9fb0b61e03571ff8b483f80940439f81.ppt

- Количество слайдов: 28

Corn &Wheat Situation and Outlook Kim B. Anderson Oklahoma State University 1

Policy comes and policy goes but weather determines prices. Luther Tweeten 2

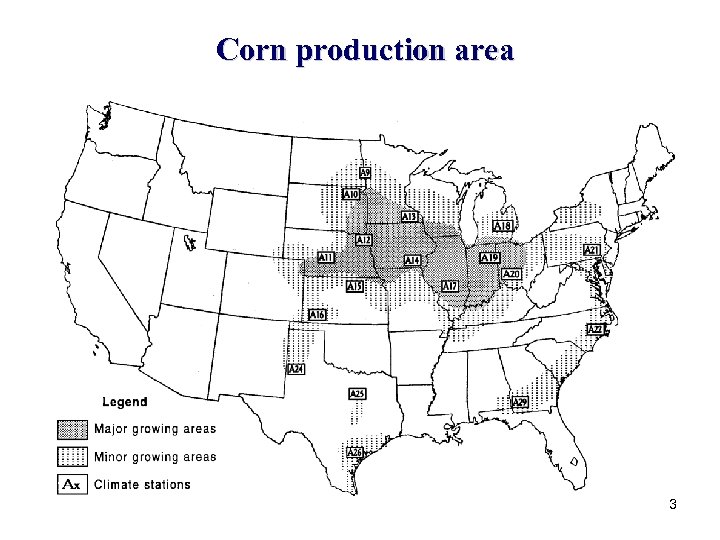

Corn production area 3

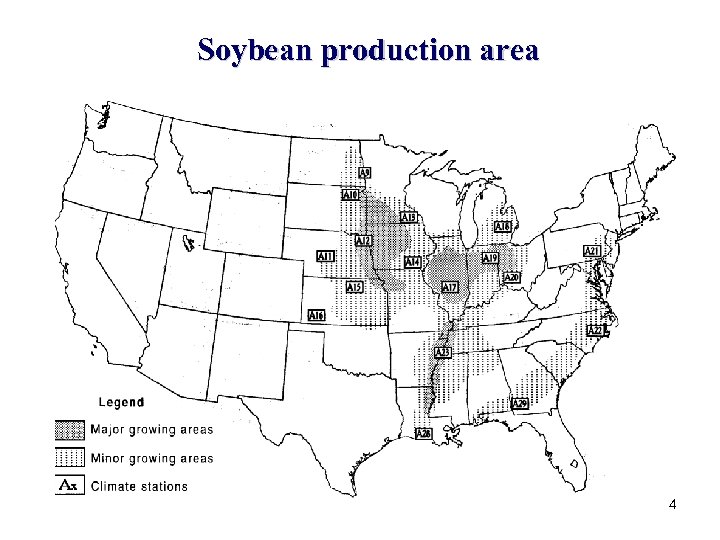

Soybean production area 4

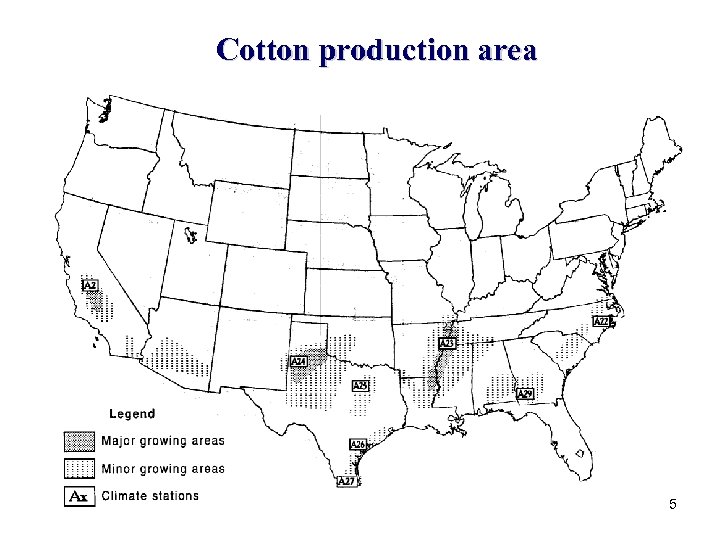

Cotton production area 5

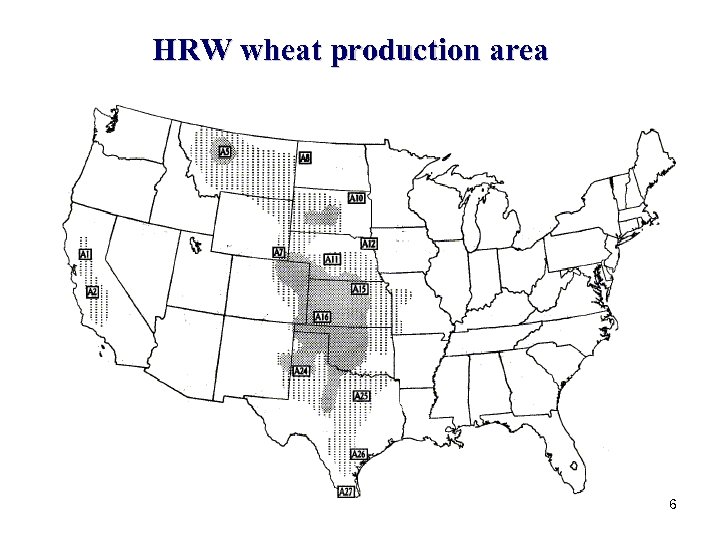

HRW wheat production area 6

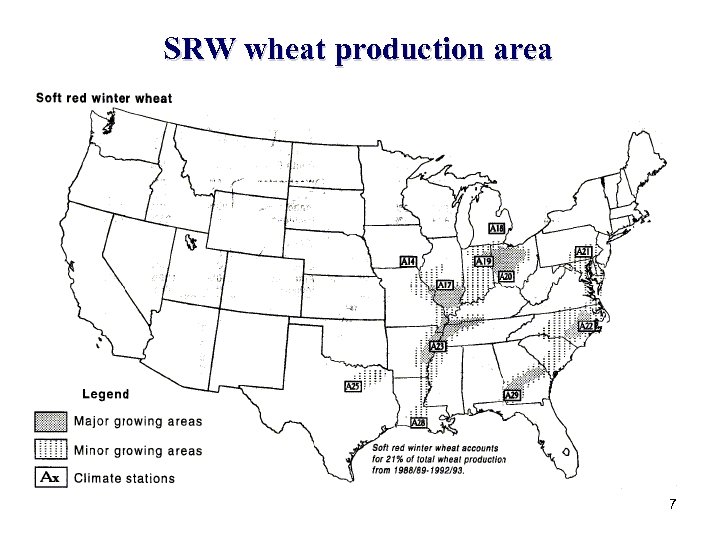

SRW wheat production area 7

Corn 8

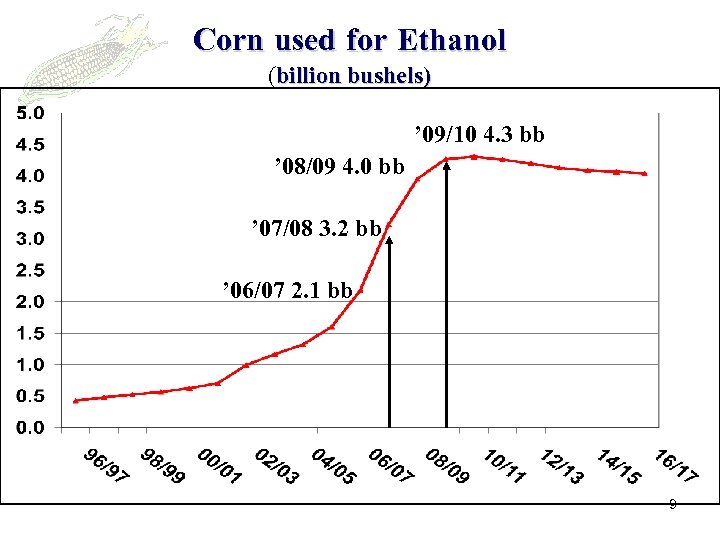

Corn used for Ethanol (billion bushels) ’ 09/10 4. 3 bb ’ 08/09 4. 0 bb ’ 07/08 3. 2 bb ’ 06/07 2. 1 bb 9

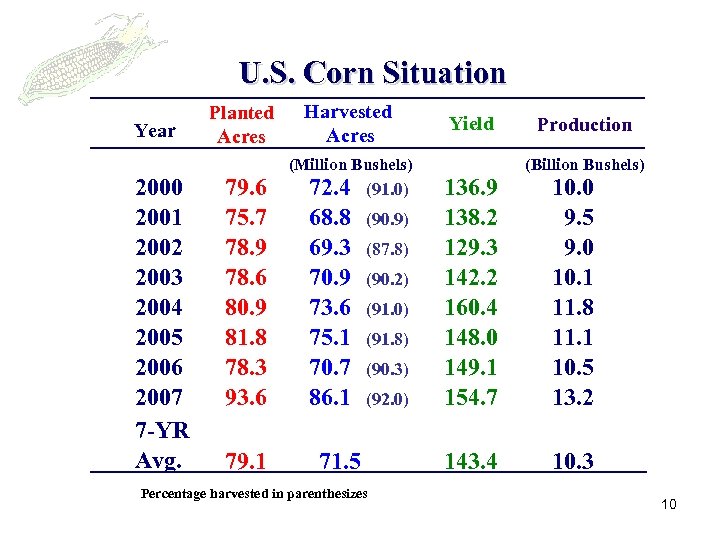

U. S. Corn Situation Year 2000 2001 2002 2003 2004 2005 2006 2007 7 -YR Avg. Planted Acres 79. 6 75. 7 78. 9 78. 6 80. 9 81. 8 78. 3 93. 6 79. 1 Harvested Acres (Million Bushels) 72. 4 68. 8 69. 3 70. 9 73. 6 75. 1 70. 7 86. 1 (91. 0) (90. 9) (87. 8) (90. 2) (91. 0) (91. 8) (90. 3) (92. 0) 71. 5 Percentage harvested in parenthesizes Yield 136. 9 138. 2 129. 3 142. 2 160. 4 148. 0 149. 1 154. 7 143. 4 Production (Billion Bushels) 10. 0 9. 5 9. 0 10. 1 11. 8 11. 1 10. 5 13. 2 10. 3 10

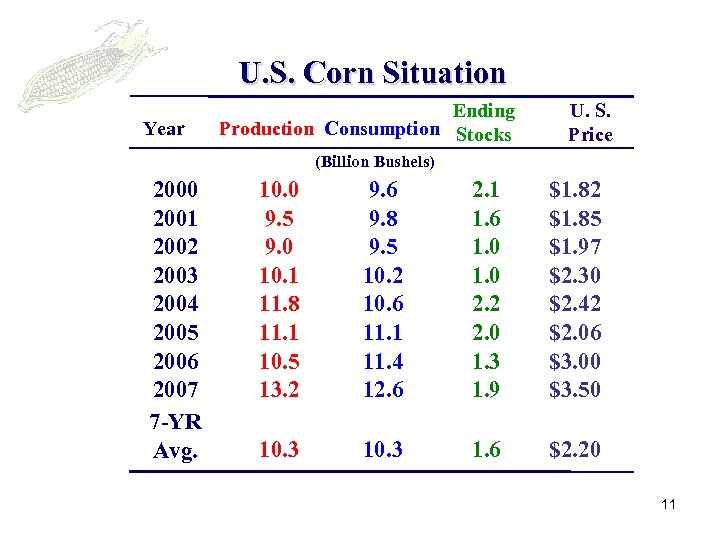

U. S. Corn Situation Year Ending Production Consumption Stocks U. S. Price (Billion Bushels) 2000 2001 2002 2003 2004 2005 2006 2007 7 -YR Avg. 10. 0 9. 5 9. 0 10. 1 11. 8 11. 1 10. 5 13. 2 9. 6 9. 8 9. 5 10. 2 10. 6 11. 1 11. 4 12. 6 2. 1 1. 6 1. 0 2. 2 2. 0 1. 3 1. 9 $1. 82 $1. 85 $1. 97 $2. 30 $2. 42 $2. 06 $3. 00 $3. 50 10. 3 1. 6 $2. 20 11

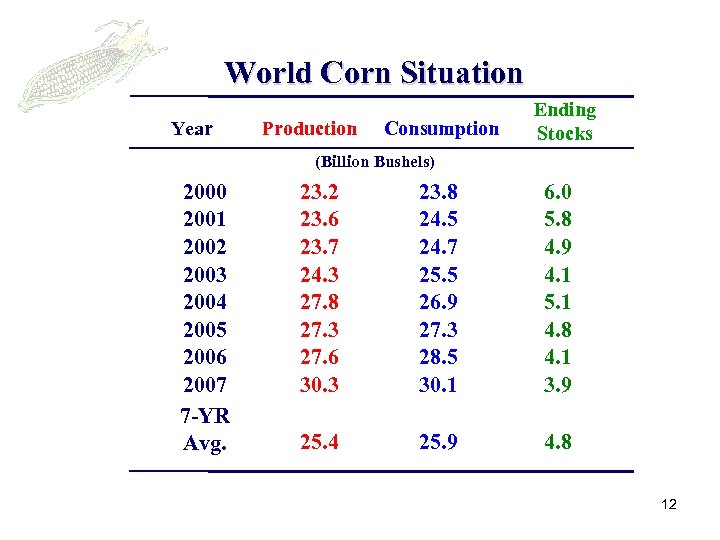

World Corn Situation Year Production Consumption Ending Stocks (Billion Bushels) 2000 2001 2002 2003 2004 2005 2006 2007 7 -YR Avg. 23. 2 23. 6 23. 7 24. 3 27. 8 27. 3 27. 6 30. 3 23. 8 24. 5 24. 7 25. 5 26. 9 27. 3 28. 5 30. 1 6. 0 5. 8 4. 9 4. 1 5. 1 4. 8 4. 1 3. 9 25. 4 25. 9 4. 8 12

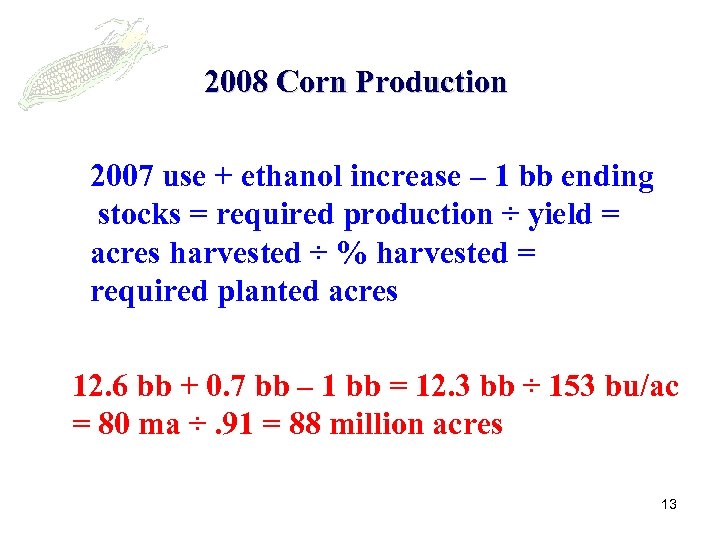

2008 Corn Production 2007 use + ethanol increase – 1 bb ending stocks = required production ÷ yield = acres harvested ÷ % harvested = required planted acres 12. 6 bb + 0. 7 bb – 1 bb = 12. 3 bb ÷ 153 bu/ac = 80 ma ÷. 91 = 88 million acres 13

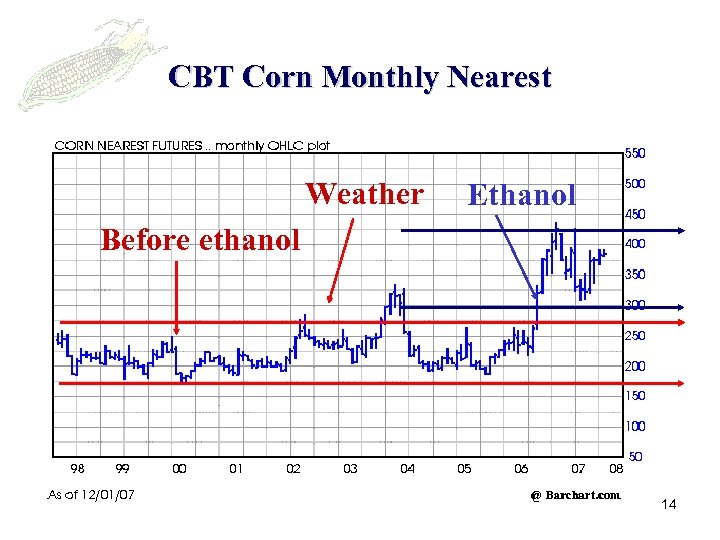

CBT Corn Monthly Nearest Weather Ethanol Before ethanol 14

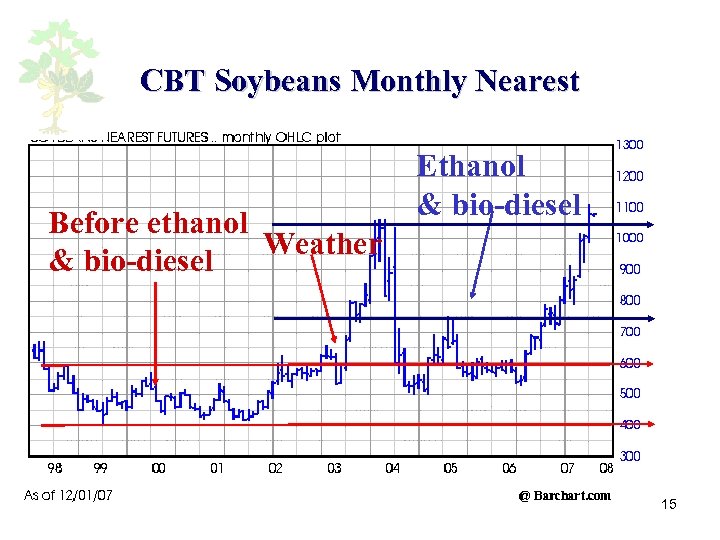

CBT Soybeans Monthly Nearest Before ethanol Weather & bio-diesel Ethanol & bio-diesel 15

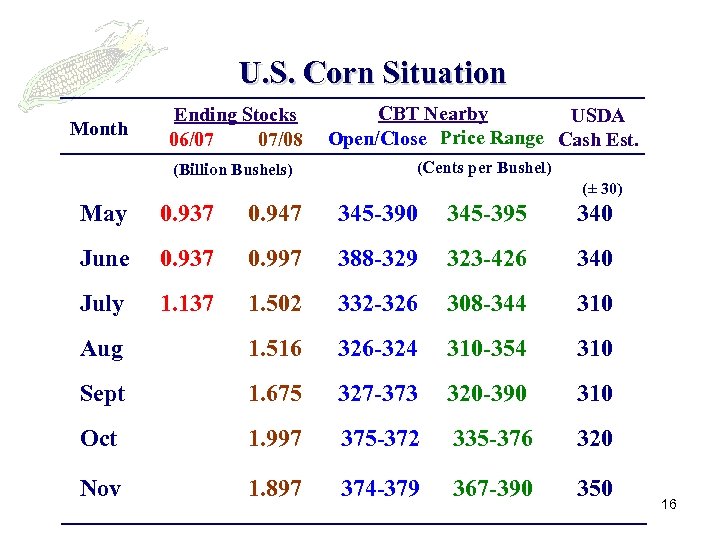

U. S. Corn Situation CBT Nearby USDA Open/Close Price Range Cash Est. (Billion Bushels) Month Ending Stocks 06/07 07/08 (Cents per Bushel) (± 30) May 0. 937 0. 947 345 -390 345 -395 340 June 0. 937 0. 997 388 -329 323 -426 340 July 1. 137 1. 502 332 -326 308 -344 310 Aug 1. 516 326 -324 310 -354 310 Sept 1. 675 327 -373 320 -390 310 Oct 1. 997 375 -372 335 -376 320 Nov 1. 897 374 -379 367 -390 350 16

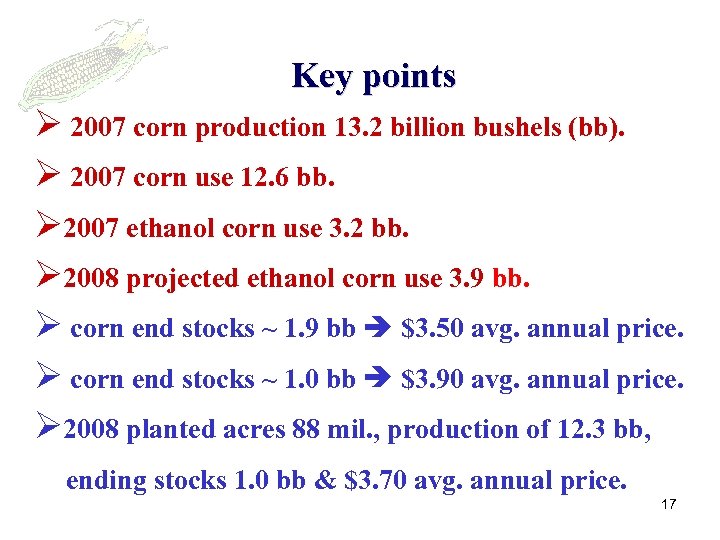

Key points Ø 2007 corn production 13. 2 billion bushels (bb). Ø 2007 corn use 12. 6 bb. Ø 2007 ethanol corn use 3. 2 bb. Ø 2008 projected ethanol corn use 3. 9 bb. Ø corn end stocks ~ 1. 9 bb $3. 50 avg. annual price. Ø corn end stocks ~ 1. 0 bb $3. 90 avg. annual price. Ø 2008 planted acres 88 mil. , production of 12. 3 bb, ending stocks 1. 0 bb & $3. 70 avg. annual price. 17

Wheat 18

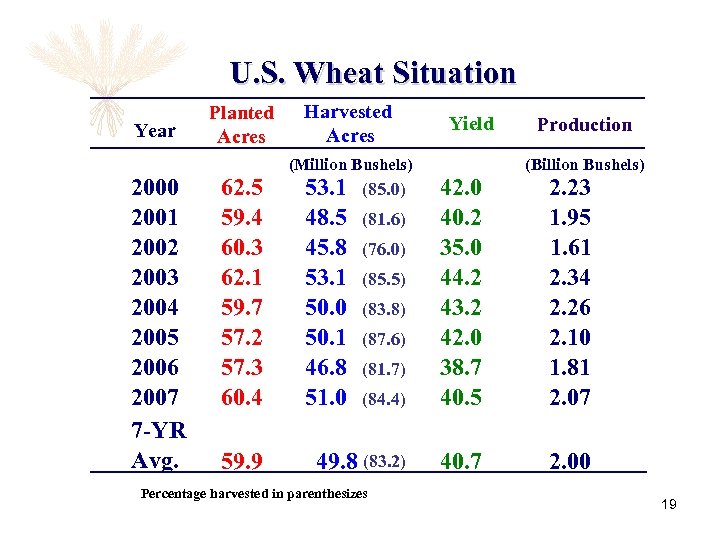

U. S. Wheat Situation Year 2000 2001 2002 2003 2004 2005 2006 2007 7 -YR Avg. Planted Acres 62. 5 59. 4 60. 3 62. 1 59. 7 57. 2 57. 3 60. 4 59. 9 Harvested Acres (Million Bushels) 53. 1 48. 5 45. 8 53. 1 50. 0 50. 1 46. 8 51. 0 Yield (84. 4) 42. 0 40. 2 35. 0 44. 2 43. 2 42. 0 38. 7 40. 5 49. 8 (83. 2) 40. 7 (85. 0) (81. 6) (76. 0) (85. 5) (83. 8) (87. 6) (81. 7) Percentage harvested in parenthesizes Production (Billion Bushels) 2. 23 1. 95 1. 61 2. 34 2. 26 2. 10 1. 81 2. 07 2. 00 19

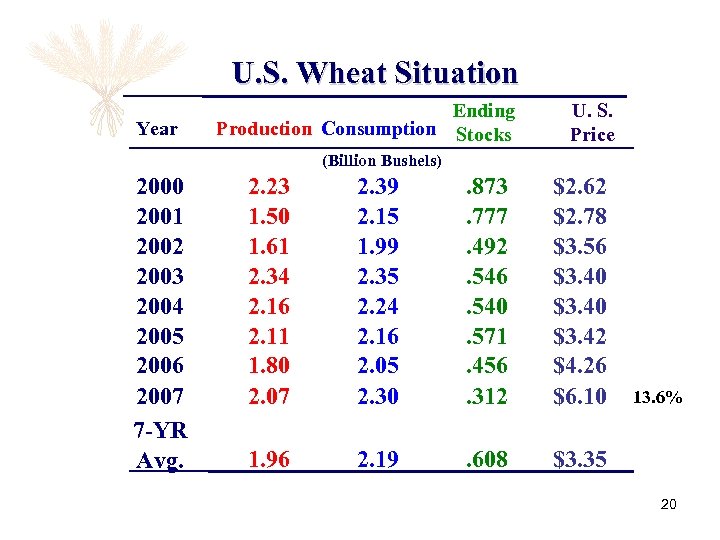

U. S. Wheat Situation Year Ending Production Consumption Stocks U. S. Price (Billion Bushels) 2000 2001 2002 2003 2004 2005 2006 2007 7 -YR Avg. 2. 23 1. 50 1. 61 2. 34 2. 16 2. 11 1. 80 2. 07 2. 39 2. 15 1. 99 2. 35 2. 24 2. 16 2. 05 2. 30 . 873. 777. 492. 546. 540. 571. 456. 312 $2. 62 $2. 78 $3. 56 $3. 40 $3. 42 $4. 26 $6. 10 1. 96 2. 19 . 608 $3. 35 13. 6% 20

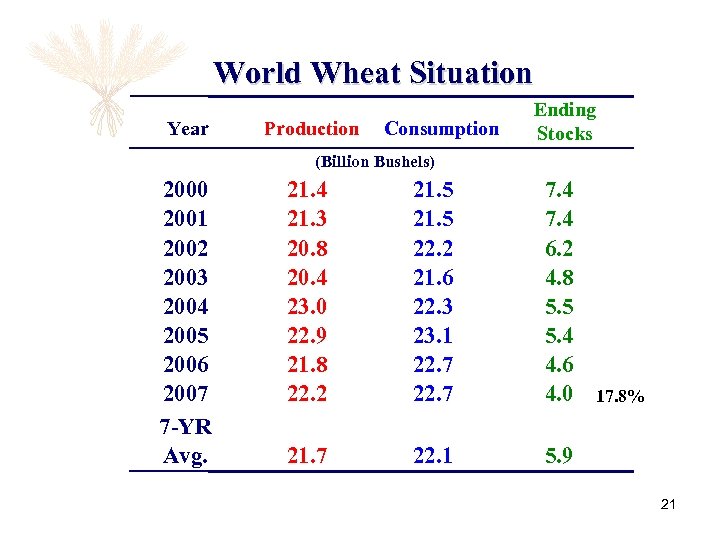

World Wheat Situation Year Production Consumption Ending Stocks (Billion Bushels) 2000 2001 2002 2003 2004 2005 2006 2007 7 -YR Avg. 21. 4 21. 3 20. 8 20. 4 23. 0 22. 9 21. 8 22. 2 21. 5 22. 2 21. 6 22. 3 23. 1 22. 7 7. 4 6. 2 4. 8 5. 5 5. 4 4. 6 4. 0 21. 7 22. 1 5. 9 17. 8% 21

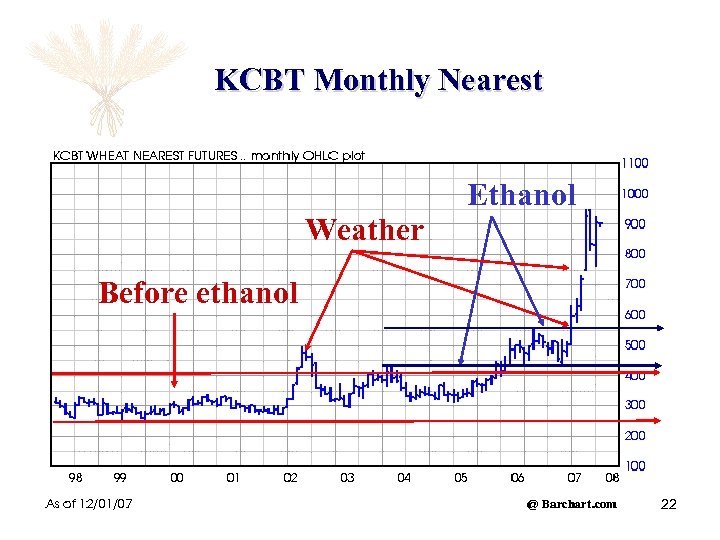

KCBT Monthly Nearest Weather Ethanol Before ethanol 22

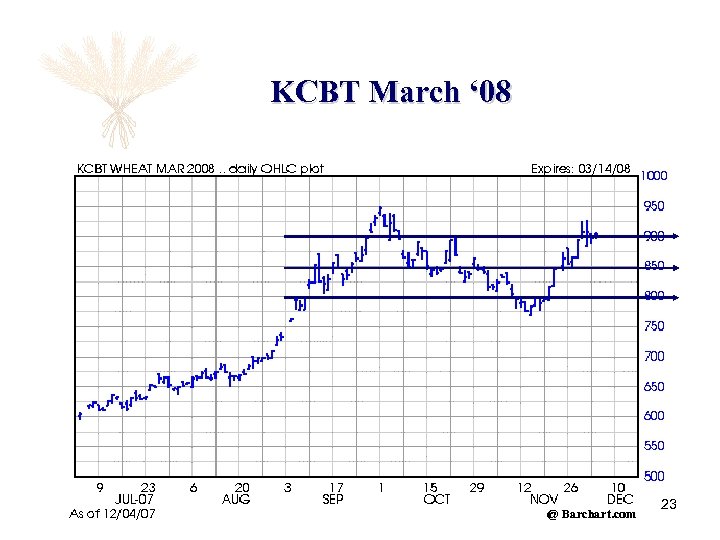

KCBT March ‘ 08 23

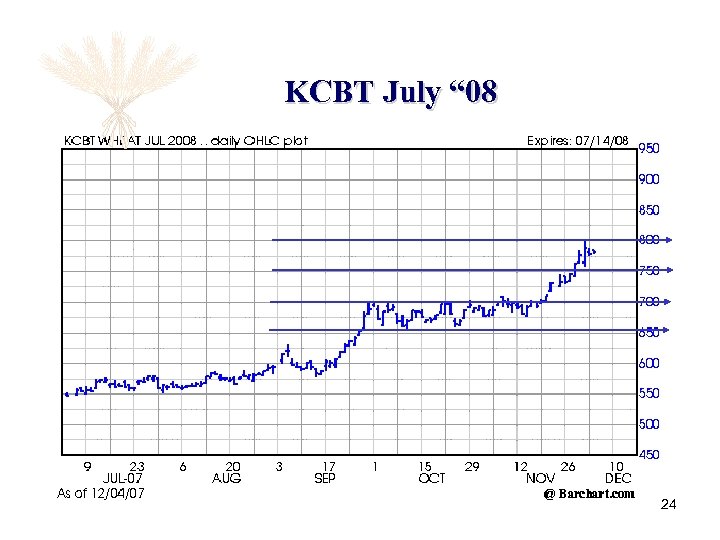

KCBT July “ 08 24

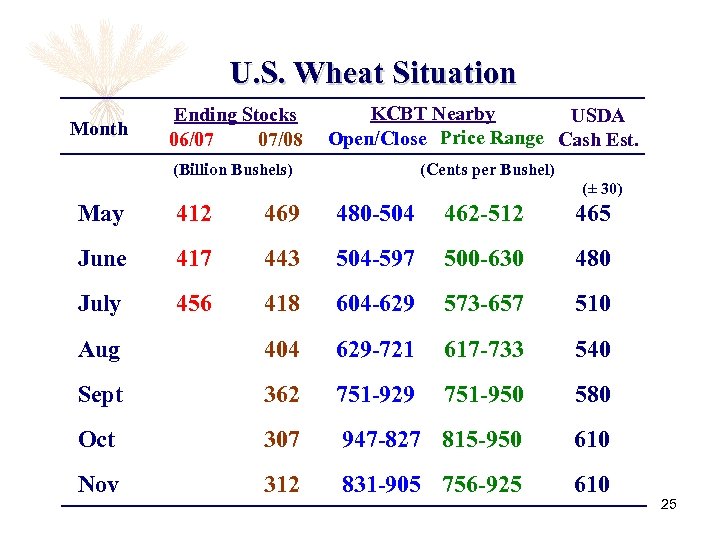

U. S. Wheat Situation Ending Stocks 06/07 07/08 KCBT Nearby USDA Open/Close Price Range Cash Est. (Billion Bushels) Month (Cents per Bushel) (± 30) May 412 469 480 -504 462 -512 465 June 417 443 504 -597 500 -630 480 July 456 418 604 -629 573 -657 510 Aug 404 629 -721 617 -733 540 Sept 362 751 -929 751 -950 580 Oct 307 947 -827 815 -950 610 Nov 312 831 -905 756 -925 610 25

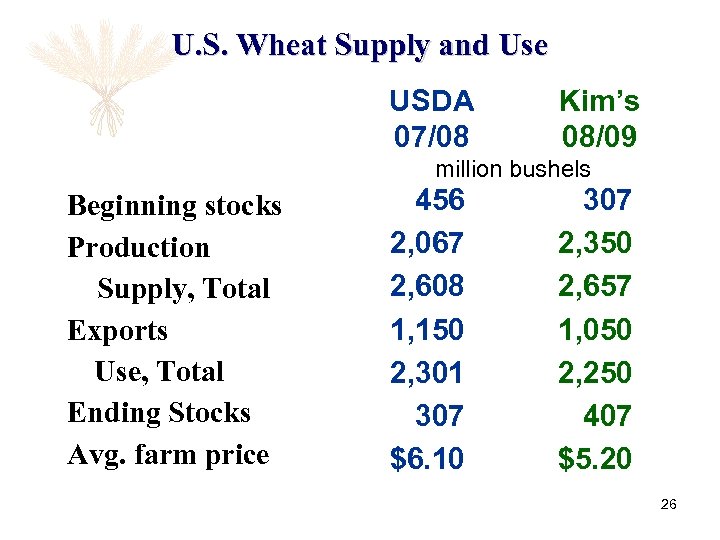

U. S. Wheat Supply and Use USDA 07/08 Kim’s 08/09 million bushels Beginning stocks Production Supply, Total Exports Use, Total Ending Stocks Avg. farm price 456 2, 067 2, 608 1, 150 2, 301 307 $6. 10 307 2, 350 2, 657 1, 050 2, 250 407 $5. 20 26

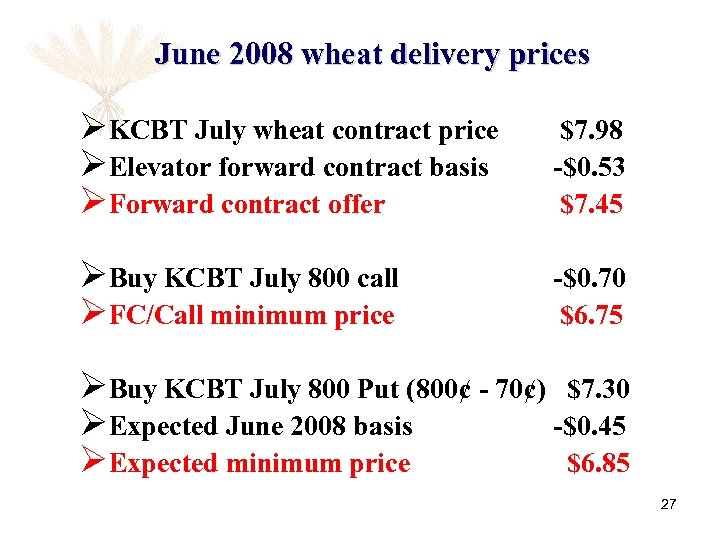

June 2008 wheat delivery prices ØKCBT July wheat contract price ØElevator forward contract basis ØForward contract offer $7. 98 -$0. 53 $7. 45 ØBuy KCBT July 800 call ØFC/Call minimum price -$0. 70 $6. 75 ØBuy KCBT July 800 Put (800¢ - 70¢) $7. 30 ØExpected June 2008 basis -$0. 45 ØExpected minimum price $6. 85 27

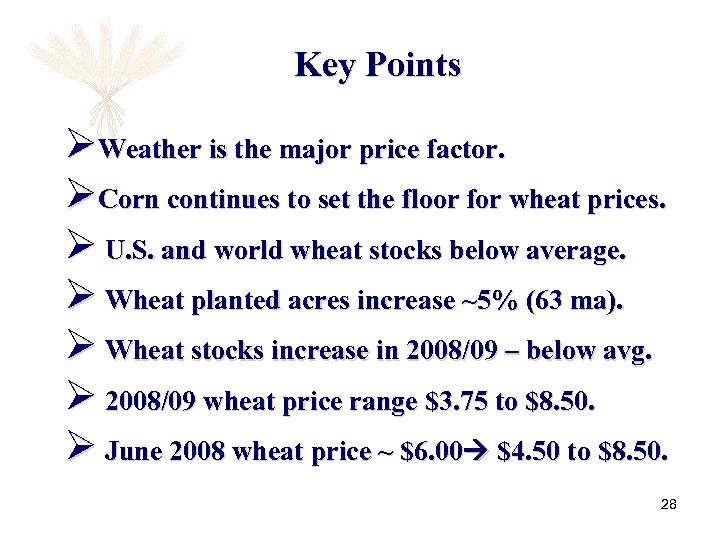

Key Points ØWeather is the major price factor. ØCorn continues to set the floor for wheat prices. Ø U. S. and world wheat stocks below average. Ø Wheat planted acres increase ~5% (63 ma). Ø Wheat stocks increase in 2008/09 – below avg. Ø 2008/09 wheat price range $3. 75 to $8. 50. Ø June 2008 wheat price ~ $6. 00 $4. 50 to $8. 50. 28

9fb0b61e03571ff8b483f80940439f81.ppt