14e73ede54dc5daa51edcc9721769b68.ppt

- Количество слайдов: 19

Corporate Governance Life Cycle Igor Filatochev, Mike Wright Strategic Entrepreneurship 2

Corporate Governance Life Cycle Igor Filatochev, Mike Wright Strategic Entrepreneurship 2

2 objectives of Corporate Governance Ensure accountability of management in order to minimize downside risks to shareholders Enable management to exercise enterprise in order to enable shareholders to benefit from upside potential of firms 3

2 objectives of Corporate Governance Ensure accountability of management in order to minimize downside risks to shareholders Enable management to exercise enterprise in order to enable shareholders to benefit from upside potential of firms 3

Competitive advantages Effective governance systems may have a positive effect on enterprise’s resources management By monitoring and incentivizing managers to undertake relevant actions Managers may be able to appropriate a disproportionate share of rents generated by the firm 4

Competitive advantages Effective governance systems may have a positive effect on enterprise’s resources management By monitoring and incentivizing managers to undertake relevant actions Managers may be able to appropriate a disproportionate share of rents generated by the firm 4

Stages of governance Governance issues arise as firm approaches the so-called entrepreneurial crisis stage (constraints to realize growth opportunities) Founders-managers have to cede control for letting the company grow Firms’ organizational learning has to develop in order to cope with a more complex environment 5

Stages of governance Governance issues arise as firm approaches the so-called entrepreneurial crisis stage (constraints to realize growth opportunities) Founders-managers have to cede control for letting the company grow Firms’ organizational learning has to develop in order to cope with a more complex environment 5

Governance life cycles Governance systems have to change in accord to the firm’s evolution Firm’s evolution is reflected by changes in ownership structure, board composition, degree of founder involvement, etc Governance focus on accountability or incentivizing management change in establishment, growth, maturity and decline 6

Governance life cycles Governance systems have to change in accord to the firm’s evolution Firm’s evolution is reflected by changes in ownership structure, board composition, degree of founder involvement, etc Governance focus on accountability or incentivizing management change in establishment, growth, maturity and decline 6

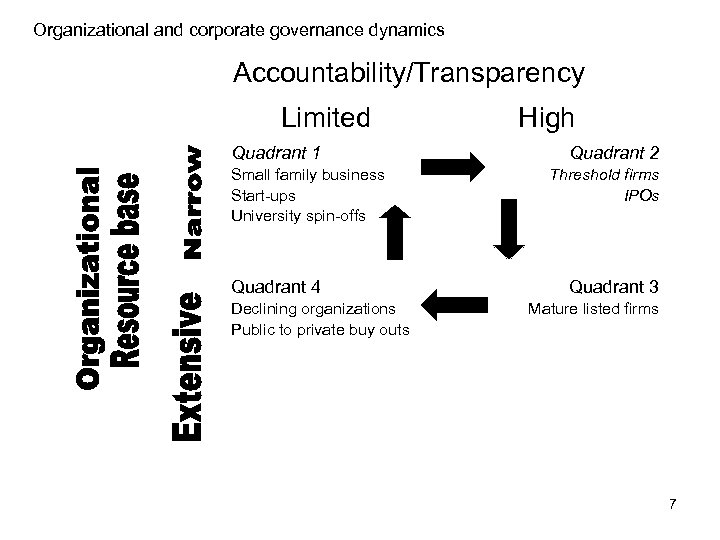

Organizational and corporate governance dynamics Accountability/Transparency Limited Quadrant 1 Small family business Start-ups University spin-offs Quadrant 4 Declining organizations Public to private buy outs High Quadrant 2 Threshold firms IPOs Quadrant 3 Mature listed firms 7

Organizational and corporate governance dynamics Accountability/Transparency Limited Quadrant 1 Small family business Start-ups University spin-offs Quadrant 4 Declining organizations Public to private buy outs High Quadrant 2 Threshold firms IPOs Quadrant 3 Mature listed firms 7

Governance life cycles As firm matures, changes in structure shift the balance to monitoring and control function of governance systems In maturity and decline resources and strategy role of governance become important Top management and outside investors have to find the right balance between multiple functions of governance in evolving firms 8

Governance life cycles As firm matures, changes in structure shift the balance to monitoring and control function of governance systems In maturity and decline resources and strategy role of governance become important Top management and outside investors have to find the right balance between multiple functions of governance in evolving firms 8

Governance and VC Firm strategy and governance life cycles should be analyzed together with economic and institutional dynamics of the country Venture capital (VC) have strong influence on governance development through firm growing stages Investors base widens from personal business angels to VC to stock market 9

Governance and VC Firm strategy and governance life cycles should be analyzed together with economic and institutional dynamics of the country Venture capital (VC) have strong influence on governance development through firm growing stages Investors base widens from personal business angels to VC to stock market 9

Governance and VC Firm’s control moves from entrepreneur to outside investors to financial institutions (with VC as screen) to stock markets VC helps to bridge a transition Notion of VC may vary in different institutional environments VC has a unique role in UK and USA, in some countries VC is just a screen for banks investing in high risk firms 10

Governance and VC Firm’s control moves from entrepreneur to outside investors to financial institutions (with VC as screen) to stock markets VC helps to bridge a transition Notion of VC may vary in different institutional environments VC has a unique role in UK and USA, in some countries VC is just a screen for banks investing in high risk firms 10

Growth and complexity As environmental and organizational complexity grow, different skills are needed Founders knowledge may create cognitive barriers (threshold enterprises) To solve this problem firms must cede control to professional managers Board composition varies from start-up (1 -5) to adolescent years (6 -8) influencing innovation and financial performance 11

Growth and complexity As environmental and organizational complexity grow, different skills are needed Founders knowledge may create cognitive barriers (threshold enterprises) To solve this problem firms must cede control to professional managers Board composition varies from start-up (1 -5) to adolescent years (6 -8) influencing innovation and financial performance 11

IPO and Venture Capital IPO is the first major shift in firms’ life cycles Emergent investors demand accountability in exchange for their support Venture capital backed IPO suffers of two sets of conflicts, between funders and managers an between founders and members of VC syndicate New forms of governance may help in managing these conflicts 12

IPO and Venture Capital IPO is the first major shift in firms’ life cycles Emergent investors demand accountability in exchange for their support Venture capital backed IPO suffers of two sets of conflicts, between funders and managers an between founders and members of VC syndicate New forms of governance may help in managing these conflicts 12

VC Syndicates When risk is high, VC syndicates (more VCs) invest in firms VC syndicate-backed IPOs have more independent board than single VC backed ones and than non VC-backed ones Lock–in arrangements: pre IPO shareholders refrained from selling firm shares after IPO Lock-in arrangements solve problems not solved by traditional governance arrangements 13

VC Syndicates When risk is high, VC syndicates (more VCs) invest in firms VC syndicate-backed IPOs have more independent board than single VC backed ones and than non VC-backed ones Lock–in arrangements: pre IPO shareholders refrained from selling firm shares after IPO Lock-in arrangements solve problems not solved by traditional governance arrangements 13

Lock-in arrangements Examples of governance issues solved by lock-in arrangements are information asymmetry in fast growing firms and need to retain key managerial talent Often firm’s post IPO performances are poor, possible causes are total risk, growth rate of assets, less involvement of founders, existence of non voting shares 14

Lock-in arrangements Examples of governance issues solved by lock-in arrangements are information asymmetry in fast growing firms and need to retain key managerial talent Often firm’s post IPO performances are poor, possible causes are total risk, growth rate of assets, less involvement of founders, existence of non voting shares 14

Governance in Mature Firms Conventional size-based remunerations of executives leads to corporate empires Share-based compensation was introduced to incentivize executives to divest non-core activities Options are a cost effective form incentive in order to persuade manager to divest 15

Governance in Mature Firms Conventional size-based remunerations of executives leads to corporate empires Share-based compensation was introduced to incentivize executives to divest non-core activities Options are a cost effective form incentive in order to persuade manager to divest 15

Governance in Mature Firms Retrenchments i. e. sales of critical assets is a form of turnaround management adopted in mature companies May hamper firm’s long term profitability Is more successful in multi product firms where resources may be switched from one sector to another Management must avoid committing to high fixed-cost sunk investments 16

Governance in Mature Firms Retrenchments i. e. sales of critical assets is a form of turnaround management adopted in mature companies May hamper firm’s long term profitability Is more successful in multi product firms where resources may be switched from one sector to another Management must avoid committing to high fixed-cost sunk investments 16

Governance in Mature Firms For mature companies it is harder to adapt governance systems to changing environment An example may be failing to exit from a declining sector Taking a public company private (delisting) leads to cut agency costs and increasing incentives for managers 17

Governance in Mature Firms For mature companies it is harder to adapt governance systems to changing environment An example may be failing to exit from a declining sector Taking a public company private (delisting) leads to cut agency costs and increasing incentives for managers 17

Governance in Mature Firms Going private means increase equity owned by manager Private equity firms are more active investors (board positions) More pressure on manager to issue effective reports and service company's debt Stronger governance than in public companies 18

Governance in Mature Firms Going private means increase equity owned by manager Private equity firms are more active investors (board positions) More pressure on manager to issue effective reports and service company's debt Stronger governance than in public companies 18

Independent Board Members Independent boards are more effective in monitoring firm management Private equity firms are more active investors (they hold board positions) In a firm going private incentive effects are stronger than monitoring effects 19

Independent Board Members Independent boards are more effective in monitoring firm management Private equity firms are more active investors (they hold board positions) In a firm going private incentive effects are stronger than monitoring effects 19