1a1d8271e58e8ad3b6b71d03d27140e9.ppt

- Количество слайдов: 53

Cornmarket Presentation Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. Friends First Life Assurance Company Ltd. is regulated by the Central Bank of Ireland. Telephone calls may be recorded for quality control and training purposes.

Cornmarket Presentation Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. Friends First Life Assurance Company Ltd. is regulated by the Central Bank of Ireland. Telephone calls may be recorded for quality control and training purposes.

About Cornmarket • • • With over 40 years' experience, we are the largest Public Sector financial services company in Ireland. We currently administer over 50 Union, Association and Employer endorsed Schemes. We are now a member of the Great. West Life. Co group of companies. In a recent survey, 95% of our customers said we were extremely/quite helpful & knowledgeable* *Source: feedback collated from 1, 347 online surveys completed by Cornmarket customers in 2014.

About Cornmarket • • • With over 40 years' experience, we are the largest Public Sector financial services company in Ireland. We currently administer over 50 Union, Association and Employer endorsed Schemes. We are now a member of the Great. West Life. Co group of companies. In a recent survey, 95% of our customers said we were extremely/quite helpful & knowledgeable* *Source: feedback collated from 1, 347 online surveys completed by Cornmarket customers in 2014.

Some our clients

Some our clients

Agenda 1. 2. 3. 4. 5. Group Life Plan Tax Savings Health Insurance Car / Home Insurance

Agenda 1. 2. 3. 4. 5. Group Life Plan Tax Savings Health Insurance Car / Home Insurance

1. Group Life Plan

1. Group Life Plan

• Death Benefit of 2. 5 times your annual salary up to age 65 or the date that you retire, if earlier (separate to any Life Cover under the UL Pension Scheme). • Reduction in cost: from 0. 558% to 0. 53% of gross salary (0. 32% of net salary based on a member paying tax at the 40% rate). • 5 year rate guarantee: The new reduced rate is guaranteed for the next 5 years (until 1 st May 2020). • Enhancements announced: the Plan is now more beneficial than ever before with new enhancements.

• Death Benefit of 2. 5 times your annual salary up to age 65 or the date that you retire, if earlier (separate to any Life Cover under the UL Pension Scheme). • Reduction in cost: from 0. 558% to 0. 53% of gross salary (0. 32% of net salary based on a member paying tax at the 40% rate). • 5 year rate guarantee: The new reduced rate is guaranteed for the next 5 years (until 1 st May 2020). • Enhancements announced: the Plan is now more beneficial than ever before with new enhancements.

Who can join the Plan? All pensionable employees of the University of Limerick, who are under age 65, are entitled to join the Plan. IMPORTANT: You must remain an employee of UL to remain an eligible member of the UL Group Life Plan. If you leave employment with UL you must inform Cornmarket in writing, as you can no longer stay in the Plan and you will not be able to claim from it.

Who can join the Plan? All pensionable employees of the University of Limerick, who are under age 65, are entitled to join the Plan. IMPORTANT: You must remain an employee of UL to remain an eligible member of the UL Group Life Plan. If you leave employment with UL you must inform Cornmarket in writing, as you can no longer stay in the Plan and you will not be able to claim from it.

Cost of Membership • Salary of € 40, 000 – cost € 2. 40 per week • Salary of € 50, 000 – cost € 3. 00 per week • Salary of € 60, 000 – cost € 3. 58 per week. 0. 53% of gross salary (0. 32% of net salary based on a member paying tax at the 40% rate).

Cost of Membership • Salary of € 40, 000 – cost € 2. 40 per week • Salary of € 50, 000 – cost € 3. 00 per week • Salary of € 60, 000 – cost € 3. 58 per week. 0. 53% of gross salary (0. 32% of net salary based on a member paying tax at the 40% rate).

How Can I Join? To apply to join the Plan or for more information on the benefits available, Call Cornmarket: (01) 470 8054 Email: pensions@ul. ie Phone UL on: (061) 202930.

How Can I Join? To apply to join the Plan or for more information on the benefits available, Call Cornmarket: (01) 470 8054 Email: pensions@ul. ie Phone UL on: (061) 202930.

2. Tax

2. Tax

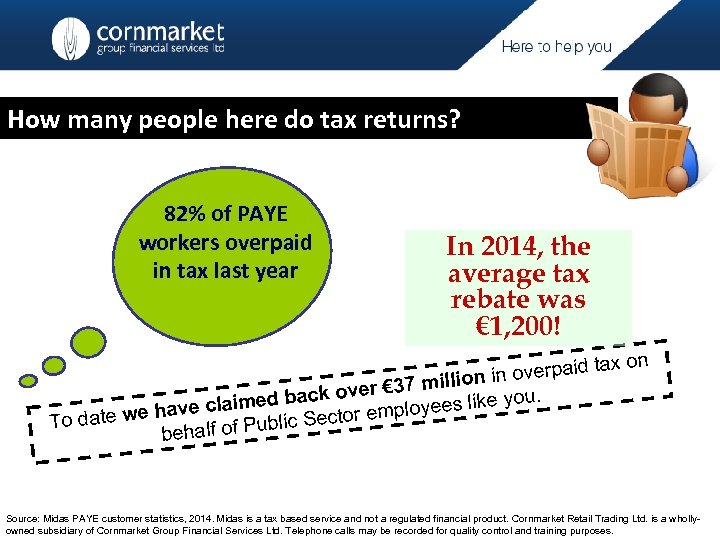

How many people here do tax returns? 82% of PAYE workers overpaid in tax last year In 2014, the average tax rebate was € 1, 200! on tax in overpaid illion over € 37 m back you. ve claimed loyees like ha r emp To date we ublic Secto behalf of P Source: Midas PAYE customer statistics, 2014. Midas is a tax based service and not a regulated financial product. Cornmarket Retail Trading Ltd. is a whollyowned subsidiary of Cornmarket Group Financial Services Ltd. Telephone calls may be recorded for quality control and training purposes.

How many people here do tax returns? 82% of PAYE workers overpaid in tax last year In 2014, the average tax rebate was € 1, 200! on tax in overpaid illion over € 37 m back you. ve claimed loyees like ha r emp To date we ublic Secto behalf of P Source: Midas PAYE customer statistics, 2014. Midas is a tax based service and not a regulated financial product. Cornmarket Retail Trading Ltd. is a whollyowned subsidiary of Cornmarket Group Financial Services Ltd. Telephone calls may be recorded for quality control and training purposes.

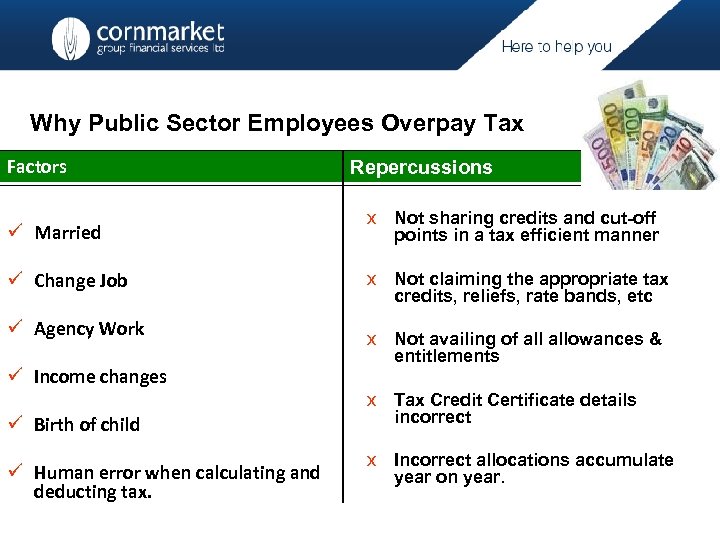

Why Public Sector Employees Overpay Tax Factors Repercussions ü Married x Not sharing credits and cut-off points in a tax efficient manner ü Change Job x Not claiming the appropriate tax credits, reliefs, rate bands, etc ü Agency Work ü Income changes ü Birth of child ü Human error when calculating and deducting tax. x Not availing of allowances & entitlements x Tax Credit Certificate details incorrect x Incorrect allocations accumulate year on year.

Why Public Sector Employees Overpay Tax Factors Repercussions ü Married x Not sharing credits and cut-off points in a tax efficient manner ü Change Job x Not claiming the appropriate tax credits, reliefs, rate bands, etc ü Agency Work ü Income changes ü Birth of child ü Human error when calculating and deducting tax. x Not availing of allowances & entitlements x Tax Credit Certificate details incorrect x Incorrect allocations accumulate year on year.

Tax Credit Cert It instructs your employer on the amount of Tax to deduct. If it’s wrong…… YOU PAY too much or too little!

Tax Credit Cert It instructs your employer on the amount of Tax to deduct. If it’s wrong…… YOU PAY too much or too little!

Check your Tax Credits & Rate Bands

Check your Tax Credits & Rate Bands

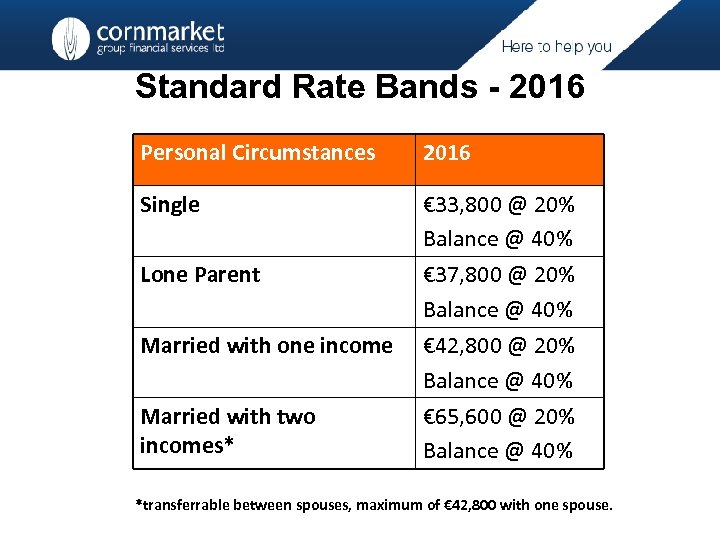

Standard Rate Bands - 2016 Personal Circumstances 2016 Single € 33, 800 @ 20% Balance @ 40% Lone Parent € 37, 800 @ 20% Balance @ 40% Married with one income € 42, 800 @ 20% Balance @ 40% Married with two incomes* € 65, 600 @ 20% Balance @ 40% *transferrable between spouses, maximum of € 42, 800 with one spouse.

Standard Rate Bands - 2016 Personal Circumstances 2016 Single € 33, 800 @ 20% Balance @ 40% Lone Parent € 37, 800 @ 20% Balance @ 40% Married with one income € 42, 800 @ 20% Balance @ 40% Married with two incomes* € 65, 600 @ 20% Balance @ 40% *transferrable between spouses, maximum of € 42, 800 with one spouse.

Maximise your Allowances & Reliefs

Maximise your Allowances & Reliefs

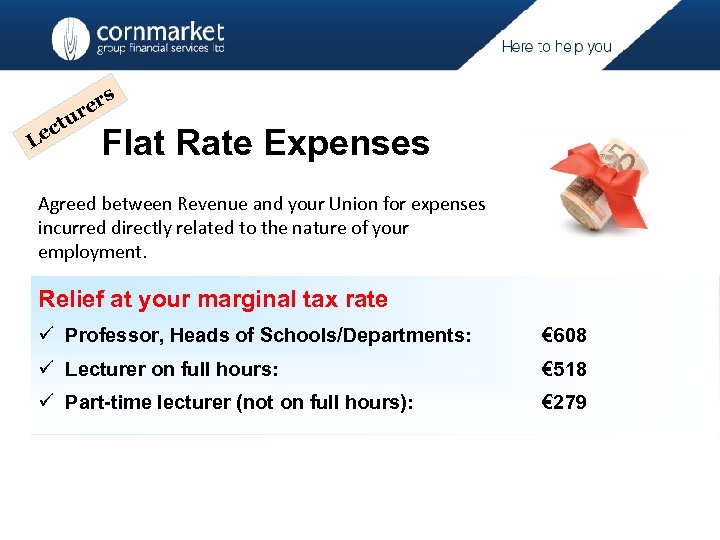

r re ctu e L s Flat Rate Expenses Agreed between Revenue and your Union for expenses incurred directly related to the nature of your employment. Relief at your marginal tax rate ü Professor, Heads of Schools/Departments: € 608 ü Lecturer on full hours: € 518 ü Part-time lecturer (not on full hours): € 279

r re ctu e L s Flat Rate Expenses Agreed between Revenue and your Union for expenses incurred directly related to the nature of your employment. Relief at your marginal tax rate ü Professor, Heads of Schools/Departments: € 608 ü Lecturer on full hours: € 518 ü Part-time lecturer (not on full hours): € 279

Claim relief on your Medical Expenses 1. Make your medical insurance claim (www. hia. ie) Tax relief at source, unless paid by employer. 2. Avail of the Drug Payments Scheme - max € 144 pm (www. hse. ie) 3. Apply for your tax relief through Form Med 1.

Claim relief on your Medical Expenses 1. Make your medical insurance claim (www. hia. ie) Tax relief at source, unless paid by employer. 2. Avail of the Drug Payments Scheme - max € 144 pm (www. hse. ie) 3. Apply for your tax relief through Form Med 1.

Qualifying Health Expenses Doctor, GP, consultant or hospital fees Items or treatments prescribed by a Doctor Approved nursing home fees (40%) Non-routine Dental Treatments Prescribed medicines Certain dietary products, e. g. Coeliac/Diabetic. Keep the receipts for 6 years.

Qualifying Health Expenses Doctor, GP, consultant or hospital fees Items or treatments prescribed by a Doctor Approved nursing home fees (40%) Non-routine Dental Treatments Prescribed medicines Certain dietary products, e. g. Coeliac/Diabetic. Keep the receipts for 6 years.

Earning more than € 3, 175 outside of PAYE Income If you earn more than € 3, 175 of income from any source outside the PAYE system you are obligated to file a return annually. If you don’t file a return, penalties and late fees apply.

Earning more than € 3, 175 outside of PAYE Income If you earn more than € 3, 175 of income from any source outside the PAYE system you are obligated to file a return annually. If you don’t file a return, penalties and late fees apply.

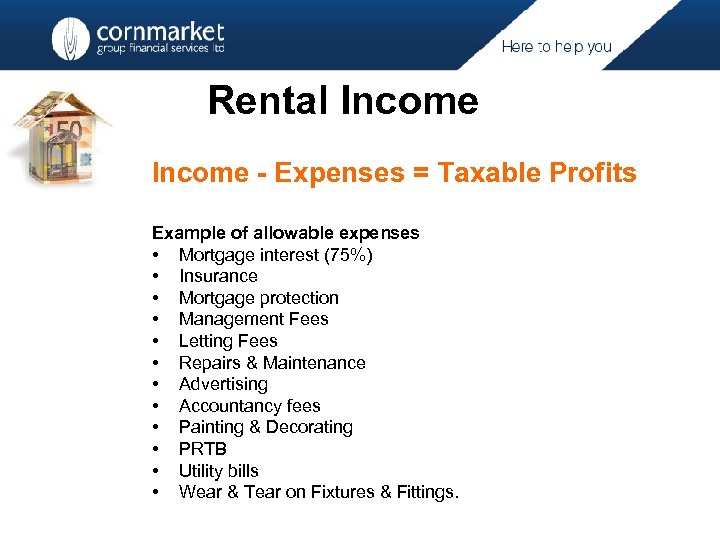

Rental Income - Expenses = Taxable Profits Example of allowable expenses • Mortgage interest (75%) • Insurance • Mortgage protection • Management Fees • Letting Fees • Repairs & Maintenance • Advertising • Accountancy fees • Painting & Decorating • PRTB • Utility bills • Wear & Tear on Fixtures & Fittings.

Rental Income - Expenses = Taxable Profits Example of allowable expenses • Mortgage interest (75%) • Insurance • Mortgage protection • Management Fees • Letting Fees • Repairs & Maintenance • Advertising • Accountancy fees • Painting & Decorating • PRTB • Utility bills • Wear & Tear on Fixtures & Fittings.

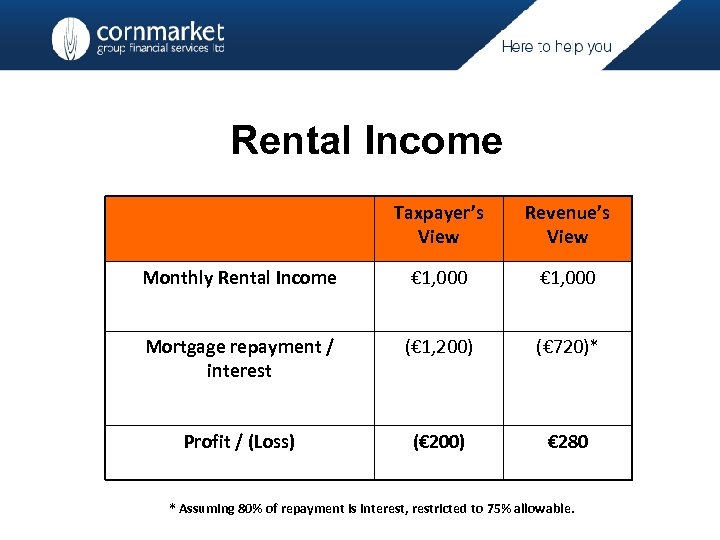

Rental Income Taxpayer’s View Revenue’s View Monthly Rental Income € 1, 000 Mortgage repayment / interest (€ 1, 200) (€ 720)* Profit / (Loss) (€ 200) € 280 * Assuming 80% of repayment is interest, restricted to 75% allowable.

Rental Income Taxpayer’s View Revenue’s View Monthly Rental Income € 1, 000 Mortgage repayment / interest (€ 1, 200) (€ 720)* Profit / (Loss) (€ 200) € 280 * Assuming 80% of repayment is interest, restricted to 75% allowable.

3. Savings

3. Savings

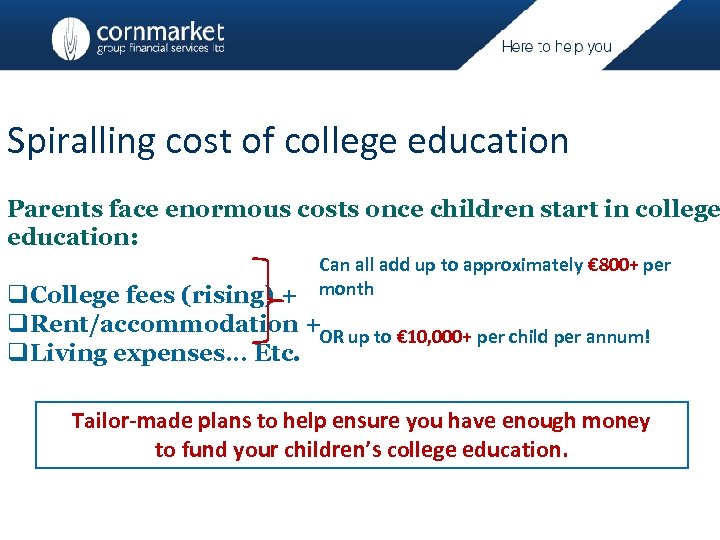

Spiralling cost of college education Parents face enormous costs once children start in college education: Can all add up to approximately € 800+ per month q. College fees (rising) + q. Rent/accommodation +OR up to € 10, 000+ per child per annum! q. Living expenses… Etc. Tailor-made plans to help ensure you have enough money to fund your children’s college education.

Spiralling cost of college education Parents face enormous costs once children start in college education: Can all add up to approximately € 800+ per month q. College fees (rising) + q. Rent/accommodation +OR up to € 10, 000+ per child per annum! q. Living expenses… Etc. Tailor-made plans to help ensure you have enough money to fund your children’s college education.

Where to save? • Bank • Credit Union • Government Bonds • Property • Managed Funds

Where to save? • Bank • Credit Union • Government Bonds • Property • Managed Funds

4. Health Insurance

4. Health Insurance

Private Health Insurance ‘Best deals to save you money’ Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. A member of the Irish Life Group Ltd. Telephone calls may be recorded for quality control and training purposes.

Private Health Insurance ‘Best deals to save you money’ Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. A member of the Irish Life Group Ltd. Telephone calls may be recorded for quality control and training purposes.

Market Overview • Costs increasing again • C. 365 plans to choose from • Difficulty making ‘Life-for-Like’ comparisons • Special Offers • Other plans for Dental and Health Cash

Market Overview • Costs increasing again • C. 365 plans to choose from • Difficulty making ‘Life-for-Like’ comparisons • Special Offers • Other plans for Dental and Health Cash

Benefit of Health Insurance Ø Choice & Control Ø Choice - Consultant - Hospital - Accommodation Type - Time of Admission Ø Control - You decide to use your cover whenever it suits you - Enables you to bypass public hospital waiting lists by going private Ø Always check everything in advance with either Cornmarket or Insurer – DON’T GET CAUGHT OUT!!

Benefit of Health Insurance Ø Choice & Control Ø Choice - Consultant - Hospital - Accommodation Type - Time of Admission Ø Control - You decide to use your cover whenever it suits you - Enables you to bypass public hospital waiting lists by going private Ø Always check everything in advance with either Cornmarket or Insurer – DON’T GET CAUGHT OUT!!

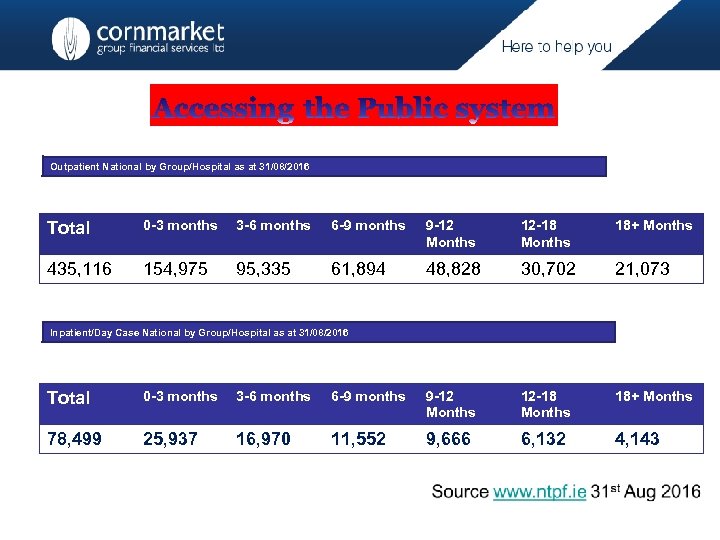

Outpatient National by Group/Hospital as at 31/08/2016 Total 0 -3 months 3 -6 months 6 -9 months 9 -12 Months 12 -18 Months 18+ Months 435, 116 154, 975 95, 335 61, 894 48, 828 30, 702 21, 073 Inpatient/Day Case National by Group/Hospital as at 31/08/2016 Total 0 -3 months 3 -6 months 6 -9 months 9 -12 Months 12 -18 Months 18+ Months 78, 499 25, 937 16, 970 11, 552 9, 666 6, 132 4, 143

Outpatient National by Group/Hospital as at 31/08/2016 Total 0 -3 months 3 -6 months 6 -9 months 9 -12 Months 12 -18 Months 18+ Months 435, 116 154, 975 95, 335 61, 894 48, 828 30, 702 21, 073 Inpatient/Day Case National by Group/Hospital as at 31/08/2016 Total 0 -3 months 3 -6 months 6 -9 months 9 -12 Months 12 -18 Months 18+ Months 78, 499 25, 937 16, 970 11, 552 9, 666 6, 132 4, 143

Our Health Insurance Comparison Service • Largest Health Insurance broker in Ireland • Unique comparison tool covering all insurers • Expert staff who deal in health insurance only • No obligation to accept our advice • Now includes Dental Cover

Our Health Insurance Comparison Service • Largest Health Insurance broker in Ireland • Unique comparison tool covering all insurers • Expert staff who deal in health insurance only • No obligation to accept our advice • Now includes Dental Cover

Is Switching Easy? ? • Credit for time served • No new waiting periods • No age loadings Cannot be penalised for switching @ renewal • Protection if an insurer goes bust • Upgrade rule may apply

Is Switching Easy? ? • Credit for time served • No new waiting periods • No age loadings Cannot be penalised for switching @ renewal • Protection if an insurer goes bust • Upgrade rule may apply

Things to watch out for! • Plans covering public hospitals only • High Excess plans • Plans with restricted hospital lists • I don’t need kids covered • Sign here…

Things to watch out for! • Plans covering public hospitals only • High Excess plans • Plans with restricted hospital lists • I don’t need kids covered • Sign here…

Did you know…. • Public treatment is not free • You can join any plan on the market • No insurer can refuse to insure you • Do you have to pay these age loadings • Why do I have to have the following on my plan; - maternity - convalescence - psychiatric

Did you know…. • Public treatment is not free • You can join any plan on the market • No insurer can refuse to insure you • Do you have to pay these age loadings • Why do I have to have the following on my plan; - maternity - convalescence - psychiatric

Play the game…. • The premium dance • Watch out for renewal changes!! – benefits aswell as price • They looked after me? • Use the call to your advantage

Play the game…. • The premium dance • Watch out for renewal changes!! – benefits aswell as price • They looked after me? • Use the call to your advantage

Making things easy…. • The premium dance • Watch out for renewal changes!! – benefits aswell as price • They looked after me? • Use the call to your advantage

Making things easy…. • The premium dance • Watch out for renewal changes!! – benefits aswell as price • They looked after me? • Use the call to your advantage

Other General Benefits available Overseas Cover Scan & claim or online claims Day to Day cover Elective Treatments A&E Return Home Overseas Cover Online GP Employee Elective Assistance Treatments Programme A&E Return Home

Other General Benefits available Overseas Cover Scan & claim or online claims Day to Day cover Elective Treatments A&E Return Home Overseas Cover Online GP Employee Elective Assistance Treatments Programme A&E Return Home

Are you on a dated plan? • Health Plus Choice (Plan C) • Health Plus Access (Plan B) • Forward Plan • Parent & Kids • Family or First Plan Plus Level 1

Are you on a dated plan? • Health Plus Choice (Plan C) • Health Plus Access (Plan B) • Forward Plan • Parent & Kids • Family or First Plan Plus Level 1

Are you on a dated plan? • Essential Plus Schemes • Health Manager Schemes • Simply Health Excess • Company Care Schemes • Complete Care

Are you on a dated plan? • Essential Plus Schemes • Health Manager Schemes • Simply Health Excess • Company Care Schemes • Complete Care

Are you on a dated plan? • Level 2 Hospital • Level 2 Family Health or Complete Health • Level 3 Schemes • Level 1 Everyday • Business Plans (Extra, Select, Choice)

Are you on a dated plan? • Level 2 Hospital • Level 2 Family Health or Complete Health • Level 3 Schemes • Level 1 Everyday • Business Plans (Extra, Select, Choice)

Are you on a dated plan? • Better Plan • Better Saver Plan • Better Smart Plan • Good Plan • Ultra Plan

Are you on a dated plan? • Better Plan • Better Saver Plan • Better Smart Plan • Good Plan • Ultra Plan

Sample Best Buys…. HP Access – Plan B (€ 1, 945) PMI 36 13 (€ 1, 248) Essential Plus Excess (€ 2, 119) Simply Connect Plus (€ 1, 169) Level 2 Hospital (€ 2, 335) Health Plan 16. 1 (€ 1, 218) Best Plan (€ 1, 903) Best Smart Plan (€ 1, 162) Rates correct at 1 st September 2016 - Source HIA

Sample Best Buys…. HP Access – Plan B (€ 1, 945) PMI 36 13 (€ 1, 248) Essential Plus Excess (€ 2, 119) Simply Connect Plus (€ 1, 169) Level 2 Hospital (€ 2, 335) Health Plan 16. 1 (€ 1, 218) Best Plan (€ 1, 903) Best Smart Plan (€ 1, 162) Rates correct at 1 st September 2016 - Source HIA

For More Cost Savings… • Split your cover or provider • Ensure you’re receiving Young Adult Rates • Take on a small Excess • Seek the Corporate plan equivalent • Do you really want Private Room cover • Watch for ‘Special Offers’ • Annual review is essential

For More Cost Savings… • Split your cover or provider • Ensure you’re receiving Young Adult Rates • Take on a small Excess • Seek the Corporate plan equivalent • Do you really want Private Room cover • Watch for ‘Special Offers’ • Annual review is essential

Why Dental Insurance? 56% of people in Ireland avoid or delay dental treatment because of cost. * However research shows that preventive dentistry, delivered on a regular basis, greatly reduces the risk of dental disease • Dental insurance can bridge this gap • Greater uptake of required dental treatment • Provides tangible financial benefits. *Based on De. Care Dental research conducted in 2014

Why Dental Insurance? 56% of people in Ireland avoid or delay dental treatment because of cost. * However research shows that preventive dentistry, delivered on a regular basis, greatly reduces the risk of dental disease • Dental insurance can bridge this gap • Greater uptake of required dental treatment • Provides tangible financial benefits. *Based on De. Care Dental research conducted in 2014

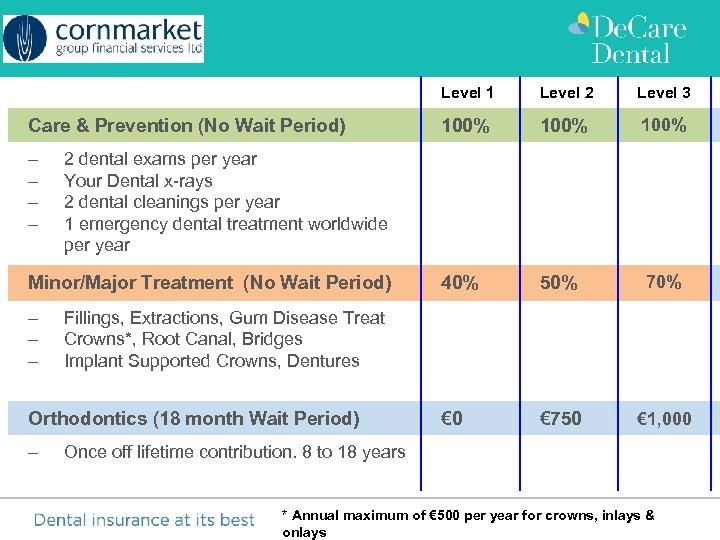

Level 1 Care & Prevention (No Wait Period) 100% 40% 50% 70% € 0 € 750 € 1, 000 Fillings, Extractions, Gum Disease Treat Crowns*, Root Canal, Bridges Implant Supported Crowns, Dentures Orthodontics (18 month Wait Period) Level 3 2 dental exams per year Your Dental x-rays 2 dental cleanings per year 1 emergency dental treatment worldwide per year Minor/Major Treatment (No Wait Period) Level 2 Once off lifetime contribution. 8 to 18 years * Annual maximum of € 500 per year for crowns, inlays & onlays

Level 1 Care & Prevention (No Wait Period) 100% 40% 50% 70% € 0 € 750 € 1, 000 Fillings, Extractions, Gum Disease Treat Crowns*, Root Canal, Bridges Implant Supported Crowns, Dentures Orthodontics (18 month Wait Period) Level 3 2 dental exams per year Your Dental x-rays 2 dental cleanings per year 1 emergency dental treatment worldwide per year Minor/Major Treatment (No Wait Period) Level 2 Once off lifetime contribution. 8 to 18 years * Annual maximum of € 500 per year for crowns, inlays & onlays

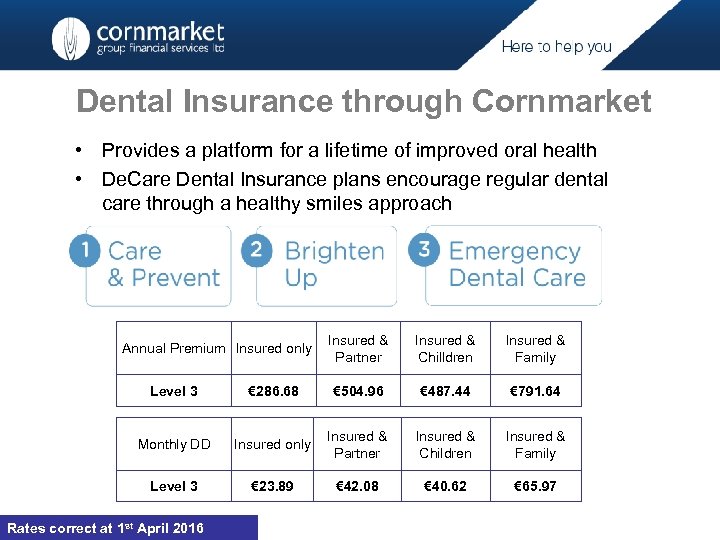

Dental Insurance through Cornmarket • Provides a platform for a lifetime of improved oral health • De. Care Dental Insurance plans encourage regular dental care through a healthy smiles approach Annual Premium Insured only Insured & Partner Insured & Chilldren Insured & Family Level 3 € 286. 68 € 504. 96 € 487. 44 € 791. 64 Monthly DD Insured only Insured & Partner Insured & Children Insured & Family Level 3 € 23. 89 € 42. 08 € 40. 62 € 65. 97 Rates correct at 1 st April 2016

Dental Insurance through Cornmarket • Provides a platform for a lifetime of improved oral health • De. Care Dental Insurance plans encourage regular dental care through a healthy smiles approach Annual Premium Insured only Insured & Partner Insured & Chilldren Insured & Family Level 3 € 286. 68 € 504. 96 € 487. 44 € 791. 64 Monthly DD Insured only Insured & Partner Insured & Children Insured & Family Level 3 € 23. 89 € 42. 08 € 40. 62 € 65. 97 Rates correct at 1 st April 2016

Our Comparison Service Contact Details Our Approach • 01 4708091 • Expert & Confidential • On-line enquiry • Covers all providers • Enquiry card • No cost to you www. cornmarket. ie

Our Comparison Service Contact Details Our Approach • 01 4708091 • Expert & Confidential • On-line enquiry • Covers all providers • Enquiry card • No cost to you www. cornmarket. ie

5. Car and House Insurance

5. Car and House Insurance

Cornmarket General Insurance Client Numbers Over 79, 000 Clients Over 57, 000 Clients Over 19, 000 Clients Over 2, 000 Clients

Cornmarket General Insurance Client Numbers Over 79, 000 Clients Over 57, 000 Clients Over 19, 000 Clients Over 2, 000 Clients

Car Insurance Proposal Build your Own

Car Insurance Proposal Build your Own

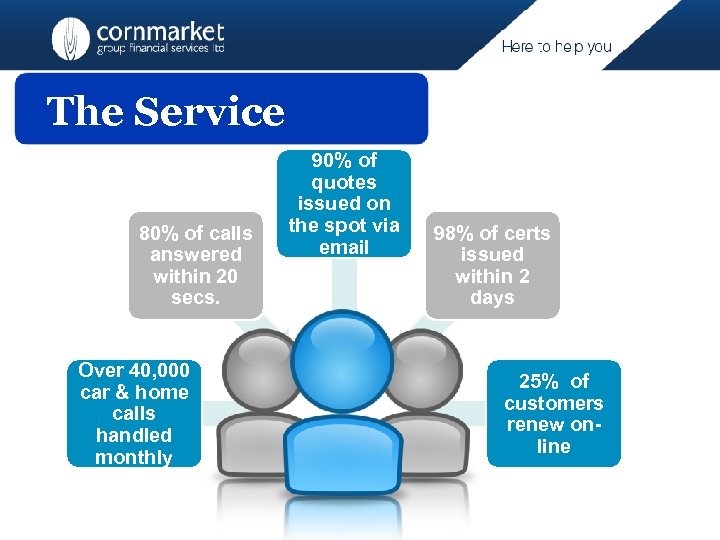

The Service 80% of calls answered within 20 secs. Over 40, 000 car & home calls handled monthly 90% of quotes issued on the spot via email What Challenge s do unions face? 98% of certs issued within 2 days 25% of customers renew online

The Service 80% of calls answered within 20 secs. Over 40, 000 car & home calls handled monthly 90% of quotes issued on the spot via email What Challenge s do unions face? 98% of certs issued within 2 days 25% of customers renew online

€ 40 Discount available to all UL members who purchase a new motor insurance policy. Special Offer: UL 3 months free* offer on Allianz home insurance policies. *Offer valid to 31 st December 2016 20% off Annual Multi-trip* using code 20%OFFCM *Offer valid to 31 st December 2016

€ 40 Discount available to all UL members who purchase a new motor insurance policy. Special Offer: UL 3 months free* offer on Allianz home insurance policies. *Offer valid to 31 st December 2016 20% off Annual Multi-trip* using code 20%OFFCM *Offer valid to 31 st December 2016

Thank you for your attention Questions? Please be advised that while Cornmarket has referenced websites in this presentations, we cannot be held responsible for the content of these websites. Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. A member of the Irish Life Group Ltd. Friends First Life Assurance Company Ltd. is regulated by the Central Bank of Ireland. Allianz plc is regulated by the Central Bank of Ireland. RSA Insurance Ireland Ltd is regulated by the Central Bank of Ireland. Telephone calls may be recorded for quality control and training purposes.

Thank you for your attention Questions? Please be advised that while Cornmarket has referenced websites in this presentations, we cannot be held responsible for the content of these websites. Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. A member of the Irish Life Group Ltd. Friends First Life Assurance Company Ltd. is regulated by the Central Bank of Ireland. Allianz plc is regulated by the Central Bank of Ireland. RSA Insurance Ireland Ltd is regulated by the Central Bank of Ireland. Telephone calls may be recorded for quality control and training purposes.