e43bb46f06fbbcaad9208f9752003fc4.ppt

- Количество слайдов: 38

Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 -1

Chapter 8 Flexible Budgets and Variance Analysis Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 -2

Chapter 8 Learning Objectives When you have finished studying this chapter, you should be able to: 1. Identify variances and label them as favorable or unfavorable. 2. Distinguish between flexible budgets and static budgets. 3. Use flexible-budget formulas to construct a flexible budget. 4. Compute and interpret static-budget variances, flexible-budget variances, and sales-activity variances. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 -3

Chapter 8 Learning Objectives 5. Understand how the setting of standards affects the computation and interpretation of variances. 6. Compute and interpret price and quantity variances for materials and labor. 7. Compute variable overhead spending and efficiency variances. 8. Compute the fixed-overhead spending variance. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 -4

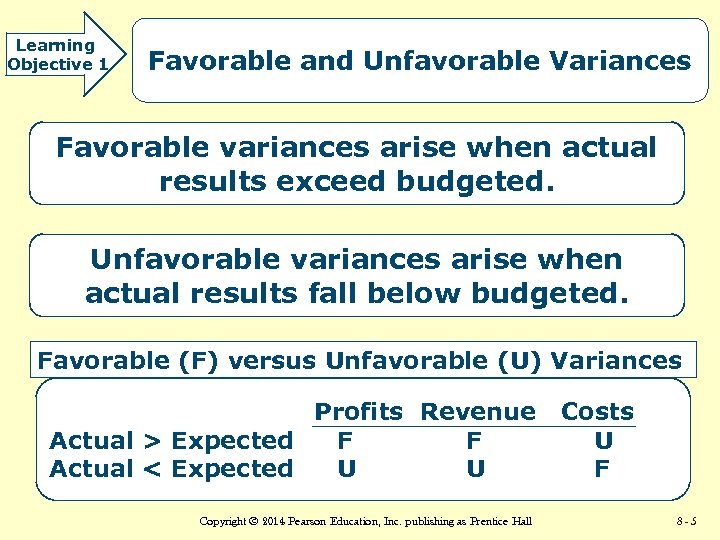

Learning Objective 1 Favorable and Unfavorable Variances Favorable variances arise when actual results exceed budgeted. Unfavorable variances arise when actual results fall below budgeted. Favorable (F) versus Unfavorable (U) Variances Profits Revenue Actual > Expected F F Actual < Expected U U Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall Costs U F 8 -5

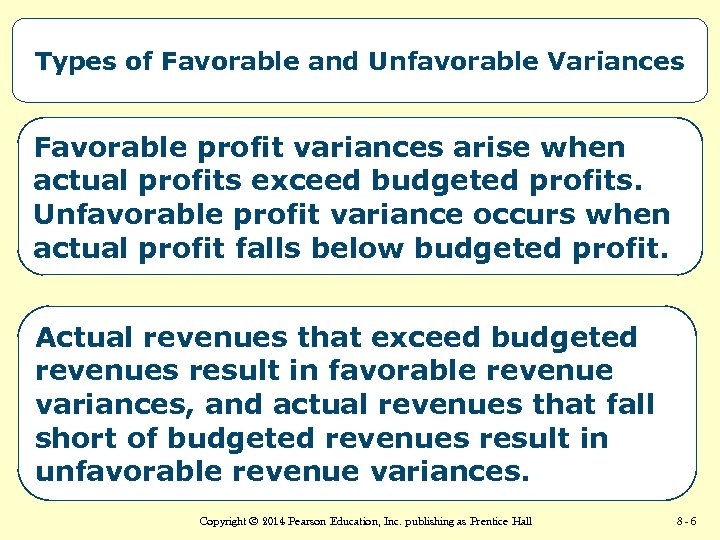

Types of Favorable and Unfavorable Variances Favorable profit variances arise when actual profits exceed budgeted profits. Unfavorable profit variance occurs when actual profit falls below budgeted profit. Actual revenues that exceed budgeted revenues result in favorable revenue variances, and actual revenues that fall short of budgeted revenues result in unfavorable revenue variances. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 -6

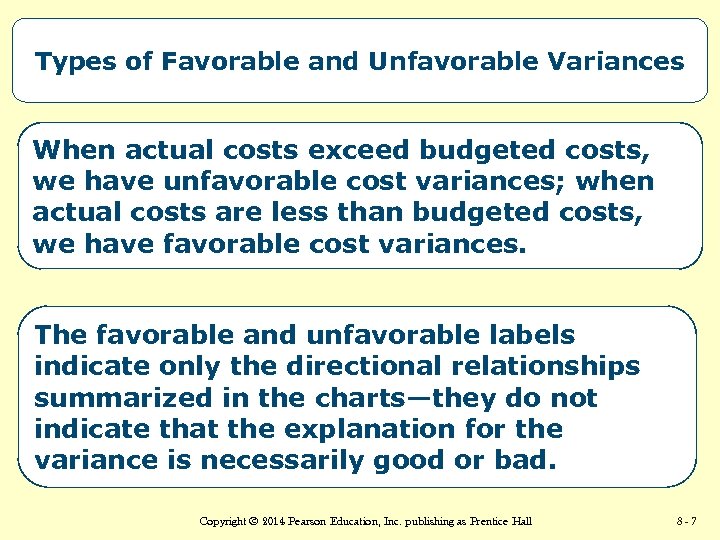

Types of Favorable and Unfavorable Variances When actual costs exceed budgeted costs, we have unfavorable cost variances; when actual costs are less than budgeted costs, we have favorable cost variances. The favorable and unfavorable labels indicate only the directional relationships summarized in the charts—they do not indicate that the explanation for the variance is necessarily good or bad. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 -7

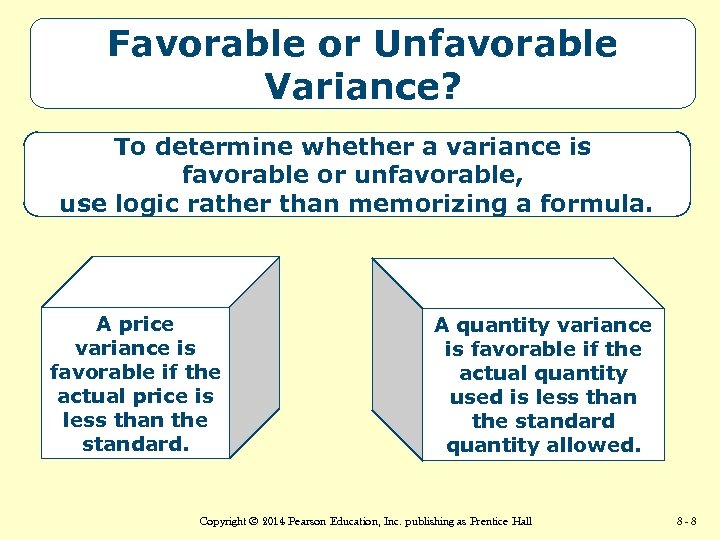

Favorable or Unfavorable Variance? To determine whether a variance is favorable or unfavorable, use logic rather than memorizing a formula. A price variance is favorable if the actual price is less than the standard. A quantity variance is favorable if the actual quantity used is less than the standard quantity allowed. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 -8

Learning Objective 2 Static and Flexible Budgets A static budget is prepared for only one expected level of activity. A budget that adjusts to different levels of activity is a flexible budget (sometimes called a variable budget). Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 -9

Learning Objective 3 Flexible Budget Formulas To develop a flexible budget, managers determine revenue and cost behavior (within the relevant range) with respect to cost drivers. Note that the static budget is just the flexible budget for a single assumed level of activity. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 10

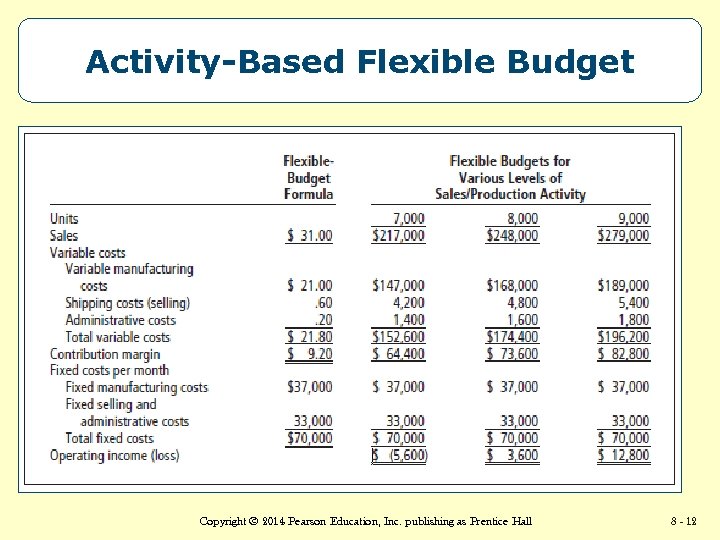

Activity-Based Flexible Budget An activity-based flexible budget is based on budgeted costs for each activity and related cost driver. For each activity, costs depend on a different cost driver. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 11

Activity-Based Flexible Budget Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 12

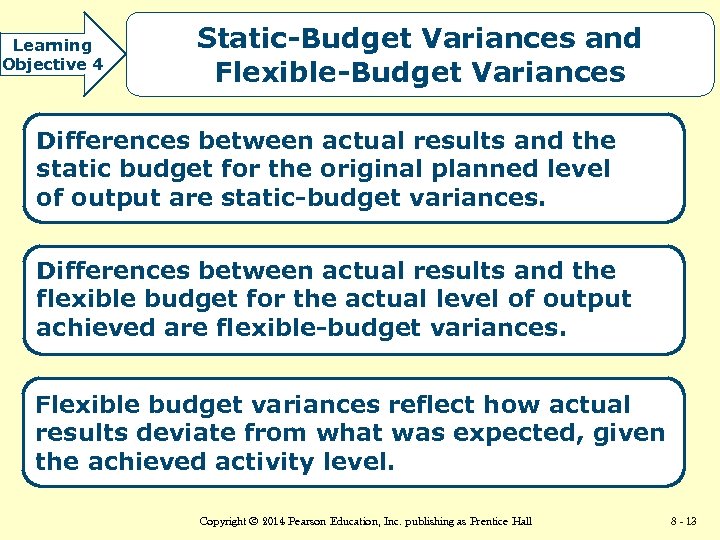

Learning Objective 4 Static-Budget Variances and Flexible-Budget Variances Differences between actual results and the static budget for the original planned level of output are static-budget variances. Differences between actual results and the flexible budget for the actual level of output achieved are flexible-budget variances. Flexible budget variances reflect how actual results deviate from what was expected, given the achieved activity level. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 13

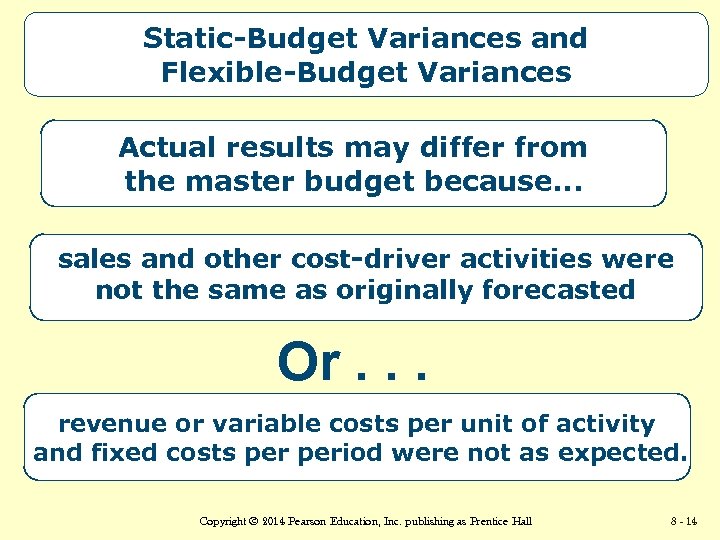

Static-Budget Variances and Flexible-Budget Variances Actual results may differ from the master budget because. . . sales and other cost-driver activities were not the same as originally forecasted Or. . . revenue or variable costs per unit of activity and fixed costs period were not as expected. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 14

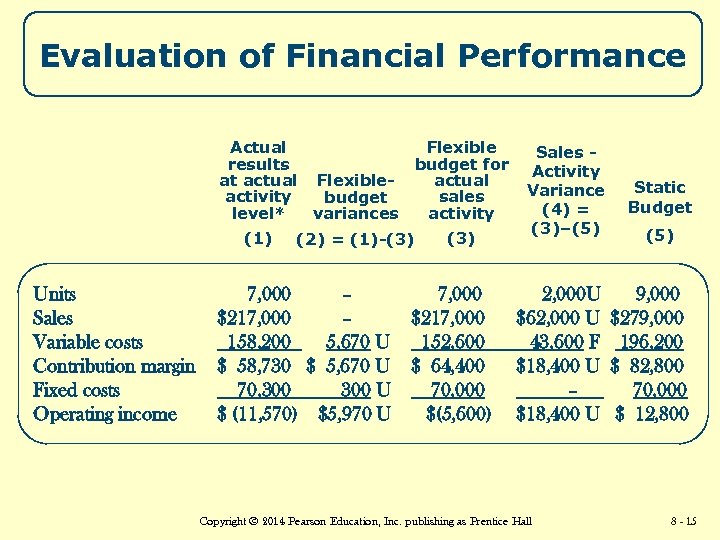

Evaluation of Financial Performance Actual Flexible results budget for at actual Flexibleactual activity sales budget level* activity variances (1) Units Sales Variable costs Contribution margin Fixed costs Operating income (2) = (1)-(3) 7, 000 – 7, 000 $217, 000 – $217, 000 158, 200 5, 670 U 152, 600 $ 58, 730 $ 5, 670 U $ 64, 400 70, 300 U 70, 000 $ (11, 570) $5, 970 U $(5, 600) Sales Activity Variance (4) = (3)–(5) Static Budget 2, 000 U $62, 000 U 43, 600 F $18, 400 U – $18, 400 U 9, 000 $279, 000 196, 200 $ 82, 800 70, 000 $ 12, 800 Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall (5) 8 - 15

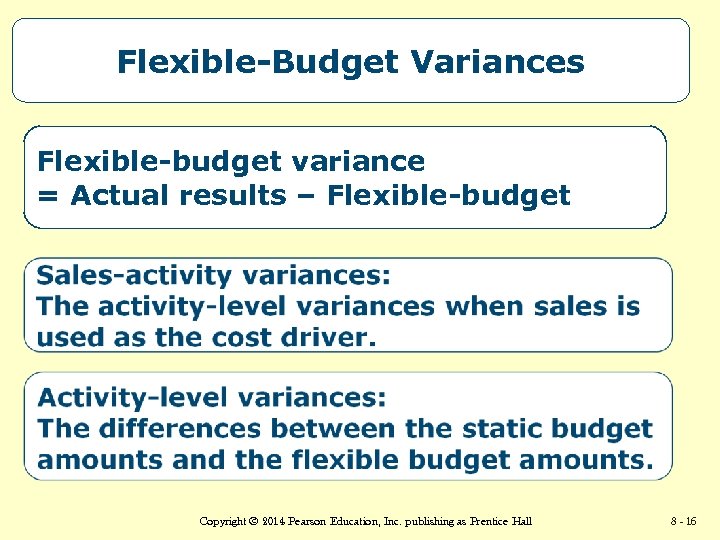

Flexible-Budget Variances Flexible-budget variance = Actual results – Flexible-budget Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 16

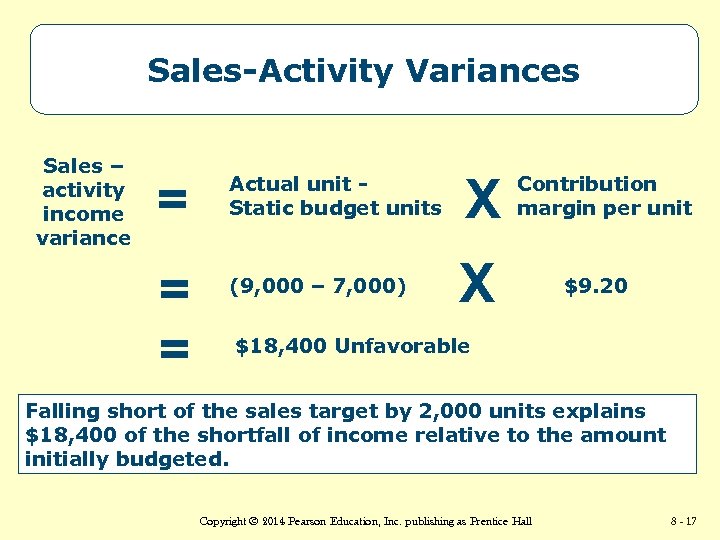

Sales-Activity Variances Sales – activity income variance = = = Actual unit Static budget units X (9, 000 – 7, 000) X Contribution margin per unit $9. 20 $18, 400 Unfavorable Falling short of the sales target by 2, 000 units explains $18, 400 of the shortfall of income relative to the amount initially budgeted. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 17

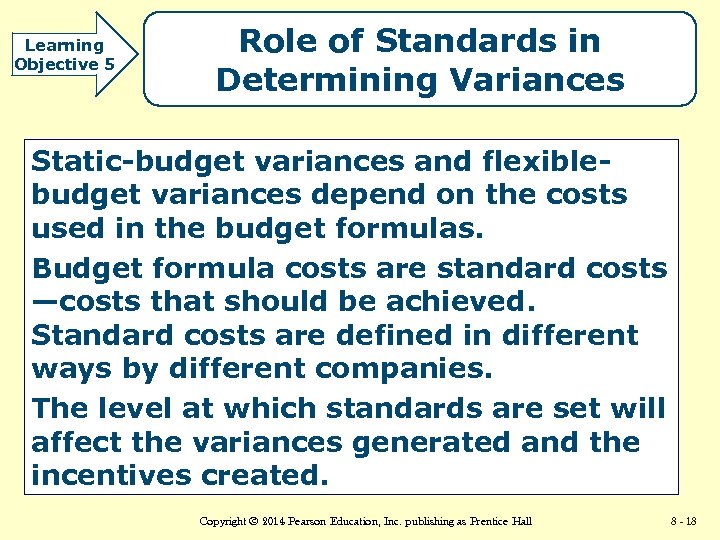

Learning Objective 5 Role of Standards in Determining Variances Static-budget variances and flexiblebudget variances depend on the costs used in the budget formulas. Budget formula costs are standard costs —costs that should be achieved. Standard costs are defined in different ways by different companies. The level at which standards are set will affect the variances generated and the incentives created. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 18

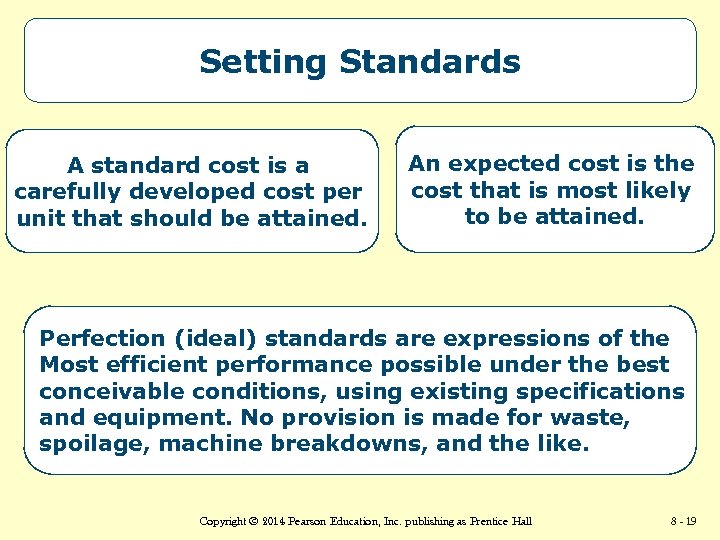

Setting Standards A standard cost is a carefully developed cost per unit that should be attained. An expected cost is the cost that is most likely to be attained. Perfection (ideal) standards are expressions of the Most efficient performance possible under the best conceivable conditions, using existing specifications and equipment. No provision is made for waste, spoilage, machine breakdowns, and the like. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 19

Currently Attainable Standards. . . are levels of performance that managers can achieve by realistic levels of effort. They make allowances for normal defects, spoilage, waste, and nonproductive time. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 20

Trade-Offs Among Variances Improvements in one area could lead to improvements in others and vice versa. Likewise, substandard performance in one area may be balanced by superior performance in others. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 21

When to Investigate Variances When should management investigate a variance? Many organizations have developed such rules of thumb as “investigate all variances exceeding either $5, 000 or 15% of expected cost. ” Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 22

Isolating the Causes of Variances Effectiveness is the degree to which a goal, objective, or target is met. Efficiency is the degree to which inputs are used in relation to a given level of outputs. Performance may be effective, efficient, both, or neither. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 23

Comparison with Prior Periods Some organizations compare the most recent budget period’s actual results with last year’s results for the same period. Even comparisons with the prior month’s actual results may not be as useful as comparisons with an up-to-date flexible budget. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 24

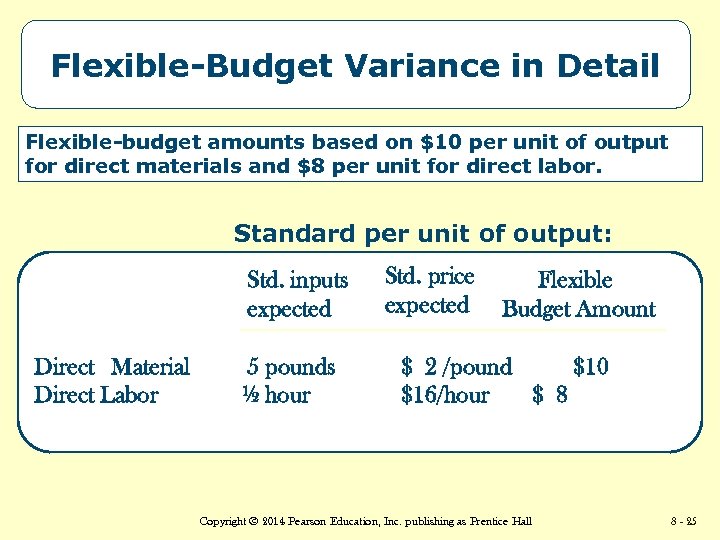

Flexible-Budget Variance in Detail Flexible-budget amounts based on $10 per unit of output for direct materials and $8 per unit for direct labor. Standard per unit of output: Std. inputs expected Direct Material Direct Labor 5 pounds ½ hour Std. price expected Flexible Budget Amount $ 2 /pound $10 $16/hour $ 8 Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 25

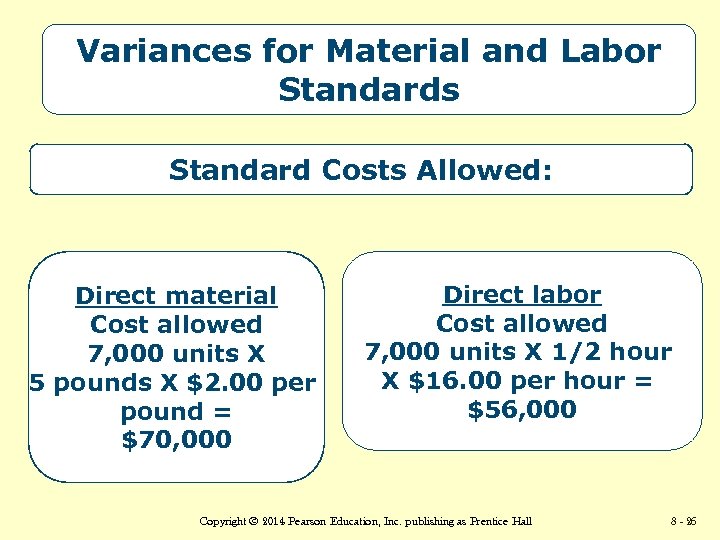

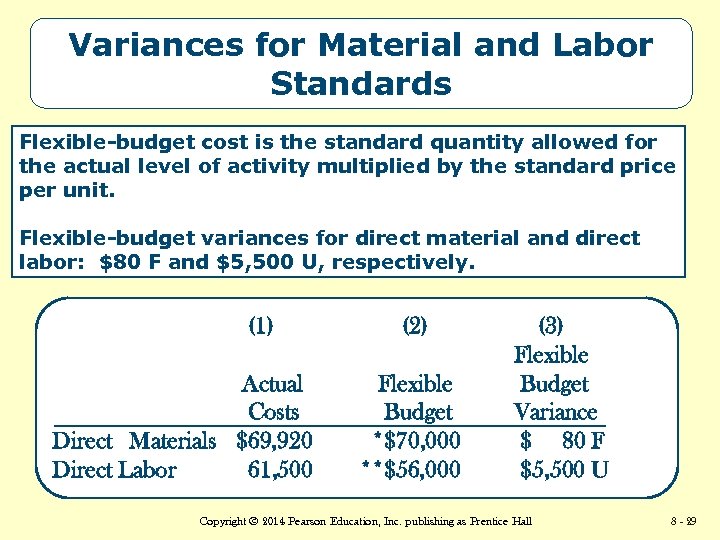

Variances for Material and Labor Standards Standard Costs Allowed: Direct material Cost allowed 7, 000 units X 5 pounds X $2. 00 per pound = $70, 000 Direct labor Cost allowed 7, 000 units X 1/2 hour X $16. 00 per hour = $56, 000 Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 26

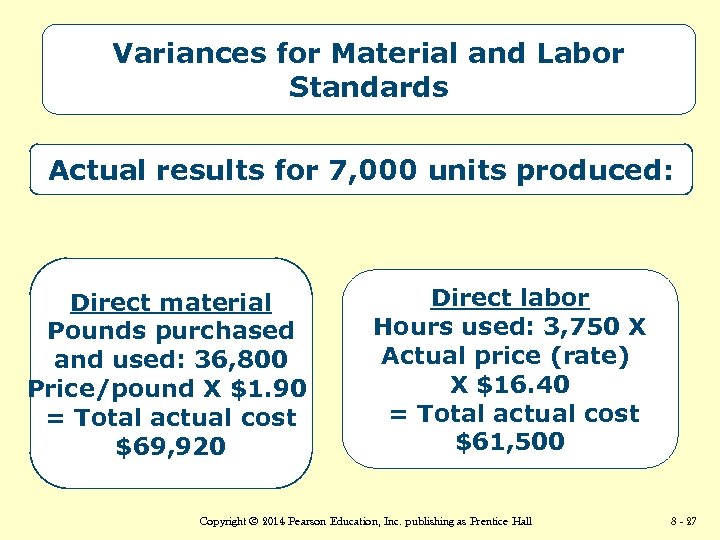

Variances for Material and Labor Standards Actual results for 7, 000 units produced: Direct material Pounds purchased and used: 36, 800 Price/pound X $1. 90 = Total actual cost $69, 920 Direct labor Hours used: 3, 750 X Actual price (rate) X $16. 40 = Total actual cost $61, 500 Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 27

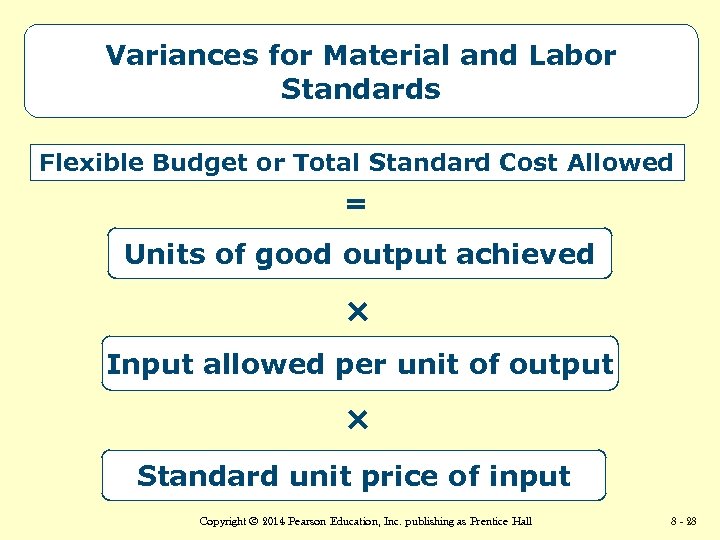

Variances for Material and Labor Standards Flexible Budget or Total Standard Cost Allowed = Units of good output achieved × Input allowed per unit of output × Standard unit price of input Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 28

Variances for Material and Labor Standards Flexible-budget cost is the standard quantity allowed for the actual level of activity multiplied by the standard price per unit. Flexible-budget variances for direct material and direct labor: $80 F and $5, 500 U, respectively. (1) Actual Costs Direct Materials $69, 920 Direct Labor 61, 500 (2) Flexible Budget *$70, 000 **$56, 000 (3) Flexible Budget Variance $ 80 F $5, 500 U Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 29

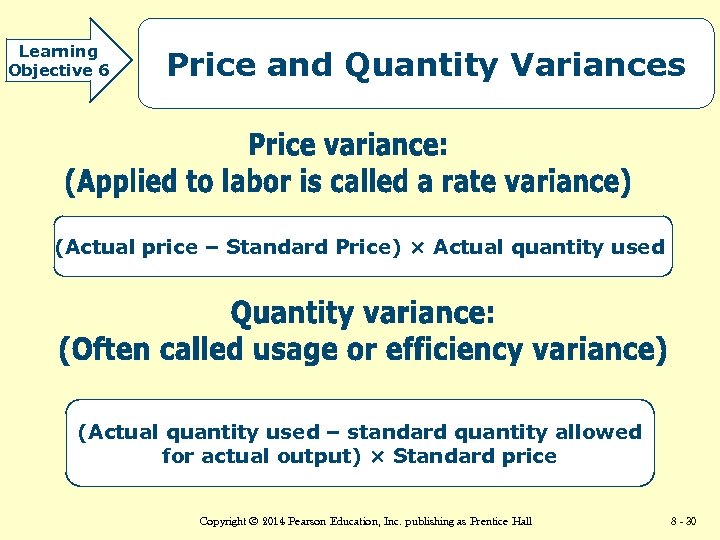

Learning Objective 6 Price and Quantity Variances (Actual price – Standard Price) × Actual quantity used (Actual quantity used – standard quantity allowed for actual output) × Standard price Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 30

![Quantity (Usage) Variance Computations [36, 800 – (7, 000 × 5)] pounds × $2 Quantity (Usage) Variance Computations [36, 800 – (7, 000 × 5)] pounds × $2](https://present5.com/presentation/e43bb46f06fbbcaad9208f9752003fc4/image-31.jpg)

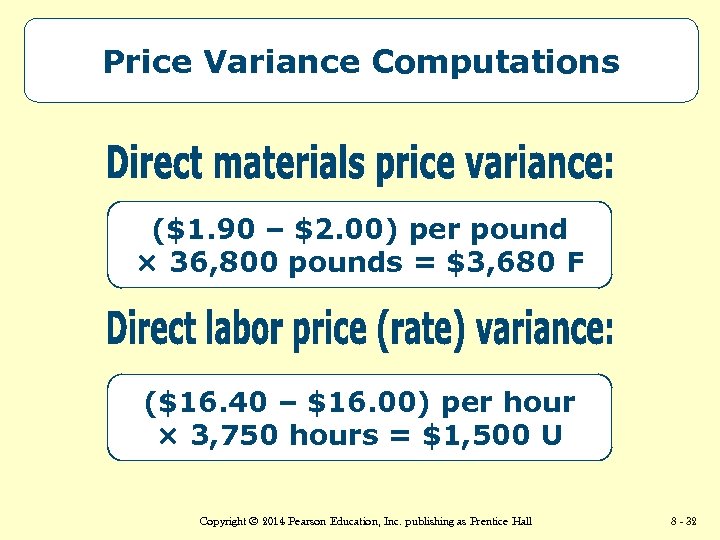

Quantity (Usage) Variance Computations [36, 800 – (7, 000 × 5)] pounds × $2 per pound = $3, 600 U [3, 750 – (7, 000 × ½)] hours × $16 per hour = $4, 000 U Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 31

Price Variance Computations ($1. 90 – $2. 00) per pound × 36, 800 pounds = $3, 680 F ($16. 40 – $16. 00) per hour × 3, 750 hours = $1, 500 U Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 32

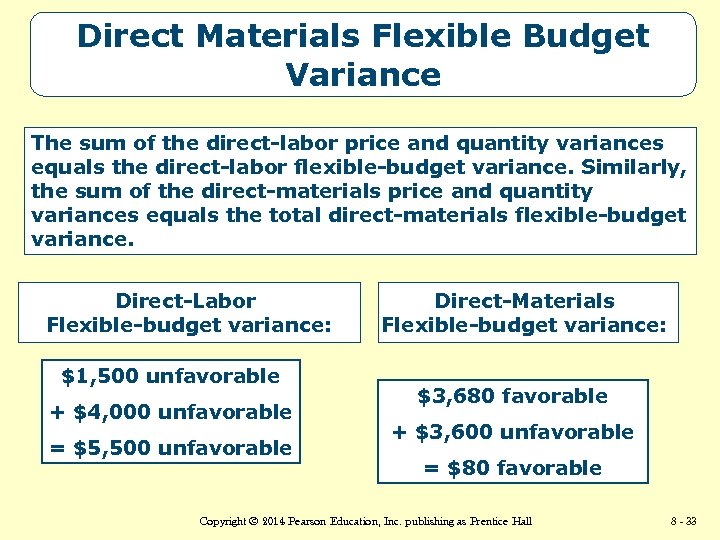

Direct Materials Flexible Budget Variance The sum of the direct-labor price and quantity variances equals the direct-labor flexible-budget variance. Similarly, the sum of the direct-materials price and quantity variances equals the total direct-materials flexible-budget variance. Direct-Labor Flexible-budget variance: $1, 500 unfavorable + $4, 000 unfavorable = $5, 500 unfavorable Direct-Materials Flexible-budget variance: $3, 680 favorable + $3, 600 unfavorable = $80 favorable Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 33

Interpretation of Price and Quantity Variances By dividing flexible-budget variances into price and quantity variances, managers can be better evaluated on variances that they can control. Price and quantity variances are helpful because they provide feedback to those responsible for managing inputs. Managers should not use these variances alone for decision making, control, or evaluation. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 34

Learning Objective 7 Variable-Overhead Spending and Efficiency Variances A variable-overhead efficiency variance occurs when actual cost-driver activity differs from the standard amount allowed for the actual output achieved. A variable-overhead spending variance occurs when the difference between the actual variable overhead and the amount of variable overhead budgeted for the actual level of cost-driver activity. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 35

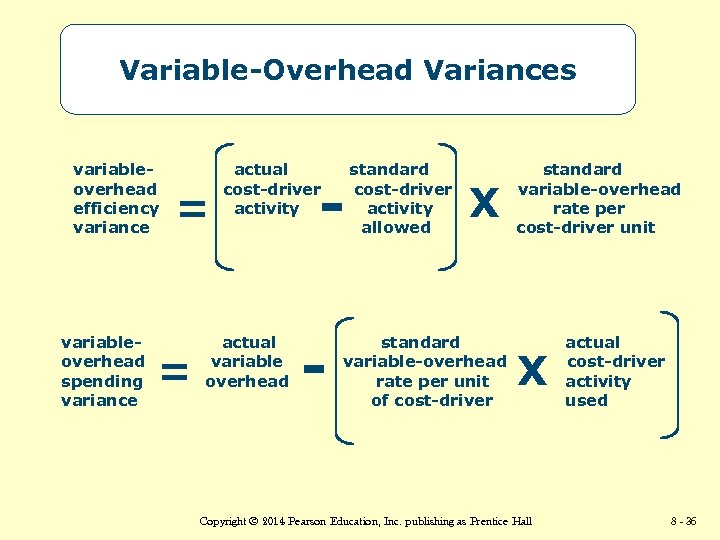

Variable-Overhead Variances variableoverhead efficiency variance variableoverhead spending variance = = actual cost-driver activity actual variable overhead - - standard cost-driver activity allowed X standard variable-overhead rate per unit of cost-driver standard variable-overhead rate per cost-driver unit X Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall actual cost-driver activity used 8 - 36

Learning Objective 8 Fixed Overhead Spending Variance The flexible budget based on actual use of the cost driver and the flexible budget based on standard use of the cost driver are always the same because fixed overhead does not vary with the level of use of the cost driver. Therefore. . . The difference between actual fixed overhead and budgeted fixed overhead is the fixed overhead spending variance. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 37

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher. Printed in the United States of America. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8 - 38

e43bb46f06fbbcaad9208f9752003fc4.ppt