fb7db8b6a307d98b050471b9fcb7639a.ppt

- Количество слайдов: 75

Cost Contribution Arrangements, Intra Group Services & Intangibles – Issues and Way Forward Intensive Workshop on Transfer Pricing 28 October 2012

Agenda • Intra-group Services • Intangibles • Cost Contribution Arrangements (CCAs) © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 2 2

Intra Group Services

Definition of Intra Group Services • • Services performed by one member of a MNE for the benefit of one or more related members (located in different tax jurisdiction) of the same group Per the OECD Guidelines - An activity (e. g. administrative, technical, financial, commercial, etc. ) for which an independent enterprise would have been willing to pay or perform for itself. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 4 4

Intra Group Services generally include… • Planning • Computer services • Coordination • Financial services • Budgetary Control • Management and administrative services • Financial advice • Purchasing, marketing and distribution • Accounting • Human resource services • Auditing • Legal services © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 5 5

The Indian Approach No specific provisions governing intra-group services are contained in Chapter X of the Income Tax Act, 1961 Indian tax authorities tend to follow the principles set forth in the OECD Guidelines © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 6 6

The Indian Approach – Documentation • Maintenance of service contracts including: Ø nature and extent of services to be provided; Ø basis for determining the fees to be charged; etc • Maintenance of relevant documents to confirm rendering of services for the benefit of the recipient • Maintenance of a detailed narrative of benefits received and supporting documents to identify services and prove non duplication of services, etc. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 7

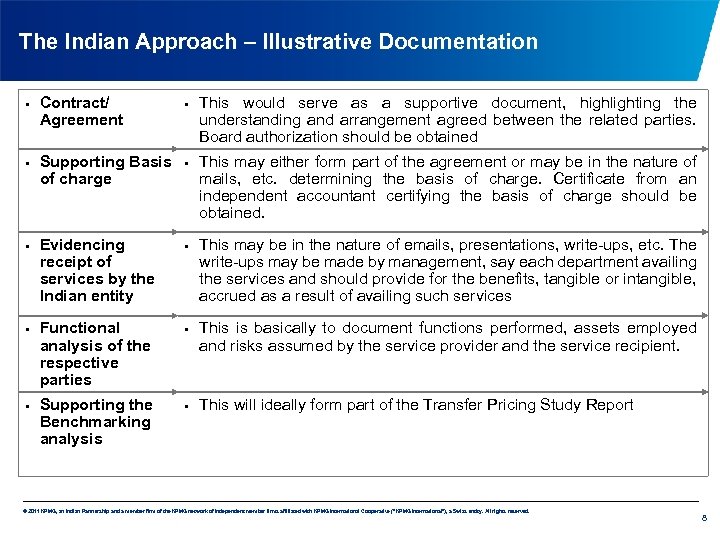

The Indian Approach – Illustrative Documentation • • • Contract/ Agreement Supporting Basis of charge Evidencing receipt of services by the Indian entity Functional analysis of the respective parties Supporting the Benchmarking analysis • • • This would serve as a supportive document, highlighting the understanding and arrangement agreed between the related parties. Board authorization should be obtained This may either form part of the agreement or may be in the nature of mails, etc. determining the basis of charge. Certificate from an independent accountant certifying the basis of charge should be obtained. This may be in the nature of emails, presentations, write-ups, etc. The write-ups may be made by management, say each department availing the services and should provide for the benefits, tangible or intangible, accrued as a result of availing such services This is basically to document functions performed, assets employed and risks assumed by the service provider and the service recipient. This will ideally form part of the Transfer Pricing Study Report © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 8

The Indian Approach – Basis of Charge Outbound Services • Cost plus Model – Determining cost base Ø Direct / indirect cost Ø Management overheads Ø Notional Cost – Determining a mark-up Ø Ø • Comparison of captive unit with independent companies Possibility of risk adjustment Hourly / Man Day Rate Model – Comparison of transactions hourly rate charged in related and unrelated – Adjustment on account of idle capacity/under-utilization of capacity © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 9

The Indian Approach – Basis of Charge Inbound Services Ø Benefit Analysis Ø Global transfer pricing policy Ø Documents evidencing services availed Recovery Ø Pass through costs Ø Costs for trial runs and initial setting up of business without mark-up Reimbursement Ø Ø Documents evidencing benefits received by Indian entity Basis of cost allocation – hourly/personnel/ actual © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 10

The OECD Approach • Whether intra-group services have in fact been provided? • What should be the arm’s length price for the above services? • Key considerations Ø Ø Would an independent enterprise pay for such activity? Would an independent enterprise perform the activity in-house by itself? Should the service be charged “at cost”? Should an arm’s length mark-up be added? © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 11 11

The U. S. Approach • • The Final Services Regulations (‘FSR’) are effective for taxable years beginning after July 31, 2009 Taxpayers may elect to apply the FSR to taxable years beginning after September 10, 2003 : Ø If election is made, all provisions of the Temporary Regulations will apply, i. e. , no cherry picking of provisions Ø Election applies to first year specified and all subsequent taxable years, e. g. , if elected for 2004, also applies to 2005 and 2006 • The regulations are relevant to ‘activities’, broadly defined Ø “includes the performance of functions, assumption of risks, or use by a renderer of tangible or intangible property or other resources, capabilities or knowledge. . ” • A service renderer must charge for activities that provide a direct benefit to a controlled party (a “controlled services transaction”) © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 12

The U. S. Approach • Beneficial services do not include: Ø Duplicative activities Ø Activities that only provide an indirect or remote benefit Ø Passive association Ø Shareholder activities • Ø Ø • Controlled services transactions must be charged at: An arm’s length price, or At cost, under the Services Cost Method if the services qualify and if the taxpayer so elects Transfer Pricing Methods (TPM) for intercompany services: Ø Services Cost Method Ø Ø Ø Comparable Uncontrolled Services Price Method (CUSP) Gross Service Margin Method (GSM) Cost Of Services Plus Method Comparable Profits Method (CPM) Profit Split Method Unspecified Methods © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 13

Chargeable and Non-Chargeable Intra Group services Chargeable services are those which provide a respective group member with economic or commercial value to enhance its commercial position in the market that it operates Non-Chargeable services include Shareholder activities and Duplicative services • Shareholder activities - Activity that a group member performs solely because of its ownership interest in one or more of the group members. Examples could include: Ø Costs of visits and reviewing subsidiary performance on a regular basis Ø Costs relating to reporting and legal requirements of the parent company e. g. consolidation of financial accounts • Duplicative services - If a group member duplicates a service already being performed by another group member. Examples of duplicative services could include: Ø Costs incurred by the parent on review of financial analysis made by subsidiary Ø Audit conducted by the parent to avoid risky or erroneous business decision © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 14 14

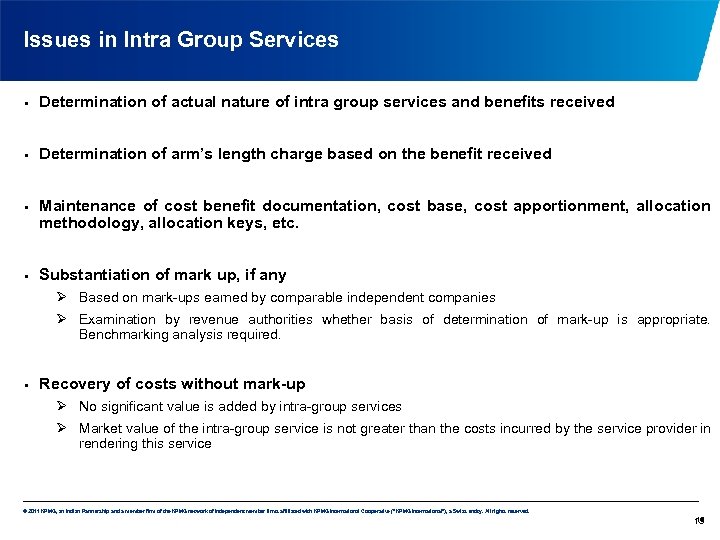

Issues in Intra Group Services • Determination of actual nature of intra group services and benefits received • Determination of arm’s length charge based on the benefit received • • Maintenance of cost benefit documentation, cost base, cost apportionment, allocation methodology, allocation keys, etc. Substantiation of mark up, if any Ø Based on mark-ups earned by comparable independent companies Ø Examination by revenue authorities whether basis of determination of mark-up is appropriate. Benchmarking analysis required. • Recovery of costs without mark-up Ø No significant value is added by intra-group services Ø Market value of the intra-group service is not greater than the costs incurred by the service provider in rendering this service © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 15 15

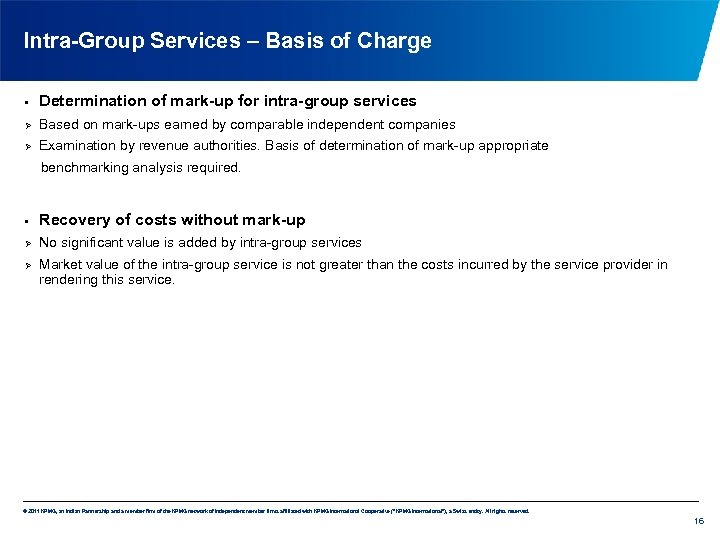

Intra-Group Services – Basis of Charge • Determination of mark-up for intra-group services Ø Based on mark-ups earned by comparable independent companies Ø Examination by revenue authorities. Basis of determination of mark-up appropriate benchmarking analysis required. • Recovery of costs without mark-up Ø No significant value is added by intra-group services Ø Market value of the intra-group service is not greater than the costs incurred by the service provider in rendering this service. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 16

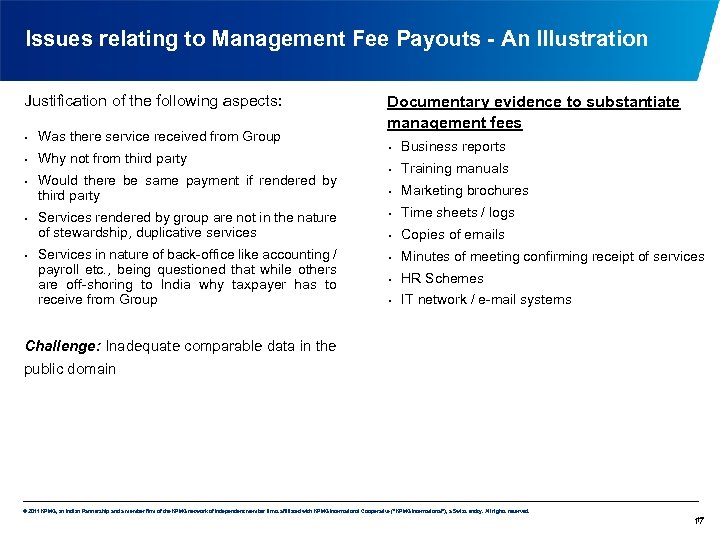

Issues relating to Management Fee Payouts - An Illustration Justification of the following aspects: • Was there service received from Group • Why not from third party • • • Would there be same payment if rendered by third party Services rendered by group are not in the nature of stewardship, duplicative services Services in nature of back-office like accounting / payroll etc. , being questioned that while others are off-shoring to India why taxpayer has to receive from Group Documentary evidence to substantiate management fees • Business reports • Training manuals • Marketing brochures • Time sheets / logs • Copies of emails • Minutes of meeting confirming receipt of services • HR Schemes • IT network / e-mail systems Challenge: Inadequate comparable data in the public domain © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 17 17

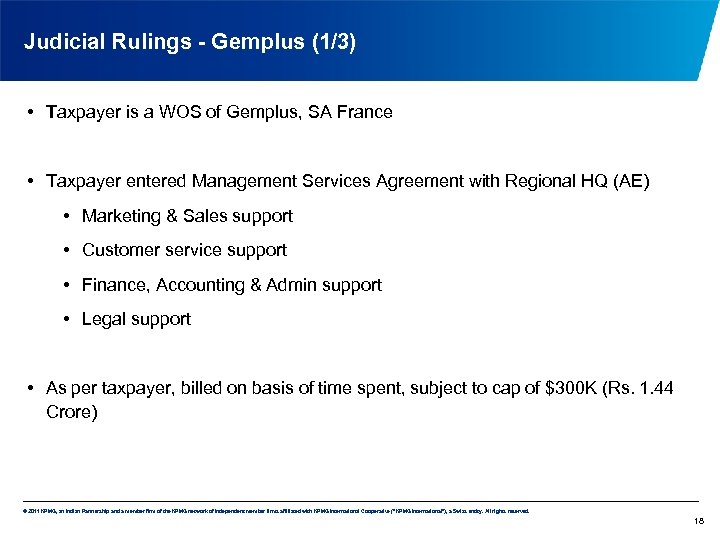

Judicial Rulings - Gemplus (1/3) • Taxpayer is a WOS of Gemplus, SA France • Taxpayer entered Management Services Agreement with Regional HQ (AE) • Marketing & Sales support • Customer service support • Finance, Accounting & Admin support • Legal support • As per taxpayer, billed on basis of time spent, subject to cap of $300 K (Rs. 1. 44 Crore) © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 18

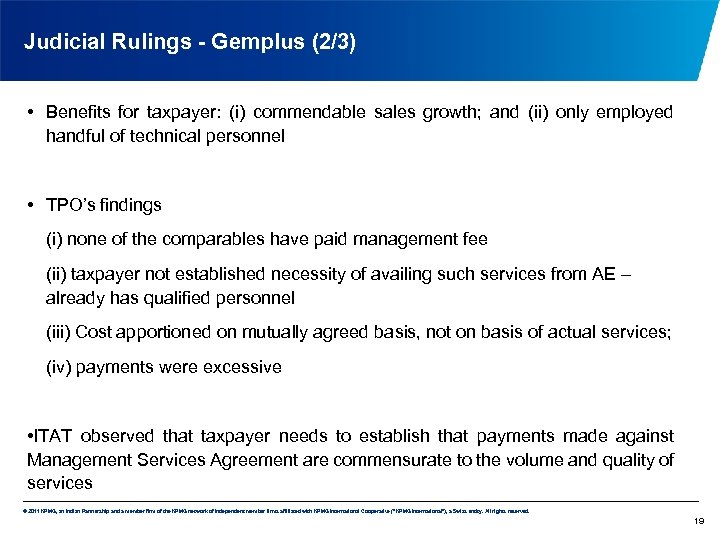

Judicial Rulings - Gemplus (2/3) • Benefits for taxpayer: (i) commendable sales growth; and (ii) only employed handful of technical personnel • TPO’s findings (i) none of the comparables have paid management fee (ii) taxpayer not established necessity of availing such services from AE – already has qualified personnel (iii) Cost apportioned on mutually agreed basis, not on basis of actual services; (iv) payments were excessive • ITAT observed that taxpayer needs to establish that payments made against Management Services Agreement are commensurate to the volume and quality of services © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 19

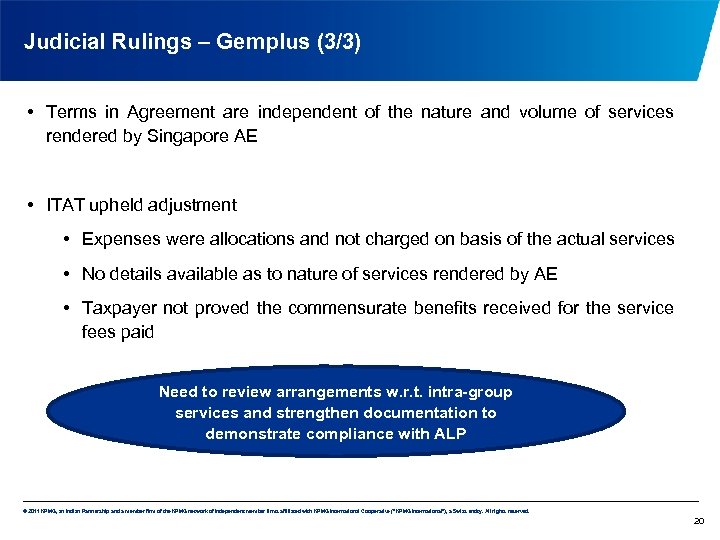

Judicial Rulings – Gemplus (3/3) • Terms in Agreement are independent of the nature and volume of services rendered by Singapore AE • ITAT upheld adjustment • Expenses were allocations and not charged on basis of the actual services • No details available as to nature of services rendered by AE • Taxpayer not proved the commensurate benefits received for the service fees paid Need to review arrangements w. r. t. intra-group services and strengthen documentation to demonstrate compliance with ALP © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 20

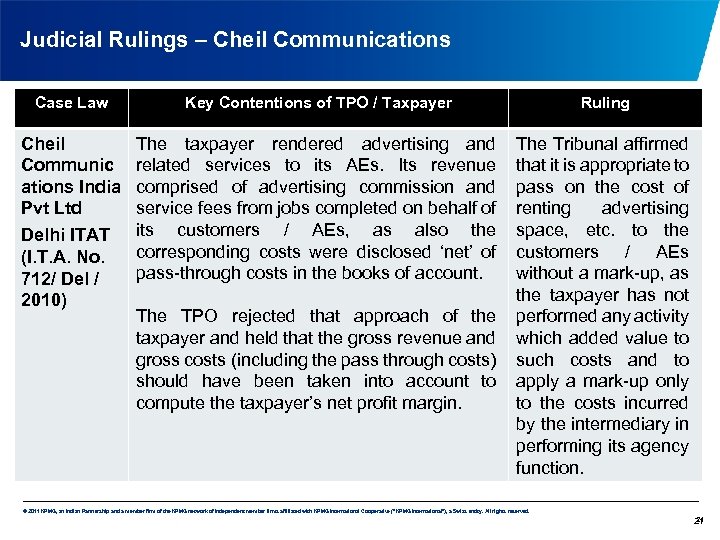

Judicial Rulings – Cheil Communications Case Law Key Contentions of TPO / Taxpayer Ruling Cheil Communic ations India Pvt Ltd The taxpayer rendered advertising and related services to its AEs. Its revenue comprised of advertising commission and service fees from jobs completed on behalf of its customers / AEs, as also the corresponding costs were disclosed ‘net’ of pass-through costs in the books of account. The Tribunal affirmed that it is appropriate to pass on the cost of renting advertising space, etc. to the customers / AEs without a mark-up, as the taxpayer has not performed any activity which added value to such costs and to apply a mark-up only to the costs incurred by the intermediary in performing its agency function. Delhi ITAT (I. T. A. No. 712/ Del / 2010) The TPO rejected that approach of the taxpayer and held that the gross revenue and gross costs (including the pass through costs) should have been taken into account to compute the taxpayer’s net profit margin. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 21 21

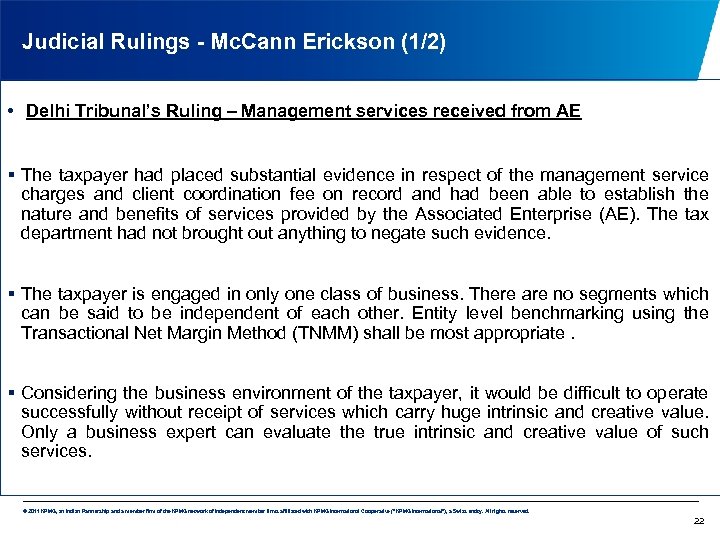

Judicial Rulings - Mc. Cann Erickson (1/2) • Delhi Tribunal’s Ruling – Management services received from AE § The taxpayer had placed substantial evidence in respect of the management service charges and client coordination fee on record and had been able to establish the nature and benefits of services provided by the Associated Enterprise (AE). The tax department had not brought out anything to negate such evidence. § The taxpayer is engaged in only one class of business. There are no segments which can be said to be independent of each other. Entity level benchmarking using the Transactional Net Margin Method (TNMM) shall be most appropriate. § Considering the business environment of the taxpayer, it would be difficult to operate successfully without receipt of services which carry huge intrinsic and creative value. Only a business expert can evaluate the true intrinsic and creative value of such services. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 22

Judicial Rulings - Mc. Cann Erickson (2/2) § The Tribunal relied on the High Court judgment in the case of Hive Communication Pvt. Ltd. wherein it was held that the legitimate business needs of the company must be judged from the perspective of the company. It is not for the AO to dictate what the business needs of the company should be. § The term “benefit” to a company in relation to its business has a very wide connotation. It is difficult to accurately measure these benefits in terms of money value separately. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 23

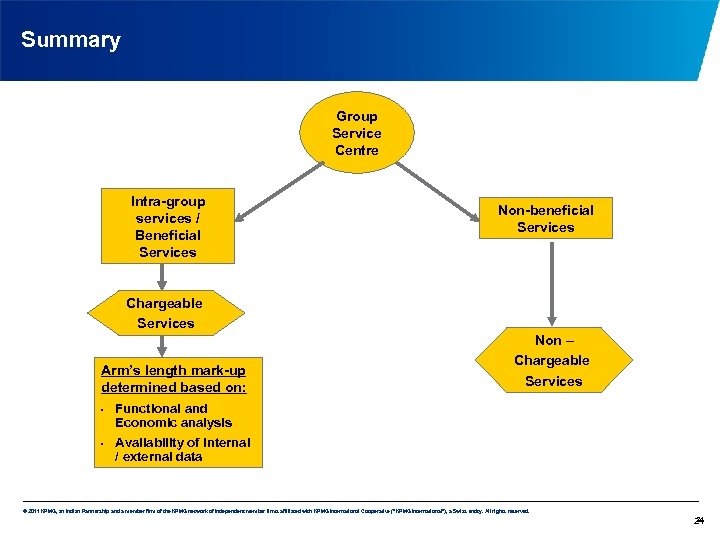

Summary Group Service Centre Intra-group services / Beneficial Services Non-beneficial Services Chargeable Services Arm’s length mark-up determined based on: • • Non – Chargeable Services Functional and Economic analysis Availability of internal / external data © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 24 24

Key Audit Issues – Services • Management / Stewardship / Technical Services Ø Benefits Test Ø Cost allocation / cost base working Ø Inbound / outbound services – No set off Ø Justification of mark-up – Routine services vs. value added services Ø Documentation © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 25

Key Audit Issues – Services • IT/ITES Determining remuneration level for Captive Units Ø Functional profile of Captive Units ü ü Captive services providers remunerated with a Cost Plus Mark-up, operating in a risk-free environment Cost base an issue Ø Quantum of “Cost Plus Mark-up” ü • Reference to profitability of third party service providers Third parties are Entrepreneurial enterprises ü Undertake full gamut of risks ü Entrepreneurial and economic risk adjustment not yet accepted • Adjustments in Audits range from mark-up of 20% - 40% • Concept of locational savings © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 26

Intangibles © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 27

What Are Intangibles? • Non-physical in nature • Capable of producing future economic benefits (profit potential) • Legally protected (brand name, patented formulae/processes etc. ) or De Facto rights (knowhow) • Limited relationship with cost • Generally need a long term evaluation • Routine vs. Non Routine Intangibles Ø Generally, enterprises possessing non-routine intangibles are expected to earn aboveaverage profits over a period of time However, enterprises earning above-average profits may not necessarily possess valuable intangibles © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 28

Intangibles Categories • Technology Intangibles Ø Ø Ø • Unpatented processes Know-how Marketing Intangibles generally associated with Ø Ø Ø • Patented processes/ Formulae/ Designs/ Models Brand name Trade name / Trademarks Copyrights Others (Customer lists/ Customer relationships, Supplier relationships, Contractual relationships) • Goodwill • Workforce in place © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 29

How are Intangibles created and who owns them? • Many intangibles are created by legal barriers to entry • Trademarks, Patents, Government licences • Intangibles are also created by investments in R&D, advertising, etc. • Lack of relationship between value and costs • Economic theory indicates a wide range of arm’s-length prices • • But not necessarily fixed costs • • Greater than variable costs; even Zero if marginal cost is low Can be set high if there are high barriers to entry Disconnect between legal and economic ownership at times • • Cases where R&D activity is contracted to a third-party Moving towards- who takes key decisions and who performs significant people’s function © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 30

Intangibles under Indian Transfer Pricing Indian Tax Regulations • • • Finance Act 2012 amendment the definition of the term ‘international transaction’ to include “purchase, sale, lease or use of intangibles (wref from April 2001) Definition of the term ‘intangible’ specifically inserted – coverage significantly wide Under transfer pricing related rules, the definition of 'property' includes 'intangible property'. In clause 9 of the Form No. 3 CEB, transactions in intangible property (IP) are described as those which relate to 'know-how, patents, copyrights, licenses etc'. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 31

OECD Guidelines (1/2) Chapter VI of the OECD Guidelines defines intangibles as the assets that may have considerable value and risks (book value not essential). • Trade Intangible An intangible used in commercial activities such as the production of a good or the provision of a service, as well as an intangible right that is itself a business asset transferred to customers or used in the operation of business. • Marketing Intangible An intangible that is concerned with marketing activities, which aids in the commercial exploitation of a product or service and/or has an important promotional value for the product concerned. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 32

OECD Guidelines (2/2) OECD Discussion Draft on intangibles OECD released a discussion draft on July 2012 in respect of revisions to be made to the existing commentary on transfer pricing aspects relating to intangibles • Significant changes proposed to the existing commentary • Comments received by the OECD from various stakeholders worldwide – comments published and released by the OECD in September 2012 • Comments being presently discussed by the OECD – final commentary expected shortly • © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 33

Why value Intangibles ? ? • • • Buy-in to an existing cost contribution arrangement Royalty for a licensing transaction Tax restructuring (IP base shifting, acquired IP shifting etc. ) • Exit cost • Other purposes © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 34

Valuing Intangibles Factors influencing Valuation • Strength and enforceability of legal protection • Risk of future litigation • Specified legal life • Life cycle • Expected remaining useful life • External commercialization opportunities OECD TP Guidelines • • consider usefulness of intangible property to associate enterprise (AE) consider perspective of transferor and transferee. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 35

Valuing Intangibles As per - OECD TP Guidelines – • • • Examine price at which comparable independent enterprise would be willing to transfer property. From transferor’s perspective – highest price From transferee’s perspective, whether comparable independent enterprise would be prepared to pay such a price, depending on the value and usefulness of the intangible property to the transferee in its business. Discussion draft on revision guidelines issued – in the process of being finalised © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 36

Valuing Intangibles – various approaches Market Approach • • • Estimates the value based on current purchases and sales of similar assets. At what price would independent parties buy/sell comparable intangibles? Generally, absolute price measure is not used for comparability reasons and lack of information. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 37

Valuing Intangibles – various approaches Income Approach • • • Estimates value by calculating present worth of future benefits expected to be derived from use /ownership of asset; Future benefits can include earnings, cost savings, tax deductions, proceeds from disposition etc. Generally uses Discounted Cash Flow (DCF) analysis. Under DCF analysis, expected cash flows are discounted to their present value equivalents - at a rate of return that is commensurate with the underlying risk of the cash flows. How much additional income or cost savings would a comparable intangible generate? © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 38

Valuing Intangibles – various approaches Cost Approach • • Based on principle of substitution -assumes a prudent investor would pay no more than cost to replace an asset with one of similar utility. Requires restatement of historical cost incurred in development of the asset to fair market value, along with revision of cost assumptions (if necessary). Generally least preferred method, as cost do not necessarily correlate with expected benefits. What would it cost to replace the intangible being valued? © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 39

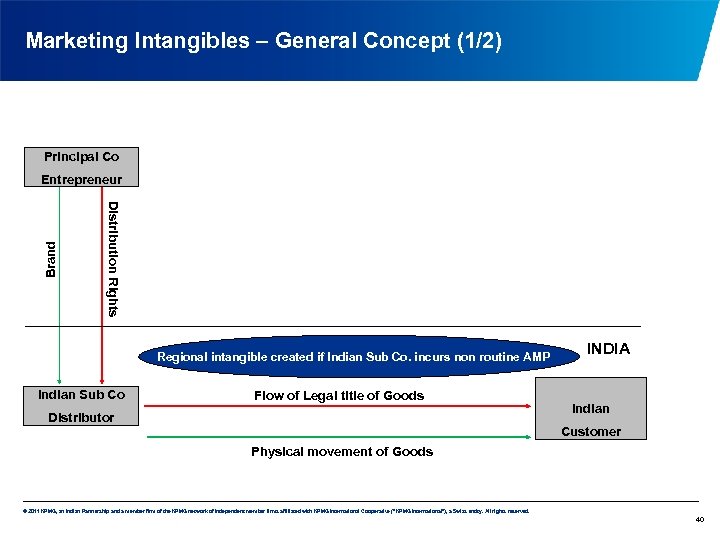

Marketing Intangibles – General Concept (1/2) Principal Co Distribution Rights Brand Entrepreneur Regional intangible created if Indian Sub Co. incurs non routine AMP Indian Sub Co Flow of Legal title of Goods Distributor INDIA Indian Customer Physical movement of Goods © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 40

Marketing Intangibles – General Concept (2/2) Economic concept – no legal ownership or legal protection Derived from valuable marketing activities performed for developing / maintaining a brand or brand Created by the entity that invests to give the brand or trademark its value High marketing expenditure by a subsidiary is increasingly being scrutinized by revenue authorities – The authorities are either a) Disallowing AMP expenditure of distributor b) Deeming a service fee for the marketing effort c) Expect higher marketing margins as return for investment © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 41

Marketing Intangibles – International Guidance Three Cheese Examples in U. S. 482 Regs FP a well known cheese manufacturer (but unknown in U. S. ) enters the U. S. market and incorporates a U. S. Sub for developing the U. S. market: Example 1 – U. S. Distributor Sub incurs normal marketing expenditure Example 2 – U. S. Distributor Sub incurs higher than normal marketing expenditure Example 3 – U. S. Distributor Sub enters long term agreement with Parent and acquires exclusive right to distribute cheese in the U. S. under FP trademark Does U. S. Distributor Sub need to be compensated? Similar Guidance from Australian Tax Office (ATO) © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 42

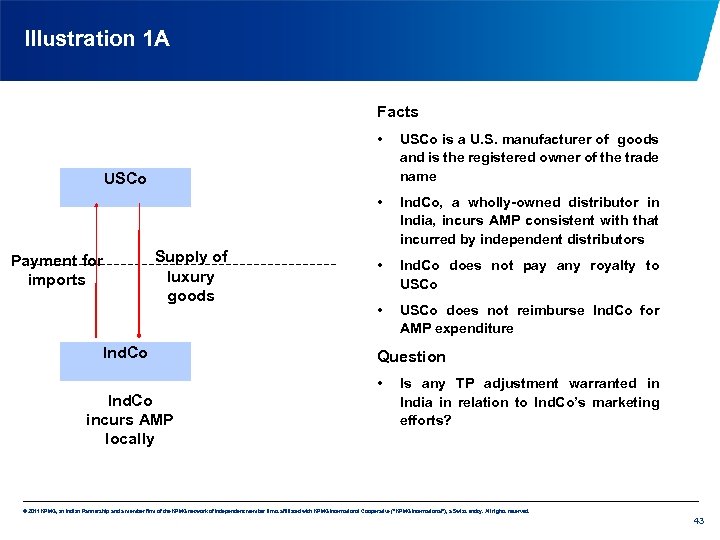

Illustration 1 A Facts • USCo is a U. S. manufacturer of goods and is the registered owner of the trade name • Ind. Co, a wholly-owned distributor in India, incurs AMP consistent with that incurred by independent distributors • Ind. Co does not pay any royalty to USCo • USCo does not reimburse Ind. Co for AMP expenditure USCo Payment for imports Supply of luxury goods Ind. Co incurs AMP locally Question • Is any TP adjustment warranted in India in relation to Ind. Co’s marketing efforts? © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 43

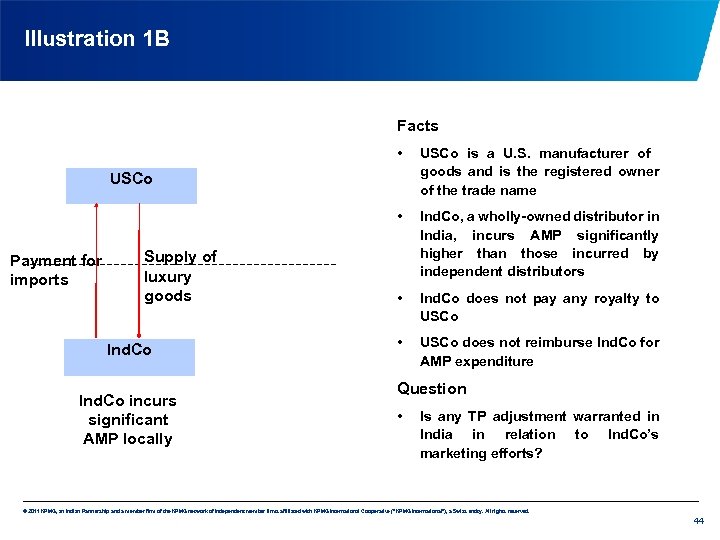

Illustration 1 B Facts • USCo is a U. S. manufacturer of goods and is the registered owner of the trade name • Ind. Co, a wholly-owned distributor in India, incurs AMP significantly higher than those incurred by independent distributors • Ind. Co does not pay any royalty to USCo • USCo does not reimburse Ind. Co for AMP expenditure USCo Payment for imports Supply of luxury goods Ind. Co incurs significant AMP locally Question • Is any TP adjustment warranted in India in relation to Ind. Co’s marketing efforts? © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 44

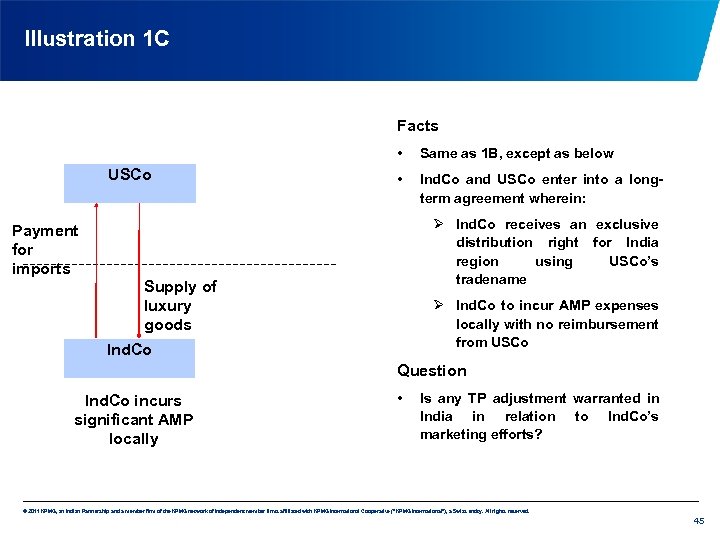

Illustration 1 C Facts • USCo Payment for imports Same as 1 B, except as below • Ind. Co and USCo enter into a longterm agreement wherein: Ø Ind. Co receives an exclusive distribution right for India region using USCo’s tradename Supply of luxury goods Ø Ind. Co to incur AMP expenses locally with no reimbursement from USCo Ind. Co Question Ind. Co incurs significant AMP locally • Is any TP adjustment warranted in India in relation to Ind. Co’s marketing efforts? © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 45

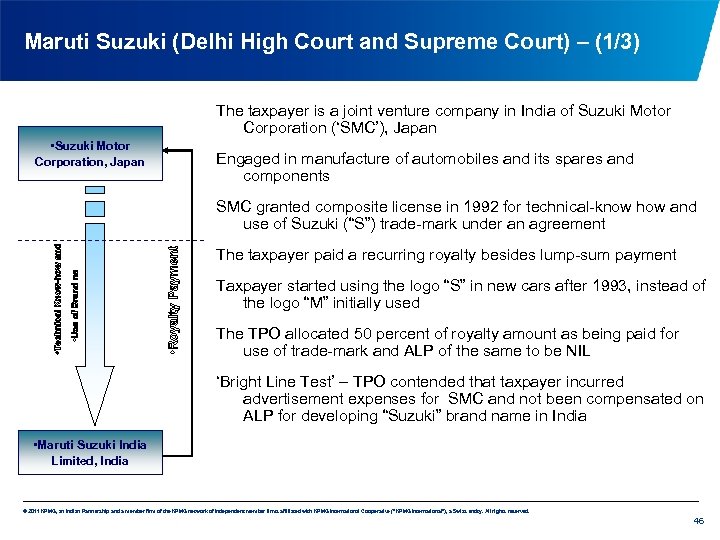

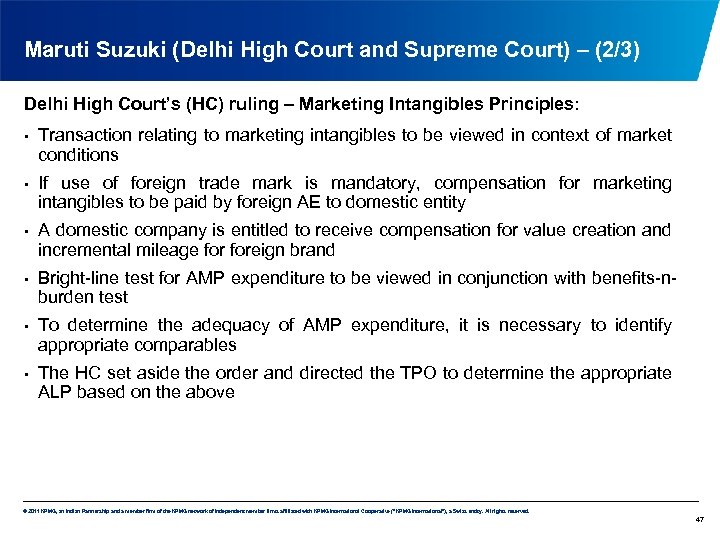

Maruti Suzuki (Delhi High Court and Supreme Court) – (1/3) The taxpayer is a joint venture company in India of Suzuki Motor Corporation (‘SMC’), Japan • Suzuki Motor Corporation, Japan Engaged in manufacture of automobiles and its spares and components SMC granted composite license in 1992 for technical-know how and use of Suzuki (“S”) trade-mark under an agreement The taxpayer paid a recurring royalty besides lump-sum payment Taxpayer started using the logo “S” in new cars after 1993, instead of the logo “M” initially used The TPO allocated 50 percent of royalty amount as being paid for use of trade-mark and ALP of the same to be NIL ‘Bright Line Test’ – TPO contended that taxpayer incurred advertisement expenses for SMC and not been compensated on ALP for developing “Suzuki” brand name in India • Maruti Suzuki India Limited, India © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 46

Maruti Suzuki (Delhi High Court and Supreme Court) – (2/3) Delhi High Court’s (HC) ruling – Marketing Intangibles Principles: • • • Transaction relating to marketing intangibles to be viewed in context of market conditions If use of foreign trade mark is mandatory, compensation for marketing intangibles to be paid by foreign AE to domestic entity A domestic company is entitled to receive compensation for value creation and incremental mileage foreign brand Bright-line test for AMP expenditure to be viewed in conjunction with benefits-nburden test To determine the adequacy of AMP expenditure, it is necessary to identify appropriate comparables The HC set aside the order and directed the TPO to determine the appropriate ALP based on the above © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 47

Maruti Suzuki (Delhi High Court and Supreme Court) – (3/3) The Supreme Court: • • Observed that the High Court has not merely set aside the original show-cause notice but has made certain observations on the merits of the case and has given directions to the TPO in the nature of guiding principles Directed the TPO to decide the matter in accordance with law and uninfluenced by the above observations/ directions given by the High Court © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 48

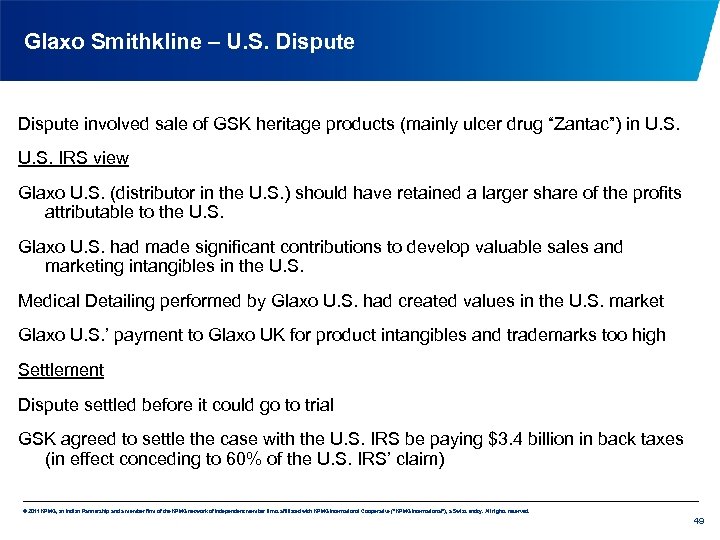

Glaxo Smithkline – U. S. Dispute involved sale of GSK heritage products (mainly ulcer drug “Zantac”) in U. S. IRS view Glaxo U. S. (distributor in the U. S. ) should have retained a larger share of the profits attributable to the U. S. Glaxo U. S. had made significant contributions to develop valuable sales and marketing intangibles in the U. S. Medical Detailing performed by Glaxo U. S. had created values in the U. S. market Glaxo U. S. ’ payment to Glaxo UK for product intangibles and trademarks too high Settlement Dispute settled before it could go to trial GSK agreed to settle the case with the U. S. IRS be paying $3. 4 billion in back taxes (in effect conceding to 60% of the U. S. IRS’ claim) © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 49

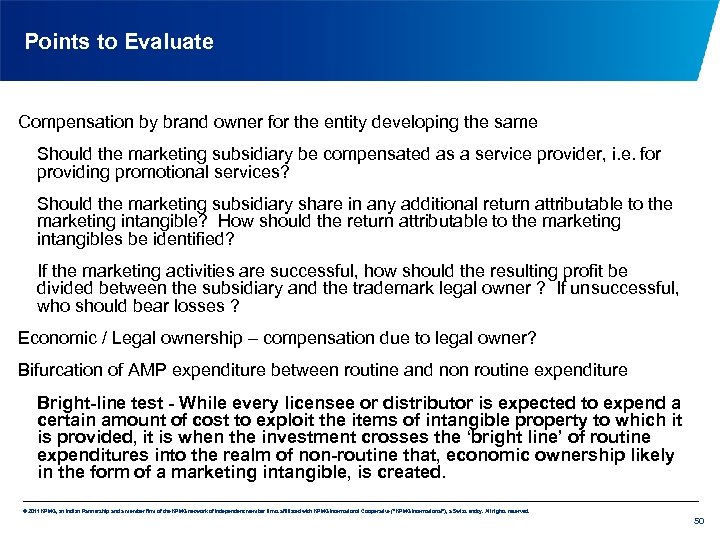

Points to Evaluate Compensation by brand owner for the entity developing the same Should the marketing subsidiary be compensated as a service provider, i. e. for providing promotional services? Should the marketing subsidiary share in any additional return attributable to the marketing intangible? How should the return attributable to the marketing intangibles be identified? If the marketing activities are successful, how should the resulting profit be divided between the subsidiary and the trademark legal owner ? If unsuccessful, who should bear losses ? Economic / Legal ownership – compensation due to legal owner? Bifurcation of AMP expenditure between routine and non routine expenditure Bright-line test - While every licensee or distributor is expected to expend a certain amount of cost to exploit the items of intangible property to which it is provided, it is when the investment crosses the ‘bright line’ of routine expenditures into the realm of non-routine that, economic ownership likely in the form of a marketing intangible, is created. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 50

Royalty payouts Issues relating to Royalty pay-outs: Royalty is widely adopted appropriate mechanism to compensate for use of manufacturing intangible Benchmarking Issues: • • • Limits specified by RBI and FEMA not considered as external CUP. Aggregation approach under TNMM – Challenged and general lack of availability of comparables Transaction specific approach has been adopted by revenue – examine the ‘cost – benefit’ analysis Is Royalty Payment justified in case of loss situation? © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 51

Royalty payouts – Points to Ponder • • Documentary evidence Benefits received / receivable by the taxpayer and quantification of the benefit Unique nature of the intangible, market where it is used and strategic advantage achieved Rights of the taxpayer to receive upgrades Comparative profits before and after use of the intangible Whethere any geographic restrictions such as to export based on the licensed technology Rates at which the royalty is paid for use of similar intangibles by any other concern / subsidiary of the AE / Group Benchmarking databases royalty payouts based on global © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 52

Judicial Rulings - EKL Appliances Ltd. (1/2) Delhi High Court’s Ruling – Payment of Royalty to AE • It is not for the Revenue authorities to dictate to the taxpayer how he or she should conduct his business and what expenditure should be incurred. • It is not necessary for the taxpayer to show that any legitimate expenditure incurred by him or her : Øwas also incurred out of necessity or Øthat the expenditure incurred by him or her for the purpose of business has actually resulted in profit or income. • The taxpayer only needs to show that the expenditure should have been incurred “wholly and exclusively” for the purpose of business. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 53

Judicial Rulings - EKL Appliances Ltd. (2/2) • The amount of expenditure can be examined by the TPO but he or she has no authority to disallow the expenditure on the basis that the taxpayer has suffered continuous losses. • The High Court also relied on the OECD Guidelines: Tax administrations should not disregard and restructure the transactions as actually undertaken by the taxpayer except Ø where the economic substance of a transaction differs from its form; and Ø where the form and substance of the transaction are the same but arrangements made in relation to the transaction differ from those which would have been adopted by independent enterprises behaving in a commercially rational manner © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 54

Judicial Rulings - Sona Okegawa Precision Forging (1/2) • Taxpayer paid royalty and technical service fee to AE • Justified using CUP Method, relying on ceiling under erstwhile FEMA regulations • Royalty paid on total sales (i. e. sales to AEs and third parties) • TPO made adjustment • (i) no actual third party transaction so there is no CUP as such • (ii) as royalty is also paid on sales to AE, it is not compliant with ALP • (iii) disallowed technical service fee © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 55

Judicial Rulings - Sona Okegawa Precision Forging (2/2) • ITAT ruled in favour of the taxpayer • Royalty computed based on sales made to AE is at arm’s length as the taxpayer is a full Entrepreneur and not a Contract Manufacturer • Royalty was recovered by the taxpayer from the AE as part of the sale price and thus the transaction was revenue neutral • Technical service fee justifiable since it is payable under the know-how license agreement and is not the responsibility of the AE under the royalty agreement © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 56

Judicial Rulings - Abhishek Auto Industries (1/2) • Taxpayer is a manufacturer of car seat belts – International transactions with AE include imports of RM; and availing of know-how from AE • Taxpayer contention - since the payment for royalty & technical fees was made in accordance with the agreements approved by regulatory agencies, the question of arm’s length consideration does not arise • Taxpayer undertook a gross level comparison of AE and non-AE operations to demonstrate compliance with arm’s length • TPO rejected the taxpayer’s analysis: (i) Applied TNMM and made adjustment to taxpayer’s margins on a companywide basis (ii) Contended that there was no transfer of technology, accordingly treated ALP of the royalty and technical know transaction as Nil © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 57

Judicial Rulings - Abhishek Auto Industries (2/2) • CIT(A) enhanced based on updated margins of comparables • Tribunal ruled in favor of the taxpayer (i) Tax authorities erroneously disregarded royalty & technical knowhow agreement merely by pleading absence of commercial need (ii) Commercial expediency is the domain of the taxpayer (iii) Legally binding agreements which are also approved by regulatory agencies cannot be disregarded without assigning cogent reasons (iv) Not alleged by the Revenue that the agreements were non-genuine or sham © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 58

Cost Contribution Arrangements © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

Cost Contribution Arrangement – An Introduction • A Cost Contribution Arrangement (CCA) is a contractual agreement among business enterprises to share costs and risks for Ø Developing, producing or obtaining assets, Ø Providing services or rights, and Ø For determination of nature & extent of the interests of participants in those assets. Definition : “A CCA is a framework agreed among business enterprises to share the costs and risks of developing, producing or obtaining assets, services, or rights, and to determine the nature and extent of the interests of each participant in those assets, services, or rights. ” -OECD Transfer Pricing Guidelines (Para 8. 03) • • Commonly observed for joint development of intangibles and management fees , it can also exist for any joint funding or sharing of costs and risks, for developing or acquiring property or for obtaining services. Many countries broadly follow the OECD approach to CCAs, but there also many countries that treat CCA’s in the same way as they do any inter-company recharge of costs. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 60

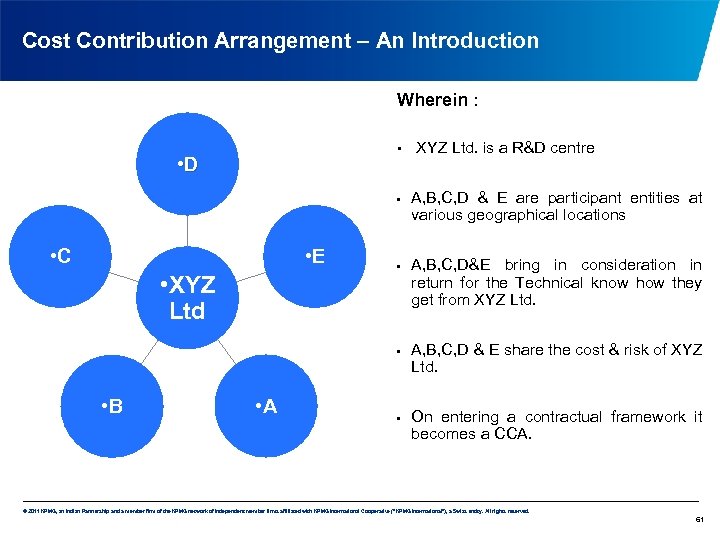

Cost Contribution Arrangement – An Introduction Wherein : • • D • • C • E • XYZ Ltd • • • B • A • XYZ Ltd. is a R&D centre A, B, C, D & E are participant entities at various geographical locations A, B, C, D&E bring in consideration in return for the Technical know how they get from XYZ Ltd. A, B, C, D & E share the cost & risk of XYZ Ltd. On entering a contractual framework it becomes a CCA. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 61

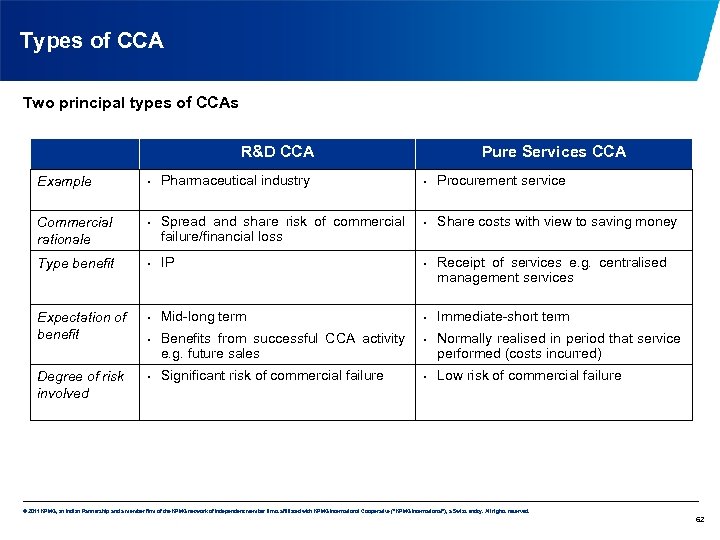

Types of CCA Two principal types of CCAs R&D CCA Pharmaceutical industry Pure Services CCA • Procurement service • Share costs with view to saving money Example • Commercial rationale • Type benefit • IP • Expectation of benefit • Mid-long term • Degree of risk involved • • Spread and share risk of commercial failure/financial loss Benefits from successful CCA activity e. g. future sales Significant risk of commercial failure • • Receipt of services e. g. centralised management services Immediate-short term Normally realised in period that service performed (costs incurred) Low risk of commercial failure © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 62

Transfer Pricing Implications • Determination of Participants • Buy-in / Buy-out Adjustments • Balancing Payments • Determination of cost base • Appropriateness of allocation & contribution • Consequences of a non-ALP CCA © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 63

Determination of Participants Who is a Participant? A Participant: • Must be assigned a beneficial Interest in the results of CCA • Have a reasonable expectation to exploit the interest assigned either directly or indirectly • Must share the Profit & Loss arising on account of a CCA © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 64

Buy-In adjustments What is a buy-in payment? Payment to already existing CCA by other new participants for the use of intangibles developed or acquired outside the CCA Definition : “The term “buy-in payment” is limited to payments made by new entrants to an already active CCA for obtaining an interest in any results of prior CCA activity. ” -OECD Transfer Pricing Guidelines (Para 8. 31) Treatment of Buy- in Payments / Receipts: • In the hands of payer -Treated for tax purpose as if payments were made outside the CCA framework for acquiring the interest • In the hands of payer - Buy –in payment will not constitute as Royalty except where participant obtains right to use the IP and doesn’t get the beneficial interest in such IP • In the hands of Recipient – Buy –in payment received will be treated as taxable income © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 65

Buy-In adjustments – Key Features • Transfer previous knowledge / IP to the new entrant • Bring their own existing IP / interests into the CCA – Netting is permitted • Transfers should be rewarded at arm’s length • Where the CCA is for the provision of services, a Buy-Out / Buy-In payments may not be needed • Absence of express terms does not prevent a CCA from being considered to exist • Payment can be • Lump sum or • Installment payments on lump sum, with arm’s length interest © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 66

Buy-out adjustments What is a buy-out payment? Payment made to/by participant at the time of disposal of interest in past activity of CCA is known as buyout payment. Definition : “If there is an effective transfer of property rights at the time of a participant’s withdrawal, the transfer should be compensated according to the arm’s length principle. This compensation is called a “buy-out” payment. ” -OECD Transfer Pricing Guidelines (Para 8. 34) Treatment of Buy- out Payments / Receipts: • • In the hands of Recipient – it will be treated in same manner as consideration received on disposal of rights in IP In the hands of payer – as if payment were made outside the framework of a CCA for purchase of rights in IP © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 67

Buy-out adjustments – Key Features • Transfer of interest in the expected results of the CCA • Compensation should consider the impact on the remaining CCA participants • • • Payment must be commensurate with the increase in value of the remaining participant’s consequent to withdrawal At termination, CCA members should receive an interest in the benefits gained from the CCA that is consistent with their contributions throughout the life of the CCA No Buy-out payment in the following cases: Ø Ø When the results of the prior CCA activity do not have any value Where the participants withdrawal results in an identifiable & quantifiable reduction in the value of IP/Assets. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 68

Balancing Payments What is Balancing Payments? When a participant’s share of expense is reduced as a part of the review or when a CCA receives a payment from participant when his share increases its called as Balancing Payment /Receipt. Need for Balancing Payments • Economic life of the intangibles extend into future & estimation of the accrued benefit is uncertain • Periodic review of the expected benefits (based on changed circumstances) • Comparison of the actual results to the Ex-Ante expectation of benefits Treatment of Balancing Payments : • • • Treated as an addition to the costs of the payer and as a reimbursement (and therefore a reduction) of costs to the recipient. When Balancing Payment > Recipient’s allowable expenditure /cost, then the excess over the allowable expenditure will be treated as taxable profit. US regulation requires truing up of expected benefits from the projected benefits to the actual outcome – where actual outcome is 20 percent > projected benefit. © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 69

Determination of cost base Definition of Cost: • • Costs associated with advertising, promotion, sales, marketing, warehousing, distribution and general administration, but excluding depreciation or amortization expense, plus the charge for the use of any tangible property made available to the qualified CCA. All stock-based compensation that is granted to the employees of CCA during the term and which is related at date of grant to the development of intangibles covered by the CCA arrangement is included as part of cost. As per OECD Guidelines • Any contribution into the CCA activity (except cash) must be at market value • Applying normal Transfer pricing principles • Must consider the rational that 3 rd party cannot be expected to contribute to CCA activity on a nonarm’s length basis. Passing on R&D credits/other fiscal incentives by reducing the cost contribution depends on whether independent entities in comparable circumstances would have passed on such savings © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 70

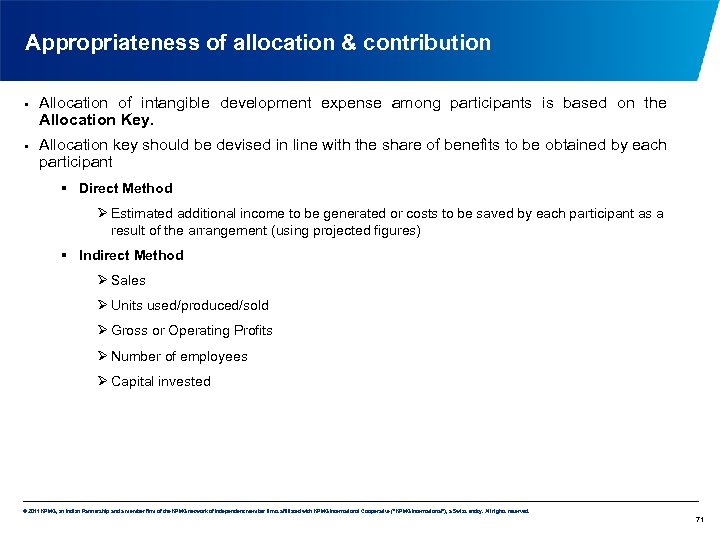

Appropriateness of allocation & contribution • • Allocation of intangible development expense among participants is based on the Allocation Key. Allocation key should be devised in line with the share of benefits to be obtained by each participant § Direct Method Ø Estimated additional income to be generated or costs to be saved by each participant as a result of the arrangement (using projected figures) § Indirect Method Ø Sales Ø Units used/produced/sold Ø Gross or Operating Profits Ø Number of employees Ø Capital invested © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 71

Appropriateness of allocation & contribution • • Determination of cost allocation is an uncertain exercise as there is a possibility that the taxable profits in some countries might be over stated and vice versa. Hence taxpayer must be prepared to substantiate the basis of allocation key. Whatever is the allocation method , adjustments must be made for differences in the expected benefits to be received by the participants. e. g. in the timing of their expected benefits © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 72

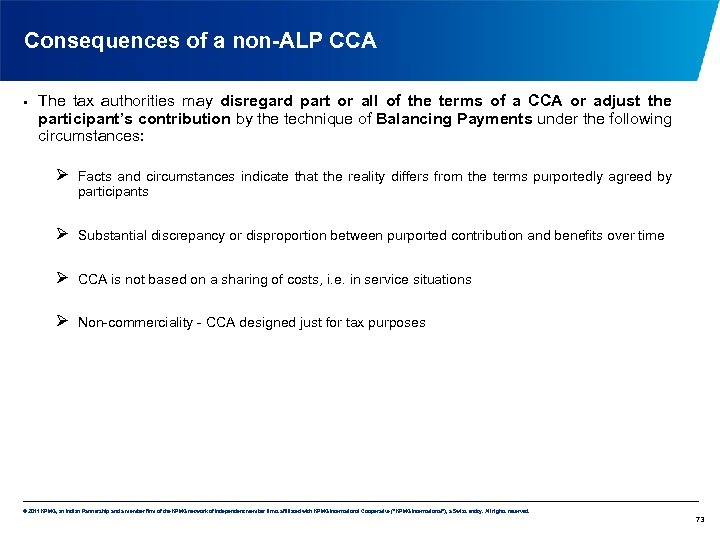

Consequences of a non-ALP CCA • The tax authorities may disregard part or all of the terms of a CCA or adjust the participant’s contribution by the technique of Balancing Payments under the following circumstances: Ø Facts and circumstances indicate that the reality differs from the terms purportedly agreed by participants Ø Substantial discrepancy or disproportion between purported contribution and benefits over time Ø CCA is not based on a sharing of costs, i. e. in service situations Ø Non-commerciality - CCA designed just for tax purposes © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 73

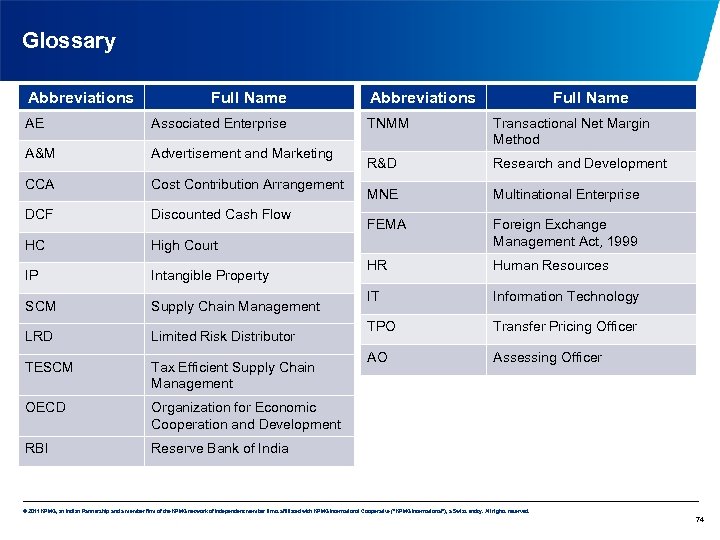

Glossary Abbreviations Full Name AE Associated Enterprise A&M Advertisement and Marketing CCA Cost Contribution Arrangement DCF Discounted Cash Flow HC High Court IP Intangible Property SCM Supply Chain Management LRD Limited Risk Distributor TESCM Tax Efficient Supply Chain Management OECD Full Name Organization for Economic Cooperation and Development RBI Abbreviations TNMM Transactional Net Margin Method R&D Research and Development MNE Multinational Enterprise FEMA Foreign Exchange Management Act, 1999 HR Human Resources IT Information Technology TPO Transfer Pricing Officer AO Assessing Officer Reserve Bank of India © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 74

Questions & © 2011 KPMG, an Indian Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 75

fb7db8b6a307d98b050471b9fcb7639a.ppt