9e7ff42c5f447f2fda6c1086fbe29f65.ppt

- Количество слайдов: 53

Corporations: A Contemporary Approach Chapter 16 Slide 1 From “Be ambitious to be quiet, engaged in your Public Shareholder Activism own affairs, and working with your hands” (2013) of 65

Corporations: A Contemporary Approach Chapter 16 Slide 1 From “Be ambitious to be quiet, engaged in your Public Shareholder Activism own affairs, and working with your hands” (2013) of 65

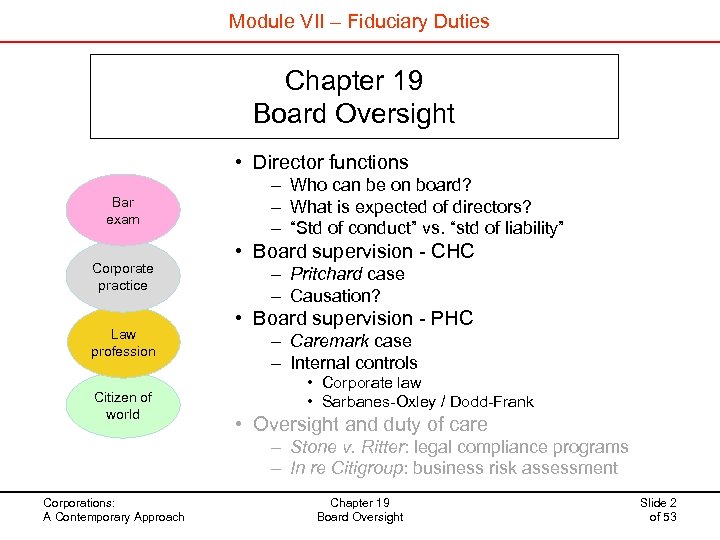

Module VII – Fiduciary Duties Chapter 19 Board Oversight • Director functions Bar exam Corporate practice Law profession Citizen of world – Who can be on board? – What is expected of directors? – “Std of conduct” vs. “std of liability” • Board supervision - CHC – Pritchard case – Causation? • Board supervision - PHC – Caremark case – Internal controls • Corporate law • Sarbanes-Oxley / Dodd-Frank • Oversight and duty of care – Stone v. Ritter: legal compliance programs – In re Citigroup: business risk assessment Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 2 of 53

Module VII – Fiduciary Duties Chapter 19 Board Oversight • Director functions Bar exam Corporate practice Law profession Citizen of world – Who can be on board? – What is expected of directors? – “Std of conduct” vs. “std of liability” • Board supervision - CHC – Pritchard case – Causation? • Board supervision - PHC – Caremark case – Internal controls • Corporate law • Sarbanes-Oxley / Dodd-Frank • Oversight and duty of care – Stone v. Ritter: legal compliance programs – In re Citigroup: business risk assessment Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 2 of 53

Director’s functions … Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 3 of 53

Director’s functions … Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 3 of 53

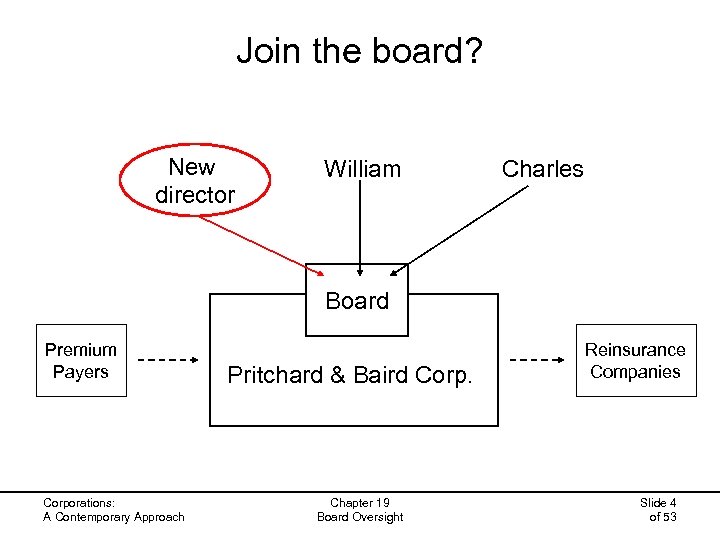

Join the board? New director William Charles Board Premium Payers Corporations: A Contemporary Approach Pritchard & Baird Corp. Chapter 19 Board Oversight Reinsurance Companies Slide 4 of 53

Join the board? New director William Charles Board Premium Payers Corporations: A Contemporary Approach Pritchard & Baird Corp. Chapter 19 Board Oversight Reinsurance Companies Slide 4 of 53

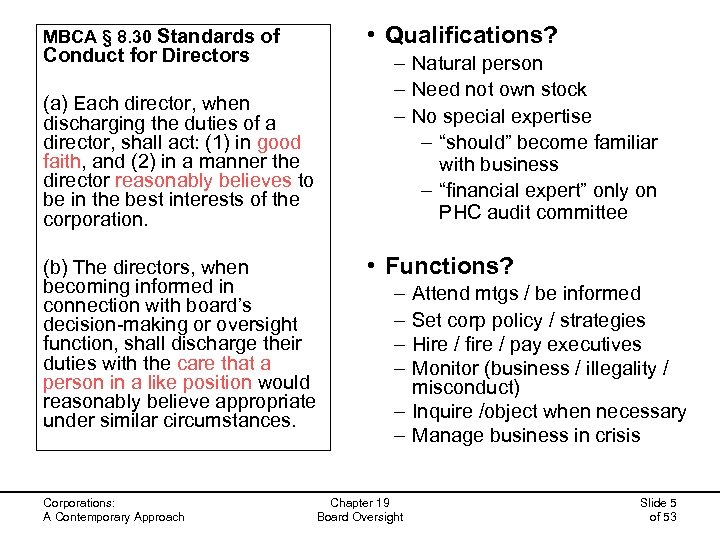

• Qualifications? MBCA § 8. 30 Standards of Conduct for Directors (a) Each director, when discharging the duties of a director, shall act: (1) in good faith, and (2) in a manner the director reasonably believes to be in the best interests of the corporation. (b) The directors, when becoming informed in connection with board’s decision-making or oversight function, shall discharge their duties with the care that a person in a like position would reasonably believe appropriate under similar circumstances. Corporations: A Contemporary Approach – Natural person – Need not own stock – No special expertise – “should” become familiar with business – “financial expert” only on PHC audit committee • Functions? – – Attend mtgs / be informed Set corp policy / strategies Hire / fire / pay executives Monitor (business / illegality / misconduct) – Inquire /object when necessary – Manage business in crisis Chapter 19 Board Oversight Slide 5 of 53

• Qualifications? MBCA § 8. 30 Standards of Conduct for Directors (a) Each director, when discharging the duties of a director, shall act: (1) in good faith, and (2) in a manner the director reasonably believes to be in the best interests of the corporation. (b) The directors, when becoming informed in connection with board’s decision-making or oversight function, shall discharge their duties with the care that a person in a like position would reasonably believe appropriate under similar circumstances. Corporations: A Contemporary Approach – Natural person – Need not own stock – No special expertise – “should” become familiar with business – “financial expert” only on PHC audit committee • Functions? – – Attend mtgs / be informed Set corp policy / strategies Hire / fire / pay executives Monitor (business / illegality / misconduct) – Inquire /object when necessary – Manage business in crisis Chapter 19 Board Oversight Slide 5 of 53

What should director do when suspicious? Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 6 of 53

What should director do when suspicious? Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 6 of 53

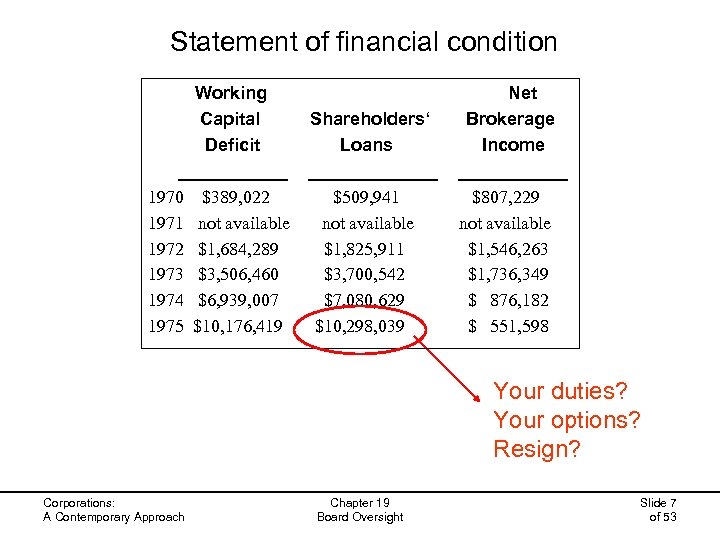

Statement of financial condition Working Net Capital Shareholders‘ Brokerage Deficit Loans Income _____________ 1970 $389, 022 $509, 941 $807, 229 1971 not available 1972 $1, 684, 289 $1, 825, 911 $1, 546, 263 1973 $3, 506, 460 $3, 700, 542 $1, 736, 349 1974 $6, 939, 007 $7, 080, 629 $ 876, 182 1975 $10, 176, 419 $10, 298, 039 $ 551, 598 Your duties? Your options? Resign? Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 7 of 53

Statement of financial condition Working Net Capital Shareholders‘ Brokerage Deficit Loans Income _____________ 1970 $389, 022 $509, 941 $807, 229 1971 not available 1972 $1, 684, 289 $1, 825, 911 $1, 546, 263 1973 $3, 506, 460 $3, 700, 542 $1, 736, 349 1974 $6, 939, 007 $7, 080, 629 $ 876, 182 1975 $10, 176, 419 $10, 298, 039 $ 551, 598 Your duties? Your options? Resign? Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 7 of 53

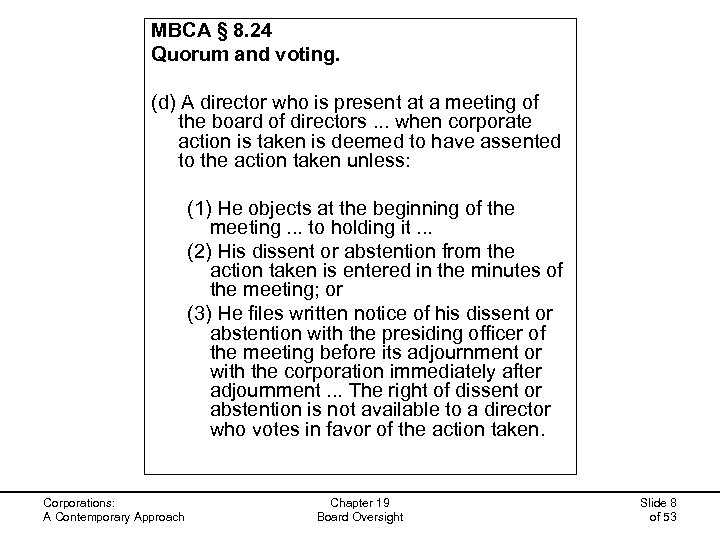

MBCA § 8. 24 Quorum and voting. (d) A director who is present at a meeting of the board of directors. . . when corporate action is taken is deemed to have assented to the action taken unless: (1) He objects at the beginning of the meeting. . . to holding it. . . (2) His dissent or abstention from the action taken is entered in the minutes of the meeting; or (3) He files written notice of his dissent or abstention with the presiding officer of the meeting before its adjournment or with the corporation immediately after adjournment. . . The right of dissent or abstention is not available to a director who votes in favor of the action taken. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 8 of 53

MBCA § 8. 24 Quorum and voting. (d) A director who is present at a meeting of the board of directors. . . when corporate action is taken is deemed to have assented to the action taken unless: (1) He objects at the beginning of the meeting. . . to holding it. . . (2) His dissent or abstention from the action taken is entered in the minutes of the meeting; or (3) He files written notice of his dissent or abstention with the presiding officer of the meeting before its adjournment or with the corporation immediately after adjournment. . . The right of dissent or abstention is not available to a director who votes in favor of the action taken. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 8 of 53

Directors & Boards e-Briefing (April 2006) How would you (as shareholder) respond to a director resignation – specifically, the kind of “noisy exit” made by a board member of XM Satellite Radio. The survey showed: • • Corporations: A Contemporary Approach Buy More on a Market Drop: 4. 8% Sell Immediately: 38. 1% Hold -- Wait and See: 38. 1% Other: 19. 0% Chapter 19 Board Oversight Slide 9 of 53

Directors & Boards e-Briefing (April 2006) How would you (as shareholder) respond to a director resignation – specifically, the kind of “noisy exit” made by a board member of XM Satellite Radio. The survey showed: • • Corporations: A Contemporary Approach Buy More on a Market Drop: 4. 8% Sell Immediately: 38. 1% Hold -- Wait and See: 38. 1% Other: 19. 0% Chapter 19 Board Oversight Slide 9 of 53

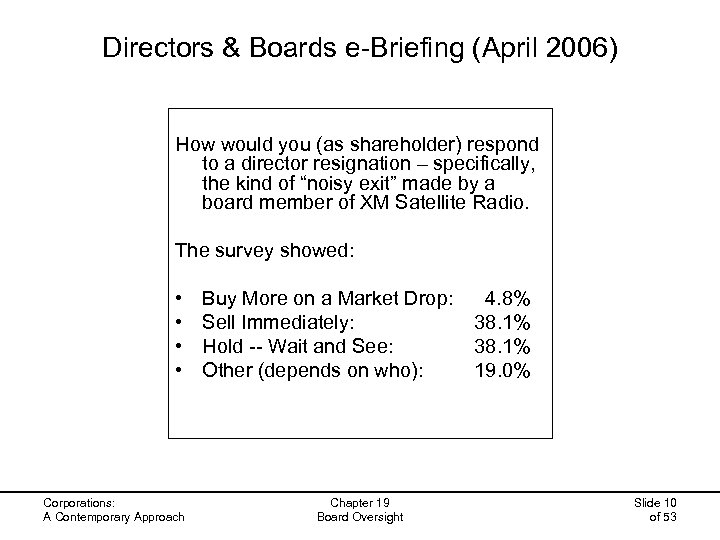

Directors & Boards e-Briefing (April 2006) How would you (as shareholder) respond to a director resignation – specifically, the kind of “noisy exit” made by a board member of XM Satellite Radio. The survey showed: • • Corporations: A Contemporary Approach Buy More on a Market Drop: 4. 8% Sell Immediately: 38. 1% Hold -- Wait and See: 38. 1% Other (depends on who): 19. 0% Chapter 19 Board Oversight Slide 10 of 53

Directors & Boards e-Briefing (April 2006) How would you (as shareholder) respond to a director resignation – specifically, the kind of “noisy exit” made by a board member of XM Satellite Radio. The survey showed: • • Corporations: A Contemporary Approach Buy More on a Market Drop: 4. 8% Sell Immediately: 38. 1% Hold -- Wait and See: 38. 1% Other (depends on who): 19. 0% Chapter 19 Board Oversight Slide 10 of 53

Liability of directors for lack of supervision … Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 11 of 53

Liability of directors for lack of supervision … Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 11 of 53

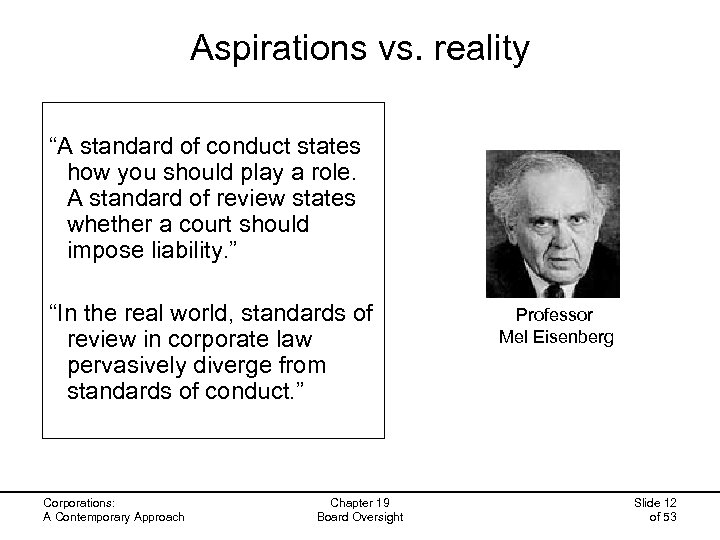

Aspirations vs. reality “A standard of conduct states how you should play a role. A standard of review states whether a court should impose liability. ” “In the real world, standards of review in corporate law pervasively diverge from standards of conduct. ” Professor Mel Eisenberg Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 12 of 53

Aspirations vs. reality “A standard of conduct states how you should play a role. A standard of review states whether a court should impose liability. ” “In the real world, standards of review in corporate law pervasively diverge from standards of conduct. ” Professor Mel Eisenberg Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 12 of 53

When is “absent” director liable? Francis v. United Jersey Bank By the way, who is Francis and why is United Jersey Bank in the case? Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 13 of 53

When is “absent” director liable? Francis v. United Jersey Bank By the way, who is Francis and why is United Jersey Bank in the case? Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 13 of 53

NJ Supreme Court: "Her neglect of duty contributed to the climate of corruption; her failure to act contributed to the continuation of that corruption. Consequently, her conduct was a substantial factor contributing to the loss. "Sometimes. . . a director may have a duty to take reasonable means to prevent illegal conduct by co-directors; in an appropriate case, this may include threat of suit. ” Francis v. United Jersey Bank (NJ 1981) Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 14 of 53

NJ Supreme Court: "Her neglect of duty contributed to the climate of corruption; her failure to act contributed to the continuation of that corruption. Consequently, her conduct was a substantial factor contributing to the loss. "Sometimes. . . a director may have a duty to take reasonable means to prevent illegal conduct by co-directors; in an appropriate case, this may include threat of suit. ” Francis v. United Jersey Bank (NJ 1981) Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 14 of 53

Malfeasance vs. misfeasance … Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 15 of 53

Malfeasance vs. misfeasance … Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 15 of 53

Hypothetical William Jr. and Charles, rather than evil, are just witless -- a case of "good genes gone bad. " They make foolish decisions and run the business into the ground through sheer incompetence. Mrs. Pritchard, absent and intoxicated, fails in her directorial responsibilities. Corporations: A Contemporary Approach Chapter 19 Board Oversight • Would witless William and Charles be liable for their lack of care? • Is Mrs Prtichard liable for her absence? What could she have done? Slide 16 of 53

Hypothetical William Jr. and Charles, rather than evil, are just witless -- a case of "good genes gone bad. " They make foolish decisions and run the business into the ground through sheer incompetence. Mrs. Pritchard, absent and intoxicated, fails in her directorial responsibilities. Corporations: A Contemporary Approach Chapter 19 Board Oversight • Would witless William and Charles be liable for their lack of care? • Is Mrs Prtichard liable for her absence? What could she have done? Slide 16 of 53

“True, he was not very suited to the job, but I cannot hold him on that account. After all it is the same corporation that chose him that now seeks to charge him. “Must a director guarantee that his judgment is good? “ Barnes v. Andrews (2 d Cir 1924) Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 17 of 53

“True, he was not very suited to the job, but I cannot hold him on that account. After all it is the same corporation that chose him that now seeks to charge him. “Must a director guarantee that his judgment is good? “ Barnes v. Andrews (2 d Cir 1924) Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 17 of 53

Board monitoring of illegality When must directors react? Internal controls required? What does Sarbanes-Oxley do? Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 18 of 53

Board monitoring of illegality When must directors react? Internal controls required? What does Sarbanes-Oxley do? Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 18 of 53

Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 19 of 53

Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 19 of 53

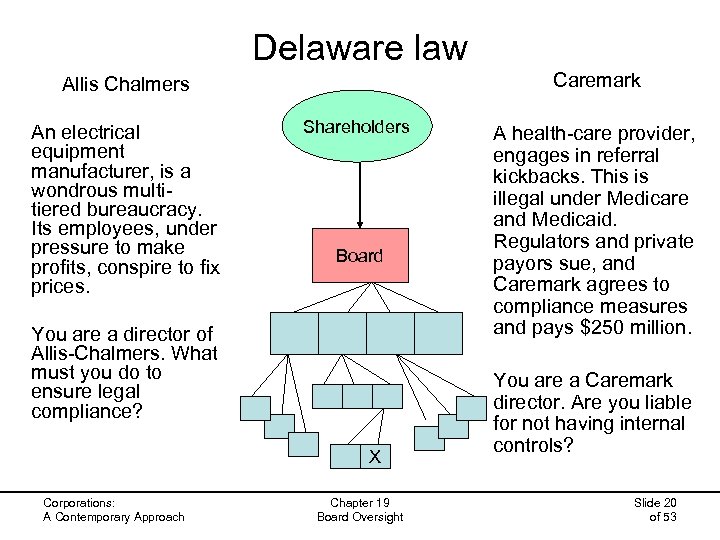

Delaware law Caremark Allis Chalmers An electrical equipment manufacturer, is a wondrous multitiered bureaucracy. Its employees, under pressure to make profits, conspire to fix prices. Shareholders Board You are a director of Allis-Chalmers. What must you do to ensure legal compliance? X Corporations: A Contemporary Approach Chapter 19 Board Oversight A health-care provider, engages in referral kickbacks. This is illegal under Medicare and Medicaid. Regulators and private payors sue, and Caremark agrees to compliance measures and pays $250 million. You are a Caremark director. Are you liable for not having internal controls? Slide 20 of 53

Delaware law Caremark Allis Chalmers An electrical equipment manufacturer, is a wondrous multitiered bureaucracy. Its employees, under pressure to make profits, conspire to fix prices. Shareholders Board You are a director of Allis-Chalmers. What must you do to ensure legal compliance? X Corporations: A Contemporary Approach Chapter 19 Board Oversight A health-care provider, engages in referral kickbacks. This is illegal under Medicare and Medicaid. Regulators and private payors sue, and Caremark agrees to compliance measures and pays $250 million. You are a Caremark director. Are you liable for not having internal controls? Slide 20 of 53

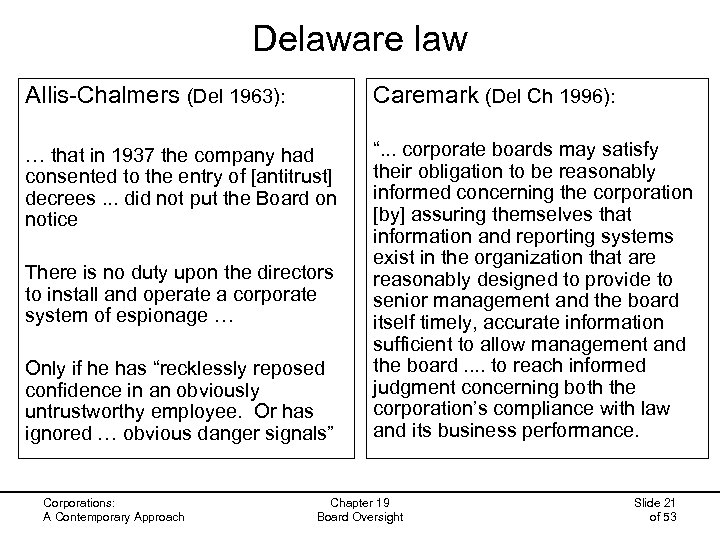

Delaware law Allis-Chalmers (Del 1963): Caremark (Del Ch 1996): … that in 1937 the company had consented to the entry of [antitrust] decrees. . . did not put the Board on notice “. . . corporate boards may satisfy their obligation to be reasonably informed concerning the corporation [by] assuring themselves that information and reporting systems exist in the organization that are reasonably designed to provide to senior management and the board itself timely, accurate information sufficient to allow management and the board. . to reach informed judgment concerning both the corporation’s compliance with law and its business performance. There is no duty upon the directors to install and operate a corporate system of espionage … Only if he has “recklessly reposed confidence in an obviously untrustworthy employee. Or has ignored … obvious danger signals” Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 21 of 53

Delaware law Allis-Chalmers (Del 1963): Caremark (Del Ch 1996): … that in 1937 the company had consented to the entry of [antitrust] decrees. . . did not put the Board on notice “. . . corporate boards may satisfy their obligation to be reasonably informed concerning the corporation [by] assuring themselves that information and reporting systems exist in the organization that are reasonably designed to provide to senior management and the board itself timely, accurate information sufficient to allow management and the board. . to reach informed judgment concerning both the corporation’s compliance with law and its business performance. There is no duty upon the directors to install and operate a corporate system of espionage … Only if he has “recklessly reposed confidence in an obviously untrustworthy employee. Or has ignored … obvious danger signals” Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 21 of 53

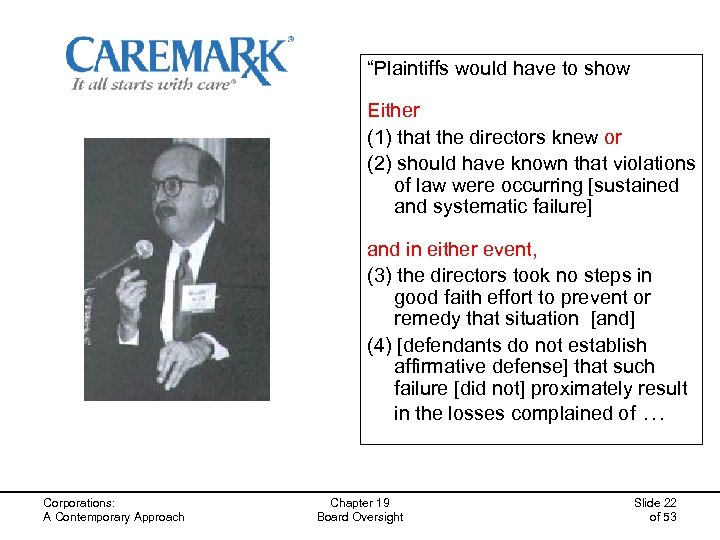

“Plaintiffs would have to show Either (1) that the directors knew or (2) should have known that violations of law were occurring [sustained and systematic failure] Corporations: A Contemporary Approach and in either event, (3) the directors took no steps in good faith effort to prevent or remedy that situation [and] (4) [defendants do not establish affirmative defense] that such failure [did not] proximately result in the losses complained of … Chapter 19 Board Oversight Slide 22 of 53

“Plaintiffs would have to show Either (1) that the directors knew or (2) should have known that violations of law were occurring [sustained and systematic failure] Corporations: A Contemporary Approach and in either event, (3) the directors took no steps in good faith effort to prevent or remedy that situation [and] (4) [defendants do not establish affirmative defense] that such failure [did not] proximately result in the losses complained of … Chapter 19 Board Oversight Slide 22 of 53

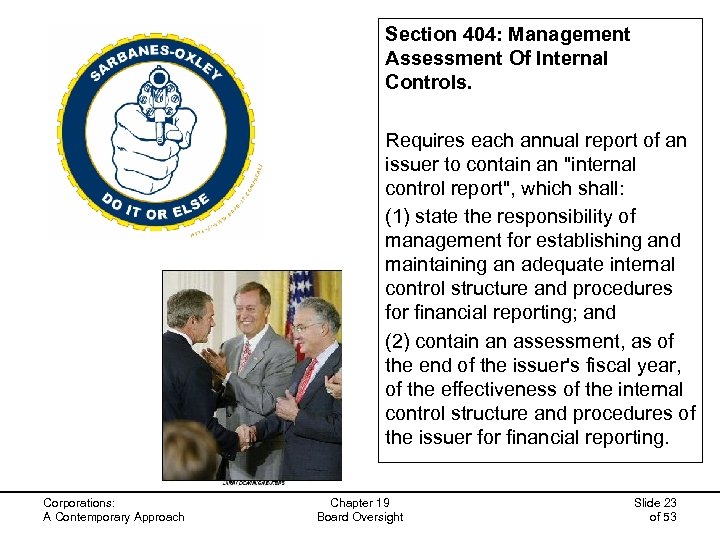

Section 404: Management Assessment Of Internal Controls. Requires each annual report of an issuer to contain an "internal control report", which shall: (1) state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting; and (2) contain an assessment, as of the end of the issuer's fiscal year, of the effectiveness of the internal control structure and procedures of the issuer for financial reporting. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 23 of 53

Section 404: Management Assessment Of Internal Controls. Requires each annual report of an issuer to contain an "internal control report", which shall: (1) state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting; and (2) contain an assessment, as of the end of the issuer's fiscal year, of the effectiveness of the internal control structure and procedures of the issuer for financial reporting. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 23 of 53

Good faith and oversight … Illegal conduct: Stone v. Ritter Business risk: In re Citigroup Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 24 of 53

Good faith and oversight … Illegal conduct: Stone v. Ritter Business risk: In re Citigroup Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 24 of 53

Stone v. Ritter (Del. 2006) Bank Secrecy Act: complicity and failure to notice Ponzi scheme - $50 million fine Issue: Demand futility? How likely that directors liable for oversight of BSA compliance program? Holding: approving and applying Caremark, no “sustained or systematic” oversight failure since “reasonable” compliance program existed Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 25 of 53

Stone v. Ritter (Del. 2006) Bank Secrecy Act: complicity and failure to notice Ponzi scheme - $50 million fine Issue: Demand futility? How likely that directors liable for oversight of BSA compliance program? Holding: approving and applying Caremark, no “sustained or systematic” oversight failure since “reasonable” compliance program existed Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 25 of 53

In re Citigroup (Del. Ch. 2009) Financial risk assessment: failure of directors to notice company’s subprime exposure - $55 billion in potential losses Issue: Demand futility? How likely that directors liable for not appreciating subprime risk? Holding: Demand required. Court applies Caremark to business risks (compared to compliance risk), but says BJR teaches against hindsight bias and for informed risk-taking / ARM Committee existed Corporations: A Contemporary Approach Chapter 19 Board Oversight Meredith Whitney 25 Most Powerful on WS Slide 26 of 53

In re Citigroup (Del. Ch. 2009) Financial risk assessment: failure of directors to notice company’s subprime exposure - $55 billion in potential losses Issue: Demand futility? How likely that directors liable for not appreciating subprime risk? Holding: Demand required. Court applies Caremark to business risks (compared to compliance risk), but says BJR teaches against hindsight bias and for informed risk-taking / ARM Committee existed Corporations: A Contemporary Approach Chapter 19 Board Oversight Meredith Whitney 25 Most Powerful on WS Slide 26 of 53

Pop quiz – MBCA S 8. 31 Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 27 of 53

Pop quiz – MBCA S 8. 31 Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 27 of 53

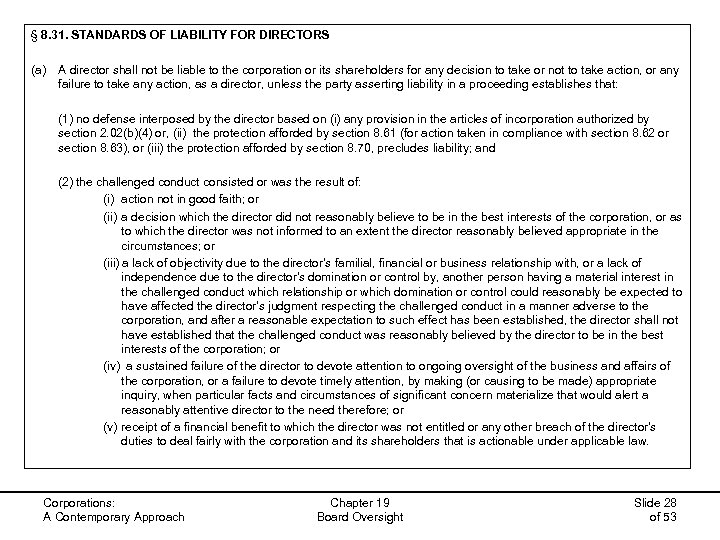

§ 8. 31. STANDARDS OF LIABILITY FOR DIRECTORS (a) A director shall not be liable to the corporation or its shareholders for any decision to take or not to take action, or any failure to take any action, as a director, unless the party asserting liability in a proceeding establishes that: (1) no defense interposed by the director based on (i) any provision in the articles of incorporation authorized by section 2. 02(b)(4) or, (ii) the protection afforded by section 8. 61 (for action taken in compliance with section 8. 62 or section 8. 63), or (iii) the protection afforded by section 8. 70, precludes liability; and (2) the challenged conduct consisted or was the result of: (i) action not in good faith; or (ii) a decision which the director did not reasonably believe to be in the best interests of the corporation, or as to which the director was not informed to an extent the director reasonably believed appropriate in the circumstances; or (iii) a lack of objectivity due to the director's familial, financial or business relationship with, or a lack of independence due to the director's domination or control by, another person having a material interest in the challenged conduct which relationship or which domination or control could reasonably be expected to have affected the director's judgment respecting the challenged conduct in a manner adverse to the corporation, and after a reasonable expectation to such effect has been established, the director shall not have established that the challenged conduct was reasonably believed by the director to be in the best interests of the corporation; or (iv) a sustained failure of the director to devote attention to ongoing oversight of the business and affairs of the corporation, or a failure to devote timely attention, by making (or causing to be made) appropriate inquiry, when particular facts and circumstances of significant concern materialize that would alert a reasonably attentive director to the need therefore; or (v) receipt of a financial benefit to which the director was not entitled or any other breach of the director's duties to deal fairly with the corporation and its shareholders that is actionable under applicable law. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 28 of 53

§ 8. 31. STANDARDS OF LIABILITY FOR DIRECTORS (a) A director shall not be liable to the corporation or its shareholders for any decision to take or not to take action, or any failure to take any action, as a director, unless the party asserting liability in a proceeding establishes that: (1) no defense interposed by the director based on (i) any provision in the articles of incorporation authorized by section 2. 02(b)(4) or, (ii) the protection afforded by section 8. 61 (for action taken in compliance with section 8. 62 or section 8. 63), or (iii) the protection afforded by section 8. 70, precludes liability; and (2) the challenged conduct consisted or was the result of: (i) action not in good faith; or (ii) a decision which the director did not reasonably believe to be in the best interests of the corporation, or as to which the director was not informed to an extent the director reasonably believed appropriate in the circumstances; or (iii) a lack of objectivity due to the director's familial, financial or business relationship with, or a lack of independence due to the director's domination or control by, another person having a material interest in the challenged conduct which relationship or which domination or control could reasonably be expected to have affected the director's judgment respecting the challenged conduct in a manner adverse to the corporation, and after a reasonable expectation to such effect has been established, the director shall not have established that the challenged conduct was reasonably believed by the director to be in the best interests of the corporation; or (iv) a sustained failure of the director to devote attention to ongoing oversight of the business and affairs of the corporation, or a failure to devote timely attention, by making (or causing to be made) appropriate inquiry, when particular facts and circumstances of significant concern materialize that would alert a reasonably attentive director to the need therefore; or (v) receipt of a financial benefit to which the director was not entitled or any other breach of the director's duties to deal fairly with the corporation and its shareholders that is actionable under applicable law. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 28 of 53

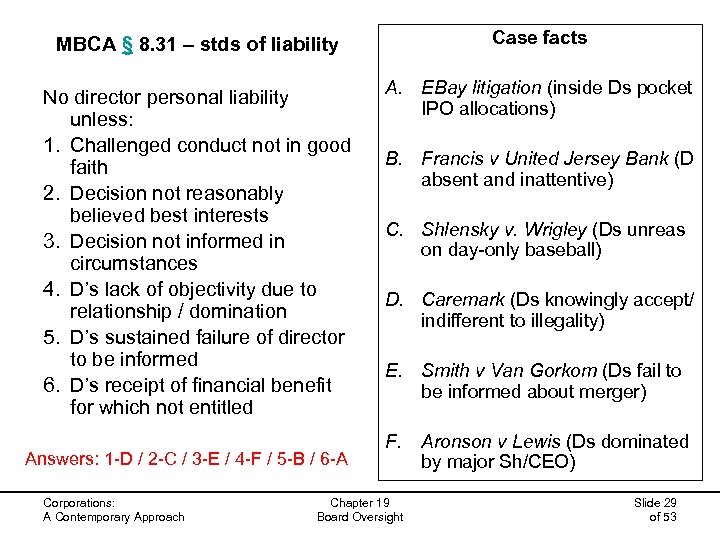

Case facts MBCA § 8. 31 – stds of liability No director personal liability unless: 1. Challenged conduct not in good faith 2. Decision not reasonably believed best interests 3. Decision not informed in circumstances 4. D’s lack of objectivity due to relationship / domination 5. D’s sustained failure of director to be informed 6. D’s receipt of financial benefit for which not entitled Answers: 1 -D / 2 -C / 3 -E / 4 -F / 5 -B / 6 -A Corporations: A Contemporary Approach A. EBay litigation (inside Ds pocket IPO allocations) B. Francis v United Jersey Bank (D absent and inattentive) C. Shlensky v. Wrigley (Ds unreas on day-only baseball) D. Caremark (Ds knowingly accept/ indifferent to illegality) E. Smith v Van Gorkom (Ds fail to be informed about merger) F. Chapter 19 Board Oversight Aronson v Lewis (Ds dominated by major Sh/CEO) Slide 29 of 53

Case facts MBCA § 8. 31 – stds of liability No director personal liability unless: 1. Challenged conduct not in good faith 2. Decision not reasonably believed best interests 3. Decision not informed in circumstances 4. D’s lack of objectivity due to relationship / domination 5. D’s sustained failure of director to be informed 6. D’s receipt of financial benefit for which not entitled Answers: 1 -D / 2 -C / 3 -E / 4 -F / 5 -B / 6 -A Corporations: A Contemporary Approach A. EBay litigation (inside Ds pocket IPO allocations) B. Francis v United Jersey Bank (D absent and inattentive) C. Shlensky v. Wrigley (Ds unreas on day-only baseball) D. Caremark (Ds knowingly accept/ indifferent to illegality) E. Smith v Van Gorkom (Ds fail to be informed about merger) F. Chapter 19 Board Oversight Aronson v Lewis (Ds dominated by major Sh/CEO) Slide 29 of 53

Apply Caremark framework… Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 30 of 53

Apply Caremark framework… Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 30 of 53

You are general counsel of Fly Away Airlines, a low-fare airline that’s facing competitive pressures and shareholder demands for more profits Group hypo The FAA board of directors is considering : PLAN A: The company's employees will comply scrupulously with the law, and their efforts will be carefully monitored – though this is expensive. PLAN B: The company’s employees will work aggressively to cut costs – of course, compliance with all safety rules may not always be “cost-effective. ” Advise the directors on their duties. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 31 of 53

You are general counsel of Fly Away Airlines, a low-fare airline that’s facing competitive pressures and shareholder demands for more profits Group hypo The FAA board of directors is considering : PLAN A: The company's employees will comply scrupulously with the law, and their efforts will be carefully monitored – though this is expensive. PLAN B: The company’s employees will work aggressively to cut costs – of course, compliance with all safety rules may not always be “cost-effective. ” Advise the directors on their duties. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 31 of 53

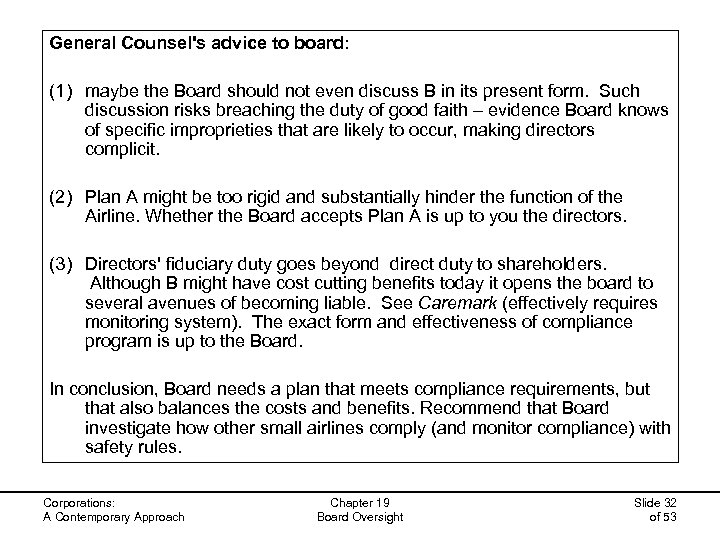

General Counsel's advice to board: (1) maybe the Board should not even discuss B in its present form. Such discussion risks breaching the duty of good faith – evidence Board knows of specific improprieties that are likely to occur, making directors complicit. (2) Plan A might be too rigid and substantially hinder the function of the Airline. Whether the Board accepts Plan A is up to you the directors. (3) Directors' fiduciary duty goes beyond direct duty to shareholders. Although B might have cost cutting benefits today it opens the board to several avenues of becoming liable. See Caremark (effectively requires monitoring system). The exact form and effectiveness of compliance program is up to the Board. In conclusion, Board needs a plan that meets compliance requirements, but that also balances the costs and benefits. Recommend that Board investigate how other small airlines comply (and monitor compliance) with safety rules. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 32 of 53

General Counsel's advice to board: (1) maybe the Board should not even discuss B in its present form. Such discussion risks breaching the duty of good faith – evidence Board knows of specific improprieties that are likely to occur, making directors complicit. (2) Plan A might be too rigid and substantially hinder the function of the Airline. Whether the Board accepts Plan A is up to you the directors. (3) Directors' fiduciary duty goes beyond direct duty to shareholders. Although B might have cost cutting benefits today it opens the board to several avenues of becoming liable. See Caremark (effectively requires monitoring system). The exact form and effectiveness of compliance program is up to the Board. In conclusion, Board needs a plan that meets compliance requirements, but that also balances the costs and benefits. Recommend that Board investigate how other small airlines comply (and monitor compliance) with safety rules. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 32 of 53

The end Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 33 of 53

The end Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 33 of 53

Trends in corporate governance … Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 34 of 53

Trends in corporate governance … Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 34 of 53

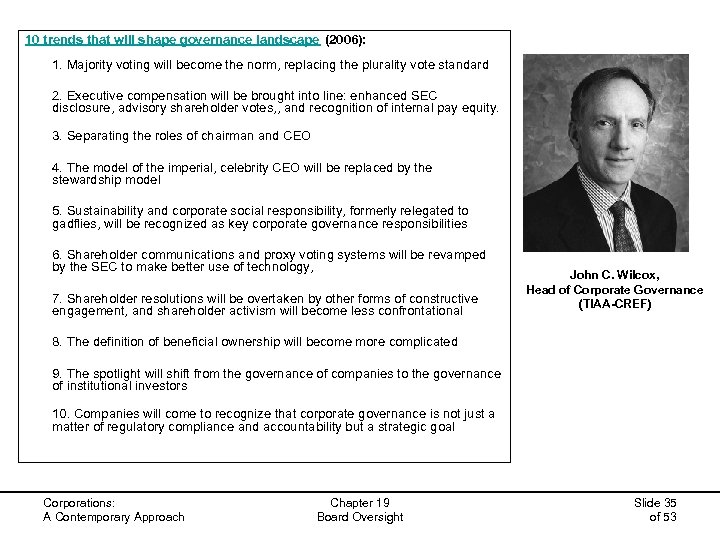

10 trends that will shape governance landscape (2006): 1. Majority voting will become the norm, replacing the plurality vote standard 2. Executive compensation will be brought into line: enhanced SEC disclosure, advisory shareholder votes, , and recognition of internal pay equity. 3. Separating the roles of chairman and CEO 4. The model of the imperial, celebrity CEO will be replaced by the stewardship model 5. Sustainability and corporate social responsibility, formerly relegated to gadflies, will be recognized as key corporate governance responsibilities 6. Shareholder communications and proxy voting systems will be revamped by the SEC to make better use of technology, 7. Shareholder resolutions will be overtaken by other forms of constructive engagement, and shareholder activism will become less confrontational John C. Wilcox, Head of Corporate Governance (TIAA-CREF) 8. The definition of beneficial ownership will become more complicated 9. The spotlight will shift from the governance of companies to the governance of institutional investors 10. Companies will come to recognize that corporate governance is not just a matter of regulatory compliance and accountability but a strategic goal Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 35 of 53

10 trends that will shape governance landscape (2006): 1. Majority voting will become the norm, replacing the plurality vote standard 2. Executive compensation will be brought into line: enhanced SEC disclosure, advisory shareholder votes, , and recognition of internal pay equity. 3. Separating the roles of chairman and CEO 4. The model of the imperial, celebrity CEO will be replaced by the stewardship model 5. Sustainability and corporate social responsibility, formerly relegated to gadflies, will be recognized as key corporate governance responsibilities 6. Shareholder communications and proxy voting systems will be revamped by the SEC to make better use of technology, 7. Shareholder resolutions will be overtaken by other forms of constructive engagement, and shareholder activism will become less confrontational John C. Wilcox, Head of Corporate Governance (TIAA-CREF) 8. The definition of beneficial ownership will become more complicated 9. The spotlight will shift from the governance of companies to the governance of institutional investors 10. Companies will come to recognize that corporate governance is not just a matter of regulatory compliance and accountability but a strategic goal Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 35 of 53

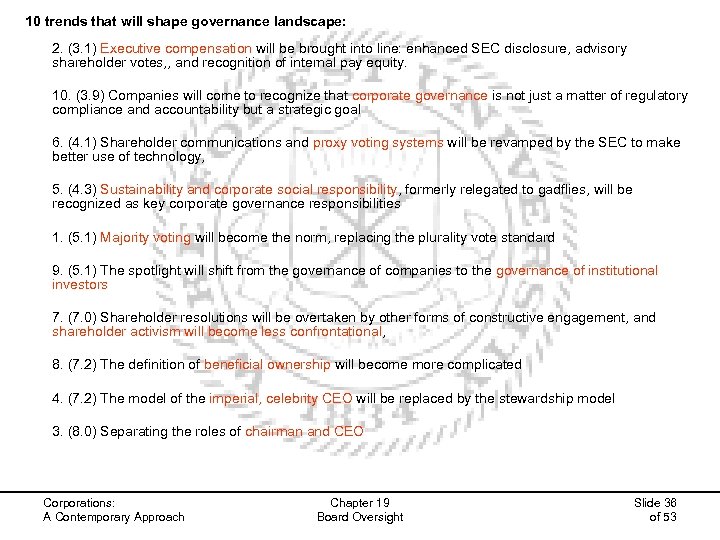

10 trends that will shape governance landscape: 2. (3. 1) Executive compensation will be brought into line: enhanced SEC disclosure, advisory shareholder votes, , and recognition of internal pay equity. 10. (3. 9) Companies will come to recognize that corporate governance is not just a matter of regulatory compliance and accountability but a strategic goal 6. (4. 1) Shareholder communications and proxy voting systems will be revamped by the SEC to make better use of technology, 5. (4. 3) Sustainability and corporate social responsibility, formerly relegated to gadflies, will be recognized as key corporate governance responsibilities 1. (5. 1) Majority voting will become the norm, replacing the plurality vote standard 9. (5. 1) The spotlight will shift from the governance of companies to the governance of institutional investors 7. (7. 0) Shareholder resolutions will be overtaken by other forms of constructive engagement, and shareholder activism will become less confrontational, 8. (7. 2) The definition of beneficial ownership will become more complicated 4. (7. 2) The model of the imperial, celebrity CEO will be replaced by the stewardship model 3. (8. 0) Separating the roles of chairman and CEO Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 36 of 53

10 trends that will shape governance landscape: 2. (3. 1) Executive compensation will be brought into line: enhanced SEC disclosure, advisory shareholder votes, , and recognition of internal pay equity. 10. (3. 9) Companies will come to recognize that corporate governance is not just a matter of regulatory compliance and accountability but a strategic goal 6. (4. 1) Shareholder communications and proxy voting systems will be revamped by the SEC to make better use of technology, 5. (4. 3) Sustainability and corporate social responsibility, formerly relegated to gadflies, will be recognized as key corporate governance responsibilities 1. (5. 1) Majority voting will become the norm, replacing the plurality vote standard 9. (5. 1) The spotlight will shift from the governance of companies to the governance of institutional investors 7. (7. 0) Shareholder resolutions will be overtaken by other forms of constructive engagement, and shareholder activism will become less confrontational, 8. (7. 2) The definition of beneficial ownership will become more complicated 4. (7. 2) The model of the imperial, celebrity CEO will be replaced by the stewardship model 3. (8. 0) Separating the roles of chairman and CEO Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 36 of 53

Role of directors NC Bus Corp Act § 55 -8 -30 General standards for directors. (a) A director shall discharge his duties as a director. . . : (1) In good faith; (2) With the care an ordinarily prudent person in a like position would exercise under similar circumstances; and (3) In a manner he reasonably believes to be in the best interests of the corporation. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 37 of 53

Role of directors NC Bus Corp Act § 55 -8 -30 General standards for directors. (a) A director shall discharge his duties as a director. . . : (1) In good faith; (2) With the care an ordinarily prudent person in a like position would exercise under similar circumstances; and (3) In a manner he reasonably believes to be in the best interests of the corporation. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 37 of 53

Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 38 of 53

Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 38 of 53

Federal legislative response in 2002 to Enron World. Com Adelphia Tyco Xerox Global Crossing Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 39 of 53

Federal legislative response in 2002 to Enron World. Com Adelphia Tyco Xerox Global Crossing Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 39 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Create PCAOB • Audit firms must register with Board • PCAOB to set new audit rules • SEC authorized to go after bad or negligent conduct Slide 40 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Create PCAOB • Audit firms must register with Board • PCAOB to set new audit rules • SEC authorized to go after bad or negligent conduct Slide 40 of 53

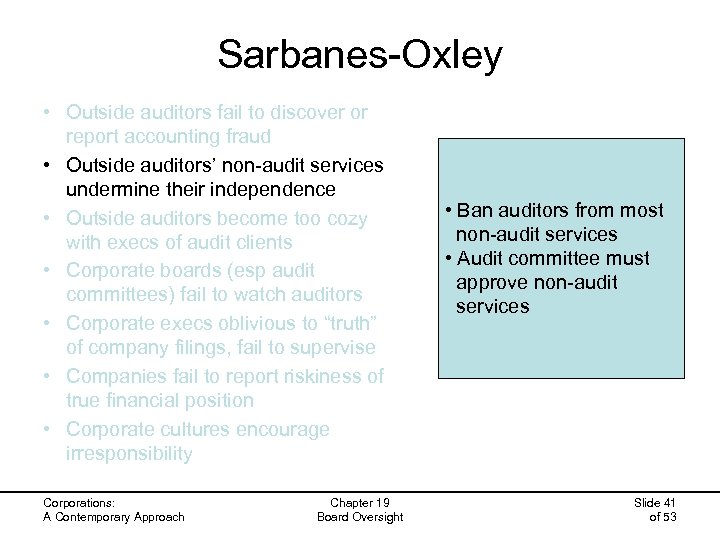

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Ban auditors from most non-audit services • Audit committee must approve non-audit services Slide 41 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Ban auditors from most non-audit services • Audit committee must approve non-audit services Slide 41 of 53

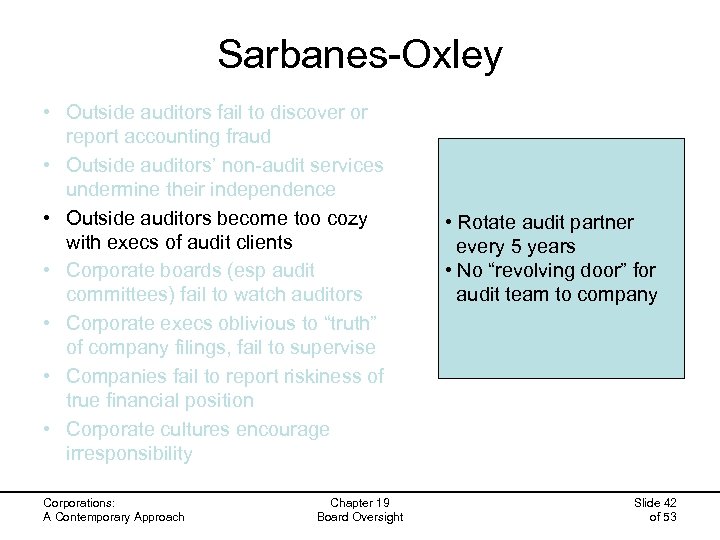

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Rotate audit partner every 5 years • No “revolving door” for audit team to company Slide 42 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Rotate audit partner every 5 years • No “revolving door” for audit team to company Slide 42 of 53

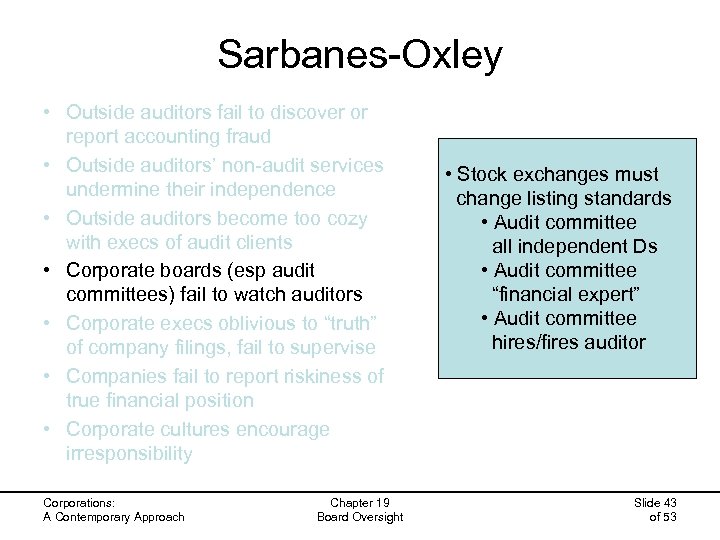

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Stock exchanges must change listing standards • Audit committee all independent Ds • Audit committee “financial expert” • Audit committee hires/fires auditor Slide 43 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Stock exchanges must change listing standards • Audit committee all independent Ds • Audit committee “financial expert” • Audit committee hires/fires auditor Slide 43 of 53

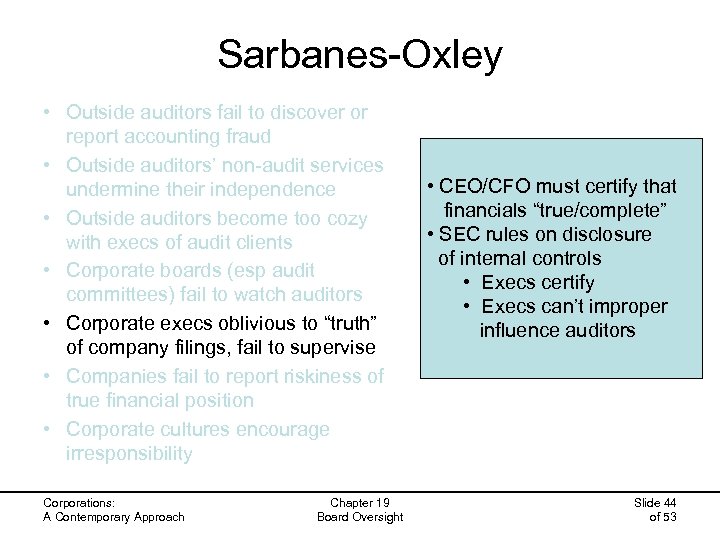

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • CEO/CFO must certify that financials “true/complete” • SEC rules on disclosure of internal controls • Execs certify • Execs can’t improper influence auditors Slide 44 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • CEO/CFO must certify that financials “true/complete” • SEC rules on disclosure of internal controls • Execs certify • Execs can’t improper influence auditors Slide 44 of 53

Sarbanes-Oxley Section 404: Management Assessment Of Internal Controls. Requires each annual report of an issuer to contain an "internal control report", which shall: (1) state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting; and (2) contain an assessment, as of the end of the issuer's fiscal year, of the effectiveness of the internal control structure and procedures of the issuer for financial reporting. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 45 of 53

Sarbanes-Oxley Section 404: Management Assessment Of Internal Controls. Requires each annual report of an issuer to contain an "internal control report", which shall: (1) state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting; and (2) contain an assessment, as of the end of the issuer's fiscal year, of the effectiveness of the internal control structure and procedures of the issuer for financial reporting. Corporations: A Contemporary Approach Chapter 19 Board Oversight Slide 45 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Real-time “plain English” current disclosures • Disclosure of off-balance sheet arrangements • SEC reviews company filings every 3 years Slide 46 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility Corporations: A Contemporary Approach Chapter 19 Board Oversight • Real-time “plain English” current disclosures • Disclosure of off-balance sheet arrangements • SEC reviews company filings every 3 years Slide 46 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility, bad practices Corporations: A Contemporary Approach Chapter 19 Board Oversight • Disclosure of code of ethics • SEC can ban or remove “unfit” directors/officers • Ban on “Personal loans” to directors and officers • Exception for “regular lending” Slide 47 of 53

Sarbanes-Oxley • Outside auditors fail to discover or report accounting fraud • Outside auditors’ non-audit services undermine their independence • Outside auditors become too cozy with execs of audit clients • Corporate boards (esp audit committees) fail to watch auditors • Corporate execs oblivious to “truth” of company filings, fail to supervise • Companies fail to report riskiness of true financial position • Corporate cultures encourage irresponsibility, bad practices Corporations: A Contemporary Approach Chapter 19 Board Oversight • Disclosure of code of ethics • SEC can ban or remove “unfit” directors/officers • Ban on “Personal loans” to directors and officers • Exception for “regular lending” Slide 47 of 53

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • Execs forfeit pay gains when company restates • Execs barred from selling during “blackout” • Insiders must disclose trades w/in 2 days Slide 48 of 53

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • Execs forfeit pay gains when company restates • Execs barred from selling during “blackout” • Insiders must disclose trades w/in 2 days Slide 48 of 53

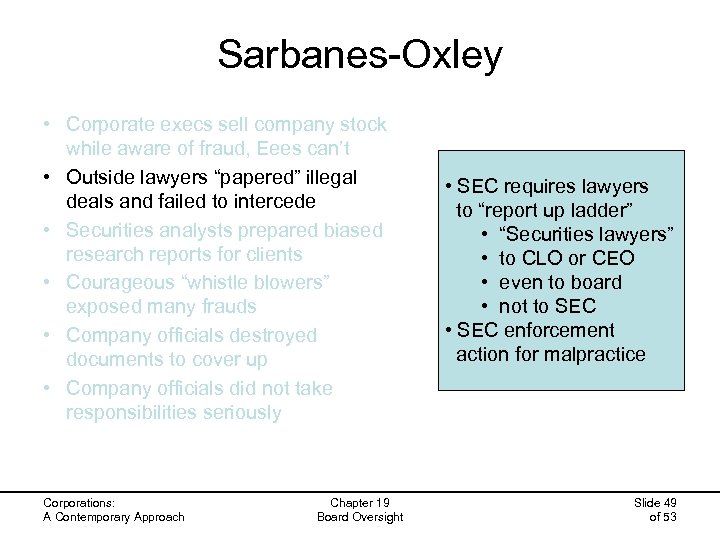

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • SEC requires lawyers to “report up ladder” • “Securities lawyers” • to CLO or CEO • even to board • not to SEC • SEC enforcement action for malpractice Slide 49 of 53

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • SEC requires lawyers to “report up ladder” • “Securities lawyers” • to CLO or CEO • even to board • not to SEC • SEC enforcement action for malpractice Slide 49 of 53

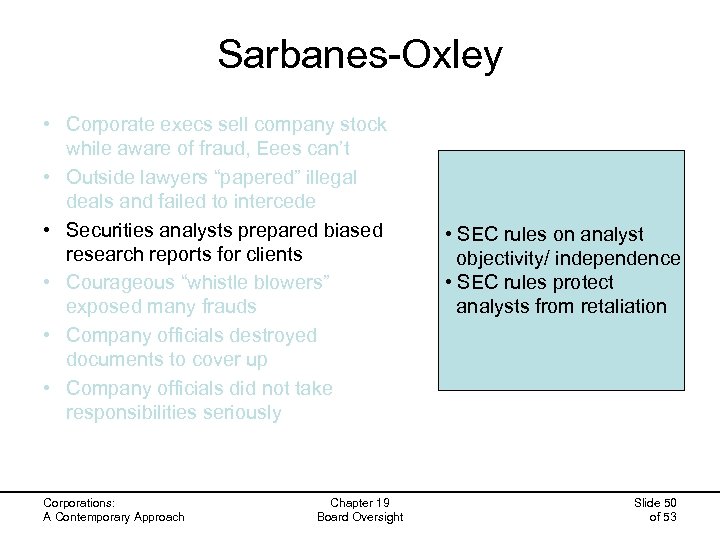

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • SEC rules on analyst objectivity/ independence • SEC rules protect analysts from retaliation Slide 50 of 53

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • SEC rules on analyst objectivity/ independence • SEC rules protect analysts from retaliation Slide 50 of 53

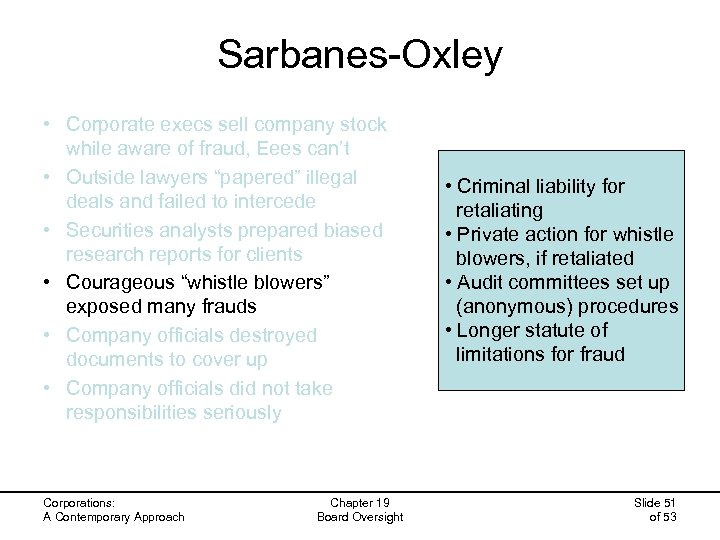

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • Criminal liability for retaliating • Private action for whistle blowers, if retaliated • Audit committees set up (anonymous) procedures • Longer statute of limitations for fraud Slide 51 of 53

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • Criminal liability for retaliating • Private action for whistle blowers, if retaliated • Audit committees set up (anonymous) procedures • Longer statute of limitations for fraud Slide 51 of 53

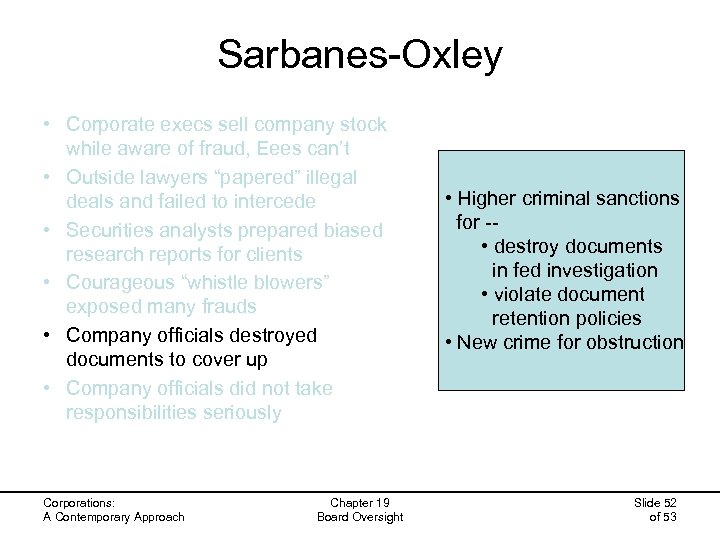

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • Higher criminal sanctions for - • destroy documents in fed investigation • violate document retention policies • New crime for obstruction Slide 52 of 53

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • Higher criminal sanctions for - • destroy documents in fed investigation • violate document retention policies • New crime for obstruction Slide 52 of 53

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • Higher criminal sentences for - • retaliating • mail/wire fraud • false certification • New crime of “knowing securities fraud” (25 yrs) Slide 53 of 53

Sarbanes-Oxley • Corporate execs sell company stock while aware of fraud, Eees can’t • Outside lawyers “papered” illegal deals and failed to intercede • Securities analysts prepared biased research reports for clients • Courageous “whistle blowers” exposed many frauds • Company officials destroyed documents to cover up • Company officials did not take responsibilities seriously Corporations: A Contemporary Approach Chapter 19 Board Oversight • Higher criminal sentences for - • retaliating • mail/wire fraud • false certification • New crime of “knowing securities fraud” (25 yrs) Slide 53 of 53