Lecture 1.pptx

- Количество слайдов: 48

Corporate Governance and Sustainable Development Professor Alexander Settles Faculty of Management, National Research University Higher School of Economics Email: asettles@hse. ru

Class Rules 1. 2. 3. 4. 5. Students must attend all lectures and seminars. Those students that arrive late will have to wait until the break between sessions to enter and will receive credit for attendance for the second session. Students must be prepared for class, complete all readings, and be ready to take notes Students may not talk during class. Students are expected to participate in class discussion but are not to interrupt the lecturer or other students Students may not enter or leave the class during the lecture unless for emergency reasons Students must turn off or place on silent mobile phones and may NOT use computers or other devices for entertainment purposes

Course Requirements Send me an email at asettles@hse. ru ¡ 50% - Paper - Settles ¡ 10% - Attendance to lectures Settles ¡ 40% - Seminar Grade (Test and attendance) - Tomoradze ¡

Due Dates ¡ Topic for literature review due March 8 th ¡ List of literature complied using Webnote – March 22 nd ¡ Draft paper – April 12 th ¡ Final paper – April 26 th ¡ Your failure to plan or act is not my problem – no action = failing grade

Potential Topics Cross-listing and IPO of emerging market firms (Russia and Brazil) ¡ Corporate governance factors related to cross-border merger and acquisitions ¡ Cross-country comparison of management and governance: Do managers have a comparative advantage? ¡

Potential Topics ¡ ¡ Difference in business environment: Convergence or divergence in governance or management practices Behavior of Directors and TMT in a cross cultural context Privatization CSR: Issues and Application across three models Russia, US, and Europe

Shirking and Stealing: How Corporate Governance Protects Investors

Learning objectives ¡ ¡ ¡ ¡ Corporate Governance and Competitiveness Investor Protection Role of Public Sector in Setting Framework for Good Corporate Governance Knowledge about theory of board operation and Role of directors Theories of board organization Regulation concerning corporate boards Practice in corporate boards

Corporate Governance Introduction ¡ ¡ ¡ What is Corporate Governance? Definition of “Governance” vs. “Administration, ” “Management, ” or “Control” Corporate Governance structures l l ¡ Board of Directors Chair of the Board Corporate Secretary Shareholders – General Meeting of Shareholders Why is it important to corporate finance? Cost of Capital

What is a Corporation? “The business corporation is an instrument through which capital is assembled for the activities of producing and distributing goods and services and making investments. Accordingly, a basic premise of corporation law is that a business corporation should have as its objective the conduct of such activities with a view to enhancing the corporation’s profit and the gains of the corporation’s owners, that is, the shareholders. ” Melvin Aaron Eisenberg

![What is a Corporation? “When they [the individuals composing a corporation] are consolidated and What is a Corporation? “When they [the individuals composing a corporation] are consolidated and](https://present5.com/presentation/5454458_95017651/image-11.jpg)

What is a Corporation? “When they [the individuals composing a corporation] are consolidated and united into a corporation, they and their successors are then considered as one person in law. . . For all the individual members that have existed from the foundation to the present time, or that shall ever hereafter exist, are but one person in law – a person that never dies: in like manner as the river Thames is still the same river, though the parts which composite are changing every instant. ” Blackstone “An ingenious device for obtaining individual profit without individual responsibility. ” Ambrose Bierce, The Devil’s Dictionary

Corporate Form 1. limited liability for investors; 2. free transferability of investor interests; 3. legal personality (entity-attributable powers, life span, and purpose); and 4. centralized management.

Corporate Governance Definitions ¡ OECD – “internal means by which a corporations are operated and controlled … which involve a set of relationships between a company’s management, its board, its shareholders and other stakeholders. ”

IFC – Russia Corporate Governance Manual ¡ ¡ Corporate Governance is a system of relationships, defined by structures and process. [Shareholders – Management] These relationships may involve parties with different and sometimes contrasting interests. All parties are involved in the direction and control of the company All this is done to properly distribute rights and responsibilities – and thus increase long term shareholder value.

Definitions ¡ “Corporate governance deals with the ways in which suppliers of finance to corporations assure themselves of getting a return on their investment”, The Journal of Finance, Shleifer and Vishny [1997, page 737].

Other Definitions ¡ ¡ "Corporate governance is about promoting corporate fairness, transparency and accountability" J. Wolfensohn, president of the Word bank, as quoted by an article in Financial Times, June 21, 1999. “The directors of companies, being managers of other people's money than their own, it cannot well be expected that they should watch over it with the same anxious vigilance with which the partners in a private co-partnery frequently watch over their own. ” Adam Smith, The Wealth of Nations 1776

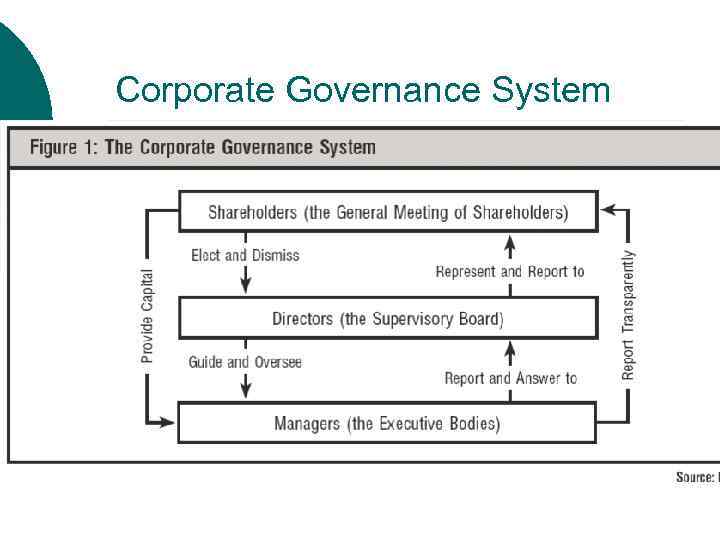

Corporate Governance System

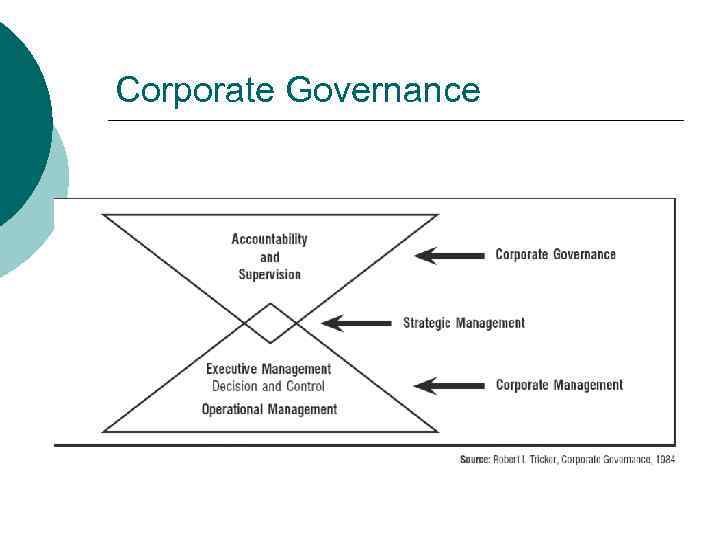

Corporate Governance

Basics of Corporate Governance ¡ By issuing corporate securities, firms sell claims to control the companies` ressources l l l The interests of the various securityholders differ Separation of owership and control implies agency relationships. Interests of agents (management) are different from those of securityholders, particulary from those of stockholders. Monitoring the activities of agents is costly - hence, full monitoring is not optimal. The value forgone due to imperfect optimal monitoring is an explicit agency cost.

Contract Theory of Corporate Governance Contract are arranged between principles (owners) and agent (managers) ¡ Contracts are also made between the firm and providers of capital ¡ Problems with contracts: ¡ l l l Moral Hazard Incomplete contracts Adverse selection bias

Agency Problem Managerial discretion - Business judgement ¡ Managerial opportunism – self dealing ¡ Duty of loyalty of management to firm ¡

Fiduciary Duty ¡ ¡ The fiduciary duty is a legal relationship between two or more parties (most commonly a "fiduciary" or "trustee" and a "principal" or "beneficiary") that in English common law is arguably the most important concept within the portion of the legal system known as equity. A fiduciary will be liable to account if it is proved that the profit, benefit, or gain was acquired by one of three means: l l l ¡ In circumstances of conflict of duty and interest In circumstances of conflict of duty and duty By taking advantage of the fiduciary position. Therefore, it is said the fiduciary has a duty not to be in a situation where personal interests and fiduciary duty conflict, a duty not to be in a situation where their fiduciary duty conflicts with another fiduciary duty, and not to profit from their fiduciary position without express knowledge and consent. A fiduciary cannot have a conflict of interest.

Fiduciary Duty

Agency Problem Duty of loyalty of management to firm Incentive contracts that align management interests with investors ¡ Agency costs – monitoring and compliance ¡ Shareholder actions- shareholder democracy, proxy fights, access to the proxy ballot, derivative lawsuits ¡

Four core values of the OECD corporate governance framework ¡ ¡ Fairness: The corporate governance framework should protect shareholder rights and ensure the equitable treatment of all shareholders, including minority and foreign shareholders. Responsibility: The corporate governance framework should recognize the rights of stakeholders as established by law, and encourage active co-operation between corporations and stakeholders in creating wealth, jobs, and the sustainability of financially sound enterprises.

OECD Core Values ¡ ¡ Transparency: The corporate governance framework should ensure that timely and accurate disclosure is made on all material matters regarding the company, including its financial situation, performance, ownership, and governance structure. Accountability: The corporate governance framework should ensure the strategic guidance of the company, the effective monitoring of management by the board, and the board’s accountability to the company and shareholders.

Advantages of Good Corporate Governance ¡ Stimulating Performance and Improving Operational Efficiency l l l Better oversight and accountability Improved decision making Better compliance and less conflict Less self-dealing Better informed Avoidance of costly litigation through adherence to laws and regulations

Advantages of Good Corporate Governance ¡ Improving Access to Capital Markets l l l Transparency, accessibility, efficiency, timeliness, completeness, and accuracy of information critical Listing requirements Inclusion of Corporate Governance in investment decision process

Accounting Scandal and Reform in the US and Western Europe

Crisis in Governance 1999 - 2002 ¡ ¡ Enron – fraud and oversight failure Worldcom – accounting fraud Adelphia – RPT securities violations, and accounting fraud Arthur Anderson

More detailed list ¡ ¡ ¡ AOL Adelphia Bristol-Myers Squibb Duke Energy Dynegy El Paso Corporation Enron Freddie Mac Global Crossing Halliburton Harken Energy ¡ ¡ ¡ ¡ ¡ Im. Clone Systems Kmart Lucent Technologies Merrill Lynch Qwest Communications Reliant Energy Sunbeam Tyco International Waste Management, Inc. World. Com

SOX reforms to US Corporate Governance Auditor independence ¡ Corporate Officer Responsibility for financial statements ¡ Internal Control Sections 404 and 302 ¡ Significant increase in monitoring costs for PLCs ¡

Accounting Scandals 2004 -2006 ¡ ¡ ¡ In late 2004, Fannie Mae was under investigation for its accounting practices. The Office of Federal Housing Enterprise Oversight released a report on September 20, 2004, alleging widespread accounting errors. On December 18, 2006, U. S. regulators filed 101 civil charges against chief executive Franklin Raines; chief financial officer J. Timothy Howard; and the former controller Leanne G. Spencer. The three are accused of manipulating Fannie Mae earnings to maximize their bonuses. The lawsuit sought to recoup more than $115 million in bonus payments, collectively accrued by the trio from 1998– 2004, and about $100 million in penalties for their involvement in the accounting scandal.

Governance Failures Prior to the 2008 Crisis ¡ ¡ ¡ Private sector demands (profits) combined with public sector responsibility (home ownership) led to the following failures Accounting – quasi-government company allowed to keep books that do not meet SOX requirements Risk management failure – too complex for event the best financial minds to figure out Trust – lack of trust & over reliance on government backing Conflicts of interest with private sector lenders – Countrywide, Washington Mutual, Lehman Brothers

Responses to Corporate Governance Failures ¡ US – TARP as means to stabilize the banking system l l New corporate governance requirements for TARP recipients including shareholder review of executive compensation Shareholder proposals

Dodd-Frank Act 2010 New investor disclosure rules for security dealers ¡ Reform of rules related to rating agencies ¡ New rules for shareholder approval of executive compensation ¡ Shareholder nominations for directors ¡

European Union Proposals Require more diverse and representative group of directors – with more women and people from a variety of professional backgrounds, skills and nationalities ¡ Shareholder participation ¡ Monitoring and enforcement of “comply or explain” ¡

Market Size

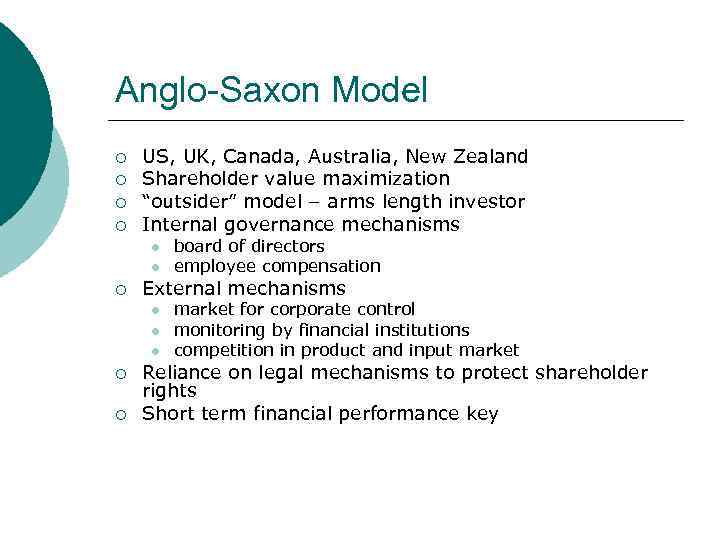

Anglo-Saxon Model ¡ ¡ US, UK, Canada, Australia, New Zealand Shareholder value maximization “outsider” model – arms length investor Internal governance mechanisms l l ¡ External mechanisms l l l ¡ ¡ board of directors employee compensation market for corporate control monitoring by financial institutions competition in product and input market Reliance on legal mechanisms to protect shareholder rights Short term financial performance key

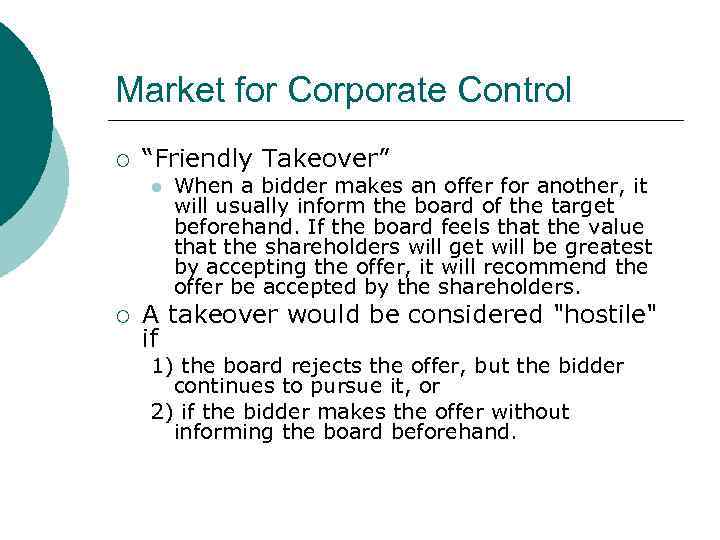

Market for Corporate Control ¡ “Friendly Takeover” l ¡ When a bidder makes an offer for another, it will usually inform the board of the target beforehand. If the board feels that the value that the shareholders will get will be greatest by accepting the offer, it will recommend the offer be accepted by the shareholders. A takeover would be considered "hostile" if 1) the board rejects the offer, but the bidder continues to pursue it, or 2) if the bidder makes the offer without informing the board beforehand.

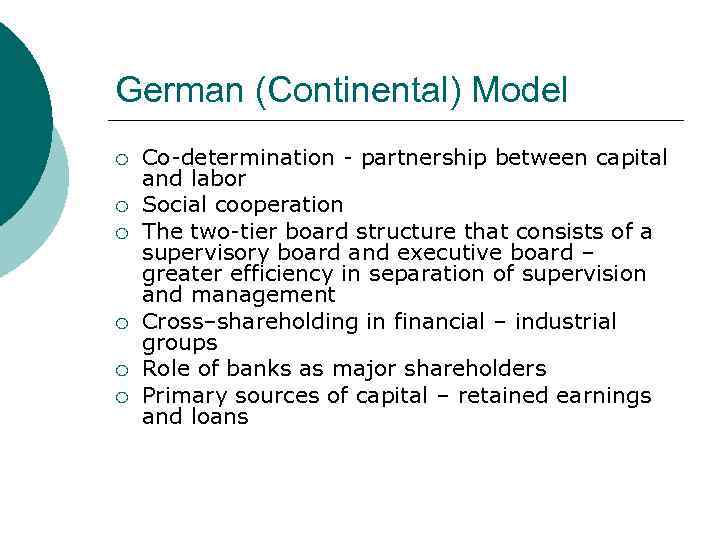

German (Continental) Model ¡ ¡ ¡ Co-determination - partnership between capital and labor Social cooperation The two-tier board structure that consists of a supervisory board and executive board – greater efficiency in separation of supervision and management Cross–shareholding in financial – industrial groups Role of banks as major shareholders Primary sources of capital – retained earnings and loans

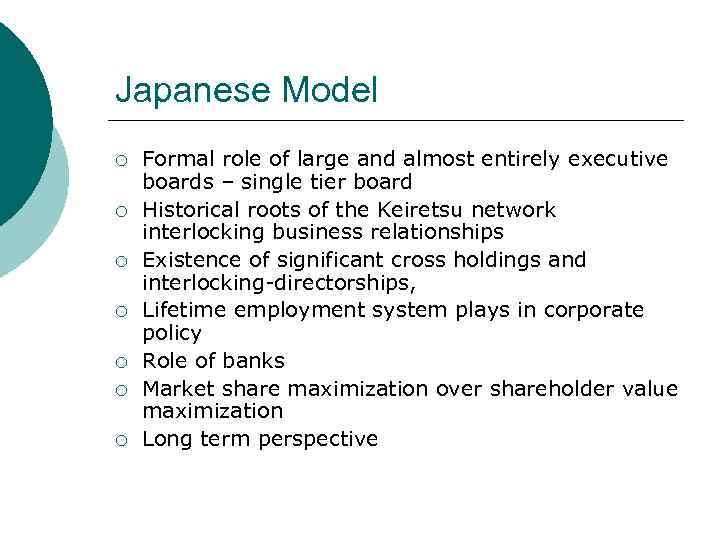

Japanese Model ¡ ¡ ¡ ¡ Formal role of large and almost entirely executive boards – single tier board Historical roots of the Keiretsu network interlocking business relationships Existence of significant cross holdings and interlocking-directorships, Lifetime employment system plays in corporate policy Role of banks Market share maximization over shareholder value maximization Long term perspective

Corporate Governance Framework in Russia ¡ ¡ ¡ Concentrated Ownership Little separation between ownership and control Unwieldy holding structures used to hide beneficial ownership, avoid taxes, or steal from minority owners Reorganizations to dilute minority stakes Inexperienced Supervisory Board (Boards of Directors)

Role of Supervisory Board ¡ ¡ ¡ ¡ Protecting the interests of the company and its shareholders Defining the Boards role and priorities Setting the company’s governance framework Organizing the General Meeting of Shareholders, Protection of company assets Resolution of conflicts Supervision of internal controls and risk management

Types of Directors a) Executive Directors Executive directors can be defined as those that also hold an executive position in the company, namely that of: The General Director; An Executive Board member; or A manager of the company who is not an Executive Board member.

Types of Directors b) Non-Executive Directors Non-executive directors are Supervisory Board members that do not hold an executive position in the company. c) Independent Directors Russian law does not define the concept of independent directors. The Company Law does, however, refer to independent directors under specific circumstances to determine the position of individuals engaged in related party transactions and to prevent possible conflicts of interests.

Company Practices in Russia ¡ ¡ ¡ Representatives of major shareholders (35%), management and employees (30%) are the most common types of directors, Independent directors (18%) and minority shareholder representatives (9%) still constitute a minority on most Supervisory Boards. A positive correlation exists between the number of shareholders in a company and the number of representatives of majority shareholders on the Supervisory Board. Hence, Supervisory Boards of large companies with many shareholders tend to include more representatives of large shareholders.

Lecture 1.pptx