78fcc9d69d88f1d64de0c9060279ec7b.ppt

- Количество слайдов: 43

Corporate Plan - FYs 2016 to 2018 PORTFOLIO COMMITTEE ON TRANSPORT 17 April 2015 1

Corporate Plan - FYs 2016 to 2018 PORTFOLIO COMMITTEE ON TRANSPORT 17 April 2015 1

Contents 1. Corporate overview 2. Our business, people and society and environment 3. Our integrated value creation model 4. Our governance and operating structures 5. SWOT 6. Operating environment 7. Stakeholder relations 8. Strategy 9. Key initiatives 10. Annual performance plan 11. Key FY 2015 – 2016 projects 12. Financial plan & Borrowing plan 13. Conclusion 14. Annexures 2

Contents 1. Corporate overview 2. Our business, people and society and environment 3. Our integrated value creation model 4. Our governance and operating structures 5. SWOT 6. Operating environment 7. Stakeholder relations 8. Strategy 9. Key initiatives 10. Annual performance plan 11. Key FY 2015 – 2016 projects 12. Financial plan & Borrowing plan 13. Conclusion 14. Annexures 2

Corporate overview Our Mandate Airports Company Act No 44 of 1993, to undertake the acquisition, establishment, development, provision, maintenance, management, control or operation of any airport, any part of any airport or any facility or service at any airport normally related to the functioning of an airport. Our Mission To develop and manage world-class airport businesses for the benefit of all stakeholders. Our Values Our values are, PRIDE: o. Passion o. Results o. Integrity o. Diversity o. Excellence Our Vision To be a world leading airport business Our strategic proposition To build an efficient customer focussed business Our pledge to our customer To drive a culture of excellence around customer service and communication. Our commitment to our stakeholders To have purposeful engagements with all our stakeholders towards having agreed scope of engagement and delivery of expected outcomes 3

Corporate overview Our Mandate Airports Company Act No 44 of 1993, to undertake the acquisition, establishment, development, provision, maintenance, management, control or operation of any airport, any part of any airport or any facility or service at any airport normally related to the functioning of an airport. Our Mission To develop and manage world-class airport businesses for the benefit of all stakeholders. Our Values Our values are, PRIDE: o. Passion o. Results o. Integrity o. Diversity o. Excellence Our Vision To be a world leading airport business Our strategic proposition To build an efficient customer focussed business Our pledge to our customer To drive a culture of excellence around customer service and communication. Our commitment to our stakeholders To have purposeful engagements with all our stakeholders towards having agreed scope of engagement and delivery of expected outcomes 3

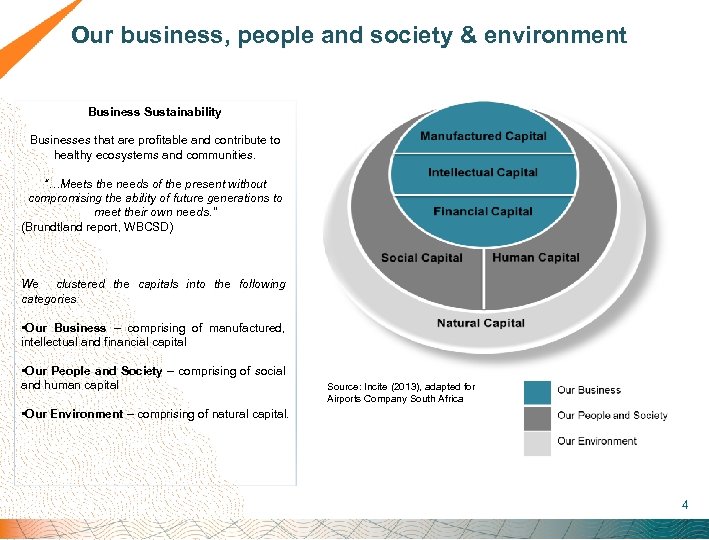

Our business, people and society & environment Business Sustainability Businesses that are profitable and contribute to healthy ecosystems and communities. “…Meets the needs of the present without compromising the ability of future generations to meet their own needs. " (Brundtland report, WBCSD) We clustered the capitals into the following categories: • Our Business – comprising of manufactured, intellectual and financial capital • Our People and Society – comprising of social Society and human capital Source: Incite (2013), adapted for Airports Company South Africa • Our Environment – comprising of natural capital. Our Environment 4

Our business, people and society & environment Business Sustainability Businesses that are profitable and contribute to healthy ecosystems and communities. “…Meets the needs of the present without compromising the ability of future generations to meet their own needs. " (Brundtland report, WBCSD) We clustered the capitals into the following categories: • Our Business – comprising of manufactured, intellectual and financial capital • Our People and Society – comprising of social Society and human capital Source: Incite (2013), adapted for Airports Company South Africa • Our Environment – comprising of natural capital. Our Environment 4

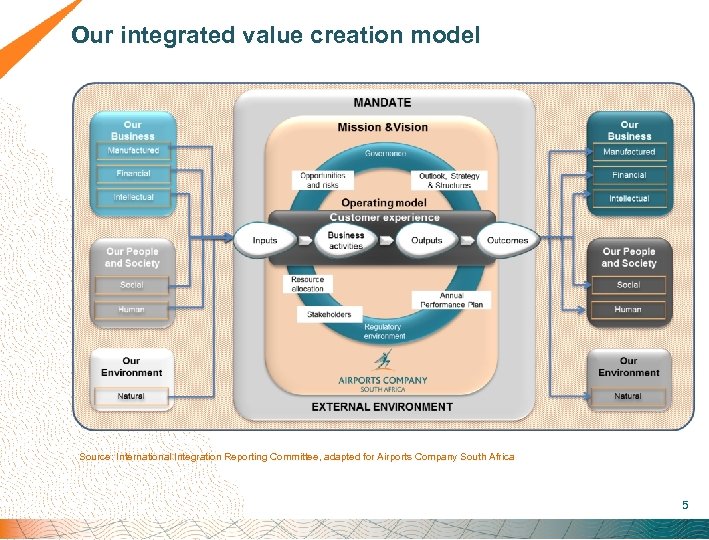

Our integrated value creation model Source: International Integration Reporting Committee, adapted for Airports Company South Africa 5

Our integrated value creation model Source: International Integration Reporting Committee, adapted for Airports Company South Africa 5

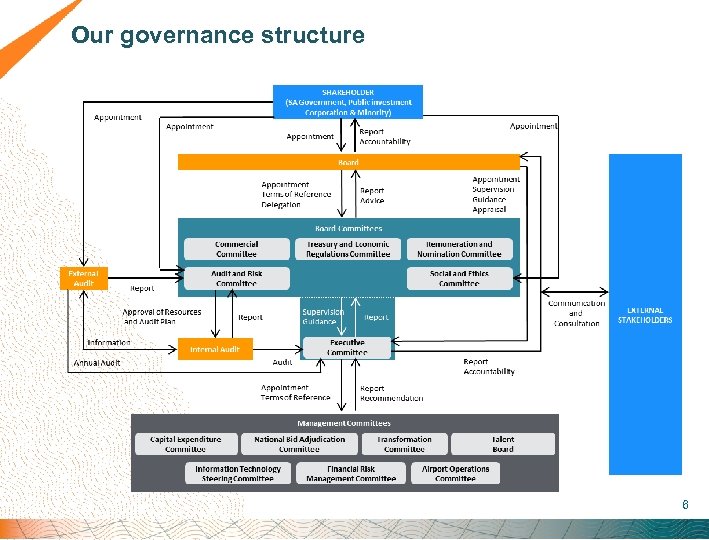

Our governance structure 6

Our governance structure 6

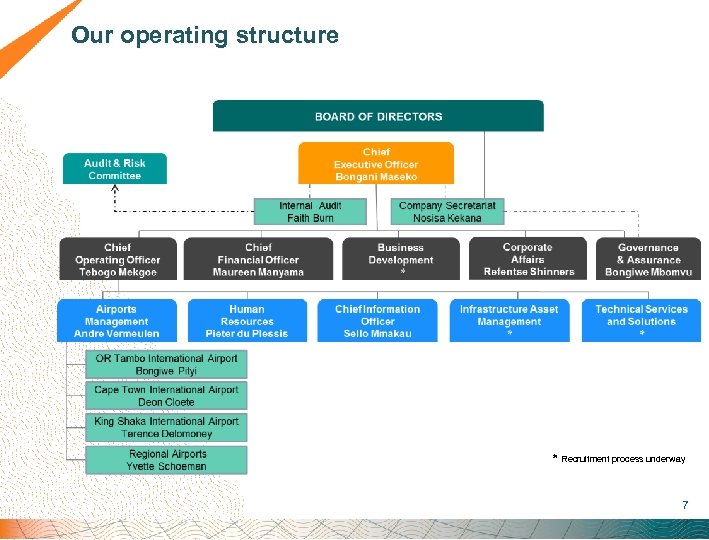

Our operating structure * * * Recruitment process underway 7

Our operating structure * * * Recruitment process underway 7

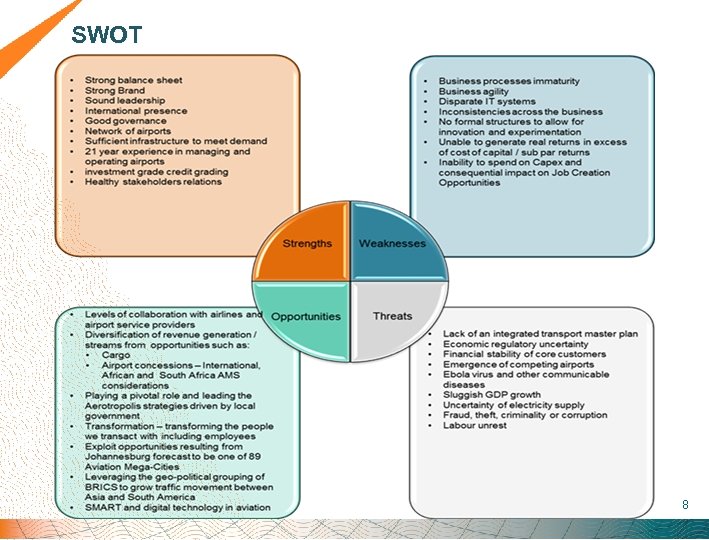

SWOT 8

SWOT 8

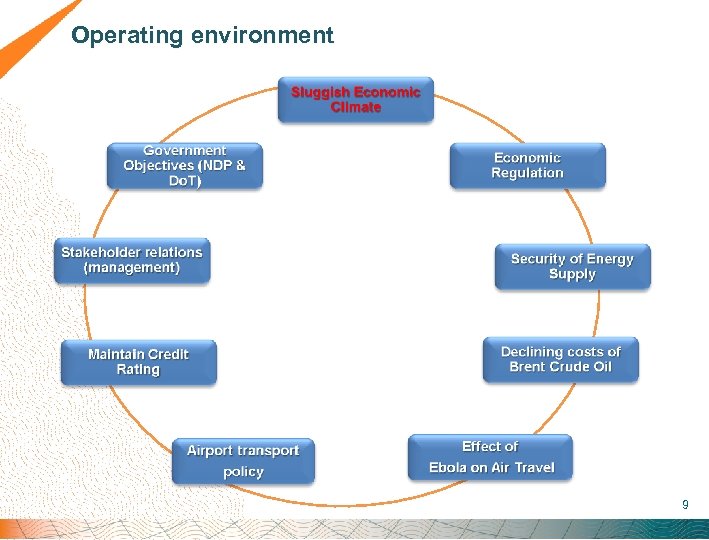

Operating environment 9

Operating environment 9

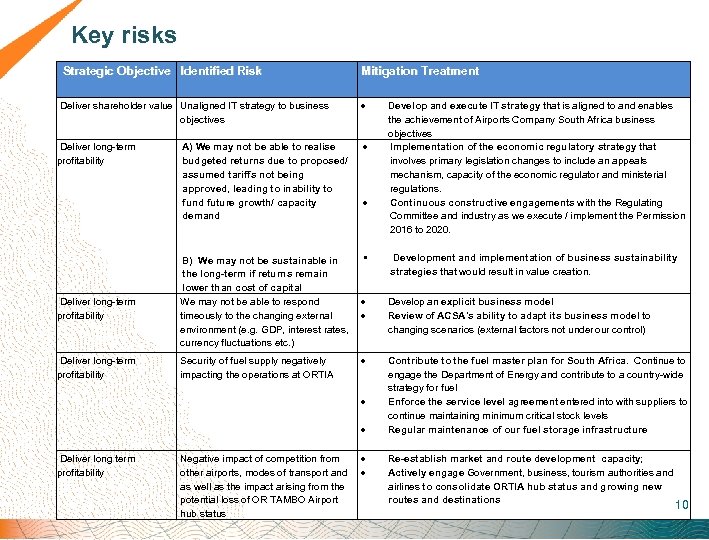

Key risks Strategic Objective Identified Risk Mitigation Treatment Deliver shareholder value Unaligned IT strategy to business objectives Deliver long-term profitability A) We may not be able to realise budgeted returns due to proposed/ assumed tariffs not being approved, leading to inability to fund future growth/ capacity demand Develop and execute IT strategy that is aligned to and enables the achievement of Airports Company South Africa business objectives Implementation of the economic regulatory strategy that Implementation of the economic regulatory strategy involves primary legislation changes to include an appeals mechanism, capacity of the economic regulator and ministerial regulations. Continuous constructive engagements with the Regulating Continuous constructive engagements Committee and industry as we execute / implement the Permission 2016 to 2020. Deliver long-term profitability § B) We may not be sustainable in the long-term if returns remain lower than cost of capital We may not be able to respond timeously to the changing external environment (e. g. GDP, interest rates, currency fluctuations etc. ) Security of fuel supply negatively impacting the operations at ORTIA Deliver long term profitability Negative impact of competition from other airports, modes of transport and as well as the impact arising from the potential loss of OR TAMBO Airport hub status Development and implementation of business sustainability strategies that would result in value creation. strategies Develop an explicit business model Review of ACSA's ability to adapt its business model to changing scenarios (external factors not under our control) Contribute to the fuel master plan for South Africa. Continue to Contribute to the fuel master plan for South Africa engage the Department of Energy and contribute to a country-wide strategy for fuel Enforce the service level agreement entered into with suppliers to Enforce the service level agreement continue maintaining minimum critical stock levels Regular maintenance of our fuel storage infrastructure Re-establish market and route development capacity; Actively engage Government, business, tourism authorities and Actively engage airlines to consolidate ORTIA hub status and growing new routes and destinations 10

Key risks Strategic Objective Identified Risk Mitigation Treatment Deliver shareholder value Unaligned IT strategy to business objectives Deliver long-term profitability A) We may not be able to realise budgeted returns due to proposed/ assumed tariffs not being approved, leading to inability to fund future growth/ capacity demand Develop and execute IT strategy that is aligned to and enables the achievement of Airports Company South Africa business objectives Implementation of the economic regulatory strategy that Implementation of the economic regulatory strategy involves primary legislation changes to include an appeals mechanism, capacity of the economic regulator and ministerial regulations. Continuous constructive engagements with the Regulating Continuous constructive engagements Committee and industry as we execute / implement the Permission 2016 to 2020. Deliver long-term profitability § B) We may not be sustainable in the long-term if returns remain lower than cost of capital We may not be able to respond timeously to the changing external environment (e. g. GDP, interest rates, currency fluctuations etc. ) Security of fuel supply negatively impacting the operations at ORTIA Deliver long term profitability Negative impact of competition from other airports, modes of transport and as well as the impact arising from the potential loss of OR TAMBO Airport hub status Development and implementation of business sustainability strategies that would result in value creation. strategies Develop an explicit business model Review of ACSA's ability to adapt its business model to changing scenarios (external factors not under our control) Contribute to the fuel master plan for South Africa. Continue to Contribute to the fuel master plan for South Africa engage the Department of Energy and contribute to a country-wide strategy for fuel Enforce the service level agreement entered into with suppliers to Enforce the service level agreement continue maintaining minimum critical stock levels Regular maintenance of our fuel storage infrastructure Re-establish market and route development capacity; Actively engage Government, business, tourism authorities and Actively engage airlines to consolidate ORTIA hub status and growing new routes and destinations 10

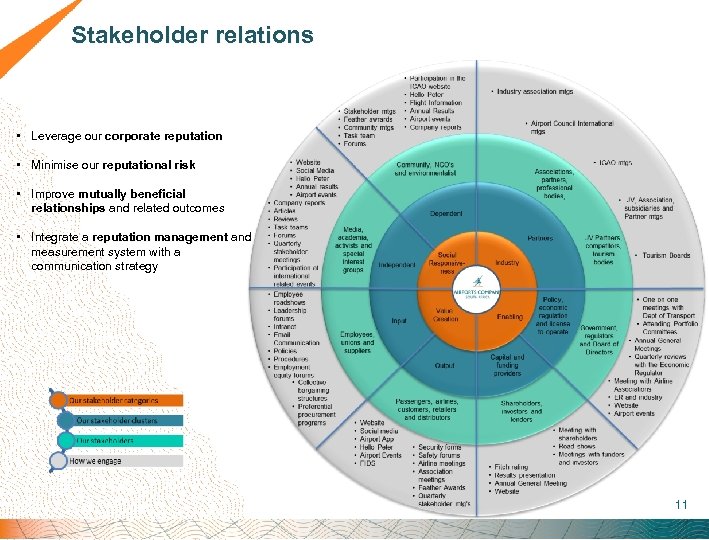

Stakeholder relations • Leverage our corporate reputation • Minimise our reputational risk • Improve mutually beneficial relationships and related outcomes relationships • Integrate a reputation management and measurement system with a communication strategy 11

Stakeholder relations • Leverage our corporate reputation • Minimise our reputational risk • Improve mutually beneficial relationships and related outcomes relationships • Integrate a reputation management and measurement system with a communication strategy 11

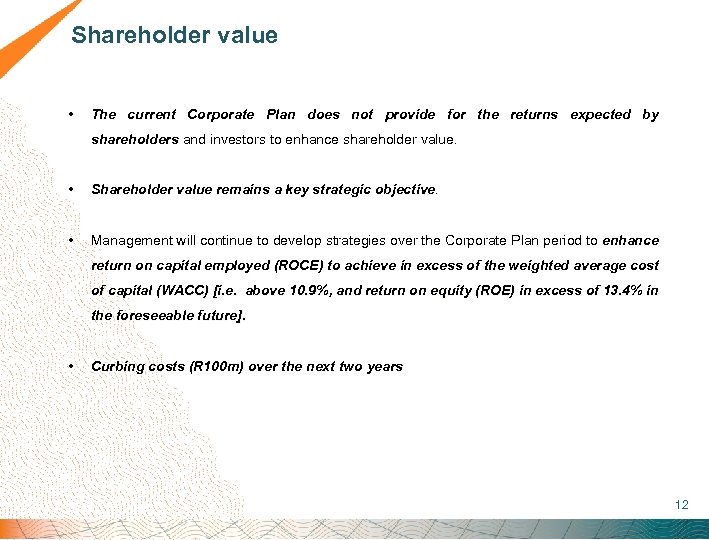

Shareholder value • The current Corporate Plan does not provide for the returns expected by shareholders and investors to enhance shareholder value. shareholders • Shareholder value remains a key strategic objective • Management will continue to develop strategies over the Corporate Plan period to enhance return on capital employed (ROCE) to achieve in excess of the weighted average cost of capital (WACC) [i. e. above 10. 9%, and return on equity (ROE) in excess of 13. 4% in the foreseeable future]. • Curbing costs (R 100 m) over the next two years 12

Shareholder value • The current Corporate Plan does not provide for the returns expected by shareholders and investors to enhance shareholder value. shareholders • Shareholder value remains a key strategic objective • Management will continue to develop strategies over the Corporate Plan period to enhance return on capital employed (ROCE) to achieve in excess of the weighted average cost of capital (WACC) [i. e. above 10. 9%, and return on equity (ROE) in excess of 13. 4% in the foreseeable future]. • Curbing costs (R 100 m) over the next two years 12

Strategic thrusts Strategy - To build an efficient and customer focussed business based on firm transformation and sustainability imperatives Deliver shareholder value Building win-win partnerships with all stakeholders Identify and secure new business opportunities Accelerate our sustainability and transformation programs Business excellence Managing and developing a high performing team 13

Strategic thrusts Strategy - To build an efficient and customer focussed business based on firm transformation and sustainability imperatives Deliver shareholder value Building win-win partnerships with all stakeholders Identify and secure new business opportunities Accelerate our sustainability and transformation programs Business excellence Managing and developing a high performing team 13

Key initiatives Re-engineer our operating model Transformation Provide commercially viable airport management solutions for South African and International Airports Grow traffic by leveraging our existing airports locational and traffic profile – Align our airport development plans to local and provincial government plans Diversify revenue opportunities 14

Key initiatives Re-engineer our operating model Transformation Provide commercially viable airport management solutions for South African and International Airports Grow traffic by leveraging our existing airports locational and traffic profile – Align our airport development plans to local and provincial government plans Diversify revenue opportunities 14

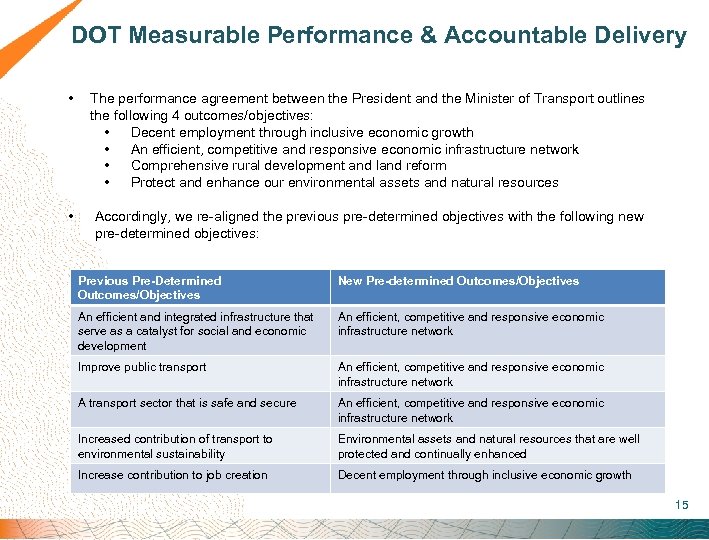

DOT Measurable Performance & Accountable Delivery • The performance agreement between the President and the Minister of Transport outlines the following 4 outcomes/objectives: • Decent employment through inclusive economic growth • An efficient, competitive and responsive economic infrastructure network • Comprehensive rural development and land reform • Protect and enhance our environmental assets and natural resources • Accordingly, we re-aligned the previous pre-determined objectives with the following new pre-determined objectives: Previous Pre-Determined Outcomes/Objectives New Pre-determined Outcomes/Objectives An efficient and integrated infrastructure that serve as a catalyst for social and economic development An efficient, competitive and responsive economic infrastructure network Improve public transport An efficient, competitive and responsive economic infrastructure network A transport sector that is safe and secure An efficient, competitive and responsive economic infrastructure network Increased contribution of transport to environmental sustainability Environmental assets and natural resources that are well protected and continually enhanced Increase contribution to job creation Decent employment through inclusive economic growth 15

DOT Measurable Performance & Accountable Delivery • The performance agreement between the President and the Minister of Transport outlines the following 4 outcomes/objectives: • Decent employment through inclusive economic growth • An efficient, competitive and responsive economic infrastructure network • Comprehensive rural development and land reform • Protect and enhance our environmental assets and natural resources • Accordingly, we re-aligned the previous pre-determined objectives with the following new pre-determined objectives: Previous Pre-Determined Outcomes/Objectives New Pre-determined Outcomes/Objectives An efficient and integrated infrastructure that serve as a catalyst for social and economic development An efficient, competitive and responsive economic infrastructure network Improve public transport An efficient, competitive and responsive economic infrastructure network A transport sector that is safe and secure An efficient, competitive and responsive economic infrastructure network Increased contribution of transport to environmental sustainability Environmental assets and natural resources that are well protected and continually enhanced Increase contribution to job creation Decent employment through inclusive economic growth 15

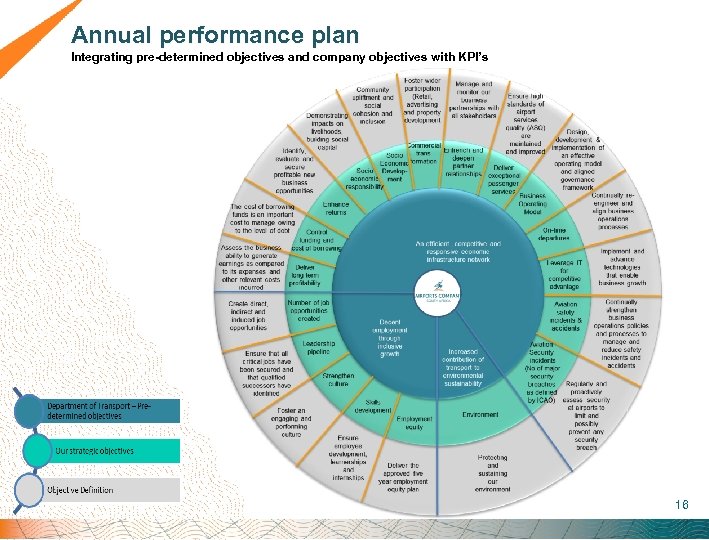

Annual performance plan Integrating pre-determined objectives and company objectives with KPI’s 16

Annual performance plan Integrating pre-determined objectives and company objectives with KPI’s 16

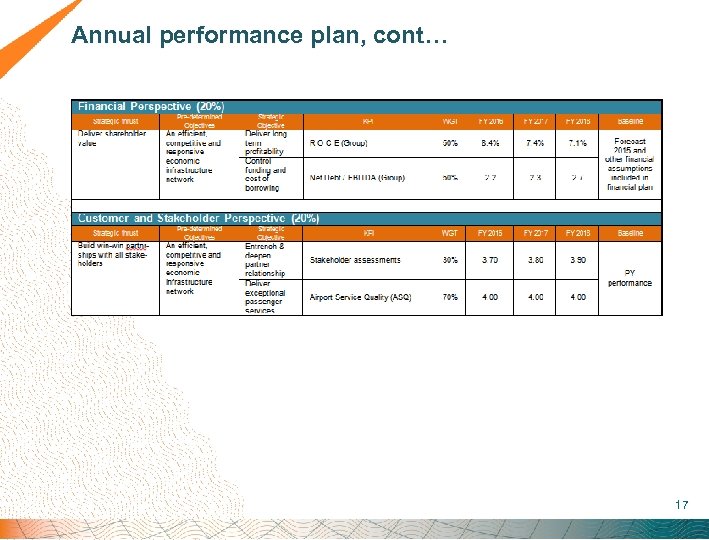

Annual performance plan, cont… 17

Annual performance plan, cont… 17

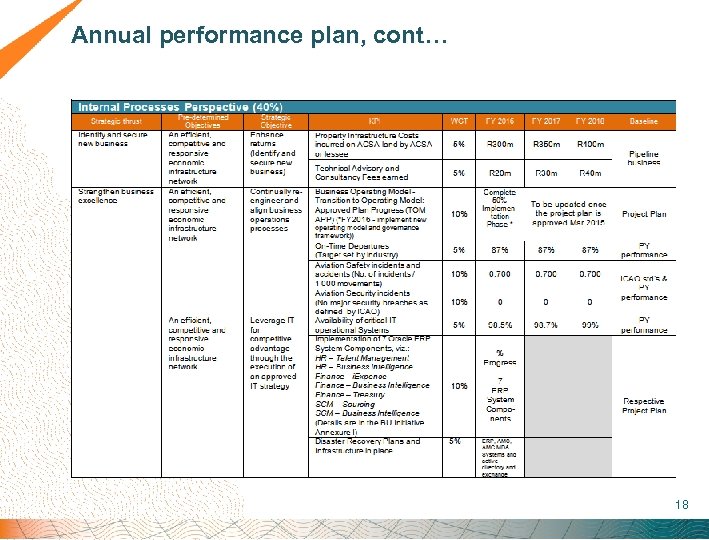

Annual performance plan, cont… 18

Annual performance plan, cont… 18

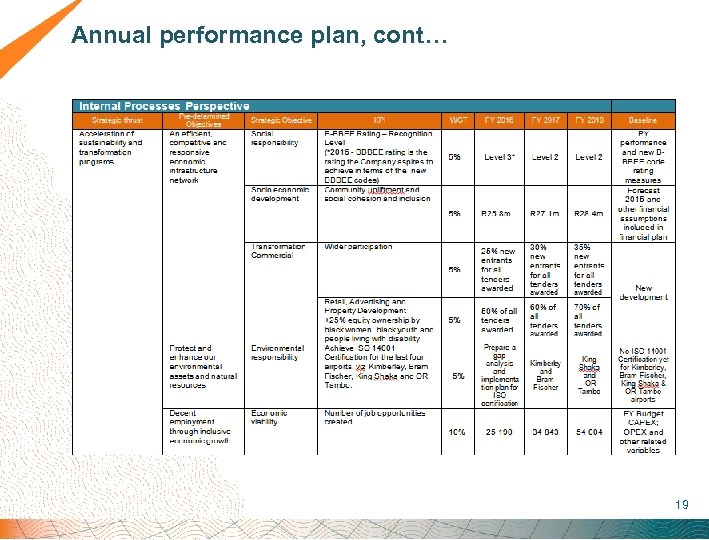

Annual performance plan, cont… 19

Annual performance plan, cont… 19

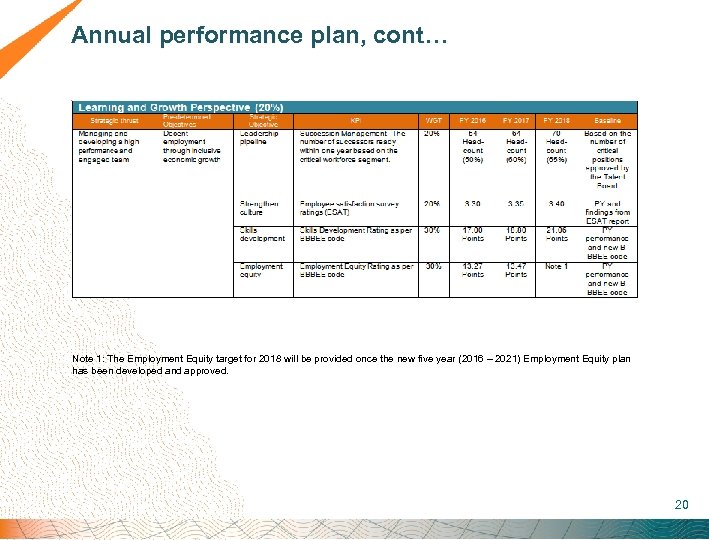

Annual performance plan, cont… Note 1: The Employment Equity target for 2018 will be provided once the new five year (2016 – 2021) Employment Equity plan has been developed and approved. 20

Annual performance plan, cont… Note 1: The Employment Equity target for 2018 will be provided once the new five year (2016 – 2021) Employment Equity plan has been developed and approved. 20

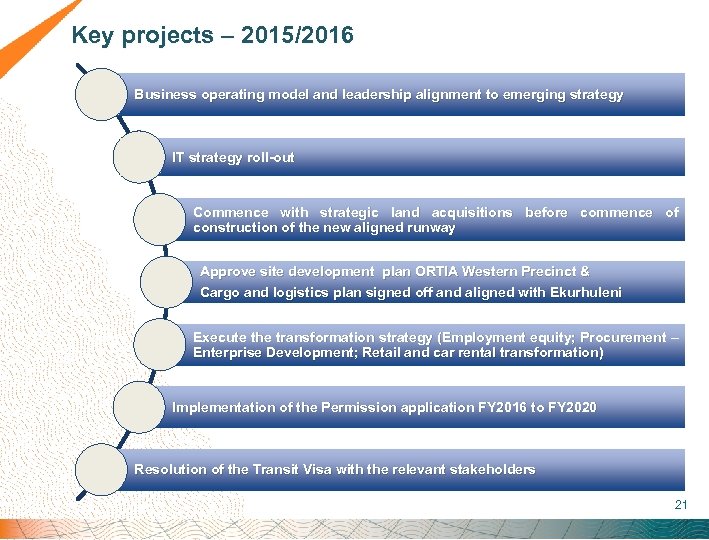

Key projects – 2015/2016 Business operating model and leadership alignment to emerging strategy IT strategy roll-out Commence with strategic land acquisitions before commence of construction of the new aligned runway Approve site development plan ORTIA Western Precinct & Cargo and logistics plan signed off and aligned with Ekurhuleni Execute the transformation strategy (Employment equity; Procurement – Enterprise Development; Retail and car rental transformation) Implementation of the Permission application FY 2016 to FY 2020 Resolution of the Transit Visa with the relevant stakeholders 21

Key projects – 2015/2016 Business operating model and leadership alignment to emerging strategy IT strategy roll-out Commence with strategic land acquisitions before commence of construction of the new aligned runway Approve site development plan ORTIA Western Precinct & Cargo and logistics plan signed off and aligned with Ekurhuleni Execute the transformation strategy (Employment equity; Procurement – Enterprise Development; Retail and car rental transformation) Implementation of the Permission application FY 2016 to FY 2020 Resolution of the Transit Visa with the relevant stakeholders 21

Financial & Borrowing Plan FYs 2016 to 2018 22

Financial & Borrowing Plan FYs 2016 to 2018 22

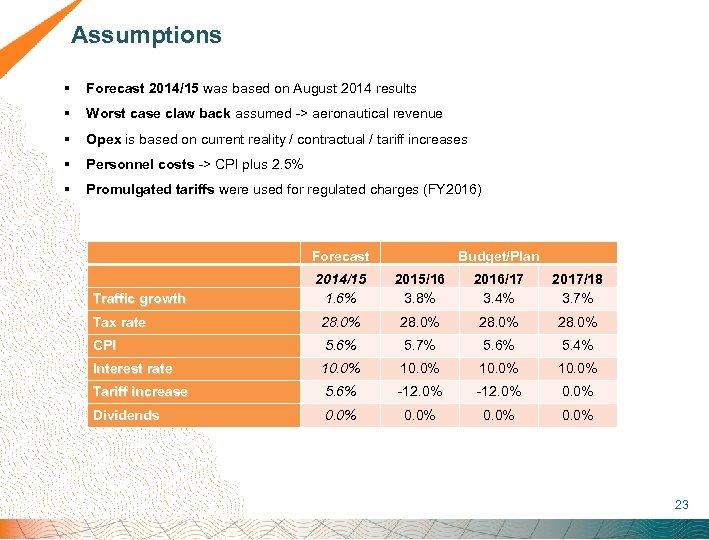

Assumptions § Forecast 2014/15 was based on August 2014 results Forecast 2014/15 § Worst case claw back assumed -> aeronautical revenue Worst case claw back § Opex is based on current reality / contractual / tariff increases Opex § Personnel costs -> CPI plus 2. 5% Personnel costs § Promulgated tariffs were used for regulated charges (FY 2016) Promulgated tariffs Forecast Traffic growth Budget/Plan 2014/15 1. 6% 2015/16 3. 8% 2016/17 3. 4% 2017/18 3. 7% Tax rate 28. 0% CPI 5. 6% 5. 7% 5. 6% 5. 4% Interest rate 10. 0% Tariff increase 5. 6% -12. 0% 0. 0% Dividends 0. 0% 23

Assumptions § Forecast 2014/15 was based on August 2014 results Forecast 2014/15 § Worst case claw back assumed -> aeronautical revenue Worst case claw back § Opex is based on current reality / contractual / tariff increases Opex § Personnel costs -> CPI plus 2. 5% Personnel costs § Promulgated tariffs were used for regulated charges (FY 2016) Promulgated tariffs Forecast Traffic growth Budget/Plan 2014/15 1. 6% 2015/16 3. 8% 2016/17 3. 4% 2017/18 3. 7% Tax rate 28. 0% CPI 5. 6% 5. 7% 5. 6% 5. 4% Interest rate 10. 0% Tariff increase 5. 6% -12. 0% 0. 0% Dividends 0. 0% 23

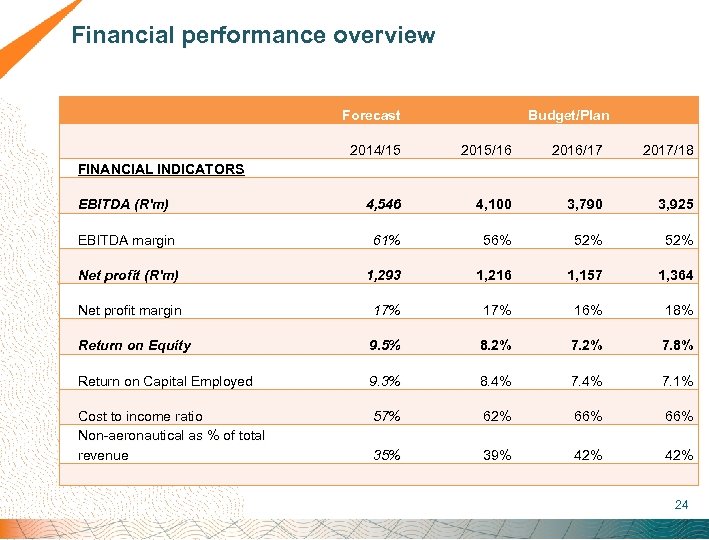

Financial performance overview Forecast FINANCIAL INDICATORS Budget/Plan 2014/15 2015/16 2016/17 2017/18 EBITDA (R'm) 4, 546 4, 100 3, 790 3, 925 EBITDA margin 61% 56% 52% Net profit (R'm) 1, 293 1, 216 1, 157 1, 364 Net profit margin 17% 16% 18% Return on Equity 9. 5% 8. 2% 7. 8% Return on Capital Employed 9. 3% 8. 4% 7. 1% Cost to income ratio Non-aeronautical as % of total revenue 57% 62% 66% 35% 39% 42% 24

Financial performance overview Forecast FINANCIAL INDICATORS Budget/Plan 2014/15 2015/16 2016/17 2017/18 EBITDA (R'm) 4, 546 4, 100 3, 790 3, 925 EBITDA margin 61% 56% 52% Net profit (R'm) 1, 293 1, 216 1, 157 1, 364 Net profit margin 17% 16% 18% Return on Equity 9. 5% 8. 2% 7. 8% Return on Capital Employed 9. 3% 8. 4% 7. 1% Cost to income ratio Non-aeronautical as % of total revenue 57% 62% 66% 35% 39% 42% 24

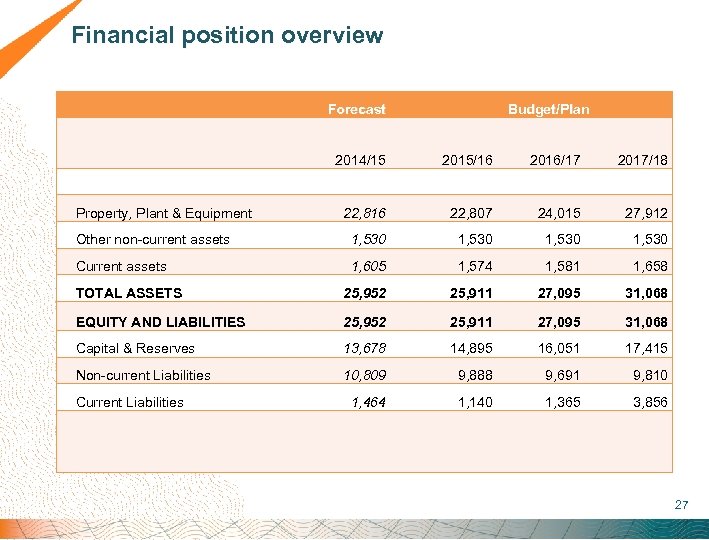

Financial position overview Forecast 2015/16 2016/17 2017/18 22, 816 22, 807 24, 015 27, 912 Other non-current assets 1, 530 Current assets 1, 605 1, 574 1, 581 1, 658 TOTAL ASSETS 25, 952 25, 911 27, 095 31, 068 EQUITY AND LIABILITIES 25, 952 25, 911 27, 095 31, 068 Capital & Reserves 13, 678 14, 895 16, 051 17, 415 Non-current Liabilities 10, 809 9, 888 9, 691 9, 810 1, 464 1, 140 1, 365 3, 856 Property, Plant & Equipment Current Liabilities 2014/15 Budget/Plan 27

Financial position overview Forecast 2015/16 2016/17 2017/18 22, 816 22, 807 24, 015 27, 912 Other non-current assets 1, 530 Current assets 1, 605 1, 574 1, 581 1, 658 TOTAL ASSETS 25, 952 25, 911 27, 095 31, 068 EQUITY AND LIABILITIES 25, 952 25, 911 27, 095 31, 068 Capital & Reserves 13, 678 14, 895 16, 051 17, 415 Non-current Liabilities 10, 809 9, 888 9, 691 9, 810 1, 464 1, 140 1, 365 3, 856 Property, Plant & Equipment Current Liabilities 2014/15 Budget/Plan 27

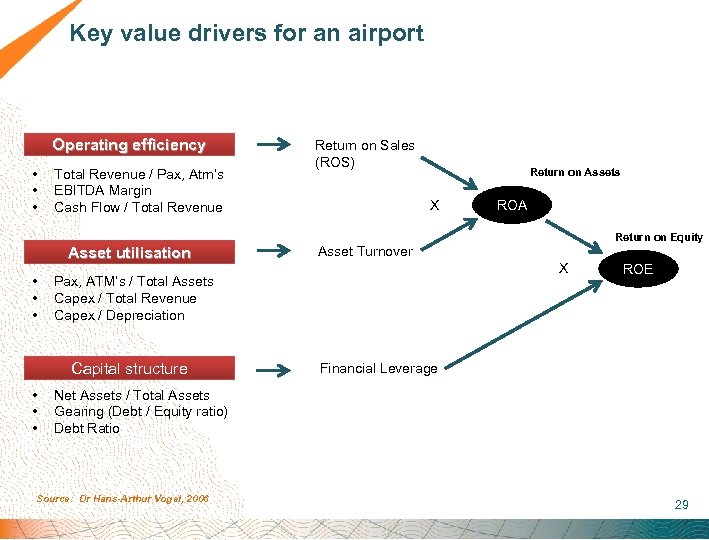

Key value drivers for an airport Operating efficiency • • • Total Revenue / Pax, Atm’s EBITDA Margin Cash Flow / Total Revenue Asset utilisation • • • Return on Assets X ROA Return on Equity Asset Turnover X Pax, ATM’s / Total Assets Capex / Total Revenue Capex / Depreciation Capital structure • • • Return on Sales (ROS) ROE Financial Leverage Net Assets / Total Assets Gearing (Debt / Equity ratio) Debt Ratio Source: Dr Hans-Arthur Vogel, 2006 29

Key value drivers for an airport Operating efficiency • • • Total Revenue / Pax, Atm’s EBITDA Margin Cash Flow / Total Revenue Asset utilisation • • • Return on Assets X ROA Return on Equity Asset Turnover X Pax, ATM’s / Total Assets Capex / Total Revenue Capex / Depreciation Capital structure • • • Return on Sales (ROS) ROE Financial Leverage Net Assets / Total Assets Gearing (Debt / Equity ratio) Debt Ratio Source: Dr Hans-Arthur Vogel, 2006 29

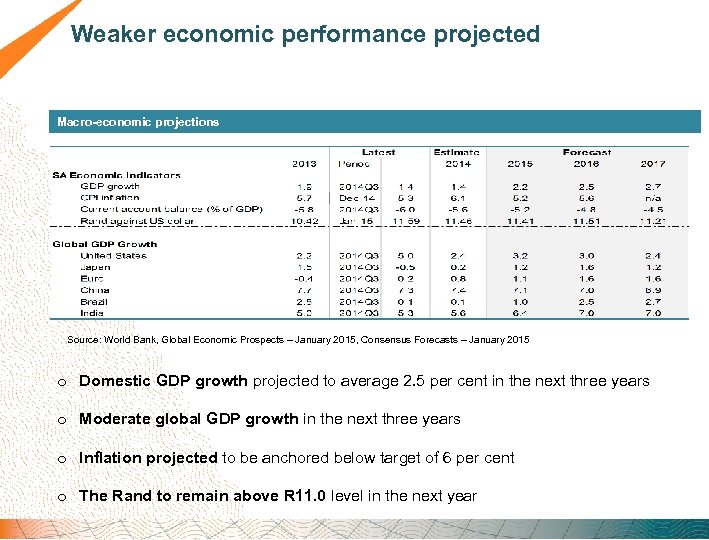

Weaker economic performance projected Macro-economic projections Source: World Bank, Global Economic Prospects – January 2015, Consensus Forecasts – January 2015 o Domestic GDP growth projected to average 2. 5 per cent in the next three years growth o Moderate global GDP growth in the next three years global GDP growth o Inflation projected to be anchored below target of 6 per cent Inflation projected o The Rand to remain above R 11. 0 level in the next year The Rand to remain above R 11. 0

Weaker economic performance projected Macro-economic projections Source: World Bank, Global Economic Prospects – January 2015, Consensus Forecasts – January 2015 o Domestic GDP growth projected to average 2. 5 per cent in the next three years growth o Moderate global GDP growth in the next three years global GDP growth o Inflation projected to be anchored below target of 6 per cent Inflation projected o The Rand to remain above R 11. 0 level in the next year The Rand to remain above R 11. 0

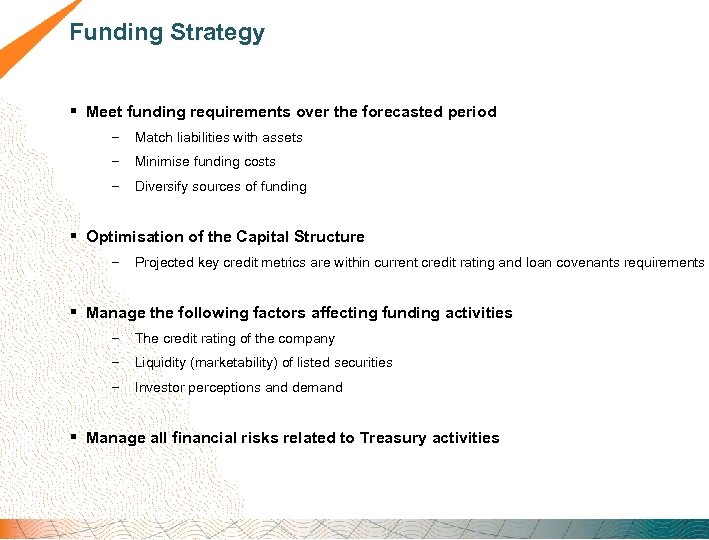

Funding Strategy § Meet funding requirements over the forecasted period – Match liabilities with assets – Minimise funding costs – Diversify sources of funding § Optimisation of the Capital Structure – Projected key credit metrics are within current credit rating and loan covenants requirements § Manage the following factors affecting funding activities – The credit rating of the company – Liquidity (marketability) of listed securities – Investor perceptions and demand § Manage all financial risks related to Treasury activities

Funding Strategy § Meet funding requirements over the forecasted period – Match liabilities with assets – Minimise funding costs – Diversify sources of funding § Optimisation of the Capital Structure – Projected key credit metrics are within current credit rating and loan covenants requirements § Manage the following factors affecting funding activities – The credit rating of the company – Liquidity (marketability) of listed securities – Investor perceptions and demand § Manage all financial risks related to Treasury activities

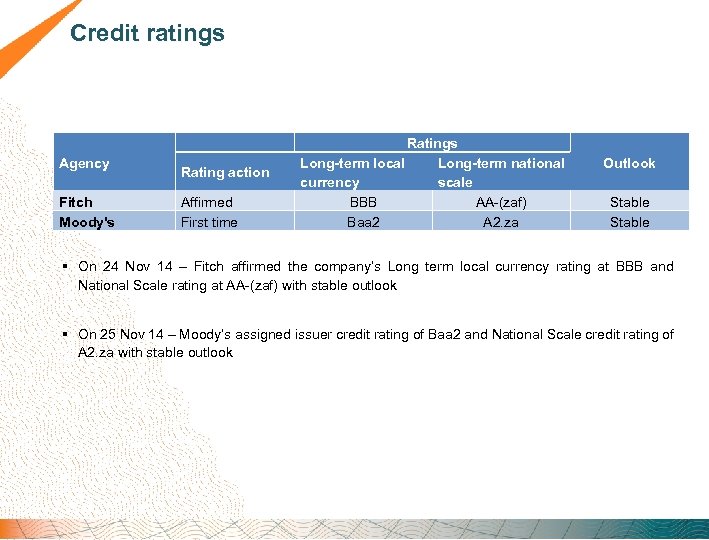

Credit ratings Agency Fitch Moody's Rating action Affirmed First time Ratings Long-term local Long-term national currency scale BBB AA-(zaf) Baa 2 A 2. za Outlook Stable § On 24 Nov 14 – Fitch affirmed the company’s Long term local currency rating at BBB and National Scale rating at AA-(zaf) with stable outlook § On 25 Nov 14 – Moody’s assigned issuer credit rating of Baa 2 and National Scale credit rating of A 2. za with stable outlook

Credit ratings Agency Fitch Moody's Rating action Affirmed First time Ratings Long-term local Long-term national currency scale BBB AA-(zaf) Baa 2 A 2. za Outlook Stable § On 24 Nov 14 – Fitch affirmed the company’s Long term local currency rating at BBB and National Scale rating at AA-(zaf) with stable outlook § On 25 Nov 14 – Moody’s assigned issuer credit rating of Baa 2 and National Scale credit rating of A 2. za with stable outlook

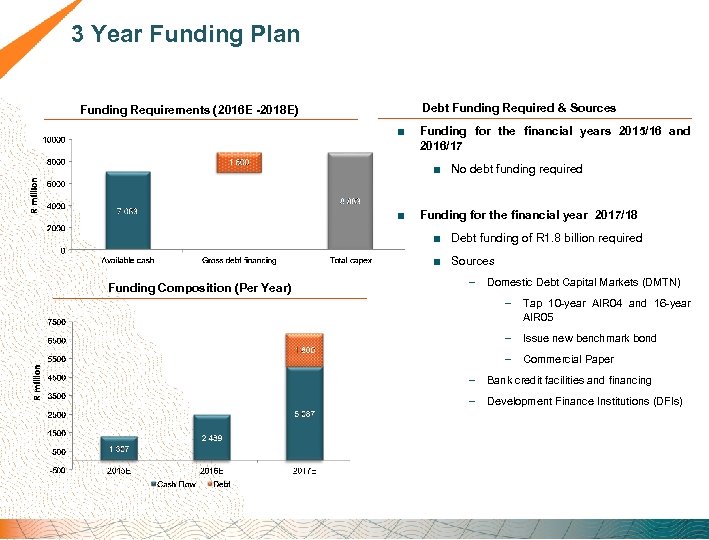

3 Year Funding Plan Debt Funding Required & Sources Funding Requirements (2016 E -2018 E) ■ Funding for the financial years 2015/16 and 2016/17 ■ No debt funding required ■ Funding for the financial year 2017/18 ■ Debt funding of R 1. 8 billion required ■ Sources Funding Composition (Per Year) – Domestic Debt Capital Markets (DMTN) – Tap 10 -year AIR 04 and 16 -year AIR 05 – Issue new benchmark bond – Commercial Paper – Bank credit facilities and financing – Development Finance Institutions (DFIs)

3 Year Funding Plan Debt Funding Required & Sources Funding Requirements (2016 E -2018 E) ■ Funding for the financial years 2015/16 and 2016/17 ■ No debt funding required ■ Funding for the financial year 2017/18 ■ Debt funding of R 1. 8 billion required ■ Sources Funding Composition (Per Year) – Domestic Debt Capital Markets (DMTN) – Tap 10 -year AIR 04 and 16 -year AIR 05 – Issue new benchmark bond – Commercial Paper – Bank credit facilities and financing – Development Finance Institutions (DFIs)

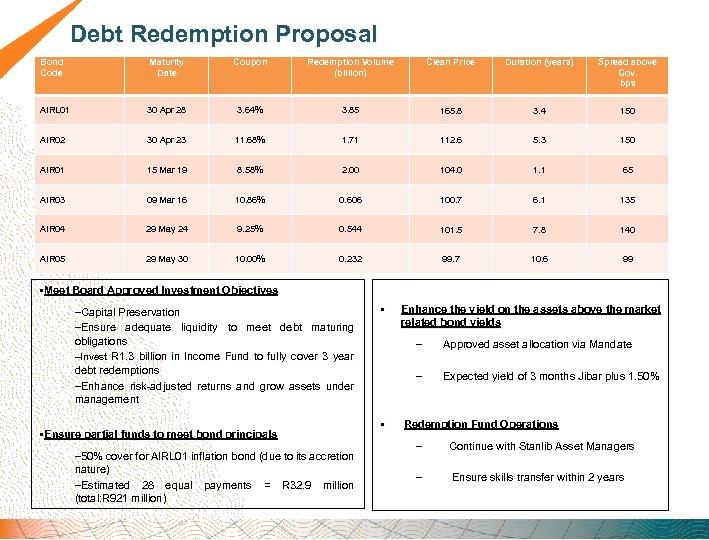

Debt Redemption Proposal Bond Code Maturity Date Coupon Redemption Volume (billion) Clean Price Duration (years) Spread above Gov. bps AIRL 01 30 Apr 28 3. 64% 3. 85 165. 8 3. 4 150 AIR 02 30 Apr 23 11. 68% 1. 71 112. 6 5. 3 150 AIR 01 15 Mar 19 8. 58% 2. 00 104. 0 1. 1 65 AIR 03 09 Mar 16 10. 86% 0. 606 100. 7 6. 1 135 AIR 04 29 May 24 9. 25% 0. 544 101. 5 7. 8 140 AIR 05 29 May 30 10. 00% 0. 232 99. 7 10. 6 99 §Meet Board Approved Investment Objectives –Capital Preservation –Ensure adequate liquidity to meet debt maturing obligations –Invest R 1. 3 billion in Income Fund to fully cover 3 year debt redemptions –Enhance risk-adjusted returns and grow assets under management §Ensure partial funds to meet bond principals – 50% cover for AIRL 01 inflation bond (due to its accretion nature) –Estimated 28 equal payments = R 32. 9 million (total: R 921 million) § Enhance the yield on the assets above the market related bond yields – – § Approved asset allocation via Mandate Expected yield of 3 months Jibar plus 1. 50% Redemption Fund Operations – Continue with Stanlib Asset Managers – Ensure skills transfer within 2 years

Debt Redemption Proposal Bond Code Maturity Date Coupon Redemption Volume (billion) Clean Price Duration (years) Spread above Gov. bps AIRL 01 30 Apr 28 3. 64% 3. 85 165. 8 3. 4 150 AIR 02 30 Apr 23 11. 68% 1. 71 112. 6 5. 3 150 AIR 01 15 Mar 19 8. 58% 2. 00 104. 0 1. 1 65 AIR 03 09 Mar 16 10. 86% 0. 606 100. 7 6. 1 135 AIR 04 29 May 24 9. 25% 0. 544 101. 5 7. 8 140 AIR 05 29 May 30 10. 00% 0. 232 99. 7 10. 6 99 §Meet Board Approved Investment Objectives –Capital Preservation –Ensure adequate liquidity to meet debt maturing obligations –Invest R 1. 3 billion in Income Fund to fully cover 3 year debt redemptions –Enhance risk-adjusted returns and grow assets under management §Ensure partial funds to meet bond principals – 50% cover for AIRL 01 inflation bond (due to its accretion nature) –Estimated 28 equal payments = R 32. 9 million (total: R 921 million) § Enhance the yield on the assets above the market related bond yields – – § Approved asset allocation via Mandate Expected yield of 3 months Jibar plus 1. 50% Redemption Fund Operations – Continue with Stanlib Asset Managers – Ensure skills transfer within 2 years

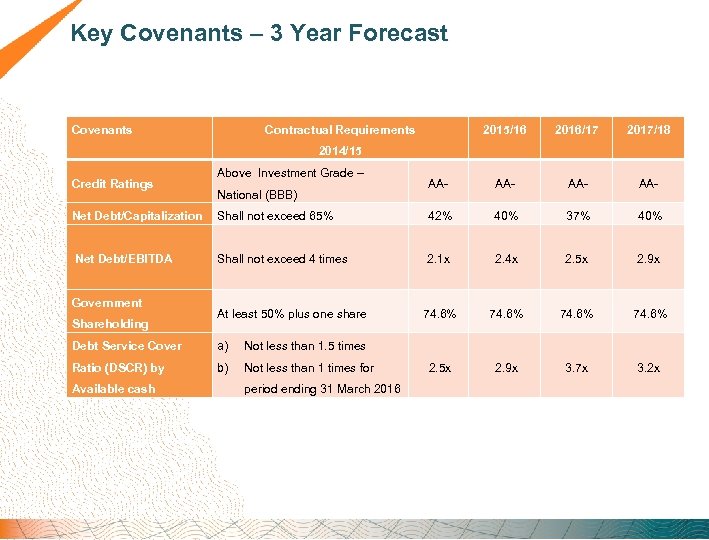

Key Covenants – 3 Year Forecast Covenants Contractual Requirements 2017/18 2015/16 2016/17 2014/15 Credit Ratings Net Debt/Capitalization Above Investment Grade – National (BBB) Shall not exceed 65% AA- AA- 42% 40% 37% 40% 2. 4 x 2. 5 x 2. 9 x 74. 6% 2. 5 x 2. 9 x 3. 7 x 3. 2 x Net Debt/EBITDA Shall not exceed 4 times 2. 1 x Government Shareholding At least 50% plus one share Debt Service Cover a) Not less than 1. 5 times Ratio (DSCR) by b) Not less than 1 times for Available cash period ending 31 March 2016

Key Covenants – 3 Year Forecast Covenants Contractual Requirements 2017/18 2015/16 2016/17 2014/15 Credit Ratings Net Debt/Capitalization Above Investment Grade – National (BBB) Shall not exceed 65% AA- AA- 42% 40% 37% 40% 2. 4 x 2. 5 x 2. 9 x 74. 6% 2. 5 x 2. 9 x 3. 7 x 3. 2 x Net Debt/EBITDA Shall not exceed 4 times 2. 1 x Government Shareholding At least 50% plus one share Debt Service Cover a) Not less than 1. 5 times Ratio (DSCR) by b) Not less than 1 times for Available cash period ending 31 March 2016

Conclusion 40

Conclusion 40

Conclusion Over the next three years (2016 to 2018), we are planning to have: • Improved shareholder value • Finalised the empowerment shareholders matters • Have a model to secure new business in Africa and other emerging markets model to secure new business • Continue to unlock value potential in-land at our airports • Accelerated our sustainability and transformation programmes as pertains to: Accelerated our sustainability and transformation programmes • • • Job creation Retail transformation Employment equity Gender Youth and people with disabilities Skills development Environmental Socio economic development Enterprise development • Engaged on, with industry players and Economic Regulator, economic on regulatory legislation and funding framework • Continue managing and developing a high performing and engaged team • Continue to deliver on and / or have delivered some of our key strategic initiatives 41

Conclusion Over the next three years (2016 to 2018), we are planning to have: • Improved shareholder value • Finalised the empowerment shareholders matters • Have a model to secure new business in Africa and other emerging markets model to secure new business • Continue to unlock value potential in-land at our airports • Accelerated our sustainability and transformation programmes as pertains to: Accelerated our sustainability and transformation programmes • • • Job creation Retail transformation Employment equity Gender Youth and people with disabilities Skills development Environmental Socio economic development Enterprise development • Engaged on, with industry players and Economic Regulator, economic on regulatory legislation and funding framework • Continue managing and developing a high performing and engaged team • Continue to deliver on and / or have delivered some of our key strategic initiatives 41

Annexures A. Risk management framework and company risks B. Shareholder compact and pre-determined objectives C. Governance D. Borrowing plan E. Significance and materiality framework F. Dividend policy G. Employment equity plan H. Fraud prevention plan I. Business unit initiatives 42

Annexures A. Risk management framework and company risks B. Shareholder compact and pre-determined objectives C. Governance D. Borrowing plan E. Significance and materiality framework F. Dividend policy G. Employment equity plan H. Fraud prevention plan I. Business unit initiatives 42

Thank you

Thank you