19fdec2089f8fd6983856baf1c07410e.ppt

- Количество слайдов: 10

Corliss Whitaker: Portfolio – Instructional Presentation Understanding BASEL II Concepts Author: Korki Whitaker Revised: 02/17/2007 Understanding BASEL II Concepts

Pillar 3 – Market Discipline Pillar 2 – Supervisory Control Pillar 1 – Addressing Risk Corliss Whitaker: Portfolio – Instructional Presentation BASEL II formulates a set of broad supervisory standards and guidelines developed by an international group, the BASEL Committee on Banking Supervision. The G-10 members and Luxemburg and Spain make up the Committee. Understanding BASEL II Concepts

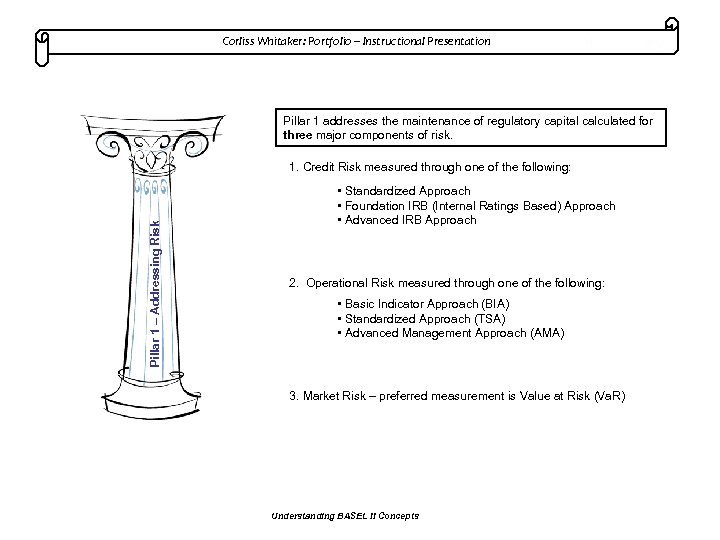

Corliss Whitaker: Portfolio – Instructional Presentation Pillar 1 addresses the maintenance of regulatory capital calculated for three major components of risk. Pillar 1 – Addressing Risk 1. Credit Risk measured through one of the following: • Standardized Approach • Foundation IRB (Internal Ratings Based) Approach • Advanced IRB Approach 2. Operational Risk measured through one of the following: • Basic Indicator Approach (BIA) • Standardized Approach (TSA) • Advanced Management Approach (AMA) 3. Market Risk – preferred measurement is Value at Risk (Va. R) Understanding BASEL II Concepts

Corliss Whitaker: Portfolio – Instructional Presentation Credit risk is the risk of loss due to a debtor's non-payment of a loan or other line of credit (either the principal or interest (coupon) or both). Pillar 1 – Addressing Risk Examples of Credit Risk: • Consumer credit risk • Commercial (business) credit risk • Counterparty risk • Sovereign risk (the risk of a government becoming unwilling or unable to meet its loan obligations ) Understanding BASEL II Concepts

Corliss Whitaker: Portfolio – Instructional Presentation Operational Risk is the risk of loss resulting from inadequate or failed internal processes, people and systems, or from external events Pillar 1 – Addressing Risk The following lists the official Basel II defined event types with some examples for each category: Internal Fraud - misappropriation of assets, tax evasion, intentional mismarking of positions, [bribery] External Fraud- theft of information, hacking damage, third-party theft and forgery Employment Practices and Workplace Safety - discrimination, workers compensation, employee health and safety Clients, Products, & Business Practice- market manipulation, antitrust, improper trade, product defects, fiduciary breaches, account churning Damage to Physical Assets - natural disasters, terrorism, vandalism Business Disruption & Systems Failures - utility disruptions, software failures, hardware failures Execution, Delivery, & Process Management - data entry errors, accounting errors, failed mandatory reporting, negligent loss of client assets Understanding BASEL II Concepts

Corliss Whitaker: Portfolio – Instructional Presentation Market risk is the risk that the value of an investment will decrease due to moves in market factors. Pillar 1 – Addressing Risk The four standard market risk factors are: Equity risk, the risk that stock prices will change. Interest rate risk, the risk that interest rates will change. Currency risk, the risk that foreign exchange rates will change. Commodity risk, the risk that commodity prices (e. g. grains, metals) will change. Understanding BASEL II Concepts

Corliss Whitaker: Portfolio – Instructional Presentation Types of calculations found within Pillar I include: Pillar 1 – Addressing Risk • Treatment of double default • Standard risk weighted assets • Probability of default • Loss given default • Exposure at Default • Expected Loss and Provisions • Others Understanding BASEL II Concepts

Corliss Whitaker: Portfolio – Instructional Presentation Pillar 2 addresses ‘residual’ risk – any other additional type of risk a bank may face. Pillar 2 – Supervisory Control • Residual Risk includes such risks as: 1. Systemic Risk 2. Pension Risk 3. Liquidity Risk • Pillar 2 gives regulators additional tools to analyze risks identified in Pillar 1. Pillar 2 includes such calculations and analysis such as: • Portfolio Exposure • Outstandings Analysis • Operational Risk Loss Assessment/Analysis • Non-performing Loan Analysis • Location Exposure • Credit Loss Allowance Analysis Understanding BASEL II Concepts

Corliss Whitaker: Portfolio – Instructional Presentation Pillar 3 – Market Discipline Pillar 3 sets up reporting details that will allow counterparties to a bank’s risk and the market in general determine how risky a particular bank might be. Pillar 3 includes such calculations and analysis such as: • Capital Structure • Capital Adequacy • Allowance for Credit Loses • Credit Risk IRB • Credit Risk Mitigation • More Understanding BASEL II Concepts

Corliss Whitaker: Portfolio – Instructional Presentation References: Bank for International Settlements: Basel II: Revised international capital framework Bank for International Settlements: Basel II: International Convergence of Capital Measurement and Capital Standards: A Revised Framework - Comprehensive Version Wikipedia: Basel II Wikipedia: Operational Risk Wikipedia: Credit Risk Understanding BASEL II Concepts

19fdec2089f8fd6983856baf1c07410e.ppt