c045437d1a4bcf5cbe7d9eaa8470845e.ppt

- Количество слайдов: 16

Corporate-Level Strategy Diversification, Mergers & Acquisitions

Corporate-Level Strategy Diversification, Mergers & Acquisitions

The Role of Diversification • Diversification strategies play a major role in the behavior of large firms • Product diversification concerns: Ø The scope of the industries and markets in which the firm competes Ø How managers buy, create and sell different businesses to match skills and strengths with opportunities presented to the firm 2

The Role of Diversification • Diversification strategies play a major role in the behavior of large firms • Product diversification concerns: Ø The scope of the industries and markets in which the firm competes Ø How managers buy, create and sell different businesses to match skills and strengths with opportunities presented to the firm 2

Two Strategy Levels • Business-level Strategy (Competitive) Ø Each business unit in a diversified firm chooses a business-level strategy as its means of competing in individual product markets • Corporate-level Strategy (Companywide) Ø Specifies actions taken by the firm to gain a competitive advantage by selecting and managing a group of different businesses competing in several industries and product markets 3

Two Strategy Levels • Business-level Strategy (Competitive) Ø Each business unit in a diversified firm chooses a business-level strategy as its means of competing in individual product markets • Corporate-level Strategy (Companywide) Ø Specifies actions taken by the firm to gain a competitive advantage by selecting and managing a group of different businesses competing in several industries and product markets 3

Corporate-Level Strategy: Key Questions • Corporate-level Strategy’s Value Ø The degree to which the businesses in the portfolio are worth more under the management of the company than they would be under other ownership Ø What businesses should the firm be in? Ø How should the corporate office manage the group of businesses? Business Units 4

Corporate-Level Strategy: Key Questions • Corporate-level Strategy’s Value Ø The degree to which the businesses in the portfolio are worth more under the management of the company than they would be under other ownership Ø What businesses should the firm be in? Ø How should the corporate office manage the group of businesses? Business Units 4

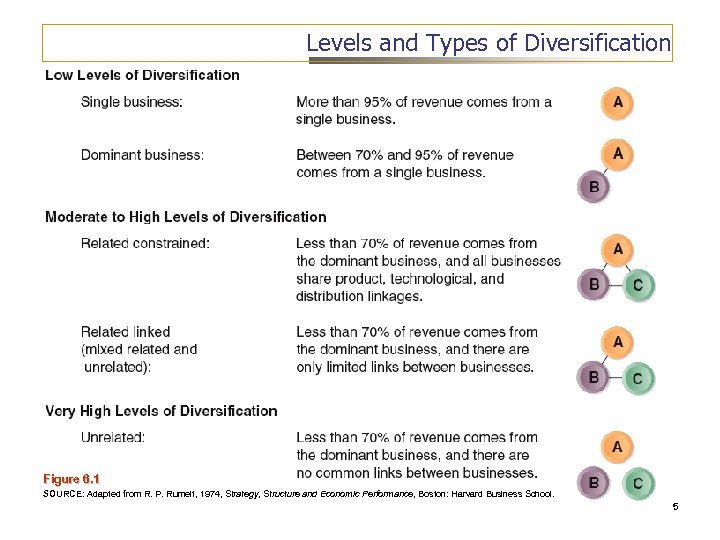

Levels and Types of Diversification Figure 6. 1 SOURCE: Adapted from R. P. Rumelt, 1974, Strategy, Structure and Economic Performance, Boston: Harvard Business School. 5

Levels and Types of Diversification Figure 6. 1 SOURCE: Adapted from R. P. Rumelt, 1974, Strategy, Structure and Economic Performance, Boston: Harvard Business School. 5

Reasons for Diversification ØAdapt to Tax Laws & Antitrust Regulations ØRemedy Poor Performance ØHedge against future market & cash flow uncertainties (risk reduction for firm) ØMore Fully Leverage Tangible/Intangible Resources ØReduce Executives’ Employment Risk and Increase Their Compensation 6

Reasons for Diversification ØAdapt to Tax Laws & Antitrust Regulations ØRemedy Poor Performance ØHedge against future market & cash flow uncertainties (risk reduction for firm) ØMore Fully Leverage Tangible/Intangible Resources ØReduce Executives’ Employment Risk and Increase Their Compensation 6

Strategic Motives for Diversification To Enhance Strategic Competitiveness via: • Economies of scope (related diversification) --Sharing activities --Transferring core competencies • Market power (related diversification) --Blocking competitors through multipoint competition --Vertical integration • Financial economies (unrelated diversification) --Efficient internal capital allocation --Business restructuring 7

Strategic Motives for Diversification To Enhance Strategic Competitiveness via: • Economies of scope (related diversification) --Sharing activities --Transferring core competencies • Market power (related diversification) --Blocking competitors through multipoint competition --Vertical integration • Financial economies (unrelated diversification) --Efficient internal capital allocation --Business restructuring 7

Related Diversification: Economies of Scope • Value is created from economies of scope through: ØOperational relatedness in sharing activities ØCorporate relatedness in transferring skills or corporate core competencies among units • The difference between sharing activities and transferring competencies is based on how the resources are jointly used to create economies of scope 8

Related Diversification: Economies of Scope • Value is created from economies of scope through: ØOperational relatedness in sharing activities ØCorporate relatedness in transferring skills or corporate core competencies among units • The difference between sharing activities and transferring competencies is based on how the resources are jointly used to create economies of scope 8

Sharing Activities • Operational Relatedness Ø Created by sharing either primary activities such as production and distribution systems, or support activities such as purchasing, IT and HR • Sharing activities often lowers costs or raises differentiation Ø Sharing activities can lower costs if it: v v v achieves economies of scale boosts efficiency of utilization helps move more rapidly down the Learning Curve Ø Sharing activities can enhance potential for or reduce the cost of differentiation • Activity sharing requires sharing strategic control over business units • Activity sharing may create risk because business-unit ties create links between outcomes (i. e. , constraints) 9

Sharing Activities • Operational Relatedness Ø Created by sharing either primary activities such as production and distribution systems, or support activities such as purchasing, IT and HR • Sharing activities often lowers costs or raises differentiation Ø Sharing activities can lower costs if it: v v v achieves economies of scale boosts efficiency of utilization helps move more rapidly down the Learning Curve Ø Sharing activities can enhance potential for or reduce the cost of differentiation • Activity sharing requires sharing strategic control over business units • Activity sharing may create risk because business-unit ties create links between outcomes (i. e. , constraints) 9

Transferring Corporate Competencies • Corporate Relatedness Ø identify & exploit ability to transfer skills or expertise among similar value chains v Using complex sets of resources and capabilities to link different businesses through managerial and technological knowledge, experience, and expertise • Creates value in two ways: Ø Eliminates resource duplication in the need to allocate resources for a second unit to develop a competence that already exists in another unit Ø Provides intangible resources that are difficult for competitors to understand imitate v A transferred intangible resource gives unit receiving it an immediate competitive advantage over its rivals 10

Transferring Corporate Competencies • Corporate Relatedness Ø identify & exploit ability to transfer skills or expertise among similar value chains v Using complex sets of resources and capabilities to link different businesses through managerial and technological knowledge, experience, and expertise • Creates value in two ways: Ø Eliminates resource duplication in the need to allocate resources for a second unit to develop a competence that already exists in another unit Ø Provides intangible resources that are difficult for competitors to understand imitate v A transferred intangible resource gives unit receiving it an immediate competitive advantage over its rivals 10

Transferring Core Competencies: Assumptions • Transferring core competencies leads to competitive advantage only if the similarities among business units meet the following conditions: Ø activities involved in the businesses are similar enough that sharing expertise is meaningful Ø transfer of skills involves activities which are important to competitive advantage Ø the skills transferred represent significant sources of competitive advantage for the receiving unit • The often substantial organizational costs of fostering/enabling transfer do not exceed the benefits 11

Transferring Core Competencies: Assumptions • Transferring core competencies leads to competitive advantage only if the similarities among business units meet the following conditions: Ø activities involved in the businesses are similar enough that sharing expertise is meaningful Ø transfer of skills involves activities which are important to competitive advantage Ø the skills transferred represent significant sources of competitive advantage for the receiving unit • The often substantial organizational costs of fostering/enabling transfer do not exceed the benefits 11

Related Diversification: Market Power • Market power exists when a firm can: Ø Sell its products above the existing competitive level and/or Ø Reduce the costs of its primary and support activities below the competitive level • Multipoint Competition Ø Two or more diversified firms simultaneously compete in the same product areas or geographic markets • Vertical Integration Ø Backward integration—a firm produces its own inputs Ø Forward integration—a firm operates its own distribution system for delivering its outputs 12

Related Diversification: Market Power • Market power exists when a firm can: Ø Sell its products above the existing competitive level and/or Ø Reduce the costs of its primary and support activities below the competitive level • Multipoint Competition Ø Two or more diversified firms simultaneously compete in the same product areas or geographic markets • Vertical Integration Ø Backward integration—a firm produces its own inputs Ø Forward integration—a firm operates its own distribution system for delivering its outputs 12

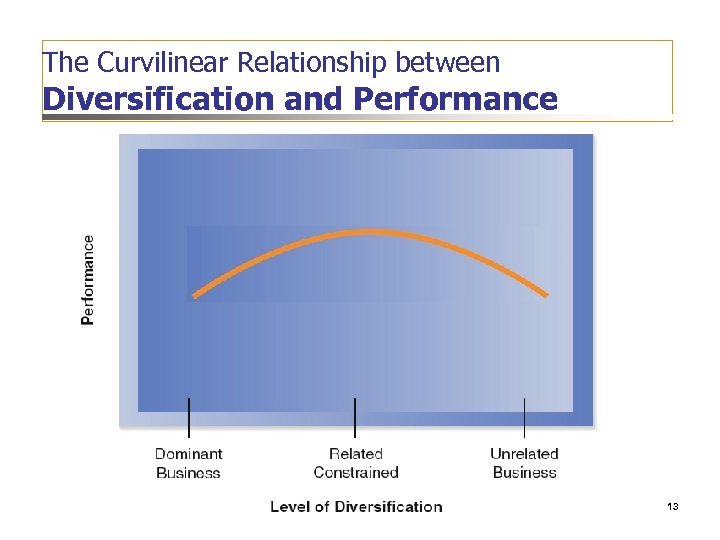

The Curvilinear Relationship between Diversification and Performance 13

The Curvilinear Relationship between Diversification and Performance 13

Mergers, Acquisitions, and Takeovers: What are the Differences? • Merger Ø A strategy through which two firms agree to integrate their operations on a relatively co-equal basis • Acquisition Ø A strategy through which one firm buys a controlling, or 100% interest in another firm with the intent of making the acquired firm a subsidiary business within its portfolio • Takeover Ø A special type of acquisition when the target firm did not solicit the acquiring firm’s bid for outright ownership 14

Mergers, Acquisitions, and Takeovers: What are the Differences? • Merger Ø A strategy through which two firms agree to integrate their operations on a relatively co-equal basis • Acquisition Ø A strategy through which one firm buys a controlling, or 100% interest in another firm with the intent of making the acquired firm a subsidiary business within its portfolio • Takeover Ø A special type of acquisition when the target firm did not solicit the acquiring firm’s bid for outright ownership 14

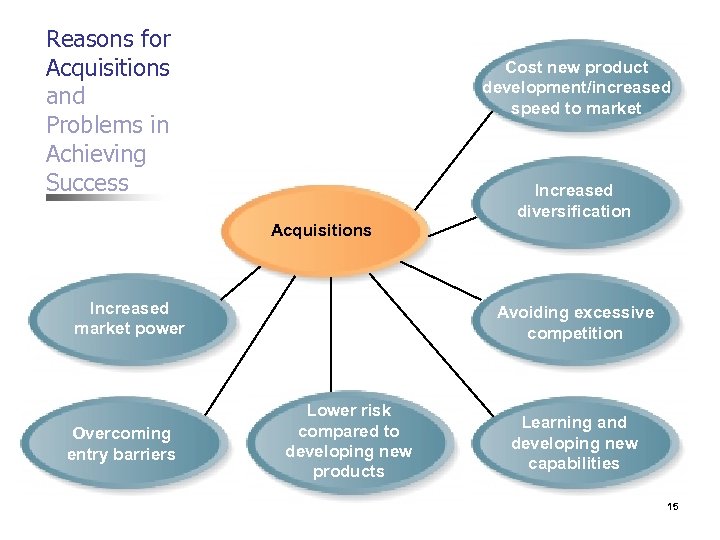

Reasons for Acquisitions and Problems in Achieving Success Cost new product development/increased speed to market Increased diversification Acquisitions Increased market power Overcoming entry barriers Avoiding excessive competition Lower risk compared to developing new products Learning and developing new capabilities 15

Reasons for Acquisitions and Problems in Achieving Success Cost new product development/increased speed to market Increased diversification Acquisitions Increased market power Overcoming entry barriers Avoiding excessive competition Lower risk compared to developing new products Learning and developing new capabilities 15

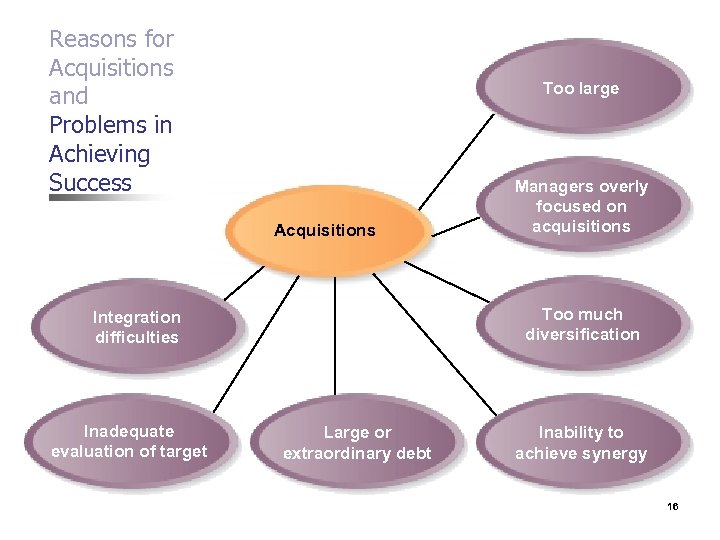

Reasons for Acquisitions and Problems in Achieving Success Too large Acquisitions Too much diversification Integration difficulties Inadequate evaluation of target Managers overly focused on acquisitions Large or extraordinary debt Inability to achieve synergy 16

Reasons for Acquisitions and Problems in Achieving Success Too large Acquisitions Too much diversification Integration difficulties Inadequate evaluation of target Managers overly focused on acquisitions Large or extraordinary debt Inability to achieve synergy 16