Corporate Governance_Golovacheva.pptx

- Количество слайдов: 17

Corporate Governance Code Golovacheva Kseniia

Corporate Governance Code Golovacheva Kseniia

Agenda • The nature of corporate governance • Main principles of corporate governance • Corporate governance models

Agenda • The nature of corporate governance • Main principles of corporate governance • Corporate governance models

The nature of corporate governance • Separation of ownership and control Risk-bearing functions Decision-making functions • Principal – agent problem • Corporate governance • the system by which companies are directed and controlled • the set of principles by means of that potential conflicts of interests between stakeholders can be prevented

The nature of corporate governance • Separation of ownership and control Risk-bearing functions Decision-making functions • Principal – agent problem • Corporate governance • the system by which companies are directed and controlled • the set of principles by means of that potential conflicts of interests between stakeholders can be prevented

Corporate stakeholders

Corporate stakeholders

Corporate governance codes • Different throughout the world • Country specific environment • Path-dependency • Not mandated by the rule of law, but necessary to tailor to the country environment

Corporate governance codes • Different throughout the world • Country specific environment • Path-dependency • Not mandated by the rule of law, but necessary to tailor to the country environment

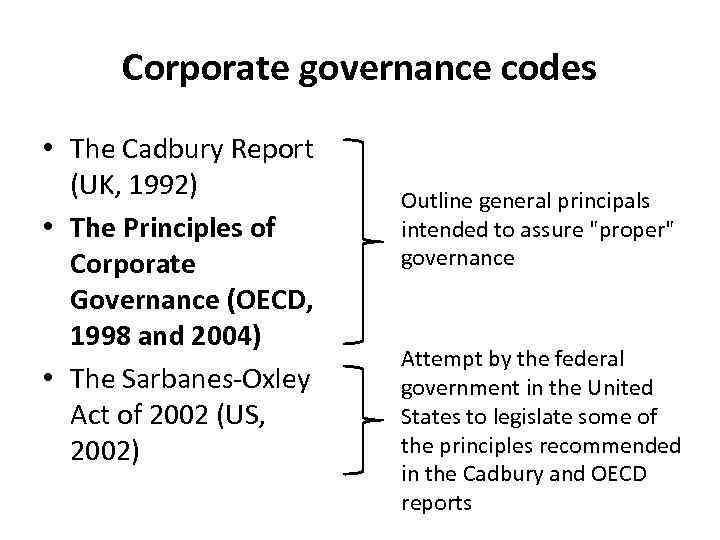

Corporate governance codes • The Cadbury Report (UK, 1992) • The Principles of Corporate Governance (OECD, 1998 and 2004) • The Sarbanes-Oxley Act of 2002 (US, 2002) Outline general principals intended to assure "proper" governance Attempt by the federal government in the United States to legislate some of the principles recommended in the Cadbury and OECD reports

Corporate governance codes • The Cadbury Report (UK, 1992) • The Principles of Corporate Governance (OECD, 1998 and 2004) • The Sarbanes-Oxley Act of 2002 (US, 2002) Outline general principals intended to assure "proper" governance Attempt by the federal government in the United States to legislate some of the principles recommended in the Cadbury and OECD reports

Corporate governance principles (OECD) • The Rights of Shareholders and Key Ownership Functions • Ensuring the Basis for an Effective Corporate Governance Framework • The Equitable Treatment of Shareholders • The Role of Stakeholders in Corporate Governance • Disclosure and Transparency • The Responsibilities of the Board

Corporate governance principles (OECD) • The Rights of Shareholders and Key Ownership Functions • Ensuring the Basis for an Effective Corporate Governance Framework • The Equitable Treatment of Shareholders • The Role of Stakeholders in Corporate Governance • Disclosure and Transparency • The Responsibilities of the Board

Corporate governance principles (OECD) • The Rights of Shareholders and Key Ownership Functions • The corporate governance framework should protect and facilitate the exercise of shareholders’ rights • Shareholders should have the right to participate in, and to be sufficiently informed on, decisions concerning fundamental corporate changes

Corporate governance principles (OECD) • The Rights of Shareholders and Key Ownership Functions • The corporate governance framework should protect and facilitate the exercise of shareholders’ rights • Shareholders should have the right to participate in, and to be sufficiently informed on, decisions concerning fundamental corporate changes

Corporate governance principles (OECD) • Ensuring the Basis for an Effective Corporate Governance Framework • An appropriate and effective legal, regulatory and institutional foundation should be established upon which all market participants can rely in establishing their private contractual relations

Corporate governance principles (OECD) • Ensuring the Basis for an Effective Corporate Governance Framework • An appropriate and effective legal, regulatory and institutional foundation should be established upon which all market participants can rely in establishing their private contractual relations

Corporate governance principles (OECD) • The Equitable Treatment of Shareholders • All shareholders of the same series of a class should be treated equally

Corporate governance principles (OECD) • The Equitable Treatment of Shareholders • All shareholders of the same series of a class should be treated equally

Corporate governance principles (OECD) • The Role of Stakeholders in Corporate Governance • The corporate governance framework should recognise the rights of stakeholders established by law or through mutual agreements • Active co-operation between corporations and stakeholders in creating wealth, jobs, and the sustainability of financially sound enterprises

Corporate governance principles (OECD) • The Role of Stakeholders in Corporate Governance • The corporate governance framework should recognise the rights of stakeholders established by law or through mutual agreements • Active co-operation between corporations and stakeholders in creating wealth, jobs, and the sustainability of financially sound enterprises

Corporate governance principles (OECD) • Disclosure and Transparency • Timely and accurate disclosure should be made on all material matters regarding the corporation, including the financial situation, performance, ownership, and governance of the company

Corporate governance principles (OECD) • Disclosure and Transparency • Timely and accurate disclosure should be made on all material matters regarding the corporation, including the financial situation, performance, ownership, and governance of the company

Corporate governance principles (OECD) • The Responsibilities of the Board • Board members should act on a fully informed basis, in good faith, with due diligence and care, and in the best interest of the company and the shareholders

Corporate governance principles (OECD) • The Responsibilities of the Board • Board members should act on a fully informed basis, in good faith, with due diligence and care, and in the best interest of the company and the shareholders

The Anglo-US model • The corporate governance triangle: shareholders, management and the board of directors • Individual or institutional shareholders are outsiders of the corporation • One-tiered board system → The board of most companies contains both insiders (executive directors) and outsiders (non-executive or independent directors)

The Anglo-US model • The corporate governance triangle: shareholders, management and the board of directors • Individual or institutional shareholders are outsiders of the corporation • One-tiered board system → The board of most companies contains both insiders (executive directors) and outsiders (non-executive or independent directors)

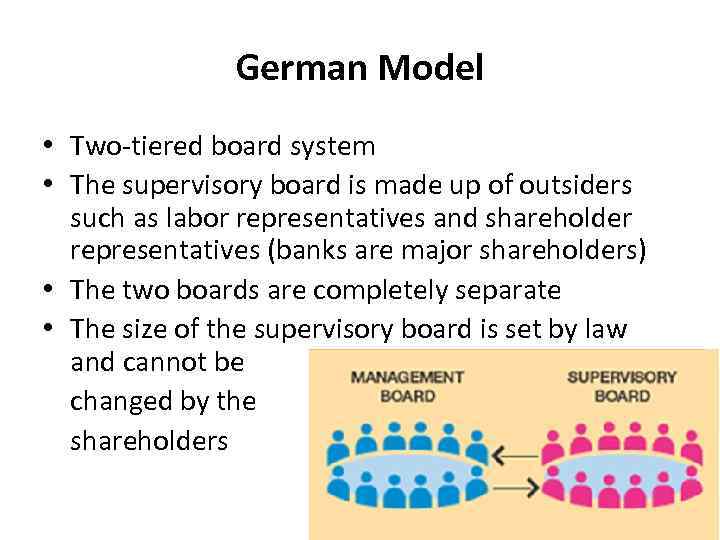

German Model • Two-tiered board system • The supervisory board is made up of outsiders such as labor representatives and shareholder representatives (banks are major shareholders) • The two boards are completely separate • The size of the supervisory board is set by law and cannot be changed by the shareholders

German Model • Two-tiered board system • The supervisory board is made up of outsiders such as labor representatives and shareholder representatives (banks are major shareholders) • The two boards are completely separate • The size of the supervisory board is set by law and cannot be changed by the shareholders

The Japanese model • The key players are the bank, the keiretsu (industrial groups linked by trading relationships and cross-shareholding), management and the government • Outside shareholders have little or no voice • The board of directors is usually made up entirely of insiders, often the heads of the different divisions of the company

The Japanese model • The key players are the bank, the keiretsu (industrial groups linked by trading relationships and cross-shareholding), management and the government • Outside shareholders have little or no voice • The board of directors is usually made up entirely of insiders, often the heads of the different divisions of the company

Thank you!

Thank you!