31dbba204558ceb7d522ee3aa718946e.ppt

- Количество слайдов: 25

Corporation – bearer shares • Compare bearer shares – registered shares – Purposes of each – Cultural preferences • Bearer shares – Transformation (vested right? ) – Cancellation procedure (lost? ) • Bearer shares and corporate governance – Effect on exercise of voting rights – Effect on hostile takeover

Corporation – bearer shares What is the difference between bearer shares and registered shares? Why do Europeans prefer bearer shares? What about usual preference for certainty through registration?

Corporation – bearer shares

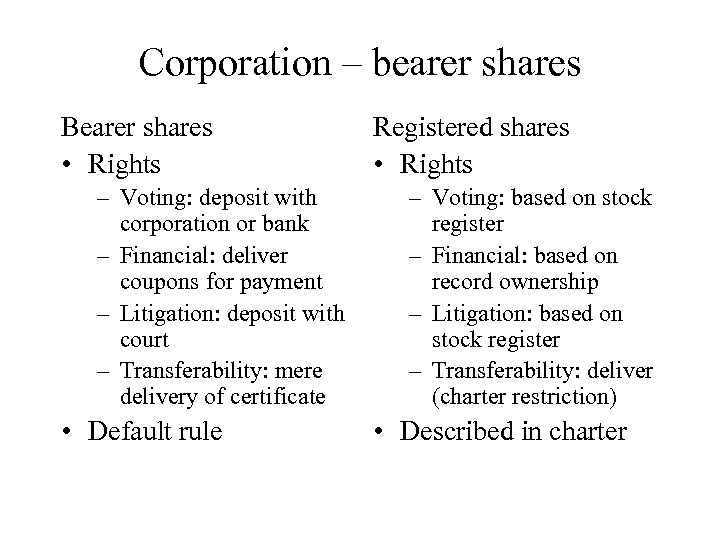

Corporation – bearer shares Bearer shares • Rights – Voting: deposit with corporation or bank – Financial: deliver coupons for payment – Litigation: deposit with court – Transferability: mere delivery of certificate • Default rule Registered shares • Rights – Voting: based on stock register – Financial: based on record ownership – Litigation: based on stock register – Transferability: deliver (charter restriction) • Described in charter

Corporation – bearer shares Belgian dentist

Corporation – bearer shares Are bearer shares a matter of right?

Corporation – bearer shares Sh v. Corporation (Commercial Court – Zurich 1947) Facts: Issue: Holding: Analysis:

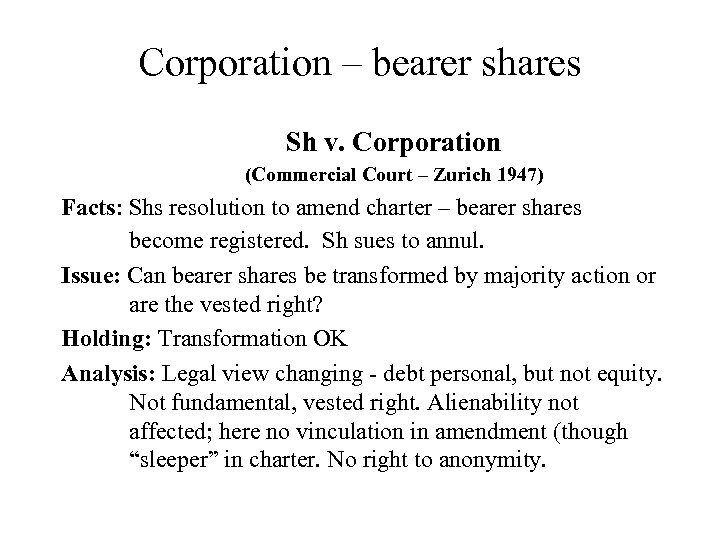

Corporation – bearer shares Sh v. Corporation (Commercial Court – Zurich 1947) Facts: Shs resolution to amend charter – bearer shares become registered. Sh sues to annul. Issue: Can bearer shares be transformed by majority action or are the vested right? Holding: Transformation OK Analysis: Legal view changing - debt personal, but not equity. Not fundamental, vested right. Alienability not affected; here no vinculation in amendment (though “sleeper” in charter. No right to anonymity.

Corporation – bearer shares What does US corporate law say about – • bearer shares? • restrictions on transferability? Could there be bearer shares in the US?

Corporation – bearer shares

Corporation – bearer shares Voting and quorum of US corporations requires record of shareholders (Del. GCL 213, 216, 219) § 213. Fixing date for determination of stockholders of record. [to determine stockholders who can vote board fixes record date] § 216. Quorum and required vote for stock corporations. [sets quorum and required vote of stockholders entitled to vote] § 219. List of stockholders entitled to vote; penalty for refusal to produce; stock ledger. [officer in charge of stock ledger makes alphabetical list of stockholders entitled to vote] Except for Wyoming and Nevada

Corporation – bearer shares Transfer restrictions valid in US corporations if reasonable Del. GCL § 202. Restriction on transfer of securities. (a) A written restriction on the transfer. . . of a security. . . may be enforced against the holder of the restricted security or any successor or transferee of the holder (b) A restriction on the transfer. . . may be imposed either by the certificate of incorporation or by the bylaws or by an agreement among any number of security holders. . (c) A restriction on the transfer. . . is permitted. . . if it: (1) [first refusal rights] (2) [purchase option] (3) [consent requirement] (4) [designated persons. . . if not manifestly unreasonable]

Corporation – bearer shares Are transfer restrictions valid under the Swiss Code of Obligations? Isn’t this interference with a vested right?

Corporation – bearer shares Sh v. Corporation (Appelationsgericht Basel-Stadt 1965) Charter amendment transforms bearer shares into registered shares and restricts transfer only with management approval (1) Transformation OK (2) Restriction invalid because management gets too much arbitrary power (must be reasonable)

Corporation – bearer shares What if bearer shares are lost … or worse?

Corporation – bearer shares Cancellation procedure • Ex parte proceeding by original owner – Certificates “lost” – Notice by publication to “unknown holder” • Outstanding certificates declared “null and void” – Corporation issues new certificates – Holder (even BFP w/o notice) loses rights • Bank custodians – Check official journal (serial numbers) – Failure to protect holder – liable for negligence

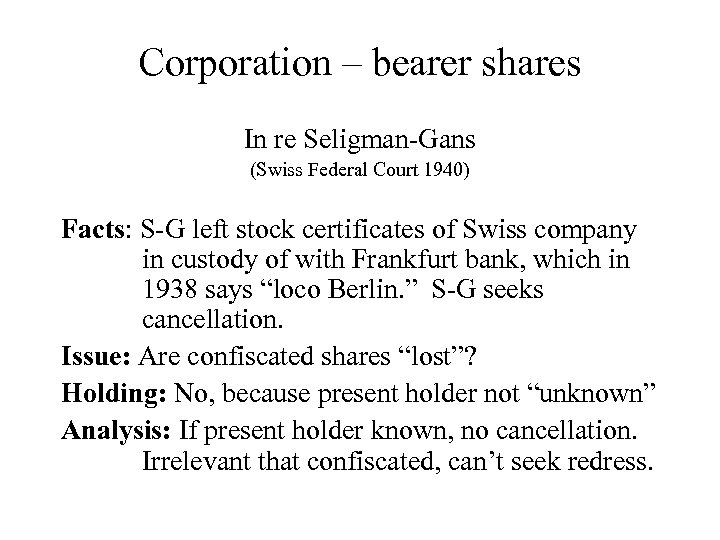

Corporation – bearer shares In re Seligman-Gans (Swiss Federal Court 1940) Facts: Issue: Holding: Analysis:

Corporation – bearer shares In re Seligman-Gans (Swiss Federal Court 1940) Facts: S-G left stock certificates of Swiss company in custody of with Frankfurt bank, which in 1938 says “loco Berlin. ” S-G seeks cancellation. Issue: Are confiscated shares “lost”? Holding: No, because present holder not “unknown” Analysis: If present holder known, no cancellation. Irrelevant that confiscated, can’t seek redress.

Corporation – bearer shares Would the S-Gs have redress in US court? Consider the sovereign immunity and jurisdictional defenses. What is the location of bearer shares?

Corporation – bearer shares How are shares of public companies held in Germany (bearer shares), compared to the United States (registered shares)? What is the effect?

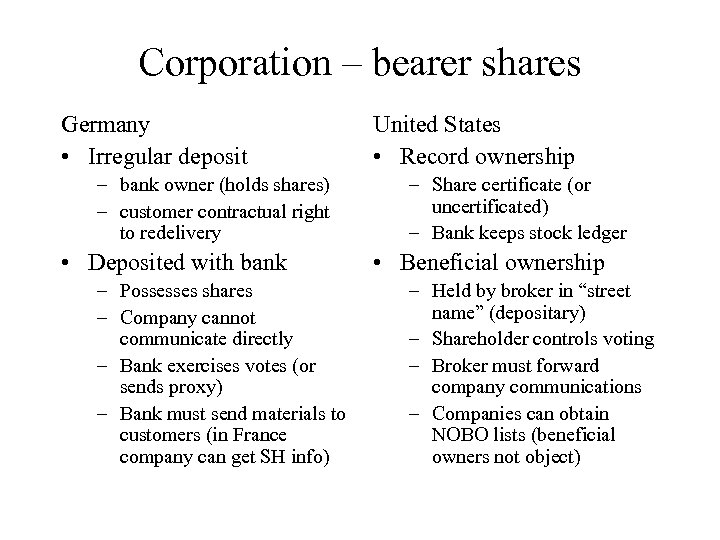

Corporation – bearer shares Germany • Irregular deposit – bank owner (holds shares) – customer contractual right to redelivery • Deposited with bank – Possesses shares – Company cannot communicate directly – Bank exercises votes (or sends proxy) – Bank must send materials to customers (in France company can get SH info) United States • Record ownership – Share certificate (or uncertificated) – Bank keeps stock ledger • Beneficial ownership – Held by broker in “street name” (depositary) – Shareholder controls voting – Broker must forward company communications – Companies can obtain NOBO lists (beneficial owners not object)

Corporation – bearer shares Who controls public companies in Germany? in the US?

Corporation – bearer shares

Corporation – bearer shares Can there be takeovers in Germany?

Corporation – bearer shares Do bearer shares make unfriendly takeovers easier or more difficult?

31dbba204558ceb7d522ee3aa718946e.ppt