ecbadd489d509f58de8aa685d7767fdf.ppt

- Количество слайдов: 29

Corporate Presentation COPIC Energy Fall Conference Questerre Energy Corporation October 2 -4, 2007

Corporate Presentation COPIC Energy Fall Conference Questerre Energy Corporation October 2 -4, 2007

Forward Looking Statement This presentation contains forward-looking information. Implicit in this information are assumptions regarding oil and natural gas prices, production, royalties and expenses that, although considered reasonable by Questerre at the time of preparation, may prove to be incorrect. These forwardlooking statements are based on certain assumptions that involve a number of risks and uncertainties and are not guarantees of future performance. Actual results could differ materially as a result of changes in Questerre’s plans, changes in commodity prices, general economic, market, regulatory and business conditions as well as production, development and operating performance and other risks associated with oil and gas operations. There is no guarantee by Questerre that actual results achieved will be the same as those forecast herein. Estimated values in this presentation do not represent fair market value.

Forward Looking Statement This presentation contains forward-looking information. Implicit in this information are assumptions regarding oil and natural gas prices, production, royalties and expenses that, although considered reasonable by Questerre at the time of preparation, may prove to be incorrect. These forwardlooking statements are based on certain assumptions that involve a number of risks and uncertainties and are not guarantees of future performance. Actual results could differ materially as a result of changes in Questerre’s plans, changes in commodity prices, general economic, market, regulatory and business conditions as well as production, development and operating performance and other risks associated with oil and gas operations. There is no guarantee by Questerre that actual results achieved will be the same as those forecast herein. Estimated values in this presentation do not represent fair market value.

Presentation Outline • Company Overview – – – Strategy Asset Overview Management & Directors Capitalization Financial Highlights • Area Overview – – Beaver River Field, British Columbia Antler, Saskatchewan – Magnus Acquisition Southern & Central Alberta St. Lawrence Lowlands, Quebec • Outlook • Investment Case

Presentation Outline • Company Overview – – – Strategy Asset Overview Management & Directors Capitalization Financial Highlights • Area Overview – – Beaver River Field, British Columbia Antler, Saskatchewan – Magnus Acquisition Southern & Central Alberta St. Lawrence Lowlands, Quebec • Outlook • Investment Case

Company Overview • Frontier Canada – full cycle exploration & development targeting pools over 60 Bcf (10 mmboe) • Strategy – Buy Early - Acquire significant land positions in overlooked or underdeveloped areas – Add Value - leverage technical expertise “understand the rocks” to high grade land positions – Reduce risk – Farmout to partners and create a diversified portfolio of upsides – Create shareholder value – Prove up reserves and production for long term value • Success to date – Created a portfolio of opportunities to discover world-scale natural gas fields with access to markets – Recently agreed to acquire a significant oil resource play – Partners including Talisman and Forest Oil have farmed in on Questerre prospects – Base of cash flow and reserves has been established

Company Overview • Frontier Canada – full cycle exploration & development targeting pools over 60 Bcf (10 mmboe) • Strategy – Buy Early - Acquire significant land positions in overlooked or underdeveloped areas – Add Value - leverage technical expertise “understand the rocks” to high grade land positions – Reduce risk – Farmout to partners and create a diversified portfolio of upsides – Create shareholder value – Prove up reserves and production for long term value • Success to date – Created a portfolio of opportunities to discover world-scale natural gas fields with access to markets – Recently agreed to acquire a significant oil resource play – Partners including Talisman and Forest Oil have farmed in on Questerre prospects – Base of cash flow and reserves has been established

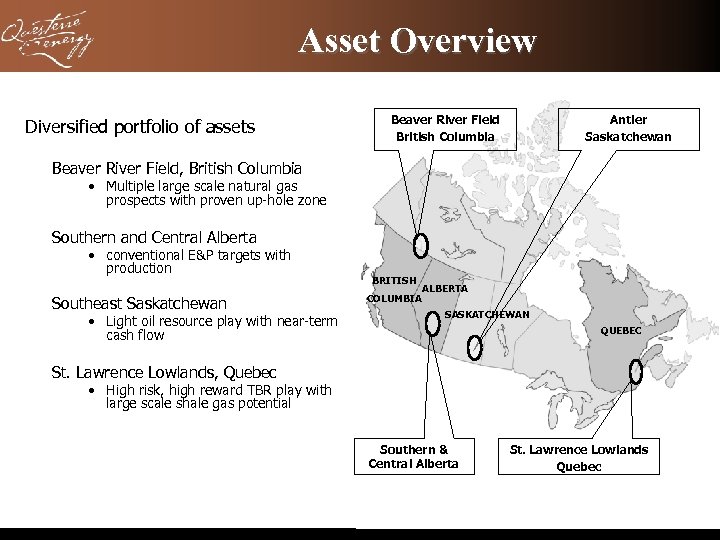

Asset Overview Diversified portfolio of assets Beaver River Field British Columbia Antler Saskatchewan Beaver River Field, British Columbia • Multiple large scale natural gas prospects with proven up-hole zone Southern and Central Alberta • conventional E&P targets with production Southeast Saskatchewan • Light oil resource play with near-term cash flow BRITISH COLUMBIA ALBERTA SASKATCHEWAN QUEBEC St. Lawrence Lowlands, Quebec • High risk, high reward TBR play with large scale shale gas potential Southern & Central Alberta St. Lawrence Lowlands Quebec

Asset Overview Diversified portfolio of assets Beaver River Field British Columbia Antler Saskatchewan Beaver River Field, British Columbia • Multiple large scale natural gas prospects with proven up-hole zone Southern and Central Alberta • conventional E&P targets with production Southeast Saskatchewan • Light oil resource play with near-term cash flow BRITISH COLUMBIA ALBERTA SASKATCHEWAN QUEBEC St. Lawrence Lowlands, Quebec • High risk, high reward TBR play with large scale shale gas potential Southern & Central Alberta St. Lawrence Lowlands Quebec

Management • • • Michael Binnion, President & Chief Executive Officer John Brodylo, VP Exploration (Nexen) Peter Coldham, VP Engineering & Operations (Chevron) Jason D’Silva, VP Finance (Can. Argo, Flowing) Wayne Hauck, Geophysicist (Murphy Oil, Philips) Richard Mindus, Operations Manager (Nexen) Ian Nicholson, Manager, Alberta (Beau Canada, Kerr Mc. Gee) Maria Rees, Corporate Secretary (Can. Argo, Flowing) Rick Tityk, VP Land (Hunt Oil) Senior multi-disciplinary team well experienced in large-scale and conventional projects have invested together with directors $12 million

Management • • • Michael Binnion, President & Chief Executive Officer John Brodylo, VP Exploration (Nexen) Peter Coldham, VP Engineering & Operations (Chevron) Jason D’Silva, VP Finance (Can. Argo, Flowing) Wayne Hauck, Geophysicist (Murphy Oil, Philips) Richard Mindus, Operations Manager (Nexen) Ian Nicholson, Manager, Alberta (Beau Canada, Kerr Mc. Gee) Maria Rees, Corporate Secretary (Can. Argo, Flowing) Rick Tityk, VP Land (Hunt Oil) Senior multi-disciplinary team well experienced in large-scale and conventional projects have invested together with directors $12 million

Board of Directors • Les Beddoes, Jr. – International Exploration - Former VP Exploration for Bow Valley Industries, Victoria, BC • • Michael Binnion, President & Chief Executive Officer Russ Hammond – Corporate Finance - Former Managing Director, Greenwell Montague, London, UK • David Mallory – Chairman of Audit, Corporate Governance and Reserves Committee – Financial Management & Governance - Former CFO Guardian Exploration, Flowing Energy, Calgary, Alberta • Tom Landry, Jr. – Oil & Gas E&P and Service Sector - Oil and gas investor & lawyer, Dallas, Texas • Peder Paus, Chairman – Merchant banker – Former Managing Director Manufacturers Hanover Trust, London, New York, Oslo • Jed Wood – Oil & Gas E&P and Service Sector - Founder and CEO High Arctic Energy Services, Red Deer, Alberta

Board of Directors • Les Beddoes, Jr. – International Exploration - Former VP Exploration for Bow Valley Industries, Victoria, BC • • Michael Binnion, President & Chief Executive Officer Russ Hammond – Corporate Finance - Former Managing Director, Greenwell Montague, London, UK • David Mallory – Chairman of Audit, Corporate Governance and Reserves Committee – Financial Management & Governance - Former CFO Guardian Exploration, Flowing Energy, Calgary, Alberta • Tom Landry, Jr. – Oil & Gas E&P and Service Sector - Oil and gas investor & lawyer, Dallas, Texas • Peder Paus, Chairman – Merchant banker – Former Managing Director Manufacturers Hanover Trust, London, New York, Oslo • Jed Wood – Oil & Gas E&P and Service Sector - Founder and CEO High Arctic Energy Services, Red Deer, Alberta

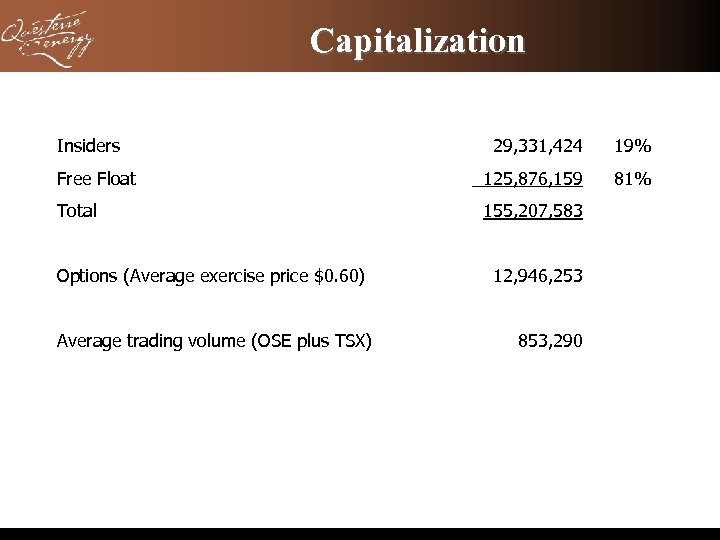

Capitalization Insiders 29, 331, 424 19% Free Float 125, 876, 159 81% Total 155, 207, 583 Options (Average exercise price $0. 60) Average trading volume (OSE plus TSX) 12, 946, 253 853, 290

Capitalization Insiders 29, 331, 424 19% Free Float 125, 876, 159 81% Total 155, 207, 583 Options (Average exercise price $0. 60) Average trading volume (OSE plus TSX) 12, 946, 253 853, 290

Financial Highlights Average daily production 1, 572 boe/d Cash flow from operations $6. 23 million Average sales price (boe) $49. 30 Operating net back (boe) $26. 21 Corporate debt Nil Net working capital surplus $29. 9 million As at and for the six months ended June 30, 2007

Financial Highlights Average daily production 1, 572 boe/d Cash flow from operations $6. 23 million Average sales price (boe) $49. 30 Operating net back (boe) $26. 21 Corporate debt Nil Net working capital surplus $29. 9 million As at and for the six months ended June 30, 2007

Beaver River Field Western Canada

Beaver River Field Western Canada

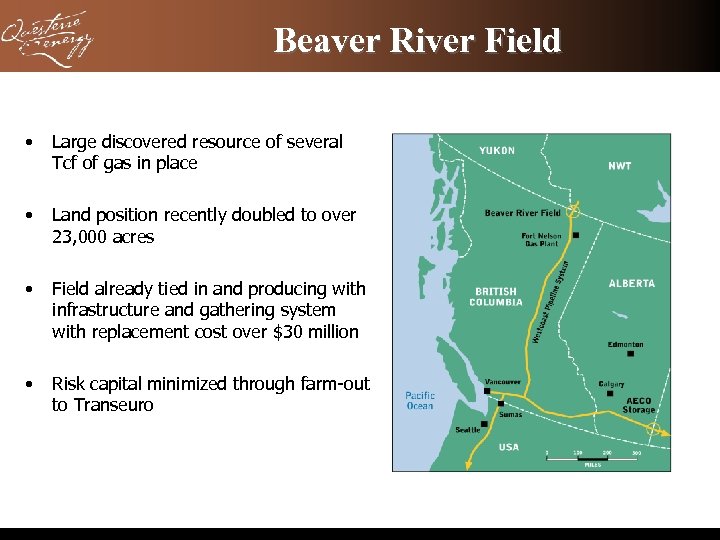

Beaver River Field • Large discovered resource of several Tcf of gas in place • Land position recently doubled to over 23, 000 acres • Field already tied in and producing with infrastructure and gathering system with replacement cost over $30 million • Risk capital minimized through farm-out to Transeuro

Beaver River Field • Large discovered resource of several Tcf of gas in place • Land position recently doubled to over 23, 000 acres • Field already tied in and producing with infrastructure and gathering system with replacement cost over $30 million • Risk capital minimized through farm-out to Transeuro

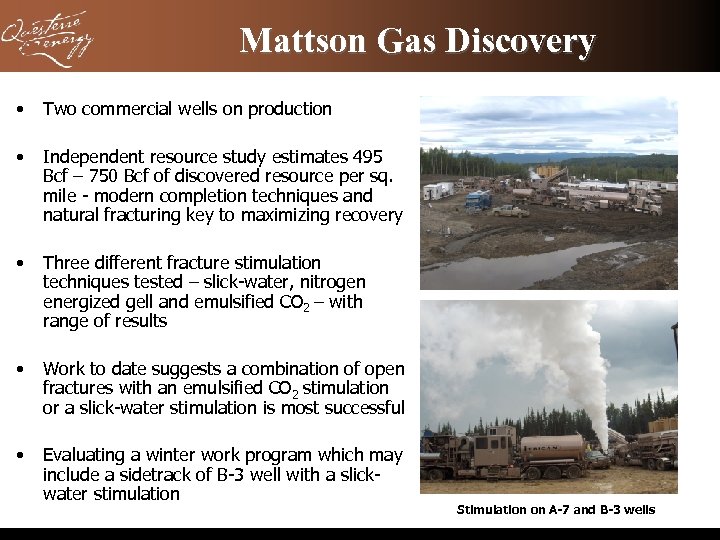

Mattson Gas Discovery • Two commercial wells on production • Independent resource study estimates 495 Bcf – 750 Bcf of discovered resource per sq. mile - modern completion techniques and natural fracturing key to maximizing recovery • Three different fracture stimulation techniques tested – slick-water, nitrogen energized gell and emulsified CO 2 – with range of results • Work to date suggests a combination of open fractures with an emulsified CO 2 stimulation or a slick-water stimulation is most successful • Evaluating a winter work program which may include a sidetrack of B-3 well with a slickwater stimulation Stimulation on A-7 and B-3 wells

Mattson Gas Discovery • Two commercial wells on production • Independent resource study estimates 495 Bcf – 750 Bcf of discovered resource per sq. mile - modern completion techniques and natural fracturing key to maximizing recovery • Three different fracture stimulation techniques tested – slick-water, nitrogen energized gell and emulsified CO 2 – with range of results • Work to date suggests a combination of open fractures with an emulsified CO 2 stimulation or a slick-water stimulation is most successful • Evaluating a winter work program which may include a sidetrack of B-3 well with a slickwater stimulation Stimulation on A-7 and B-3 wells

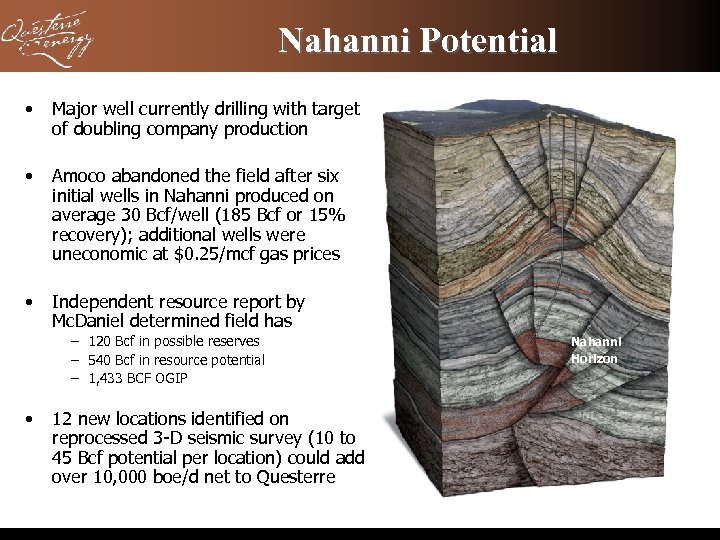

Nahanni Potential • Major well currently drilling with target of doubling company production • Amoco abandoned the field after six initial wells in Nahanni produced on average 30 Bcf/well (185 Bcf or 15% recovery); additional wells were uneconomic at $0. 25/mcf gas prices • Independent resource report by Mc. Daniel determined field has – 120 Bcf in possible reserves – 540 Bcf in resource potential – 1, 433 BCF OGIP • 12 new locations identified on reprocessed 3 -D seismic survey (10 to 45 Bcf potential per location) could add over 10, 000 boe/d net to Questerre Nahanni Horizon

Nahanni Potential • Major well currently drilling with target of doubling company production • Amoco abandoned the field after six initial wells in Nahanni produced on average 30 Bcf/well (185 Bcf or 15% recovery); additional wells were uneconomic at $0. 25/mcf gas prices • Independent resource report by Mc. Daniel determined field has – 120 Bcf in possible reserves – 540 Bcf in resource potential – 1, 433 BCF OGIP • 12 new locations identified on reprocessed 3 -D seismic survey (10 to 45 Bcf potential per location) could add over 10, 000 boe/d net to Questerre Nahanni Horizon

Additional Prospective Horizons • Mississippian Prophet – fractured carbonate lies above Nahanni at depth of approximately 2800 m – High pressure natural gas in the Prophet responsible for blowout of Amoco A-1 well and Amoco produced 0. 5 Bcf from one well – Horizontal drilling and fracture stimulation required to assess connectivity of fractures and productive capability • Devonian shales – Organically rich black shales that have not been assessed to date • Porous Mattson zone – 10, 000 boe/d deliverability prospect on flank of structure

Additional Prospective Horizons • Mississippian Prophet – fractured carbonate lies above Nahanni at depth of approximately 2800 m – High pressure natural gas in the Prophet responsible for blowout of Amoco A-1 well and Amoco produced 0. 5 Bcf from one well – Horizontal drilling and fracture stimulation required to assess connectivity of fractures and productive capability • Devonian shales – Organically rich black shales that have not been assessed to date • Porous Mattson zone – 10, 000 boe/d deliverability prospect on flank of structure

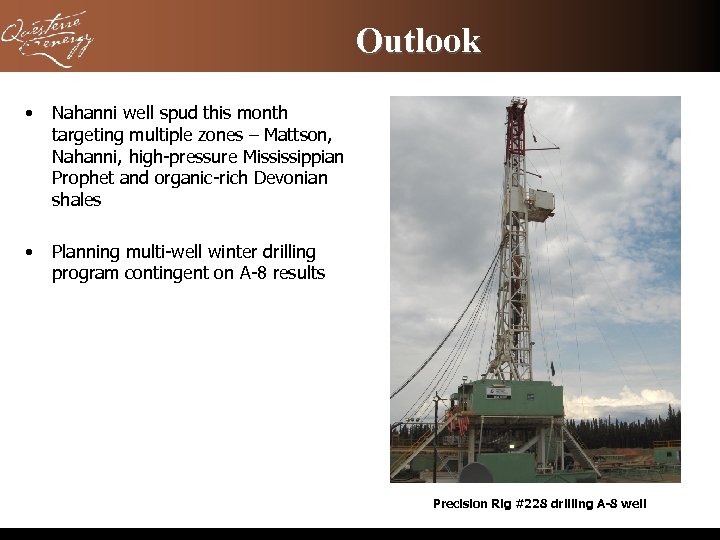

Outlook • Nahanni well spud this month targeting multiple zones – Mattson, Nahanni, high-pressure Mississippian Prophet and organic-rich Devonian shales • Planning multi-well winter drilling program contingent on A-8 results Precision Rig #228 drilling A-8 well

Outlook • Nahanni well spud this month targeting multiple zones – Mattson, Nahanni, high-pressure Mississippian Prophet and organic-rich Devonian shales • Planning multi-well winter drilling program contingent on A-8 results Precision Rig #228 drilling A-8 well

Alberta Western Canada

Alberta Western Canada

Vulcan, Southern Alberta • 50% interest in significant discovery in one gas and one oil pool in Vulcan • Gas pool commenced production in early 2007 at approximately 2, 000 boe/d (1, 000 boe/d net) • Infill development of oil pool delayed until waterflood developed and GPP approval received – potential to add 500, 000 to 750, 000 barrels • Aggressively pursuing farm-in opportunities and sales to further expand acreage – recently drilled two successful well with Pengrowth & Monterey

Vulcan, Southern Alberta • 50% interest in significant discovery in one gas and one oil pool in Vulcan • Gas pool commenced production in early 2007 at approximately 2, 000 boe/d (1, 000 boe/d net) • Infill development of oil pool delayed until waterflood developed and GPP approval received – potential to add 500, 000 to 750, 000 barrels • Aggressively pursuing farm-in opportunities and sales to further expand acreage – recently drilled two successful well with Pengrowth & Monterey

Magnus Energy Inc. Acquisition

Magnus Energy Inc. Acquisition

Overview • Exciting light oil play with over 70 million barrels of oil in place - Magnus' capital constraints did not allow them to fully capitalize on this opportunity • Acquisition price of $18. 5 million net of expected adjustments – paid through 9. 09 million common shares @ $1. 04/share and $9 million in debt • Proved plus probable reserves of 851, 000 boe with NPV 10% of $17. 91 million • Tax pools of over $25 million and current production of 210 boe/d • 220 sq. km (86 sq. miles) of land seismic independently valued at over $8 million • Transaction scheduled to close in October 2007

Overview • Exciting light oil play with over 70 million barrels of oil in place - Magnus' capital constraints did not allow them to fully capitalize on this opportunity • Acquisition price of $18. 5 million net of expected adjustments – paid through 9. 09 million common shares @ $1. 04/share and $9 million in debt • Proved plus probable reserves of 851, 000 boe with NPV 10% of $17. 91 million • Tax pools of over $25 million and current production of 210 boe/d • 220 sq. km (86 sq. miles) of land seismic independently valued at over $8 million • Transaction scheduled to close in October 2007

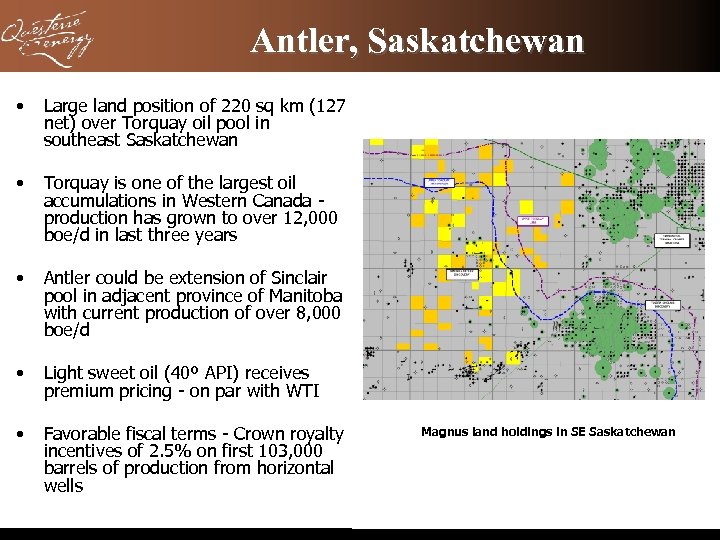

Antler, Saskatchewan • Large land position of 220 sq km (127 net) over Torquay oil pool in southeast Saskatchewan • Torquay is one of the largest oil accumulations in Western Canada production has grown to over 12, 000 boe/d in last three years • Antler could be extension of Sinclair pool in adjacent province of Manitoba with current production of over 8, 000 boe/d • Light sweet oil (40º API) receives premium pricing - on par with WTI • Favorable fiscal terms - Crown royalty incentives of 2. 5% on first 103, 000 barrels of production from horizontal wells Magnus land holdings in SE Saskatchewan

Antler, Saskatchewan • Large land position of 220 sq km (127 net) over Torquay oil pool in southeast Saskatchewan • Torquay is one of the largest oil accumulations in Western Canada production has grown to over 12, 000 boe/d in last three years • Antler could be extension of Sinclair pool in adjacent province of Manitoba with current production of over 8, 000 boe/d • Light sweet oil (40º API) receives premium pricing - on par with WTI • Favorable fiscal terms - Crown royalty incentives of 2. 5% on first 103, 000 barrels of production from horizontal wells Magnus land holdings in SE Saskatchewan

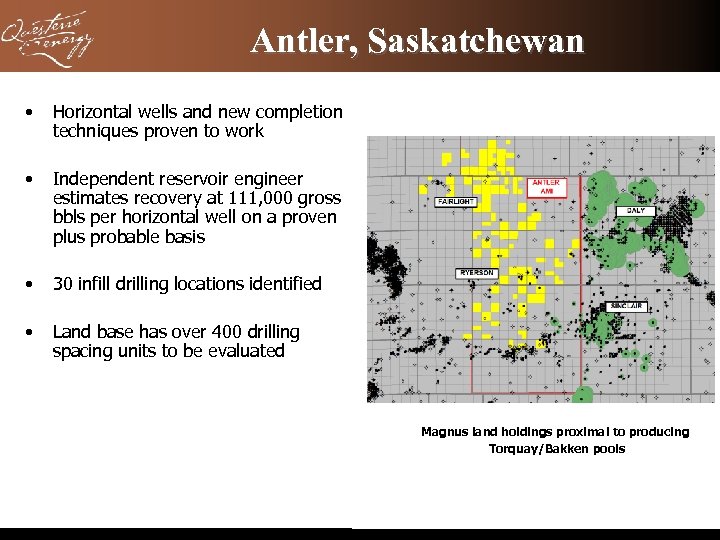

Antler, Saskatchewan • Horizontal wells and new completion techniques proven to work • Independent reservoir engineer estimates recovery at 111, 000 gross bbls per horizontal well on a proven plus probable basis • 30 infill drilling locations identified • Land base has over 400 drilling spacing units to be evaluated Magnus land holdings proximal to producing Torquay/Bakken pools

Antler, Saskatchewan • Horizontal wells and new completion techniques proven to work • Independent reservoir engineer estimates recovery at 111, 000 gross bbls per horizontal well on a proven plus probable basis • 30 infill drilling locations identified • Land base has over 400 drilling spacing units to be evaluated Magnus land holdings proximal to producing Torquay/Bakken pools

St. Lawrence Lowlands Eastern Canada

St. Lawrence Lowlands Eastern Canada

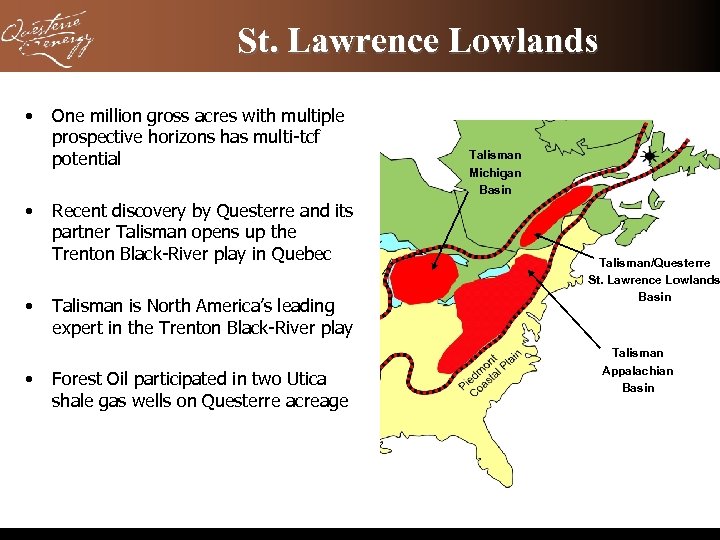

St. Lawrence Lowlands • • One million gross acres with multiple prospective horizons has multi-tcf potential Recent discovery by Questerre and its partner Talisman opens up the Trenton Black-River play in Quebec Talisman is North America’s leading expert in the Trenton Black-River play Forest Oil participated in two Utica shale gas wells on Questerre acreage Talisman Michigan Basin Talisman/Questerre St. Lawrence Lowlands Basin Talisman Appalachian Basin

St. Lawrence Lowlands • • One million gross acres with multiple prospective horizons has multi-tcf potential Recent discovery by Questerre and its partner Talisman opens up the Trenton Black-River play in Quebec Talisman is North America’s leading expert in the Trenton Black-River play Forest Oil participated in two Utica shale gas wells on Questerre acreage Talisman Michigan Basin Talisman/Questerre St. Lawrence Lowlands Basin Talisman Appalachian Basin

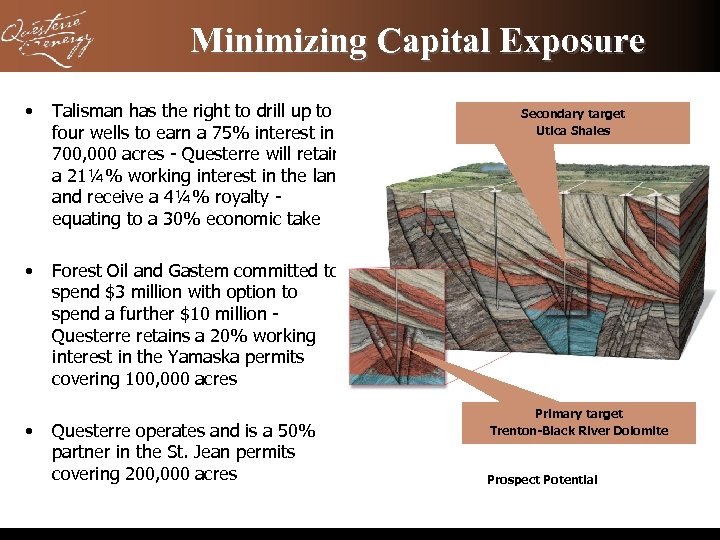

Minimizing Capital Exposure • Talisman has the right to drill up to four wells to earn a 75% interest in 700, 000 acres - Questerre will retain a 21¼% working interest in the land receive a 4¼% royalty equating to a 30% economic take • Forest Oil and Gastem committed to spend $3 million with option to spend a further $10 million Questerre retains a 20% working interest in the Yamaska permits covering 100, 000 acres • Questerre operates and is a 50% partner in the St. Jean permits covering 200, 000 acres Secondary target Utica Shales Primary target Trenton-Black River Dolomite Prospect Potential

Minimizing Capital Exposure • Talisman has the right to drill up to four wells to earn a 75% interest in 700, 000 acres - Questerre will retain a 21¼% working interest in the land receive a 4¼% royalty equating to a 30% economic take • Forest Oil and Gastem committed to spend $3 million with option to spend a further $10 million Questerre retains a 20% working interest in the Yamaska permits covering 100, 000 acres • Questerre operates and is a 50% partner in the St. Jean permits covering 200, 000 acres Secondary target Utica Shales Primary target Trenton-Black River Dolomite Prospect Potential

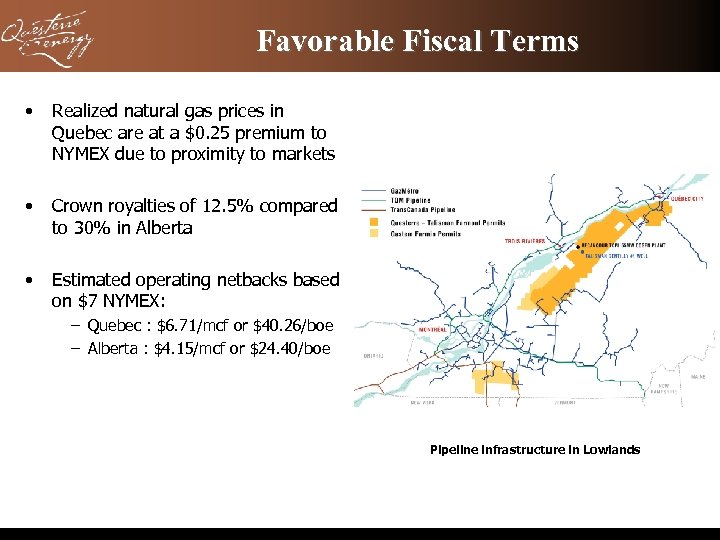

Favorable Fiscal Terms • Realized natural gas prices in Quebec are at a $0. 25 premium to NYMEX due to proximity to markets • Crown royalties of 12. 5% compared to 30% in Alberta • Estimated operating netbacks based on $7 NYMEX: – Quebec : $6. 71/mcf or $40. 26/boe – Alberta : $4. 15/mcf or $24. 40/boe Pipeline infrastructure in Lowlands

Favorable Fiscal Terms • Realized natural gas prices in Quebec are at a $0. 25 premium to NYMEX due to proximity to markets • Crown royalties of 12. 5% compared to 30% in Alberta • Estimated operating netbacks based on $7 NYMEX: – Quebec : $6. 71/mcf or $40. 26/boe – Alberta : $4. 15/mcf or $24. 40/boe Pipeline infrastructure in Lowlands

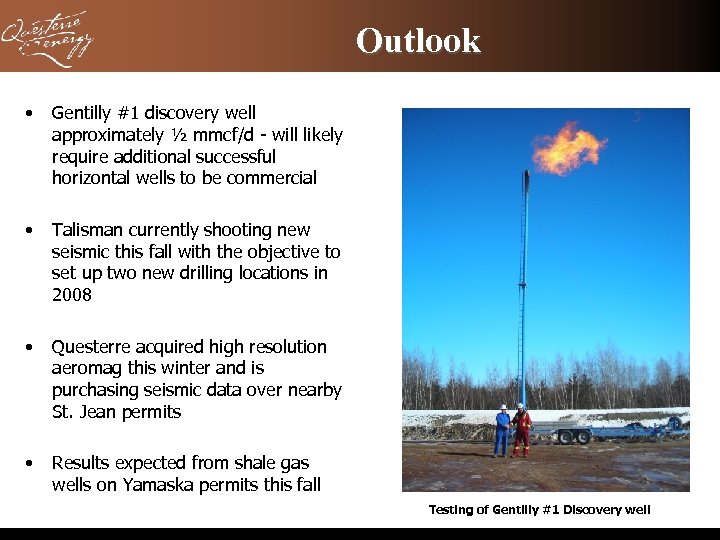

Outlook • Gentilly #1 discovery well approximately ½ mmcf/d - will likely require additional successful horizontal wells to be commercial • Talisman currently shooting new seismic this fall with the objective to set up two new drilling locations in 2008 • Questerre acquired high resolution aeromag this winter and is purchasing seismic data over nearby St. Jean permits • Results expected from shale gas wells on Yamaska permits this fall Testing of Gentilly #1 Discovery well

Outlook • Gentilly #1 discovery well approximately ½ mmcf/d - will likely require additional successful horizontal wells to be commercial • Talisman currently shooting new seismic this fall with the objective to set up two new drilling locations in 2008 • Questerre acquired high resolution aeromag this winter and is purchasing seismic data over nearby St. Jean permits • Results expected from shale gas wells on Yamaska permits this fall Testing of Gentilly #1 Discovery well

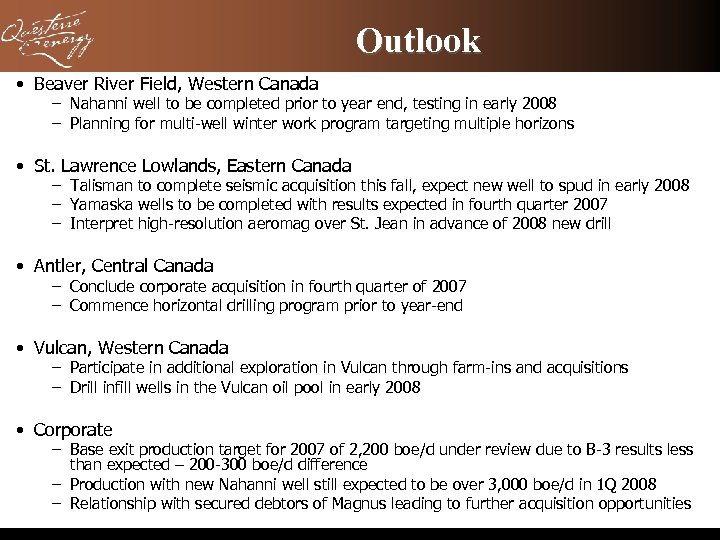

Outlook • Beaver River Field, Western Canada – Nahanni well to be completed prior to year end, testing in early 2008 – Planning for multi-well winter work program targeting multiple horizons • St. Lawrence Lowlands, Eastern Canada – Talisman to complete seismic acquisition this fall, expect new well to spud in early 2008 – Yamaska wells to be completed with results expected in fourth quarter 2007 – Interpret high-resolution aeromag over St. Jean in advance of 2008 new drill • Antler, Central Canada – Conclude corporate acquisition in fourth quarter of 2007 – Commence horizontal drilling program prior to year-end • Vulcan, Western Canada – Participate in additional exploration in Vulcan through farm-ins and acquisitions – Drill infill wells in the Vulcan oil pool in early 2008 • Corporate – Base exit production target for 2007 of 2, 200 boe/d under review due to B-3 results less than expected – 200 -300 boe/d difference – Production with new Nahanni well still expected to be over 3, 000 boe/d in 1 Q 2008 – Relationship with secured debtors of Magnus leading to further acquisition opportunities

Outlook • Beaver River Field, Western Canada – Nahanni well to be completed prior to year end, testing in early 2008 – Planning for multi-well winter work program targeting multiple horizons • St. Lawrence Lowlands, Eastern Canada – Talisman to complete seismic acquisition this fall, expect new well to spud in early 2008 – Yamaska wells to be completed with results expected in fourth quarter 2007 – Interpret high-resolution aeromag over St. Jean in advance of 2008 new drill • Antler, Central Canada – Conclude corporate acquisition in fourth quarter of 2007 – Commence horizontal drilling program prior to year-end • Vulcan, Western Canada – Participate in additional exploration in Vulcan through farm-ins and acquisitions – Drill infill wells in the Vulcan oil pool in early 2008 • Corporate – Base exit production target for 2007 of 2, 200 boe/d under review due to B-3 results less than expected – 200 -300 boe/d difference – Production with new Nahanni well still expected to be over 3, 000 boe/d in 1 Q 2008 – Relationship with secured debtors of Magnus leading to further acquisition opportunities

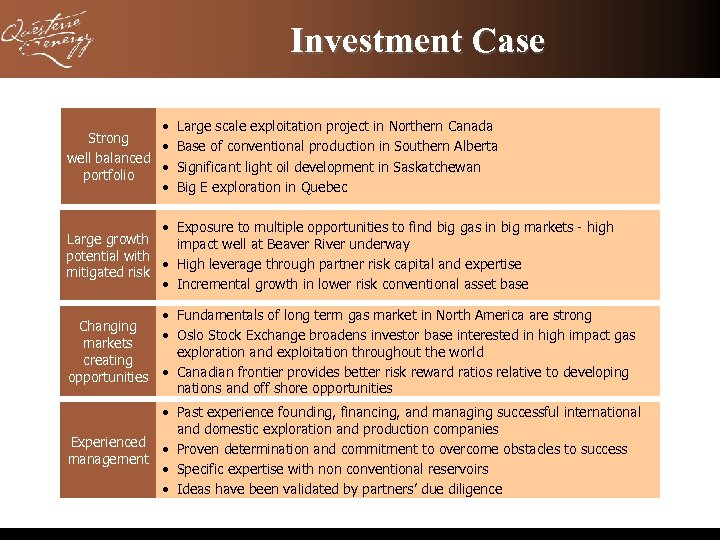

Investment Case • Large scale exploitation project in Northern Canada Strong • Base of conventional production in Southern Alberta well balanced • Significant light oil development in Saskatchewan portfolio • Big E exploration in Quebec • Exposure to multiple opportunities to find big gas in big markets - high Large growth impact well at Beaver River underway potential with • High leverage through partner risk capital and expertise mitigated risk • Incremental growth in lower risk conventional asset base • Fundamentals of long term gas market in North America are strong Changing • Oslo Stock Exchange broadens investor base interested in high impact gas markets exploration and exploitation throughout the world creating opportunities • Canadian frontier provides better risk reward ratios relative to developing nations and off shore opportunities • Past experience founding, financing, and managing successful international and domestic exploration and production companies Experienced • Proven determination and commitment to overcome obstacles to success management • Specific expertise with non conventional reservoirs • Ideas have been validated by partners’ due diligence

Investment Case • Large scale exploitation project in Northern Canada Strong • Base of conventional production in Southern Alberta well balanced • Significant light oil development in Saskatchewan portfolio • Big E exploration in Quebec • Exposure to multiple opportunities to find big gas in big markets - high Large growth impact well at Beaver River underway potential with • High leverage through partner risk capital and expertise mitigated risk • Incremental growth in lower risk conventional asset base • Fundamentals of long term gas market in North America are strong Changing • Oslo Stock Exchange broadens investor base interested in high impact gas markets exploration and exploitation throughout the world creating opportunities • Canadian frontier provides better risk reward ratios relative to developing nations and off shore opportunities • Past experience founding, financing, and managing successful international and domestic exploration and production companies Experienced • Proven determination and commitment to overcome obstacles to success management • Specific expertise with non conventional reservoirs • Ideas have been validated by partners’ due diligence

1580 Guinness House 727 Seventh Avenue SW Calgary, Alberta T 2 P 0 Z 5 Canada Tel : (403) 777 -1185 Fax : (403) 777 -1578 Web: www. questerre. com Email : info@questerre. com

1580 Guinness House 727 Seventh Avenue SW Calgary, Alberta T 2 P 0 Z 5 Canada Tel : (403) 777 -1185 Fax : (403) 777 -1578 Web: www. questerre. com Email : info@questerre. com