ec3bd98d0e4fc8565148a989360b91bc.ppt

- Количество слайдов: 28

Corporate Governance and Strategy Distance Learning Course Video Conference November 15, 2001 Corporate Social Responsibility, and Sustainable Competitiveness-An Integrated Approach D. Petkoski, World Bank Institute World Bank Group

Corporate Governance and Strategy Distance Learning Course Video Conference November 15, 2001 Corporate Social Responsibility, and Sustainable Competitiveness-An Integrated Approach D. Petkoski, World Bank Institute World Bank Group

“Bolstering the ties between companies and the communities in which they operate is crucial if economic and social development are really to succeed. ” James D. Wolfensohn Davos, Switzerland January 31, 2000

“Bolstering the ties between companies and the communities in which they operate is crucial if economic and social development are really to succeed. ” James D. Wolfensohn Davos, Switzerland January 31, 2000

The Main Equation CG+CSR+BE C Corporate Governance + Corporate Social Responsibilities + Business Ethics = Competitiveness (through people)

The Main Equation CG+CSR+BE C Corporate Governance + Corporate Social Responsibilities + Business Ethics = Competitiveness (through people)

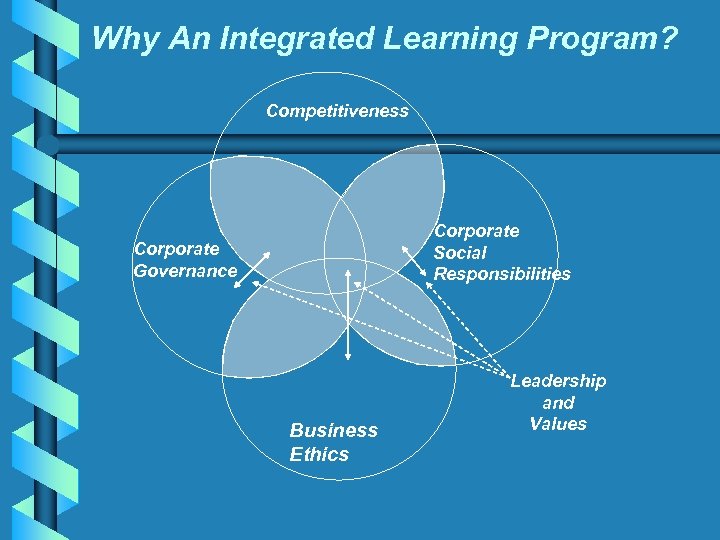

Why An Integrated Learning Program? Competitiveness Corporate Social Responsibilities Corporate Governance Business Ethics Leadership and Values

Why An Integrated Learning Program? Competitiveness Corporate Social Responsibilities Corporate Governance Business Ethics Leadership and Values

The Tyranny of Either/Or Company Choice Maximizing Shareholder Value Contributing to Social and Environmental Improvement

The Tyranny of Either/Or Company Choice Maximizing Shareholder Value Contributing to Social and Environmental Improvement

Financial Capital â Debt • Commercial bank loans and bond purchases private and sovereign debt ã Portfolio Investment • Publicly traded companies (very few in developing countries) • More liquid and thus, more volatile ã Foreign Direct Investment • Bigger impact due to increased access to markets, technology and management know-how

Financial Capital â Debt • Commercial bank loans and bond purchases private and sovereign debt ã Portfolio Investment • Publicly traded companies (very few in developing countries) • More liquid and thus, more volatile ã Foreign Direct Investment • Bigger impact due to increased access to markets, technology and management know-how

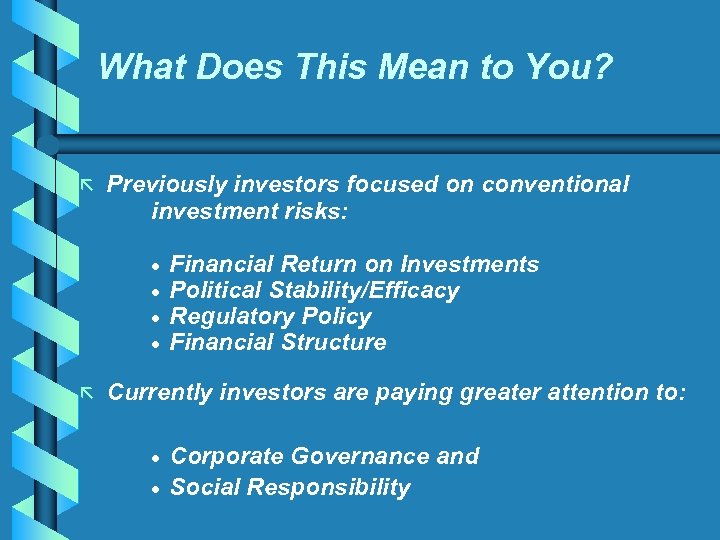

What Does This Mean to You? ã Previously investors focused on conventional investment risks: · · ã Financial Return on Investments Political Stability/Efficacy Regulatory Policy Financial Structure Currently investors are paying greater attention to: Corporate Governance and · Social Responsibility ·

What Does This Mean to You? ã Previously investors focused on conventional investment risks: · · ã Financial Return on Investments Political Stability/Efficacy Regulatory Policy Financial Structure Currently investors are paying greater attention to: Corporate Governance and · Social Responsibility ·

Why We Need Corporate Governance? Because weak corporate governance limits investments in corporations, thus limiting growth and development … And the effectiveness of corporate governance cannot be taken for granted.

Why We Need Corporate Governance? Because weak corporate governance limits investments in corporations, thus limiting growth and development … And the effectiveness of corporate governance cannot be taken for granted.

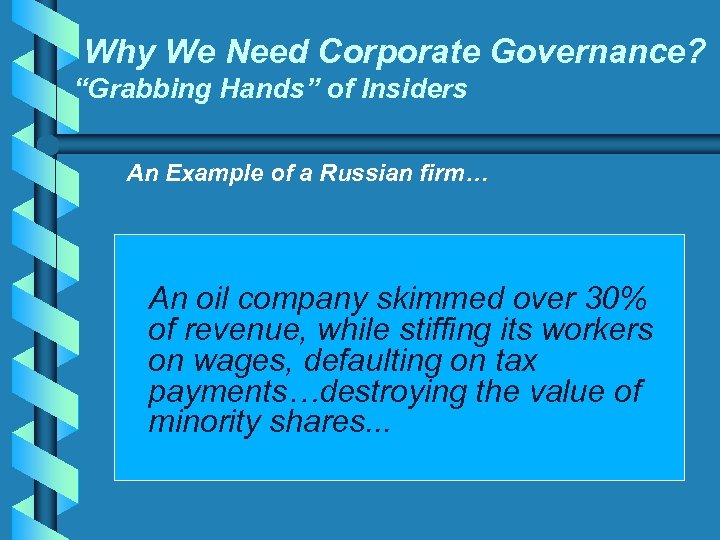

Why We Need Corporate Governance? “Grabbing Hands” of Insiders An Example of a Russian firm… An oil company skimmed over 30% of revenue, while stiffing its workers on wages, defaulting on tax payments…destroying the value of minority shares. . .

Why We Need Corporate Governance? “Grabbing Hands” of Insiders An Example of a Russian firm… An oil company skimmed over 30% of revenue, while stiffing its workers on wages, defaulting on tax payments…destroying the value of minority shares. . .

Why We Need Corporate Governance? “Grabbing Hands” of Insiders Another Example of Russian firms… Market Estimated Discounted Value Actual Value Ratio Firm A $90 mil $50 bil 556 Times Less Firm B $20 bil $600 bil 30 Times Less

Why We Need Corporate Governance? “Grabbing Hands” of Insiders Another Example of Russian firms… Market Estimated Discounted Value Actual Value Ratio Firm A $90 mil $50 bil 556 Times Less Firm B $20 bil $600 bil 30 Times Less

Why We Need Corporate Governance? “Grabbing Hands” of Insiders · The strength of private “grabbing hands” is measured by the difference in the share prices of voting and non-voting shares within a country · For example, the difference is 5% in the US, 13% in the UK, 45% in Israel, 32%-45% in Korea, 82% in Italy and higher in the Czech and Russia. · And such concerns are echoing across other developing countries, making it more difficult to raise capital to fund future investment projects. . .

Why We Need Corporate Governance? “Grabbing Hands” of Insiders · The strength of private “grabbing hands” is measured by the difference in the share prices of voting and non-voting shares within a country · For example, the difference is 5% in the US, 13% in the UK, 45% in Israel, 32%-45% in Korea, 82% in Italy and higher in the Czech and Russia. · And such concerns are echoing across other developing countries, making it more difficult to raise capital to fund future investment projects. . .

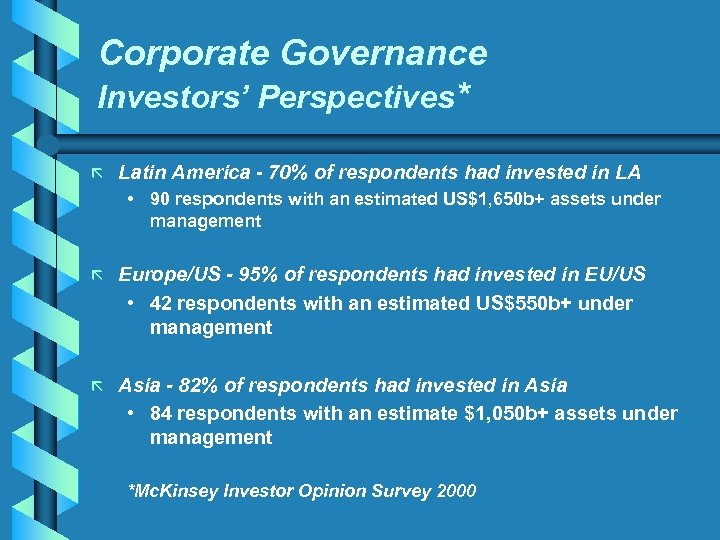

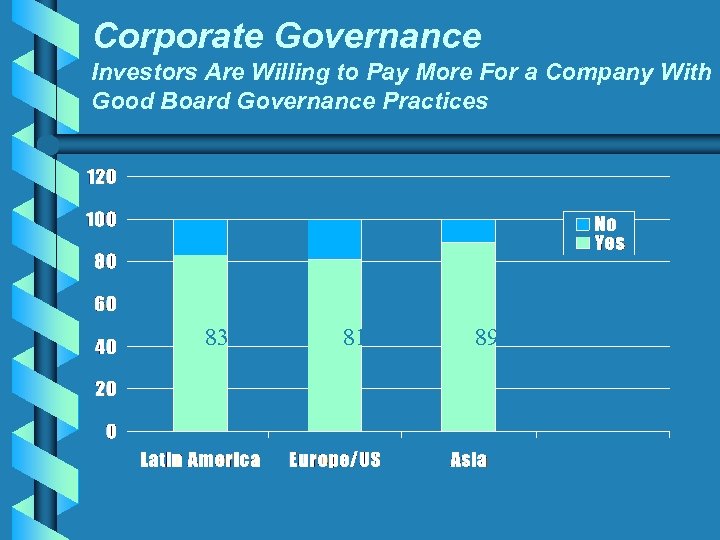

Corporate Governance Investors’ Perspectives* ã Latin America - 70% of respondents had invested in LA • 90 respondents with an estimated US$1, 650 b+ assets under management ã Europe/US - 95% of respondents had invested in EU/US • 42 respondents with an estimated US$550 b+ under management ã Asia - 82% of respondents had invested in Asia • 84 respondents with an estimate $1, 050 b+ assets under management *Mc. Kinsey Investor Opinion Survey 2000

Corporate Governance Investors’ Perspectives* ã Latin America - 70% of respondents had invested in LA • 90 respondents with an estimated US$1, 650 b+ assets under management ã Europe/US - 95% of respondents had invested in EU/US • 42 respondents with an estimated US$550 b+ under management ã Asia - 82% of respondents had invested in Asia • 84 respondents with an estimate $1, 050 b+ assets under management *Mc. Kinsey Investor Opinion Survey 2000

Corporate Governance Investors’ Perspectives* 1. 75% - Board practices are at least as important as financial performance 2. 80% - Would pay more for shares of a wellgoverned company then for a poorly governed company with comparable financial performance ã Premium differs by country and whether the investor is local or foreign. *Mc. Kinsey Investor Opinion Survey 2000

Corporate Governance Investors’ Perspectives* 1. 75% - Board practices are at least as important as financial performance 2. 80% - Would pay more for shares of a wellgoverned company then for a poorly governed company with comparable financial performance ã Premium differs by country and whether the investor is local or foreign. *Mc. Kinsey Investor Opinion Survey 2000

Corporate Governance Investors Are Willing to Pay More For a Company With Good Board Governance Practices 83 81 89

Corporate Governance Investors Are Willing to Pay More For a Company With Good Board Governance Practices 83 81 89

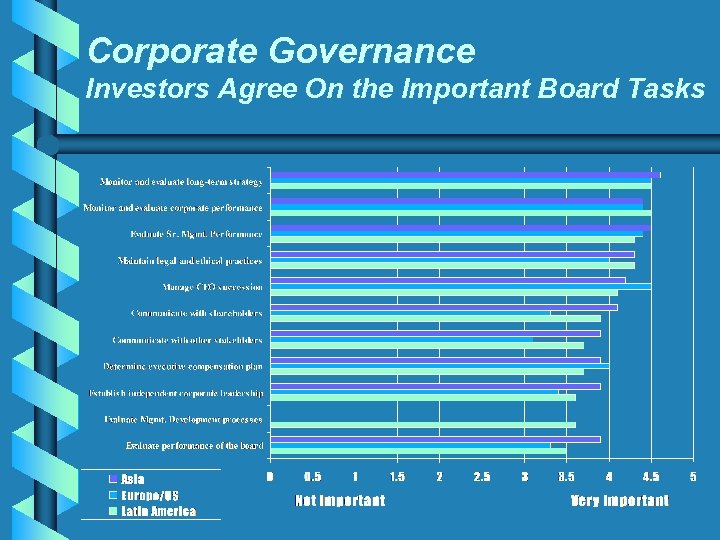

Corporate Governance Investors Agree On the Important Board Tasks

Corporate Governance Investors Agree On the Important Board Tasks

Investors’ Interests Beyond the Balance Sheet ã ã ã ã Ethical and responsible business behavior Corporate codes of conduct New ideas and information technology Western business practices Environmental, energy efficiency, health and safety standards Workplace issues: compensation, benefits and training Volunteerism, charitable giving, and community activism Rule of law

Investors’ Interests Beyond the Balance Sheet ã ã ã ã Ethical and responsible business behavior Corporate codes of conduct New ideas and information technology Western business practices Environmental, energy efficiency, health and safety standards Workplace issues: compensation, benefits and training Volunteerism, charitable giving, and community activism Rule of law

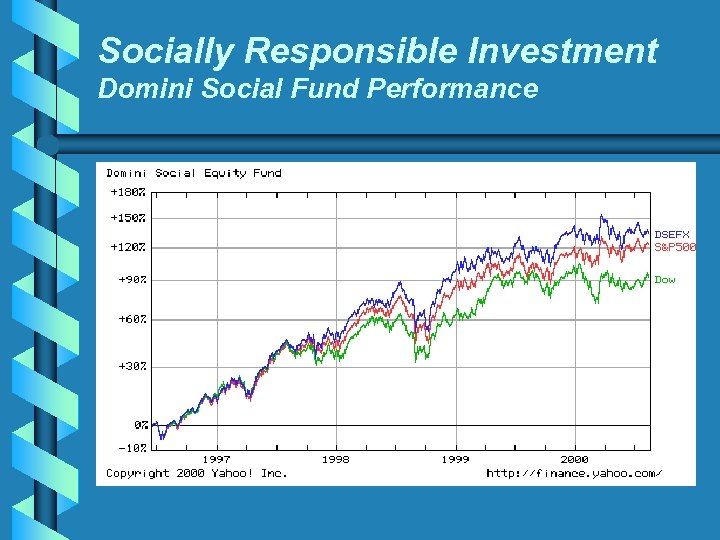

Socially Responsible Investment Going Beyond Corporate Governance ã Funds that pass multiple, broad-based social or ethical screens, e. g. , community involvement, environment, employee relations, product-related issues, and workplace practices ã Seeks to provide shareholders with long-term total return ã Is rapidly expanding with assets over $2. 1 trillion in the United States

Socially Responsible Investment Going Beyond Corporate Governance ã Funds that pass multiple, broad-based social or ethical screens, e. g. , community involvement, environment, employee relations, product-related issues, and workplace practices ã Seeks to provide shareholders with long-term total return ã Is rapidly expanding with assets over $2. 1 trillion in the United States

Socially Responsible Investment Domini Social Fund Performance

Socially Responsible Investment Domini Social Fund Performance

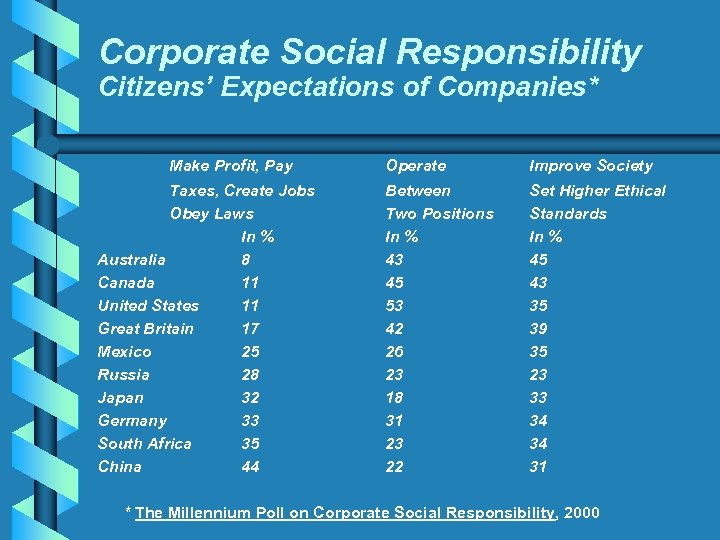

Corporate Social Responsibility Citizens’ Expectations of Companies* Make Profit, Pay Taxes, Create Jobs Obey Laws In % Australia 8 Canada 11 United States 11 Great Britain 17 Mexico 25 Russia 28 Japan 32 Germany 33 South Africa 35 China 44 Operate Improve Society Between Two Positions In % 43 45 53 42 26 23 18 31 23 22 Set Higher Ethical Standards In % 45 43 35 39 35 23 33 34 34 31 * The Millennium Poll on Corporate Social Responsibility, 2000

Corporate Social Responsibility Citizens’ Expectations of Companies* Make Profit, Pay Taxes, Create Jobs Obey Laws In % Australia 8 Canada 11 United States 11 Great Britain 17 Mexico 25 Russia 28 Japan 32 Germany 33 South Africa 35 China 44 Operate Improve Society Between Two Positions In % 43 45 53 42 26 23 18 31 23 22 Set Higher Ethical Standards In % 45 43 35 39 35 23 33 34 34 31 * The Millennium Poll on Corporate Social Responsibility, 2000

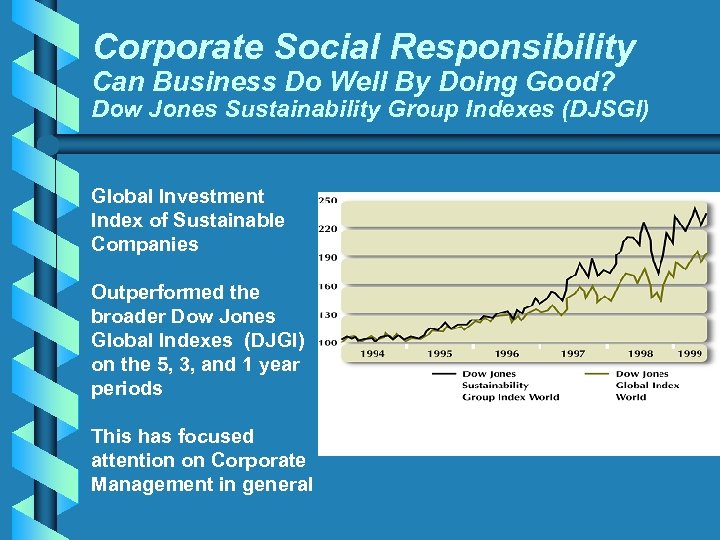

Corporate Social Responsibility Can Business Do Well By Doing Good? Dow Jones Sustainability Group Indexes (DJSGI) Global Investment Index of Sustainable Companies Outperformed the broader Dow Jones Global Indexes (DJGI) on the 5, 3, and 1 year periods This has focused attention on Corporate Management in general

Corporate Social Responsibility Can Business Do Well By Doing Good? Dow Jones Sustainability Group Indexes (DJSGI) Global Investment Index of Sustainable Companies Outperformed the broader Dow Jones Global Indexes (DJGI) on the 5, 3, and 1 year periods This has focused attention on Corporate Management in general

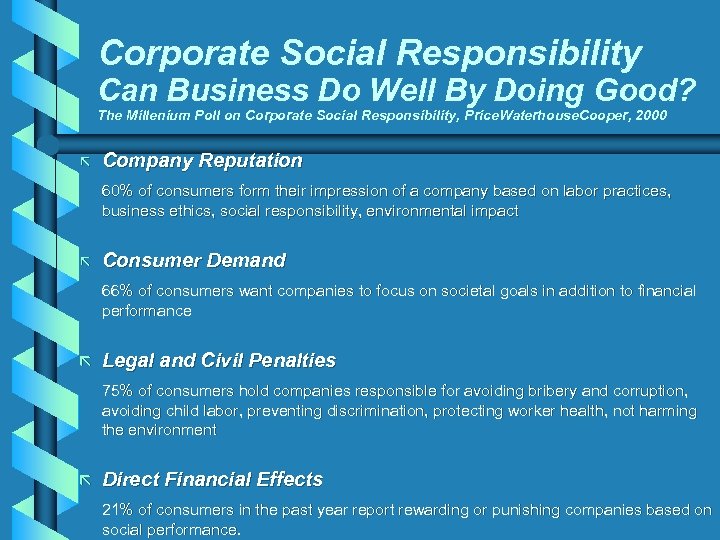

Corporate Social Responsibility Can Business Do Well By Doing Good? The Millenium Poll on Corporate Social Responsibility, Price. Waterhouse. Cooper, 2000 ã Company Reputation 60% of consumers form their impression of a company based on labor practices, business ethics, social responsibility, environmental impact ã Consumer Demand 66% of consumers want companies to focus on societal goals in addition to financial performance ã Legal and Civil Penalties 75% of consumers hold companies responsible for avoiding bribery and corruption, avoiding child labor, preventing discrimination, protecting worker health, not harming the environment ã Direct Financial Effects 21% of consumers in the past year report rewarding or punishing companies based on social performance.

Corporate Social Responsibility Can Business Do Well By Doing Good? The Millenium Poll on Corporate Social Responsibility, Price. Waterhouse. Cooper, 2000 ã Company Reputation 60% of consumers form their impression of a company based on labor practices, business ethics, social responsibility, environmental impact ã Consumer Demand 66% of consumers want companies to focus on societal goals in addition to financial performance ã Legal and Civil Penalties 75% of consumers hold companies responsible for avoiding bribery and corruption, avoiding child labor, preventing discrimination, protecting worker health, not harming the environment ã Direct Financial Effects 21% of consumers in the past year report rewarding or punishing companies based on social performance.

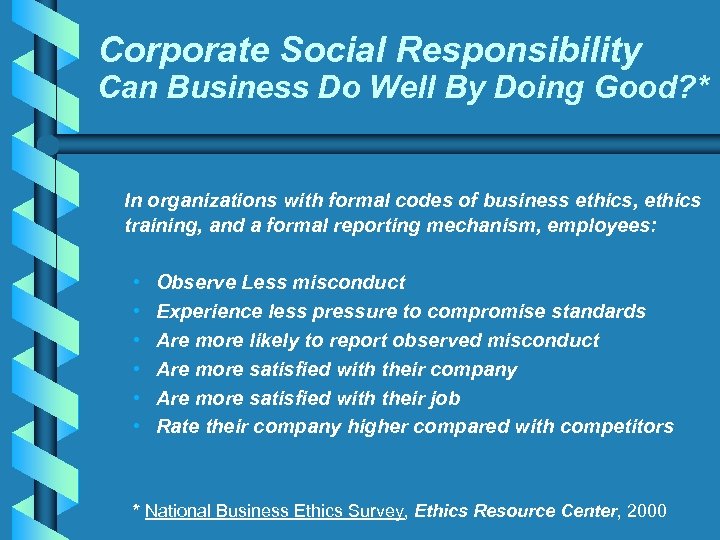

Corporate Social Responsibility Can Business Do Well By Doing Good? * In organizations with formal codes of business ethics, ethics training, and a formal reporting mechanism, employees: • • • Observe Less misconduct Experience less pressure to compromise standards Are more likely to report observed misconduct Are more satisfied with their company Are more satisfied with their job Rate their company higher compared with competitors * National Business Ethics Survey, Ethics Resource Center, 2000

Corporate Social Responsibility Can Business Do Well By Doing Good? * In organizations with formal codes of business ethics, ethics training, and a formal reporting mechanism, employees: • • • Observe Less misconduct Experience less pressure to compromise standards Are more likely to report observed misconduct Are more satisfied with their company Are more satisfied with their job Rate their company higher compared with competitors * National Business Ethics Survey, Ethics Resource Center, 2000

Why Business Ethics? What Do All These Names Have in Common? NBC, Sears, General Electric, Westinghouse, Salomon Brothers, Dow Corning, Pfizer, American Express, Hertz, NYNEX, Northrop, Teledyne, Lockheed, Arthur Andersen, Ernst & Young, Price Waterhouse, Alleco, Drexel Burnham Lambert, A. H Robbins, Gitano Group, Cendant, Archer Daniels Midland, Texaco, Mitsubishi, Nike, Prudential, Shell, Union Carbide, Hudson Foods, BCCI, Barings, Maxwell Communications, Sumitomo, Dow Chemical, United Way of America

Why Business Ethics? What Do All These Names Have in Common? NBC, Sears, General Electric, Westinghouse, Salomon Brothers, Dow Corning, Pfizer, American Express, Hertz, NYNEX, Northrop, Teledyne, Lockheed, Arthur Andersen, Ernst & Young, Price Waterhouse, Alleco, Drexel Burnham Lambert, A. H Robbins, Gitano Group, Cendant, Archer Daniels Midland, Texaco, Mitsubishi, Nike, Prudential, Shell, Union Carbide, Hudson Foods, BCCI, Barings, Maxwell Communications, Sumitomo, Dow Chemical, United Way of America

Why Business Ethics? Financial and Reputational Risks to the Corporation ã Assets not used for intended purposes ã Non-compliance with laws and regulations ã Corrupt behavior, poor business practices ã Shareholder activism – boards, senior management are held accountable ã Employee responses: impact on quality and productivity “Exit, Voice and Loyalty”

Why Business Ethics? Financial and Reputational Risks to the Corporation ã Assets not used for intended purposes ã Non-compliance with laws and regulations ã Corrupt behavior, poor business practices ã Shareholder activism – boards, senior management are held accountable ã Employee responses: impact on quality and productivity “Exit, Voice and Loyalty”

International Trends Ethical Issues of Corporate Governance ã Making management accountable to shareholders ã Creating and maintaining adequate control systems ã Ensuring Board oversight of corporate management Ordinary decency–fairness, honesty–are central ethical principles of corporate governance

International Trends Ethical Issues of Corporate Governance ã Making management accountable to shareholders ã Creating and maintaining adequate control systems ã Ensuring Board oversight of corporate management Ordinary decency–fairness, honesty–are central ethical principles of corporate governance

International Trends Ensuring Management Accountability OECD, ICC, Russian Chamber of Commerce, Hong Kong EDC, Gulf Centre EE, U. S. Federal Sentencing Guidelines, OAS, TI, Ethics South Africa ã Written code of ethics, business practice standards, prioritized values clearly communicated to provide broad and specific guidance ã Senior executive/management, oversight and reporting, visible commitment by organizational leaders ã Formal mechanisms, e. g. , helpline/hotline, to report suspected instances of improper conduct Staff encouraged to make reports Disciplinary, corrective actions are taken Fair and consistent enforcement · · · ã Regular communication/training on the standards, business practices, values of the organization ã Internal and external auditing and monitoring, ethical work culture assessments/surveys, regular review of policies, procedures, business practices

International Trends Ensuring Management Accountability OECD, ICC, Russian Chamber of Commerce, Hong Kong EDC, Gulf Centre EE, U. S. Federal Sentencing Guidelines, OAS, TI, Ethics South Africa ã Written code of ethics, business practice standards, prioritized values clearly communicated to provide broad and specific guidance ã Senior executive/management, oversight and reporting, visible commitment by organizational leaders ã Formal mechanisms, e. g. , helpline/hotline, to report suspected instances of improper conduct Staff encouraged to make reports Disciplinary, corrective actions are taken Fair and consistent enforcement · · · ã Regular communication/training on the standards, business practices, values of the organization ã Internal and external auditing and monitoring, ethical work culture assessments/surveys, regular review of policies, procedures, business practices