fcd3bb92ed340b79c258f55b34b0e8e4.ppt

- Количество слайдов: 14

Corporate Financial Services Roger Davis Group Managing Director Australia and New Zealand Banking Group Limited 20 July 2001

Corporate Financial Services Roger Davis Group Managing Director Australia and New Zealand Banking Group Limited 20 July 2001

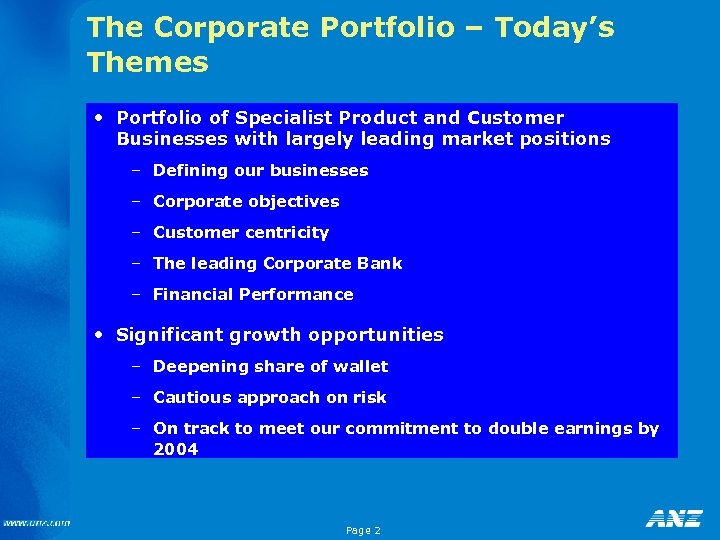

The Corporate Portfolio – Today’s Themes • Portfolio of Specialist Product and Customer Businesses with largely leading market positions – Defining our businesses – Corporate objectives – Customer centricity – The leading Corporate Bank – Financial Performance • Significant growth opportunities – Deepening share of wallet – Cautious approach on risk – On track to meet our commitment to double earnings by 2004 Page 2

The Corporate Portfolio – Today’s Themes • Portfolio of Specialist Product and Customer Businesses with largely leading market positions – Defining our businesses – Corporate objectives – Customer centricity – The leading Corporate Bank – Financial Performance • Significant growth opportunities – Deepening share of wallet – Cautious approach on risk – On track to meet our commitment to double earnings by 2004 Page 2

ANZ Corporate is different • Size: Corporate generates 40% of ANZ’s earnings • International: Corporate earns 30%+ from outside Australia • Growth: On track to double profits 1999 – 2004 • Customers: Rank #1 on most independent measures • Strategy: Moving focus from balance sheet to value added services • Key success factors: Leveraging our intellectual capital – Mid-market customers – Wall St to Main St – Institutional customers – increasingly complex product offering Page 3

ANZ Corporate is different • Size: Corporate generates 40% of ANZ’s earnings • International: Corporate earns 30%+ from outside Australia • Growth: On track to double profits 1999 – 2004 • Customers: Rank #1 on most independent measures • Strategy: Moving focus from balance sheet to value added services • Key success factors: Leveraging our intellectual capital – Mid-market customers – Wall St to Main St – Institutional customers – increasingly complex product offering Page 3

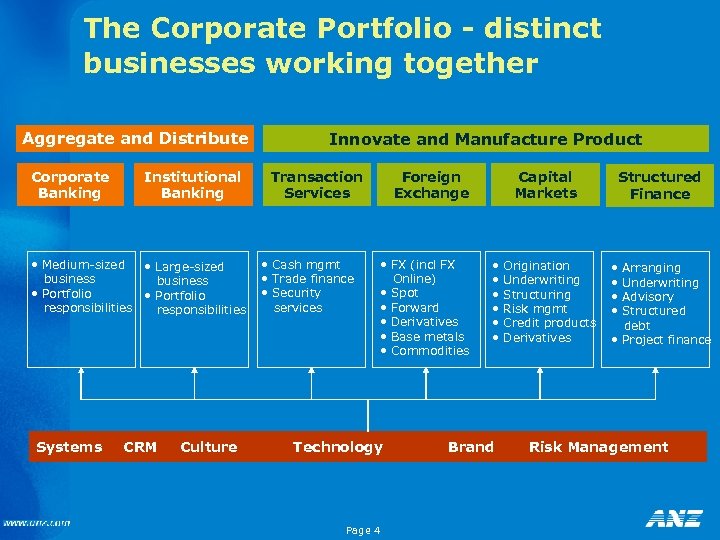

The Corporate Portfolio - distinct businesses working together Aggregate and Distribute Corporate Banking Institutional Banking • Medium-sized • Large-sized business • Portfolio responsibilities Systems CRM Culture Innovate and Manufacture Product Transaction Services • Cash mgmt • Trade finance • Security services Foreign Exchange • FX (incl FX Online) • Spot • Forward • Derivatives • Base metals • Commodities Technology Page 4 Capital Markets • • • Brand Origination Underwriting Structuring Risk mgmt Credit products Derivatives Structured Finance • • Arranging Underwriting Advisory Structured debt • Project finance Risk Management

The Corporate Portfolio - distinct businesses working together Aggregate and Distribute Corporate Banking Institutional Banking • Medium-sized • Large-sized business • Portfolio responsibilities Systems CRM Culture Innovate and Manufacture Product Transaction Services • Cash mgmt • Trade finance • Security services Foreign Exchange • FX (incl FX Online) • Spot • Forward • Derivatives • Base metals • Commodities Technology Page 4 Capital Markets • • • Brand Origination Underwriting Structuring Risk mgmt Credit products Derivatives Structured Finance • • Arranging Underwriting Advisory Structured debt • Project finance Risk Management

Our activities & earnings are generated from 30 countries ANZ Z AN ANZ ANZANZ ANZ AN ANZ Z ANZ ANZ ANZ Page 5

Our activities & earnings are generated from 30 countries ANZ Z AN ANZ ANZANZ ANZ AN ANZ Z ANZ ANZ ANZ Page 5

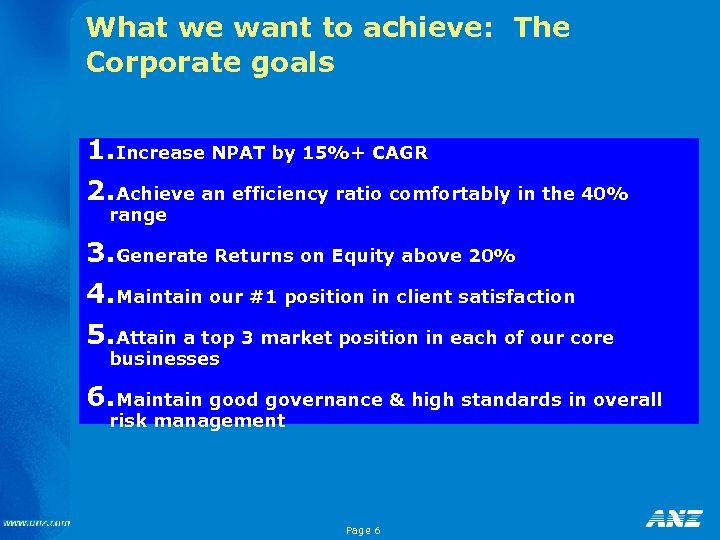

What we want to achieve: The Corporate goals 1. Increase NPAT by 15%+ CAGR 2. Achieve an efficiency ratio comfortably in the 40% range 3. Generate Returns on Equity above 20% 4. Maintain our #1 position in client satisfaction 5. Attain a top 3 market position in each of our core businesses 6. Maintain good governance & high standards in overall risk management Page 6

What we want to achieve: The Corporate goals 1. Increase NPAT by 15%+ CAGR 2. Achieve an efficiency ratio comfortably in the 40% range 3. Generate Returns on Equity above 20% 4. Maintain our #1 position in client satisfaction 5. Attain a top 3 market position in each of our core businesses 6. Maintain good governance & high standards in overall risk management Page 6

We are transforming the way we operate Ø Reorganised into separate customer & product businesses Specialise Ø Focus on businesses where we have a competitive advantage - exit those where we don’t (Futures) Ø Industry specialisation Ø e-Enable commodity functions and processes e-Transform Ø Trade - Magellan/Proponix Ø FX - Atriax; FX On-line Ø Capital Markets – Aus Markets Ø Cash – Web-Pay, Identrus, PKI Perform Grow & Breakout Ø ‘Customer Obsession’ – an experience which delights Ø Share of Wallet vs Share of Market emphasis Ø Product driven growth initiatives Ø Culture - The ANZ way Page 7

We are transforming the way we operate Ø Reorganised into separate customer & product businesses Specialise Ø Focus on businesses where we have a competitive advantage - exit those where we don’t (Futures) Ø Industry specialisation Ø e-Enable commodity functions and processes e-Transform Ø Trade - Magellan/Proponix Ø FX - Atriax; FX On-line Ø Capital Markets – Aus Markets Ø Cash – Web-Pay, Identrus, PKI Perform Grow & Breakout Ø ‘Customer Obsession’ – an experience which delights Ø Share of Wallet vs Share of Market emphasis Ø Product driven growth initiatives Ø Culture - The ANZ way Page 7

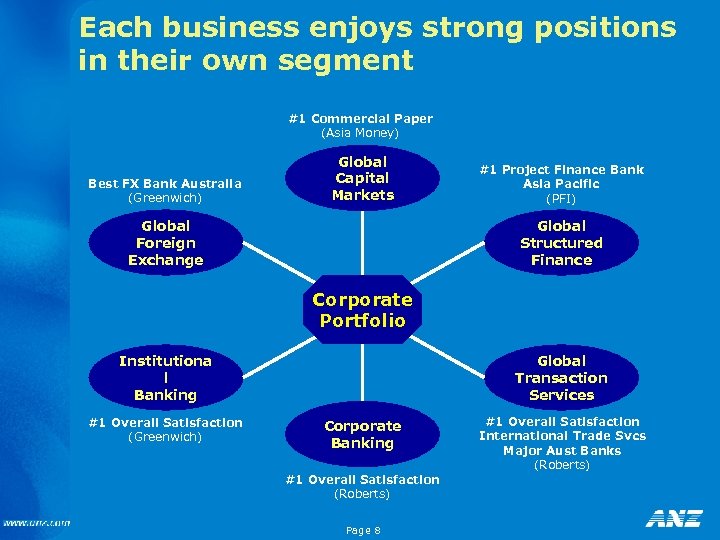

Each business enjoys strong positions in their own segment #1 Commercial Paper (Asia Money) Best FX Bank Australia (Greenwich) Global Capital Markets Global Foreign Exchange #1 Project Finance Bank Asia Pacific (PFI) Global Structured Finance Corporate Portfolio Institutiona l Banking #1 Overall Satisfaction (Greenwich) Global Transaction Services Corporate Banking #1 Overall Satisfaction (Roberts) Page 8 #1 Overall Satisfaction International Trade Svcs Major Aust Banks (Roberts)

Each business enjoys strong positions in their own segment #1 Commercial Paper (Asia Money) Best FX Bank Australia (Greenwich) Global Capital Markets Global Foreign Exchange #1 Project Finance Bank Asia Pacific (PFI) Global Structured Finance Corporate Portfolio Institutiona l Banking #1 Overall Satisfaction (Greenwich) Global Transaction Services Corporate Banking #1 Overall Satisfaction (Roberts) Page 8 #1 Overall Satisfaction International Trade Svcs Major Aust Banks (Roberts)

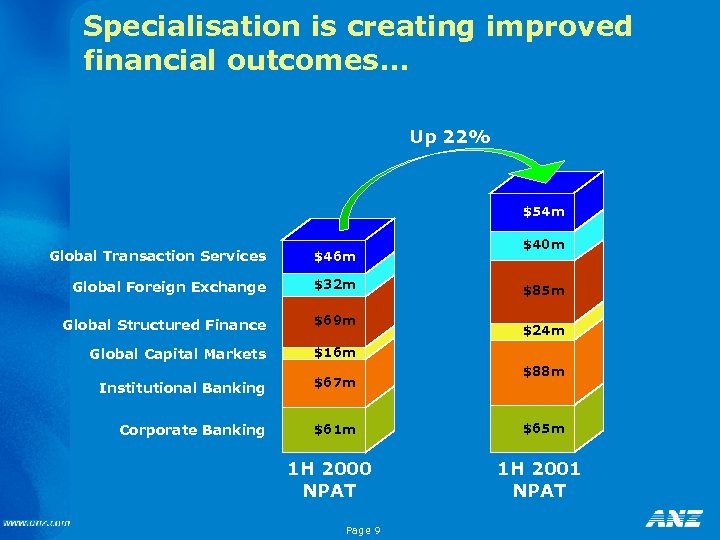

Specialisation is creating improved financial outcomes. . . Up 22% $54 m Global Transaction Services $46 m Global Foreign Exchange $32 m Global Structured Finance $69 m Global Capital Markets $16 m Institutional Banking $67 m Corporate Banking $61 m $40 m 1 H 2000 NPAT Page 9 $85 m $24 m $88 m $65 m 1 H 2001 NPAT

Specialisation is creating improved financial outcomes. . . Up 22% $54 m Global Transaction Services $46 m Global Foreign Exchange $32 m Global Structured Finance $69 m Global Capital Markets $16 m Institutional Banking $67 m Corporate Banking $61 m $40 m 1 H 2000 NPAT Page 9 $85 m $24 m $88 m $65 m 1 H 2001 NPAT

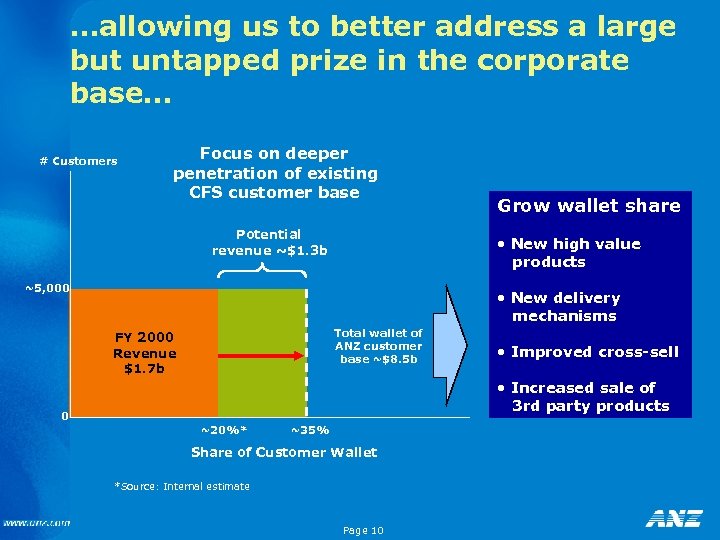

…allowing us to better address a large but untapped prize in the corporate base… # Customers Focus on deeper penetration of existing CFS customer base Potential revenue ~$1. 3 b Grow wallet share • New high value products ~5, 000 • New delivery mechanisms Total wallet of ANZ customer base ~$8. 5 b FY 2000 Revenue $1. 7 b • Improved cross-sell • Increased sale of 3 rd party products 0 ~20%* ~35% Share of Customer Wallet *Source: Internal estimate Page 10

…allowing us to better address a large but untapped prize in the corporate base… # Customers Focus on deeper penetration of existing CFS customer base Potential revenue ~$1. 3 b Grow wallet share • New high value products ~5, 000 • New delivery mechanisms Total wallet of ANZ customer base ~$8. 5 b FY 2000 Revenue $1. 7 b • Improved cross-sell • Increased sale of 3 rd party products 0 ~20%* ~35% Share of Customer Wallet *Source: Internal estimate Page 10

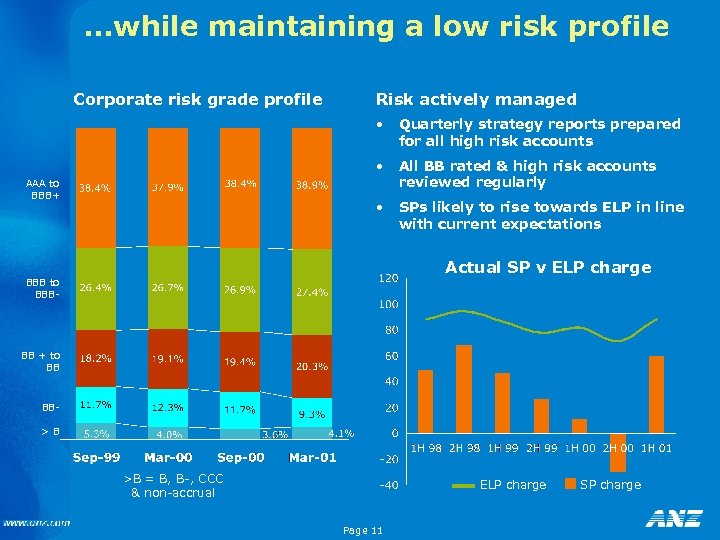

…while maintaining a low risk profile Corporate risk grade profile Risk actively managed • • All BB rated & high risk accounts reviewed regularly • AAA to BBB+ Quarterly strategy reports prepared for all high risk accounts SPs likely to rise towards ELP in line with current expectations Actual SP v ELP charge BBB to BBB- BB + to BB BB>B >B = B, B-, CCC & non-accrual ELP charge Page 11 SP charge

…while maintaining a low risk profile Corporate risk grade profile Risk actively managed • • All BB rated & high risk accounts reviewed regularly • AAA to BBB+ Quarterly strategy reports prepared for all high risk accounts SPs likely to rise towards ELP in line with current expectations Actual SP v ELP charge BBB to BBB- BB + to BB BB>B >B = B, B-, CCC & non-accrual ELP charge Page 11 SP charge

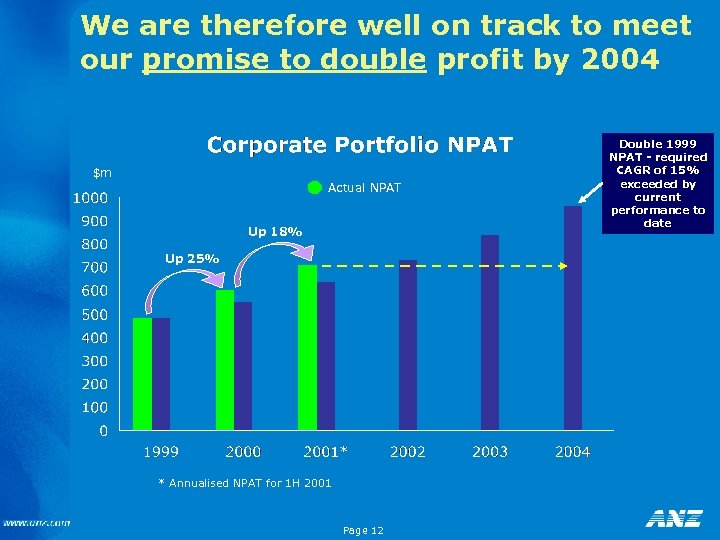

We are therefore well on track to meet our promise to double profit by 2004 $m Actual NPAT Up 18% Up 25% * Annualised NPAT for 1 H 2001 Page 12 Double 1999 NPAT - required CAGR of 15% exceeded by current performance to date

We are therefore well on track to meet our promise to double profit by 2004 $m Actual NPAT Up 18% Up 25% * Annualised NPAT for 1 H 2001 Page 12 Double 1999 NPAT - required CAGR of 15% exceeded by current performance to date

Summary • We are performing well • Our corporate portfolio is lower risk • We are focussing on non-lending fee income as we transition from being a balance sheet based business to being an intellectual capital services firm • Our new strategy is creating value and better positioning us for growth Page 13 We are on track to double profit by 2004

Summary • We are performing well • Our corporate portfolio is lower risk • We are focussing on non-lending fee income as we transition from being a balance sheet based business to being an intellectual capital services firm • Our new strategy is creating value and better positioning us for growth Page 13 We are on track to double profit by 2004

Copy of presentation available on www. anz. com Page 14

Copy of presentation available on www. anz. com Page 14