54805a78fc908e7638585b59fe6a433c.ppt

- Количество слайдов: 36

Corr. Ocean customers have a competitive edge 1

Corr. Ocean customers have a competitive edge 1

Corr. Ocean ASA Presentation of 3. Q 2001 Accounts Friday 2. November 2001 by Roe D Strømmen, Mng Director, and Roar Østbø, Finance Director Corr. Ocean customers have a competitive edge 2

Corr. Ocean ASA Presentation of 3. Q 2001 Accounts Friday 2. November 2001 by Roe D Strømmen, Mng Director, and Roar Østbø, Finance Director Corr. Ocean customers have a competitive edge 2

Corr. Oceans Vision and Business Mission · Corr. Ocean - a World Class provider of knowledge based solutions in Monitoring Technology, Asset Integrity and Risk Management. · We are committed to helping our Corr. Ocean customers have a competitive edge Customers reduce risk, increase safety, improve environmental performance and enhance profits through the application of innovative technical solutions. 3

Corr. Oceans Vision and Business Mission · Corr. Ocean - a World Class provider of knowledge based solutions in Monitoring Technology, Asset Integrity and Risk Management. · We are committed to helping our Corr. Ocean customers have a competitive edge Customers reduce risk, increase safety, improve environmental performance and enhance profits through the application of innovative technical solutions. 3

Corr. Ocean ASA · Share capital: · Number of shares: 26. 0 million NOK 26. 0 million par value 1 NOK. · Stock options and proxy: ~ 5. 9 million · Number of shareholders: Corr. Ocean customers have a competitive edge 1, 749. Largest shareholder, Hubro AS owns 7. 7% of the capital, the 10 largest hold 42% · Equity as per 30. 09. 01: 127. 2 million NOK corresponding to 57, 6% of total capital 4

Corr. Ocean ASA · Share capital: · Number of shares: 26. 0 million NOK 26. 0 million par value 1 NOK. · Stock options and proxy: ~ 5. 9 million · Number of shareholders: Corr. Ocean customers have a competitive edge 1, 749. Largest shareholder, Hubro AS owns 7. 7% of the capital, the 10 largest hold 42% · Equity as per 30. 09. 01: 127. 2 million NOK corresponding to 57, 6% of total capital 4

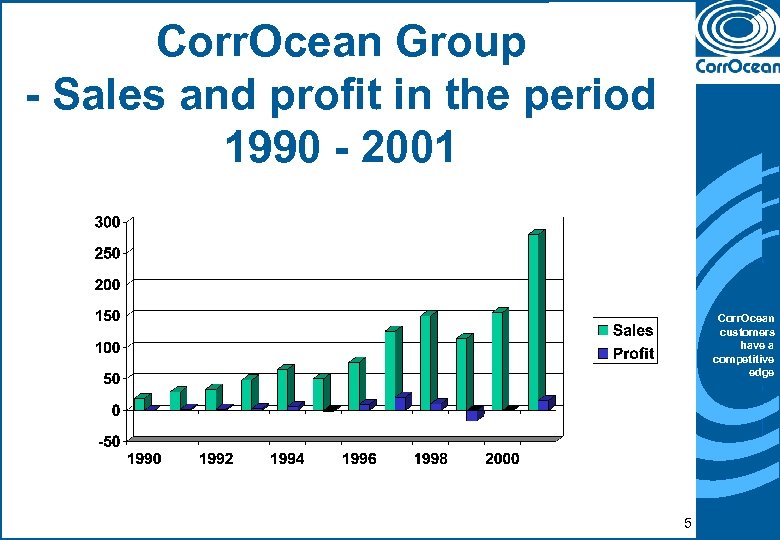

Corr. Ocean Group - Sales and profit in the period 1990 - 2001 Corr. Ocean customers have a competitive edge 5

Corr. Ocean Group - Sales and profit in the period 1990 - 2001 Corr. Ocean customers have a competitive edge 5

Highlights 3. Q-01 · Operational profit bf. D&A: 2. 4 mill · Operational profit: 0. 2 mill · Net profit before tax: -2. 9 mill · Delays in MOT · Finance & disagio costs 3. 0 mill · Investm new technology: 4. 5 mill · Corr. Ocean customers have a competitive edge (MOT technology for frame agreements) · New orders in 3. Q: · Backlog at end of 3. Q: 114 mill 172 mill 6

Highlights 3. Q-01 · Operational profit bf. D&A: 2. 4 mill · Operational profit: 0. 2 mill · Net profit before tax: -2. 9 mill · Delays in MOT · Finance & disagio costs 3. 0 mill · Investm new technology: 4. 5 mill · Corr. Ocean customers have a competitive edge (MOT technology for frame agreements) · New orders in 3. Q: · Backlog at end of 3. Q: 114 mill 172 mill 6

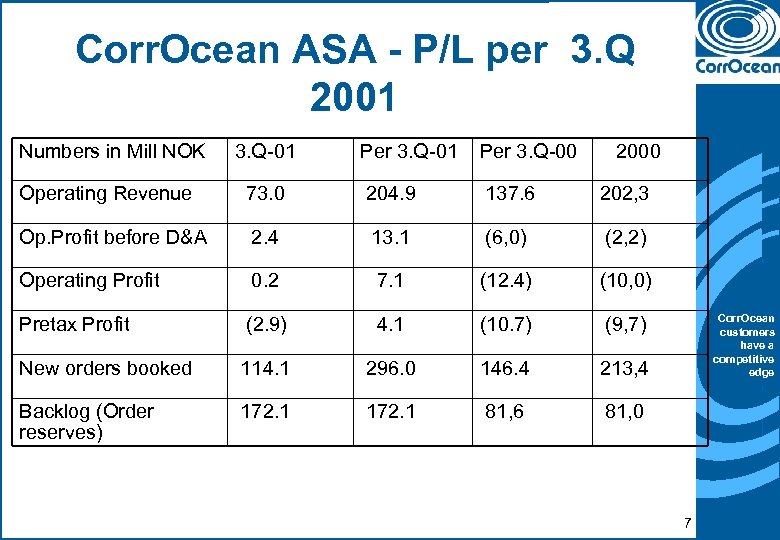

Corr. Ocean ASA - P/L per 3. Q 2001 Numbers in Mill NOK 3. Q-01 Per 3. Q-00 2000 Operating Revenue 73. 0 204. 9 137. 6 202, 3 Op. Profit before D&A 2. 4 13. 1 (6, 0) (2, 2) Operating Profit 0. 2 7. 1 (12. 4) (10, 0) Pretax Profit (2. 9) 4. 1 (10. 7) (9, 7) New orders booked 114. 1 296. 0 146. 4 213, 4 Backlog (Order reserves) 172. 1 81, 6 81, 0 Corr. Ocean customers have a competitive edge 7

Corr. Ocean ASA - P/L per 3. Q 2001 Numbers in Mill NOK 3. Q-01 Per 3. Q-00 2000 Operating Revenue 73. 0 204. 9 137. 6 202, 3 Op. Profit before D&A 2. 4 13. 1 (6, 0) (2, 2) Operating Profit 0. 2 7. 1 (12. 4) (10, 0) Pretax Profit (2. 9) 4. 1 (10. 7) (9, 7) New orders booked 114. 1 296. 0 146. 4 213, 4 Backlog (Order reserves) 172. 1 81, 6 81, 0 Corr. Ocean customers have a competitive edge 7

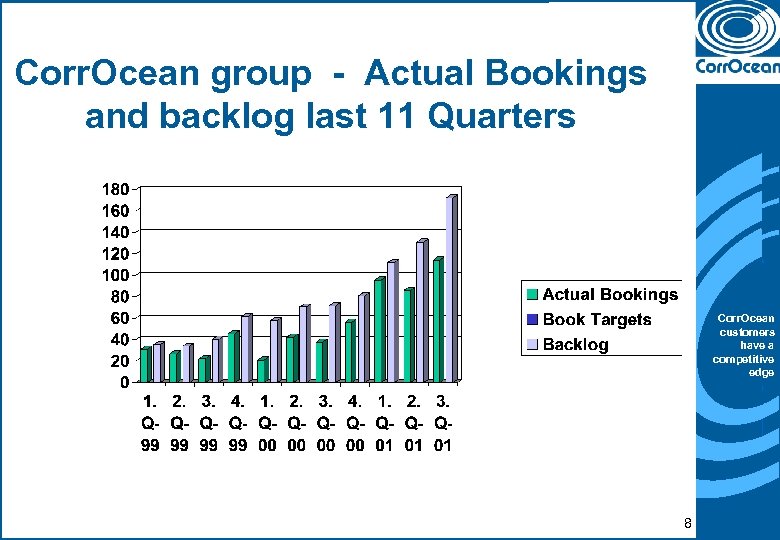

Corr. Ocean group - Actual Bookings and backlog last 11 Quarters Corr. Ocean customers have a competitive edge 8

Corr. Ocean group - Actual Bookings and backlog last 11 Quarters Corr. Ocean customers have a competitive edge 8

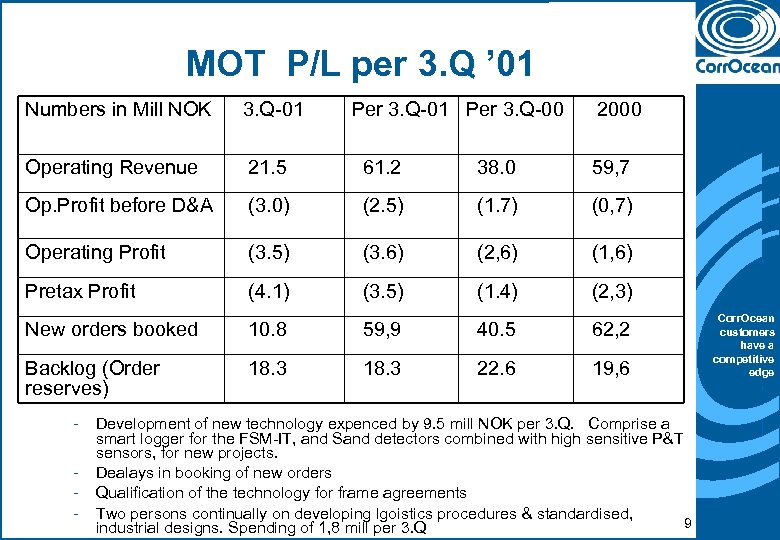

MOT P/L per 3. Q ’ 01 Numbers in Mill NOK 3. Q-01 Per 3. Q-00 2000 Operating Revenue 21. 5 61. 2 38. 0 59, 7 Op. Profit before D&A (3. 0) (2. 5) (1. 7) (0, 7) Operating Profit (3. 5) (3. 6) (2, 6) (1, 6) Pretax Profit (4. 1) (3. 5) (1. 4) (2, 3) New orders booked 10. 8 59, 9 40. 5 62, 2 Backlog (Order reserves) 18. 3 22. 6 19, 6 - Development of new technology expenced by 9. 5 mill NOK per 3. Q. Comprise a smart logger for the FSM-IT, and Sand detectors combined with high sensitive P&T sensors, for new projects. Dealays in booking of new orders Qualification of the technology for frame agreements Two persons continually on developing lgoistics procedures & standardised, 9 industrial designs. Spending of 1, 8 mill per 3. Q Corr. Ocean customers have a competitive edge

MOT P/L per 3. Q ’ 01 Numbers in Mill NOK 3. Q-01 Per 3. Q-00 2000 Operating Revenue 21. 5 61. 2 38. 0 59, 7 Op. Profit before D&A (3. 0) (2. 5) (1. 7) (0, 7) Operating Profit (3. 5) (3. 6) (2, 6) (1, 6) Pretax Profit (4. 1) (3. 5) (1. 4) (2, 3) New orders booked 10. 8 59, 9 40. 5 62, 2 Backlog (Order reserves) 18. 3 22. 6 19, 6 - Development of new technology expenced by 9. 5 mill NOK per 3. Q. Comprise a smart logger for the FSM-IT, and Sand detectors combined with high sensitive P&T sensors, for new projects. Dealays in booking of new orders Qualification of the technology for frame agreements Two persons continually on developing lgoistics procedures & standardised, 9 industrial designs. Spending of 1, 8 mill per 3. Q Corr. Ocean customers have a competitive edge

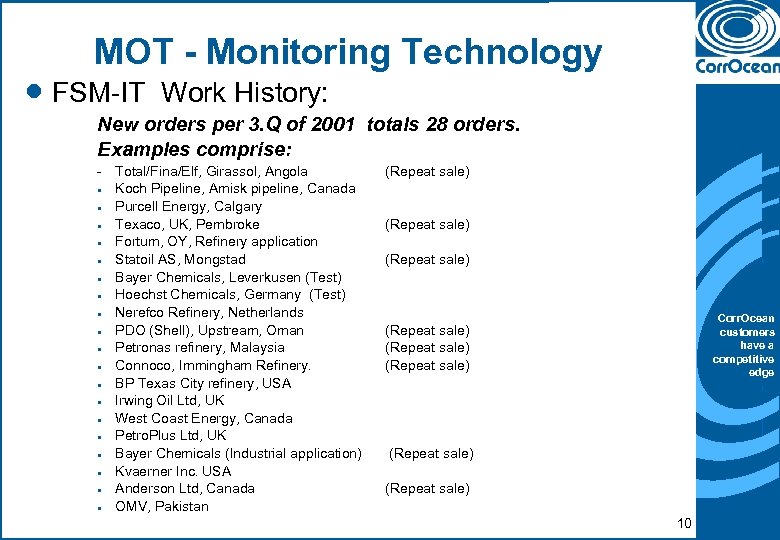

MOT - Monitoring Technology · FSM-IT Work History: New orders per 3. Q of 2001 totals 28 orders. Examples comprise: - Total/Fina/Elf, Girassol, Angola · Koch Pipeline, Amisk pipeline, Canada · Purcell Energy, Calgary · Texaco, UK, Pembroke · Fortum, OY, Refinery application · Statoil AS, Mongstad · Bayer Chemicals, Leverkusen (Test) · Hoechst Chemicals, Germany (Test) · Nerefco Refinery, Netherlands · PDO (Shell), Upstream, Oman · Petronas refinery, Malaysia · Connoco, Immingham Refinery. · BP Texas City refinery, USA · Irwing Oil Ltd, UK · West Coast Energy, Canada · Petro. Plus Ltd, UK · Bayer Chemicals (Industrial application) · Kvaerner Inc. USA · Anderson Ltd, Canada · OMV, Pakistan (Repeat sale) Corr. Ocean customers have a competitive edge (Repeat sale) (Repeat sale) 10

MOT - Monitoring Technology · FSM-IT Work History: New orders per 3. Q of 2001 totals 28 orders. Examples comprise: - Total/Fina/Elf, Girassol, Angola · Koch Pipeline, Amisk pipeline, Canada · Purcell Energy, Calgary · Texaco, UK, Pembroke · Fortum, OY, Refinery application · Statoil AS, Mongstad · Bayer Chemicals, Leverkusen (Test) · Hoechst Chemicals, Germany (Test) · Nerefco Refinery, Netherlands · PDO (Shell), Upstream, Oman · Petronas refinery, Malaysia · Connoco, Immingham Refinery. · BP Texas City refinery, USA · Irwing Oil Ltd, UK · West Coast Energy, Canada · Petro. Plus Ltd, UK · Bayer Chemicals (Industrial application) · Kvaerner Inc. USA · Anderson Ltd, Canada · OMV, Pakistan (Repeat sale) Corr. Ocean customers have a competitive edge (Repeat sale) (Repeat sale) 10

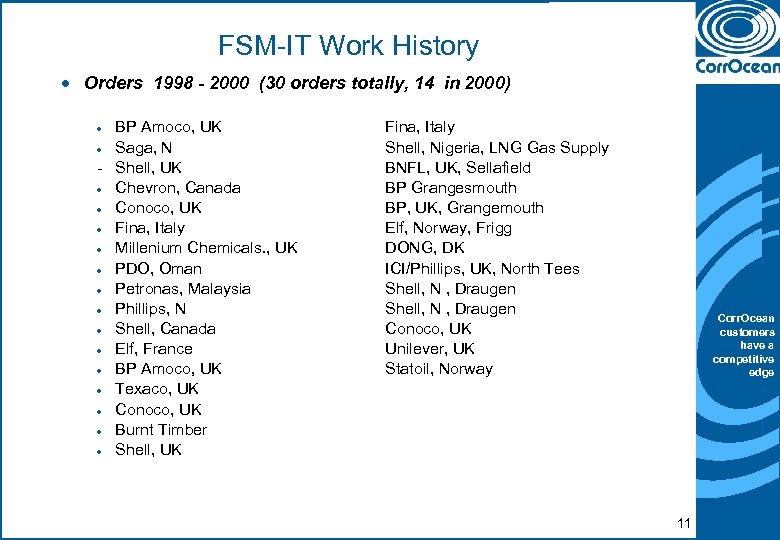

FSM-IT Work History · Orders 1998 - 2000 (30 orders totally, 14 in 2000) BP Amoco, UK · Saga, N - Shell, UK · Chevron, Canada · Conoco, UK · Fina, Italy · Millenium Chemicals. , UK · PDO, Oman · Petronas, Malaysia · Phillips, N · Shell, Canada · Elf, France · BP Amoco, UK · Texaco, UK · Conoco, UK · Burnt Timber · Shell, UK · Fina, Italy Shell, Nigeria, LNG Gas Supply BNFL, UK, Sellafield BP Grangesmouth BP, UK, Grangemouth Elf, Norway, Frigg DONG, DK ICI/Phillips, UK, North Tees Shell, N , Draugen Conoco, UK Unilever, UK Statoil, Norway Corr. Ocean customers have a competitive edge 11

FSM-IT Work History · Orders 1998 - 2000 (30 orders totally, 14 in 2000) BP Amoco, UK · Saga, N - Shell, UK · Chevron, Canada · Conoco, UK · Fina, Italy · Millenium Chemicals. , UK · PDO, Oman · Petronas, Malaysia · Phillips, N · Shell, Canada · Elf, France · BP Amoco, UK · Texaco, UK · Conoco, UK · Burnt Timber · Shell, UK · Fina, Italy Shell, Nigeria, LNG Gas Supply BNFL, UK, Sellafield BP Grangesmouth BP, UK, Grangemouth Elf, Norway, Frigg DONG, DK ICI/Phillips, UK, North Tees Shell, N , Draugen Conoco, UK Unilever, UK Statoil, Norway Corr. Ocean customers have a competitive edge 11

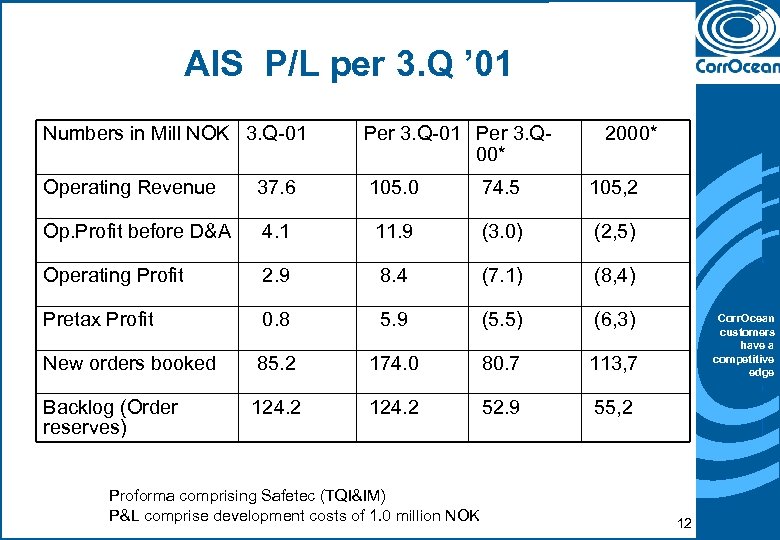

AIS P/L per 3. Q ’ 01 Numbers in Mill NOK 3. Q-01 Per 3. Q 00* 2000* Operating Revenue 37. 6 105. 0 74. 5 105, 2 Op. Profit before D&A 4. 1 11. 9 (3. 0) (2, 5) Operating Profit 2. 9 8. 4 (7. 1) (8, 4) Pretax Profit 0. 8 5. 9 (5. 5) (6, 3) New orders booked 85. 2 174. 0 80. 7 113, 7 Backlog (Order reserves) 124. 2 52. 9 55, 2 Proforma comprising Safetec (TQI&IM) P&L comprise development costs of 1. 0 million NOK Corr. Ocean customers have a competitive edge 12

AIS P/L per 3. Q ’ 01 Numbers in Mill NOK 3. Q-01 Per 3. Q 00* 2000* Operating Revenue 37. 6 105. 0 74. 5 105, 2 Op. Profit before D&A 4. 1 11. 9 (3. 0) (2, 5) Operating Profit 2. 9 8. 4 (7. 1) (8, 4) Pretax Profit 0. 8 5. 9 (5. 5) (6, 3) New orders booked 85. 2 174. 0 80. 7 113, 7 Backlog (Order reserves) 124. 2 52. 9 55, 2 Proforma comprising Safetec (TQI&IM) P&L comprise development costs of 1. 0 million NOK Corr. Ocean customers have a competitive edge 12

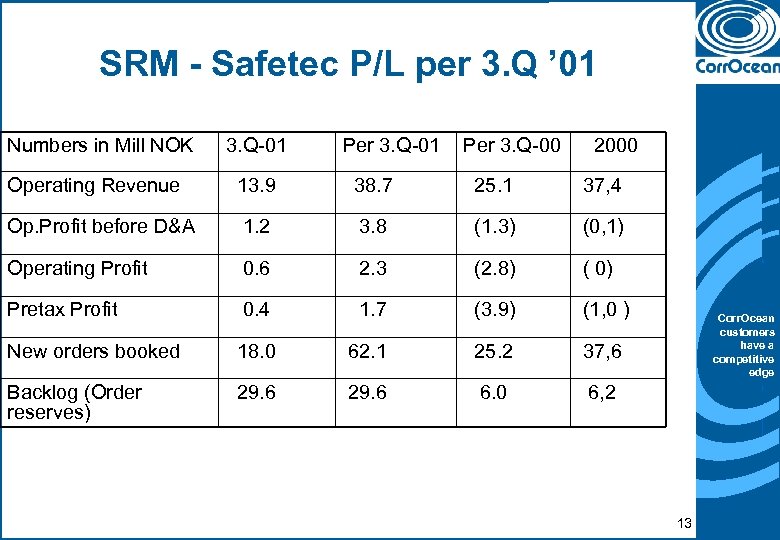

SRM - Safetec P/L per 3. Q ’ 01 Numbers in Mill NOK 3. Q-01 Per 3. Q-00 2000 Operating Revenue 13. 9 38. 7 25. 1 37, 4 Op. Profit before D&A 1. 2 3. 8 (1. 3) (0, 1) Operating Profit 0. 6 2. 3 (2. 8) ( 0) Pretax Profit 0. 4 1. 7 (3. 9) (1, 0 ) New orders booked 18. 0 62. 1 25. 2 37, 6 Backlog (Order reserves) 29. 6 6. 0 6, 2 Corr. Ocean customers have a competitive edge 13

SRM - Safetec P/L per 3. Q ’ 01 Numbers in Mill NOK 3. Q-01 Per 3. Q-00 2000 Operating Revenue 13. 9 38. 7 25. 1 37, 4 Op. Profit before D&A 1. 2 3. 8 (1. 3) (0, 1) Operating Profit 0. 6 2. 3 (2. 8) ( 0) Pretax Profit 0. 4 1. 7 (3. 9) (1, 0 ) New orders booked 18. 0 62. 1 25. 2 37, 6 Backlog (Order reserves) 29. 6 6. 0 6, 2 Corr. Ocean customers have a competitive edge 13

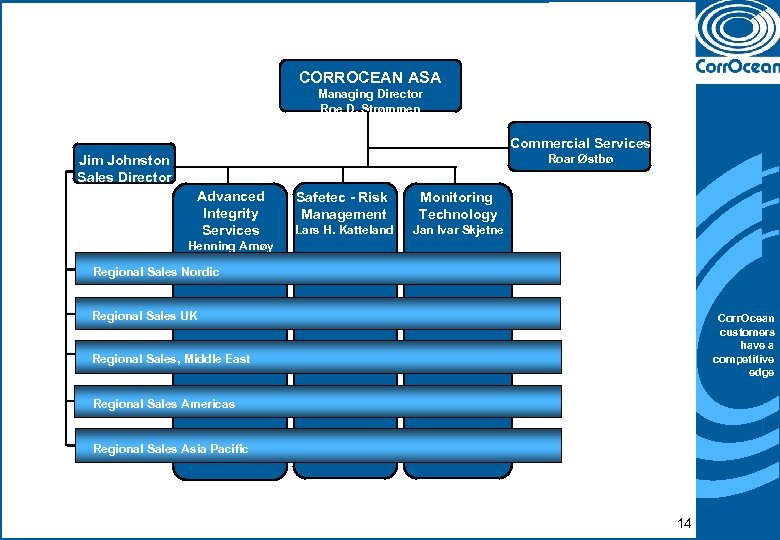

CORROCEAN ASA Managing Director Roe D. Strømmen Commercial Services Roar Østbø Jim Johnston Sales Director Advanced Integrity Services Safetec - Risk Management Monitoring Technology Lars H. Katteland Jan Ivar Skjetne Henning Arnøy Regional Sales Nordic Regional Sales UK Corr. Ocean customers have a competitive edge Regional Sales, Middle East Regional Sales Americas Regional Sales Asia Pacific 14

CORROCEAN ASA Managing Director Roe D. Strømmen Commercial Services Roar Østbø Jim Johnston Sales Director Advanced Integrity Services Safetec - Risk Management Monitoring Technology Lars H. Katteland Jan Ivar Skjetne Henning Arnøy Regional Sales Nordic Regional Sales UK Corr. Ocean customers have a competitive edge Regional Sales, Middle East Regional Sales Americas Regional Sales Asia Pacific 14

Corr. Ocean – an International Company Corr. Ocean customers have a competitive edge Subsidiary Agent 15

Corr. Ocean – an International Company Corr. Ocean customers have a competitive edge Subsidiary Agent 15

Corr. Ocean Products and Services: · MOT - Monitoring Technology · · Condition Monitoring & Inspection Corrosion & Erosion Monitoring Sand detection in oil and gas wells Pressure and temperature sensors · AIS - Advanced Integrity Services · · · Integrity Management/Inspection planning, corrosion&materials technology Inspection and Testing Technical Qualification & Innovation Corr. Ocean customers have a competitive edge · SRM – Safetec Risk Management (to be decided) · · · Risk Assessment Risk and Safety Management Project Risk Assesment 16

Corr. Ocean Products and Services: · MOT - Monitoring Technology · · Condition Monitoring & Inspection Corrosion & Erosion Monitoring Sand detection in oil and gas wells Pressure and temperature sensors · AIS - Advanced Integrity Services · · · Integrity Management/Inspection planning, corrosion&materials technology Inspection and Testing Technical Qualification & Innovation Corr. Ocean customers have a competitive edge · SRM – Safetec Risk Management (to be decided) · · · Risk Assessment Risk and Safety Management Project Risk Assesment 16

Clients Petroleum Industry: · Oil companies · Rig owners · Engineering companies · Suppliers Corr. Ocean customers have a competitive edge Maritime Industry: · Ship owners · Ship yards · Ferry companies 17

Clients Petroleum Industry: · Oil companies · Rig owners · Engineering companies · Suppliers Corr. Ocean customers have a competitive edge Maritime Industry: · Ship owners · Ship yards · Ferry companies 17

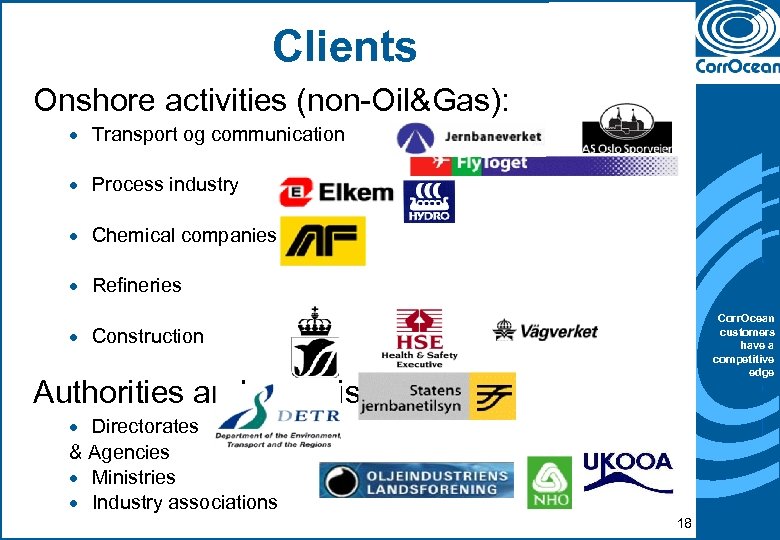

Clients Onshore activities (non-Oil&Gas): · Transport og communication · Process industry · Chemical companies · Refineries Corr. Ocean customers have a competitive edge · Construction Authorities and organisations: · Directorates & Agencies · Ministries · Industry associations 18

Clients Onshore activities (non-Oil&Gas): · Transport og communication · Process industry · Chemical companies · Refineries Corr. Ocean customers have a competitive edge · Construction Authorities and organisations: · Directorates & Agencies · Ministries · Industry associations 18

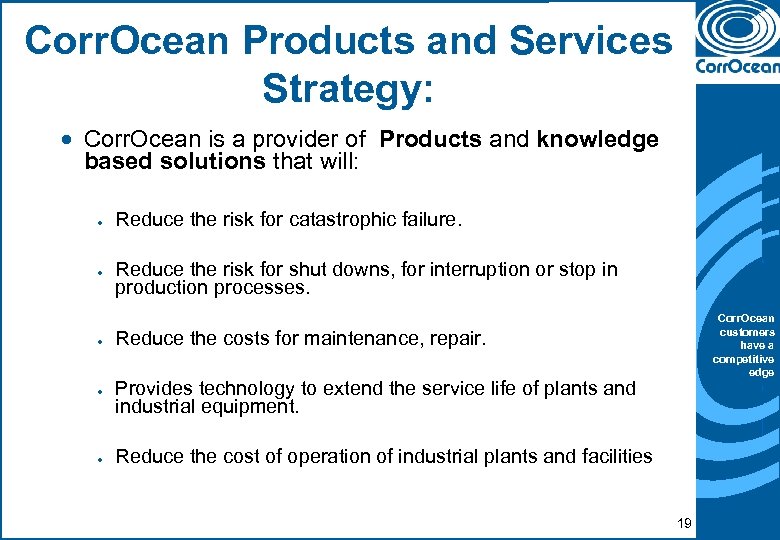

Corr. Ocean Products and Services Strategy: · Corr. Ocean is a provider of Products and knowledge based solutions that will: · Reduce the risk for catastrophic failure. · Reduce the risk for shut downs, for interruption or stop in production processes. · Reduce the costs for maintenance, repair. · Provides technology to extend the service life of plants and industrial equipment. · Corr. Ocean customers have a competitive edge Reduce the cost of operation of industrial plants and facilities 19

Corr. Ocean Products and Services Strategy: · Corr. Ocean is a provider of Products and knowledge based solutions that will: · Reduce the risk for catastrophic failure. · Reduce the risk for shut downs, for interruption or stop in production processes. · Reduce the costs for maintenance, repair. · Provides technology to extend the service life of plants and industrial equipment. · Corr. Ocean customers have a competitive edge Reduce the cost of operation of industrial plants and facilities 19

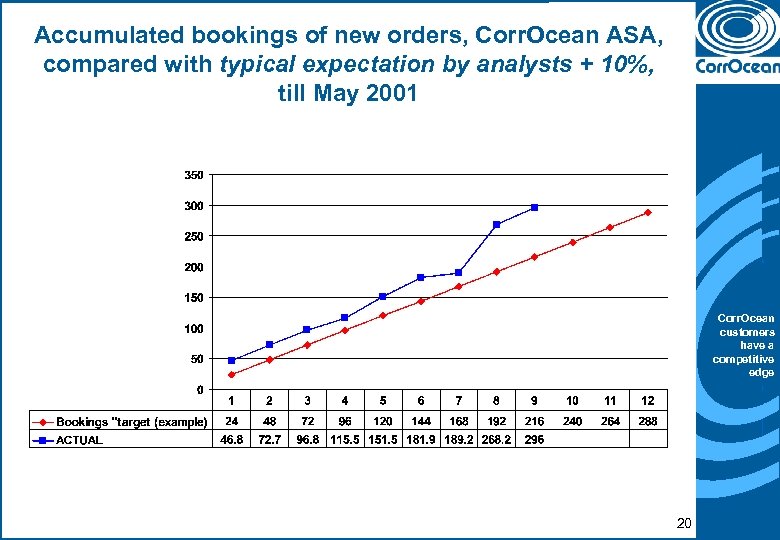

Accumulated bookings of new orders, Corr. Ocean ASA, compared with typical expectation by analysts + 10%, till May 2001 Corr. Ocean customers have a competitive edge 20

Accumulated bookings of new orders, Corr. Ocean ASA, compared with typical expectation by analysts + 10%, till May 2001 Corr. Ocean customers have a competitive edge 20

MOT - Monitoring Technology · Increase in new deepwater projects plus gradually increasing sales of FSM-IT: · MOT bookings for 2001 expected to exceed 100 million NOKs · MOT Market: · · · SM and P&T Subsea and topsides: FSM Subsea and under ground pl: FSM-IT, all applications: Conventional CM: Totals: Corr. Ocean customers have a competitive edge 800 mill/yr 1. 000 mill/yr 2. 200 mill/yr 400 mill/yr 4. 400 mill/yr 21

MOT - Monitoring Technology · Increase in new deepwater projects plus gradually increasing sales of FSM-IT: · MOT bookings for 2001 expected to exceed 100 million NOKs · MOT Market: · · · SM and P&T Subsea and topsides: FSM Subsea and under ground pl: FSM-IT, all applications: Conventional CM: Totals: Corr. Ocean customers have a competitive edge 800 mill/yr 1. 000 mill/yr 2. 200 mill/yr 400 mill/yr 4. 400 mill/yr 21

· MOT - Monitoring Technology Contract forecast, identified Projects for next 15 – 18 months, SM+P/T, FSM Subsea: · · · · · · Kizomba A, Angola – Exxon. Mobil: Abo, Nigeria Agip: Dalia, Angola - Total. Fina. Elf: Ehra, Nigeria - Exxon. Mobil: Ceiba, W Africa – Triton Crazy Horse, GOM - BP Amoco BP Frame Agreement White Rose, Can - Huskey Hebron Ben. Nevis, Can - Chevron/Hydro Corrib, UK - Enterprise Golden Eye, UK - Shell Marlin, UK - BP Amoco Mandarin, UK - BP Amoco (Ringhorne, Norw - Exxon. Mobile Kvitebjørn, Norw - Statoil Kristin, Norw - Statoil Mikkel, Norw - Statoil Snøhvit, Norw - Statoil Penguin, UK - Shell Harding, UK - BP Amoco (Juno, UK (Misc. 12. 0 mill 2. 3 ” 42. 0 ” 26. 5 ” 9. 5 ” 35. 0 ” 45. 0 ” 16. 5 ” 32. 5 ” 4. 5 ” 6. 5 ” 3. 5 ” 1. 7 ”) 1. 8 mill awarded 1. 2 ” 7. 0 ” 5. 2 ” 21. 0 ” 6. 1 ” 4. 0 ”) 4 mill awarded 24. 0 ”) 5 mill awarded Corr. Ocean customers have a competitive edge · Totals projects with good probability of success 352 mill 22

· MOT - Monitoring Technology Contract forecast, identified Projects for next 15 – 18 months, SM+P/T, FSM Subsea: · · · · · · Kizomba A, Angola – Exxon. Mobil: Abo, Nigeria Agip: Dalia, Angola - Total. Fina. Elf: Ehra, Nigeria - Exxon. Mobil: Ceiba, W Africa – Triton Crazy Horse, GOM - BP Amoco BP Frame Agreement White Rose, Can - Huskey Hebron Ben. Nevis, Can - Chevron/Hydro Corrib, UK - Enterprise Golden Eye, UK - Shell Marlin, UK - BP Amoco Mandarin, UK - BP Amoco (Ringhorne, Norw - Exxon. Mobile Kvitebjørn, Norw - Statoil Kristin, Norw - Statoil Mikkel, Norw - Statoil Snøhvit, Norw - Statoil Penguin, UK - Shell Harding, UK - BP Amoco (Juno, UK (Misc. 12. 0 mill 2. 3 ” 42. 0 ” 26. 5 ” 9. 5 ” 35. 0 ” 45. 0 ” 16. 5 ” 32. 5 ” 4. 5 ” 6. 5 ” 3. 5 ” 1. 7 ”) 1. 8 mill awarded 1. 2 ” 7. 0 ” 5. 2 ” 21. 0 ” 6. 1 ” 4. 0 ”) 4 mill awarded 24. 0 ”) 5 mill awarded Corr. Ocean customers have a competitive edge · Totals projects with good probability of success 352 mill 22

MOT - Monitoring Technology · Contracts forecast for next 15 – 18 months, Misc: · Misc small contracts in the Americas, next 12 months: · Misc contracts estimated in the UK · Misc small contracts, Norway + exports: · FSM – IT: · Misc contracts next 12 months · Contracts expected from Bayer Chemicals, to make up 60 million NOKs over 4 years, next 12 months: · Hoechst Chemicals, expected to make up sales of 75 – 80 mill over next 5 years, next 12 monrhs: · Projects, from previous page · Contracts potential next 12 – 18 months: 15 mill 20 ” 25 ” 20 ” Corr. Ocean customers have a competitive edge 8 ” 5 ” 352 445 mill · Forecast is 220 mill or more of these opportunities 23

MOT - Monitoring Technology · Contracts forecast for next 15 – 18 months, Misc: · Misc small contracts in the Americas, next 12 months: · Misc contracts estimated in the UK · Misc small contracts, Norway + exports: · FSM – IT: · Misc contracts next 12 months · Contracts expected from Bayer Chemicals, to make up 60 million NOKs over 4 years, next 12 months: · Hoechst Chemicals, expected to make up sales of 75 – 80 mill over next 5 years, next 12 monrhs: · Projects, from previous page · Contracts potential next 12 – 18 months: 15 mill 20 ” 25 ” 20 ” Corr. Ocean customers have a competitive edge 8 ” 5 ” 352 445 mill · Forecast is 220 mill or more of these opportunities 23

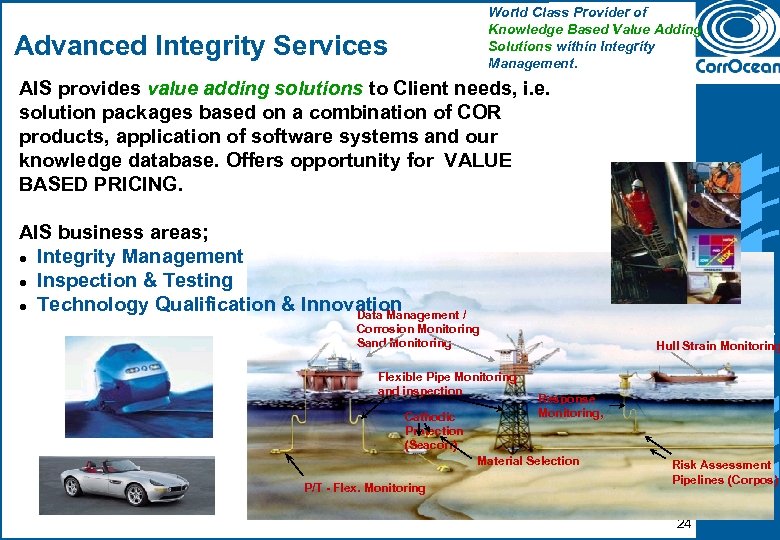

World Class Provider of Knowledge Based Value Adding Solutions within Integrity Management. Advanced Integrity Services AIS provides value adding solutions to Client needs, i. e. solution packages based on a combination of COR products, application of software systems and our knowledge database. Offers opportunity for VALUE BASED PRICING. AIS business areas; l Integrity Management l Inspection & Testing l Technology Qualification & Innovation Data Management / Corr. Ocean customers have a Hull Strain Monitoring competitive edge Corrosion Monitoring Sand Monitoring Flexible Pipe Monitoring and inspection Cathodic Protection (Seacorr) Response Monitoring, Material Selection P/T - Flex. Monitoring Risk Assessment Pipelines (Corpos) 24

World Class Provider of Knowledge Based Value Adding Solutions within Integrity Management. Advanced Integrity Services AIS provides value adding solutions to Client needs, i. e. solution packages based on a combination of COR products, application of software systems and our knowledge database. Offers opportunity for VALUE BASED PRICING. AIS business areas; l Integrity Management l Inspection & Testing l Technology Qualification & Innovation Data Management / Corr. Ocean customers have a Hull Strain Monitoring competitive edge Corrosion Monitoring Sand Monitoring Flexible Pipe Monitoring and inspection Cathodic Protection (Seacorr) Response Monitoring, Material Selection P/T - Flex. Monitoring Risk Assessment Pipelines (Corpos) 24

AIS – Integrity Management · Contracts: · Total. Fina. Elf, Norway, increased to 10 mill NOK per year, 30 mill in 3 years · Offers testing and supply of new technology, FSM-IT to Girassol · BP in Norway: 6 -7 mill per year · Shell Expro UK, Northern, 12 mill NOK (4 mill/year · Shell Expro Mid North sea, UK, 2. 5 mill NOK/year · Shell Draugen · Brazil/Petronas (AIS + Safetec), 4 years, potential for expansion · Airport Train Safety Contract: 15 – 18 mill · NSB Signatur Train Inspection Mngment: 26 mill + · maintenance of Quay structures in the UK: + 10 mill · New contracts negotiated presently · Offers new Inspection/monitoring contracts Corr. Ocean customers have a competitive edge 25

AIS – Integrity Management · Contracts: · Total. Fina. Elf, Norway, increased to 10 mill NOK per year, 30 mill in 3 years · Offers testing and supply of new technology, FSM-IT to Girassol · BP in Norway: 6 -7 mill per year · Shell Expro UK, Northern, 12 mill NOK (4 mill/year · Shell Expro Mid North sea, UK, 2. 5 mill NOK/year · Shell Draugen · Brazil/Petronas (AIS + Safetec), 4 years, potential for expansion · Airport Train Safety Contract: 15 – 18 mill · NSB Signatur Train Inspection Mngment: 26 mill + · maintenance of Quay structures in the UK: + 10 mill · New contracts negotiated presently · Offers new Inspection/monitoring contracts Corr. Ocean customers have a competitive edge 25

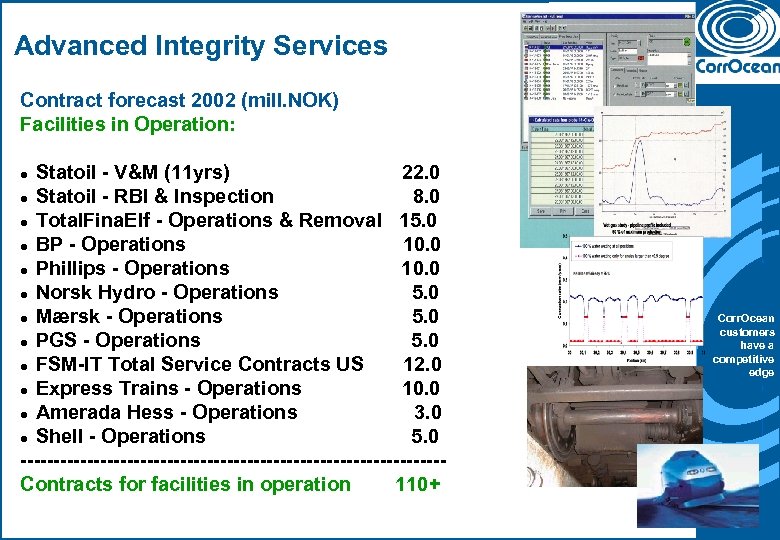

Advanced Integrity Services Contract forecast 2002 (mill. NOK) Facilities in Operation: Statoil - V&M (11 yrs) 22. 0 l Statoil - RBI & Inspection 8. 0 l Total. Fina. Elf - Operations & Removal 15. 0 l BP - Operations 10. 0 l Phillips - Operations 10. 0 l Norsk Hydro - Operations 5. 0 l Mærsk - Operations 5. 0 l PGS - Operations 5. 0 l FSM-IT Total Service Contracts US 12. 0 l Express Trains - Operations 10. 0 l Amerada Hess - Operations 3. 0 l Shell - Operations 5. 0 --------------------------------Contracts for facilities in operation 110+ l Corr. Ocean customers have a competitive edge 26

Advanced Integrity Services Contract forecast 2002 (mill. NOK) Facilities in Operation: Statoil - V&M (11 yrs) 22. 0 l Statoil - RBI & Inspection 8. 0 l Total. Fina. Elf - Operations & Removal 15. 0 l BP - Operations 10. 0 l Phillips - Operations 10. 0 l Norsk Hydro - Operations 5. 0 l Mærsk - Operations 5. 0 l PGS - Operations 5. 0 l FSM-IT Total Service Contracts US 12. 0 l Express Trains - Operations 10. 0 l Amerada Hess - Operations 3. 0 l Shell - Operations 5. 0 --------------------------------Contracts for facilities in operation 110+ l Corr. Ocean customers have a competitive edge 26

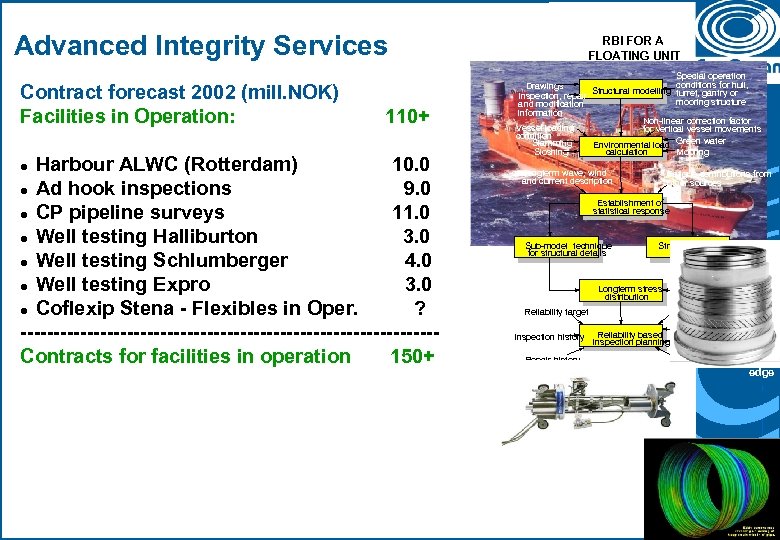

Advanced Integrity Services Contract forecast 2002 (mill. NOK) Facilities in Operation: 110+ Harbour ALWC (Rotterdam) 10. 0 l Ad hook inspections 9. 0 l CP pipeline surveys 11. 0 l Well testing Halliburton 3. 0 l Well testing Schlumberger 4. 0 l Well testing Expro 3. 0 l Coflexip Stena - Flexibles in Oper. ? -------------------------------Contracts for facilities in operation 150+ l RBI FOR A FLOATING UNIT Special operation conditions for hull, Drawings Structural modelling turret, gantry or Inspection, repair mooring structure and modification information Non-linear correction factor Vessel loading for vertical vessel movements condition Slamming Environmental load Green water Sloshing calculation Mooring Longterm wave, wind and current description Fatigue contributions from other sources Establishment of statistical response Sub-model technique for structural details Stress concentration factors Longterm stress distribution Reliability target Inspection history Repair history Weld type Corr. Ocean Material data customers Reliability based inspection planning Uncertainty have a modelling Plate thickness competitive edge 27

Advanced Integrity Services Contract forecast 2002 (mill. NOK) Facilities in Operation: 110+ Harbour ALWC (Rotterdam) 10. 0 l Ad hook inspections 9. 0 l CP pipeline surveys 11. 0 l Well testing Halliburton 3. 0 l Well testing Schlumberger 4. 0 l Well testing Expro 3. 0 l Coflexip Stena - Flexibles in Oper. ? -------------------------------Contracts for facilities in operation 150+ l RBI FOR A FLOATING UNIT Special operation conditions for hull, Drawings Structural modelling turret, gantry or Inspection, repair mooring structure and modification information Non-linear correction factor Vessel loading for vertical vessel movements condition Slamming Environmental load Green water Sloshing calculation Mooring Longterm wave, wind and current description Fatigue contributions from other sources Establishment of statistical response Sub-model technique for structural details Stress concentration factors Longterm stress distribution Reliability target Inspection history Repair history Weld type Corr. Ocean Material data customers Reliability based inspection planning Uncertainty have a modelling Plate thickness competitive edge 27

Advanced Integrity Services Contract forecast 2002 (mill. NOK) New Facilities: BP - Crazy Horse - AIS technology 4. 0 l BP - Riser Tension Monitoring for Spars 10. 0 l Automotive - Component vendors 3. 0 l National Road Admin (N, S, DK) 4. 0 l Statoil, Norsk Hydro, BP developments ? ---------------------------------Contracts for new facilities 20+ l Contracts for facilities in operation Corr. Ocean customers have a competitive edge 150+ 28

Advanced Integrity Services Contract forecast 2002 (mill. NOK) New Facilities: BP - Crazy Horse - AIS technology 4. 0 l BP - Riser Tension Monitoring for Spars 10. 0 l Automotive - Component vendors 3. 0 l National Road Admin (N, S, DK) 4. 0 l Statoil, Norsk Hydro, BP developments ? ---------------------------------Contracts for new facilities 20+ l Contracts for facilities in operation Corr. Ocean customers have a competitive edge 150+ 28

Risk Assessment and Management Systematic Risk Assessment and effective Risk Management reduce the likeli-hood of accidents like these. Corr. Ocean customers have a competitive edge 29

Risk Assessment and Management Systematic Risk Assessment and effective Risk Management reduce the likeli-hood of accidents like these. Corr. Ocean customers have a competitive edge 29

Safety and HSE Management (1) · Planning, implementation and follow-up of systematic HSE activities in projects and organisations · Accident investigation and analysis of incidents and near accidents · Safety audits and Corr. Ocean customers have a competitive edge verification 30

Safety and HSE Management (1) · Planning, implementation and follow-up of systematic HSE activities in projects and organisations · Accident investigation and analysis of incidents and near accidents · Safety audits and Corr. Ocean customers have a competitive edge verification 30

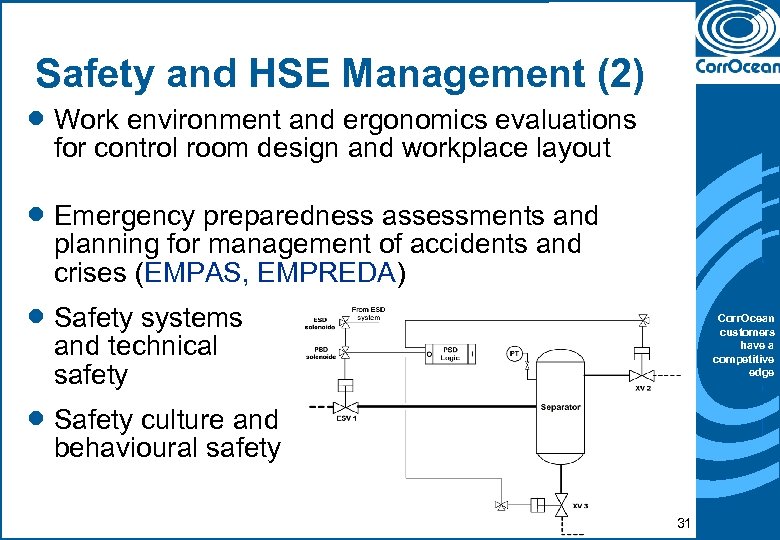

Safety and HSE Management (2) · Work environment and ergonomics evaluations for control room design and workplace layout · Emergency preparedness assessments and planning for management of accidents and crises (EMPAS, EMPREDA) · Safety systems Corr. Ocean customers have a competitive edge and technical safety · Safety culture and behavioural safety 31

Safety and HSE Management (2) · Work environment and ergonomics evaluations for control room design and workplace layout · Emergency preparedness assessments and planning for management of accidents and crises (EMPAS, EMPREDA) · Safety systems Corr. Ocean customers have a competitive edge and technical safety · Safety culture and behavioural safety 31

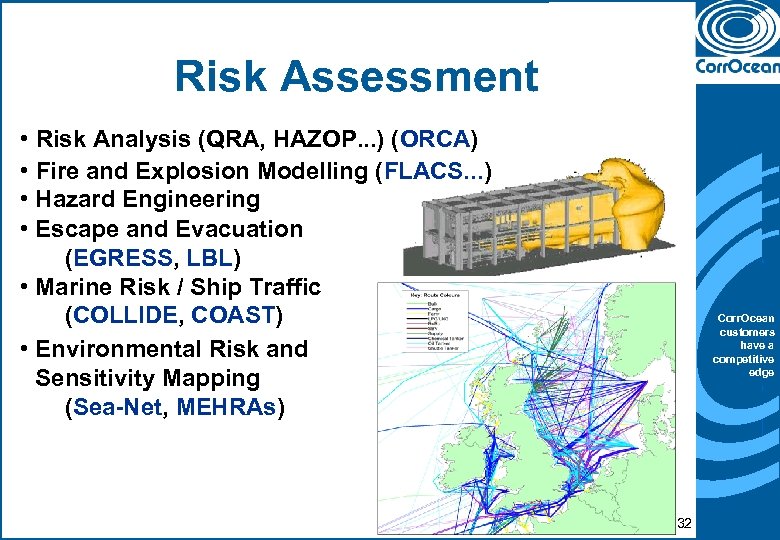

Risk Assessment • Risk Analysis (QRA, HAZOP. . . ) (ORCA) • Fire and Explosion Modelling (FLACS. . . ) • Hazard Engineering • Escape and Evacuation (EGRESS, LBL) • Marine Risk / Ship Traffic (COLLIDE, COAST) • Environmental Risk and Sensitivity Mapping (Sea-Net, MEHRAs) Corr. Ocean customers have a competitive edge 32

Risk Assessment • Risk Analysis (QRA, HAZOP. . . ) (ORCA) • Fire and Explosion Modelling (FLACS. . . ) • Hazard Engineering • Escape and Evacuation (EGRESS, LBL) • Marine Risk / Ship Traffic (COLLIDE, COAST) • Environmental Risk and Sensitivity Mapping (Sea-Net, MEHRAs) Corr. Ocean customers have a competitive edge 32

RAMS / ILS Activities · Development and follow-up of R&M/ILS plans ILS Analysis · · Reliability and Availability Analysis · SIL and Vulnerability Analysis · Reliability Centred Maintenance (RCM) · Risk Based Inspection (RBI) · Logistics Support Analysis (LSA) · Life Cycle Cost (LCC) Corr. Ocean customers have a competitive edge 33

RAMS / ILS Activities · Development and follow-up of R&M/ILS plans ILS Analysis · · Reliability and Availability Analysis · SIL and Vulnerability Analysis · Reliability Centred Maintenance (RCM) · Risk Based Inspection (RBI) · Logistics Support Analysis (LSA) · Life Cycle Cost (LCC) Corr. Ocean customers have a competitive edge 33

New possibilities · Some key projects next 6 months Estimated value 20 million NOK: · · · · Iztar, Norwegian Frigate Norwegian railway proj. Jernbanetilsynet Oslo Sporveier Collision Risk –MCA, COAST Norge, COAST Brasil BP- Valhall-IP, Valhall Flanke, Update Valhall RA, Skarv Smedvig Safety Case West Alpha Statoil: Kristin and Snøhvit Corr. Ocean customers have a competitive edge 34

New possibilities · Some key projects next 6 months Estimated value 20 million NOK: · · · · Iztar, Norwegian Frigate Norwegian railway proj. Jernbanetilsynet Oslo Sporveier Collision Risk –MCA, COAST Norge, COAST Brasil BP- Valhall-IP, Valhall Flanke, Update Valhall RA, Skarv Smedvig Safety Case West Alpha Statoil: Kristin and Snøhvit Corr. Ocean customers have a competitive edge 34

SRM – Safetec Risk Management · Contracts forecast: · Offshore Risk assessment: 35 mill – Clients: PPCo. N, Statoil, Agip, BP-Amoco Exxon. Mobil, Ekofisk Alliance, Hydro, Total. Fina. Elf ABB, Kvaerner, Smedvik, DSND, Trans. Ocean Coflexip. Stena Offshore · Marine Risk assessment: Corr. Ocean customers have a competitive edge 15 -20 mill – Izar Offset program, Coast Norge (Trafikk data base for OLF, OD, Sjøfartsdirektoratet) Collide, SW for risk assessment ships collisions, Coast data base for Brasil Campus Basin, Indonesia, Australia 35

SRM – Safetec Risk Management · Contracts forecast: · Offshore Risk assessment: 35 mill – Clients: PPCo. N, Statoil, Agip, BP-Amoco Exxon. Mobil, Ekofisk Alliance, Hydro, Total. Fina. Elf ABB, Kvaerner, Smedvik, DSND, Trans. Ocean Coflexip. Stena Offshore · Marine Risk assessment: Corr. Ocean customers have a competitive edge 15 -20 mill – Izar Offset program, Coast Norge (Trafikk data base for OLF, OD, Sjøfartsdirektoratet) Collide, SW for risk assessment ships collisions, Coast data base for Brasil Campus Basin, Indonesia, Australia 35

SRM – Safetec Risk Management · Contracts forecast next 12 months: · Transportation sector: 18 mill – Sporveien Oslo, Jernbanetilsynet Jernbaneverket, same in Sweden and Denmark · Risk assessment Industrial: 15 -20 mill – Refineries, chemical industries and plants, – misc · From previous page: 50 mill + · Totals forecast next 12 months: Corr. Ocean customers have a competitive edge 83 mill 36

SRM – Safetec Risk Management · Contracts forecast next 12 months: · Transportation sector: 18 mill – Sporveien Oslo, Jernbanetilsynet Jernbaneverket, same in Sweden and Denmark · Risk assessment Industrial: 15 -20 mill – Refineries, chemical industries and plants, – misc · From previous page: 50 mill + · Totals forecast next 12 months: Corr. Ocean customers have a competitive edge 83 mill 36