6828f5559016a3e5b07e7245a80c62f9.ppt

- Количество слайдов: 76

Corporate Responsibility Programme 2009 / 2010 Provident Pénzügyi Zrt. Contact: Mr. Csongor HAJNA, CR manager csongor. hajna@provident. hu, +36 -20 -339 -0549 0

Who are we? 1

IPF and Provident Pénzügyi Zrt. § IPF: a multinational finance company § listed on the London Stock Exchange § as International Personal Finance (IPF) § British origins, 125 years of history § 2, 100, 000+ customers worldwide § (UK), Mexico, Poland, Czech Republic, Slovakia, Hungary, Romania § Hungarian affiliate: Provident Pénzügyi Zrt. 2

Provident Pénzügyi Zrt. § Hungarian affiliate of IPF Provident Pénzügyi Zrt. § founded in 2001 § offers small fast cash loans • to individuals • with (optional) home service § 230, 000 customers § 120 facilities § 3, 500 employees • a major employer in Hungary 3

The Provident service in Hungary § Fast loans § § with (optional) home service: in 48 hours if credit assessment is positive § Amount between 30, 000 and 220, 000 HUF § Short term, 30/45/60 weeks § No limitations in use § Bank transfer (with optional unique home service based on customer decision) § Non-secured 4

Customer satisfaction* § § § 92 % satisfied with efficiency and speed of service 90 % finds loan agreement easy to understand 93 % satisfied with the work of our agents 90 % satisfied with home service above KPIs increased year by year so far Our experience says … Provident customers are well satisfied; they recommend our services to acquaintances. 20 % of our customers contact us based on recommendations from our present customers. This is an important ingredient of our success. 5 * ‘Usage & Attitude Survey‘ by external marketing research supplier, 2009

Challenges § Low financial education level in Hungary § business model virtually unknown issues • extra services higher price (home service) • short term high APR § decision makers and the media needs education • e. g. : APR confused with interest or profit (!) § Special economic and political environment § financial crisis sensitive public § continuous „election campaign” criticism motivated by politics 6

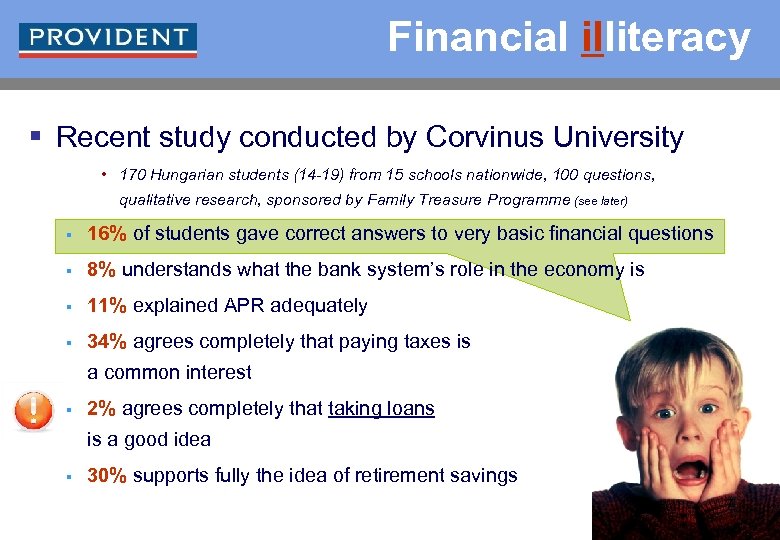

Financial illiteracy § Recent study conducted by Corvinus University • 170 Hungarian students (14 -19) from 15 schools nationwide, 100 questions, qualitative research, sponsored by Family Treasure Programme (see later) § 16% of students gave correct answers to very basic financial questions § 8% understands what the bank system’s role in the economy is § 11% explained APR adequately § 34% agrees completely that paying taxes is a common interest § 2% agrees completely that taking loans is a good idea § 30% supports fully the idea of retirement savings 7

Approach and Framework 8

CR aspects we find important § responsible marketing § governance and transparency § responsible management of resources § (environment, RSCM, …) § employee relations § (not just financial) sustainability equal opportunities § reputation management § compliance § reporting (investor relations) § … community relations § § responsible lending inform regulators and legislation (‘PA’) 9

Policies, programmes, resources § Policies & programmes § Responsible lending (FSA TCF) § Community investment (financial literacy) § Environment § Responsible supply chain management § Bribery & corruption, political donations, lobbying § Whistleblowing § Human rights, … § Effectiveness measures § Dedicated resource in-country § Incentives & job descriptions § Wider targets and objectives § Training § Monitoring and auditing, … 10

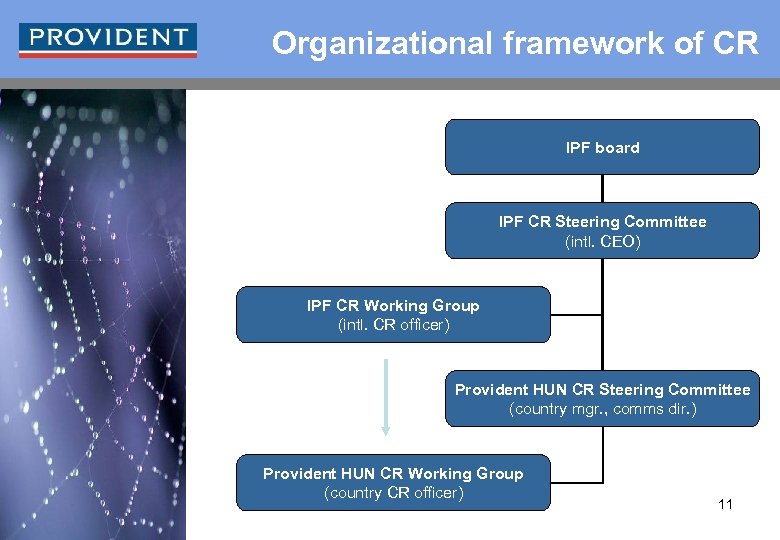

Organizational framework of CR IPF board IPF CR Steering Committee (intl. CEO) IPF CR Working Group (intl. CR officer) Provident HUN CR Steering Committee (country mgr. , comms dir. ) Provident HUN CR Working Group (country CR officer) 11

Business Performance 2009* 12 *2010 financial results not available yet

![IPF share price and FTSE 250 [ recovery from the crisis ] [ global IPF share price and FTSE 250 [ recovery from the crisis ] [ global](https://present5.com/presentation/6828f5559016a3e5b07e7245a80c62f9/image-14.jpg)

IPF share price and FTSE 250 [ recovery from the crisis ] [ global financial crisis ] 13

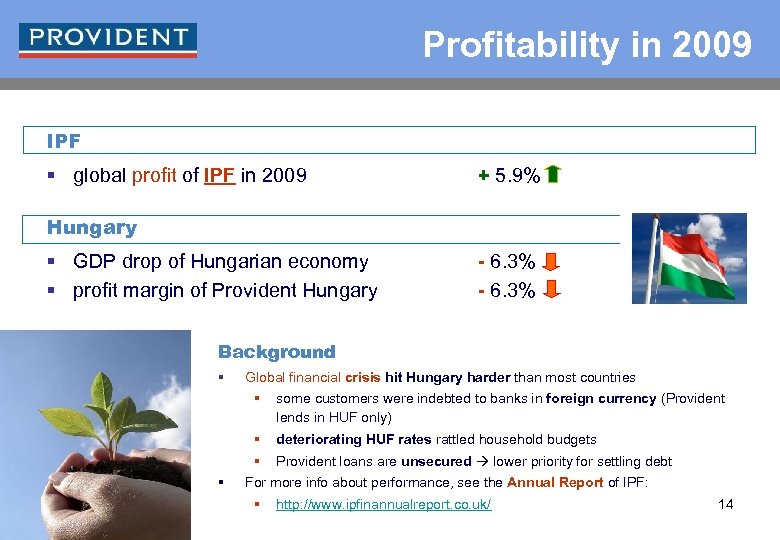

Profitability in 2009 IPF § global profit of IPF in 2009 + 5. 9% Hungary § GDP drop of Hungarian economy § profit margin of Provident Hungary - 6. 3% Background § Global financial crisis hit Hungary harder than most countries § § deteriorating HUF rates rattled household budgets § § some customers were indebted to banks in foreign currency (Provident lends in HUF only) Provident loans are unsecured lower priority for settling debt For more info about performance, see the Annual Report of IPF: § http: //www. ipfinannualreport. co. uk/ 14

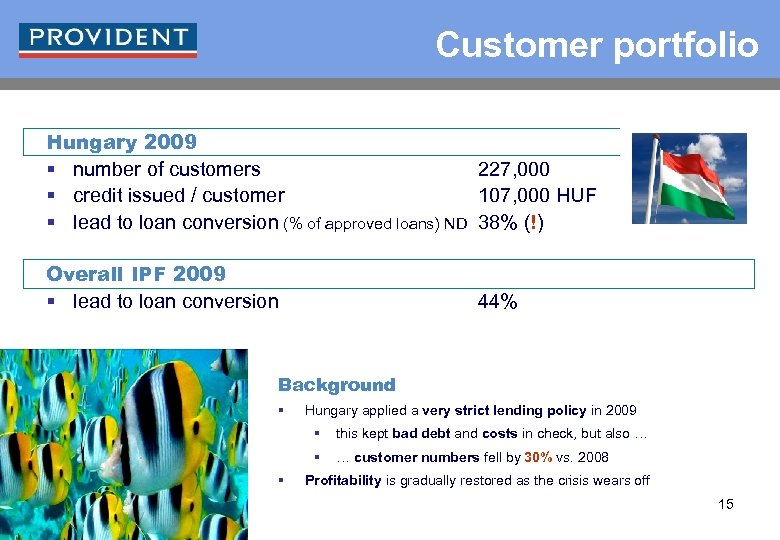

Customer portfolio Hungary 2009 § number of customers 227, 000 § credit issued / customer 107, 000 HUF § lead to loan conversion (% of approved loans) ND 38% (!) Overall IPF 2009 § lead to loan conversion 44% Background § Hungary applied a very strict lending policy in 2009 § § § this kept bad debt and costs in check, but also … … customer numbers fell by 30% vs. 2008 Profitability is gradually restored as the crisis wears off 15

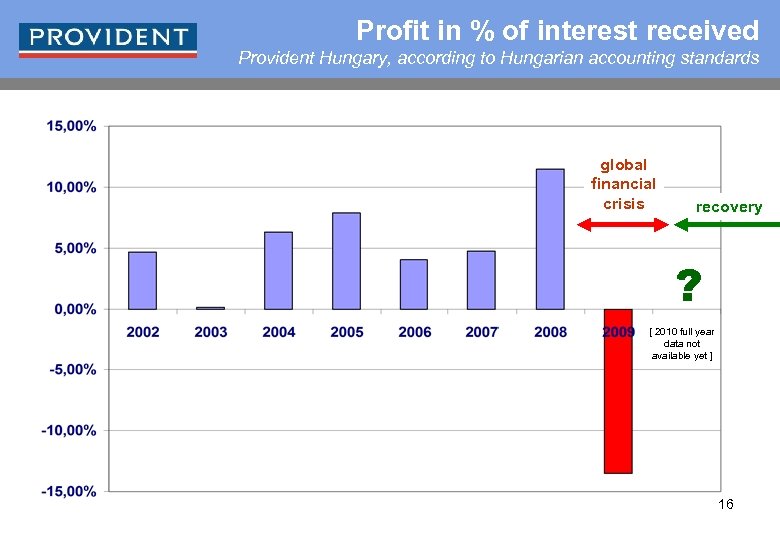

Profit in % of interest received Provident Hungary, according to Hungarian accounting standards global financial crisis recovery ? [ 2010 full year data not available yet ] 16

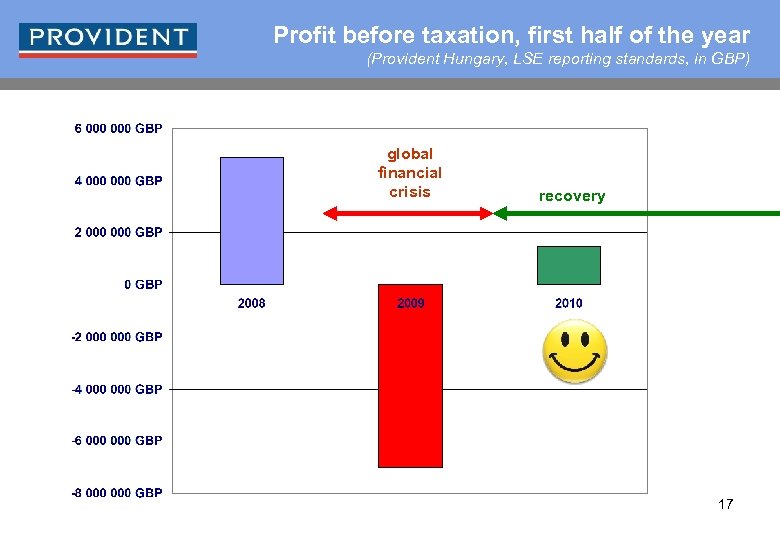

Profit before taxation, first half of the year (Provident Hungary, LSE reporting standards, in GBP) global financial crisis recovery 17

Credit control measures § Self imposed limitations in issuing loans (list not full) § weekly installment per customer must not exceed HUF 9. 000 § one customer can’t take more than 3 loans § total amount issued to one customer is limited in HUF 500. 000 § above HUF 180. 000 employment certificate is required 18

Responsibility and profitability § Responsible lending helped Provident minimize losses § strict lending policies improved customer portfolio § Provident has started tightening lending criteria BEFORE the crisis § IPF is committed to maintain operations in Hungary 19

Responsible Corporate Management 20

Governance § Safeguarding mechanisms § yearly independent audits, internal inspectorate reporting to intl. board, whistle blowing, … § Base documents § § § corporate policies for each functional area to comply with practical best practice guides for each business unit Evidence based yearly compliance check 21

Sample BPG testing sheet (excerpt) Each of our business units regularly test themselves against best practice guides. Provident markets check each other’s performance for more accountability and dissemination of knowledge. 22

RSCM (Responsible Supply Chain Management) § RSCM aims to eliminate CR risks involved with suppliers § societal, ethical, environmental, … § Feeds into the purchasing system § enforces evaluation of key suppliers based on CR criteria as well § contains clear policies about how to deal with suppliers • exerts counter-corruption effect 23

RSCM (Responsible Supply Chain Management) § RSCM questionnaire is part of tendering materials § Clearly communicates principles to suppliers § Linked to the Environmental Programme § environmental risk assessment of all major suppliers • cars, cell phones, paper, fuel, cleaning, stationery, … 24

Code of Conduct § Provident has voluntarily signed the Code of Conduct for Hungarian banks and financial institutions on 13 th October, 2009 § Aim of the Code is to strengthen the confidence indispensable in the relationship between retail borrowers and creditors „Creditor institutions commit themselves to responsible and transparent lending to their retail customers, in their proceedings during the period preceding the lending transaction and the entire term of the credit granted alike, as well as upon the occurrence of payment difficulties” 25

Treating Customers Fairly 26

Treating Customers Fairly (TCF) § A complex consumer protection initiative § Started by the UK Financial Supervisory Authority • UK equivalent of „PSZÁF” § FSA co-operates with companies in reaching TCF standards • responsible marketing, best practice guides for operation, informing customers properly, no-barrier early settlement procedures, etc. • For more info follow << this >> link to the FSA's TCF website § IPF joined TCF in 2008 § all Provident affiliates (including Hungary) participate § top management commitments, high priority 27

Treating Customers Fairly (TCF) § Our participation is voluntary § IPF is not a bank technically we were not required to join § FSA regulations do not bind in Hungary § In some areas TCF standards are stricter than Hungarian regulations § Still, we believe that … § … sustainable growth stems from responsible lending § … responsible lending is a competitive advantage 28

Treating Customers Fairly (TCF) Several requirements by TCF: § Provide customers with clear and sufficient information about loan products § Center your service around customer needs and satisfaction § Offer customers a variety of choices (flexible products) §Make sure your agents and customers know their rights and obligations § Enhance Best Practice Guides (esp. for operations) and stick to them § Make sure all complaints are properly dealt with § Observe responsible lending KPIs (‘TCF MI’) while making decisions § etc, etc … 29

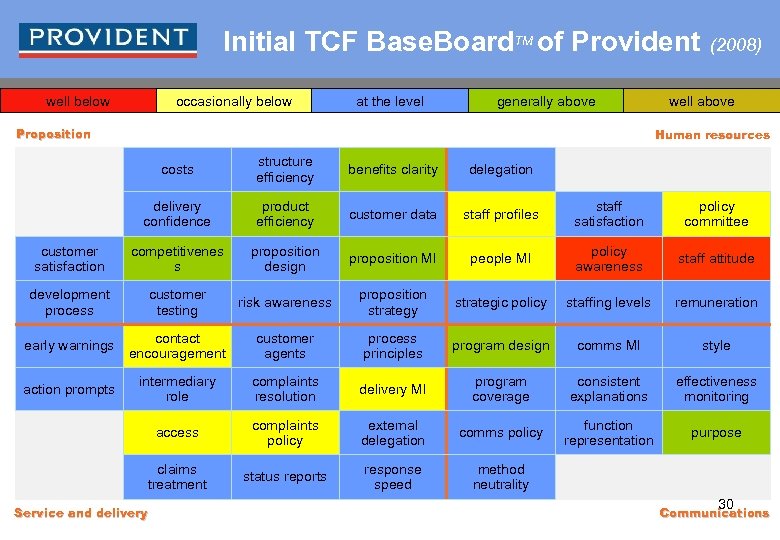

Initial TCF Base. Board. TM of Provident well below occasionally below at the level generally above Proposition (2008) well above Human resources costs structure efficiency benefits clarity delegation delivery confidence product efficiency customer data staff profiles staff satisfaction policy committee customer satisfaction competitivenes s proposition design proposition MI people MI policy awareness staff attitude development process customer testing risk awareness proposition strategy strategic policy staffing levels remuneration early warnings contact encouragement customer agents process principles program design comms MI style action prompts intermediary role complaints resolution delivery MI program coverage consistent explanations effectiveness monitoring access complaints policy external delegation comms policy function representation purpose claims treatment status reports response speed method neutrality Service and delivery 30 Communications

Responsible marketing The ‘ 60/30/10’ concept § 60% product marketing § What is APR? with new, human focused approach § 30% education § 10% image building „Get cash, now!” „In case you fell a bit short. ” 31

Examples for TCF tools § Agent charter § a document given to all Provident representatives • booklet, part of starter kit § aims for mutual understanding • clearly explains rights and obligations of Provident representatives • includes notions about required service level, safety, responsible lending, etc. • informs about feedback channels 32

Examples for TCF tools § Customer Charter § a document sent to all customers • included into the welcome letter § clearly explains • what we offer • fast, comfortable, honest service • what we expect • taking loans responsibly, timely repayments, respect 33

TCF Management Information (TCF MI) 34

TCF Management Information § Purpose § MEASURE responsible lending • 35 (!) different factors, monthly § USE DATA while making decisions § SAFEGUARD interests of customers § Model § collect data from internal data owners § compare data to required levels § refine operations based on results § start again (monthly) 35

TCF MI sample KPIs § Product – relevant? § § customer satisfaction % customer retention § Customer care – high quality? § § § perception of service complaints (module under discussion, not yet implemented) call centre response time and % § Agents – available? § § training level retention and turnover 36

TCF MI sample KPIs § Lending – responsible? § compliance with policies • lending, admin, comms, … • checked by independent agency § exceptions % vs. RISK standards • block manual override of policies • benchmark: 0% § meaningful indicators • acceptance rates (lead to loan conversion) • loans cancelled within 15 days • arrears (under discussion, not yet implemented) 37

Provident Community Programme 38

Provident community grants § Support local community initiatives or good causes § through recommendations from colleagues § Dedicated application form & guide § available through intranet and managers § Strict evaluation criteria § benefits for the cause AND the company § earmarked funds assigned in advance § projects compete for resources § proven model with 4 years’ history 39

Community projects Evaluation criteria Provident Community Grant Scoring Model § Weighed, percentage based evaluation of eligibility factors § Grants depend on score ranking and available budget § Alignment to CR strategy § Impact / investment (efficiency) § Adequacy to community needs § Professional background of applicants § Employee involvement § Comms and public affairs value • for the supported cause and for us § Long term opportunities 40

Community investments (LBG KPIs) 2009 § 15. 35 M HUF community investment § § 55 community projects § § both company and free time 1. 4 M HUF in-kind donations § § incl. financial literacy and environment 2, 169 volunteers § § excluding management costs used computers donated to charities 45. 23 M leverage § incl. partnerships, employee gifts vocational training, etc. § Ranked 17 th on the Hungarian Donors Forum’s „ 2009 Corporate Donor of the Year” TOP 20 list 41

Guardian Angel Programme § Toy collection volunteer campaign § for disadvantaged kids, countrywide • Provident employees collect used or new toys § children’s wards, nurseries, school for handicapped, … • 5, 000 toys, 1, 000 donors, 25 partners 42

Flood relief 2010 § 8 M HUF aid to communities hit by the flood § distributed by the Hungarian Interchurch Aid § 40 contributed with their own individual cash donations § Edelény – financial crisis management training for local social workers and professionals § on request of the local community, involving a social psychologist 43

A sample community project § Handicapped Children’s Day, Eger (June 2010) § organized by the Heves County Home for Disabled Children § children, conductors and parents prepare for the celebrations together § Provident supports the cause since 2005 § colleagues regularly help the institution with volunteer work as well 44

A sample community project § HBLF Wheelchair Basketball Cup § corporate teams compete each other, helped by handicapped sportsmen § Provident participates and sponsors the Cup since 2005 § the project facilitates re-integration of disabled people 45

Reporting, KPIs IPF Community Report § Follow << this >> link to the 2009 CR report of IPF § Provident Hungary reports its „official” (=audited) CR performance through IPF § Report is based on GRI (Global Reporting Initiative) § data compiled from IPF members through standardized reporting system 46

Environmental Management System 47

Environmental Programme Goals § keep eco footprint of the company low § give people an opportunity to get involved (volunteerism) § shape the opinion of 3. 400 people ( community impact) 48

Reporting, KPIs Environmental Management System § Reporting is based on ISO 14001 environmental management standards* § Yearly audit and trainings by SEQM Ltd. in each country § controls, management § KPIs § achievements vs. targets * IPF has not applied for an official ISO 14001 certificate but follows the model’s standards 49

Environmental Programme Annual work plan – main target areas § Save energy § Minimize transport related CO 2 emission § Reduce reliance on and use of paper § Enhance recycling § Improve measuring and reporting § Motivate and educate people § For 2009, we have set 24 specific goals • 18 were fully achieved • 4 we have reached at least partially • only 2 remained uncomplete 50

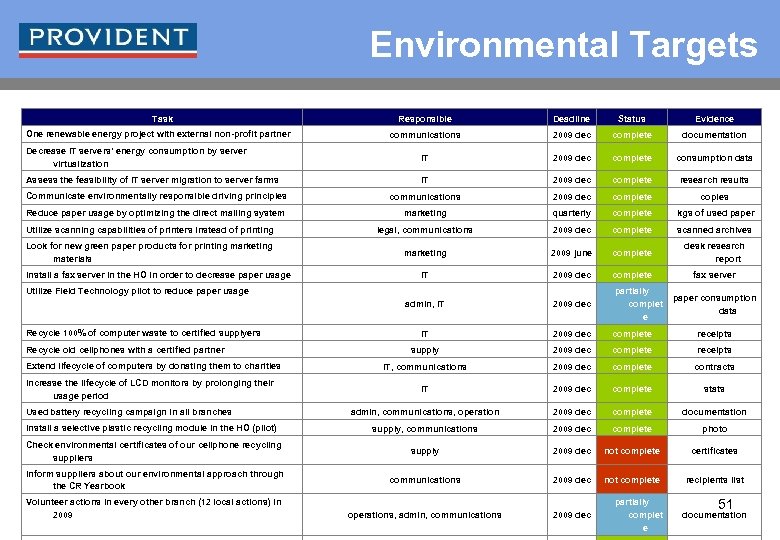

Environmental Targets Task Responsible Deadline Status Evidence communications 2009 dec complete documentation Decrease IT servers' energy consumption by server virtualization IT 2009 dec complete consumption data Assess the feasibility of IT server migration to server farms IT 2009 dec complete research results Communicate environmentally responsible driving principles communications 2009 dec complete copies Reduce paper usage by optimizing the direct mailing system marketing quarterly complete kgs of used paper Utilize scanning capabilities of printers instead of printing legal, communications 2009 dec complete scanned archives Look for new green paper products for printing marketing materials marketing 2009 june complete desk research report IT 2009 dec complete fax server admin, IT 2009 dec partially complet e IT 2009 dec complete receipts supply 2009 dec complete receipts IT, communications 2009 dec complete contracts IT 2009 dec complete stats admin, communications, operation 2009 dec complete documentation Install a selective plastic recycling module in the HO (pilot) supply, communications 2009 dec complete photo Check environmental certificates of our cellphone recycling suppliers supply 2009 dec not complete certificates Inform suppliers about our environmental approach through the CR Yearbook communications 2009 dec not complete recipients list operations, admin, communications 2009 dec One renewable energy project with external non-profit partner Install a fax server in the HO in order to decrease paper usage Utilize Field Technology pilot to reduce paper usage Recycle 100% of computer waste to certified supplyers Recycle old cellphones with a certified partner Extend lifecycle of computers by donating them to charities Increase the lifecycle of LCD monitors by prolonging their usage period Used battery recycling campaign in all branches Volunteer actions in every other branch (12 local actions) in 2009 partially complet e paper consumption data 51 documentation

Environmental highlights 2009 § 11% less car fleet CO 2, 63% less flight CO 2 § 75% (!) saved on IT server electricity (virtualization) § 24 (=all) branches collect batteries & toners separately § 4 branches with plastic bottle shrinking device § 26% increase in recycled paper § 8 local environmental volunteer projects § 60% (!) decrease in marketing paper purchase § 57% (!) decrease in printer and fax toner use § 23 used computers donated to charities 52

Partnerships 53

Professional bodies § Membership § British Chamber of Commerce in Hungary (BCCH) § American Chamber of Commerce in Hungary (Am. Cham) § National Union of Financial Enterprises (PVOE) § Co-operation § Hungarian Business Leaders Forum (HBLF) § KÖVET Association for Sustainable Economies (CSR Europe HUN) § Hungarian Donors Forum (MAF) 54

NGO Partners (sample selection) 55

Provident and CSR Europe § IPF is an active member of CSR Europe § participant in major international CR projects • CSR Market. Place, CSR Laboratories, stakeholder dialogue, CSR Newsbundle, … § continuous, mutual exchange of information and knowledge • responsible lending, diversity, environment, financial self-sustainability, financial literacy … Kerstin Born CEO, CSR Europe special guest in the 2009 IPF corporate responsibility report 56

Mediums started to recognize CR § 288 clippings about Provident’s CR projects in 6 months (Jan-June 2010) § appx. 70% (!) branded (2007: 50%) 57

Financial literacy Family Treasure Programme 58

Financial literacy Why is it important for us? § Vast societal needs overlap with our core business • „A company is as much responsible as its core business” § Financial illiteracy is a major problem in Hungary • Social workers, researchers, teachers recognized the gap • We can react faster than the education system § EU priority § consumer protection, consumer credit directive, … 59

Financial literacy The programme in a nutshell The Family Treasure Programme § Education of families in finances § financial self sustainability § Open partnership of organizations § § Activity + communication Provident: initiator and chief sponsor § Started in 2008 § no end date defined www. csaladikassza. hu 60

Financial literacy Contents of the programme § Attitude § think ahead, calculate, save, read before sign, buy smart, be responsible, … § Methodology § how to plan ahead, how to save / buy smart, etc. § Tools § e. g. : family budget calculator § Exchange of knowledge 61

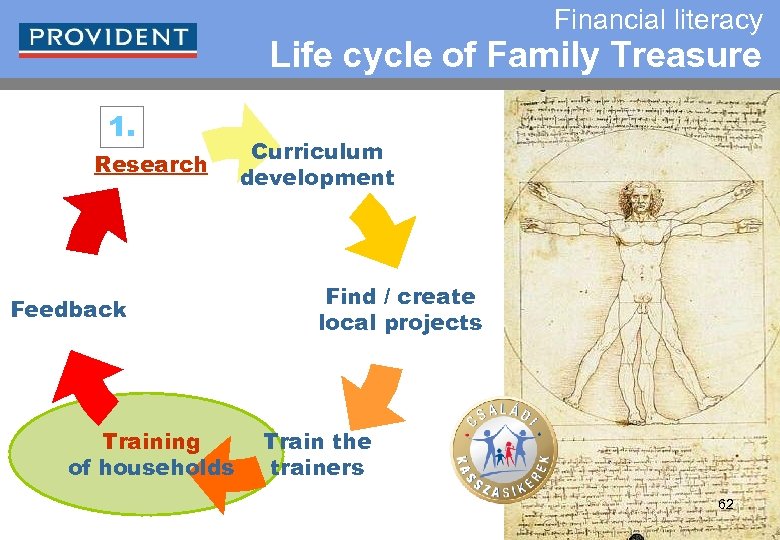

Financial literacy Life cycle of Family Treasure 1. Research Feedback Training of households Curriculum development Find / create local projects Train the trainers 62

Financial literacy partners § Corvinus University of Economics § Development of training materials § United Way Hungary § Project recruitment, training and monitoring § Training project networks § Maltese Charity Service, SOS Childrens’ Village, Association of Foster Homes, … § Family Help Centers § local training projects, curriculum development § link to local (or sometimes national) government 63

„Family Treasure” Programme Sample project – Family budget training § Home budgeting and financial self-sustainability training course for underprivileged families in the Hatvan Local Family Help Center (2009 summer) § utilizing the „Family Treasure” curriculum § by local social workers 64

Sa mp le „Family Treasure” Programme Training for professionals pro j e c § Balatonalmádi Training Day * June 9 th, 2010 t § Financial self-sustainability training for regional social experts • 20+ settlements covered, knowledge disseminated to clients § All self-governmental institutions delegated participants § Event opened by the Chairman of the Social Committee 65

Youth citizenship and financial education with Eötvös University of Sciences Bíbó István College 66 30. 04. 2009 // Kunfehértó

„Family Treasure” Programme Grant programme for local governments § Announcement of grant recipients * April 20 th, 2010 § 5 local governments received resources for launching fin. lit. projects § event combined with conference and training for recipients § „Family Treasure” partners congratulated to the winners • Corvinus University, Hungarian Maltese Charity Service, United Way 67 Lajos Győri-Dani, vice president of the Hungarian Maltese Charity Service

„Family Treasure” Programme § 5 local pilots in 2008 § 40 + In numbers Budapest XIII and VIII, Kaposvár, Hernádvécse, Tápiószecső § 8 local pilots in 2009 § Kistarcsa, Veresegyház, Hatvan, Békéscsaba, Kiskunfélegyháza, Szombathely, Budapest III, Siklós § 5 local projects in 2010 § Körmend, Keszthely, Zalaszentgrót, Komárom, Kisvárda § 2 regional trainings for social workers § Szolnok, Balatonalmádi § Partnerships § 3 x ELTE Bibó College, 9 x Maltese Charity Service, 3 x Eco. Sim Student Management Championship, 2 x SOS Children’s Village § 3 x TAMOP partnerships: BHKE, Sellye, Bonnya 68

Financial literacy The website Website http: //www. csaladikassza. hu V 2. 0 § Knowledge base § practical hints for households § Resources to download § Reports on projects, news § Feedback opportunity 69

Financial literacy Family Budget Calculator § Downloadable from www. csaladikassza. hu § Smart – incomes, expenditures, stats, … § Easy to use (design based on research) § Freeware § Developed exclusively for the programme 70

Financial literacy Family Budget Notebook v 1. 0 § Downloadable from www. csaladikassza. hu § Printable (*. pdf) tool, tracks and plans family budget § 4 different tools (incomes/expenditures, planning, statistics) § developed especially for the programme § in co-operation with social workers 71

Financial literacy What’s in it for us? § Manage risks with (potential) customers § taking loans responsibly § proper home budgeting reliable repayments § APR education § Platform for stakeholder dialogue § presence within the local communities § contacts with decision makers and opinion leaders § Improved corporate image 72

„Family Treasure” Programme Links to society at large § Knowledge competitiveness • Responsible financial decisions of citizens result in a more stable and prosperous economy § Self-sustainability or dependence on the state social care system? • Rational and pro-active behaviour on the labour market requires knowledge and responsible attitude • Investing in financial literacy and shaping attitudes may cost less than unemployment benefits • A sustainable pension system would require more savings from the citizens’ side 73

„Family Treasure” Programme Further benefits for decision makers § Responsible attitude of citizens better labour and tax morale § Balance of the state budget fairly depends on attitudes of citizens § Votes politics economy politics (ultimately) § Prudent voters ~ prudent directions • home budget ~ state budget § Lack of knowledge gives room for populism 74

Thank you for your attention! 75

6828f5559016a3e5b07e7245a80c62f9.ppt