Corporate Governance What does it deal with and why has it been put on the agenda recently?

Corporate Governance What does it deal with and why has it been put on the agenda recently?

Corporate scandals: Responses to corporate scandals and questionable bonus systems and option programmes: • The US: the Sarbanes-Oxley Act (July 2002) • Europe: the EU Commission launches Framework for a Modernised Company Law and Corporate Governance in Europe

Corporate scandals: Responses to corporate scandals and questionable bonus systems and option programmes: • The US: the Sarbanes-Oxley Act (July 2002) • Europe: the EU Commission launches Framework for a Modernised Company Law and Corporate Governance in Europe

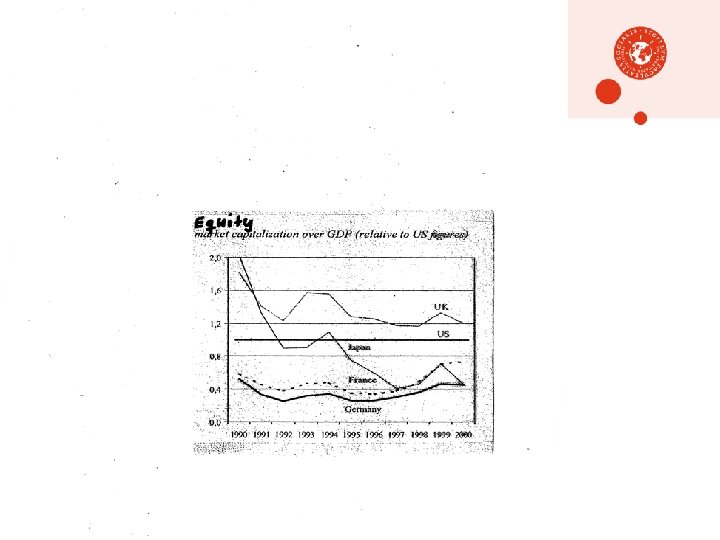

Other reasons for intense interest in Corporate Governance: • Changes in the structure of ownership – ”equity culture” and growing importance of institutional investors • Equity Funds: buy majority stakes in companies and close involvement of investors with the companies they finance (high leverage and provision of valuable support and governance) • The globalisation of Corporate Governance: • • Convergence towards the Anglo-Saxon system? Emerging market economies (former planned economies and developing countries)

Other reasons for intense interest in Corporate Governance: • Changes in the structure of ownership – ”equity culture” and growing importance of institutional investors • Equity Funds: buy majority stakes in companies and close involvement of investors with the companies they finance (high leverage and provision of valuable support and governance) • The globalisation of Corporate Governance: • • Convergence towards the Anglo-Saxon system? Emerging market economies (former planned economies and developing countries)

What does CG deal with in theory: • The corporate control problem • The standard view of CG deals with the ways in which suppliers of finance to corporations assure themselves of getting a return on their investments • Alternatives to the ”Shareholder value model” • Cadbury report: Corporate governance is the system by which companies are directed and controlled • The managerial competition model • Discipline within the classic theory of finance: A debt contract is an alternative to shareholder capital as a tool for reducing the agency costs.

What does CG deal with in theory: • The corporate control problem • The standard view of CG deals with the ways in which suppliers of finance to corporations assure themselves of getting a return on their investments • Alternatives to the ”Shareholder value model” • Cadbury report: Corporate governance is the system by which companies are directed and controlled • The managerial competition model • Discipline within the classic theory of finance: A debt contract is an alternative to shareholder capital as a tool for reducing the agency costs.

Europe: • Polarization between the Anglo-Saxon UK system (similar to the US system) and the Continental French and German systems. • The continental system has some characteristic features of the “stakeholder model”: interests of non-investing parties considered • France: managements and directors aim at “social interests” • Germany: a “governing coalition” (blockholder, employee representatives and banks) in large firms, which depend on banks as lenders

Europe: • Polarization between the Anglo-Saxon UK system (similar to the US system) and the Continental French and German systems. • The continental system has some characteristic features of the “stakeholder model”: interests of non-investing parties considered • France: managements and directors aim at “social interests” • Germany: a “governing coalition” (blockholder, employee representatives and banks) in large firms, which depend on banks as lenders

Pressure on the EU Commission to copy the American system? • A Framework for a New Company Law in Europe • EU subsidarity principle applied: guidelines for the national governments • EU Lisbon Strategy for the promotion of sustainable growth: “well managed companies, with strong corporate governance records … outperform their competitors. Europe needs more of them to generate employment and higher long term sustainable growth” • Disciplinary role to the suppliers of finance but also the need to achieve efficient protection of “third parties”

Pressure on the EU Commission to copy the American system? • A Framework for a New Company Law in Europe • EU subsidarity principle applied: guidelines for the national governments • EU Lisbon Strategy for the promotion of sustainable growth: “well managed companies, with strong corporate governance records … outperform their competitors. Europe needs more of them to generate employment and higher long term sustainable growth” • Disciplinary role to the suppliers of finance but also the need to achieve efficient protection of “third parties”

Course Outline: Course web-side: http: //www. econ. ku. dk/okojang/Corp. Gov. htm Section 1: The standard view in corporate governance 36. 1 -36. 2 The Shareholder Value model of Corporate Governance. Lazonick, O’Sullivan, Tirole sections 1 – 2. 1. . 38. The legal approach to corporate governance. La Porta et. al + Student groups I. . Section 2: Corporate Governance in and outside the EU Section 3: A general framework for analyzing corporate control Section 4: Alternative views of corporate governance

Course Outline: Course web-side: http: //www. econ. ku. dk/okojang/Corp. Gov. htm Section 1: The standard view in corporate governance 36. 1 -36. 2 The Shareholder Value model of Corporate Governance. Lazonick, O’Sullivan, Tirole sections 1 – 2. 1. . 38. The legal approach to corporate governance. La Porta et. al + Student groups I. . Section 2: Corporate Governance in and outside the EU Section 3: A general framework for analyzing corporate control Section 4: Alternative views of corporate governance