1a392dbe43e72b5c79e2479d94ebeec4.ppt

- Количество слайдов: 22

Core concepts to structure microinsurance products Brandon Mathews World Bank Workshop Uganda 2 March 2009 Microinsurance

Agenda of core product issues Incentives Utility for customers (demand) Utility for providers (supply) Technical © Zurich Financial Services Insurance & operational risks Partners and intermediaries Customer needs Microinsurance 3/1/2009 2

Agenda of core product issues Incentives Utility for customers (demand) Utility for providers (supply) Technical © Zurich Financial Services Insurance & operational risks Partners and intermediaries Customer needs Microinsurance 3/1/2009 3

Utility… insurance must be useful for those that use it (that have a claim). Ten people know there’s a risk event that they believe costs $30 and it will happen to one of them so ten buy insurance. For the one that claims, insurance must Correctly pay incurred losses. Pay in time to be useful. Pay in a way that is useful. Be in a useful amount. © Zurich Financial Services Make certain that the claims benefit suits customer requirements Microinsurance 3/1/2009 4

… should be useful for those that don’t use it (don’t claim). Nine people bought the insurance but didn’t have a claim… but also no longer saved toward the $30 event. Insurance should allow: Release of savings Acceptance of ordinary risk. © Zurich Financial Services Good insurance changes the behavior of the insured. Microinsurance 3/1/2009 5

… perhaps will be useful for those that don’t even buy it. Ten insurance buyers live in a community of twenty people. The $30 claim pays for services that otherwise aren’t available. © Zurich Financial Services Insurance allows services to form that eventually can also serve the uninsured. Microinsurance 3/1/2009 6

Customer utility affects product design… Products that benefit the claimant directly and sufficiently are more valued and will drive sales over the medium term. Products that benefit non-claimants are more valued. Voluntary purchases are more likely to have proven their use Products that deliver services directly add utility. © Zurich Financial Services Funeral / burial insurance Medical services instead of reimbursement. Microinsurance 3/1/2009 7

Agenda of core product issues Incentives Utility for customers (demand) Utility for providers (supply) Technical © Zurich Financial Services Insurance & operational risks Partners and intermediaries Customer needs Microinsurance 3/1/2009 8

Providers should supply microinsurance out of self-interest. Insurance capital, opportunity, & other costs exist. Demand is marginally affected, at best, by profitability. Whether the premium in my example was $3. 00, $2. 90, or $3. 10: Person whose claim was paid is better off People that didn’t claim assessed experience based on total price Formation of services for non-buyers is not affected © Zurich Financial Services Possible to justify with some other benefits: Employee moral – good to work for a company that is good. Innovation – disaggregating value-chain improves performance. Alignment with other market actors. Microinsurance 3/1/2009 9

Provider utility impacts product design… Corporate responsibility is to try to make a profit in this space… not just CR on its own. © Zurich Financial Services To continuously lower the median income of customers requires profit. Microinsurance 3/1/2009 10

Agenda of core product issues Incentives Utility for customers (demand) Utility for providers (supply) Technical © Zurich Financial Services Insurance & operational risks Partners and intermediaries Customer needs Microinsurance 3/1/2009 11

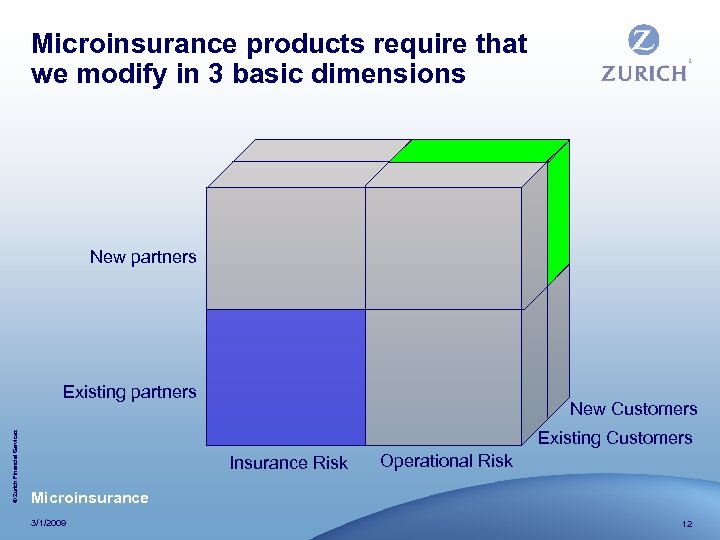

Microinsurance products require that we modify in 3 basic dimensions New partners © Zurich Financial Services Existing partners New Customers Existing Customers Insurance Risk Operational Risk Microinsurance 3/1/2009 12

Agenda of core product issues Incentives Utility for customers (demand) Utility for providers (supply) Technical © Zurich Financial Services Insurance & operational risks Partners and intermediaries Customer needs and situations Microinsurance 3/1/2009 13

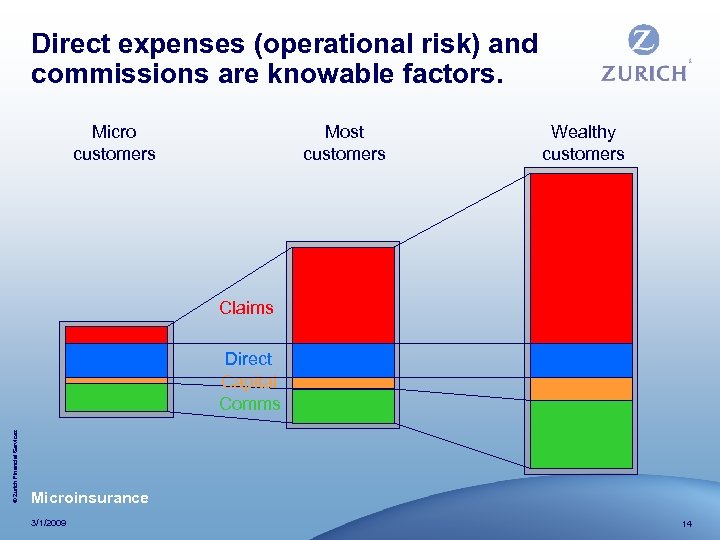

Direct expenses (operational risk) and commissions are knowable factors. Micro customers Most customers Wealthy customers Claims © Zurich Financial Services Direct Capital Comms Microinsurance 3/1/2009 14

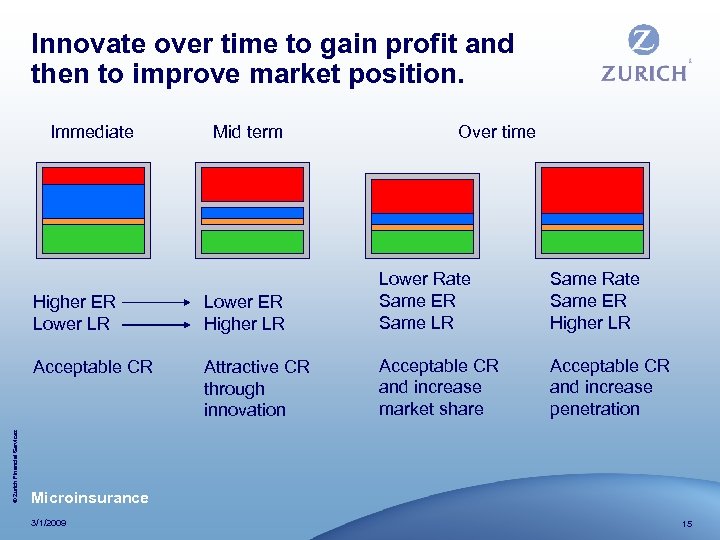

Innovate over time to gain profit and then to improve market position. Immediate Mid term Over time Lower ER Higher LR Acceptable CR © Zurich Financial Services Higher ER Lower LR Lower Rate Same ER Same LR Attractive CR through innovation Acceptable CR and increase market share Same Rate Same ER Higher LR Acceptable CR and increase penetration Microinsurance 3/1/2009 15

Product design must reduce or anticipate operational requirements. Pre-underwritten one-price-fits-all Make obvious who the product targets Female health insurance Specific item property Timing of cashflows should be priced Reducing operational risks often systemically benefits insurance risk. Cash maybe collected any time during a month More frequent cancel/rewrite possible © Zurich Financial Services In-kind claims benefits reduces moral hazard Warranty Prosthesis vs payment Microinsurance 3/1/2009 16

Control and anticipate operational risk in each step of product rollout. Start with products that require the fewest changes from present: Sell through a known intermediary type Sell products with a low operational risk © Zurich Financial Services Progress to products that require organizational adaptation. Microinsurance 3/1/2009 17

© Zurich Financial Services Do we need to reinvent the wheel? Microinsurance 3/1/2009 Credit: Q-Drum 18

Zurich programs have grown more ambitious over the years. Bolivia Credit Life -> Savings Linked -> Health -> Retail PA Bank -> Multiple channels Venezuela Credit Life -> Credit Auto Bank -> Voluntary Pick Four -> Bank / Multiple © Zurich Financial Services Brazil Personal Accident -> Unemployment -> Small property Retailers -> Utilities Microinsurance 3/1/2009 19

Zurich programs have grown more ambitious over the years. (2) China Personal Accident -> Critical Illness Agent -> Agent to group Indonesia Credit PA/Property -> Cattle Bank -> Bank © Zurich Financial Services South Africa Funeral/Property -> Credit life Agent -> Bank Microinsurance 3/1/2009 20

Sequence products realistically for value and operational achievement. Customers value products which They know about They choose to purchase That deliver when it matters Insurance companies value products which © Zurich Financial Services Limit operational risk in implementation Create innovation value for other lines/segments Deliver profit Microinsurance 3/1/2009 21

Thank you © Zurich Financial Services Brandon Mathews Zurich Financial Services brandon. mathews@zurich. com Tel: +41 (0)44 639 2000 www. zurich. com Microinsurance 3/1/2009 22

1a392dbe43e72b5c79e2479d94ebeec4.ppt