cf7724534e378ebbe6addfd3eee0a9c6.ppt

- Количество слайдов: 26

Corporate Development Update Finance Off-site June 10, 2011 CONFIDENTIAL

Corporate Development Update Finance Off-site June 10, 2011 CONFIDENTIAL

Discussion Topics • Corporate Development – M&A Strategy – Recent Activity – Current Activity • Margin Analysis CONFIDENTIAL page 1

Discussion Topics • Corporate Development – M&A Strategy – Recent Activity – Current Activity • Margin Analysis CONFIDENTIAL page 1

You may have heard we sold some things… CONFIDENTIAL

You may have heard we sold some things… CONFIDENTIAL

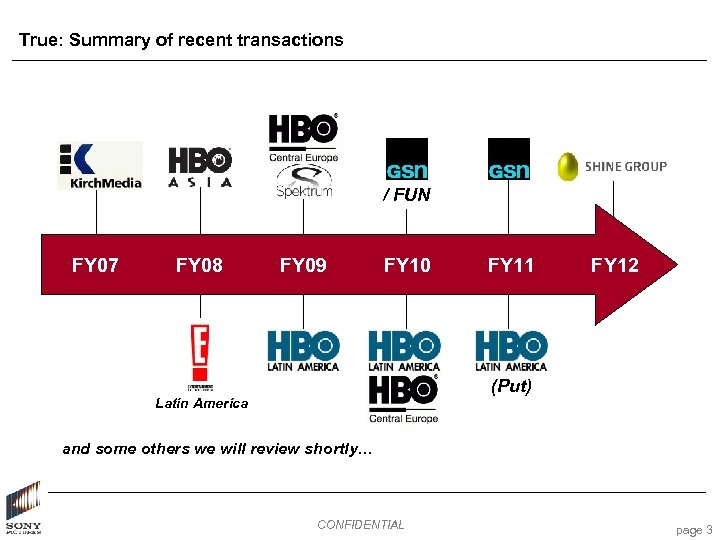

True: Summary of recent transactions / FUN FY 07 FY 08 FY 09 FY 10 FY 11 FY 12 (Put) Latin America and some others we will review shortly… CONFIDENTIAL page 3

True: Summary of recent transactions / FUN FY 07 FY 08 FY 09 FY 10 FY 11 FY 12 (Put) Latin America and some others we will review shortly… CONFIDENTIAL page 3

You may have heard we have some earnings pressure… CONFIDENTIAL

You may have heard we have some earnings pressure… CONFIDENTIAL

True: The economics of filmed entertainment have changed in recent years • Consumption patterns in Home Entertainment have changed – Consumers are “trading down” from purchase to rental generally, and within rental from high-margin “in store” rental to low margin subscription and kiosk – DVD new release sell-through is down 43% from its peak in 2006 – Catalog revenues are down double digits • Studios are responding by decreasing film costs, but they remain high and the cost of capital is increasing • SPE faces its own unique challenges (at least in the near-term) – Our current-year film slate is smaller than normal and lacks a traditional franchise – Our animated films are in “investment mode” this year – Our TV “annuities” generate significant profit, but face pressure as they age As a result, it has been difficult to achieve EBIT targets without transactions CONFIDENTIAL page 5

True: The economics of filmed entertainment have changed in recent years • Consumption patterns in Home Entertainment have changed – Consumers are “trading down” from purchase to rental generally, and within rental from high-margin “in store” rental to low margin subscription and kiosk – DVD new release sell-through is down 43% from its peak in 2006 – Catalog revenues are down double digits • Studios are responding by decreasing film costs, but they remain high and the cost of capital is increasing • SPE faces its own unique challenges (at least in the near-term) – Our current-year film slate is smaller than normal and lacks a traditional franchise – Our animated films are in “investment mode” this year – Our TV “annuities” generate significant profit, but face pressure as they age As a result, it has been difficult to achieve EBIT targets without transactions CONFIDENTIAL page 5

But, it’s not all bad news… • SPE has been taking action to improve margins – Better containment of capital costs for films • High margin Home Entertainment models are growing and we’re encouraging that – Higher margin digital product (EST and VOD) is growing at 12% and has potential to accelerate with early window offerings • Our film slate looks strong in FY 13, with several major tentpoles • Television continues to experience growth – Networks are expected to add $100 MM of EBIT between FY 11 and FY 13 – International TV production is expected to add $30 MM of EBIT in the same period Our profits are set to expand we have the potential CONFIDENTIAL page 6

But, it’s not all bad news… • SPE has been taking action to improve margins – Better containment of capital costs for films • High margin Home Entertainment models are growing and we’re encouraging that – Higher margin digital product (EST and VOD) is growing at 12% and has potential to accelerate with early window offerings • Our film slate looks strong in FY 13, with several major tentpoles • Television continues to experience growth – Networks are expected to add $100 MM of EBIT between FY 11 and FY 13 – International TV production is expected to add $30 MM of EBIT in the same period Our profits are set to expand we have the potential CONFIDENTIAL page 6

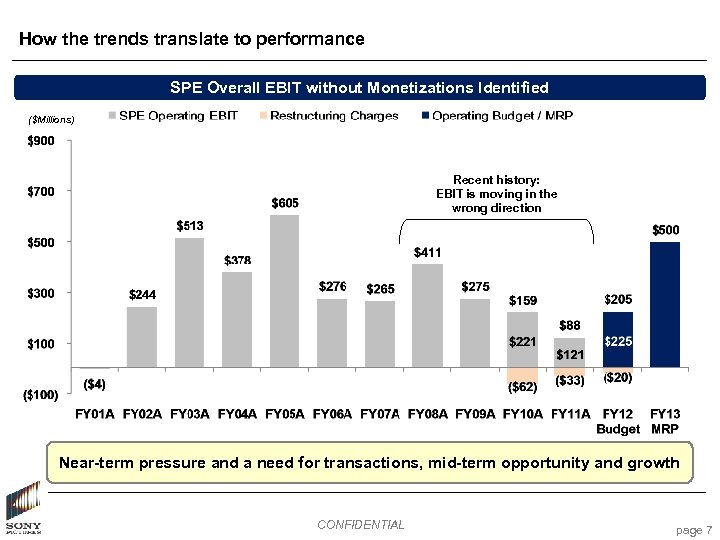

How the trends translate to performance SPE Overall EBIT without Monetizations Identified ($Millions) Recent history: EBIT is moving in the wrong direction Near-term pressure and a need for transactions, mid-term opportunity and growth CONFIDENTIAL page 7

How the trends translate to performance SPE Overall EBIT without Monetizations Identified ($Millions) Recent history: EBIT is moving in the wrong direction Near-term pressure and a need for transactions, mid-term opportunity and growth CONFIDENTIAL page 7

Is that the only reason we sold? … CONFIDENTIAL

Is that the only reason we sold? … CONFIDENTIAL

No: It makes sense to sell an asset when… • The deal is right – Eager buyer – Attractive valuation; more than we can be certain to extract by holding the asset – In some cases, generate significant gain while selling very little future EBIT • In some cases, we can solve a problem – Resolve a complex and/or contentious operating relationship with a partner • We can sell an asset without damage to our core business – Passive economic interests – Minority interests with limited control . . . and we’ve had several deals that met these criteria in the last few years CONFIDENTIAL page 9

No: It makes sense to sell an asset when… • The deal is right – Eager buyer – Attractive valuation; more than we can be certain to extract by holding the asset – In some cases, generate significant gain while selling very little future EBIT • In some cases, we can solve a problem – Resolve a complex and/or contentious operating relationship with a partner • We can sell an asset without damage to our core business – Passive economic interests – Minority interests with limited control . . . and we’ve had several deals that met these criteria in the last few years CONFIDENTIAL page 9

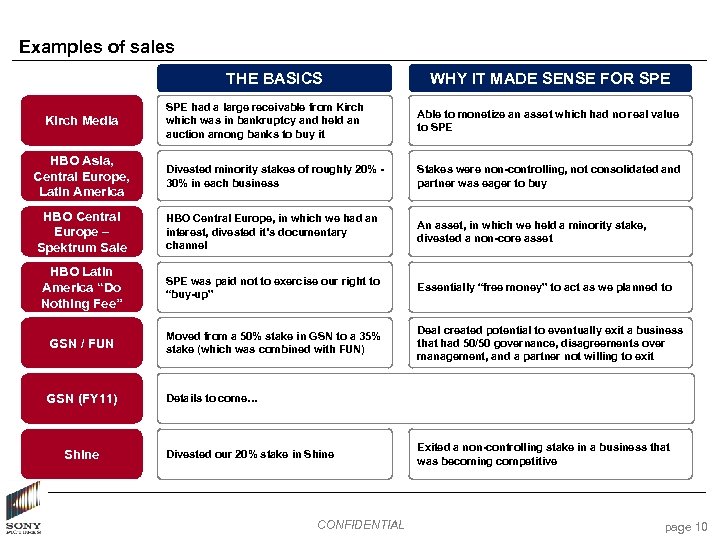

Examples of sales THE BASICS WHY IT MADE SENSE FOR SPE had a large receivable from Kirch which was in bankruptcy and held an auction among banks to buy it Able to monetize an asset which had no real value to SPE HBO Asia, Central Europe, Latin America Divested minority stakes of roughly 20% 30% in each business Stakes were non-controlling, not consolidated and partner was eager to buy HBO Central Europe – Spektrum Sale HBO Central Europe, in which we had an interest, divested it’s documentary channel An asset, in which we held a minority stake, divested a non-core asset HBO Latin America “Do Nothing Fee” SPE was paid not to exercise our right to “buy-up” Essentially “free money” to act as we planned to GSN / FUN Moved from a 50% stake in GSN to a 35% stake (which was combined with FUN) Deal created potential to eventually exit a business that had 50/50 governance, disagreements over management, and a partner not willing to exit GSN (FY 11) Details to come… Kirch Media Shine Divested our 20% stake in Shine CONFIDENTIAL Exited a non-controlling stake in a business that was becoming competitive page 10

Examples of sales THE BASICS WHY IT MADE SENSE FOR SPE had a large receivable from Kirch which was in bankruptcy and held an auction among banks to buy it Able to monetize an asset which had no real value to SPE HBO Asia, Central Europe, Latin America Divested minority stakes of roughly 20% 30% in each business Stakes were non-controlling, not consolidated and partner was eager to buy HBO Central Europe – Spektrum Sale HBO Central Europe, in which we had an interest, divested it’s documentary channel An asset, in which we held a minority stake, divested a non-core asset HBO Latin America “Do Nothing Fee” SPE was paid not to exercise our right to “buy-up” Essentially “free money” to act as we planned to GSN / FUN Moved from a 50% stake in GSN to a 35% stake (which was combined with FUN) Deal created potential to eventually exit a business that had 50/50 governance, disagreements over management, and a partner not willing to exit GSN (FY 11) Details to come… Kirch Media Shine Divested our 20% stake in Shine CONFIDENTIAL Exited a non-controlling stake in a business that was becoming competitive page 10

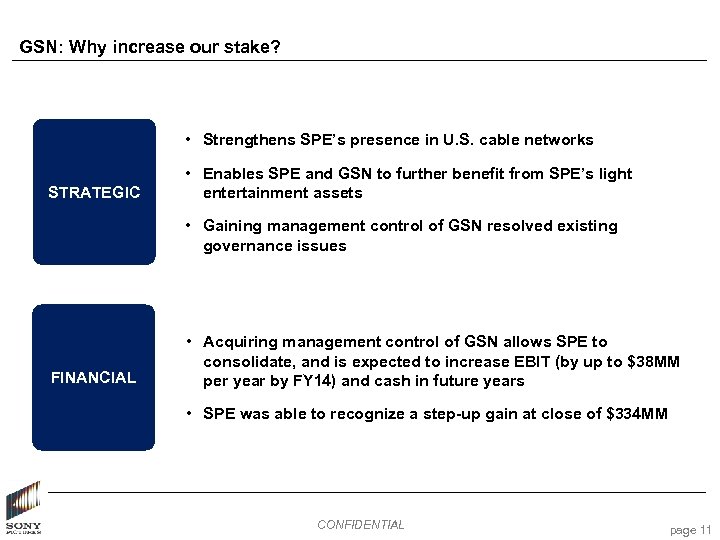

GSN: Why increase our stake? • Strengthens SPE’s presence in U. S. cable networks STRATEGIC • Enables SPE and GSN to further benefit from SPE’s light entertainment assets • Gaining management control of GSN resolved existing governance issues FINANCIAL • Acquiring management control of GSN allows SPE to consolidate, and is expected to increase EBIT (by up to $38 MM per year by FY 14) and cash in future years • SPE was able to recognize a step-up gain at close of $334 MM CONFIDENTIAL page 11

GSN: Why increase our stake? • Strengthens SPE’s presence in U. S. cable networks STRATEGIC • Enables SPE and GSN to further benefit from SPE’s light entertainment assets • Gaining management control of GSN resolved existing governance issues FINANCIAL • Acquiring management control of GSN allows SPE to consolidate, and is expected to increase EBIT (by up to $38 MM per year by FY 14) and cash in future years • SPE was able to recognize a step-up gain at close of $334 MM CONFIDENTIAL page 11

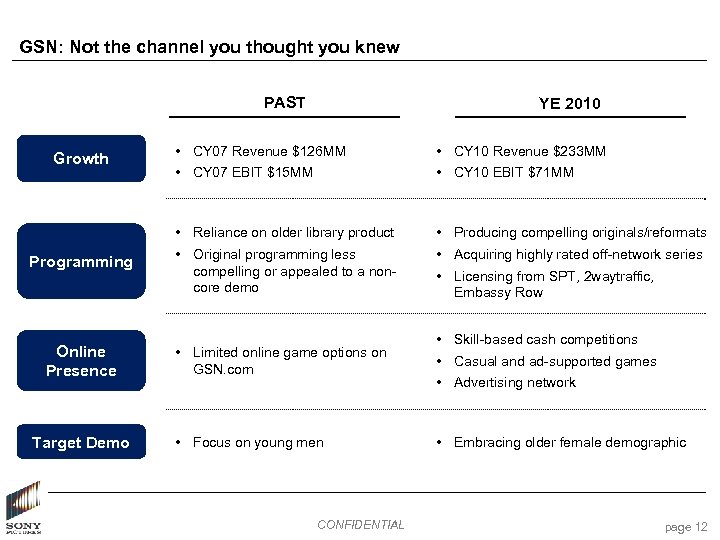

GSN: Not the channel you thought you knew PAST YE 2010 Programming Online Presence Target Demo • CY 07 Revenue $126 MM • CY 10 Revenue $233 MM • CY 07 EBIT $15 MM • CY 10 EBIT $71 MM • Reliance on older library product Growth • Producing compelling originals/reformats • Original programming less compelling or appealed to a noncore demo • Acquiring highly rated off-network series • Limited online game options on GSN. com • Focus on young men CONFIDENTIAL • Licensing from SPT, 2 waytraffic, Embassy Row • Skill-based cash competitions • Casual and ad-supported games • Advertising network • Embracing older female demographic page 12

GSN: Not the channel you thought you knew PAST YE 2010 Programming Online Presence Target Demo • CY 07 Revenue $126 MM • CY 10 Revenue $233 MM • CY 07 EBIT $15 MM • CY 10 EBIT $71 MM • Reliance on older library product Growth • Producing compelling originals/reformats • Original programming less compelling or appealed to a noncore demo • Acquiring highly rated off-network series • Limited online game options on GSN. com • Focus on young men CONFIDENTIAL • Licensing from SPT, 2 waytraffic, Embassy Row • Skill-based cash competitions • Casual and ad-supported games • Advertising network • Embracing older female demographic page 12

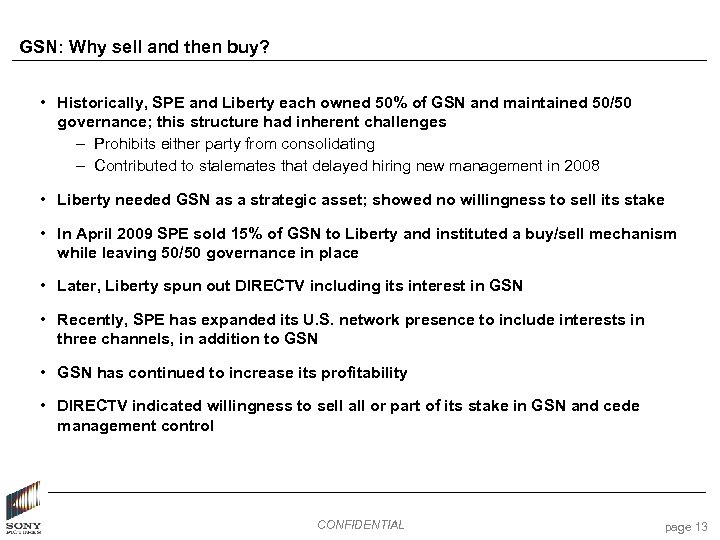

GSN: Why sell and then buy? • Historically, SPE and Liberty each owned 50% of GSN and maintained 50/50 governance; this structure had inherent challenges – Prohibits either party from consolidating – Contributed to stalemates that delayed hiring new management in 2008 • Liberty needed GSN as a strategic asset; showed no willingness to sell its stake • In April 2009 SPE sold 15% of GSN to Liberty and instituted a buy/sell mechanism while leaving 50/50 governance in place • Later, Liberty spun out DIRECTV including its interest in GSN • Recently, SPE has expanded its U. S. network presence to include interests in three channels, in addition to GSN • GSN has continued to increase its profitability • DIRECTV indicated willingness to sell all or part of its stake in GSN and cede management control CONFIDENTIAL page 13

GSN: Why sell and then buy? • Historically, SPE and Liberty each owned 50% of GSN and maintained 50/50 governance; this structure had inherent challenges – Prohibits either party from consolidating – Contributed to stalemates that delayed hiring new management in 2008 • Liberty needed GSN as a strategic asset; showed no willingness to sell its stake • In April 2009 SPE sold 15% of GSN to Liberty and instituted a buy/sell mechanism while leaving 50/50 governance in place • Later, Liberty spun out DIRECTV including its interest in GSN • Recently, SPE has expanded its U. S. network presence to include interests in three channels, in addition to GSN • GSN has continued to increase its profitability • DIRECTV indicated willingness to sell all or part of its stake in GSN and cede management control CONFIDENTIAL page 13

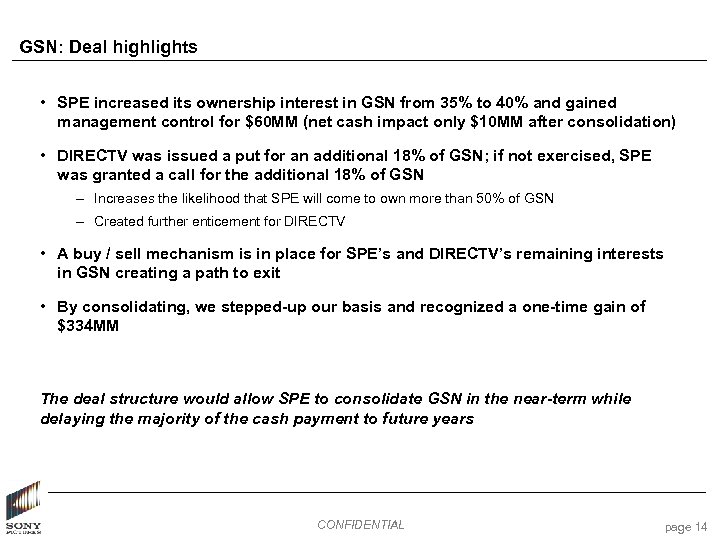

GSN: Deal highlights • SPE increased its ownership interest in GSN from 35% to 40% and gained management control for $60 MM (net cash impact only $10 MM after consolidation) • DIRECTV was issued a put for an additional 18% of GSN; if not exercised, SPE was granted a call for the additional 18% of GSN – Increases the likelihood that SPE will come to own more than 50% of GSN – Created further enticement for DIRECTV • A buy / sell mechanism is in place for SPE’s and DIRECTV’s remaining interests in GSN creating a path to exit • By consolidating, we stepped-up our basis and recognized a one-time gain of $334 MM The deal structure would allow SPE to consolidate GSN in the near-term while delaying the majority of the cash payment to future years CONFIDENTIAL page 14

GSN: Deal highlights • SPE increased its ownership interest in GSN from 35% to 40% and gained management control for $60 MM (net cash impact only $10 MM after consolidation) • DIRECTV was issued a put for an additional 18% of GSN; if not exercised, SPE was granted a call for the additional 18% of GSN – Increases the likelihood that SPE will come to own more than 50% of GSN – Created further enticement for DIRECTV • A buy / sell mechanism is in place for SPE’s and DIRECTV’s remaining interests in GSN creating a path to exit • By consolidating, we stepped-up our basis and recognized a one-time gain of $334 MM The deal structure would allow SPE to consolidate GSN in the near-term while delaying the majority of the cash payment to future years CONFIDENTIAL page 14

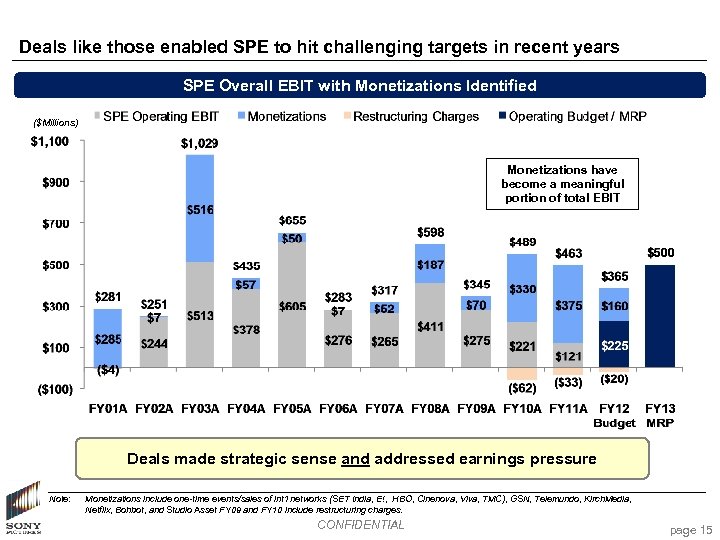

Deals like those enabled SPE to hit challenging targets in recent years SPE Overall EBIT with Monetizations Identified ($Millions) Monetizations have become a meaningful portion of total EBIT Deals made strategic sense and addressed earnings pressure Note: Monetizations include one-time events/sales of int’l networks (SET India, E!, HBO, Cinenova, Viva, TMC), GSN, Telemundo, Kirch. Media, Netflix, Bohbot, and Studio Asset FY 09 and FY 10 include restructuring charges. CONFIDENTIAL page 15

Deals like those enabled SPE to hit challenging targets in recent years SPE Overall EBIT with Monetizations Identified ($Millions) Monetizations have become a meaningful portion of total EBIT Deals made strategic sense and addressed earnings pressure Note: Monetizations include one-time events/sales of int’l networks (SET India, E!, HBO, Cinenova, Viva, TMC), GSN, Telemundo, Kirch. Media, Netflix, Bohbot, and Studio Asset FY 09 and FY 10 include restructuring charges. CONFIDENTIAL page 15

What’s in process? CONFIDENTIAL

What’s in process? CONFIDENTIAL

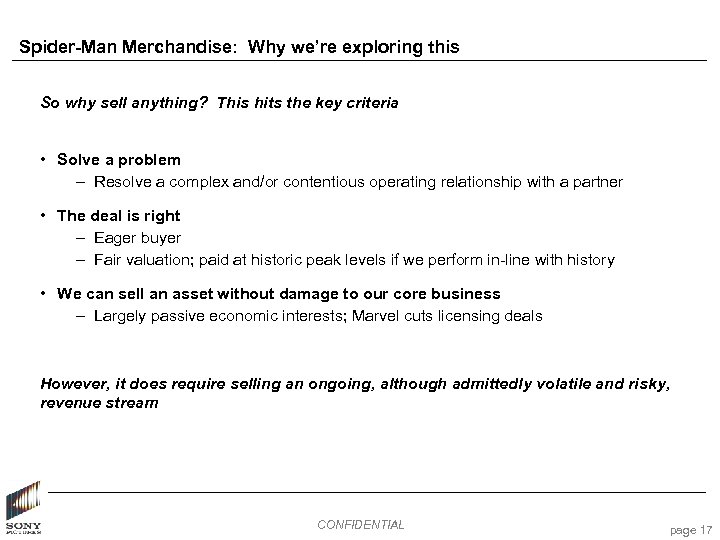

Spider-Man Merchandise: Why we’re exploring this So why sell anything? This hits the key criteria • Solve a problem – Resolve a complex and/or contentious operating relationship with a partner • The deal is right – Eager buyer – Fair valuation; paid at historic peak levels if we perform in-line with history • We can sell an asset without damage to our core business – Largely passive economic interests; Marvel cuts licensing deals However, it does require selling an ongoing, although admittedly volatile and risky, revenue stream CONFIDENTIAL page 17

Spider-Man Merchandise: Why we’re exploring this So why sell anything? This hits the key criteria • Solve a problem – Resolve a complex and/or contentious operating relationship with a partner • The deal is right – Eager buyer – Fair valuation; paid at historic peak levels if we perform in-line with history • We can sell an asset without damage to our core business – Largely passive economic interests; Marvel cuts licensing deals However, it does require selling an ongoing, although admittedly volatile and risky, revenue stream CONFIDENTIAL page 17

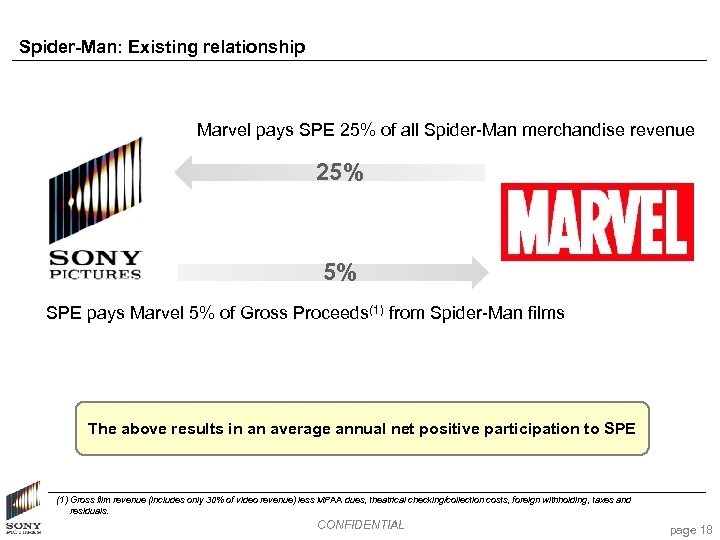

Spider-Man: Existing relationship Marvel pays SPE 25% of all Spider-Man merchandise revenue 25% 5% SPE pays Marvel 5% of Gross Proceeds(1) from Spider-Man films The above results in an average annual net positive participation to SPE (1) Gross film revenue (includes only 30% of video revenue) less MPAA dues, theatrical checking/collection costs, foreign withholding, taxes and residuals. CONFIDENTIAL page 18

Spider-Man: Existing relationship Marvel pays SPE 25% of all Spider-Man merchandise revenue 25% 5% SPE pays Marvel 5% of Gross Proceeds(1) from Spider-Man films The above results in an average annual net positive participation to SPE (1) Gross film revenue (includes only 30% of video revenue) less MPAA dues, theatrical checking/collection costs, foreign withholding, taxes and residuals. CONFIDENTIAL page 18

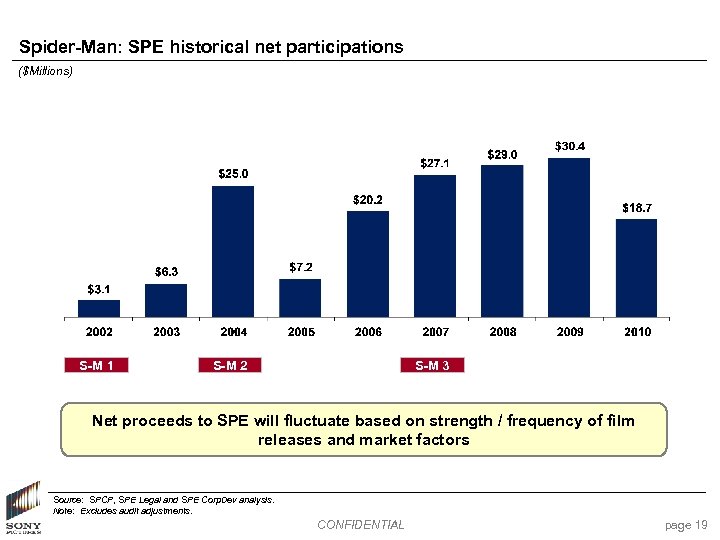

Spider-Man: SPE historical net participations ($Millions) S-M 1 S-M 2 S-M 3 Net proceeds to SPE will fluctuate based on strength / frequency of film releases and market factors Source: SPCP, SPE Legal and SPE Corp. Dev analysis. Note: Excludes audit adjustments. CONFIDENTIAL page 19

Spider-Man: SPE historical net participations ($Millions) S-M 1 S-M 2 S-M 3 Net proceeds to SPE will fluctuate based on strength / frequency of film releases and market factors Source: SPCP, SPE Legal and SPE Corp. Dev analysis. Note: Excludes audit adjustments. CONFIDENTIAL page 19

Spider-Man: Benefits for SPE STRATEGIC • Simplifies a complex relationship between SPE and Marvel – Gives SPE more clarity to produce films without approvals – Gives Marvel more leeway to license and drive brand awareness – Eliminates the need for contentious audits • Creates more certainty for SPE with respect to the value of Spider-Man merchandise FINANCIAL • Guarantees a minimum amount of compensation for a cash flow that has some risk, while creating potential to be paid at historical peak levels if films perform • SPE would recognize a one-time gain CONFIDENTIAL page 20

Spider-Man: Benefits for SPE STRATEGIC • Simplifies a complex relationship between SPE and Marvel – Gives SPE more clarity to produce films without approvals – Gives Marvel more leeway to license and drive brand awareness – Eliminates the need for contentious audits • Creates more certainty for SPE with respect to the value of Spider-Man merchandise FINANCIAL • Guarantees a minimum amount of compensation for a cash flow that has some risk, while creating potential to be paid at historical peak levels if films perform • SPE would recognize a one-time gain CONFIDENTIAL page 20

Where do we go from here? CONFIDENTIAL

Where do we go from here? CONFIDENTIAL

Let’s recap • We completed monetizations when: – The right deal was on the table (right value, right counter-party, limited long-term EBIT impact, attractive near-term impact) – Our business faced significant economic pressures • We are likely to complete another transaction this year as the right deal is available and we face continued pressures • But the cost of sales is rising and its harder to meet the criteria we discussed CONFIDENTIAL page 22

Let’s recap • We completed monetizations when: – The right deal was on the table (right value, right counter-party, limited long-term EBIT impact, attractive near-term impact) – Our business faced significant economic pressures • We are likely to complete another transaction this year as the right deal is available and we face continued pressures • But the cost of sales is rising and its harder to meet the criteria we discussed CONFIDENTIAL page 22

One time monetizations are increasingly at a cost to future EBIT ($Millions) Source: SPE Finance. (1) Recognized for ASPIRE in FY 09. CONFIDENTIAL page 23

One time monetizations are increasingly at a cost to future EBIT ($Millions) Source: SPE Finance. (1) Recognized for ASPIRE in FY 09. CONFIDENTIAL page 23

Deals also need to contribute to long-term growth • As our business begins to expand, the emphasis is shifting to acquisitions that: – Expand the highest margin, fastest growing segments of our business – Diversify our revenue and profit streams – “Buy ongoing EBIT, ” using transactions to supplement steady-state earnings rather than create one-time gains • Several acquisition categories and specific opportunities are being explored now – Careful prioritization is important given capital requirements, competing deals within Sony, and increasing levels of goodwill associated with deals CONFIDENTIAL page 24

Deals also need to contribute to long-term growth • As our business begins to expand, the emphasis is shifting to acquisitions that: – Expand the highest margin, fastest growing segments of our business – Diversify our revenue and profit streams – “Buy ongoing EBIT, ” using transactions to supplement steady-state earnings rather than create one-time gains • Several acquisition categories and specific opportunities are being explored now – Careful prioritization is important given capital requirements, competing deals within Sony, and increasing levels of goodwill associated with deals CONFIDENTIAL page 24

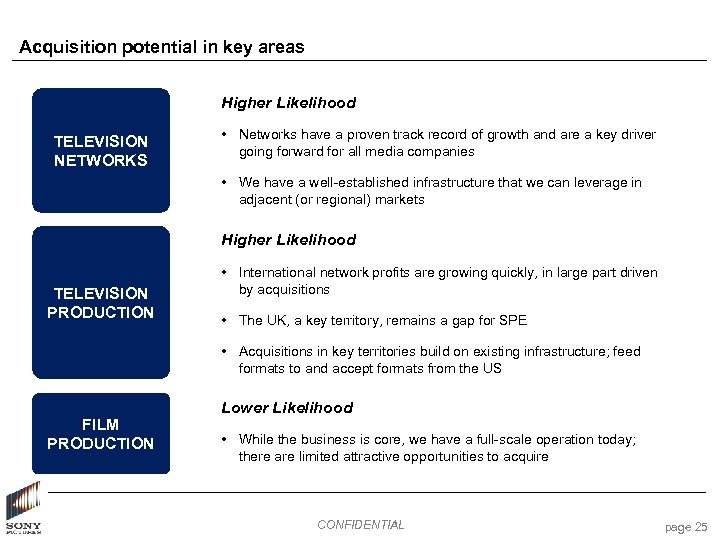

Acquisition potential in key areas Higher Likelihood TELEVISION NETWORKS • Networks have a proven track record of growth and are a key driver going forward for all media companies • We have a well-established infrastructure that we can leverage in adjacent (or regional) markets Higher Likelihood TELEVISION PRODUCTION • International network profits are growing quickly, in large part driven by acquisitions • The UK, a key territory, remains a gap for SPE • Acquisitions in key territories build on existing infrastructure; feed formats to and accept formats from the US FILM PRODUCTION Lower Likelihood • While the business is core, we have a full-scale operation today; there are limited attractive opportunities to acquire CONFIDENTIAL page 25

Acquisition potential in key areas Higher Likelihood TELEVISION NETWORKS • Networks have a proven track record of growth and are a key driver going forward for all media companies • We have a well-established infrastructure that we can leverage in adjacent (or regional) markets Higher Likelihood TELEVISION PRODUCTION • International network profits are growing quickly, in large part driven by acquisitions • The UK, a key territory, remains a gap for SPE • Acquisitions in key territories build on existing infrastructure; feed formats to and accept formats from the US FILM PRODUCTION Lower Likelihood • While the business is core, we have a full-scale operation today; there are limited attractive opportunities to acquire CONFIDENTIAL page 25