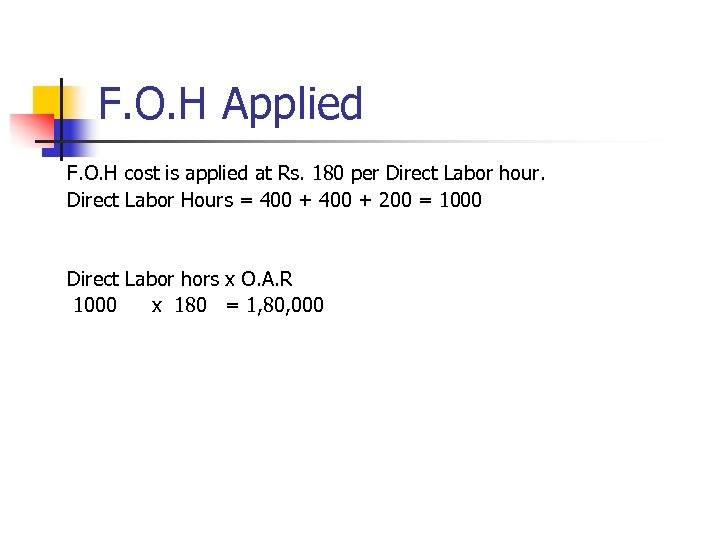

F. O. H Applied F. O. H cost is applied at Rs. 180 per Direct Labor hour. Direct Labor Hours = 400 + 200 = 1000 Direct Labor hors x O. A. R 1000 x 180 = 1, 80, 000

Job Order Cost Sheet Amount Direct Material Direct Labor F. O. H Total Production Cost + Selling & Admin overhead Total Cost -Selling Price Profit 115, 000 50, 000 180, 000 345, 000 40, 000 3, 85, 000 4, 000 15, 000

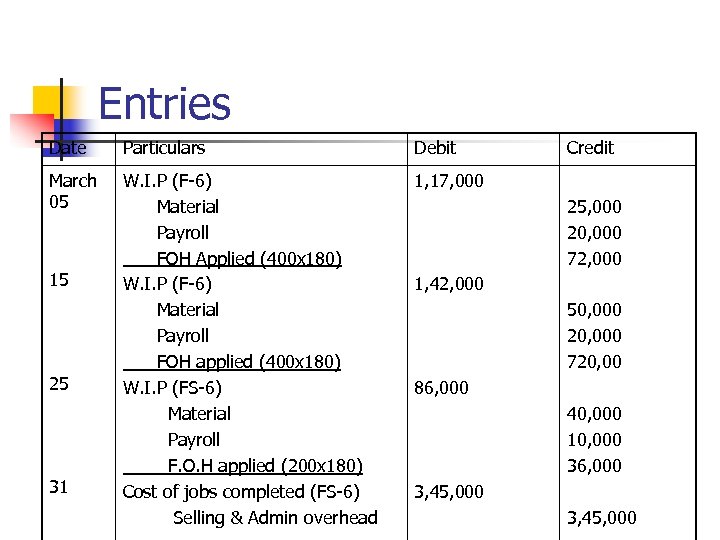

Entries Date Particulars Debit March 05 W. I. P (F-6) Material Payroll FOH Applied (400 x 180) W. I. P (F-6) Material Payroll FOH applied (400 x 180) W. I. P (FS-6) Material Payroll F. O. H applied (200 x 180) Cost of jobs completed (FS-6) Selling & Admin overhead 1, 17, 000 15 25 31 Credit 25, 000 20, 000 72, 000 1, 42, 000 50, 000 20, 000 720, 00 86, 000 40, 000 10, 000 36, 000 3, 45, 000

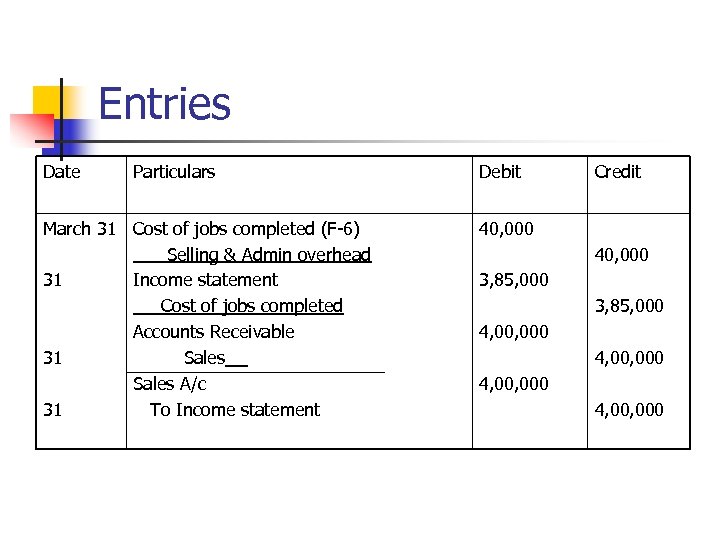

Entries Date Particulars March 31 Cost of jobs completed (F-6) Selling & Admin overhead 31 Income statement Cost of jobs completed Accounts Receivable 31 Sales A/c 31 To Income statement Debit Credit 40, 000 3, 85, 000 4, 00, 000

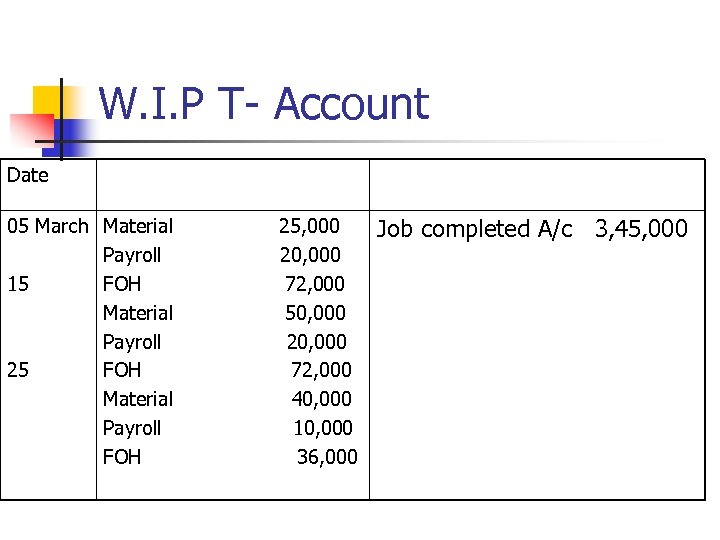

W. I. P T- Account Date 05 March Material Payroll 15 FOH Material Payroll 25 FOH Material Payroll FOH 25, 000 20, 000 72, 000 50, 000 20, 000 72, 000 40, 000 10, 000 36, 000 Job completed A/c 3, 45, 000

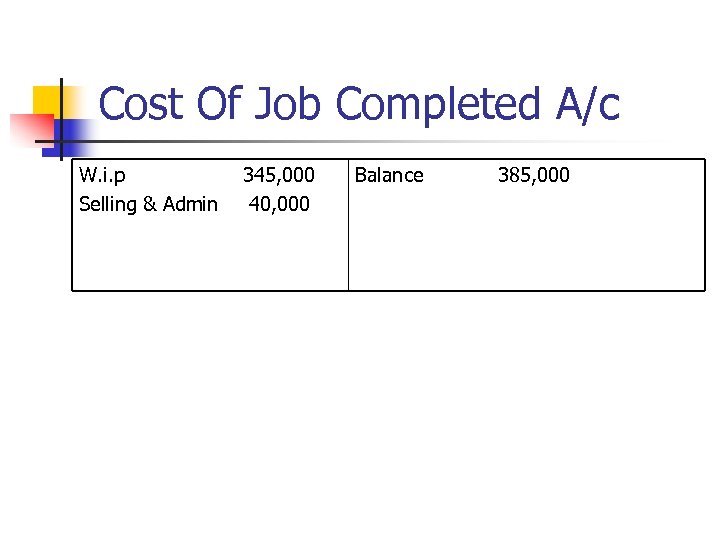

Cost Of Job Completed A/c W. i. p Selling & Admin 345, 000 40, 000 Balance 385, 000

f4ee9a74cde166b7539da0d2e1ffb906.ppt