03b7cbc3605cdae3c7ed179f8a8e627c.ppt

- Количество слайдов: 36

COS 444 Internet Auctions: Theory and Practice Spring 2009 Ken Steiglitz ken@cs. princeton. edu week 10 1

COS 444 Internet Auctions: Theory and Practice Spring 2009 Ken Steiglitz ken@cs. princeton. edu week 10 1

The common-value model • All buyers have the same actual value, V. • Buyers are uncertain about this value: thus not private values. Efficiency not relevant. • Buyers estimate values variously, by consulting experts, say. We say they receive “noisy signals” that are correlated with the true value. • In a popular special case, buyers receive the signals si = V + ni , where ni is a zero-mean random process common to all buyers. • We can think of real-world bidders as living in the range between IPV and common-value. week 10 2

The common-value model • All buyers have the same actual value, V. • Buyers are uncertain about this value: thus not private values. Efficiency not relevant. • Buyers estimate values variously, by consulting experts, say. We say they receive “noisy signals” that are correlated with the true value. • In a popular special case, buyers receive the signals si = V + ni , where ni is a zero-mean random process common to all buyers. • We can think of real-world bidders as living in the range between IPV and common-value. week 10 2

Winner’s Curse • The paradigmatic experiment: bid on a jar of nickels • The systematic error is to fail to take into account the fact that winning may be an informative event! • A persistent violation of the beloved hypothesis of homo economicus, the rational self-interested actor. Can be considered a “cognitive illusion” week 10 3

Winner’s Curse • The paradigmatic experiment: bid on a jar of nickels • The systematic error is to fail to take into account the fact that winning may be an informative event! • A persistent violation of the beloved hypothesis of homo economicus, the rational self-interested actor. Can be considered a “cognitive illusion” week 10 3

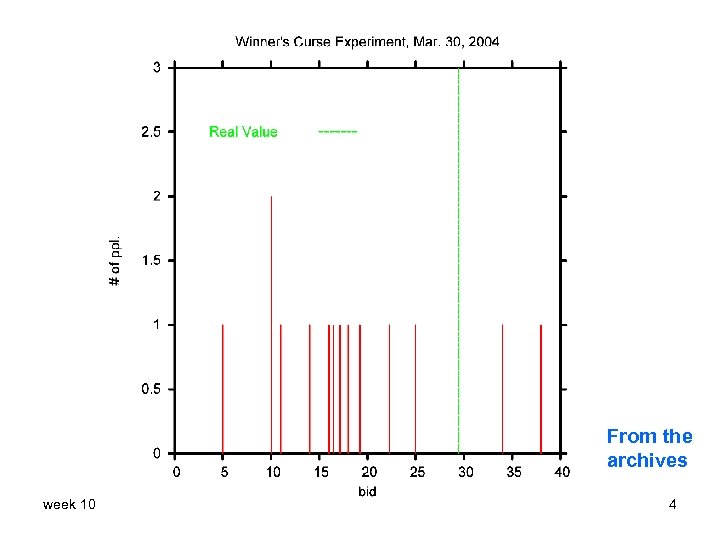

From the archives week 10 4

From the archives week 10 4

![Buy-a-Company experiment • [R. H. Thaler, The Winner’s Curse, 1992] reports the unpublished results Buy-a-Company experiment • [R. H. Thaler, The Winner’s Curse, 1992] reports the unpublished results](https://present5.com/presentation/03b7cbc3605cdae3c7ed179f8a8e627c/image-5.jpg) Buy-a-Company experiment • [R. H. Thaler, The Winner’s Curse, 1992] reports the unpublished results of Weiner, Bazerman, & Carroll, 1987 with Bidding for Paramount. • 69 NWU MBA students played the game 20 rounds each, with financial incentives and feedback after each trial. 5 learned to bid ≤ $1 by end, after avg. of 8 trials No sign of learning among the others! week 10 5

Buy-a-Company experiment • [R. H. Thaler, The Winner’s Curse, 1992] reports the unpublished results of Weiner, Bazerman, & Carroll, 1987 with Bidding for Paramount. • 69 NWU MBA students played the game 20 rounds each, with financial incentives and feedback after each trial. 5 learned to bid ≤ $1 by end, after avg. of 8 trials No sign of learning among the others! week 10 5

Winner’s Curse, references • Seminal paper: E. C. Capen, R. V. Clapp, W. M. Campbell, “Competitive bidding in high -risk situations, ” J. Petroleum Technology, 23, 1971, pp. 641 -653. See: R. Thaler, The Winner’s Curse: Paradoxes and Anomalies of Economic Life, Princeton Univ. Press, 1992. J. H. Kagel and D. Levin, Common value auctions and the Winner’s curse, Princeton Univ. Press, 2002. week 10 6

Winner’s Curse, references • Seminal paper: E. C. Capen, R. V. Clapp, W. M. Campbell, “Competitive bidding in high -risk situations, ” J. Petroleum Technology, 23, 1971, pp. 641 -653. See: R. Thaler, The Winner’s Curse: Paradoxes and Anomalies of Economic Life, Princeton Univ. Press, 1992. J. H. Kagel and D. Levin, Common value auctions and the Winner’s curse, Princeton Univ. Press, 2002. week 10 6

Claims of Winner’s Curse in the field • Oil industry • Book publication rights • Professional baseball free-agent market [Blecherman & Camerer 96] • • • Corporate takeover battles Real-estate auctions Stock market investments, IPOs Blind bidding by movie exhibitors Construction industry … etc. … but difficult to prove using field data because of the existence other factors week 10 7

Claims of Winner’s Curse in the field • Oil industry • Book publication rights • Professional baseball free-agent market [Blecherman & Camerer 96] • • • Corporate takeover battles Real-estate auctions Stock market investments, IPOs Blind bidding by movie exhibitors Construction industry … etc. … but difficult to prove using field data because of the existence other factors week 10 7

• What do you do if you find your competitors are making consistent errors? week 10 8

• What do you do if you find your competitors are making consistent errors? week 10 8

• What do you do if you find your competitors are making consistent errors? Publish. Share your knowledge. --- this lowers bids! [Thaler, pp. 61 -62, after Julia Grant] week 10 9

• What do you do if you find your competitors are making consistent errors? Publish. Share your knowledge. --- this lowers bids! [Thaler, pp. 61 -62, after Julia Grant] week 10 9

• What do you do if you find your competitors are making consistent errors? Publish. Share your knowledge. --- this lowers bids! [Thaler, pp. 61 -62, after Julia Grant] • When to share information and when to hide it? week 10 10

• What do you do if you find your competitors are making consistent errors? Publish. Share your knowledge. --- this lowers bids! [Thaler, pp. 61 -62, after Julia Grant] • When to share information and when to hide it? week 10 10

First laboratory experiment M. H. Bazerman and W. F. Samuelson, “I won the auction but I don’t want the prize, ” J. Conflict Resolution, 27, pp. 618 -34, 1983. • M. B. A. students, Boston University • Four first-price sealed-bid auctions • 800 pennies; 160 nickels; 200 large paper clips @ 4¢; 400 small paper clips @ 2¢. All thus worth V = $8. 00. week 10 [Kagel & Levin 02] 11

First laboratory experiment M. H. Bazerman and W. F. Samuelson, “I won the auction but I don’t want the prize, ” J. Conflict Resolution, 27, pp. 618 -34, 1983. • M. B. A. students, Boston University • Four first-price sealed-bid auctions • 800 pennies; 160 nickels; 200 large paper clips @ 4¢; 400 small paper clips @ 2¢. All thus worth V = $8. 00. week 10 [Kagel & Levin 02] 11

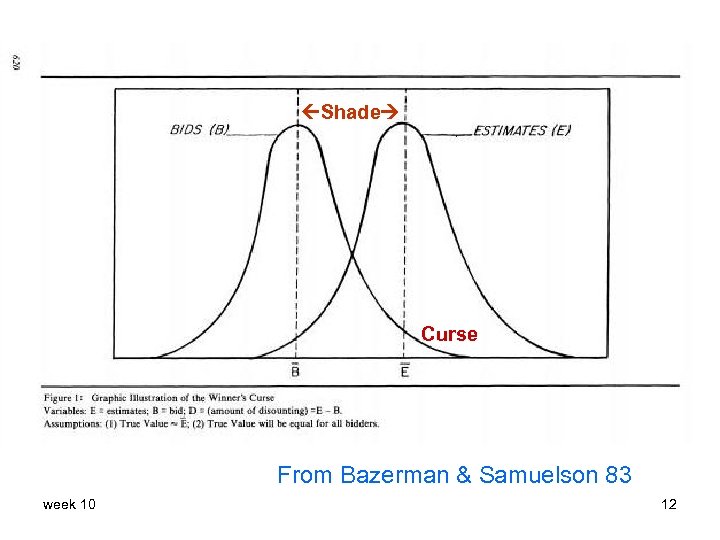

Shade Curse From Bazerman & Samuelson 83 week 10 12

Shade Curse From Bazerman & Samuelson 83 week 10 12

Bazerman and Samuelson 83 • Bidders were asked for estimates as well as bids. 48 auctions were run altogether. • Average estimate was $5. 13 = $8 – $2. 87 • Average winning bid was $10. 01 = $8 + $2. 01 • The experimental design was sophisticated, subjects were told they were competing against different numbers of bidders, and the effects of uncertainty and group size measured week 10 [Kagel & Levin 02] 13

Bazerman and Samuelson 83 • Bidders were asked for estimates as well as bids. 48 auctions were run altogether. • Average estimate was $5. 13 = $8 – $2. 87 • Average winning bid was $10. 01 = $8 + $2. 01 • The experimental design was sophisticated, subjects were told they were competing against different numbers of bidders, and the effects of uncertainty and group size measured week 10 [Kagel & Levin 02] 13

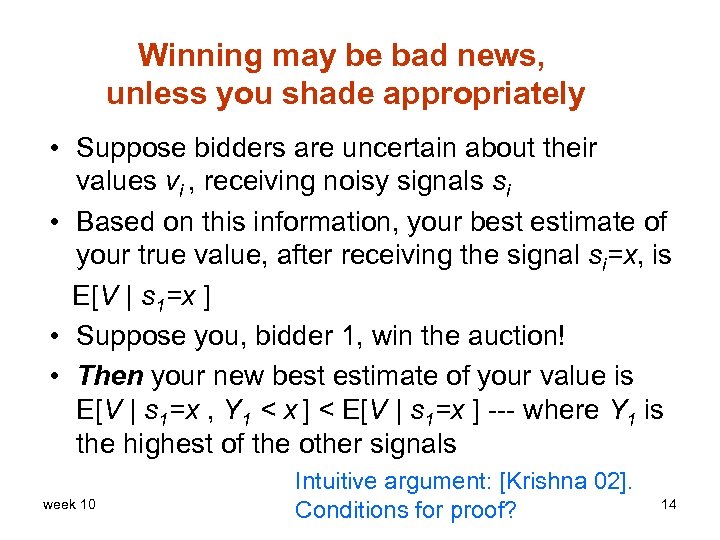

Winning may be bad news, unless you shade appropriately • Suppose bidders are uncertain about their values vi , receiving noisy signals si • Based on this information, your best estimate of your true value, after receiving the signal si=x, is E[V | s 1=x ] • Suppose you, bidder 1, win the auction! • Then your new best estimate of your value is E[V | s 1=x , Y 1 < x ] < E[V | s 1=x ] --- where Y 1 is the highest of the other signals week 10 Intuitive argument: [Krishna 02]. Conditions for proof? 14

Winning may be bad news, unless you shade appropriately • Suppose bidders are uncertain about their values vi , receiving noisy signals si • Based on this information, your best estimate of your true value, after receiving the signal si=x, is E[V | s 1=x ] • Suppose you, bidder 1, win the auction! • Then your new best estimate of your value is E[V | s 1=x , Y 1 < x ] < E[V | s 1=x ] --- where Y 1 is the highest of the other signals week 10 Intuitive argument: [Krishna 02]. Conditions for proof? 14

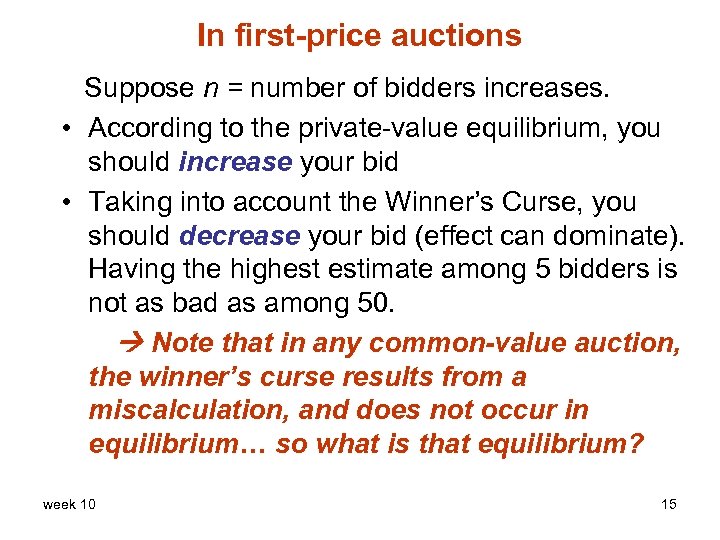

In first-price auctions Suppose n = number of bidders increases. • According to the private-value equilibrium, you should increase your bid • Taking into account the Winner’s Curse, you should decrease your bid (effect can dominate). Having the highest estimate among 5 bidders is not as bad as among 50. Note that in any common-value auction, the winner’s curse results from a miscalculation, and does not occur in equilibrium… so what is that equilibrium? week 10 15

In first-price auctions Suppose n = number of bidders increases. • According to the private-value equilibrium, you should increase your bid • Taking into account the Winner’s Curse, you should decrease your bid (effect can dominate). Having the highest estimate among 5 bidders is not as bad as among 50. Note that in any common-value auction, the winner’s curse results from a miscalculation, and does not occur in equilibrium… so what is that equilibrium? week 10 15

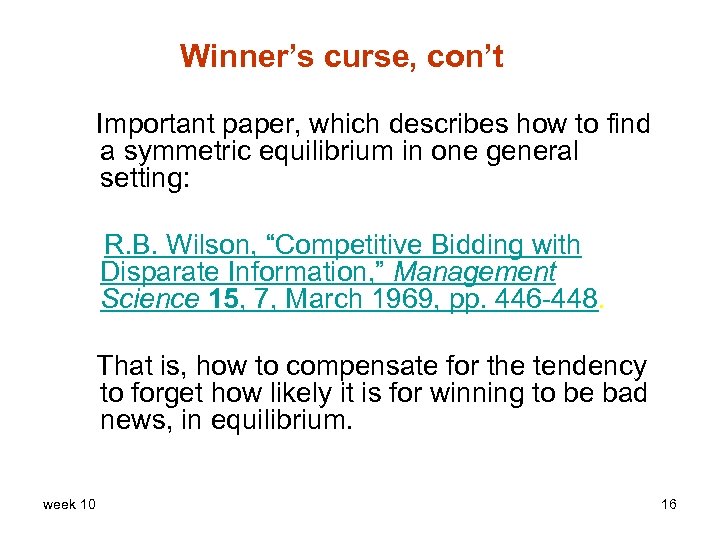

Winner’s curse, con’t Important paper, which describes how to find a symmetric equilibrium in one general setting: R. B. Wilson, “Competitive Bidding with Disparate Information, ” Management Science 15, 7, March 1969, pp. 446 -448. That is, how to compensate for the tendency to forget how likely it is for winning to be bad news, in equilibrium. week 10 16

Winner’s curse, con’t Important paper, which describes how to find a symmetric equilibrium in one general setting: R. B. Wilson, “Competitive Bidding with Disparate Information, ” Management Science 15, 7, March 1969, pp. 446 -448. That is, how to compensate for the tendency to forget how likely it is for winning to be bad news, in equilibrium. week 10 16

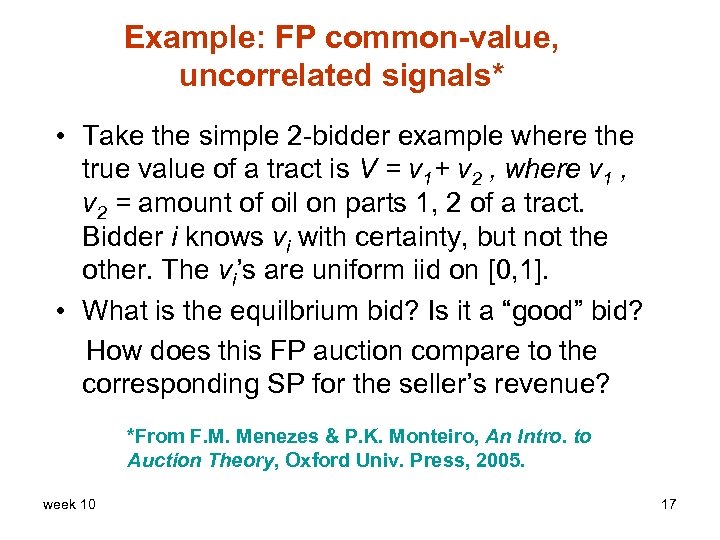

Example: FP common-value, uncorrelated signals* • Take the simple 2 -bidder example where the true value of a tract is V = v 1+ v 2 , where v 1 , v 2 = amount of oil on parts 1, 2 of a tract. Bidder i knows vi with certainty, but not the other. The vi’s are uniform iid on [0, 1]. • What is the equilbrium bid? Is it a “good” bid? How does this FP auction compare to the corresponding SP for the seller’s revenue? *From F. M. Menezes & P. K. Monteiro, An Intro. to Auction Theory, Oxford Univ. Press, 2005. week 10 17

Example: FP common-value, uncorrelated signals* • Take the simple 2 -bidder example where the true value of a tract is V = v 1+ v 2 , where v 1 , v 2 = amount of oil on parts 1, 2 of a tract. Bidder i knows vi with certainty, but not the other. The vi’s are uniform iid on [0, 1]. • What is the equilbrium bid? Is it a “good” bid? How does this FP auction compare to the corresponding SP for the seller’s revenue? *From F. M. Menezes & P. K. Monteiro, An Intro. to Auction Theory, Oxford Univ. Press, 2005. week 10 17

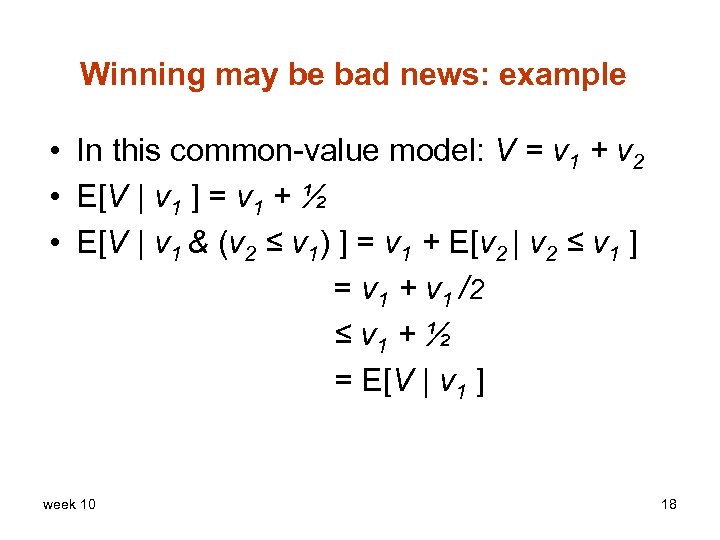

Winning may be bad news: example • In this common-value model: V = v 1 + v 2 • E[V | v 1 ] = v 1 + ½ • E[V | v 1 & (v 2 ≤ v 1) ] = v 1 + E[v 2 | v 2 ≤ v 1 ] = v 1 + v 1 /2 ≤ v 1 + ½ = E[V | v 1 ] week 10 18

Winning may be bad news: example • In this common-value model: V = v 1 + v 2 • E[V | v 1 ] = v 1 + ½ • E[V | v 1 & (v 2 ≤ v 1) ] = v 1 + E[v 2 | v 2 ≤ v 1 ] = v 1 + v 1 /2 ≤ v 1 + ½ = E[V | v 1 ] week 10 18

![Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • We’ll look for a Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • We’ll look for a](https://present5.com/presentation/03b7cbc3605cdae3c7ed179f8a8e627c/image-19.jpg) Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • We’ll look for a symmetric, differentiable, and increasing equil. bidding fctn. b(v). As usual, suppose bidder 1 bids as if her value is z. Her expected surplus (profit) is • The equilibrium condition is week 10 19

Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • We’ll look for a symmetric, differentiable, and increasing equil. bidding fctn. b(v). As usual, suppose bidder 1 bids as if her value is z. Her expected surplus (profit) is • The equilibrium condition is week 10 19

![Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • This differential equation is Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • This differential equation is](https://present5.com/presentation/03b7cbc3605cdae3c7ed179f8a8e627c/image-20.jpg) Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • This differential equation is of a familiar, linear type: • Integrate from 0 to v, letting b(0) = b 0. Note: we can’t assume b 0 = 0 … Why not? • Argue from finiteness of b(0) that c= 0. … So week 10 20

Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • This differential equation is of a familiar, linear type: • Integrate from 0 to v, letting b(0) = b 0. Note: we can’t assume b 0 = 0 … Why not? • Argue from finiteness of b(0) that c= 0. … So week 10 20

![Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • Notice that bidder i Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • Notice that bidder i](https://present5.com/presentation/03b7cbc3605cdae3c7ed179f8a8e627c/image-21.jpg) Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • Notice that bidder i never pays more than the true value V. . • But now suppose signals vi are distributed as F on [0, 1], instead of being uniform. Exactly the same procedure gets us the symmetric equilibrium […is this always increasing? ] • Take the special case F = vθ , where θ > 0. week 10 21

Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • Notice that bidder i never pays more than the true value V. . • But now suppose signals vi are distributed as F on [0, 1], instead of being uniform. Exactly the same procedure gets us the symmetric equilibrium […is this always increasing? ] • Take the special case F = vθ , where θ > 0. week 10 21

![Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • The symmetric equilibrium then Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • The symmetric equilibrium then](https://present5.com/presentation/03b7cbc3605cdae3c7ed179f8a8e627c/image-22.jpg) Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • The symmetric equilibrium then becomes • If θ > 1, the winning bidder may well bid higher, and hence pay more than, the true value V. …Is this an example of the Winner’s Curse? week 10 22

Example: FP common-value, uncorrelated signals [Menezes & Monteiro 05] • The symmetric equilibrium then becomes • If θ > 1, the winning bidder may well bid higher, and hence pay more than, the true value V. …Is this an example of the Winner’s Curse? week 10 22

![Example: SP common-value, uncorrelated signals [Menezes & Monteiro 05] • In the SP auction Example: SP common-value, uncorrelated signals [Menezes & Monteiro 05] • In the SP auction](https://present5.com/presentation/03b7cbc3605cdae3c7ed179f8a8e627c/image-23.jpg) Example: SP common-value, uncorrelated signals [Menezes & Monteiro 05] • In the SP auction with this common-value model, the equilibrium in the uniform case, using the same technique, is b(v) = 2 v. • This may be higher than the true value V, and the winner may very well pay more than V. In fact, she may pay more than the expected value of V conditional on having the highest bid. …What is that? Again, is this an example of the Winner’s Curse? week 10 23

Example: SP common-value, uncorrelated signals [Menezes & Monteiro 05] • In the SP auction with this common-value model, the equilibrium in the uniform case, using the same technique, is b(v) = 2 v. • This may be higher than the true value V, and the winner may very well pay more than V. In fact, she may pay more than the expected value of V conditional on having the highest bid. …What is that? Again, is this an example of the Winner’s Curse? week 10 23

![Example: common-value, uncorrelated signals [Menezes & Monteiro 05] • It turns out that the Example: common-value, uncorrelated signals [Menezes & Monteiro 05] • It turns out that the](https://present5.com/presentation/03b7cbc3605cdae3c7ed179f8a8e627c/image-24.jpg) Example: common-value, uncorrelated signals [Menezes & Monteiro 05] • It turns out that the FP and SP auctions with this common-value model are revenue equivalent. In fact, this is generally true for common-value cases with independent signals [Menezes & Monteiro 05, pp. 117 ff ]. • But revenue equivalence finally breaks down when the signals are correlated. week 10 24

Example: common-value, uncorrelated signals [Menezes & Monteiro 05] • It turns out that the FP and SP auctions with this common-value model are revenue equivalent. In fact, this is generally true for common-value cases with independent signals [Menezes & Monteiro 05, pp. 117 ff ]. • But revenue equivalence finally breaks down when the signals are correlated. week 10 24

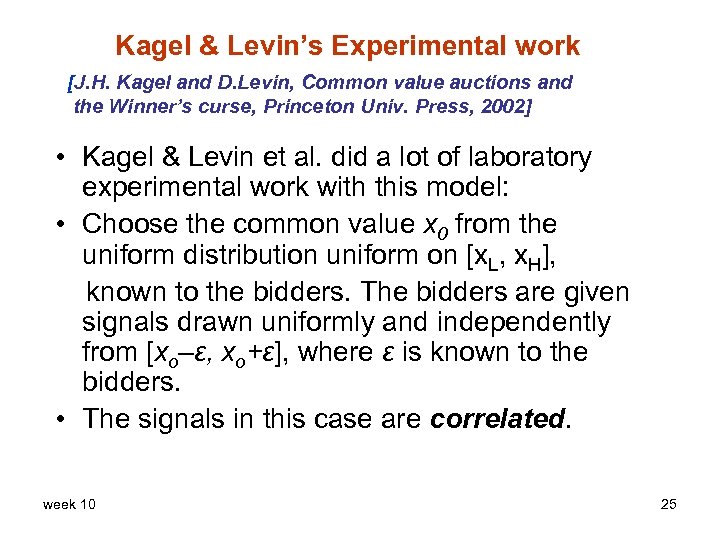

Kagel & Levin’s Experimental work [J. H. Kagel and D. Levin, Common value auctions and the Winner’s curse, Princeton Univ. Press, 2002] • Kagel & Levin et al. did a lot of laboratory experimental work with this model: • Choose the common value x 0 from the uniform distribution uniform on [x. L, x. H], known to the bidders. The bidders are given signals drawn uniformly and independently from [xo–ε, xo+ε], where ε is known to the bidders. • The signals in this case are correlated. week 10 25

Kagel & Levin’s Experimental work [J. H. Kagel and D. Levin, Common value auctions and the Winner’s curse, Princeton Univ. Press, 2002] • Kagel & Levin et al. did a lot of laboratory experimental work with this model: • Choose the common value x 0 from the uniform distribution uniform on [x. L, x. H], known to the bidders. The bidders are given signals drawn uniformly and independently from [xo–ε, xo+ε], where ε is known to the bidders. • The signals in this case are correlated. week 10 25

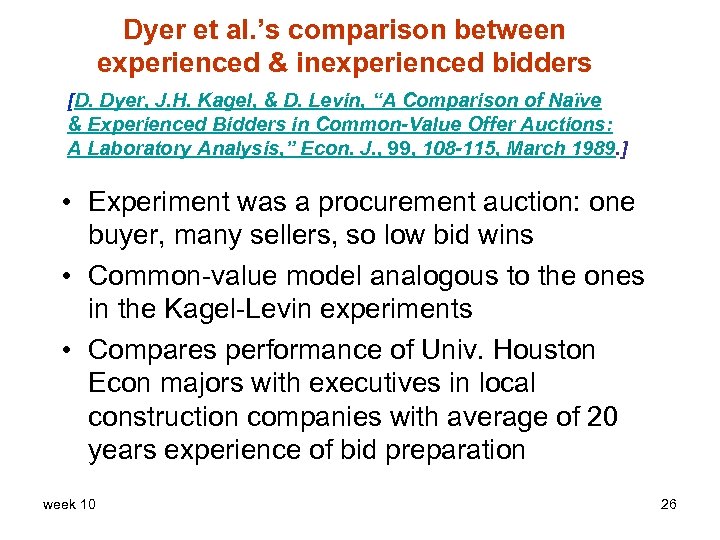

Dyer et al. ’s comparison between experienced & inexperienced bidders [D. Dyer, J. H. Kagel, & D. Levin, “A Comparison of Naïve & Experienced Bidders in Common-Value Offer Auctions: A Laboratory Analysis, ” Econ. J. , 99, 108 -115, March 1989. ] • Experiment was a procurement auction: one buyer, many sellers, so low bid wins • Common-value model analogous to the ones in the Kagel-Levin experiments • Compares performance of Univ. Houston Econ majors with executives in local construction companies with average of 20 years experience of bid preparation week 10 26

Dyer et al. ’s comparison between experienced & inexperienced bidders [D. Dyer, J. H. Kagel, & D. Levin, “A Comparison of Naïve & Experienced Bidders in Common-Value Offer Auctions: A Laboratory Analysis, ” Econ. J. , 99, 108 -115, March 1989. ] • Experiment was a procurement auction: one buyer, many sellers, so low bid wins • Common-value model analogous to the ones in the Kagel-Levin experiments • Compares performance of Univ. Houston Econ majors with executives in local construction companies with average of 20 years experience of bid preparation week 10 26

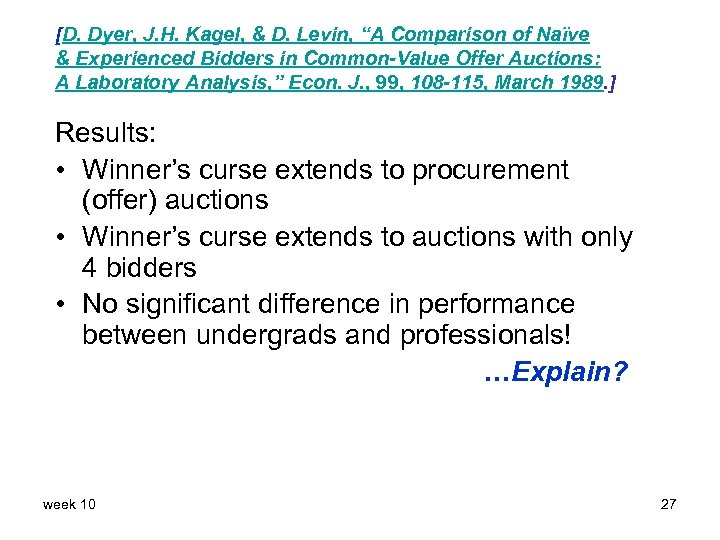

[D. Dyer, J. H. Kagel, & D. Levin, “A Comparison of Naïve & Experienced Bidders in Common-Value Offer Auctions: A Laboratory Analysis, ” Econ. J. , 99, 108 -115, March 1989. ] Results: • Winner’s curse extends to procurement (offer) auctions • Winner’s curse extends to auctions with only 4 bidders • No significant difference in performance between undergrads and professionals! …Explain? week 10 27

[D. Dyer, J. H. Kagel, & D. Levin, “A Comparison of Naïve & Experienced Bidders in Common-Value Offer Auctions: A Laboratory Analysis, ” Econ. J. , 99, 108 -115, March 1989. ] Results: • Winner’s curse extends to procurement (offer) auctions • Winner’s curse extends to auctions with only 4 bidders • No significant difference in performance between undergrads and professionals! …Explain? week 10 27

Executives didn’t take the experiment seriously? Executives’ auctions in practice have a strong private -value component (overhead, opportunity costs), and losses can be mitigated by renegotiation, or changeorders? • Dyer et al. conclude, however, that “…executives have learned a set of situation specific rules of thumb which permit them to avoid the winner’s curse in the field but which could not be applied in the lab. ” (by feedback or selection) • Learning occurs “…Not through understanding and absorbing ‘the theory’, but from rules of thumb that are likely to breakdown under extreme changes, or truly novel, economic conditions. ” week 10 28

Executives didn’t take the experiment seriously? Executives’ auctions in practice have a strong private -value component (overhead, opportunity costs), and losses can be mitigated by renegotiation, or changeorders? • Dyer et al. conclude, however, that “…executives have learned a set of situation specific rules of thumb which permit them to avoid the winner’s curse in the field but which could not be applied in the lab. ” (by feedback or selection) • Learning occurs “…Not through understanding and absorbing ‘the theory’, but from rules of thumb that are likely to breakdown under extreme changes, or truly novel, economic conditions. ” week 10 28

Next… • Common-value auctions lead to the next, and most general treatment of single-item auctions, Milgrom & Weber 82. • The model here is called the “affiliated values” model, and represents a spectrum, with IPV at one extreme, and common-value at the other. Most auctions have elements of both. • To wrap up the Winner’s Curse: week 10 29

Next… • Common-value auctions lead to the next, and most general treatment of single-item auctions, Milgrom & Weber 82. • The model here is called the “affiliated values” model, and represents a spectrum, with IPV at one extreme, and common-value at the other. Most auctions have elements of both. • To wrap up the Winner’s Curse: week 10 29

Capen et al. ’s fortune cookie: “He who bids on a parcel what he thinks it is worth, will, in the long run, be taken for a cleaning. ” week 10 30

Capen et al. ’s fortune cookie: “He who bids on a parcel what he thinks it is worth, will, in the long run, be taken for a cleaning. ” week 10 30

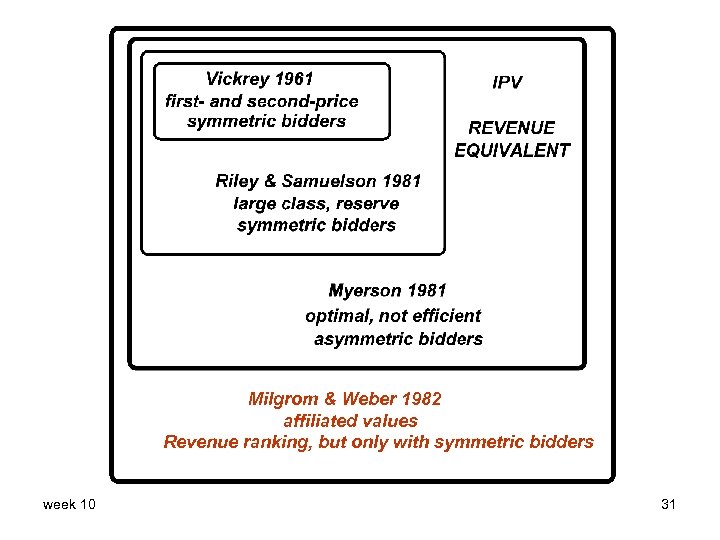

Milgrom & Weber 1982 affiliated values Revenue ranking, but only with symmetric bidders week 10 31

Milgrom & Weber 1982 affiliated values Revenue ranking, but only with symmetric bidders week 10 31

Interdependent Values In general, we relax two IPV assumptions: • • Bidders are no longer sure of their values (as in the common-value case discussed in connection with the Winner’s Curse) Bidders’ signals are statistically correlated; technically positively affiliated (see Milgrom & Weber 82, Krishna 02) Intuitively: if some subset of signals is large, it’s more likely that the remaining signals are large week 10 32

Interdependent Values In general, we relax two IPV assumptions: • • Bidders are no longer sure of their values (as in the common-value case discussed in connection with the Winner’s Curse) Bidders’ signals are statistically correlated; technically positively affiliated (see Milgrom & Weber 82, Krishna 02) Intuitively: if some subset of signals is large, it’s more likely that the remaining signals are large week 10 32

Major results in Milgrom & Weber 82 For the general symmetric, affiliated values model: • English > 2 nd -Price > 1 st -Price = Dutch (“revenue ranking”) • If the seller has private information, full disclosure maximizes price (“Honesty is the best policy” … in the long run) week 10 33

Major results in Milgrom & Weber 82 For the general symmetric, affiliated values model: • English > 2 nd -Price > 1 st -Price = Dutch (“revenue ranking”) • If the seller has private information, full disclosure maximizes price (“Honesty is the best policy” … in the long run) week 10 33

Milgrom & Weber 82: Caveats • Symmetry assumption is crucial; results fail without it • English is Japanese button model • For disclosure result: seller must be credible, pre-committed to known policy • Game-theoretic setting assumes distributions of signals are common knowledge week 10 34

Milgrom & Weber 82: Caveats • Symmetry assumption is crucial; results fail without it • English is Japanese button model • For disclosure result: seller must be credible, pre-committed to known policy • Game-theoretic setting assumes distributions of signals are common knowledge week 10 34

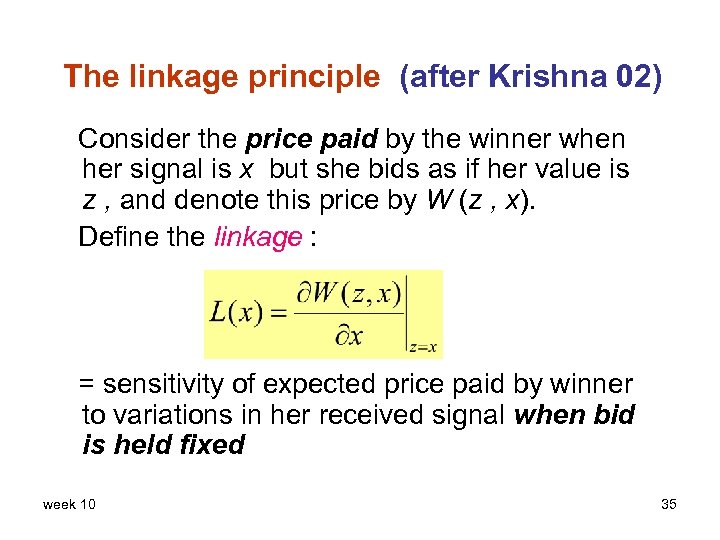

The linkage principle (after Krishna 02) Consider the price paid by the winner when her signal is x but she bids as if her value is z , and denote this price by W (z , x). Define the linkage : = sensitivity of expected price paid by winner to variations in her received signal when bid is held fixed week 10 35

The linkage principle (after Krishna 02) Consider the price paid by the winner when her signal is x but she bids as if her value is z , and denote this price by W (z , x). Define the linkage : = sensitivity of expected price paid by winner to variations in her received signal when bid is held fixed week 10 35

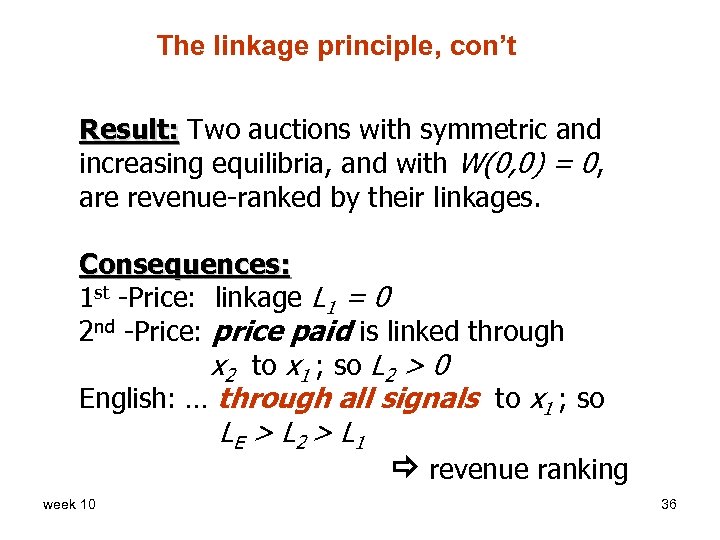

The linkage principle, con’t Result: Two auctions with symmetric and increasing equilibria, and with W(0, 0) = 0, are revenue-ranked by their linkages. Consequences: 1 st -Price: linkage L 1 = 0 2 nd -Price: price paid is linked through x 2 to x 1 ; so L 2 > 0 English: … through all signals to x 1 ; so LE > L 2 > L 1 week 10 revenue ranking 36

The linkage principle, con’t Result: Two auctions with symmetric and increasing equilibria, and with W(0, 0) = 0, are revenue-ranked by their linkages. Consequences: 1 st -Price: linkage L 1 = 0 2 nd -Price: price paid is linked through x 2 to x 1 ; so L 2 > 0 English: … through all signals to x 1 ; so LE > L 2 > L 1 week 10 revenue ranking 36