7ba9b8f66e0595cdf61df6548b6fa66b.ppt

- Количество слайдов: 21

Corporate Transactions for IP Lawyers The Impact of IP on Corporate Transactions EFFECTIVE IP DILIGENCE: PROCESSES FOR CORPORATE TRANSACTIONS Maria S. Spustek IP Partner Schnader Harrison Segal & Lewis LLP One Montgomery Street, Suite 2200 San Francisco, California 94104 -5501 001. 415. 364. 6742 mspustek@schnader. com

Corporate Transactions for IP Lawyers The Impact of IP on Corporate Transactions EFFECTIVE IP DILIGENCE: PROCESSES FOR CORPORATE TRANSACTIONS Maria S. Spustek IP Partner Schnader Harrison Segal & Lewis LLP One Montgomery Street, Suite 2200 San Francisco, California 94104 -5501 001. 415. 364. 6742 mspustek@schnader. com

What is IP Diligence? • Managing business risk • Analysis of Target’s IP – – – Ownership (the Holy Grail) Right to Use Right to Stop Others from Using

What is IP Diligence? • Managing business risk • Analysis of Target’s IP – – – Ownership (the Holy Grail) Right to Use Right to Stop Others from Using

What is IP Diligence? (con’t) • Context of the Business Transaction – – – Investment/Financing Acquisition or Merger Licensing • Different Interests and Goals • Business always drives outcome (!)

What is IP Diligence? (con’t) • Context of the Business Transaction – – – Investment/Financing Acquisition or Merger Licensing • Different Interests and Goals • Business always drives outcome (!)

Why is IP Diligence Important? • Knowledge is Power – – – Assists in Transaction Valuation Highlights Potential Showstoppers Creates Leverage • Role Play – Strategically Fix “Problems” – Before Revealed as Weaknesses

Why is IP Diligence Important? • Knowledge is Power – – – Assists in Transaction Valuation Highlights Potential Showstoppers Creates Leverage • Role Play – Strategically Fix “Problems” – Before Revealed as Weaknesses

Why is IP Diligence Important? (con’t) • Process More Important than After-the-Fact Analysis – – – Different End Goals Likely Target’s Success ≠ Drive Purchaser to Complete the Deal Better Developed and Protected Portfolio = Greater Chance of Closing a Win-Win Deal

Why is IP Diligence Important? (con’t) • Process More Important than After-the-Fact Analysis – – – Different End Goals Likely Target’s Success ≠ Drive Purchaser to Complete the Deal Better Developed and Protected Portfolio = Greater Chance of Closing a Win-Win Deal

Practice Pointers • Create a Team • Familiarize the Team with Relevant Background Information • Check and Cross-Check – – – Personnel Interviews Document Review Independent Record Review

Practice Pointers • Create a Team • Familiarize the Team with Relevant Background Information • Check and Cross-Check – – – Personnel Interviews Document Review Independent Record Review

Create a Team • Team Members – In-house counsel • IP or corporate? – Outside counsel • IP and corporate? – Management • Directly involved with internal strategy regarding negotiations – Senior technical person(s) • Directly familiar with technology and product line(s) at issue

Create a Team • Team Members – In-house counsel • IP or corporate? – Outside counsel • IP and corporate? – Management • Directly involved with internal strategy regarding negotiations – Senior technical person(s) • Directly familiar with technology and product line(s) at issue

Create a Team (con’t) • Don’t reinvent the wheel (!) – Use 3 rd party resource checklists – Deviate when necessary • Drill-Down on specific IP sub-areas – Assess Strength, e. g. , for Patents • Breadth of patent claims • Design around options • Infringement by competitors • One Team Member to Coordinate – Act as Liaison between IP sub-specialties and Team’s goals, process and end result

Create a Team (con’t) • Don’t reinvent the wheel (!) – Use 3 rd party resource checklists – Deviate when necessary • Drill-Down on specific IP sub-areas – Assess Strength, e. g. , for Patents • Breadth of patent claims • Design around options • Infringement by competitors • One Team Member to Coordinate – Act as Liaison between IP sub-specialties and Team’s goals, process and end result

Familiarize with Relevant Background Information • Target’s Industry • Type of IP & Interplay with Target’s Industry – Pet food vs. integrated circuit design • Nature of Deal – Context, purpose, key terms • Practical Considerations – Target’s policies and practices • Look for the “Fit” between Target’s IP with Purchaser’s business goals

Familiarize with Relevant Background Information • Target’s Industry • Type of IP & Interplay with Target’s Industry – Pet food vs. integrated circuit design • Nature of Deal – Context, purpose, key terms • Practical Considerations – Target’s policies and practices • Look for the “Fit” between Target’s IP with Purchaser’s business goals

Check and Cross-Check • Verify information learned through multiple sources – No surprises (!) – Set internal timeframe for completion • “Getting Ready” for responding to Purchaser’s Due Diligence Requests • Anticipate…

Check and Cross-Check • Verify information learned through multiple sources – No surprises (!) – Set internal timeframe for completion • “Getting Ready” for responding to Purchaser’s Due Diligence Requests • Anticipate…

Personnel Interviews • Target’s knowledgeable employees and consultants – Attorney client privilege • Others at Target with potentially relevant information • Former employees and consultants?

Personnel Interviews • Target’s knowledgeable employees and consultants – Attorney client privilege • Others at Target with potentially relevant information • Former employees and consultants?

Document Review • Analyze all information and documents • Determine relevance • Organize in logical fashion – Create easy to follow tables, charts – Highlight key provisions, e. g. , • Ability to assign in light of change of control • Notice periods

Document Review • Analyze all information and documents • Determine relevance • Organize in logical fashion – Create easy to follow tables, charts – Highlight key provisions, e. g. , • Ability to assign in light of change of control • Notice periods

Independent Record Review • USPTO and WIPO • US Copyright Office • Patent annuity and maintenance fee records • Assignment records • Prosecution files • UCC filings • Internet and other resources • Applicability of foreign laws • SEC filings

Independent Record Review • USPTO and WIPO • US Copyright Office • Patent annuity and maintenance fee records • Assignment records • Prosecution files • UCC filings • Internet and other resources • Applicability of foreign laws • SEC filings

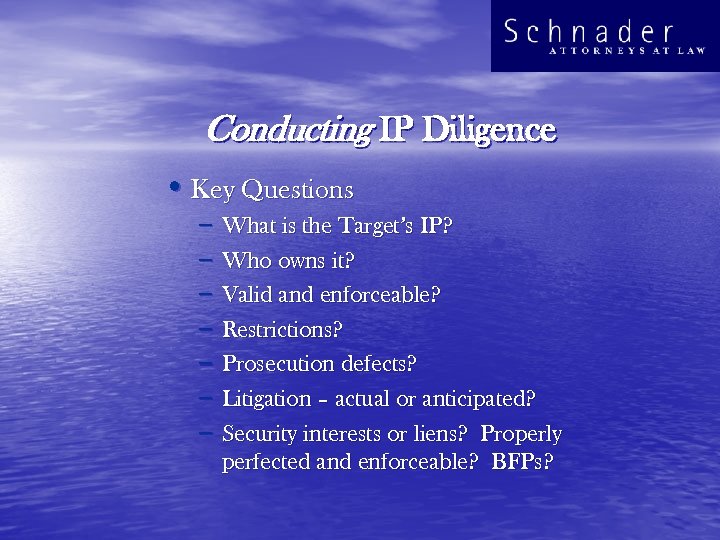

Conducting IP Diligence • Key Questions – – – – What is the Target’s IP? Who owns it? Valid and enforceable? Restrictions? Prosecution defects? Litigation – actual or anticipated? Security interests or liens? Properly perfected and enforceable? BFPs?

Conducting IP Diligence • Key Questions – – – – What is the Target’s IP? Who owns it? Valid and enforceable? Restrictions? Prosecution defects? Litigation – actual or anticipated? Security interests or liens? Properly perfected and enforceable? BFPs?

The IP and its Owner(s) • Identify and inventory – – Every IP asset Owned by or used in Target’s business Every supporting document Include inbound and outbound licenses • Categorize by Target’s products and services – Past, present, future • Keep format easy to understand

The IP and its Owner(s) • Identify and inventory – – Every IP asset Owned by or used in Target’s business Every supporting document Include inbound and outbound licenses • Categorize by Target’s products and services – Past, present, future • Keep format easy to understand

Nature and Scope of the Target’s Claimed Rights in its IP • Independently confirm – Ownership – Scope of rights in • Derivative works • Tech support services • Notice period • Non-solicitation and Non-compete – Availability of comparable technology – Ability to second source

Nature and Scope of the Target’s Claimed Rights in its IP • Independently confirm – Ownership – Scope of rights in • Derivative works • Tech support services • Notice period • Non-solicitation and Non-compete – Availability of comparable technology – Ability to second source

Validity of the Target’s Rights • Type specific • Assess relative strength – Trade secrets • Employee and 3 rd Party Consulting Agreements • NDAs, IP Assignments, entrance/exit interviews • Card swipe and Firewall policies and procedures • Evaluate internal IP maintenance programs – Written policies – Compliance procedures – (Unwritten) practices • Corrective measures? Conditions to closing?

Validity of the Target’s Rights • Type specific • Assess relative strength – Trade secrets • Employee and 3 rd Party Consulting Agreements • NDAs, IP Assignments, entrance/exit interviews • Card swipe and Firewall policies and procedures • Evaluate internal IP maintenance programs – Written policies – Compliance procedures – (Unwritten) practices • Corrective measures? Conditions to closing?

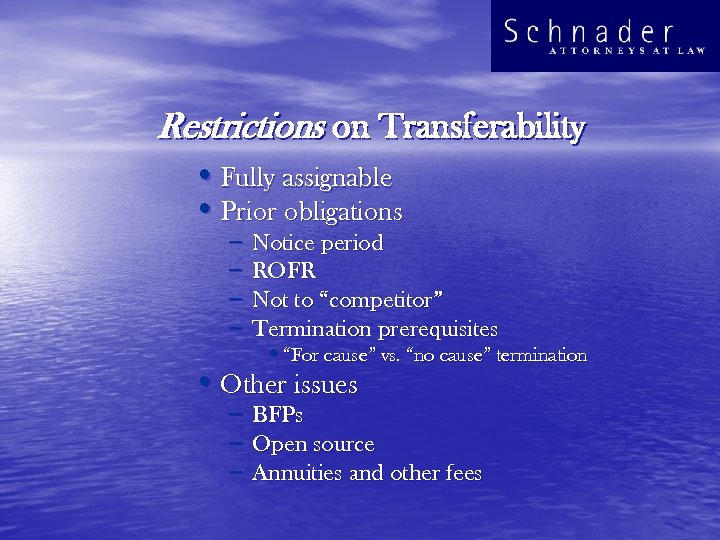

Restrictions on Transferability • Fully assignable • Prior obligations – – Notice period ROFR Not to “competitor” Termination prerequisites • “For cause” vs. “no cause” termination • Other issues – – – BFPs Open source Annuities and other fees

Restrictions on Transferability • Fully assignable • Prior obligations – – Notice period ROFR Not to “competitor” Termination prerequisites • “For cause” vs. “no cause” termination • Other issues – – – BFPs Open source Annuities and other fees

IP Infringement Claims and Other Issues • Why important? – Reps/Warranties – Indemnification • By Target and by individual founders • Past, present, or anticipated disputes – Which companies (specific products/services) compete? • Both vantages (!) • Actually protect in a commercially relevant manner?

IP Infringement Claims and Other Issues • Why important? – Reps/Warranties – Indemnification • By Target and by individual founders • Past, present, or anticipated disputes – Which companies (specific products/services) compete? • Both vantages (!) • Actually protect in a commercially relevant manner?

Wrap-Up • Multitude of factors and players – Transaction specific • Even for separate deals for same Target – Drill down – Keep it real – Be cost sensitive – Be malleable • Job isn’t over until closing docs signed and post close details completed

Wrap-Up • Multitude of factors and players – Transaction specific • Even for separate deals for same Target – Drill down – Keep it real – Be cost sensitive – Be malleable • Job isn’t over until closing docs signed and post close details completed

Thank You!

Thank You!