Слайды Macroeconomics.pptx

- Количество слайдов: 113

Copyright EAD - Faculté d'Economie - UPMF - 2014

Copyright EAD - Faculté d'Economie - UPMF - 2014

This document reproduces the main content of the course document (especially mathematical formula) and add explanatory diagrams, graphs and tables. . The explanatory diagrams help explain step by step reasoning. It is recommended to consult this document on your computer with the "slideshow" Microsoft Powerpoint function to take advantage of the animation (especially for the two last chapters). The numbering of each slide corresponds to the number of the chapter followed by the n° of the section and a sequential number. For this year at least, text contained in the slides have not been translated in English. I’m sorry for that and I hope you understand a little bit french! Copyright EAD - Faculté d'Economie - UPMF - 2014

This document reproduces the main content of the course document (especially mathematical formula) and add explanatory diagrams, graphs and tables. . The explanatory diagrams help explain step by step reasoning. It is recommended to consult this document on your computer with the "slideshow" Microsoft Powerpoint function to take advantage of the animation (especially for the two last chapters). The numbering of each slide corresponds to the number of the chapter followed by the n° of the section and a sequential number. For this year at least, text contained in the slides have not been translated in English. I’m sorry for that and I hope you understand a little bit french! Copyright EAD - Faculté d'Economie - UPMF - 2014

Chapter 1: Methods and Data for Macroeconomics Copyright EAD - Faculté d'Economie - UPMF - 2014

Chapter 1: Methods and Data for Macroeconomics Copyright EAD - Faculté d'Economie - UPMF - 2014

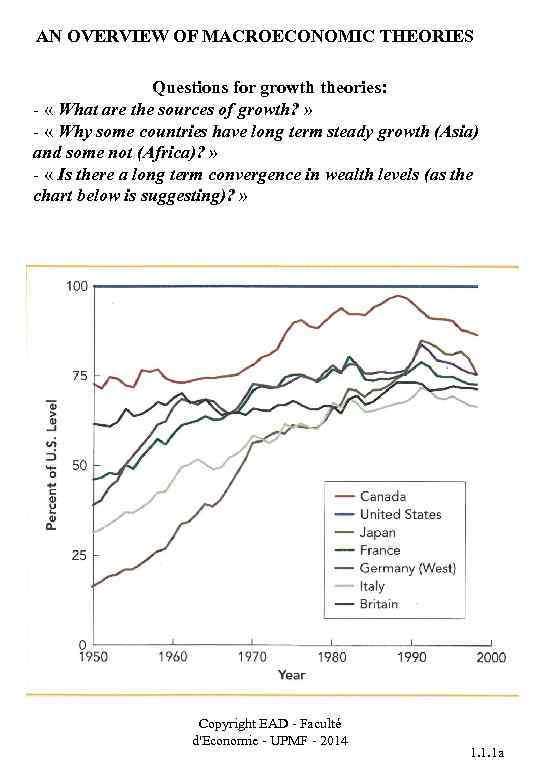

AN OVERVIEW OF MACROECONOMIC THEORIES Questions for growth theories: - « What are the sources of growth? » - « Why some countries have long term steady growth (Asia) and some not (Africa)? » - « Is there a long term convergence in wealth levels (as the chart below is suggesting)? » Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 1. 1 a

AN OVERVIEW OF MACROECONOMIC THEORIES Questions for growth theories: - « What are the sources of growth? » - « Why some countries have long term steady growth (Asia) and some not (Africa)? » - « Is there a long term convergence in wealth levels (as the chart below is suggesting)? » Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 1. 1 a

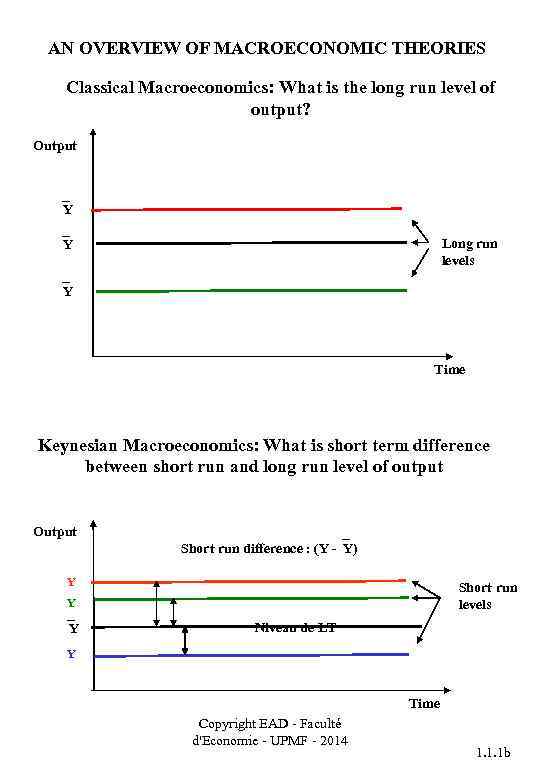

AN OVERVIEW OF MACROECONOMIC THEORIES Classical Macroeconomics: What is the long run level of output? Output Y Y Long run levels Y Time Keynesian Macroeconomics: What is short term difference between short run and long run level of output Output Short run difference : (Y - Y) Y Short run levels Y Y Niveau de LT Y Time Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 1. 1 b

AN OVERVIEW OF MACROECONOMIC THEORIES Classical Macroeconomics: What is the long run level of output? Output Y Y Long run levels Y Time Keynesian Macroeconomics: What is short term difference between short run and long run level of output Output Short run difference : (Y - Y) Y Short run levels Y Y Niveau de LT Y Time Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 1. 1 b

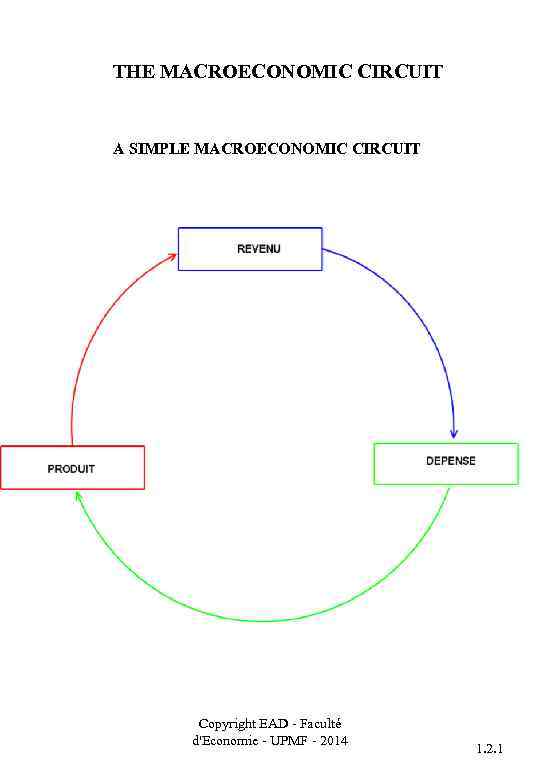

THE MACROECONOMIC CIRCUIT A SIMPLE MACROECONOMIC CIRCUIT Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 1

THE MACROECONOMIC CIRCUIT A SIMPLE MACROECONOMIC CIRCUIT Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 1

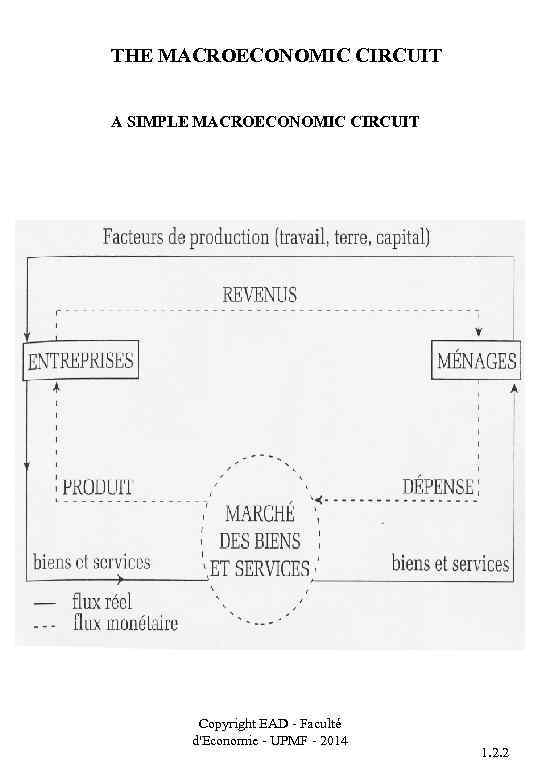

THE MACROECONOMIC CIRCUIT A SIMPLE MACROECONOMIC CIRCUIT Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 2

THE MACROECONOMIC CIRCUIT A SIMPLE MACROECONOMIC CIRCUIT Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 2

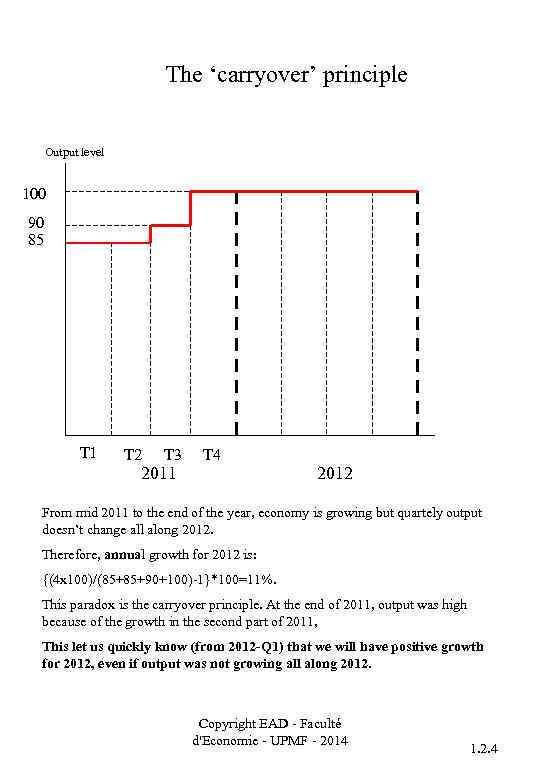

The ‘carryover’ principle Output level 100 90 85 T 1 T 2 T 3 2011 T 4 2012 From mid 2011 to the end of the year, economy is growing but quartely output doesn’t change all along 2012. Therefore, annual growth for 2012 is: {(4 x 100)/(85+85+90+100)-1}*100=11%. This paradox is the carryover principle. At the end of 2011, output was high because of the growth in the second part of 2011, This let us quickly know (from 2012 -Q 1) that we will have positive growth for 2012, even if output was not growing all along 2012. Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 4

The ‘carryover’ principle Output level 100 90 85 T 1 T 2 T 3 2011 T 4 2012 From mid 2011 to the end of the year, economy is growing but quartely output doesn’t change all along 2012. Therefore, annual growth for 2012 is: {(4 x 100)/(85+85+90+100)-1}*100=11%. This paradox is the carryover principle. At the end of 2011, output was high because of the growth in the second part of 2011, This let us quickly know (from 2012 -Q 1) that we will have positive growth for 2012, even if output was not growing all along 2012. Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 4

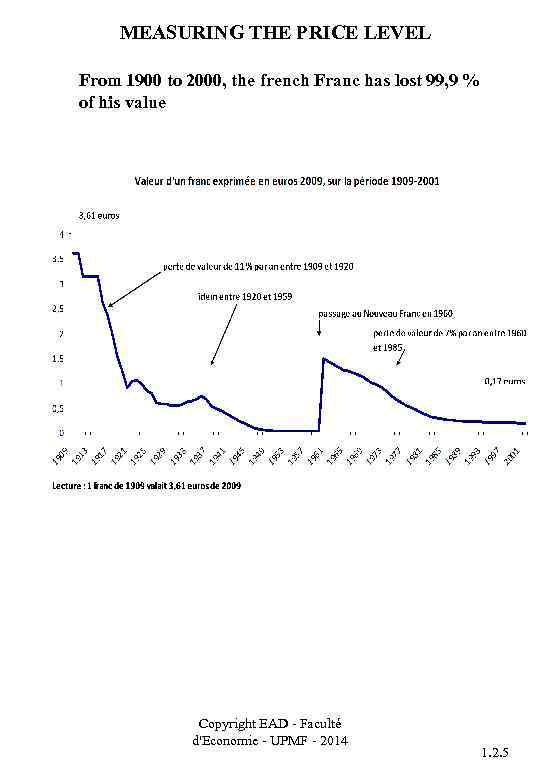

MEASURING THE PRICE LEVEL From 1900 to 2000, the french Franc has lost 99, 9 % of his value Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 5

MEASURING THE PRICE LEVEL From 1900 to 2000, the french Franc has lost 99, 9 % of his value Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 5

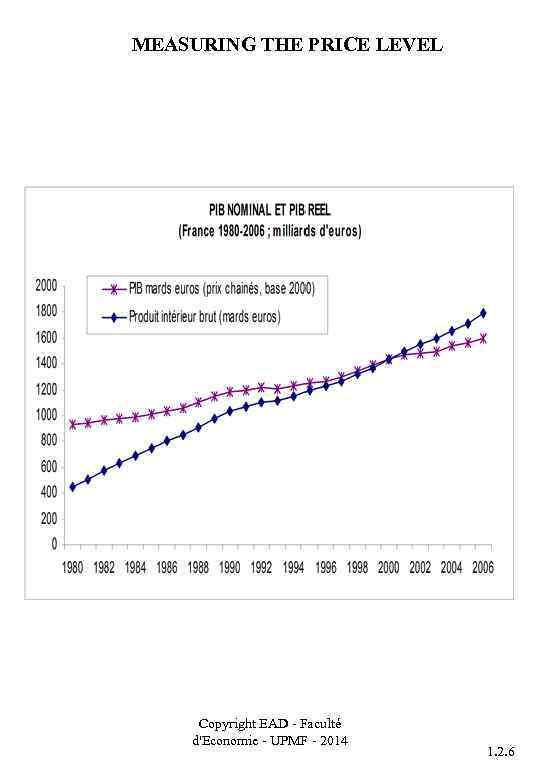

MEASURING THE PRICE LEVEL Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 6

MEASURING THE PRICE LEVEL Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 6

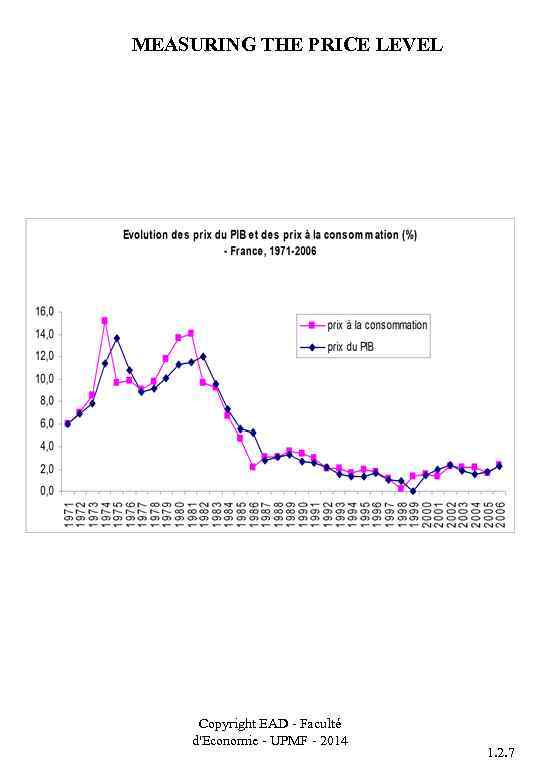

MEASURING THE PRICE LEVEL Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 7

MEASURING THE PRICE LEVEL Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 7

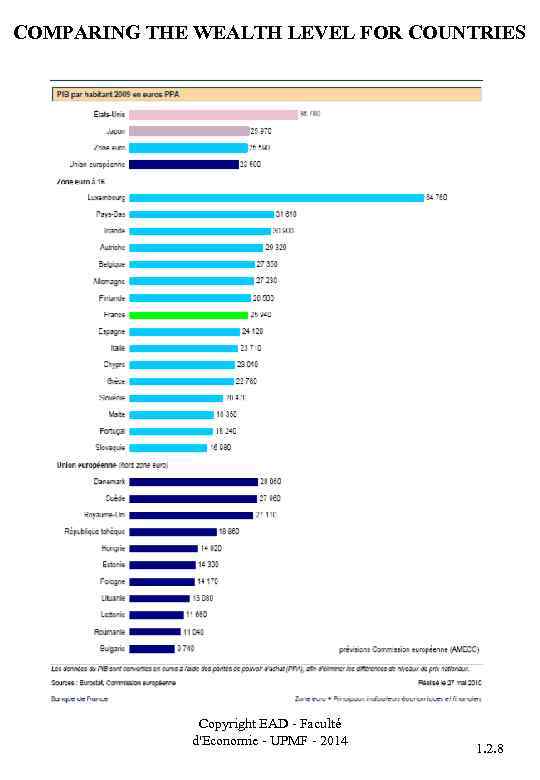

COMPARING THE WEALTH LEVEL FOR COUNTRIES Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 8

COMPARING THE WEALTH LEVEL FOR COUNTRIES Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 8

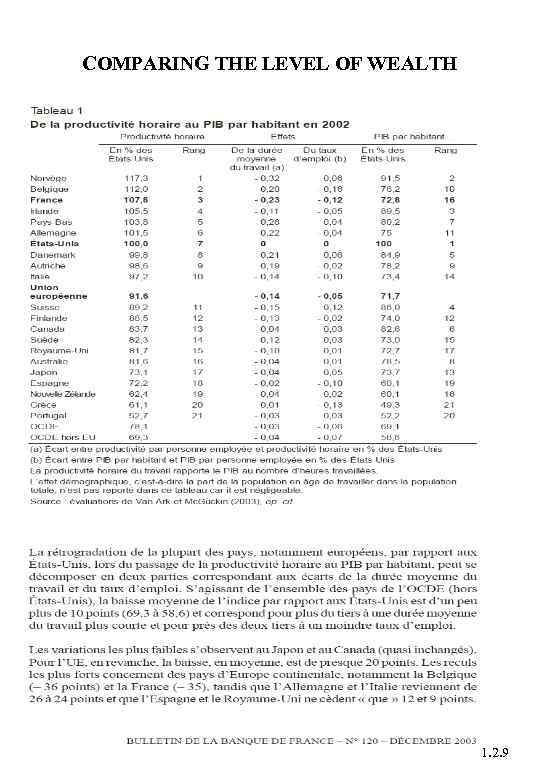

COMPARING THE LEVEL OF WEALTH Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 9

COMPARING THE LEVEL OF WEALTH Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 2. 9

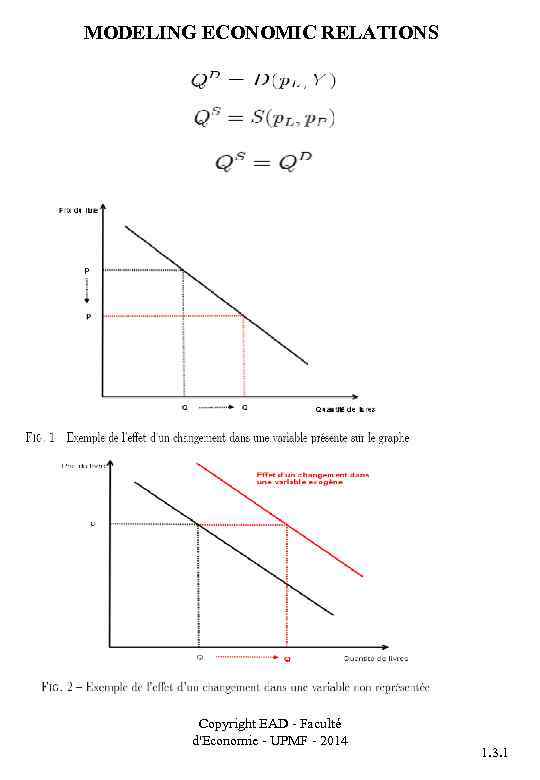

MODELING ECONOMIC RELATIONS Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 3. 1

MODELING ECONOMIC RELATIONS Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 3. 1

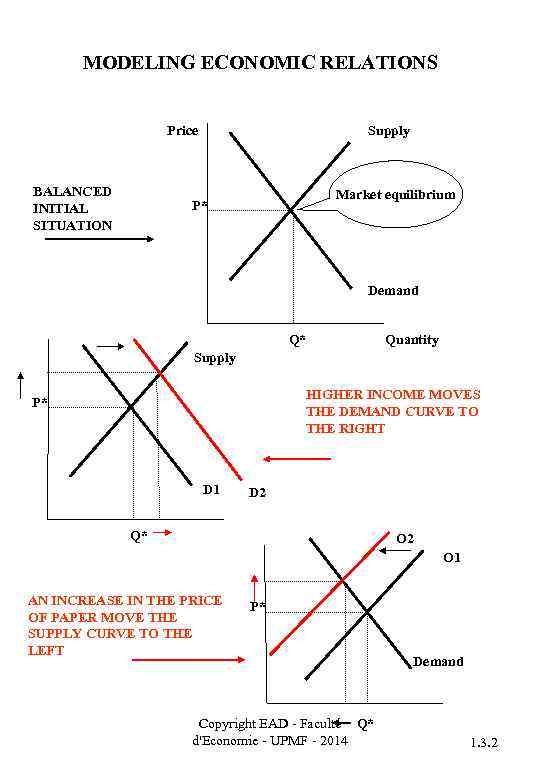

MODELING ECONOMIC RELATIONS Supply Price BALANCED INITIAL SITUATION Market equilibrium P* Demand Q* Quantity Supply HIGHER INCOME MOVES THE DEMAND CURVE TO THE RIGHT P* D 1 D 2 Q* O 2 O 1 AN INCREASE IN THE PRICE OF PAPER MOVE THE SUPPLY CURVE TO THE LEFT P* Copyright EAD - Faculté Q* d'Economie - UPMF - 2014 Demand 1. 3. 2

MODELING ECONOMIC RELATIONS Supply Price BALANCED INITIAL SITUATION Market equilibrium P* Demand Q* Quantity Supply HIGHER INCOME MOVES THE DEMAND CURVE TO THE RIGHT P* D 1 D 2 Q* O 2 O 1 AN INCREASE IN THE PRICE OF PAPER MOVE THE SUPPLY CURVE TO THE LEFT P* Copyright EAD - Faculté Q* d'Economie - UPMF - 2014 Demand 1. 3. 2

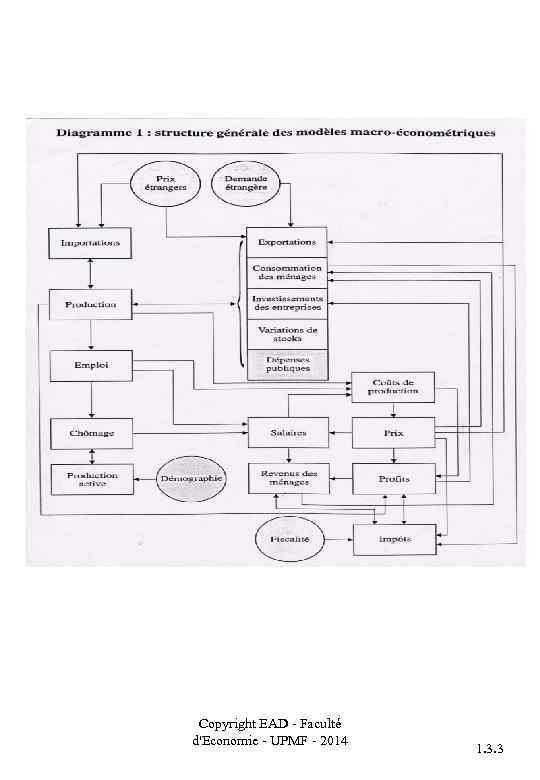

Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 3. 3

Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 3. 3

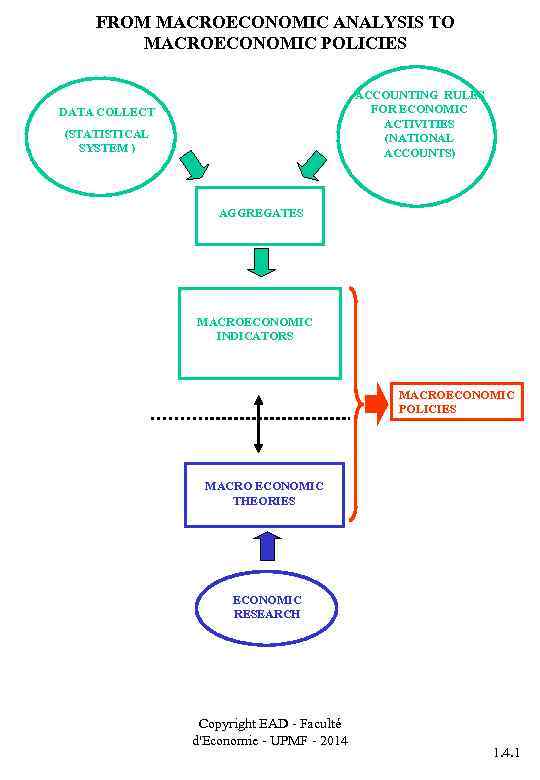

FROM MACROECONOMIC ANALYSIS TO MACROECONOMIC POLICIES ACCOUNTING RULES FOR ECONOMIC ACTIVITIES (NATIONAL ACCOUNTS) DATA COLLECT (STATISTICAL SYSTEM ) AGGREGATES MACROECONOMIC INDICATORS MACROECONOMIC POLICIES MACRO ECONOMIC THEORIES ECONOMIC RESEARCH Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 4. 1

FROM MACROECONOMIC ANALYSIS TO MACROECONOMIC POLICIES ACCOUNTING RULES FOR ECONOMIC ACTIVITIES (NATIONAL ACCOUNTS) DATA COLLECT (STATISTICAL SYSTEM ) AGGREGATES MACROECONOMIC INDICATORS MACROECONOMIC POLICIES MACRO ECONOMIC THEORIES ECONOMIC RESEARCH Copyright EAD - Faculté d'Economie - UPMF - 2014 1. 4. 1

Chapter 5: The Determination of Output, Income, Expenditure and a Real Equilibrium Model Copyright EAD - Faculté d'Economie - UPMF - 2014

Chapter 5: The Determination of Output, Income, Expenditure and a Real Equilibrium Model Copyright EAD - Faculté d'Economie - UPMF - 2014

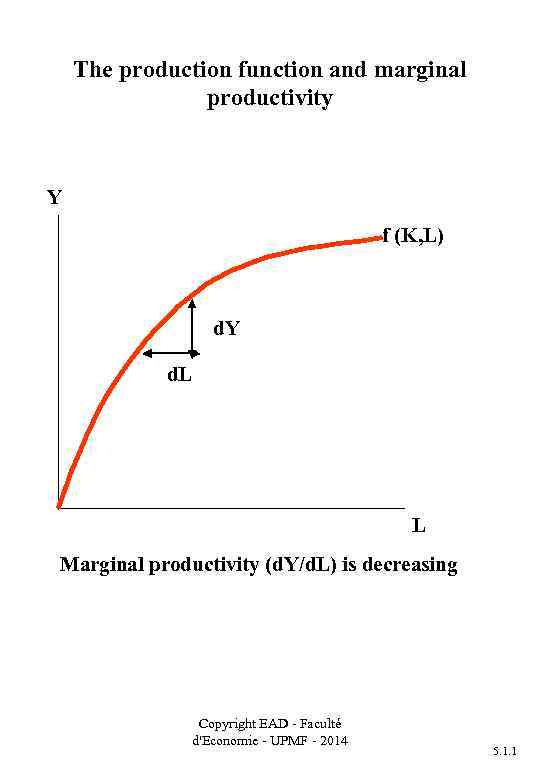

The production function and marginal productivity Y f (K, L) d. Y d. L L Marginal productivity (d. Y/d. L) is decreasing Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 1. 1

The production function and marginal productivity Y f (K, L) d. Y d. L L Marginal productivity (d. Y/d. L) is decreasing Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 1. 1

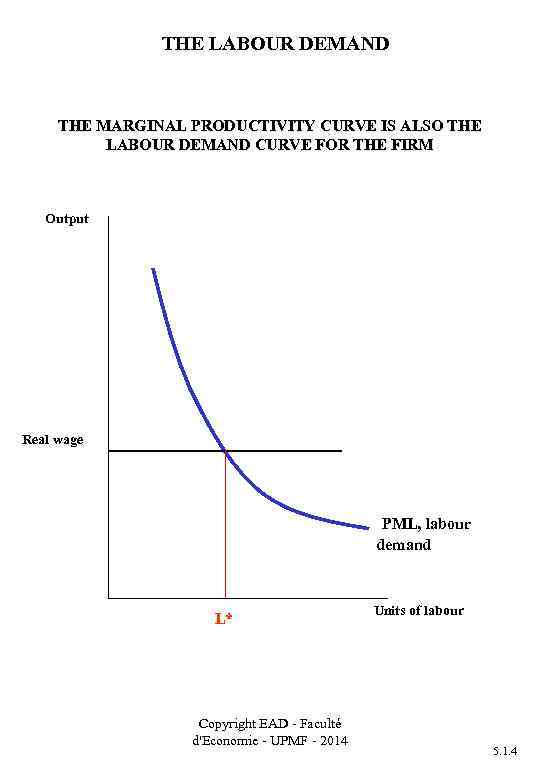

THE LABOUR DEMAND THE MARGINAL PRODUCTIVITY CURVE IS ALSO THE LABOUR DEMAND CURVE FOR THE FIRM Output Real wage PML, labour demand L* Copyright EAD - Faculté d'Economie - UPMF - 2014 Units of labour 5. 1. 4

THE LABOUR DEMAND THE MARGINAL PRODUCTIVITY CURVE IS ALSO THE LABOUR DEMAND CURVE FOR THE FIRM Output Real wage PML, labour demand L* Copyright EAD - Faculté d'Economie - UPMF - 2014 Units of labour 5. 1. 4

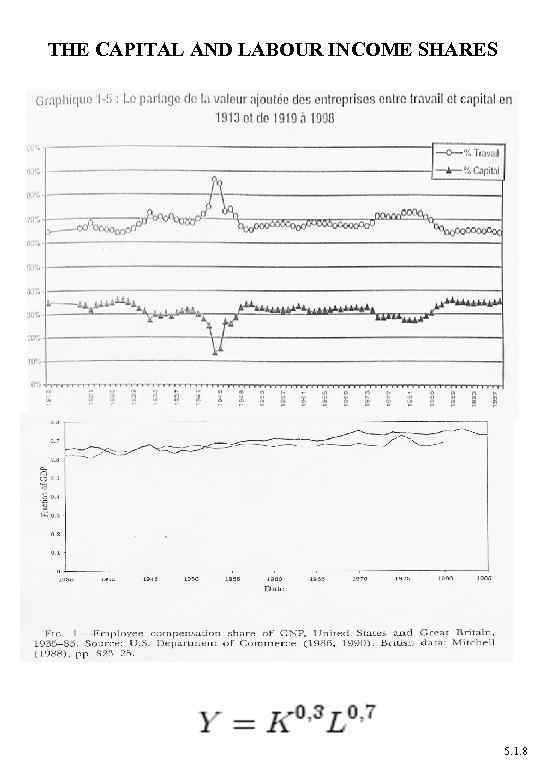

THE CAPITAL AND LABOUR INCOME SHARES Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 1. 8

THE CAPITAL AND LABOUR INCOME SHARES Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 1. 8

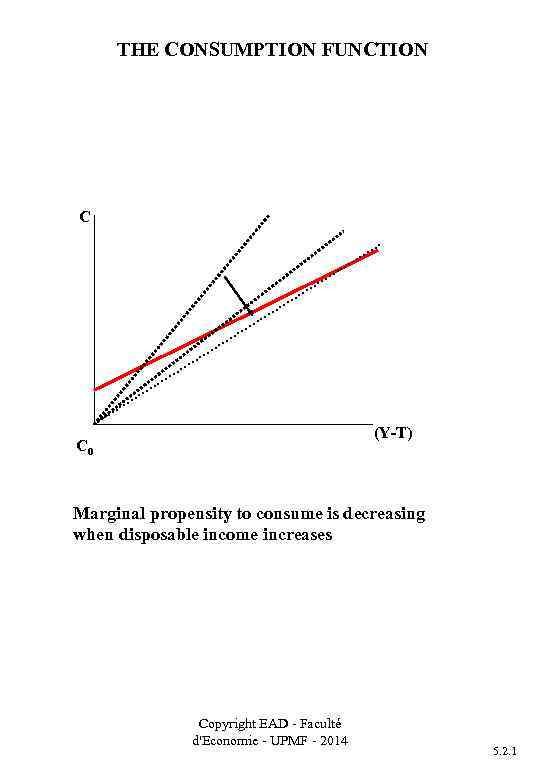

THE CONSUMPTION FUNCTION C (Y-T) C 0 Marginal propensity to consume is decreasing when disposable income increases Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 1

THE CONSUMPTION FUNCTION C (Y-T) C 0 Marginal propensity to consume is decreasing when disposable income increases Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 1

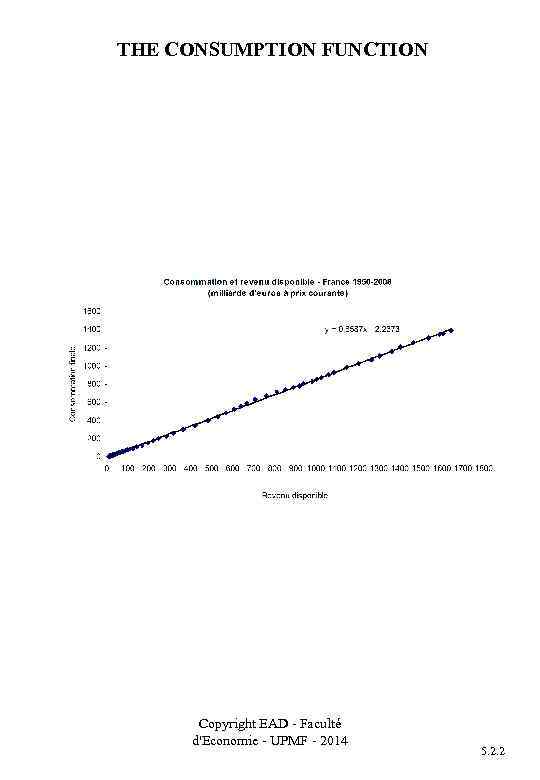

THE CONSUMPTION FUNCTION Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 2

THE CONSUMPTION FUNCTION Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 2

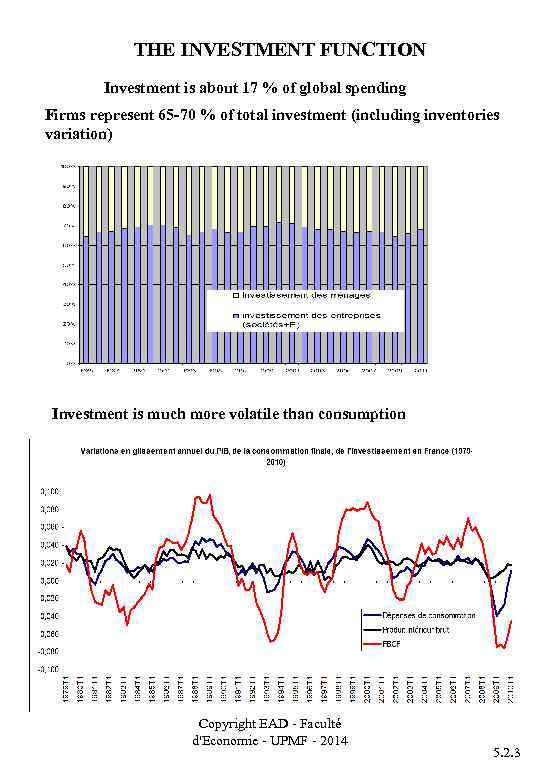

THE INVESTMENT FUNCTION Investment is about 17 % of global spending Firms represent 65 -70 % of total investment (including inventories variation) Investment is much more volatile than consumption Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 3

THE INVESTMENT FUNCTION Investment is about 17 % of global spending Firms represent 65 -70 % of total investment (including inventories variation) Investment is much more volatile than consumption Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 3

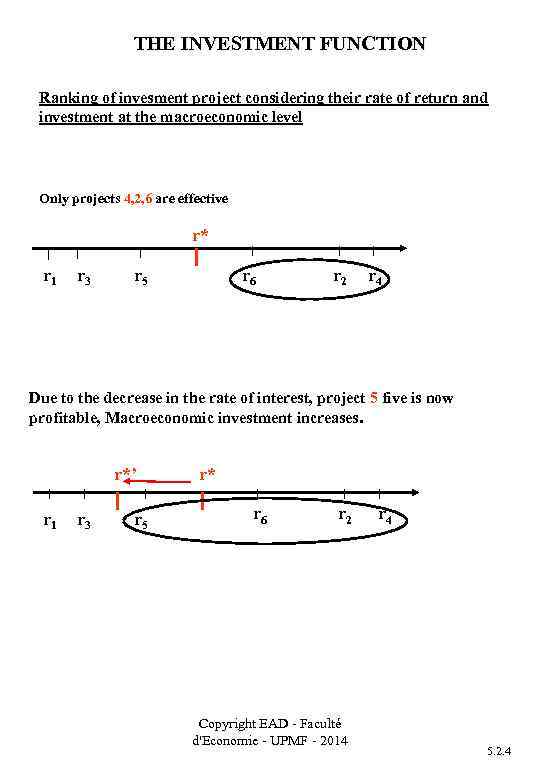

THE INVESTMENT FUNCTION Ranking of invesment project considering their rate of return and investment at the macroeconomic level Only projects 4, 2, 6 are effective r* r 1 r 3 r 5 r 6 r 2 r 4 Due to the decrease in the rate of interest, project 5 five is now profitable, Macroeconomic investment increases. r*’ r 1 r 3 r 5 r* r 6 r 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 r 4 5. 2. 4

THE INVESTMENT FUNCTION Ranking of invesment project considering their rate of return and investment at the macroeconomic level Only projects 4, 2, 6 are effective r* r 1 r 3 r 5 r 6 r 2 r 4 Due to the decrease in the rate of interest, project 5 five is now profitable, Macroeconomic investment increases. r*’ r 1 r 3 r 5 r* r 6 r 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 r 4 5. 2. 4

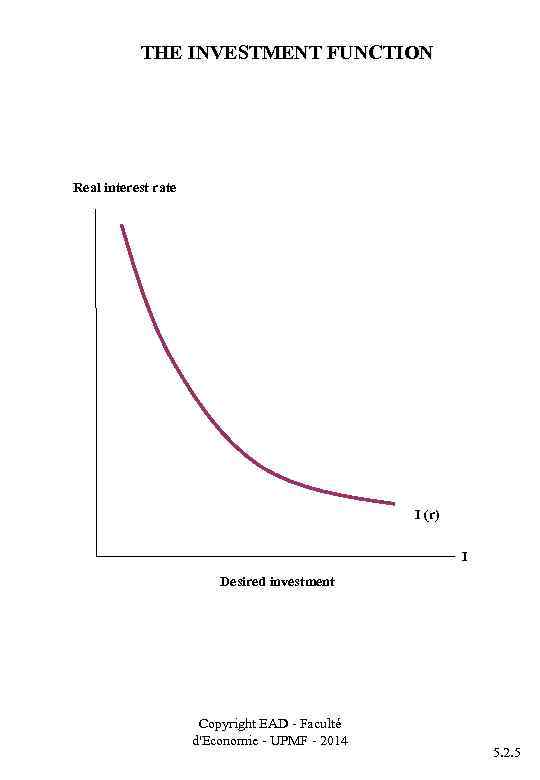

THE INVESTMENT FUNCTION Real interest rate I (r) I Desired investment Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 5

THE INVESTMENT FUNCTION Real interest rate I (r) I Desired investment Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 5

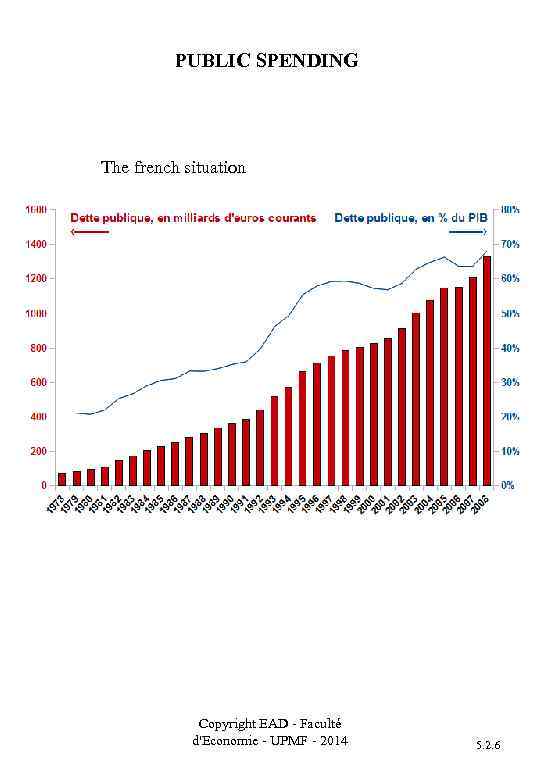

PUBLIC SPENDING The french situation Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 6

PUBLIC SPENDING The french situation Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 2. 6

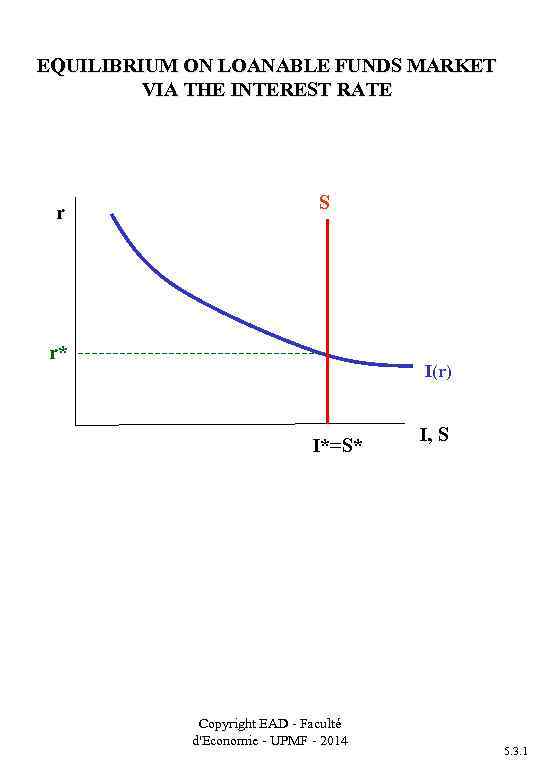

EQUILIBRIUM ON LOANABLE FUNDS MARKET VIA THE INTEREST RATE r S r* I(r) I*=S* Copyright EAD - Faculté d'Economie - UPMF - 2014 I, S 5. 3. 1

EQUILIBRIUM ON LOANABLE FUNDS MARKET VIA THE INTEREST RATE r S r* I(r) I*=S* Copyright EAD - Faculté d'Economie - UPMF - 2014 I, S 5. 3. 1

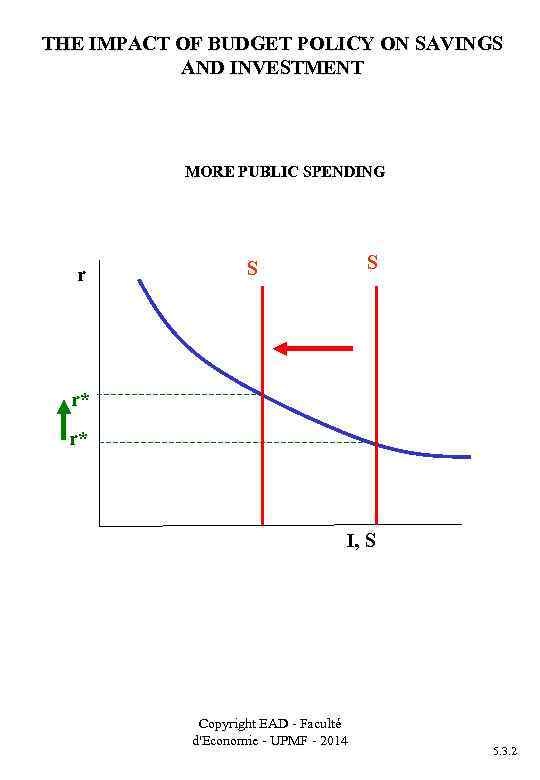

THE IMPACT OF BUDGET POLICY ON SAVINGS AND INVESTMENT MORE PUBLIC SPENDING r S S r* r* I, S Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 3. 2

THE IMPACT OF BUDGET POLICY ON SAVINGS AND INVESTMENT MORE PUBLIC SPENDING r S S r* r* I, S Copyright EAD - Faculté d'Economie - UPMF - 2014 5. 3. 2

Chapter 6: Money, Inflation and the Rate of Interest Copyright EAD - Faculté d'Economie - UPMF - 2014

Chapter 6: Money, Inflation and the Rate of Interest Copyright EAD - Faculté d'Economie - UPMF - 2014

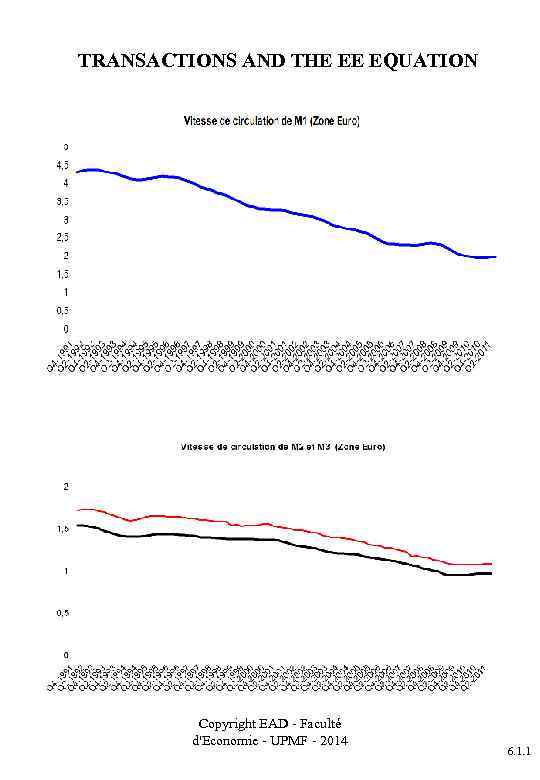

TRANSACTIONS AND THE EE EQUATION Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 1. 1

TRANSACTIONS AND THE EE EQUATION Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 1. 1

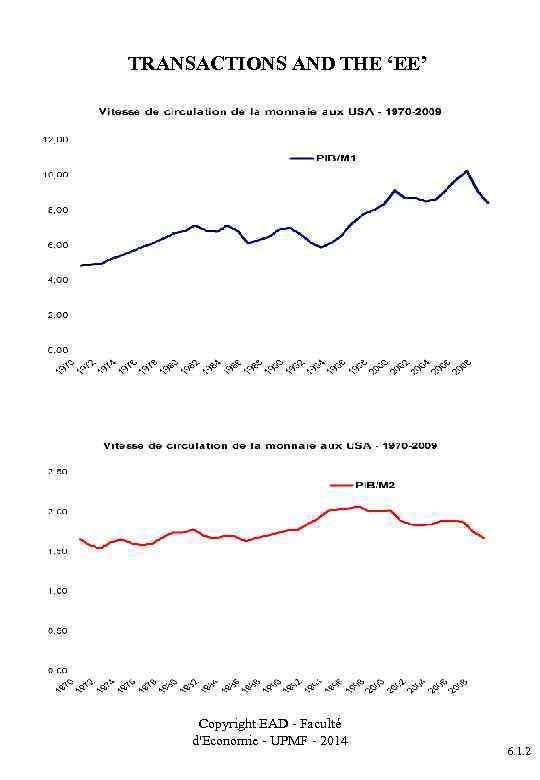

TRANSACTIONS AND THE ‘EE’ Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 1. 2

TRANSACTIONS AND THE ‘EE’ Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 1. 2

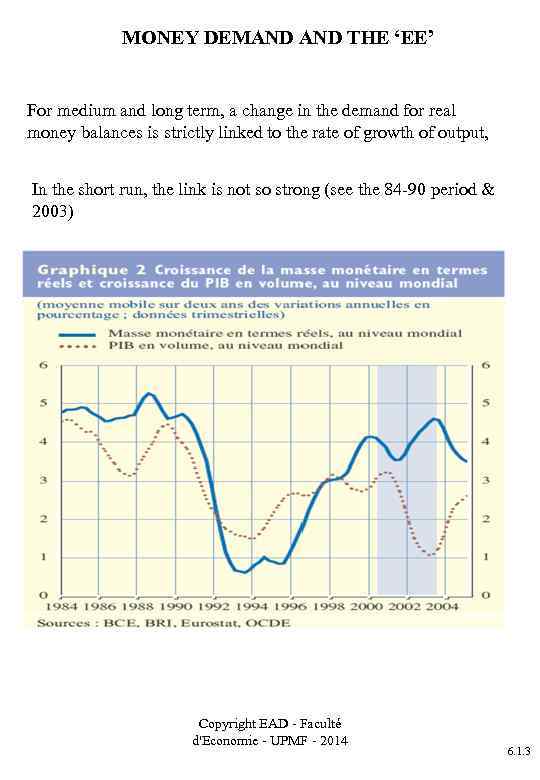

MONEY DEMAND THE ‘EE’ For medium and long term, a change in the demand for real money balances is strictly linked to the rate of growth of output, In the short run, the link is not so strong (see the 84 -90 period & 2003) Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 1. 3

MONEY DEMAND THE ‘EE’ For medium and long term, a change in the demand for real money balances is strictly linked to the rate of growth of output, In the short run, the link is not so strong (see the 84 -90 period & 2003) Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 1. 3

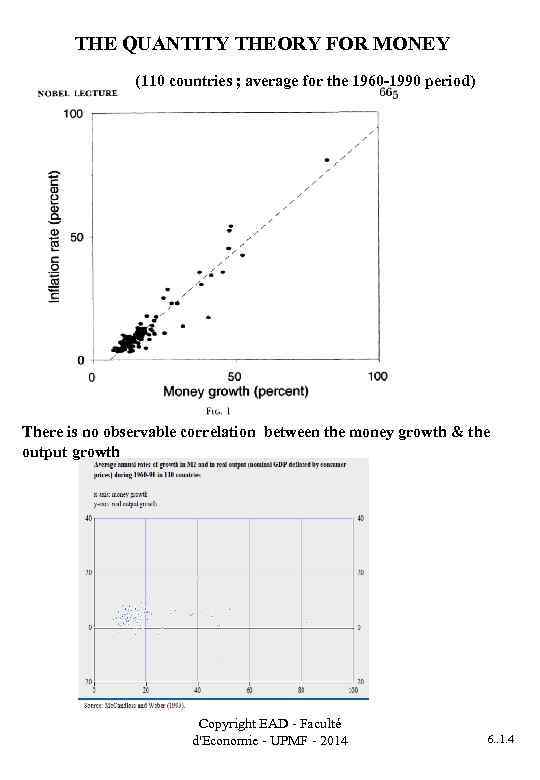

THE QUANTITY THEORY FOR MONEY (110 countries ; average for the 1960 -1990 period) There is no observable correlation between the money growth & the output growth Copyright EAD - Faculté d'Economie - UPMF - 2014 6. . 1. 4

THE QUANTITY THEORY FOR MONEY (110 countries ; average for the 1960 -1990 period) There is no observable correlation between the money growth & the output growth Copyright EAD - Faculté d'Economie - UPMF - 2014 6. . 1. 4

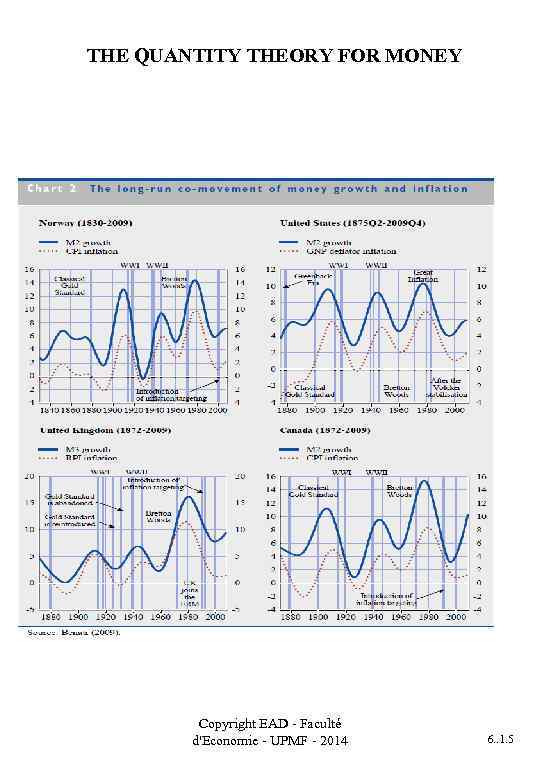

THE QUANTITY THEORY FOR MONEY Copyright EAD - Faculté d'Economie - UPMF - 2014 6. . 1. 5

THE QUANTITY THEORY FOR MONEY Copyright EAD - Faculté d'Economie - UPMF - 2014 6. . 1. 5

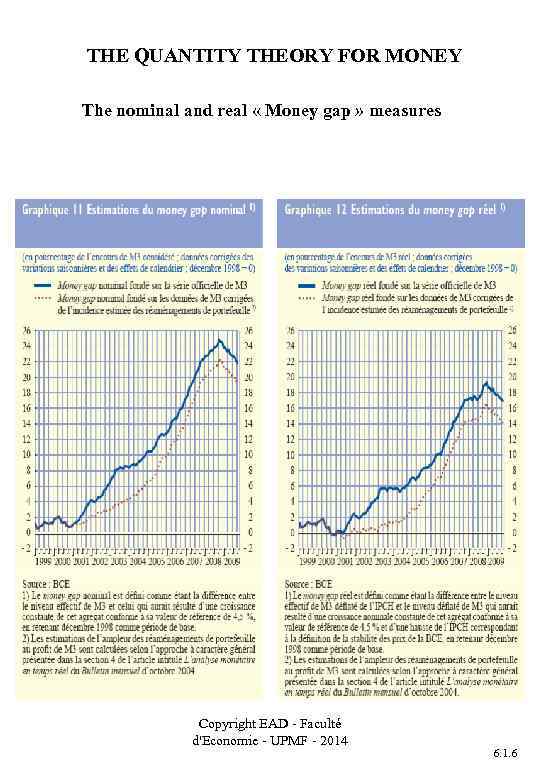

THE QUANTITY THEORY FOR MONEY The nominal and real « Money gap » measures Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 1. 6

THE QUANTITY THEORY FOR MONEY The nominal and real « Money gap » measures Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 1. 6

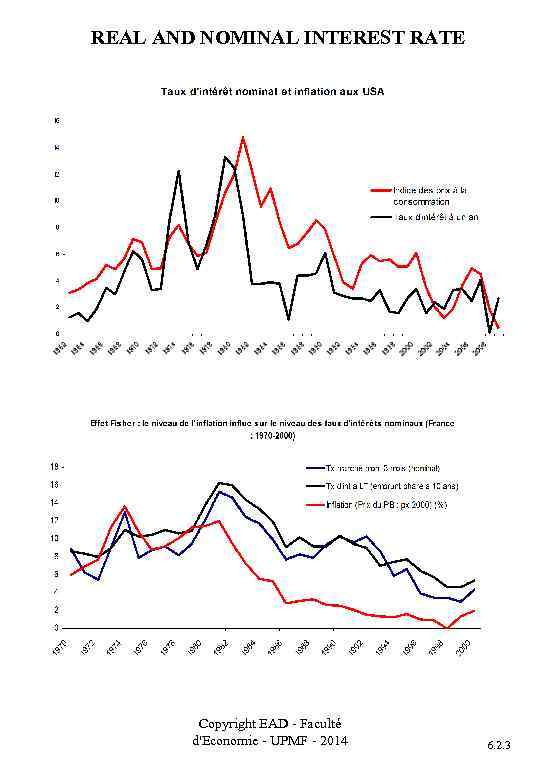

REAL AND NOMINAL INTEREST RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 2. 3

REAL AND NOMINAL INTEREST RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 2. 3

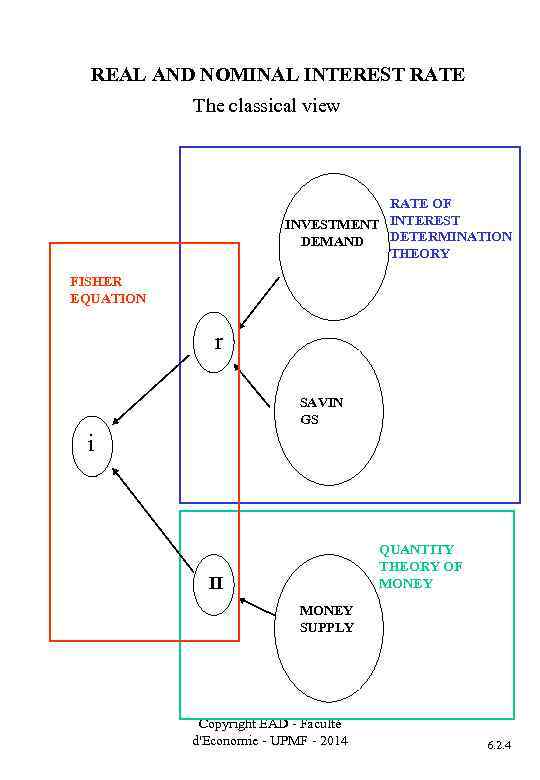

REAL AND NOMINAL INTEREST RATE The classical view RATE OF INVESTMENT INTEREST DETERMINATION DEMAND THEORY FISHER EQUATION r SAVIN GS i QUANTITY THEORY OF MONEY П MONEY SUPPLY Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 2. 4

REAL AND NOMINAL INTEREST RATE The classical view RATE OF INVESTMENT INTEREST DETERMINATION DEMAND THEORY FISHER EQUATION r SAVIN GS i QUANTITY THEORY OF MONEY П MONEY SUPPLY Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 2. 4

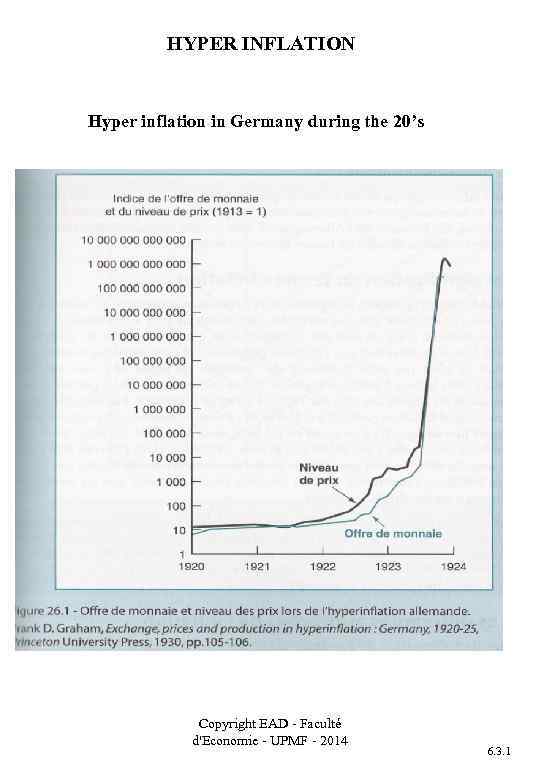

HYPER INFLATION Hyper inflation in Germany during the 20’s Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 3. 1

HYPER INFLATION Hyper inflation in Germany during the 20’s Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 3. 1

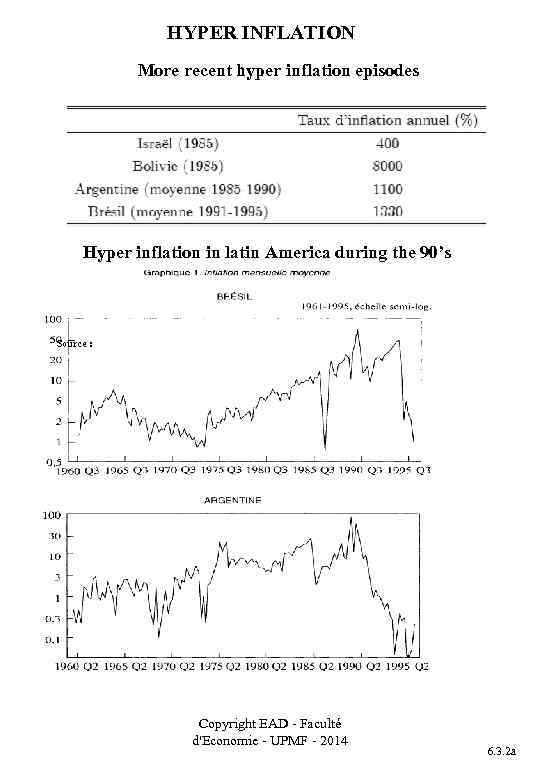

HYPER INFLATION More recent hyper inflation episodes Hyper inflation in latin America during the 90’s Source : Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 3. 2 a

HYPER INFLATION More recent hyper inflation episodes Hyper inflation in latin America during the 90’s Source : Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 3. 2 a

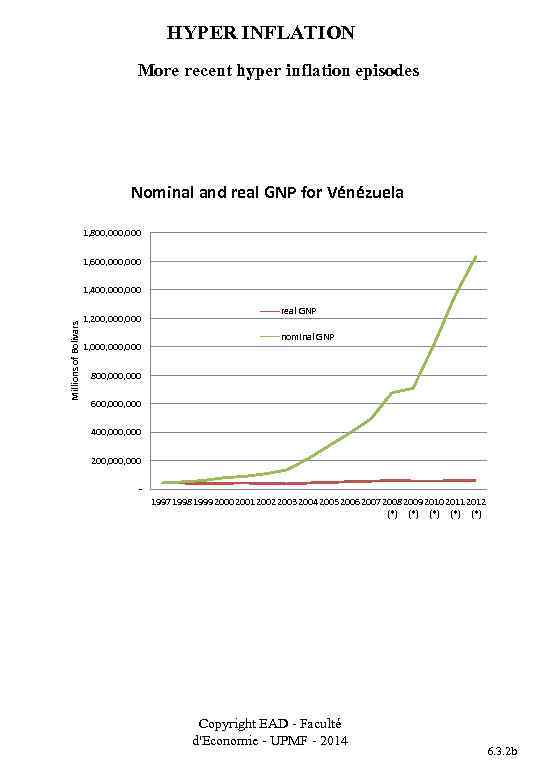

HYPER INFLATION More recent hyper inflation episodes Nominal and real GNP for Vénézuela 1, 800, 000 1, 600, 000 Millions of Bolivars 1, 400, 000 1, 200, 000 1, 000, 000 real GNP nominal GNP 800, 000 600, 000 400, 000 200, 000 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 (*) (*) (*) Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 3. 2 b

HYPER INFLATION More recent hyper inflation episodes Nominal and real GNP for Vénézuela 1, 800, 000 1, 600, 000 Millions of Bolivars 1, 400, 000 1, 200, 000 1, 000, 000 real GNP nominal GNP 800, 000 600, 000 400, 000 200, 000 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 (*) (*) (*) Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 3. 2 b

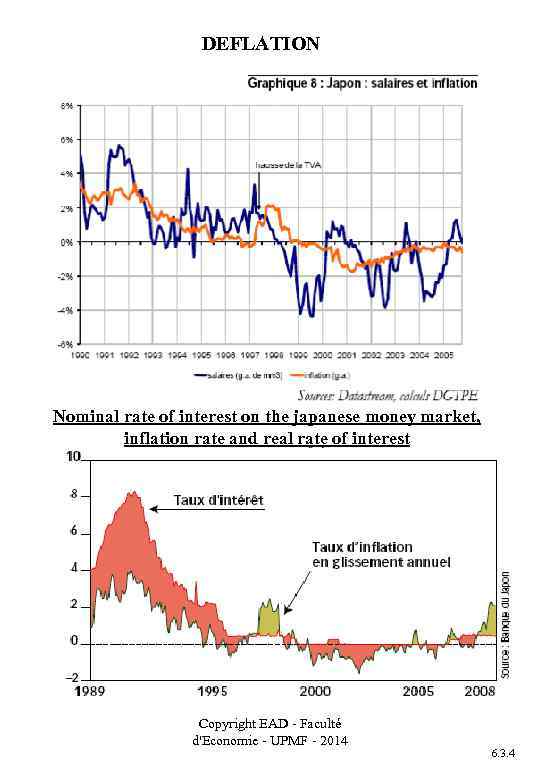

DEFLATION Nominal rate of interest on the japanese money market, inflation rate and real rate of interest Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 3. 4

DEFLATION Nominal rate of interest on the japanese money market, inflation rate and real rate of interest Copyright EAD - Faculté d'Economie - UPMF - 2014 6. 3. 4

Chapter 7: Labour Market, Employment and Unemployment Copyright EAD - Faculté d'Economie - UPMF - 2014

Chapter 7: Labour Market, Employment and Unemployment Copyright EAD - Faculté d'Economie - UPMF - 2014

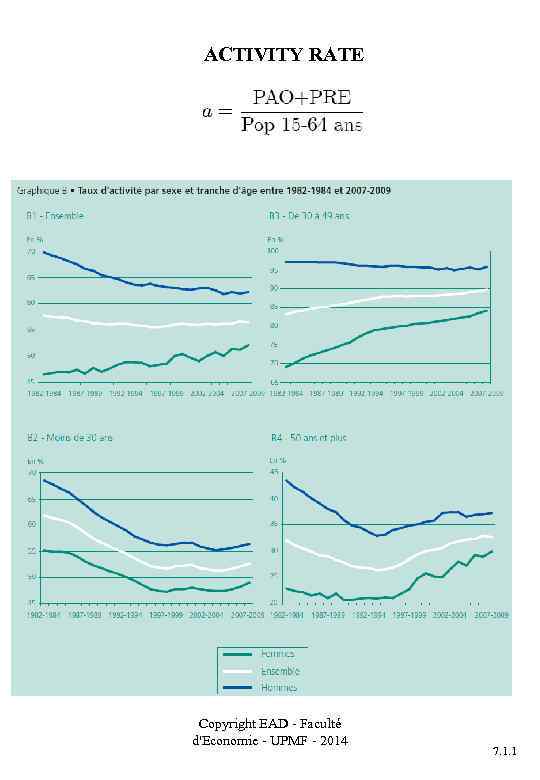

ACTIVITY RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 1

ACTIVITY RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 1

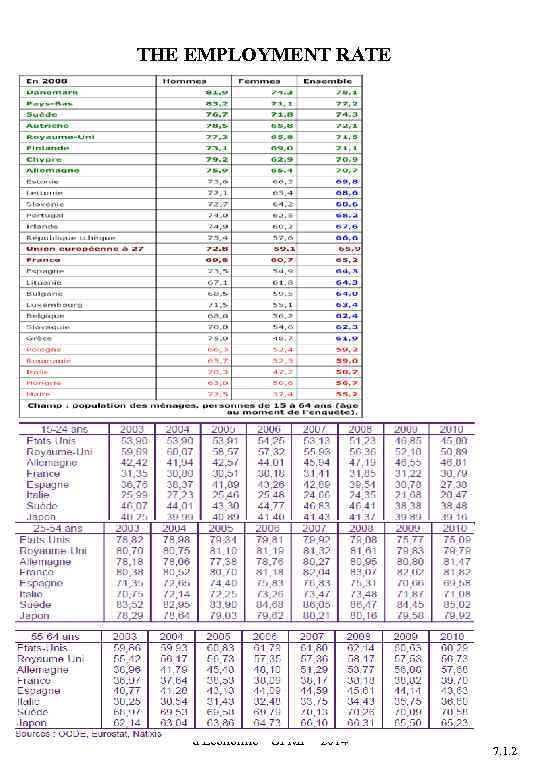

THE EMPLOYMENT RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 2

THE EMPLOYMENT RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 2

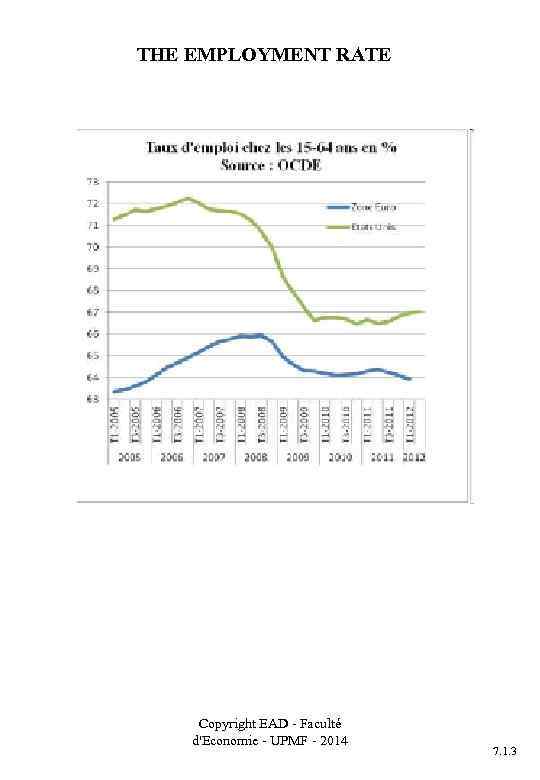

THE EMPLOYMENT RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 3

THE EMPLOYMENT RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 3

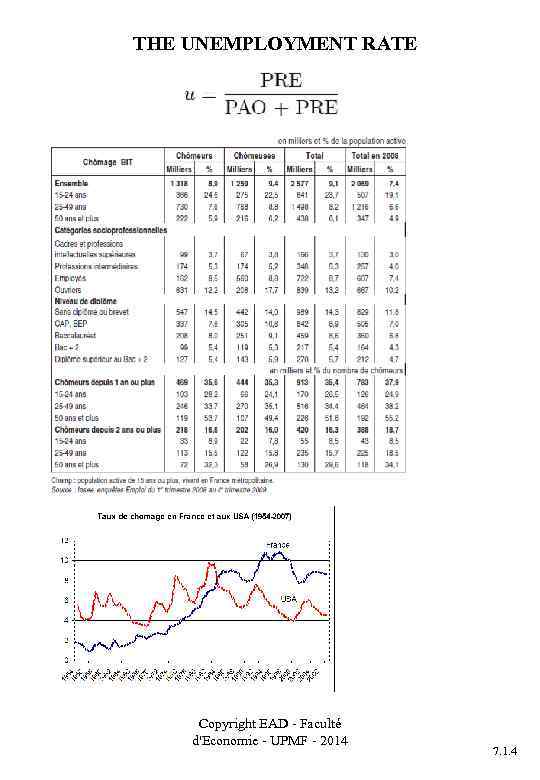

THE UNEMPLOYMENT RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 4

THE UNEMPLOYMENT RATE Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 4

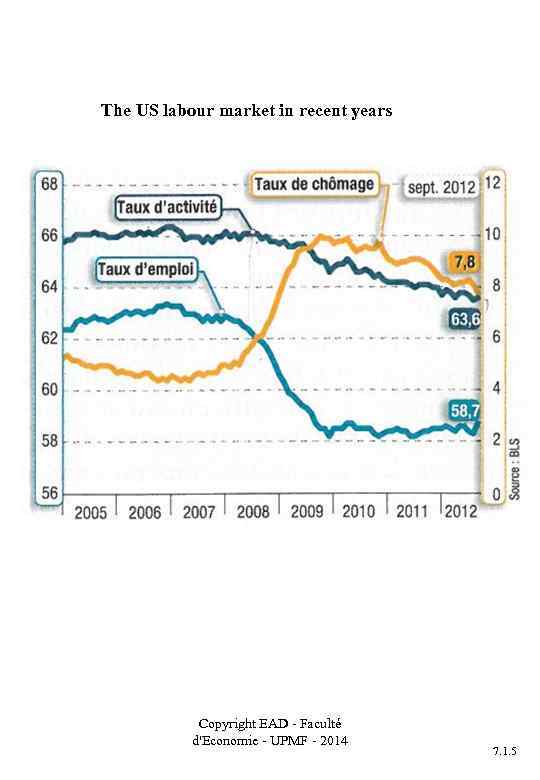

The US labour market in recent years Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 5

The US labour market in recent years Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 5

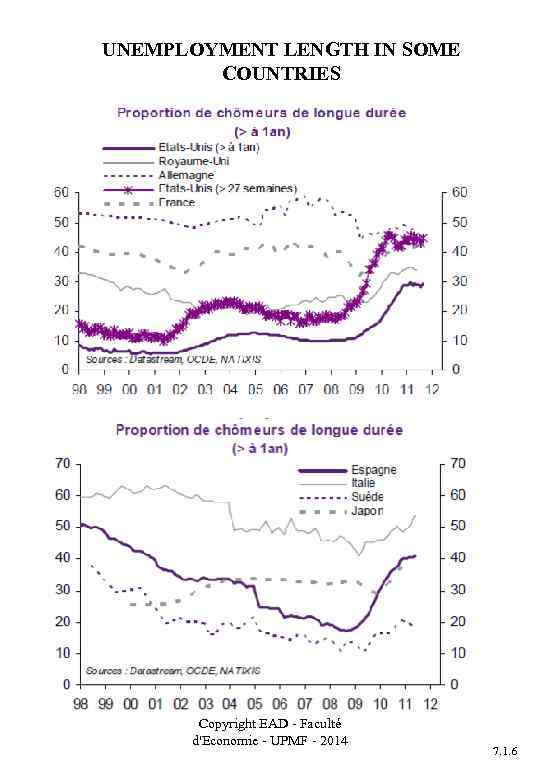

UNEMPLOYMENT LENGTH IN SOME COUNTRIES Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 6

UNEMPLOYMENT LENGTH IN SOME COUNTRIES Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 1. 6

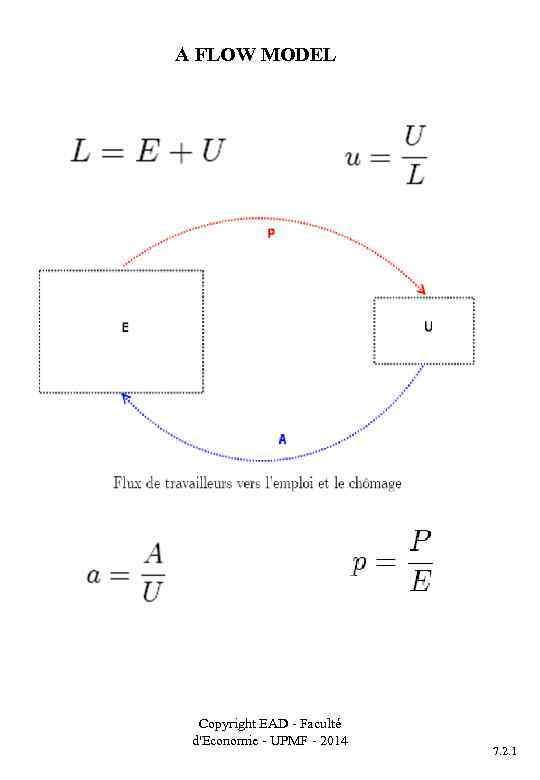

A FLOW MODEL Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 2. 1

A FLOW MODEL Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 2. 1

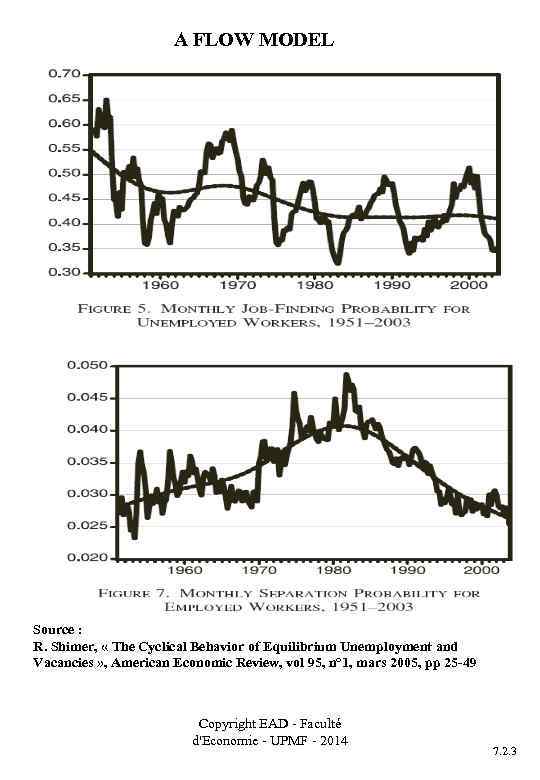

A FLOW MODEL Source : R. Shimer, « The Cyclical Behavior of Equilibrium Unemployment and Vacancies » , American Economic Review, vol 95, n° 1, mars 2005, pp 25 -49 Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 2. 3

A FLOW MODEL Source : R. Shimer, « The Cyclical Behavior of Equilibrium Unemployment and Vacancies » , American Economic Review, vol 95, n° 1, mars 2005, pp 25 -49 Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 2. 3

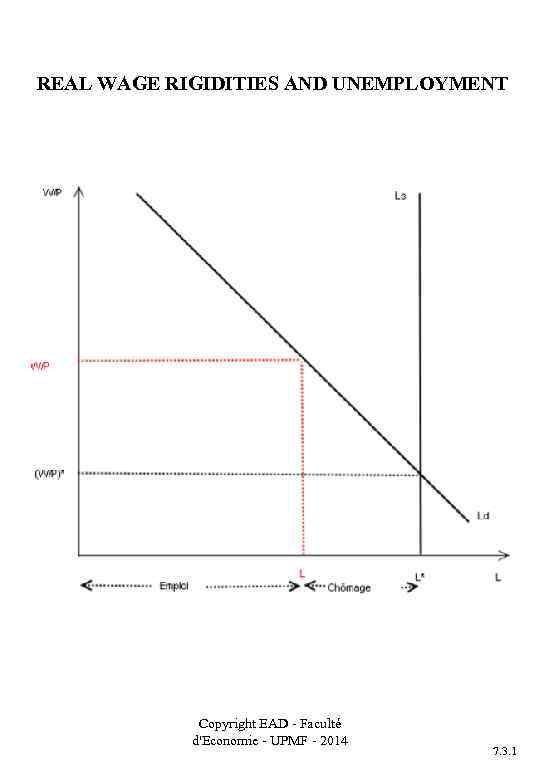

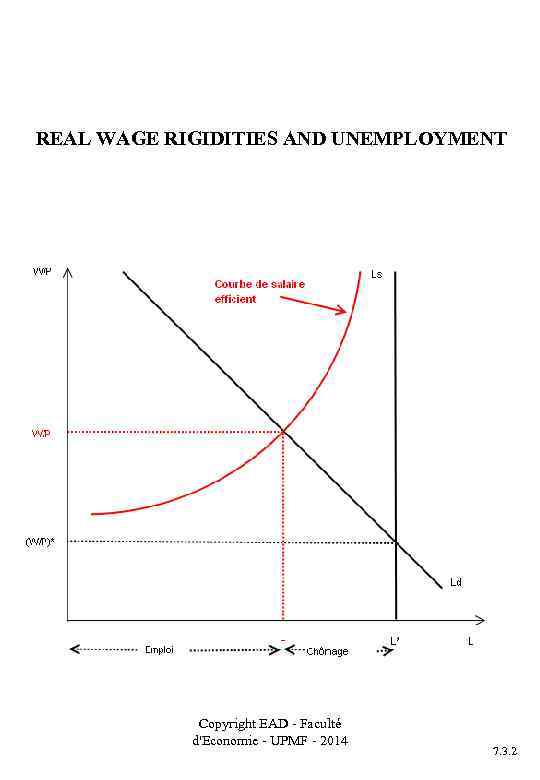

REAL WAGE RIGIDITIES AND UNEMPLOYMENT Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 3. 1

REAL WAGE RIGIDITIES AND UNEMPLOYMENT Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 3. 1

REAL WAGE RIGIDITIES AND UNEMPLOYMENT Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 3. 2

REAL WAGE RIGIDITIES AND UNEMPLOYMENT Copyright EAD - Faculté d'Economie - UPMF - 2014 7. 3. 2

Chapter 8: Business Fluctuations Copyright EAD - Faculté d'Economie - UPMF - 2014

Chapter 8: Business Fluctuations Copyright EAD - Faculté d'Economie - UPMF - 2014

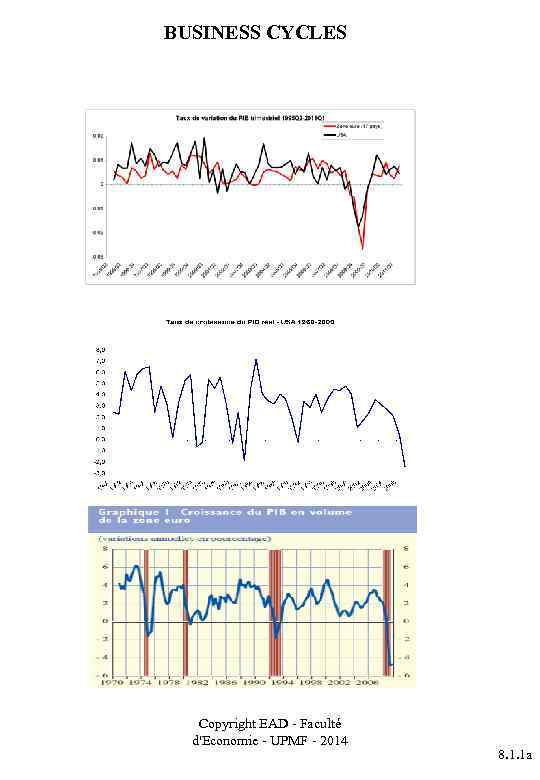

BUSINESS CYCLES Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 1. 1 a

BUSINESS CYCLES Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 1. 1 a

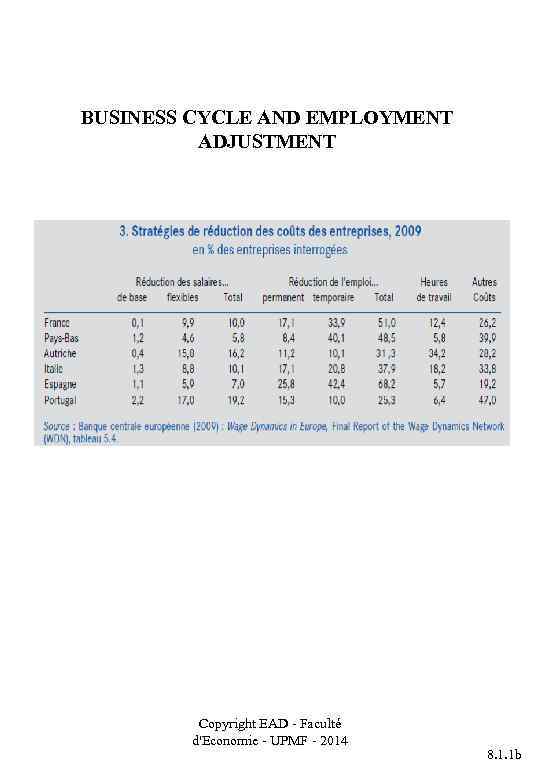

BUSINESS CYCLE AND EMPLOYMENT ADJUSTMENT Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 1. 1 b

BUSINESS CYCLE AND EMPLOYMENT ADJUSTMENT Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 1. 1 b

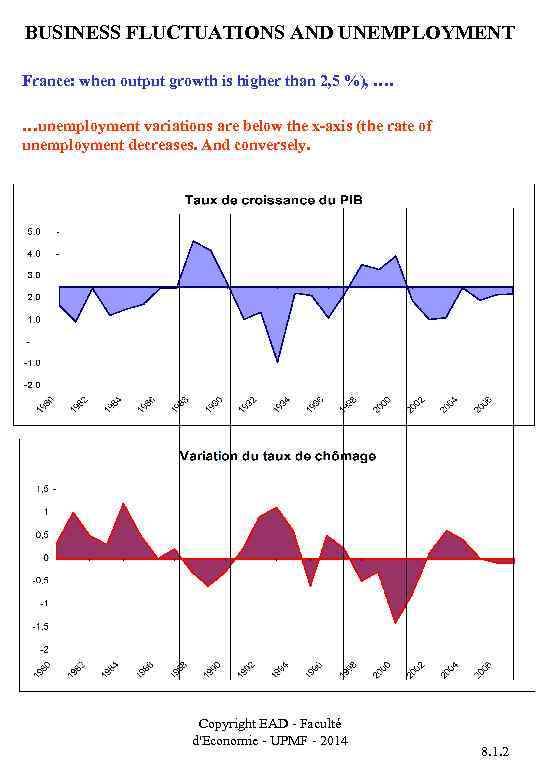

BUSINESS FLUCTUATIONS AND UNEMPLOYMENT France: when output growth is higher than 2, 5 %), …. …unemployment variations are below the x-axis (the rate of unemployment decreases. And conversely. Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 1. 2

BUSINESS FLUCTUATIONS AND UNEMPLOYMENT France: when output growth is higher than 2, 5 %), …. …unemployment variations are below the x-axis (the rate of unemployment decreases. And conversely. Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 1. 2

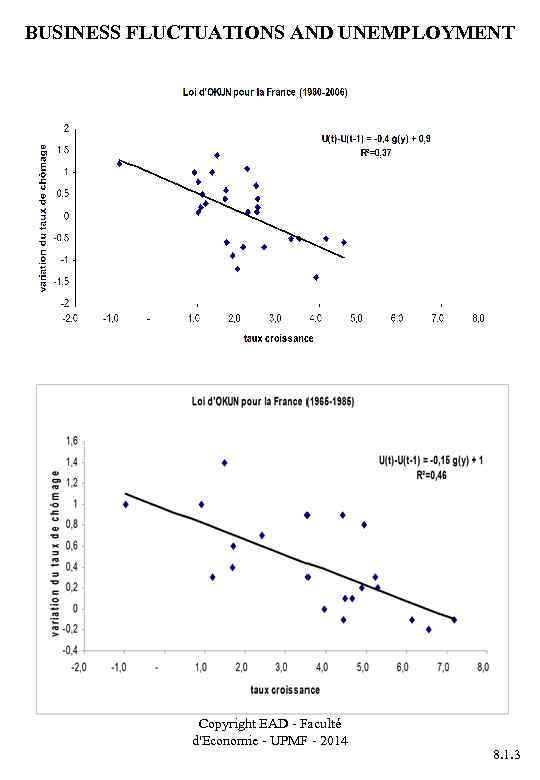

BUSINESS FLUCTUATIONS AND UNEMPLOYMENT Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 1. 3

BUSINESS FLUCTUATIONS AND UNEMPLOYMENT Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 1. 3

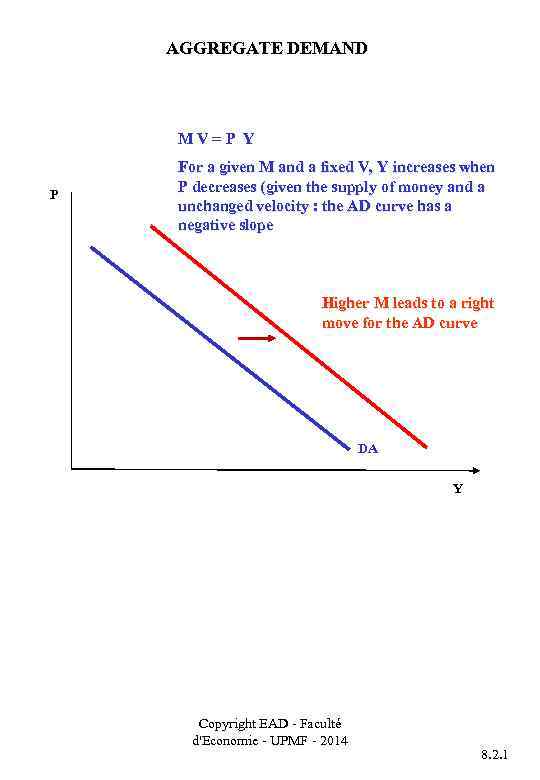

AGGREGATE DEMAND M V = P Y P For a given M and a fixed V, Y increases when P decreases (given the supply of money and a unchanged velocity : the AD curve has a negative slope Higher M leads to a right move for the AD curve DA Y Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 1

AGGREGATE DEMAND M V = P Y P For a given M and a fixed V, Y increases when P decreases (given the supply of money and a unchanged velocity : the AD curve has a negative slope Higher M leads to a right move for the AD curve DA Y Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 1

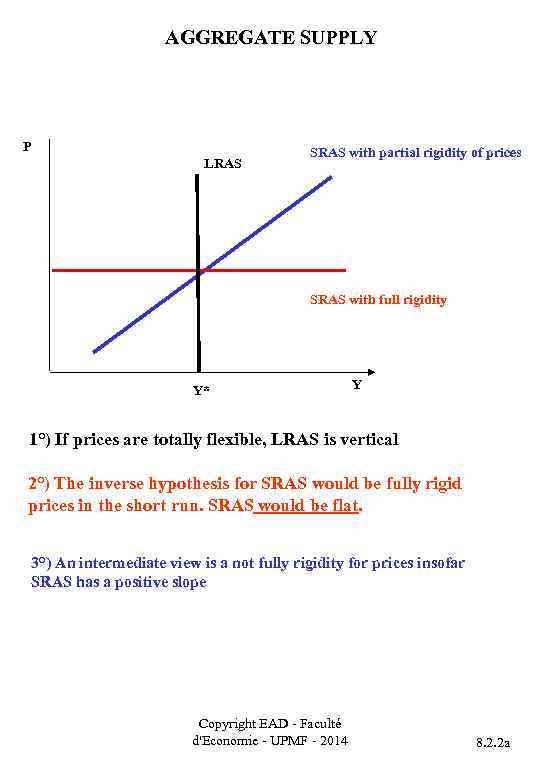

AGGREGATE SUPPLY P LRAS SRAS with partial rigidity of prices SRAS with full rigidity Y* Y 1°) If prices are totally flexible, LRAS is vertical 2°) The inverse hypothesis for SRAS would be fully rigid prices in the short run. SRAS would be flat. 3°) An intermediate view is a not fully rigidity for prices insofar SRAS has a positive slope Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 2 a

AGGREGATE SUPPLY P LRAS SRAS with partial rigidity of prices SRAS with full rigidity Y* Y 1°) If prices are totally flexible, LRAS is vertical 2°) The inverse hypothesis for SRAS would be fully rigid prices in the short run. SRAS would be flat. 3°) An intermediate view is a not fully rigidity for prices insofar SRAS has a positive slope Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 2 a

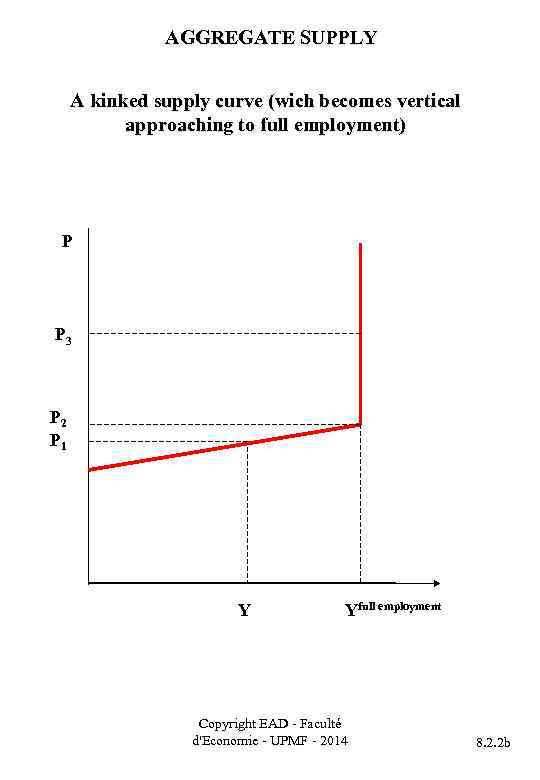

AGGREGATE SUPPLY A kinked supply curve (wich becomes vertical approaching to full employment) P P 3 P 2 P 1 Y Yfull employment Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 2 b

AGGREGATE SUPPLY A kinked supply curve (wich becomes vertical approaching to full employment) P P 3 P 2 P 1 Y Yfull employment Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 2 b

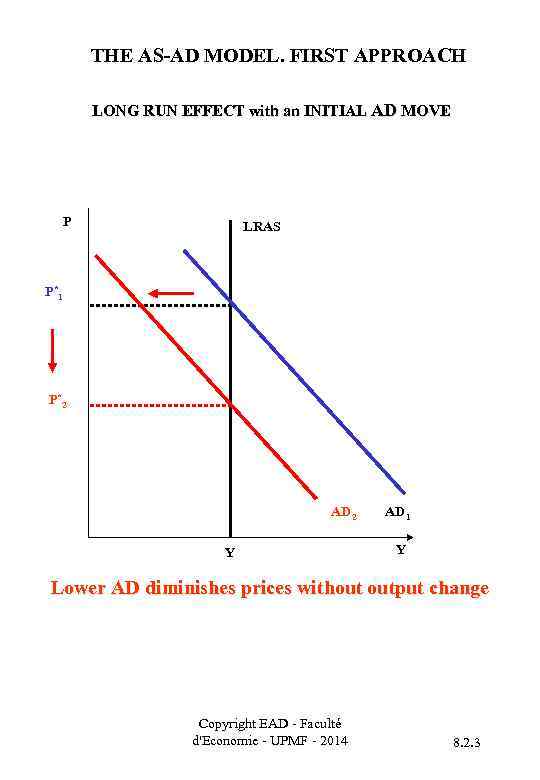

THE AS-AD MODEL. FIRST APPROACH LONG RUN EFFECT with an INITIAL AD MOVE P LRAS P *1 P *2 AD 2 Y AD 1 Y Lower AD diminishes prices without output change Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 3

THE AS-AD MODEL. FIRST APPROACH LONG RUN EFFECT with an INITIAL AD MOVE P LRAS P *1 P *2 AD 2 Y AD 1 Y Lower AD diminishes prices without output change Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 3

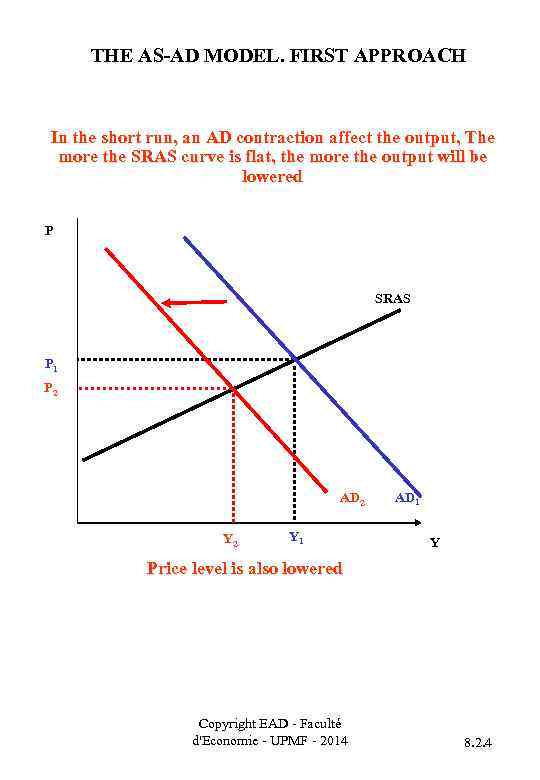

THE AS-AD MODEL. FIRST APPROACH In the short run, an AD contraction affect the output, The more the SRAS curve is flat, the more the output will be lowered P SRAS P 1 P 2 AD 2 Y 1 AD 1 Y Price level is also lowered Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 4

THE AS-AD MODEL. FIRST APPROACH In the short run, an AD contraction affect the output, The more the SRAS curve is flat, the more the output will be lowered P SRAS P 1 P 2 AD 2 Y 1 AD 1 Y Price level is also lowered Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 2. 4

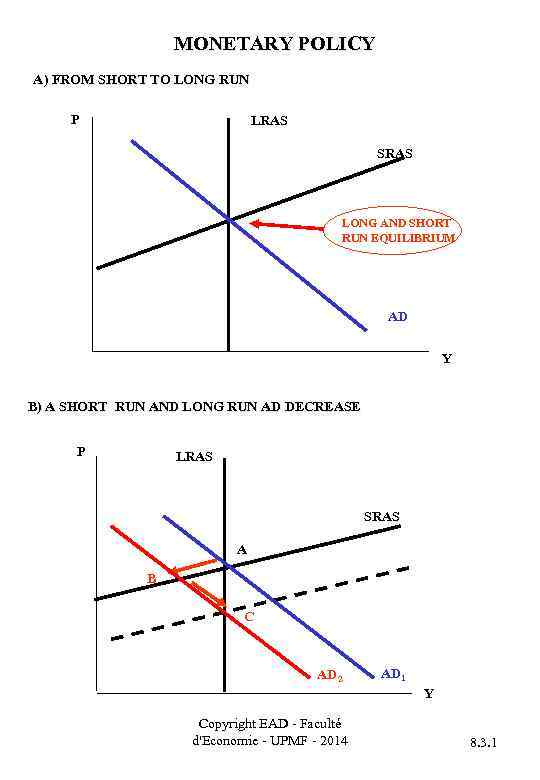

MONETARY POLICY A) FROM SHORT TO LONG RUN P LRAS SRAS LONG AND SHORT RUN EQUILIBRIUM AD Y B) A SHORT RUN AND LONG RUN AD DECREASE P LRAS SRAS A B C AD 2 AD 1 Y Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 3. 1

MONETARY POLICY A) FROM SHORT TO LONG RUN P LRAS SRAS LONG AND SHORT RUN EQUILIBRIUM AD Y B) A SHORT RUN AND LONG RUN AD DECREASE P LRAS SRAS A B C AD 2 AD 1 Y Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 3. 1

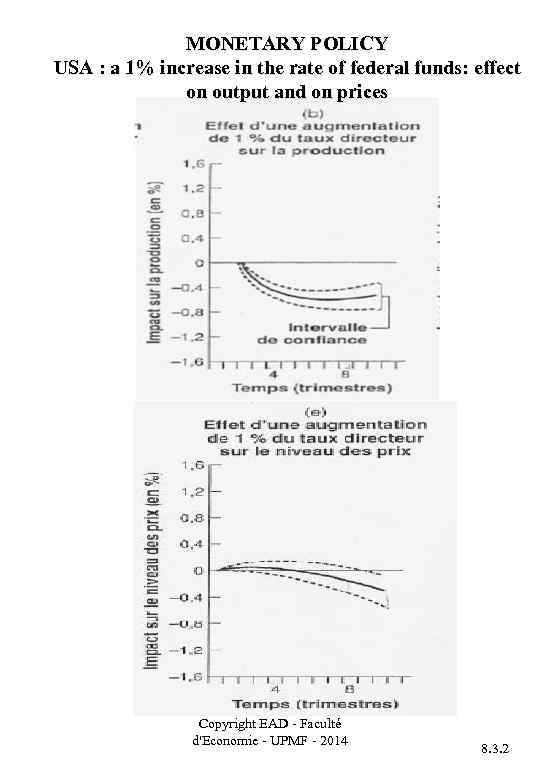

MONETARY POLICY USA : a 1% increase in the rate of federal funds: effect on output and on prices Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 3. 2

MONETARY POLICY USA : a 1% increase in the rate of federal funds: effect on output and on prices Copyright EAD - Faculté d'Economie - UPMF - 2014 8. 3. 2

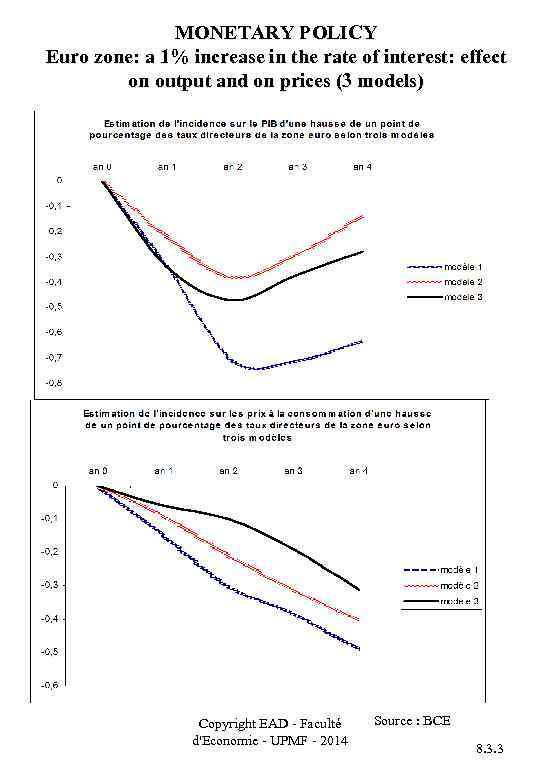

MONETARY POLICY Euro zone: a 1% increase in the rate of interest: effect on output and on prices (3 models) Copyright EAD - Faculté d'Economie - UPMF - 2014 Source : BCE 8. 3. 3

MONETARY POLICY Euro zone: a 1% increase in the rate of interest: effect on output and on prices (3 models) Copyright EAD - Faculté d'Economie - UPMF - 2014 Source : BCE 8. 3. 3

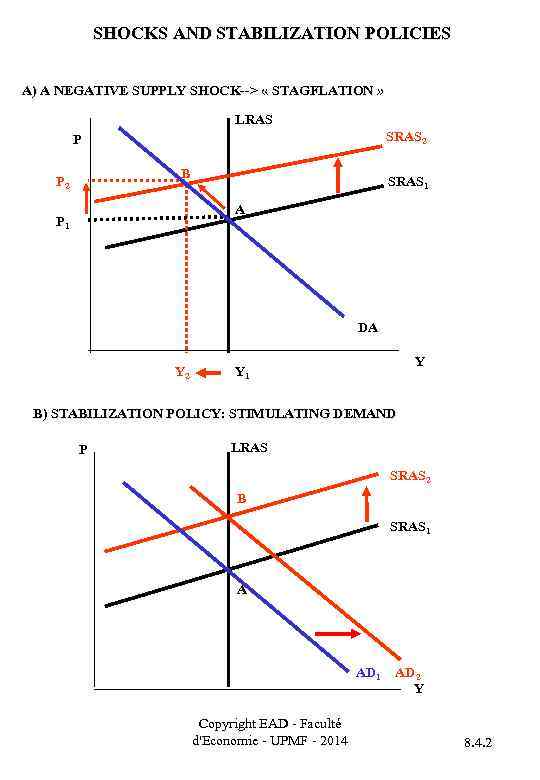

SHOCKS AND STABILIZATION POLICIES A) A NEGATIVE SUPPLY SHOCK--> « STAGFLATION » LRAS SRAS 2 P B P 2 SRAS 1 A P 1 DA Y 2 Y Y 1 B) STABILIZATION POLICY: STIMULATING DEMAND P LRAS SRAS 2 B SRAS 1 A AD 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 AD 2 Y 8. 4. 2

SHOCKS AND STABILIZATION POLICIES A) A NEGATIVE SUPPLY SHOCK--> « STAGFLATION » LRAS SRAS 2 P B P 2 SRAS 1 A P 1 DA Y 2 Y Y 1 B) STABILIZATION POLICY: STIMULATING DEMAND P LRAS SRAS 2 B SRAS 1 A AD 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 AD 2 Y 8. 4. 2

Chapter 9: The Keynesian Model of Short-Run Equilibrium Copyright EAD - Faculté d'Economie - UPMF - 2014

Chapter 9: The Keynesian Model of Short-Run Equilibrium Copyright EAD - Faculté d'Economie - UPMF - 2014

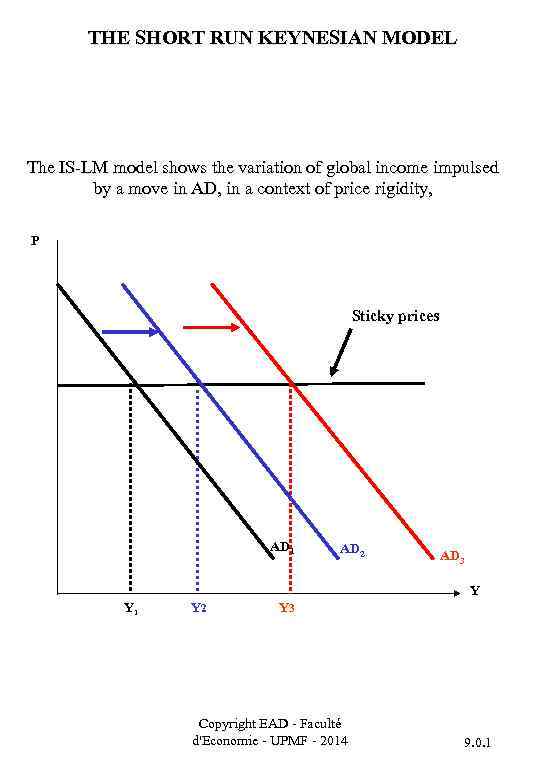

THE SHORT RUN KEYNESIAN MODEL The IS-LM model shows the variation of global income impulsed by a move in AD, in a context of price rigidity, P Sticky prices AD 1 AD 2 AD 3 Y Y 1 Y 2 Y 3 Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 0. 1

THE SHORT RUN KEYNESIAN MODEL The IS-LM model shows the variation of global income impulsed by a move in AD, in a context of price rigidity, P Sticky prices AD 1 AD 2 AD 3 Y Y 1 Y 2 Y 3 Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 0. 1

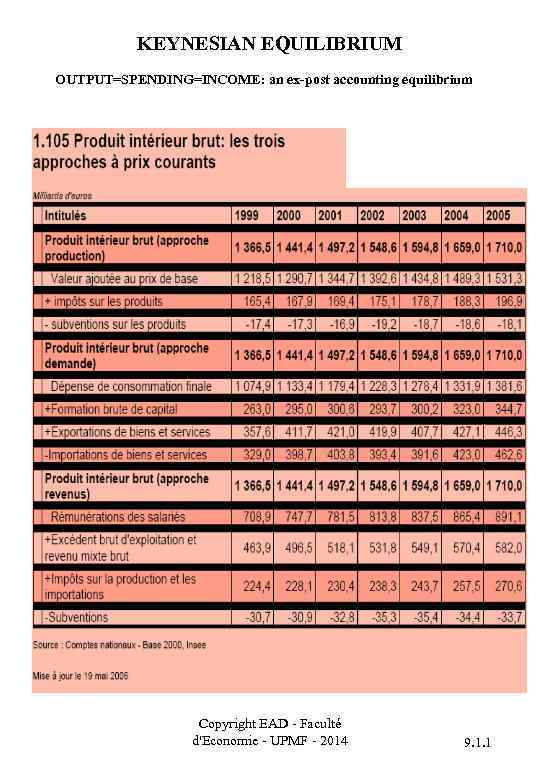

KEYNESIAN EQUILIBRIUM OUTPUT=SPENDING=INCOME: an ex-post accounting equilibrium Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 1

KEYNESIAN EQUILIBRIUM OUTPUT=SPENDING=INCOME: an ex-post accounting equilibrium Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 1

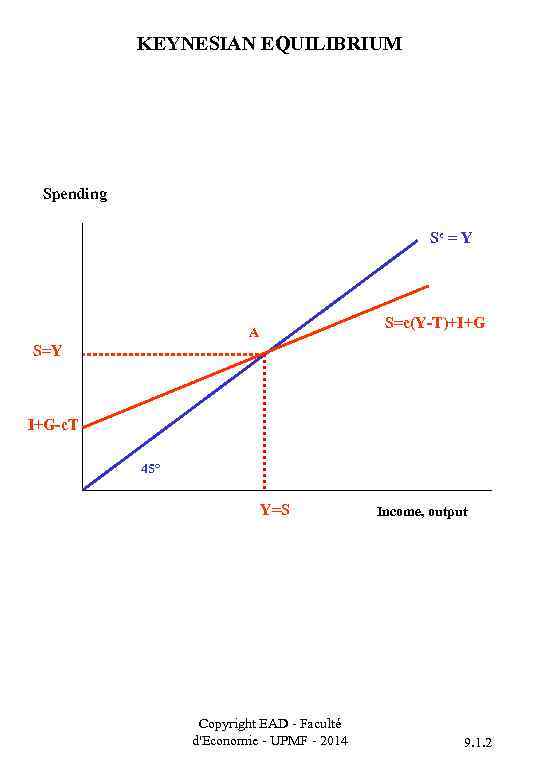

KEYNESIAN EQUILIBRIUM Spending Se = Y S=c(Y-T)+I+G A S=Y I+G-c. T 45° Y=S Copyright EAD - Faculté d'Economie - UPMF - 2014 Income, output 9. 1. 2

KEYNESIAN EQUILIBRIUM Spending Se = Y S=c(Y-T)+I+G A S=Y I+G-c. T 45° Y=S Copyright EAD - Faculté d'Economie - UPMF - 2014 Income, output 9. 1. 2

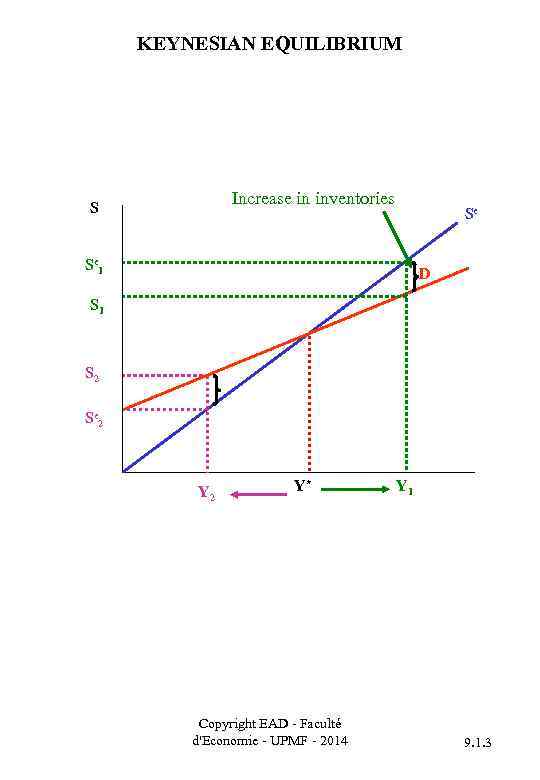

KEYNESIAN EQUILIBRIUM Increase in inventories S Se Se 1 D S 1 S 2 Se 2 Y* Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 1 9. 1. 3

KEYNESIAN EQUILIBRIUM Increase in inventories S Se Se 1 D S 1 S 2 Se 2 Y* Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 1 9. 1. 3

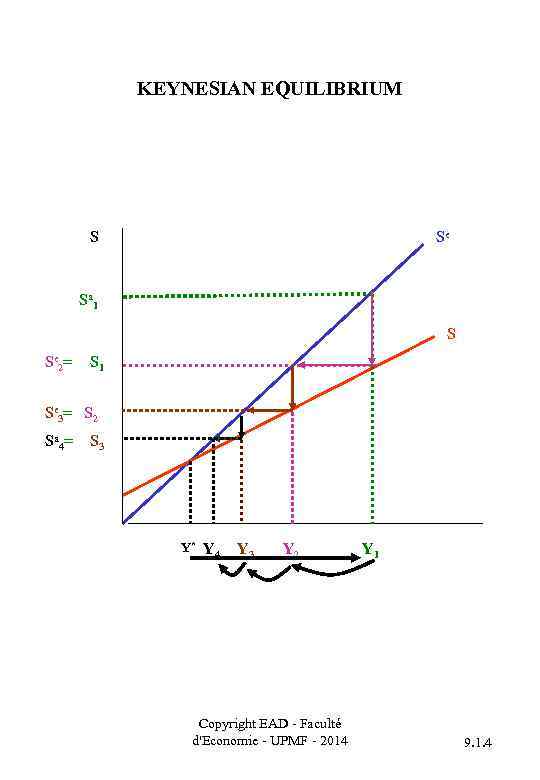

KEYNESIAN EQUILIBRIUM S Se Sa 1 S Se 2= S 1 Se 3= S 2 Sa 4= S 3 Y* Y 4 Y 3 Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 1 9. 1. 4

KEYNESIAN EQUILIBRIUM S Se Sa 1 S Se 2= S 1 Se 3= S 2 Sa 4= S 3 Y* Y 4 Y 3 Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 1 9. 1. 4

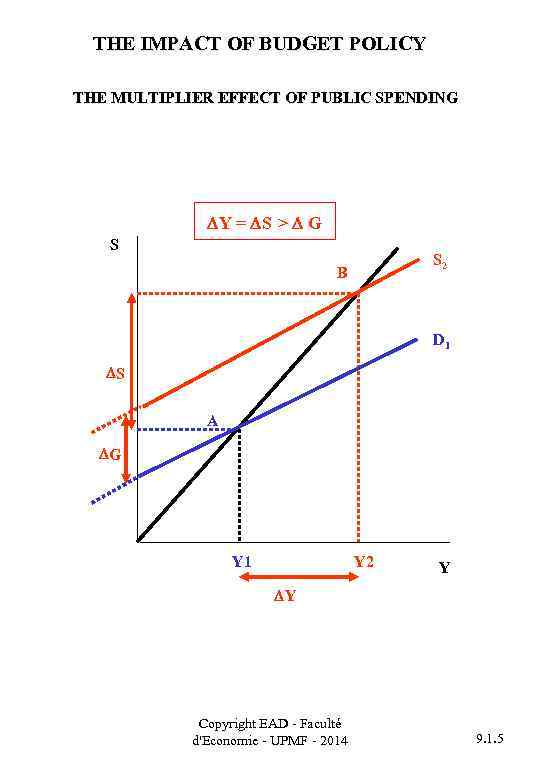

THE IMPACT OF BUDGET POLICY THE MULTIPLIER EFFECT OF PUBLIC SPENDING Y = S > G S S 2 B D 1 S A G Y 1 Y 2 Y Y Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 5

THE IMPACT OF BUDGET POLICY THE MULTIPLIER EFFECT OF PUBLIC SPENDING Y = S > G S S 2 B D 1 S A G Y 1 Y 2 Y Y Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 5

THE IMPACT OF BUDGET POLICY Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 6

THE IMPACT OF BUDGET POLICY Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 6

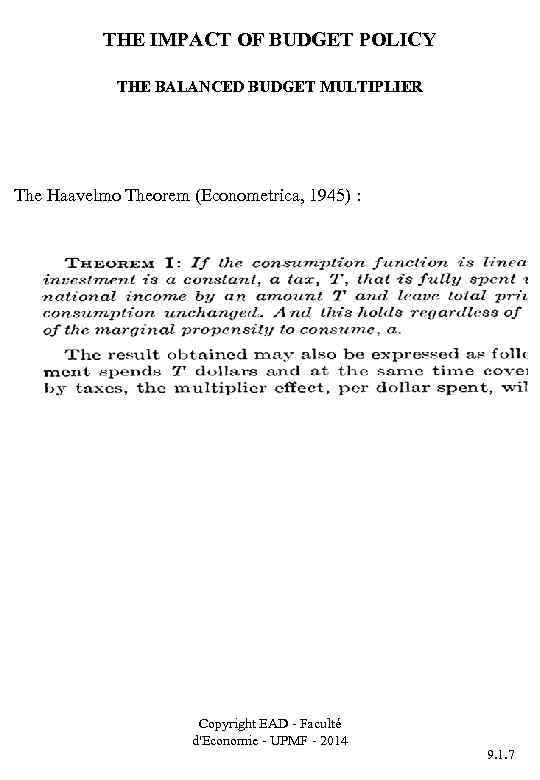

THE IMPACT OF BUDGET POLICY THE BALANCED BUDGET MULTIPLIER The Haavelmo Theorem (Econometrica, 1945) : Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 7

THE IMPACT OF BUDGET POLICY THE BALANCED BUDGET MULTIPLIER The Haavelmo Theorem (Econometrica, 1945) : Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 7

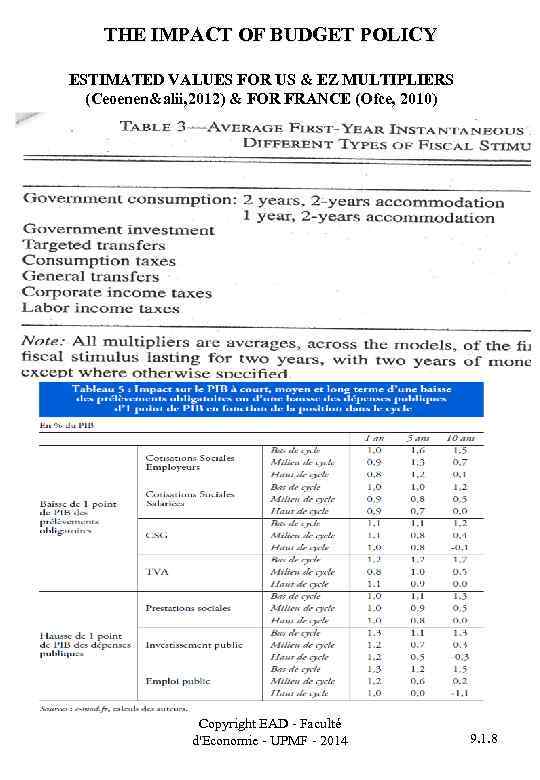

THE IMPACT OF BUDGET POLICY ESTIMATED VALUES FOR US & EZ MULTIPLIERS (Ceoenen&alii, 2012) & FOR FRANCE (Ofce, 2010) Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 8

THE IMPACT OF BUDGET POLICY ESTIMATED VALUES FOR US & EZ MULTIPLIERS (Ceoenen&alii, 2012) & FOR FRANCE (Ofce, 2010) Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 8

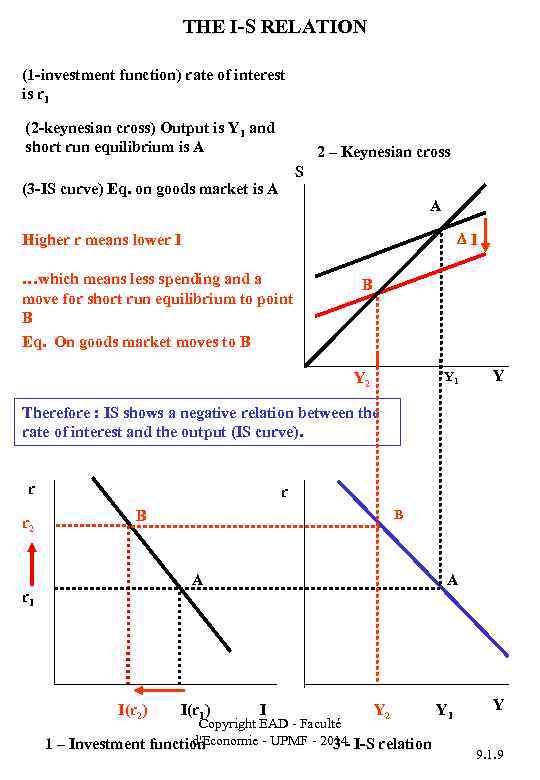

THE I-S RELATION (1 -investment function) rate of interest is r 1 (2 -keynesian cross) Output is Y 1 and short run equilibrium is A 2 – Keynesian cross S (3 -IS curve) Eq. on goods market is A A I Higher r means lower I …which means less spending and a move for short run equilibrium to point B Eq. On goods market moves to B B Y 1 Y 2 Y Therefore : IS shows a negative relation between the rate of interest and the output (IS curve). r r 2 r B B A r 1 I(r 2) I(r 1) A I Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 1 – Investment function 3 - I-S relation Y 1 Y 9. 1. 9

THE I-S RELATION (1 -investment function) rate of interest is r 1 (2 -keynesian cross) Output is Y 1 and short run equilibrium is A 2 – Keynesian cross S (3 -IS curve) Eq. on goods market is A A I Higher r means lower I …which means less spending and a move for short run equilibrium to point B Eq. On goods market moves to B B Y 1 Y 2 Y Therefore : IS shows a negative relation between the rate of interest and the output (IS curve). r r 2 r B B A r 1 I(r 2) I(r 1) A I Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 1 – Investment function 3 - I-S relation Y 1 Y 9. 1. 9

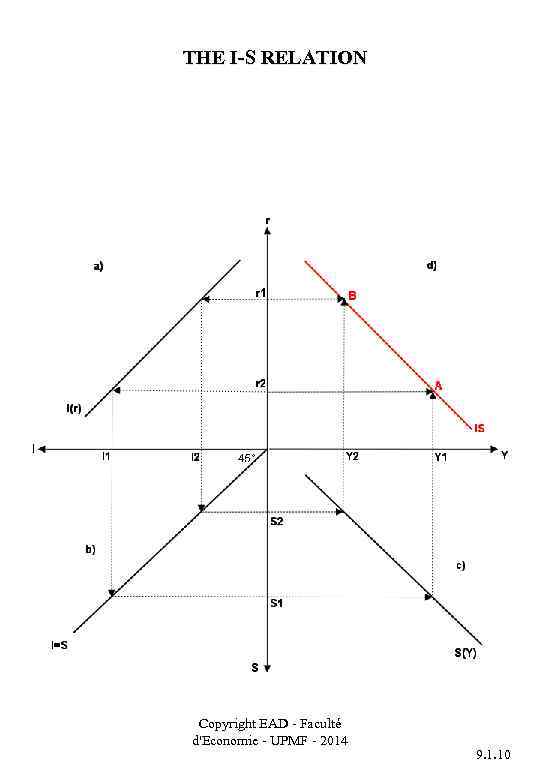

THE I-S RELATION Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 10

THE I-S RELATION Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 1. 10

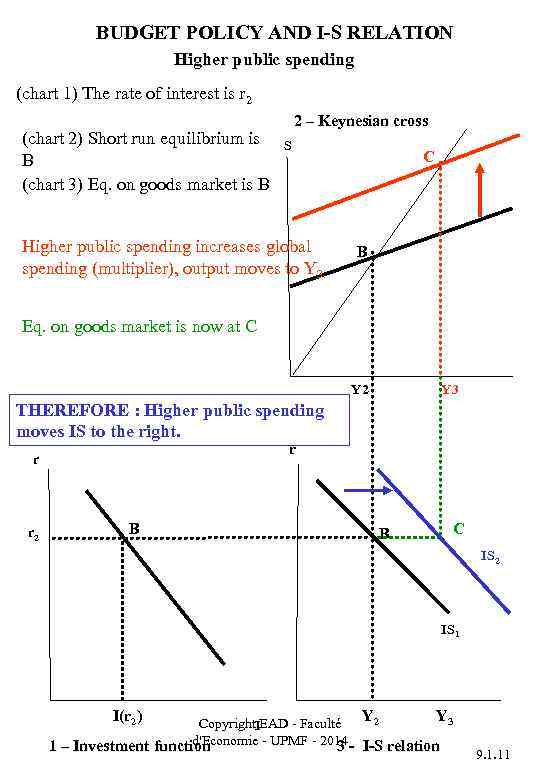

BUDGET POLICY AND I-S RELATION Higher public spending (chart 1) The rate of interest is r 2 (chart 2) Short run equilibrium is B (chart 3) Eq. on goods market is B 2 – Keynesian cross S Higher public spending increases global spending (multiplier), output moves to Y 3. C B Eq. on goods market is now at C Y 2 Y 3 THEREFORE : Higher public spending moves IS to the right. r r r 2 B C B IS 2 IS 1 I(r 2) Y 2 Y 3 Copyright. IEAD - Faculté d'Economie - UPMF - 2014 1 – Investment function 3 - I-S relation 9. 1. 11

BUDGET POLICY AND I-S RELATION Higher public spending (chart 1) The rate of interest is r 2 (chart 2) Short run equilibrium is B (chart 3) Eq. on goods market is B 2 – Keynesian cross S Higher public spending increases global spending (multiplier), output moves to Y 3. C B Eq. on goods market is now at C Y 2 Y 3 THEREFORE : Higher public spending moves IS to the right. r r r 2 B C B IS 2 IS 1 I(r 2) Y 2 Y 3 Copyright. IEAD - Faculté d'Economie - UPMF - 2014 1 – Investment function 3 - I-S relation 9. 1. 11

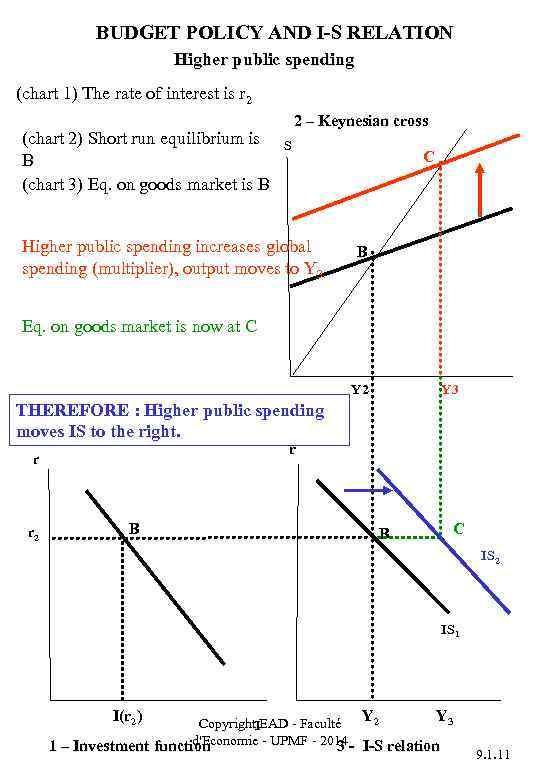

BUDGET POLICY AND I-S RELATION Higher public spending (chart 1) The rate of interest is r 2 (chart 2) Short run equilibrium is B (chart 3) Eq. on goods market is B 2 – Keynesian cross S Higher public spending increases global spending (multiplier), output moves to Y 3. C B Eq. on goods market is now at C Y 2 Y 3 THEREFORE : Higher public spending moves IS to the right. r r r 2 B C B IS 2 IS 1 I(r 2) Y 2 Y 3 Copyright. IEAD - Faculté d'Economie - UPMF - 2014 1 – Investment function 3 - I-S relation 9. 1. 11

BUDGET POLICY AND I-S RELATION Higher public spending (chart 1) The rate of interest is r 2 (chart 2) Short run equilibrium is B (chart 3) Eq. on goods market is B 2 – Keynesian cross S Higher public spending increases global spending (multiplier), output moves to Y 3. C B Eq. on goods market is now at C Y 2 Y 3 THEREFORE : Higher public spending moves IS to the right. r r r 2 B C B IS 2 IS 1 I(r 2) Y 2 Y 3 Copyright. IEAD - Faculté d'Economie - UPMF - 2014 1 – Investment function 3 - I-S relation 9. 1. 11

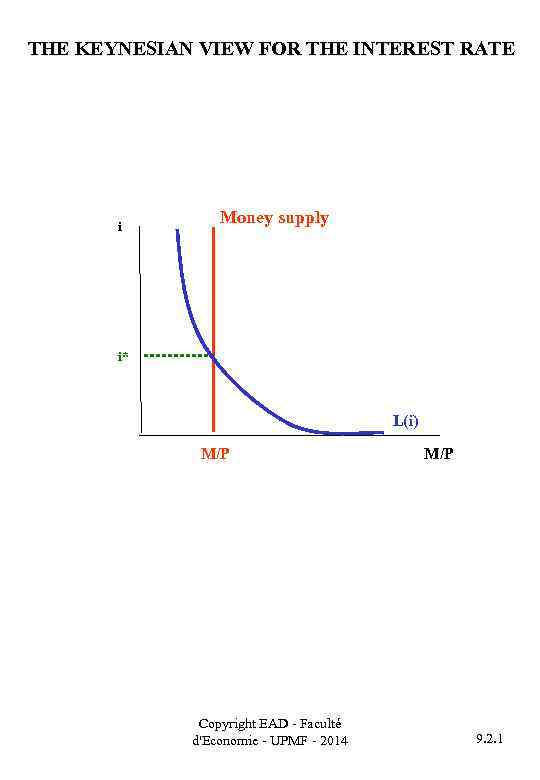

THE KEYNESIAN VIEW FOR THE INTEREST RATE i Money supply i* L(i) M/P Copyright EAD - Faculté d'Economie - UPMF - 2014 M/P 9. 2. 1

THE KEYNESIAN VIEW FOR THE INTEREST RATE i Money supply i* L(i) M/P Copyright EAD - Faculté d'Economie - UPMF - 2014 M/P 9. 2. 1

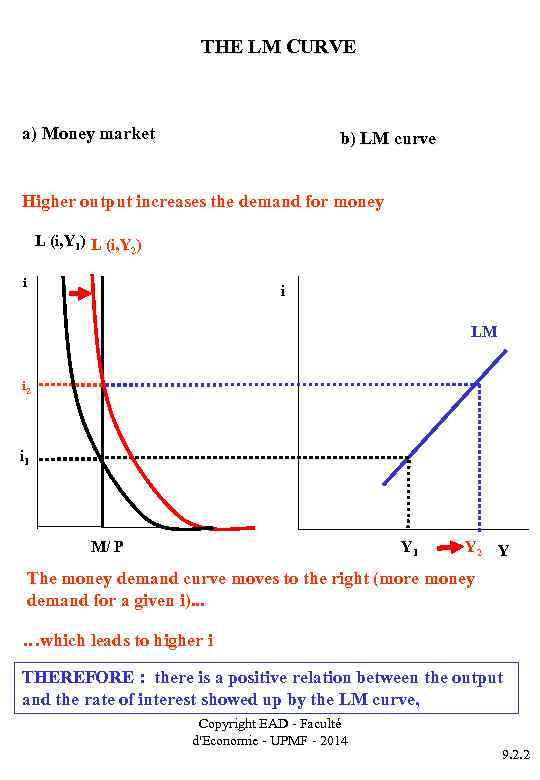

THE LM CURVE a) Money market b) LM curve Higher output increases the demand for money L (i, Y 1) L (i, Y 2) i i LM i 2 i 1 M/ P Y 1 Y 2 Y The money demand curve moves to the right (more money demand for a given i). . . …which leads to higher i THEREFORE : there is a positive relation between the output and the rate of interest showed up by the LM curve, Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 2. 2

THE LM CURVE a) Money market b) LM curve Higher output increases the demand for money L (i, Y 1) L (i, Y 2) i i LM i 2 i 1 M/ P Y 1 Y 2 Y The money demand curve moves to the right (more money demand for a given i). . . …which leads to higher i THEREFORE : there is a positive relation between the output and the rate of interest showed up by the LM curve, Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 2. 2

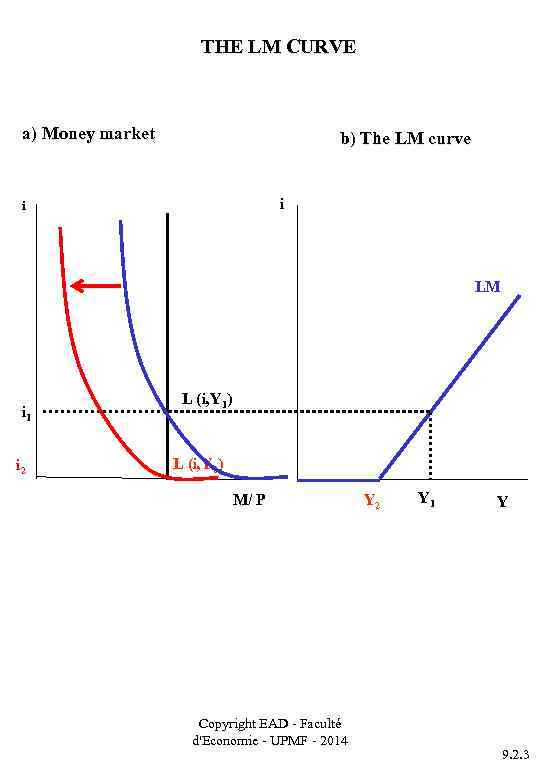

THE LM CURVE a) Money market b) The LM curve i i LM i 1 i 2 L (i, Y 1) L (i, Y 2) M/ P Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 2 Y 1 Y 9. 2. 3

THE LM CURVE a) Money market b) The LM curve i i LM i 1 i 2 L (i, Y 1) L (i, Y 2) M/ P Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 2 Y 1 Y 9. 2. 3

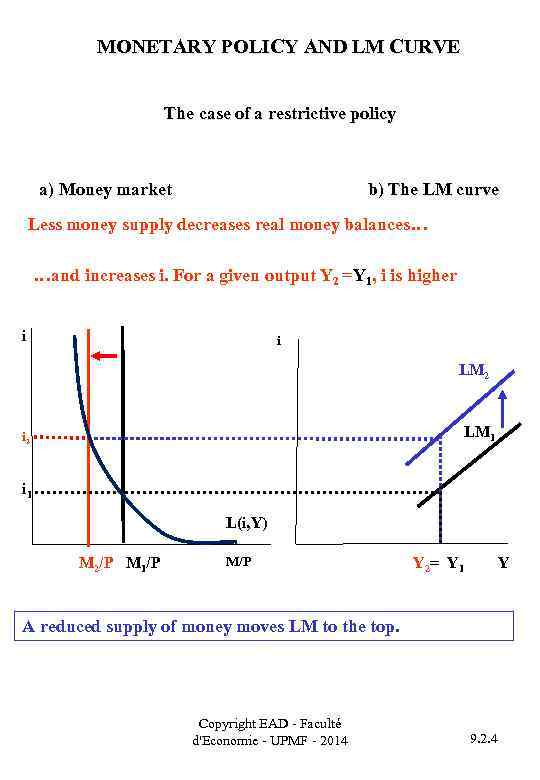

MONETARY POLICY AND LM CURVE The case of a restrictive policy a) Money market b) The LM curve Less money supply decreases real money balances… …and increases i. For a given output Y 2 =Y 1, i is higher i i LM 2 LM 1 i 2 i 1 L(i, Y) M 2/P M 1/P M/P Y 2= Y 1 Y A reduced supply of money moves LM to the top. Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 2. 4

MONETARY POLICY AND LM CURVE The case of a restrictive policy a) Money market b) The LM curve Less money supply decreases real money balances… …and increases i. For a given output Y 2 =Y 1, i is higher i i LM 2 LM 1 i 2 i 1 L(i, Y) M 2/P M 1/P M/P Y 2= Y 1 Y A reduced supply of money moves LM to the top. Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 2. 4

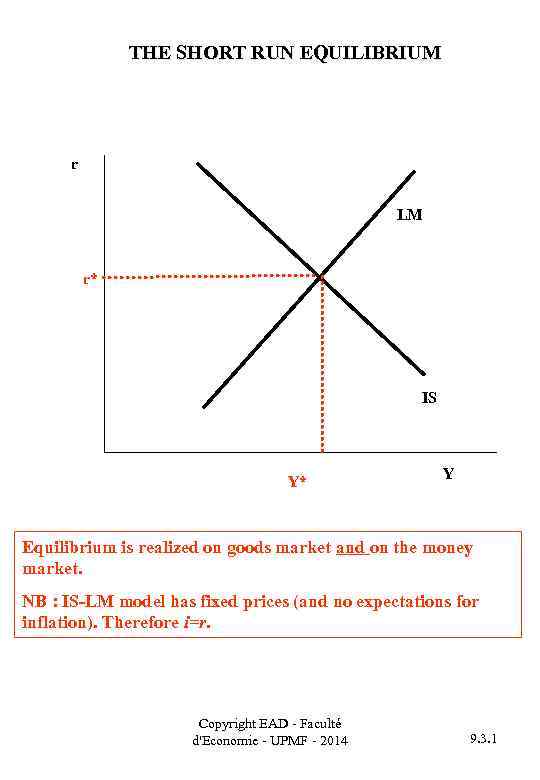

THE SHORT RUN EQUILIBRIUM r LM r* IS Y* Y Equilibrium is realized on goods market and on the money market. NB : IS-LM model has fixed prices (and no expectations for inflation). Therefore i=r. Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 3. 1

THE SHORT RUN EQUILIBRIUM r LM r* IS Y* Y Equilibrium is realized on goods market and on the money market. NB : IS-LM model has fixed prices (and no expectations for inflation). Therefore i=r. Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 3. 1

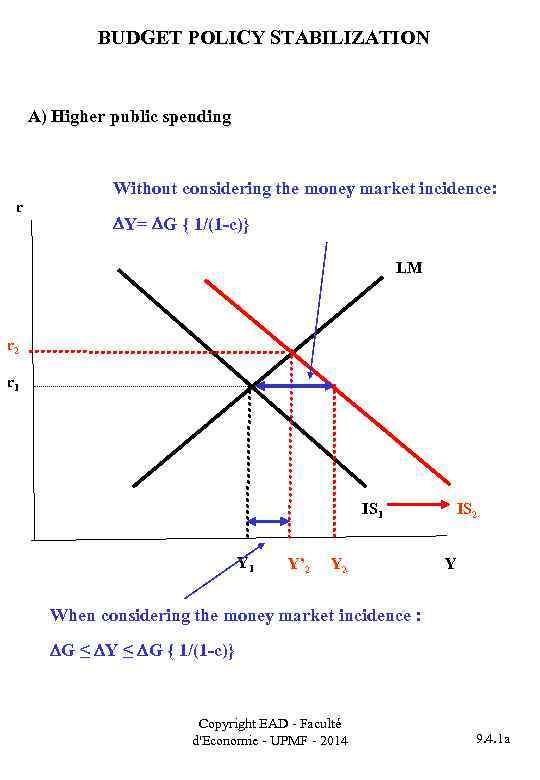

BUDGET POLICY STABILIZATION A) Higher public spending r Without considering the money market incidence: Y= G { 1/(1 -c)} LM r 2 r 1 IS 1 Y’ 2 Y 2 IS 2 Y When considering the money market incidence : G ≤ Y ≤ G { 1/(1 -c)} Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 1 a

BUDGET POLICY STABILIZATION A) Higher public spending r Without considering the money market incidence: Y= G { 1/(1 -c)} LM r 2 r 1 IS 1 Y’ 2 Y 2 IS 2 Y When considering the money market incidence : G ≤ Y ≤ G { 1/(1 -c)} Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 1 a

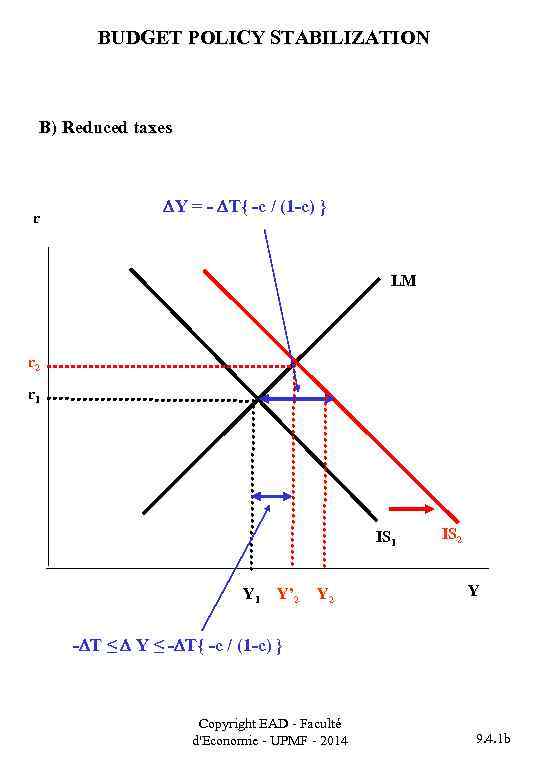

BUDGET POLICY STABILIZATION B) Reduced taxes r Y = - T{ -c / (1 -c) } LM r 2 r 1 IS 1 Y’ 2 Y 2 IS 2 Y - T ≤ Y ≤ - T{ -c / (1 -c) } Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 1 b

BUDGET POLICY STABILIZATION B) Reduced taxes r Y = - T{ -c / (1 -c) } LM r 2 r 1 IS 1 Y’ 2 Y 2 IS 2 Y - T ≤ Y ≤ - T{ -c / (1 -c) } Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 1 b

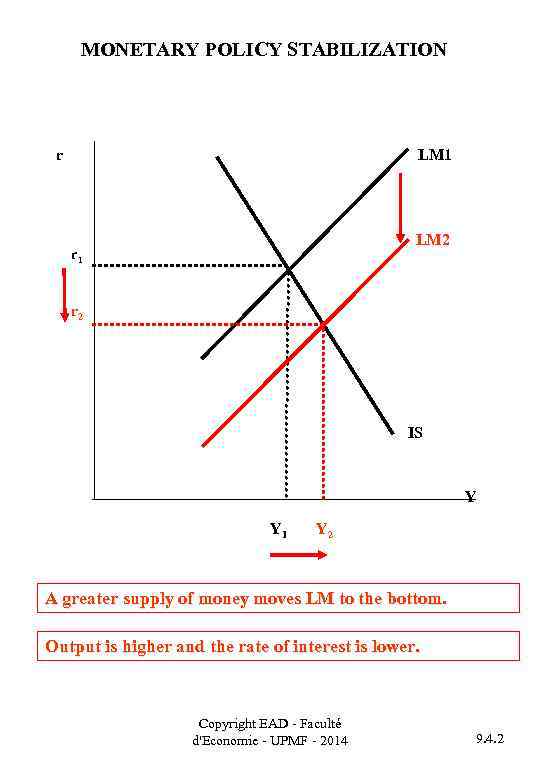

MONETARY POLICY STABILIZATION r LM 1 LM 2 r 1 r 2 IS Y Y 1 Y 2 A greater supply of money moves LM to the bottom. Output is higher and the rate of interest is lower. Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 2

MONETARY POLICY STABILIZATION r LM 1 LM 2 r 1 r 2 IS Y Y 1 Y 2 A greater supply of money moves LM to the bottom. Output is higher and the rate of interest is lower. Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 2

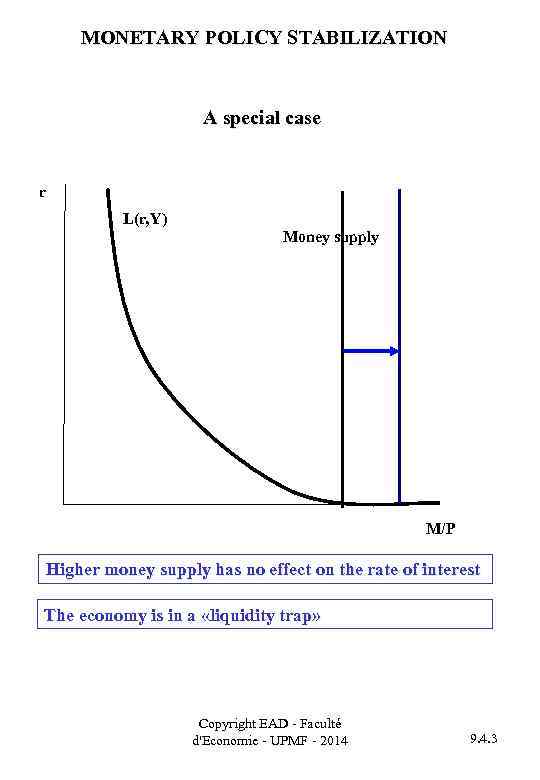

MONETARY POLICY STABILIZATION A special case r L(r, Y) Money supply M/P Higher money supply has no effect on the rate of interest The economy is in a «liquidity trap» Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 3

MONETARY POLICY STABILIZATION A special case r L(r, Y) Money supply M/P Higher money supply has no effect on the rate of interest The economy is in a «liquidity trap» Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 3

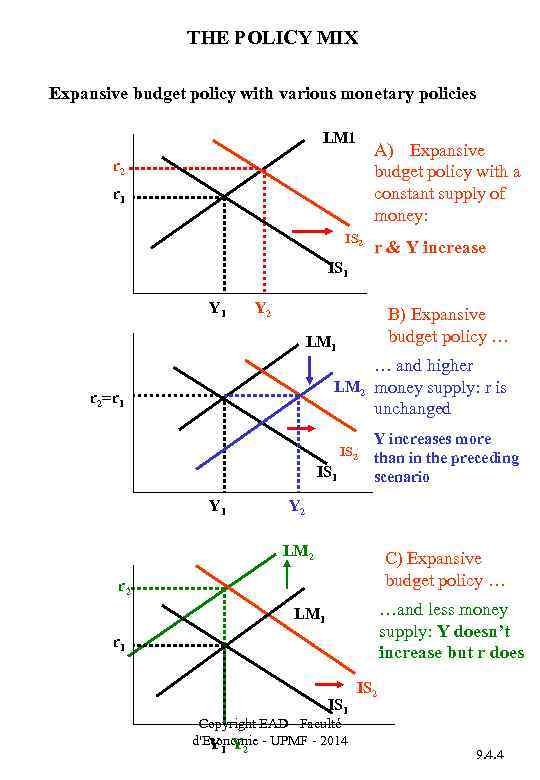

THE POLICY MIX Expansive budget policy with various monetary policies LM 1 A) Expansive budget policy with a constant supply of money: r 2 r 1 IS 2 r & Y increase IS 1 Y 2 B) Expansive budget policy … LM 1 … and higher LM 2 money supply: r is unchanged r 2=r 1 IS 2 IS 1 Y increases more than in the preceding scenario Y 2 LM 2 C) Expansive budget policy … r 2 …and less money supply: Y doesn’t increase but r does LM 1 r 1 IS 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y Y 1 2 IS 2 9. 4. 4

THE POLICY MIX Expansive budget policy with various monetary policies LM 1 A) Expansive budget policy with a constant supply of money: r 2 r 1 IS 2 r & Y increase IS 1 Y 2 B) Expansive budget policy … LM 1 … and higher LM 2 money supply: r is unchanged r 2=r 1 IS 2 IS 1 Y increases more than in the preceding scenario Y 2 LM 2 C) Expansive budget policy … r 2 …and less money supply: Y doesn’t increase but r does LM 1 r 1 IS 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y Y 1 2 IS 2 9. 4. 4

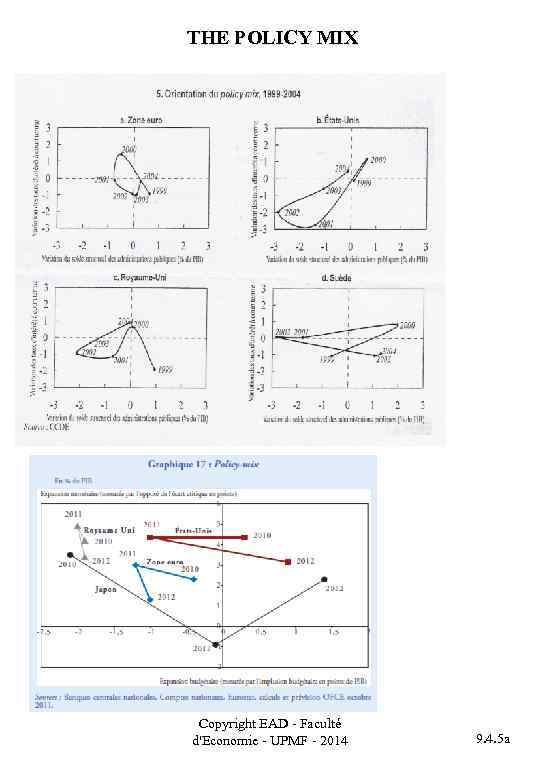

THE POLICY MIX Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 5 a

THE POLICY MIX Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 5 a

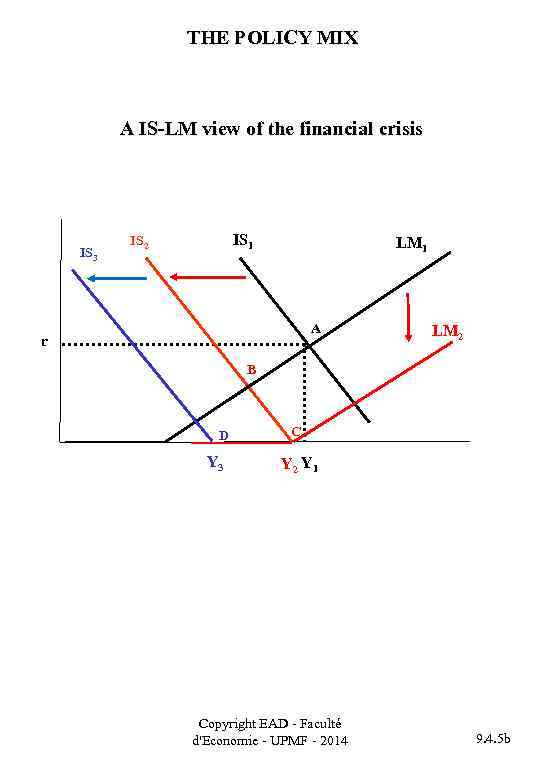

THE POLICY MIX A IS-LM view of the financial crisis IS 3 IS 1 IS 2 LM 1 A r LM 2 B D Y 3 C Y 2 Y 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 5 b

THE POLICY MIX A IS-LM view of the financial crisis IS 3 IS 1 IS 2 LM 1 A r LM 2 B D Y 3 C Y 2 Y 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 5 b

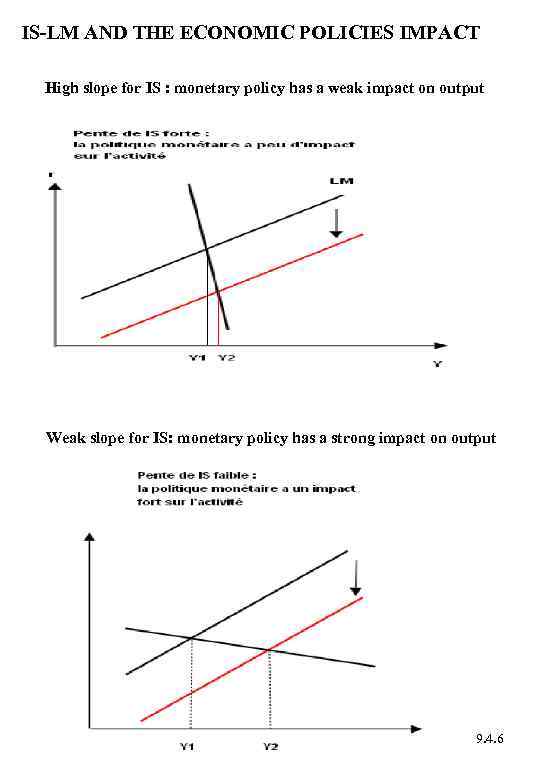

IS-LM AND THE ECONOMIC POLICIES IMPACT High slope for IS : monetary policy has a weak impact on output Weak slope for IS: monetary policy has a strong impact on output Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 6

IS-LM AND THE ECONOMIC POLICIES IMPACT High slope for IS : monetary policy has a weak impact on output Weak slope for IS: monetary policy has a strong impact on output Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 6

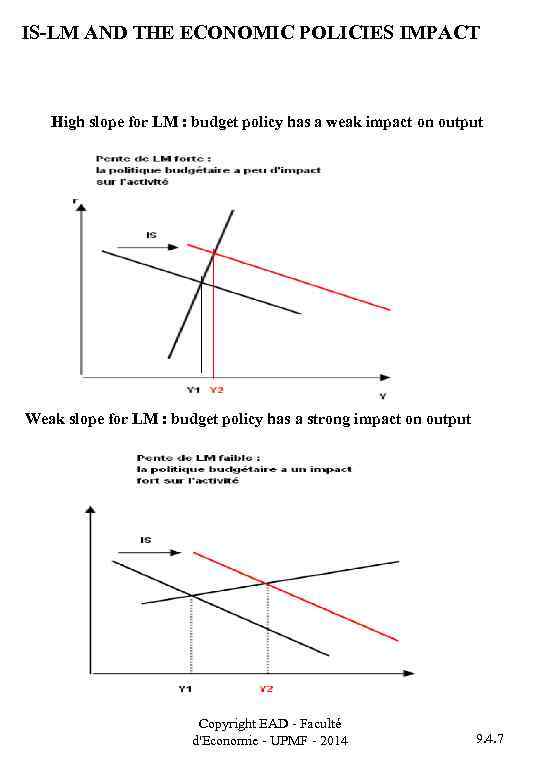

IS-LM AND THE ECONOMIC POLICIES IMPACT High slope for LM : budget policy has a weak impact on output Weak slope for LM : budget policy has a strong impact on output Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 7

IS-LM AND THE ECONOMIC POLICIES IMPACT High slope for LM : budget policy has a weak impact on output Weak slope for LM : budget policy has a strong impact on output Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 7

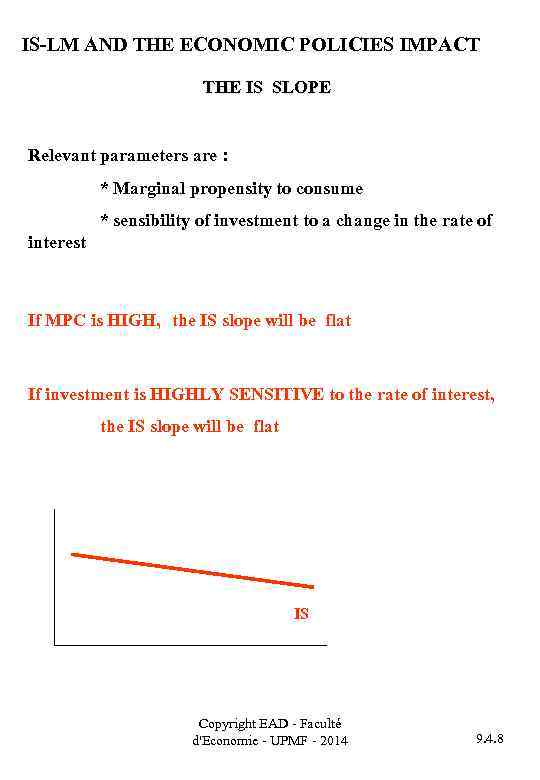

IS-LM AND THE ECONOMIC POLICIES IMPACT THE IS SLOPE Relevant parameters are : * Marginal propensity to consume * sensibility of investment to a change in the rate of interest If MPC is HIGH, the IS slope will be flat If investment is HIGHLY SENSITIVE to the rate of interest, the IS slope will be flat IS Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 8

IS-LM AND THE ECONOMIC POLICIES IMPACT THE IS SLOPE Relevant parameters are : * Marginal propensity to consume * sensibility of investment to a change in the rate of interest If MPC is HIGH, the IS slope will be flat If investment is HIGHLY SENSITIVE to the rate of interest, the IS slope will be flat IS Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 8

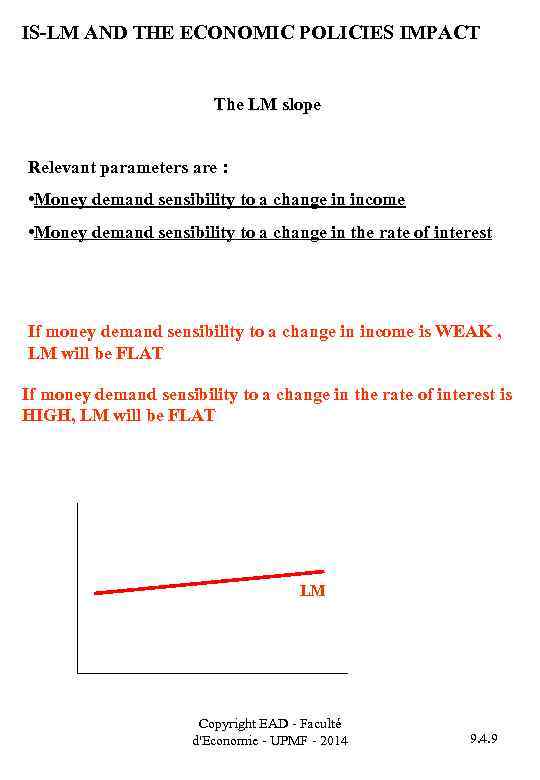

IS-LM AND THE ECONOMIC POLICIES IMPACT The LM slope Relevant parameters are : • Money demand sensibility to a change in income • Money demand sensibility to a change in the rate of interest If money demand sensibility to a change in income is WEAK , LM will be FLAT If money demand sensibility to a change in the rate of interest is HIGH, LM will be FLAT LM Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 9

IS-LM AND THE ECONOMIC POLICIES IMPACT The LM slope Relevant parameters are : • Money demand sensibility to a change in income • Money demand sensibility to a change in the rate of interest If money demand sensibility to a change in income is WEAK , LM will be FLAT If money demand sensibility to a change in the rate of interest is HIGH, LM will be FLAT LM Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 9

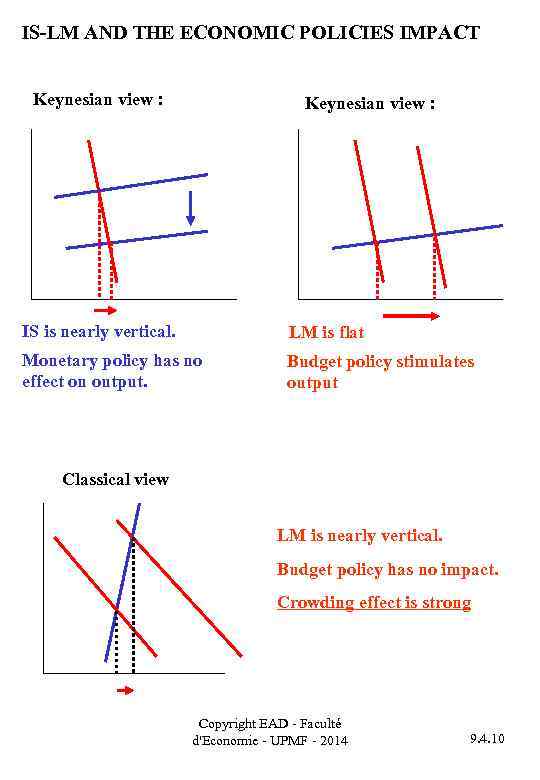

IS-LM AND THE ECONOMIC POLICIES IMPACT Keynesian view : IS is nearly vertical. LM is flat Monetary policy has no effect on output. Budget policy stimulates output Classical view LM is nearly vertical. Budget policy has no impact. Crowding effect is strong Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 10

IS-LM AND THE ECONOMIC POLICIES IMPACT Keynesian view : IS is nearly vertical. LM is flat Monetary policy has no effect on output. Budget policy stimulates output Classical view LM is nearly vertical. Budget policy has no impact. Crowding effect is strong Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 4. 10

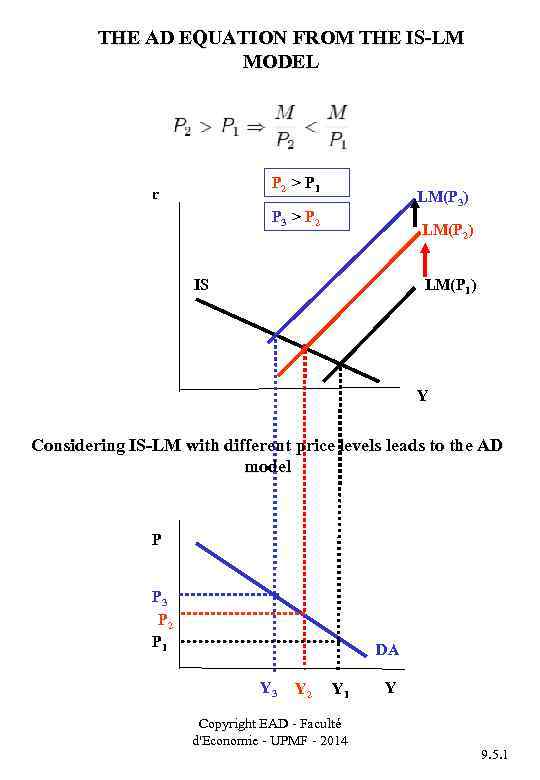

THE AD EQUATION FROM THE IS-LM MODEL P 2 > P 1 r LM(P 3) P 3 > P 2 LM(P 2) LM(P 1) IS Y Considering IS-LM with different price levels leads to the AD model P P 3 P 2 P 1 DA Y 3 Y 2 Y 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 9. 5. 1

THE AD EQUATION FROM THE IS-LM MODEL P 2 > P 1 r LM(P 3) P 3 > P 2 LM(P 2) LM(P 1) IS Y Considering IS-LM with different price levels leads to the AD model P P 3 P 2 P 1 DA Y 3 Y 2 Y 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 9. 5. 1

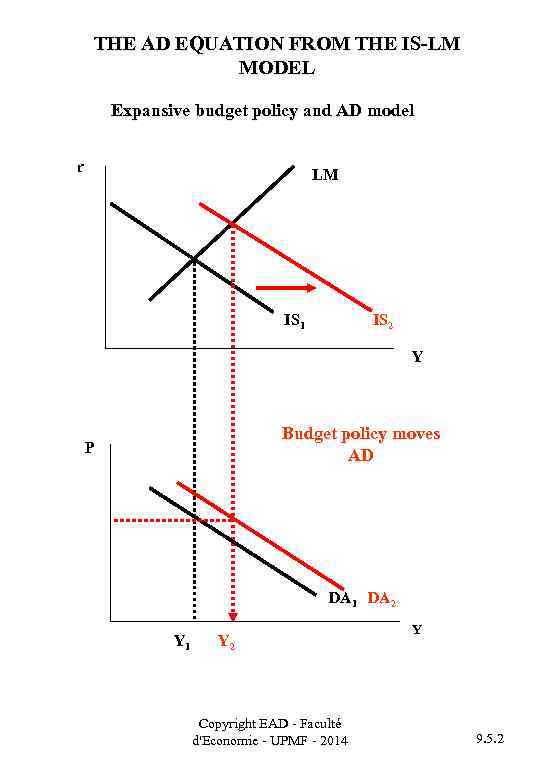

THE AD EQUATION FROM THE IS-LM MODEL Expansive budget policy and AD model r LM IS 1 IS 2 Y Budget policy moves AD P DA 1 DA 2 Y 1 Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 9. 5. 2

THE AD EQUATION FROM THE IS-LM MODEL Expansive budget policy and AD model r LM IS 1 IS 2 Y Budget policy moves AD P DA 1 DA 2 Y 1 Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 9. 5. 2

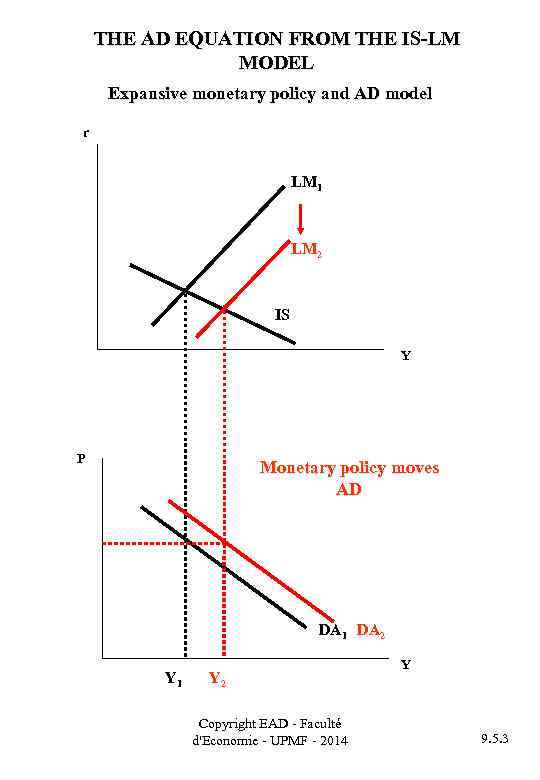

THE AD EQUATION FROM THE IS-LM MODEL Expansive monetary policy and AD model r LM 1 LM 2 IS Y P Monetary policy moves AD DA 1 DA 2 Y 1 Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 9. 5. 3

THE AD EQUATION FROM THE IS-LM MODEL Expansive monetary policy and AD model r LM 1 LM 2 IS Y P Monetary policy moves AD DA 1 DA 2 Y 1 Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 9. 5. 3

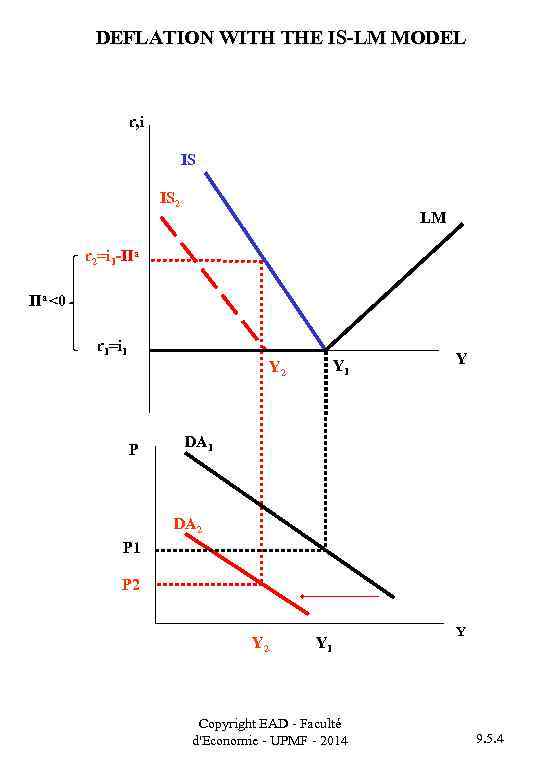

DEFLATION WITH THE IS-LM MODEL r, i IS IS 2 LM r 2=i 1 -Πa Πa <0 r 1=i 1 Y 2 P Y DA 1 DA 2 P 1 P 2 Y 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 9. 5. 4

DEFLATION WITH THE IS-LM MODEL r, i IS IS 2 LM r 2=i 1 -Πa Πa <0 r 1=i 1 Y 2 P Y DA 1 DA 2 P 1 P 2 Y 1 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 9. 5. 4

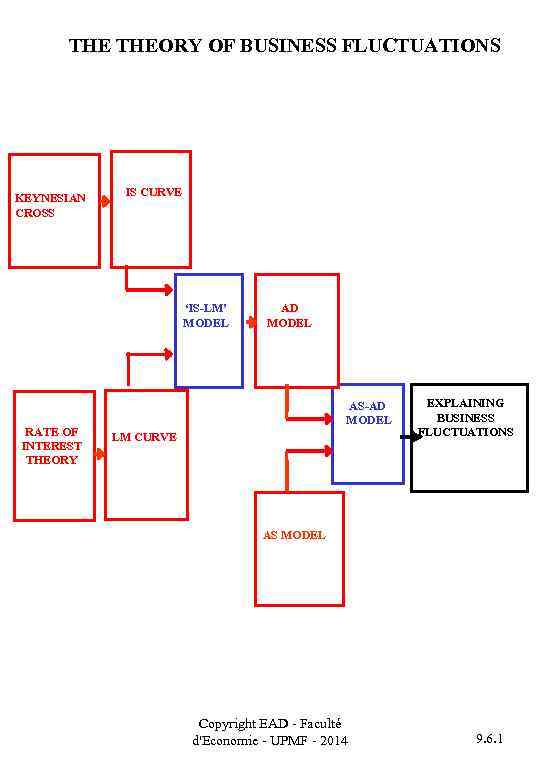

THE THEORY OF BUSINESS FLUCTUATIONS KEYNESIAN CROSS IS CURVE ‘IS-LM’ MODEL RATE OF INTEREST THEORY AD MODEL AS-AD MODEL LM CURVE EXPLAINING BUSINESS FLUCTUATIONS AS MODEL Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 6. 1

THE THEORY OF BUSINESS FLUCTUATIONS KEYNESIAN CROSS IS CURVE ‘IS-LM’ MODEL RATE OF INTEREST THEORY AD MODEL AS-AD MODEL LM CURVE EXPLAINING BUSINESS FLUCTUATIONS AS MODEL Copyright EAD - Faculté d'Economie - UPMF - 2014 9. 6. 1

Chapter 10: The Aggregate Supply Copyright EAD - Faculté d'Economie - UPMF - 2014

Chapter 10: The Aggregate Supply Copyright EAD - Faculté d'Economie - UPMF - 2014

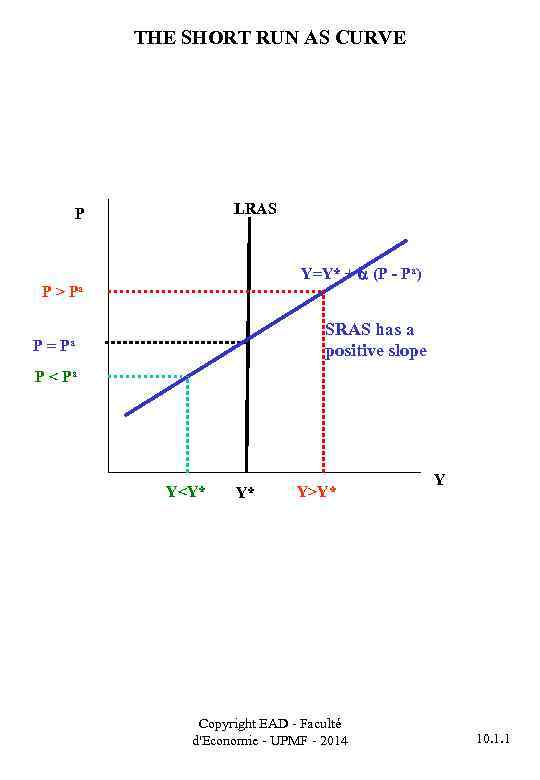

THE SHORT RUN AS CURVE LRAS P Y=Y* + (P - Pa) P > Pa SRAS has a positive slope P = Pa P < Pa Y

THE SHORT RUN AS CURVE LRAS P Y=Y* + (P - Pa) P > Pa SRAS has a positive slope P = Pa P < Pa Y

![A MODEL FOR NOMINAL WAGE RIGIDITIES W/P [1] Prices and real wages [2] Labour A MODEL FOR NOMINAL WAGE RIGIDITIES W/P [1] Prices and real wages [2] Labour](https://present5.com/presentation/1/4817569_348897366.pdf-img/4817569_348897366.pdf-106.jpg) A MODEL FOR NOMINAL WAGE RIGIDITIES W/P [1] Prices and real wages [2] Labour demand Hyp : nominal wages are sticky: real wages decrease when prices increase Hyp : LD increase when real wages decrease. W/P If prices are P’, higher than expected… … output is increasing (Y’) … W/P’ …and supply is at point B. P P’a= P P’ L L L’ Supply is at point A SRAS links A to B. LRAS A Y Output is Y Y’ B SRAS [4] AGGREGATE SUPPLY [3] Production function Y Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 1. 2

A MODEL FOR NOMINAL WAGE RIGIDITIES W/P [1] Prices and real wages [2] Labour demand Hyp : nominal wages are sticky: real wages decrease when prices increase Hyp : LD increase when real wages decrease. W/P If prices are P’, higher than expected… … output is increasing (Y’) … W/P’ …and supply is at point B. P P’a= P P’ L L L’ Supply is at point A SRAS links A to B. LRAS A Y Output is Y Y’ B SRAS [4] AGGREGATE SUPPLY [3] Production function Y Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 1. 2

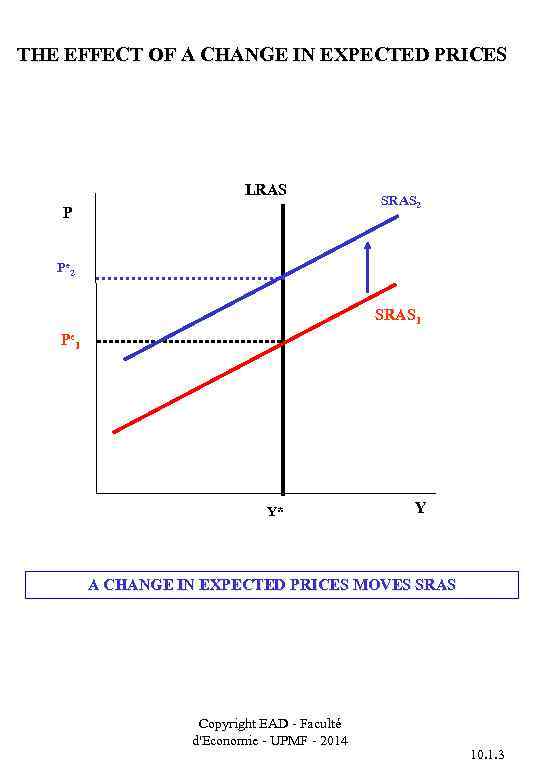

THE EFFECT OF A CHANGE IN EXPECTED PRICES LRAS P SRAS 2 Pe 2 SRAS 1 Pe 1 Y* Y A CHANGE IN EXPECTED PRICES MOVES SRAS Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 1. 3

THE EFFECT OF A CHANGE IN EXPECTED PRICES LRAS P SRAS 2 Pe 2 SRAS 1 Pe 1 Y* Y A CHANGE IN EXPECTED PRICES MOVES SRAS Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 1. 3

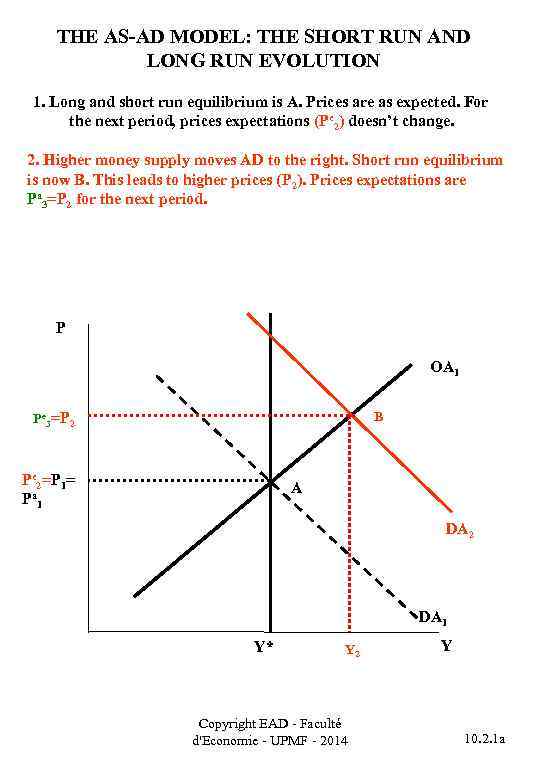

THE AS-AD MODEL: THE SHORT RUN AND LONG RUN EVOLUTION 1. Long and short run equilibrium is A. Prices are as expected. For the next period, prices expectations (Pe 2) doesn’t change. 2. Higher money supply moves AD to the right. Short run equilibrium is now B. This leads to higher prices (P 2). Prices expectations are Pa 3=P 2 for the next period. P OA 1 B Pe 3=P 2 Pe 2=P 1= Pa 1 A DA 2 DA 1 Y* Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 10. 2. 1 a

THE AS-AD MODEL: THE SHORT RUN AND LONG RUN EVOLUTION 1. Long and short run equilibrium is A. Prices are as expected. For the next period, prices expectations (Pe 2) doesn’t change. 2. Higher money supply moves AD to the right. Short run equilibrium is now B. This leads to higher prices (P 2). Prices expectations are Pa 3=P 2 for the next period. P OA 1 B Pe 3=P 2 Pe 2=P 1= Pa 1 A DA 2 DA 1 Y* Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y 10. 2. 1 a

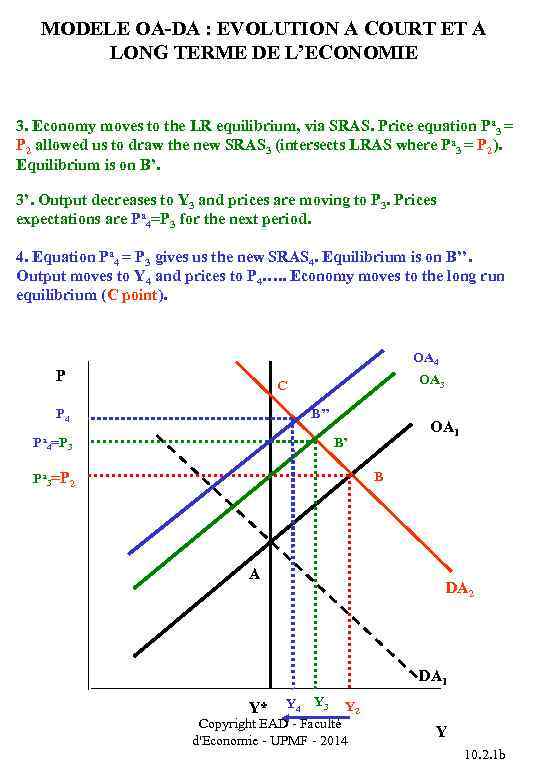

MODELE OA-DA : EVOLUTION A COURT ET A LONG TERME DE L’ECONOMIE 3. Economy moves to the LR equilibrium, via SRAS. Price equation Pa 3 = P 2 allowed us to draw the new SRAS 3 (intersects LRAS where Pa 3 = P 2). Equilibrium is on B’. 3’. Output decreases to Y 3 and prices are moving to P 3. Prices expectations are Pa 4=P 3 for the next period. 4. Equation Pa 4 = P 3 gives us the new SRAS 4. Equilibrium is on B’’. Output moves to Y 4 and prices to P 4…. . Economy moves to the long run equilibrium (C point). OA 4 P P 4 Pa OA 3 C B’’ 4=P 3 OA 1 B’ B Pa 3=P 2 A DA 2 DA 1 Y 4 Y 3 Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y* Y 10. 2. 1 b

MODELE OA-DA : EVOLUTION A COURT ET A LONG TERME DE L’ECONOMIE 3. Economy moves to the LR equilibrium, via SRAS. Price equation Pa 3 = P 2 allowed us to draw the new SRAS 3 (intersects LRAS where Pa 3 = P 2). Equilibrium is on B’. 3’. Output decreases to Y 3 and prices are moving to P 3. Prices expectations are Pa 4=P 3 for the next period. 4. Equation Pa 4 = P 3 gives us the new SRAS 4. Equilibrium is on B’’. Output moves to Y 4 and prices to P 4…. . Economy moves to the long run equilibrium (C point). OA 4 P P 4 Pa OA 3 C B’’ 4=P 3 OA 1 B’ B Pa 3=P 2 A DA 2 DA 1 Y 4 Y 3 Y 2 Copyright EAD - Faculté d'Economie - UPMF - 2014 Y* Y 10. 2. 1 b

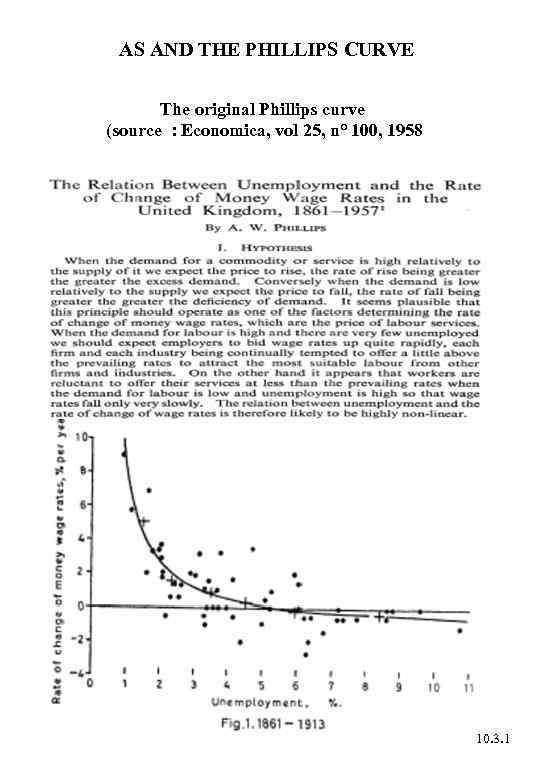

AS AND THE PHILLIPS CURVE The original Phillips curve (source : Economica, vol 25, n° 100, 1958 Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 3. 1

AS AND THE PHILLIPS CURVE The original Phillips curve (source : Economica, vol 25, n° 100, 1958 Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 3. 1

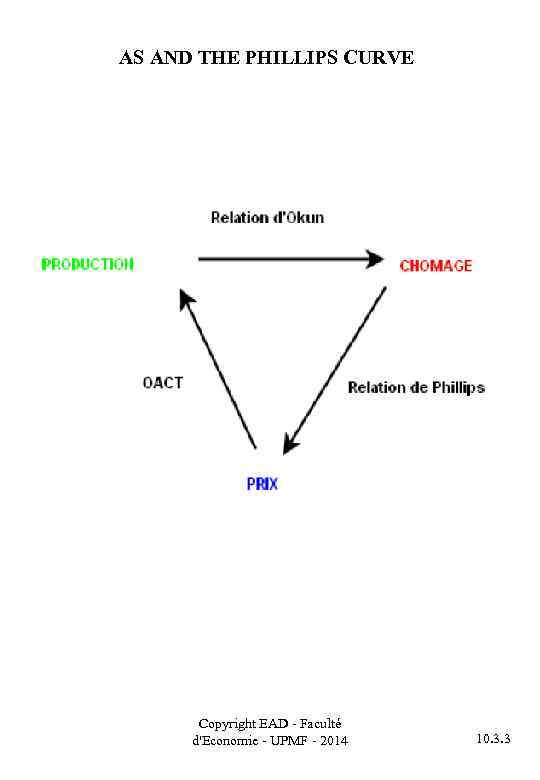

AS AND THE PHILLIPS CURVE Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 3. 3

AS AND THE PHILLIPS CURVE Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 3. 3

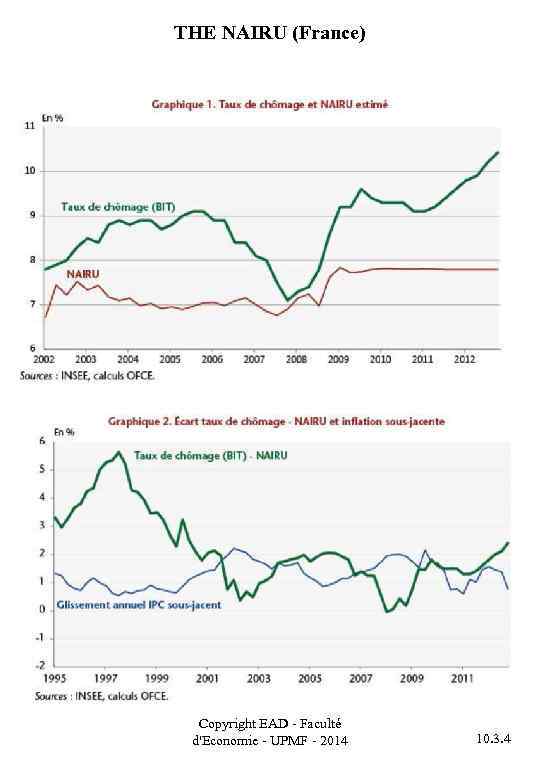

THE NAIRU (France) Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 3. 4

THE NAIRU (France) Copyright EAD - Faculté d'Economie - UPMF - 2014 10. 3. 4

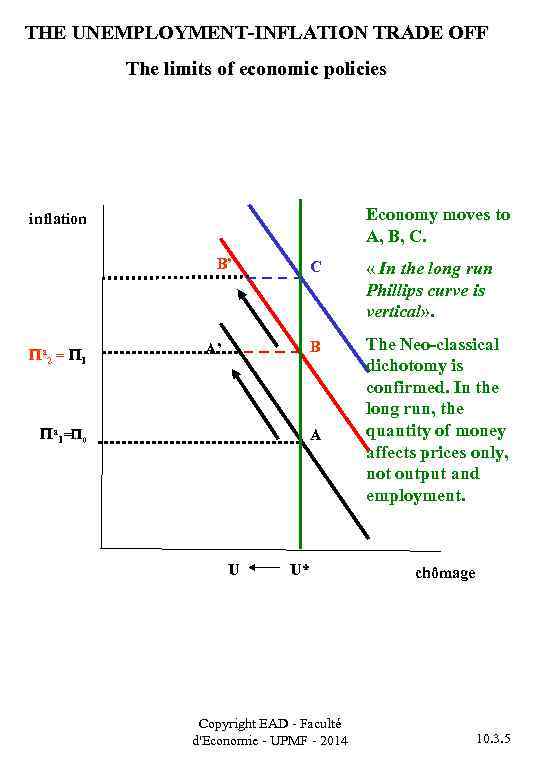

THE UNEMPLOYMENT-INFLATION TRADE OFF The limits of economic policies Economy moves to A, B, C. inflation B’ a 2 = 1 C B A’ a 1= 0 « In the long run Phillips curve is vertical» . The Neo-classical dichotomy is confirmed. In the long run, the quantity of money affects prices only, not output and employment. A U U* Copyright EAD - Faculté d'Economie - UPMF - 2014 chômage 10. 3. 5

THE UNEMPLOYMENT-INFLATION TRADE OFF The limits of economic policies Economy moves to A, B, C. inflation B’ a 2 = 1 C B A’ a 1= 0 « In the long run Phillips curve is vertical» . The Neo-classical dichotomy is confirmed. In the long run, the quantity of money affects prices only, not output and employment. A U U* Copyright EAD - Faculté d'Economie - UPMF - 2014 chômage 10. 3. 5