75c9d3c8c7f242cbaa8ab561884254f8.ppt

- Количество слайдов: 23

Corporate Overview March, 2010

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: Statements in this presentation regarding Zix Corporation's business that are not historical facts are "forward-looking statements" that involve risks and uncertainties. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see "Risk Factors" in the Company's most recently filed Annual Report on Form 10 -K, recent earnings press release related to the period ending December 31, 2009 and subsequent press releases. 2

Who we are The issue: Internet-based email is insecure, so limits use for: – – Healthcare Financial services Government Other industries dealing with sensitive informaiton The solution: Zix. Corp secures email for sensitive information – Enables use of Internet for sensitive information – Improves work flows Zix. Corp is a Dallas-based company traded on Nasdaq (ZIXI) – Founded as a public company in 1998 – 125 employees – Offices also in Burlington, MA and Ottawa, Canada 3

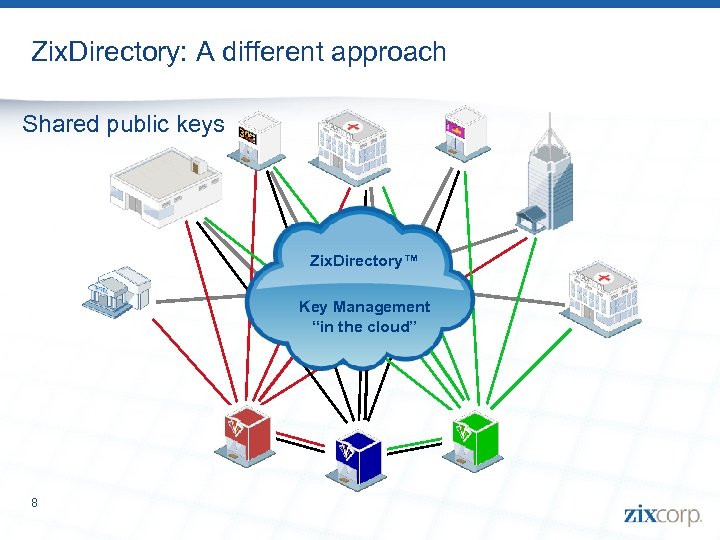

Investment Highlights for Zix. Corp (Nasdaq: ZIXI) Email Encryption offered in Software as a Service (Saa. S) model – Subscription model provides very high visibility and predictability – Fixed cost infrastructure highly scalable; incremental revenues ~90% margin – 7 Years of rapid growth with high customer retention Unique architecture provides differentiated, “best of breed” offering – Shared architecture with key management “in the cloud” leads to viral growth of user base – Transparent, automatic delivery of encrypted email using the Zix. Gateway provides unparalleled ease-of-use Projected first year of profitability in 2010 – Announced exit from e-Prescribing business by 12/31/2010 – Industry consolidation means few competitors in growing market – Only public Email Encryption “pure play” 4

Update: Q 4 Results § Revenue: Record $8. 2 million for Q 4 exceeded guidance – Email: $7. 1 million (up 17%), e-Prescribing: $1. 1 million (down 1%) – Full-year revenue $30. 7 million (up 9% over 2008) – Email: $26. 4 million (up 17%), e-Prescribing: $4. 4 million (down 22%) § Gross Margin: Record 77% overall adjusted gross margin in Q 4 – 82% gross margin in Email, 43% in e-Prescribing – Gross profit up 20% in 2009, with overall margin at 72% for year § Email orders: Record $2. 4 million new first-year orders in Q 4 – 35% higher than any previous quarter; 61% growth over Q 4 2008 – Records in total orders for quarter ($11. 3 M), year ($35. 2 M) – Record $44. 5 million backlog at 12/31/2009 § Adjusted EPS: $0. 01 for the year marks first positive annual result – Record $. 02 adjusted EPS for Q 4, achieved high end of guidance 5

Zix. Data Center™: Robust, On-Demand, Secure Platform § Open platform with industry standards – Multiple layers of authentication – Highly scalable with dynamic key exchange for unsurpassed flexibility – 100% increase in throughput possible with minimal CAPEX requirement – Sys. Trust and SAS-70 II certified § Infrastructure features – Highly secure NOC with biometric access and video surveillance, manned 24 x 7 x 365 – Fully redundant systems – Hot-site back-up facility – Capacity sufficient to scale worldwide 6 § Sent over 130 million encrypted messages in 2009 with significant unused capacity

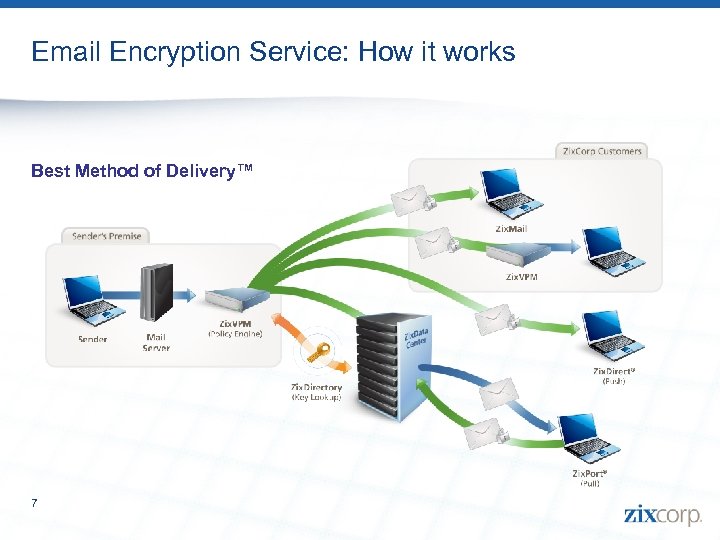

Email Encryption Service: How it works Best Method of Delivery™ 7

Zix. Directory: A different approach Shared public keys Zix. Directory™ Key Management “in the cloud” 8

Included in the Zix. Directory are: Many of the nation’s most trusted institutions: – – – – 9 The US Federal Banking Regulators (FFIEC) More than 20 State Banking Regulators U. S. Securities and Exchange Commission (SEC) Over 1, 200 financial institutions in the US More than 30 Blue Cross Blue Shield organizations Health insurance customers protecting over 85 million Americans Over 1, 000 (1 in 7) hospitals in the US

Zix. Corp has the only solution to send and receive encrypted email automatically and transparently Send Email as Usual Receive Securely Using our appliance, the sender’s email is automatically scanned for content that triggers a policy to encrypt the email – Sender has option to force encryption When encrypted email hits recipient’s appliance, it is decrypted and placed into inbox 10 – Receiver does not have to perform any additional action – Completely transparent to sender and receiver

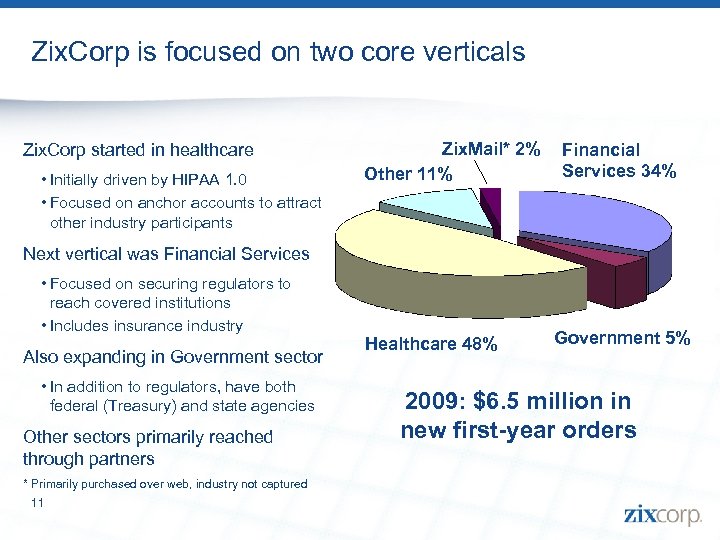

Zix. Corp is focused on two core verticals Zix. Corp started in healthcare • Initially driven by HIPAA 1. 0 • Focused on anchor accounts to attract other industry participants Zix. Mail* 2% Other 11% Financial Services 34% Next vertical was Financial Services • Focused on securing regulators to reach covered institutions • Includes insurance industry Also expanding in Government sector • In addition to regulators, have both federal (Treasury) and state agencies Other sectors primarily reached through partners * Primarily purchased over web, industry not captured 11 Healthcare 48% Government 5% 2009: $6. 5 million in new first-year orders

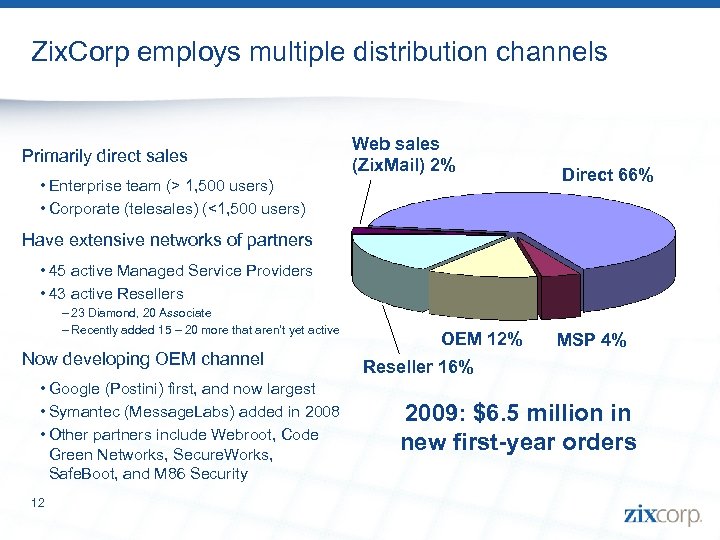

Zix. Corp employs multiple distribution channels Primarily direct sales Web sales (Zix. Mail) 2% • Enterprise team (> 1, 500 users) • Corporate (telesales) (<1, 500 users) Direct 66% Have extensive networks of partners • 45 active Managed Service Providers • 43 active Resellers – 23 Diamond, 20 Associate – Recently added 15 – 20 more that aren’t yet active Now developing OEM channel • Google (Postini) first, and now largest • Symantec (Message. Labs) added in 2008 • Other partners include Webroot, Code Green Networks, Secure. Works, Safe. Boot, and M 86 Security 12 OEM 12% MSP 4% Reseller 16% 2009: $6. 5 million in new first-year orders

Expected Drivers of Future Growth § Overall market projected to grow ~20%/year through 2012 – Osterman Research estimates growth from $171 M in ’ 09 to $290 M in ‘ 12 § OEM channel contribution to new orders grew 195% in 2009 – OEM partners tell us that their customers are asking for email encryption – As we deepen relationships, expect to see increased contribution from OEM partners § International expansion via channels – Already added several European customers through Message. Labs – Established data center in UK to facilitate sales to European customers § Regulatory compliance and enforcement – HITECH Act expanded HIPAA to include business associates, increased penalties and enforcement, and brought new breach notification requirements – Other laws, such as required encryption of personal info in MA and NV 13

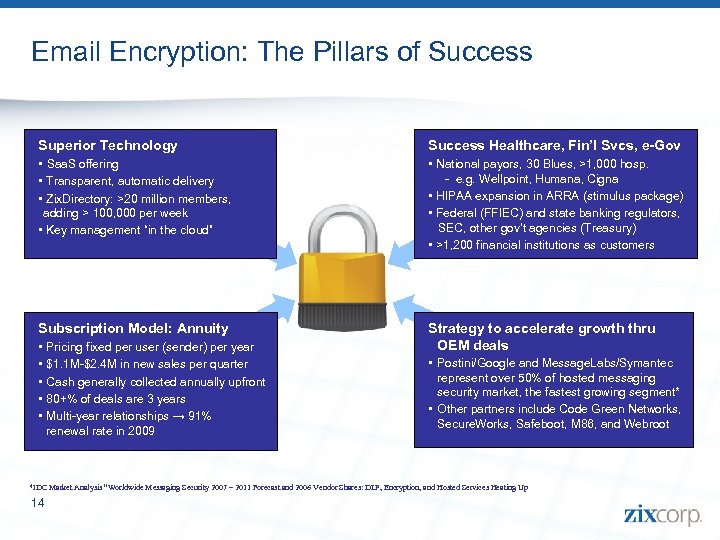

Email Encryption: The Pillars of Success Superior Technology Success Healthcare, Fin’l Svcs, e-Gov • Saa. S offering • Transparent, automatic delivery • Zix. Directory: >20 million members, adding > 100, 000 per week • Key management “in the cloud” • National payors, 30 Blues, >1, 000 hosp. - e. g. Wellpoint, Humana, Cigna • HIPAA expansion in ARRA (stimulus package) • Federal (FFIEC) and state banking regulators, SEC, other gov’t agencies (Treasury) • >1, 200 financial institutions as customers Subscription Model: Annuity Strategy to accelerate growth thru OEM deals • Pricing fixed per user (sender) per year • $1. 1 M-$2. 4 M in new sales per quarter • Cash generally collected annually upfront • 80+% of deals are 3 years • Multi-year relationships → 91% renewal rate in 2009 • Postini/Google and Message. Labs/Symantec represent over 50% of hosted messaging security market, the fastest growing segment* • Other partners include Code Green Networks, Secure. Works, Safeboot, M 86, and Webroot *IDC Market Analysis “Worldwide Messaging Security 2007 – 2011 Forecast and 2006 Vendor Shares: DLP, Encryption, and Hosted Services Heating Up 14

Zix. Corp is exiting e-Prescribing business § On December 8, 2009, Zix. Corp announced wind down of e-Prescribing business – Planned end date December 31, 2010 – Intend to fulfill existing contractual obligations § Expect e-Prescribing business will be breakeven to slightly profitable in 2010 – Already reduced headcount to maintenance levels § Allows focus on more profitable Email Encryption business 15

Financial Information 16

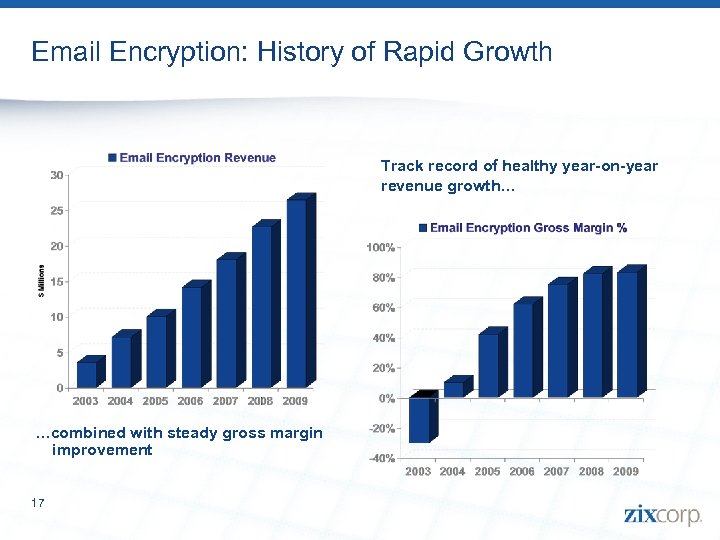

Email Encryption: History of Rapid Growth Track record of healthy year-on-year revenue growth… …combined with steady gross margin improvement 17

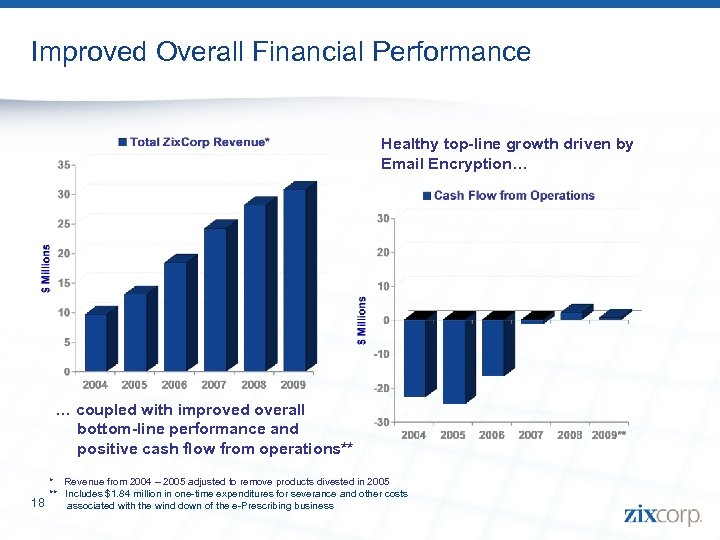

Improved Overall Financial Performance Healthy top-line growth driven by Email Encryption… … coupled with improved overall bottom-line performance and positive cash flow from operations** 18 * Revenue from 2004 – 2005 adjusted to remove products divested in 2005 ** Includes $1. 84 million in one-time expenditures for severance and other costs associated with the wind down of the e-Prescribing business

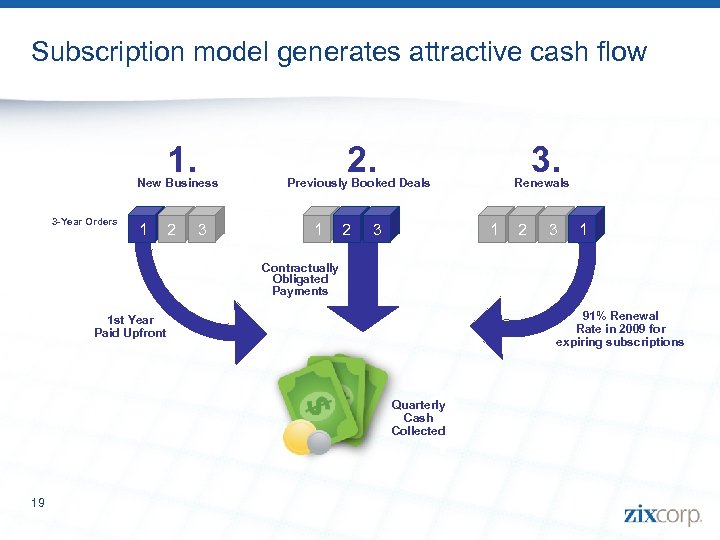

Subscription model generates attractive cash flow 1. New Business 3 -Year Orders 1 2 3 2. 3. Previously Booked Deals 1 2 3 Renewals 1 2 3 1 Contractually Obligated Payments 91% Renewal Rate in 2009 for expiring subscriptions 1 st Year Paid Upfront $ 19 $ Quarterly Cash Collected

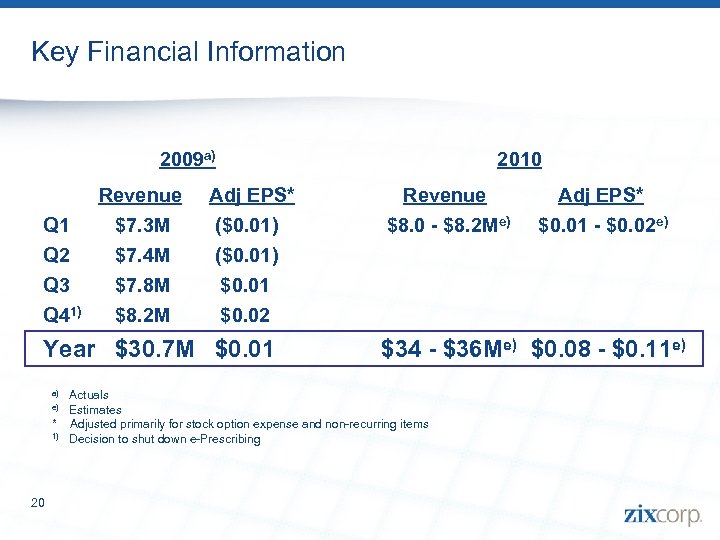

Key Financial Information 2009 a) 2010 Revenue Q 1 Q 2 Q 3 Q 41) Adj EPS* Revenue Adj EPS* $7. 3 M $7. 4 M $7. 8 M $8. 2 M ($0. 01) $0. 01 $0. 02 $8. 0 - $8. 2 Me) $0. 01 - $0. 02 e) Year $30. 7 M $0. 01 a) e) * 1) 20 $34 - $36 Me) $0. 08 - $0. 11 e) Actuals Estimates Adjusted primarily for stock option expense and non-recurring items Decision to shut down e-Prescribing

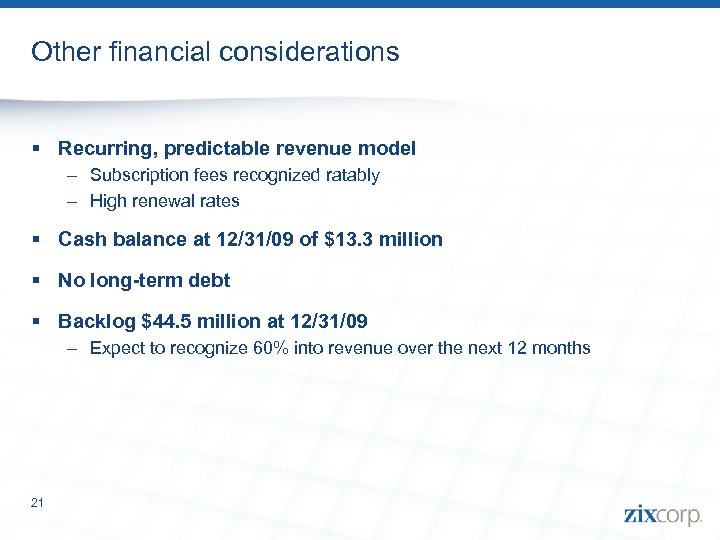

Other financial considerations § Recurring, predictable revenue model – Subscription fees recognized ratably – High renewal rates § Cash balance at 12/31/09 of $13. 3 million § No long-term debt § Backlog $44. 5 million at 12/31/09 – Expect to recognize 60% into revenue over the next 12 months 21

Summary Email Encryption offered in Software as a Service (Saa. S) model – Subscription model provides very high visibility and predictability – Fixed cost infrastructure highly scalable; incremental revenues ~90% margin – 7 Years of rapid growth with high customer retention Unique architecture provides differentiated, “best of breed” offering – Shared architecture with key management “in the cloud” leads to viral growth of user base – Transparent, automatic delivery of encrypted email using the Zix. Gateway provides unparalleled ease-of-use Projected first year of profitability in 2010 – Announced exit from e-Prescribing business by 12/31/2010 – Industry consolidation means few competitors in growing market – Only public Email Encryption “pure play” 22

Thank you from 23

75c9d3c8c7f242cbaa8ab561884254f8.ppt