d12671c478f29c31ee4dcede61173dc2.ppt

- Количество слайдов: 30

Corporate expectations for electronic payment solutions Moderator: • Claus F. Hilles, EBA CLEARING Speakers: • Petri Aalto, Pohjola Bank • Marc Braet, SWIFT • Mervi Mäkelä, Finnair

Corporate expectations for electronic payment solutions Moderator: • Claus F. Hilles, EBA CLEARING Speakers: • Petri Aalto, Pohjola Bank • Marc Braet, SWIFT • Mervi Mäkelä, Finnair

Corporate expectations for electronic payment solutions Mervi Mäkelä, Director, Cash Management, Finnair

Corporate expectations for electronic payment solutions Mervi Mäkelä, Director, Cash Management, Finnair

Trends in payment automation & new banking services needed • • E-Invoices automated ‛Order to Pay’-process automated settlement reconciliation on-line banking even in B 2 B Finnair Group: global retailer, sales in 34 countries, total 2. 2 billion € in 2007, 10, 000 empl. , national carrier, state ownership 55. 8 %, listed in Helsinki Stock Exchange since 1989, ‛Art of flying’ since 1923

Trends in payment automation & new banking services needed • • E-Invoices automated ‛Order to Pay’-process automated settlement reconciliation on-line banking even in B 2 B Finnair Group: global retailer, sales in 34 countries, total 2. 2 billion € in 2007, 10, 000 empl. , national carrier, state ownership 55. 8 %, listed in Helsinki Stock Exchange since 1989, ‛Art of flying’ since 1923

Finnair networking • First interface between banks & Finnair in 1985 Today banks are linking companies with • customers • vendors • employees • shareholders

Finnair networking • First interface between banks & Finnair in 1985 Today banks are linking companies with • customers • vendors • employees • shareholders

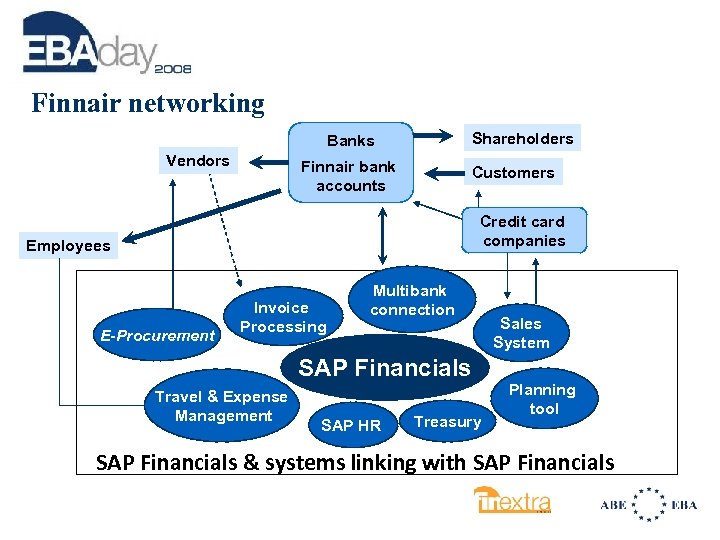

Finnair networking Shareholders Banks Vendors Finnair bank accounts Customers Credit card companies Employees E-Procurement Invoice Processing Multibank connection SAP Financials Travel & Expense Management SAP HR Treasury Sales System Planning tool SAP Financials & systems linking with SAP Financials

Finnair networking Shareholders Banks Vendors Finnair bank accounts Customers Credit card companies Employees E-Procurement Invoice Processing Multibank connection SAP Financials Travel & Expense Management SAP HR Treasury Sales System Planning tool SAP Financials & systems linking with SAP Financials

A message to banks: how to help companies in payment automation • to transport – receive and to forward – accounting information between companies; payment reference, information on bank statement • To speed up payments; charge transactions fees, no bank float • to develop on-line banking, even B 2 B

A message to banks: how to help companies in payment automation • to transport – receive and to forward – accounting information between companies; payment reference, information on bank statement • To speed up payments; charge transactions fees, no bank float • to develop on-line banking, even B 2 B

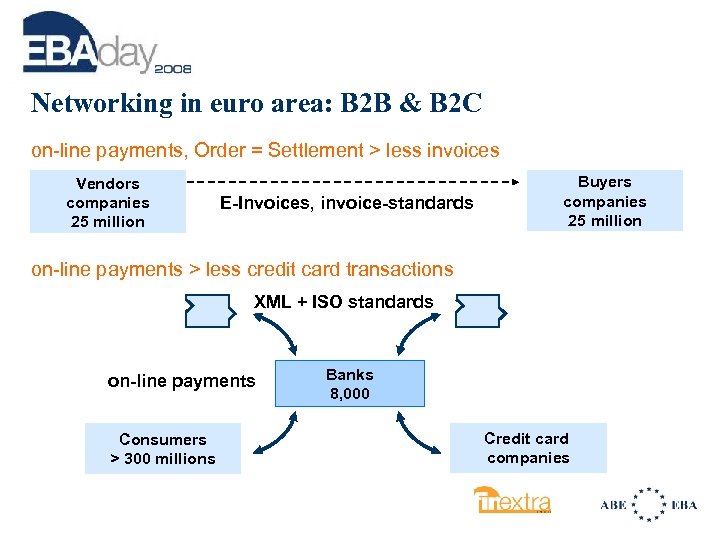

Networking in euro area: B 2 B & B 2 C on-line payments, Order = Settlement > less invoices Vendors companies 25 million E-Invoices, invoice-standards Buyers companies 25 million on-line payments > less credit card transactions XML + ISO standards on-line payments Consumers > 300 millions Banks 8, 000 Credit card companies

Networking in euro area: B 2 B & B 2 C on-line payments, Order = Settlement > less invoices Vendors companies 25 million E-Invoices, invoice-standards Buyers companies 25 million on-line payments > less credit card transactions XML + ISO standards on-line payments Consumers > 300 millions Banks 8, 000 Credit card companies

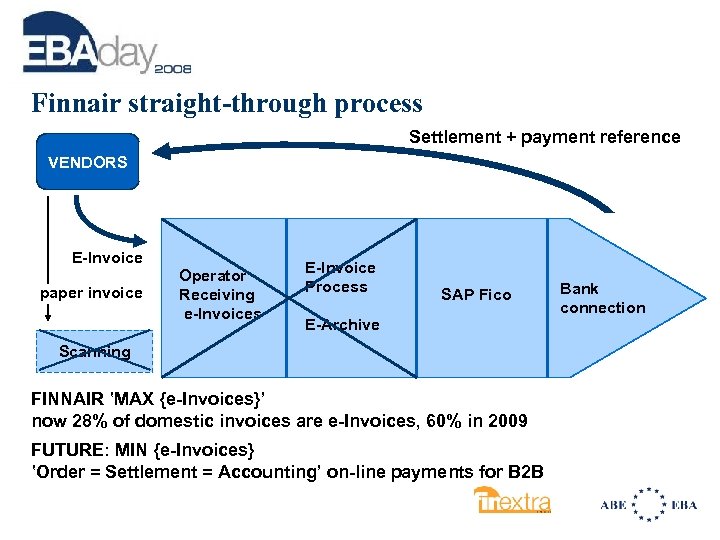

Finnair straight-through process Settlement + payment reference VENDORS E-Invoice paper invoice Operator Receiving e-Invoices E-Invoice Process SAP Fico E-Archive Scanning FINNAIR ‛MAX {e-Invoices}’ now 28% of domestic invoices are e-Invoices, 60% in 2009 FUTURE: MIN {e-Invoices} ‛Order = Settlement = Accounting’ on-line payments for B 2 B Bank connection

Finnair straight-through process Settlement + payment reference VENDORS E-Invoice paper invoice Operator Receiving e-Invoices E-Invoice Process SAP Fico E-Archive Scanning FINNAIR ‛MAX {e-Invoices}’ now 28% of domestic invoices are e-Invoices, 60% in 2009 FUTURE: MIN {e-Invoices} ‛Order = Settlement = Accounting’ on-line payments for B 2 B Bank connection

• SEPA – Banking industry is investing 10 billion euros to our common payment language & grammar and products, this will be a huge benefit to us all; to consumers, to companies and eventually to banks • SEPA & Finnair – Three payment file formats of today to XML during 2009 -2010 (no benefit if a quick replacing) – No impact on bank account structure – Euro area outgoing payments already centralised, and cross border euros BIC/IBAN • Benefits to Finnair – Faster payment traffic – A lot of competition, possibly even lower transaction fees… – On-line banking, chip cards • Waiting for new common products…. Thank you!

• SEPA – Banking industry is investing 10 billion euros to our common payment language & grammar and products, this will be a huge benefit to us all; to consumers, to companies and eventually to banks • SEPA & Finnair – Three payment file formats of today to XML during 2009 -2010 (no benefit if a quick replacing) – No impact on bank account structure – Euro area outgoing payments already centralised, and cross border euros BIC/IBAN • Benefits to Finnair – Faster payment traffic – A lot of competition, possibly even lower transaction fees… – On-line banking, chip cards • Waiting for new common products…. Thank you!

Corporate expectations for electronic payment solutions A Bank’s perspective Petri Aalto, Pohjola Bank plc

Corporate expectations for electronic payment solutions A Bank’s perspective Petri Aalto, Pohjola Bank plc

Corporate expectations for electronic payment solutions Agenda • Current status of SEPA migration • Corporate expectations; remember the service level • Additional benefits and SEPA enablers for corporate customers • Conclusions

Corporate expectations for electronic payment solutions Agenda • Current status of SEPA migration • Corporate expectations; remember the service level • Additional benefits and SEPA enablers for corporate customers • Conclusions

Current status of SEPA migration • National Migration plans published • SEPA Credit Transfer successfully launched at January 28 th 2008 • Over 4, 300 banks have signed the EPC SEPA Credit Transfer Adherence Agreement • Close follow-up of SEPA implementation and progress in the member countries • European and National Stakeholder Forums established • Dialogue among consumers, corporate customers and public sector has started • Migration Period and SEPA End Date are under discussion • The SEPA End Date: is it coming too soon?

Current status of SEPA migration • National Migration plans published • SEPA Credit Transfer successfully launched at January 28 th 2008 • Over 4, 300 banks have signed the EPC SEPA Credit Transfer Adherence Agreement • Close follow-up of SEPA implementation and progress in the member countries • European and National Stakeholder Forums established • Dialogue among consumers, corporate customers and public sector has started • Migration Period and SEPA End Date are under discussion • The SEPA End Date: is it coming too soon?

Corporate expectations; remember the service level • Maintain the good national payment service level • Enable continued development of better services – Automated reconciliation of incoming payments – Integration beyond the payment transaction level, e. g. e. Invoicing • Final goal: full STP end-to-end • No change for the sake of change – Services must improve if and when technology changes

Corporate expectations; remember the service level • Maintain the good national payment service level • Enable continued development of better services – Automated reconciliation of incoming payments – Integration beyond the payment transaction level, e. g. e. Invoicing • Final goal: full STP end-to-end • No change for the sake of change – Services must improve if and when technology changes

Additional benefits and SEPA enablers for corporate customers • Structured Creditor Reference • Globally standardised remittance information will bring added value for corporate customers with cross-border invoicing • Invoice number and customer’s identification number are generally used as part of the Creditor Reference • Creditor Reference Number is key element in reconciliation and making internal processes efficient

Additional benefits and SEPA enablers for corporate customers • Structured Creditor Reference • Globally standardised remittance information will bring added value for corporate customers with cross-border invoicing • Invoice number and customer’s identification number are generally used as part of the Creditor Reference • Creditor Reference Number is key element in reconciliation and making internal processes efficient

SEEBACH • SEEBACH = SEPA + EBA + PE-ACH • Finnish Banking Community approached EBA in 2006 • Drivers for the project are – utilise the night time processing capacity – improves liquidity management and customer service: incoming payments and liquidity is available from the beginning of the day • Win-Win for both customers and banks

SEEBACH • SEEBACH = SEPA + EBA + PE-ACH • Finnish Banking Community approached EBA in 2006 • Drivers for the project are – utilise the night time processing capacity – improves liquidity management and customer service: incoming payments and liquidity is available from the beginning of the day • Win-Win for both customers and banks

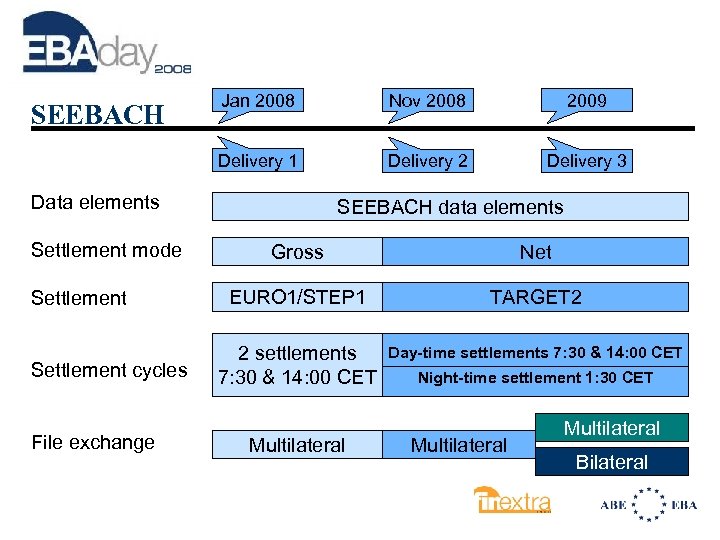

Nov 2008 2009 Delivery 1 SEEBACH Jan 2008 Delivery 2 Delivery 3 Data elements Settlement mode Settlement cycles File exchange SEEBACH data elements Gross Net EURO 1/STEP 1 TARGET 2 2 settlements 7: 30 & 14: 00 CET Day-time settlements 7: 30 & 14: 00 CET Multilateral Night-time settlement 1: 30 CET Multilateral Bilateral

Nov 2008 2009 Delivery 1 SEEBACH Jan 2008 Delivery 2 Delivery 3 Data elements Settlement mode Settlement cycles File exchange SEEBACH data elements Gross Net EURO 1/STEP 1 TARGET 2 2 settlements 7: 30 & 14: 00 CET Day-time settlements 7: 30 & 14: 00 CET Multilateral Night-time settlement 1: 30 CET Multilateral Bilateral

Conclusions • There is room for value-added services on top of the standard SEPA Credit Transfer • Full STP end-to-end is key success factor and prerequisite for corporate customers • SEEBACH project ensures additional benefits for moving to SEPA • Structured Creditor Reference is a powerful tool to improve efficiency and STP • Start moving to SEPA to avoid last minute rush and shortage of delivery capacity in the market

Conclusions • There is room for value-added services on top of the standard SEPA Credit Transfer • Full STP end-to-end is key success factor and prerequisite for corporate customers • SEEBACH project ensures additional benefits for moving to SEPA • Structured Creditor Reference is a powerful tool to improve efficiency and STP • Start moving to SEPA to avoid last minute rush and shortage of delivery capacity in the market

SWIFT for Corporates: Current situation & key developments Marc Braet Head of Northern Europe SWIFT

SWIFT for Corporates: Current situation & key developments Marc Braet Head of Northern Europe SWIFT

What is SWIFT? • A co-operative organisation serving the financial services industry • A provider of highly secure financial messaging services • The financial standardisation body

What is SWIFT? • A co-operative organisation serving the financial services industry • A provider of highly secure financial messaging services • The financial standardisation body

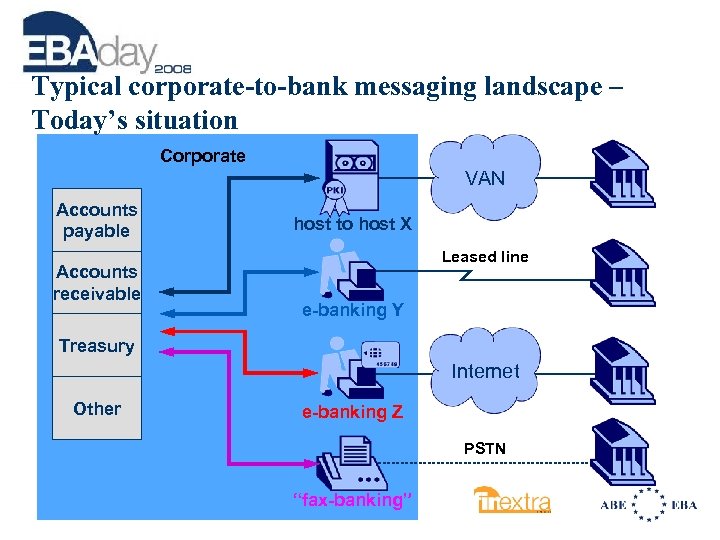

Typical corporate-to-bank messaging landscape – Today’s situation Corporate VAN Accounts payable Accounts receivable host to host X Leased line e-banking Y Treasury Internet Other e-banking Z PSTN “fax-banking”

Typical corporate-to-bank messaging landscape – Today’s situation Corporate VAN Accounts payable Accounts receivable host to host X Leased line e-banking Y Treasury Internet Other e-banking Z PSTN “fax-banking”

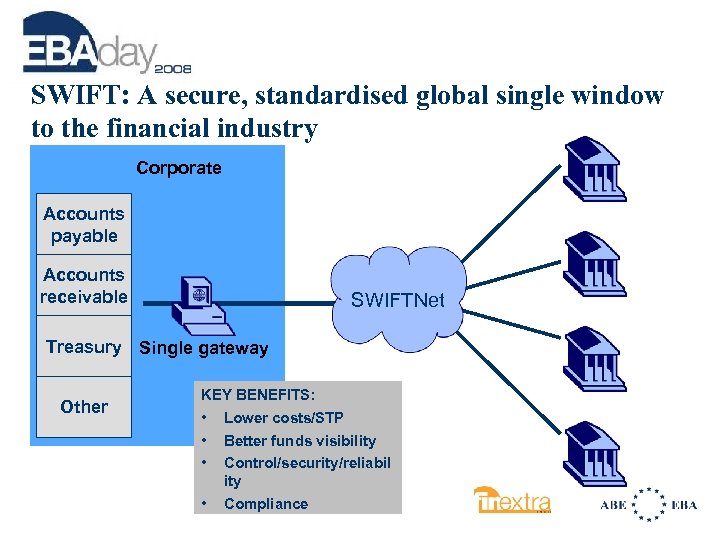

SWIFT: A secure, standardised global single window to the financial industry Corporate Accounts payable Accounts receivable SWIFTNet Treasury Single gateway Other KEY BENEFITS: • • Lower costs/STP Better funds visibility Control/security/reliabil ity Compliance

SWIFT: A secure, standardised global single window to the financial industry Corporate Accounts payable Accounts receivable SWIFTNet Treasury Single gateway Other KEY BENEFITS: • • Lower costs/STP Better funds visibility Control/security/reliabil ity Compliance

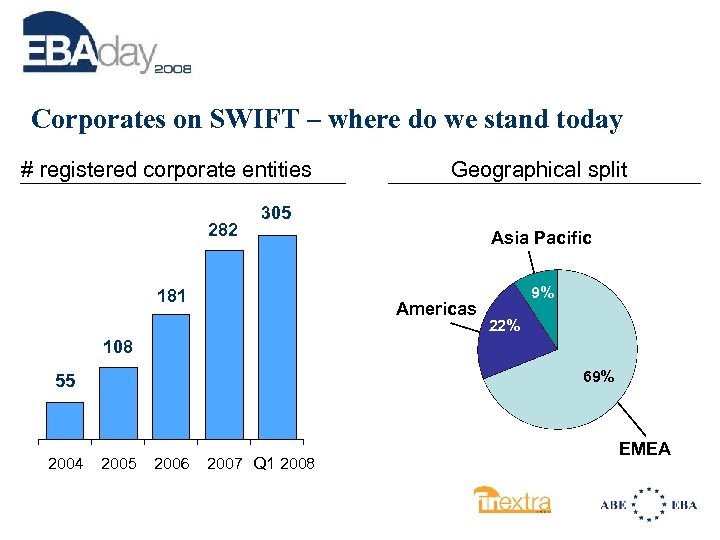

Corporates on SWIFT – where do we stand today # registered corporate entities 282 Geographical split 305 181 Asia Pacific Americas 9% 22% 108 69% 55 2004 2005 2006 2007 Q 1 2008 EMEA

Corporates on SWIFT – where do we stand today # registered corporate entities 282 Geographical split 305 181 Asia Pacific Americas 9% 22% 108 69% 55 2004 2005 2006 2007 Q 1 2008 EMEA

Corporate entities on SWIFT Examples of users which joined recently Large • North America Google, Pay. Pal, Ebay, Delphi, IBM, UPS, Chevron • Europe STMicroelectronics, Telefonica, Tesco, Air France, Nokia, Siemens, Iberdrola, Deutsche Telekom, Ingram-Micro, Johnson & Johnson • Asia Matsushita, Petronas, Samsung, China Petroleum Finance Company Limited But also “mid-size” • • Decathlon Autostrade Alten Belcorp Also suited to corporates with only domestic traffic and/or a few banks

Corporate entities on SWIFT Examples of users which joined recently Large • North America Google, Pay. Pal, Ebay, Delphi, IBM, UPS, Chevron • Europe STMicroelectronics, Telefonica, Tesco, Air France, Nokia, Siemens, Iberdrola, Deutsche Telekom, Ingram-Micro, Johnson & Johnson • Asia Matsushita, Petronas, Samsung, China Petroleum Finance Company Limited But also “mid-size” • • Decathlon Autostrade Alten Belcorp Also suited to corporates with only domestic traffic and/or a few banks

Bank adoption: on the rise • Already more than 830 banks currently interacting with corporates … • From 98 countries! • New programme in place to support banks in offering their services over SWIFTNet

Bank adoption: on the rise • Already more than 830 banks currently interacting with corporates … • From 98 countries! • New programme in place to support banks in offering their services over SWIFTNet

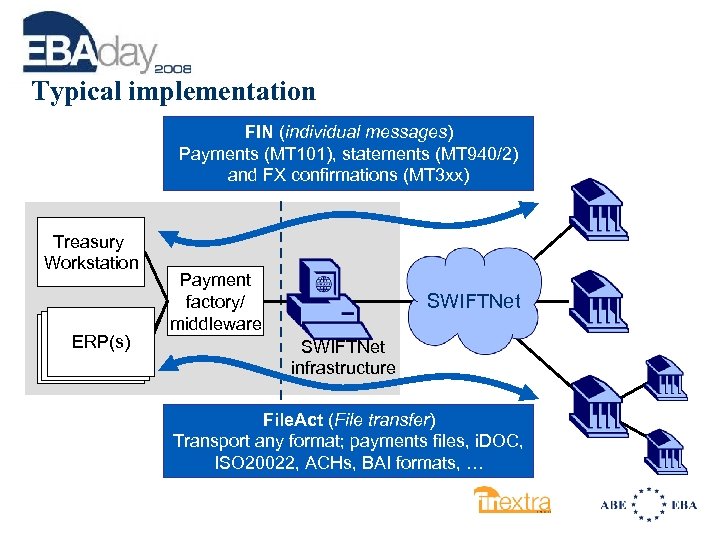

Typical implementation FIN (individual messages) Payments (MT 101), statements (MT 940/2) and FX confirmations (MT 3 xx) Treasury Workstation ERP(s) ERP Payment factory/ middleware SWIFTNet infrastructure File. Act (File transfer) Transport any format; payments files, i. DOC, ISO 20022, ACHs, BAI formats, …

Typical implementation FIN (individual messages) Payments (MT 101), statements (MT 940/2) and FX confirmations (MT 3 xx) Treasury Workstation ERP(s) ERP Payment factory/ middleware SWIFTNet infrastructure File. Act (File transfer) Transport any format; payments files, i. DOC, ISO 20022, ACHs, BAI formats, …

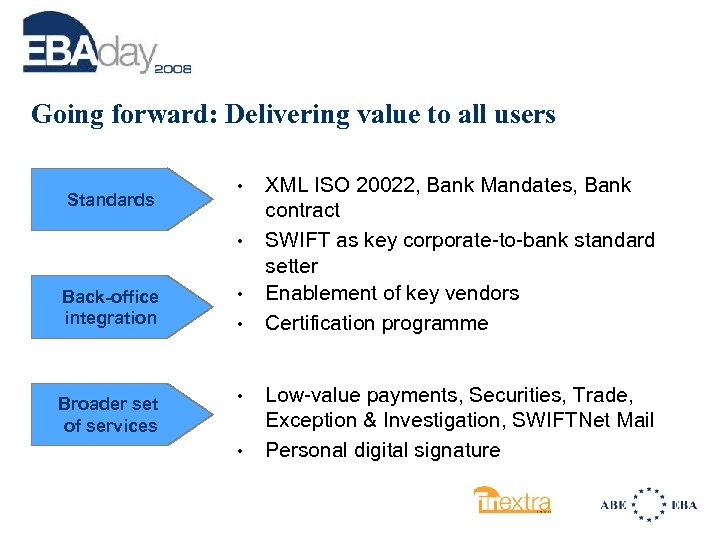

Going forward: Delivering value to all users Standards • • Back-office integration • Broader set of services • • • XML ISO 20022, Bank Mandates, Bank contract SWIFT as key corporate-to-bank standard setter Enablement of key vendors Certification programme Low-value payments, Securities, Trade, Exception & Investigation, SWIFTNet Mail Personal digital signature

Going forward: Delivering value to all users Standards • • Back-office integration • Broader set of services • • • XML ISO 20022, Bank Mandates, Bank contract SWIFT as key corporate-to-bank standard setter Enablement of key vendors Certification programme Low-value payments, Securities, Trade, Exception & Investigation, SWIFTNet Mail Personal digital signature

Two ways to connect to SWIFT • Direct Connectivity: – SWIFT Interface platform – Alliance Lite NEW • Indirect connectivity – Member Concentrator model – Service Bureau

Two ways to connect to SWIFT • Direct Connectivity: – SWIFT Interface platform – Alliance Lite NEW • Indirect connectivity – Member Concentrator model – Service Bureau

Alliance Lite: what is it? • • A new hassle-free way for customers to connect to SWIFT Accessible in a secure way Over the Internet Targeted at new low volume customers

Alliance Lite: what is it? • • A new hassle-free way for customers to connect to SWIFT Accessible in a secure way Over the Internet Targeted at new low volume customers

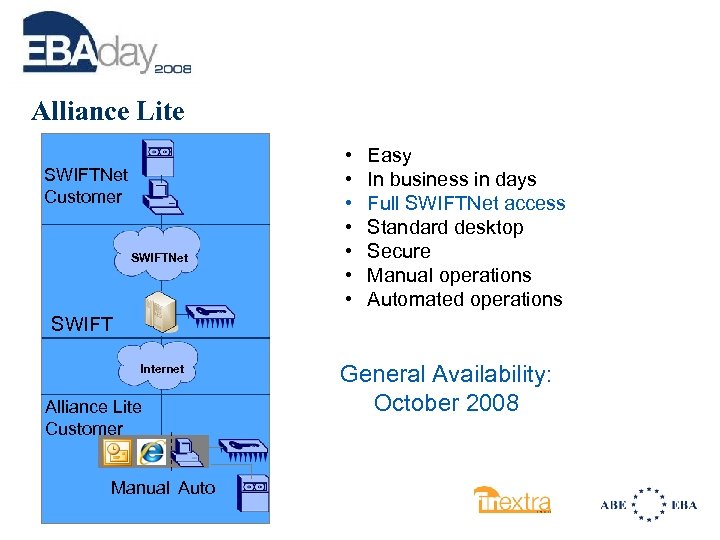

Alliance Lite SWIFTNet Customer SWIFTNet • • Easy In business in days Full SWIFTNet access Standard desktop Secure Manual operations Automated operations SWIFT Internet Alliance Lite Customer Manual Auto General Availability: October 2008

Alliance Lite SWIFTNet Customer SWIFTNet • • Easy In business in days Full SWIFTNet access Standard desktop Secure Manual operations Automated operations SWIFT Internet Alliance Lite Customer Manual Auto General Availability: October 2008

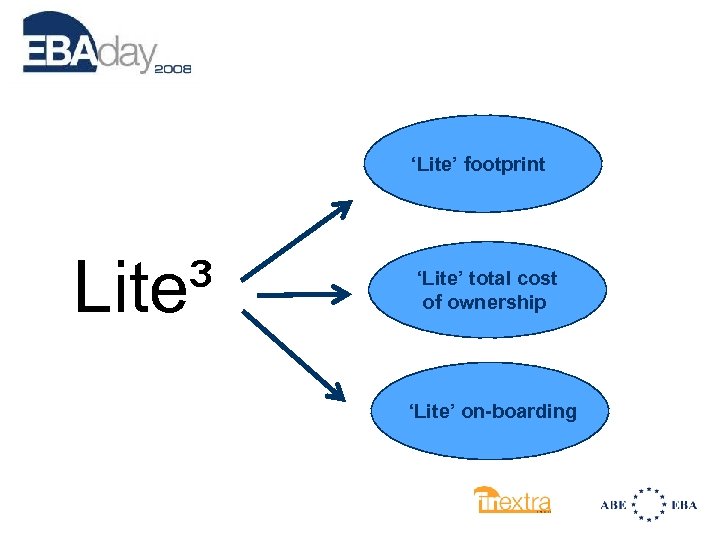

‘Lite’ footprint Lite³ ‘Lite’ total cost of ownership ‘Lite’ on-boarding

‘Lite’ footprint Lite³ ‘Lite’ total cost of ownership ‘Lite’ on-boarding