047c69da806d364855713ab77c603a91.ppt

- Количество слайдов: 51

Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -1

Chapter 4 Cost Management Systems and Activity-Based Costing Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -2

Chapter 4 Learning Objectives 1. Describe the purposes of cost management systems. 2. Explain the relationship among cost, cost object, cost accumulation, and cost assignment. 3. Distinguish between direct and indirect costs. 4. Explain the major reasons for allocating costs. 5. Identify the main types of manufacturing costs: direct materials, direct labor, and indirect production costs. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -3

Chapter 4 Learning Objectives 6. Explain how the financial statements of merchandisers and manufacturers differ because of the types of goods they sell. 7. Understand the main differences between traditional and activity-based costing (ABC) systems and why ABC systems provide value to managers. 8. Use activity-based management (ABM) to make strategic and operational control decisions. 9. Describe the steps in designing an activity-based costing system (Appendix 4). Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -4

Learning Objective 1 Cost Management System A cost management system (CMS) is a collection of tools and techniques that identifies how management’s decisions affect costs. The primary purposes of a cost management system are: 1. To provide cost information for strategic management decisions and operational control and 2. For measures of inventory value and cost of goods sold for financial reporting. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -5

Cost A cost is a sacrifice or giving up of resources for a particular purpose. Costs are frequently measured by the monetary units that must be paid for goods and services. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -6

Cost Object A cost object (objective) is anything for which a separate measurement of costs is desired. Customers Service Processing orders Departments Product Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -7

Cost Accounting Systems Cost accounting is that part of the cost management system that measures costs for the purposes of management decision making and financial reporting. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -8

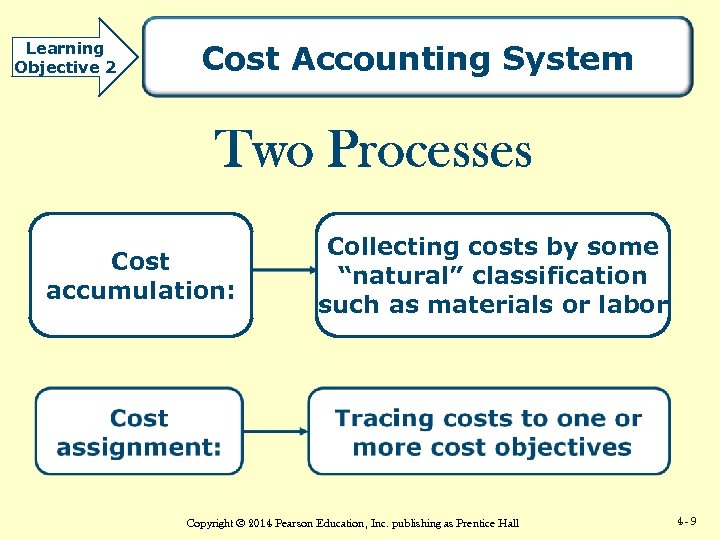

Learning Objective 2 Cost Accounting System Two Processes Cost accumulation: Collecting costs by some “natural” classification such as materials or labor Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 44 -9

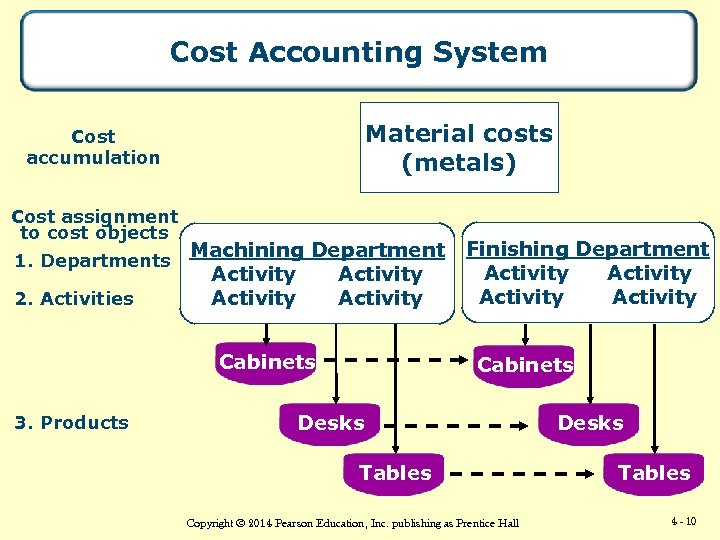

Cost Accounting System Material costs (metals) Cost accumulation Cost assignment to cost objects 1. Departments 2. Activities Machining Department Activity Cabinets 3. Products Finishing Department Activity Cabinets Desks Tables Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall Desks Tables 4 4 -- 10

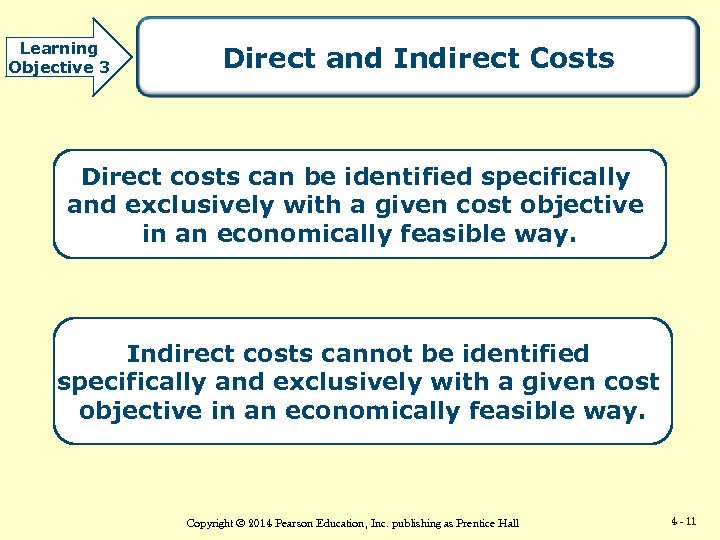

Learning Objective 3 Direct and Indirect Costs Direct costs can be identified specifically and exclusively with a given cost objective in an economically feasible way. Indirect costs cannot be identified specifically and exclusively with a given cost objective in an economically feasible way. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 11

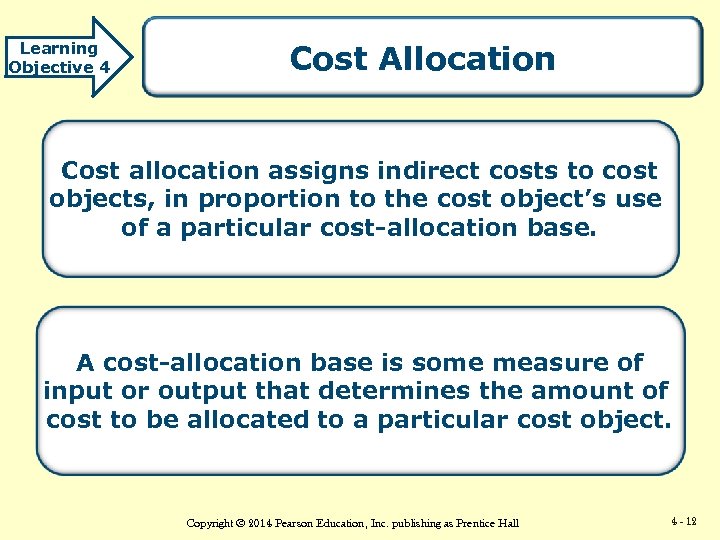

Learning Objective 4 Cost Allocation Cost allocation assigns indirect costs to cost objects, in proportion to the cost object’s use of a particular cost-allocation base. A cost-allocation base is some measure of input or output that determines the amount of cost to be allocated to a particular cost object. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 12

Cost Allocation An ideal cost-allocation base would measure how much of the particular cost is caused by the cost objective. Note the similarity of this definition to that of a cost driver—an output measure that causes costs. Therefore, most allocation bases are cost drivers. Cost allocations support a company’s CMS that provides cost measurements for strategic decision making, operational control, and external reporting. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 13

Cost Allocation Four purposes of cost allocation: v Predict economic effects of strategic and operational control decisions. v. Provide desired motivation and feedback for performance evaluation. v. Compute income and asset valuations for financial reporting. v. Justify costs or obtain reimbursement. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 14

Cost Pool Individual costs allocated to cost objects using a single cost-allocation base. 1. Accumulate indirect costs for a period of time. 2. Select an allocation base for each cost pool, preferably a cost driver, that is, a measure that causes the costs in the cost pool. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 15

Cost Pool 3. Measure the units of the cost-allocation base used for each cost object and compute the total units used for all cost objects. 4. Multiply the percentage by the total costs in the cost pool to determine the cost allocated to each cost object. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 16

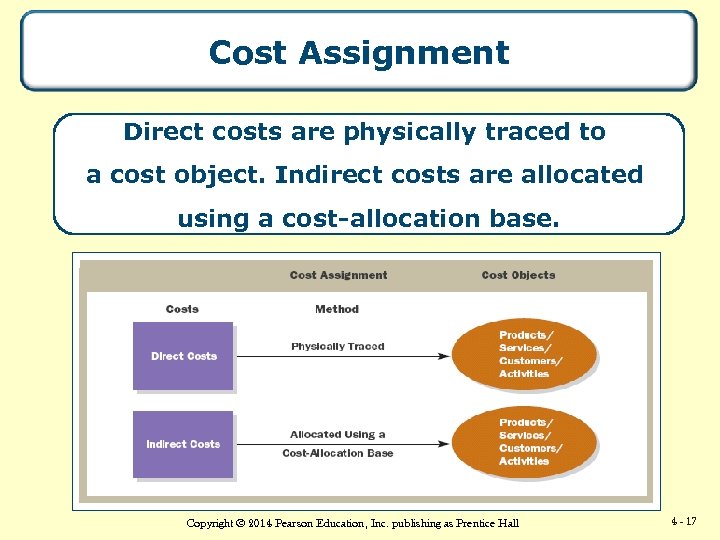

Cost Assignment Direct costs are physically traced to a cost object. Indirect costs are allocated using a cost-allocation base. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 17

Unallocated Costs Some costs lack an identifiable relationship to a cost object. Often it is best to leave such costs unallocated. An unallocated cost for one company may be an allocated cost or even a direct cost for another. These unallocated costs are recorded but not assigned to any cost object. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 18

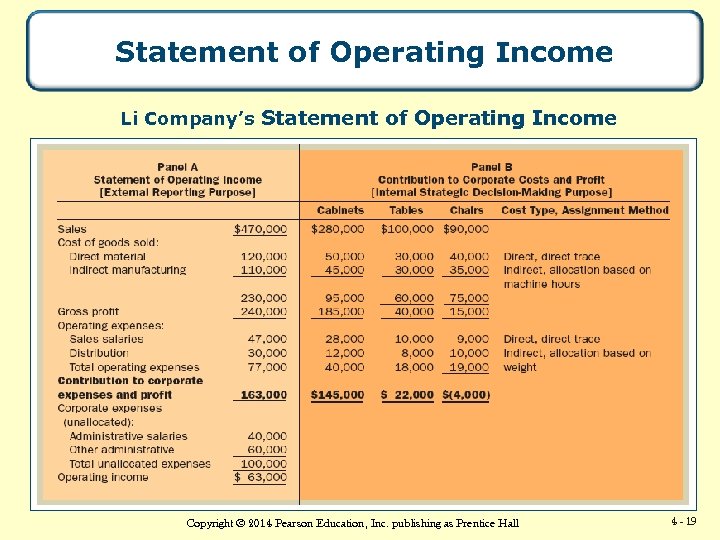

Statement of Operating Income Li Company’s Statement of Operating Income Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 19

Learning Objective 5 Categories of Manufacturing Costs Manufacturing operations transform raw materials, the basic materials from which a product is made, into other goods through the use of labor and factory facilities. In manufacturing companies, products are frequently the cost object. Manufacturing companies classify production costs as either (1) direct material, (2) direct-labor, or (3) indirect production costs Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 20

Categories of Manufacturing Costs Direct materials include the acquisition costs of all materials that a company identifies as a part of the manufactured goods. These costs are identified in an economically feasible way. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 21

Direct Labor Costs Direct Labor costs include the wages of all labor that can be traced specifically and exclusively to the manufactured goods in an economically feasible way. In highly automated factories with a flexible workforce, there may not be any direct-labor costs because all workers may spend time overseeing numerous products, making it economically infeasible to physically trace any labor cost directly to specified products. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 22

Indirect Production Costs (Manufacturing Overhead) Manufacturing overhead includes all costs associated with the production process that the company cannot trace to the manufactured goods in an economically feasible way. Depreciation , property taxes, supplies, and insurance are examples of indirect costs of production. Minor items, such as tacks or glue, and many labor costs, such as janitors and forklift operators, are considered indirect labor costs and economically infeasible to trace. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 23

Product Costs Product costs are costs identified with goods produced or purchased for resale. These costs first become part of the inventory on hand, sometimes called inventoriable costs. Inventoriable costs become expenses in the form of cost of goods sold only when the inventory is sold. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 24

Period Costs Period costs are deducted as expenses during the current period without going through an inventory stage. These costs are accumulated by departments, such as R&D, advertising, and sales. Most of these costs are reported as selling and administrative expenses. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 25

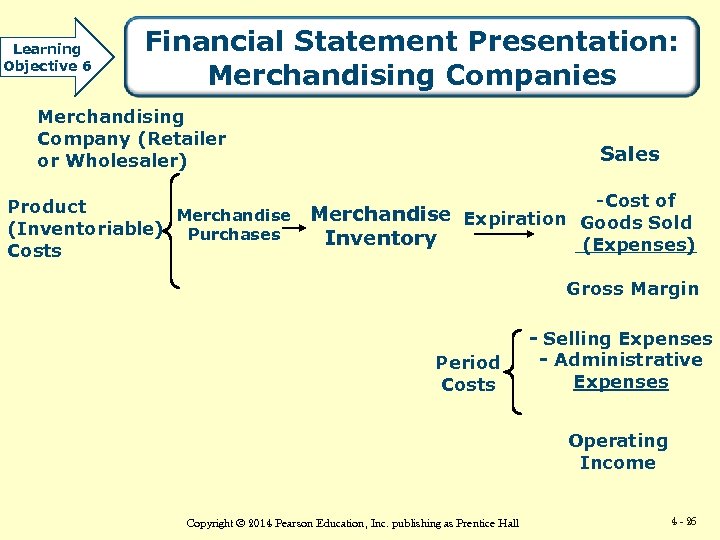

Learning Objective 6 Financial Statement Presentation: Merchandising Companies Merchandising Company (Retailer or Wholesaler) Product Merchandise (Inventoriable) Purchases Costs Sales -Cost of Merchandise Expiration Goods Sold Inventory (Expenses) Gross Margin Period Costs - Selling Expenses - Administrative Expenses Operating Income Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 26

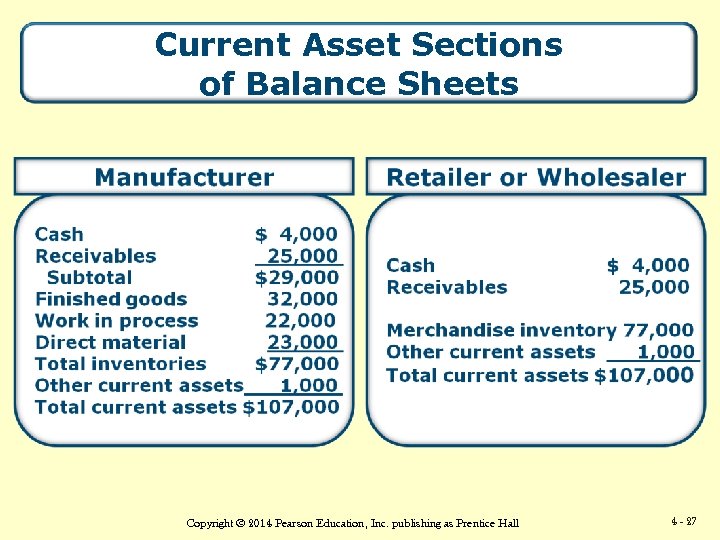

Current Asset Sections of Balance Sheets Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 27

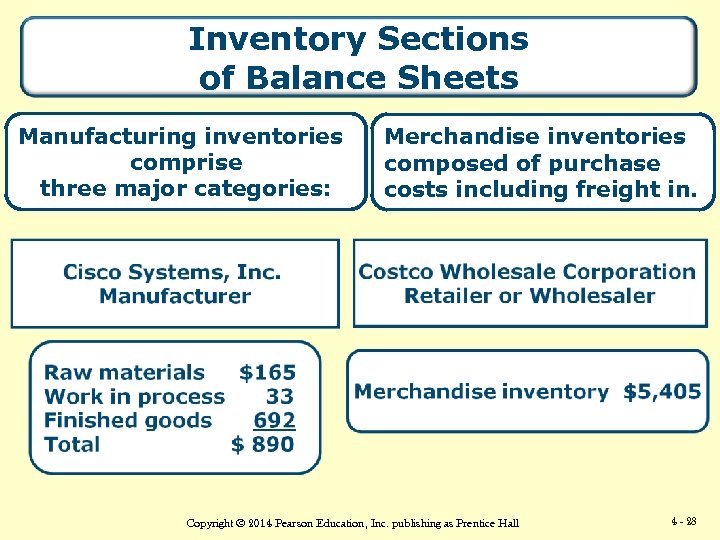

Inventory Sections of Balance Sheets Manufacturing inventories comprise three major categories: Merchandise inventories composed of purchase costs including freight in. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 28

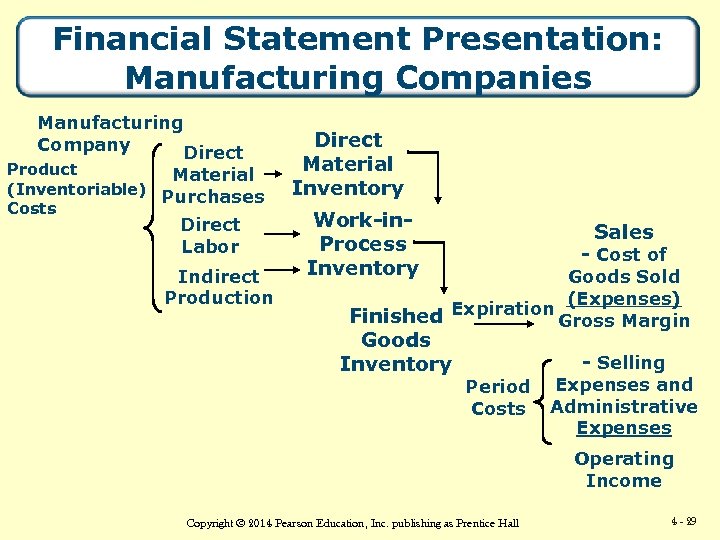

Financial Statement Presentation: Manufacturing Companies Manufacturing Company Direct Product Material (Inventoriable) Purchases Costs Direct Labor Indirect Production Direct Material Inventory Work-in. Process Inventory Sales - Cost of Goods Sold (Expenses) Expiration Finished Gross Margin Goods Inventory Period Costs - Selling Expenses and Administrative Expenses Operating Income Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 29

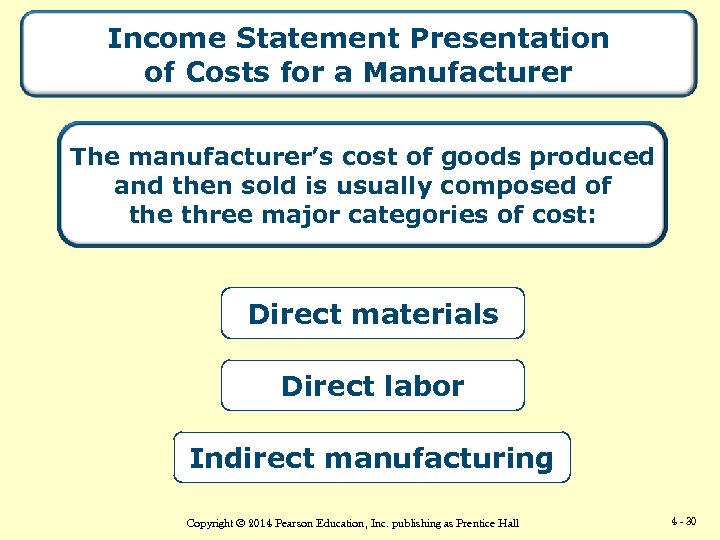

Income Statement Presentation of Costs for a Manufacturer The manufacturer’s cost of goods produced and then sold is usually composed of the three major categories of cost: Direct materials Direct labor Indirect manufacturing Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 30

Income Statement Presentation of Costs for a Retailer The merchandiser’s cost of goods sold is usually composed of the purchase cost of items, including freight-in, that are acquired and then resold. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 31

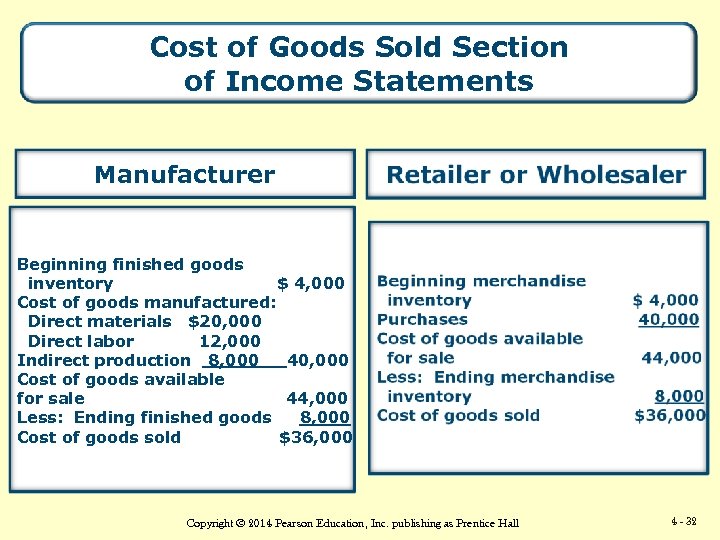

Cost of Goods Sold Section of Income Statements Manufacturer Beginning finished goods inventory $ 4, 000 Cost of goods manufactured: Direct materials $20, 000 Direct labor 12, 000 Indirect production 8, 000 40, 000 Cost of goods available for sale 44, 000 Less: Ending finished goods 8, 000 Cost of goods sold $36, 000 Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 32

Learning Objective 7 Types of Costing Systems There are many different cost accounting systems, but most of the important features of these systems can be described in terms of two general types—traditional and activity-based cost accounting systems. Companies adopt cost accounting systems that are consistent with their management philosophies and their production and operating technologies. Changes in philosophies or technologies often prompt corresponding changes in cost accounting systems. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 33

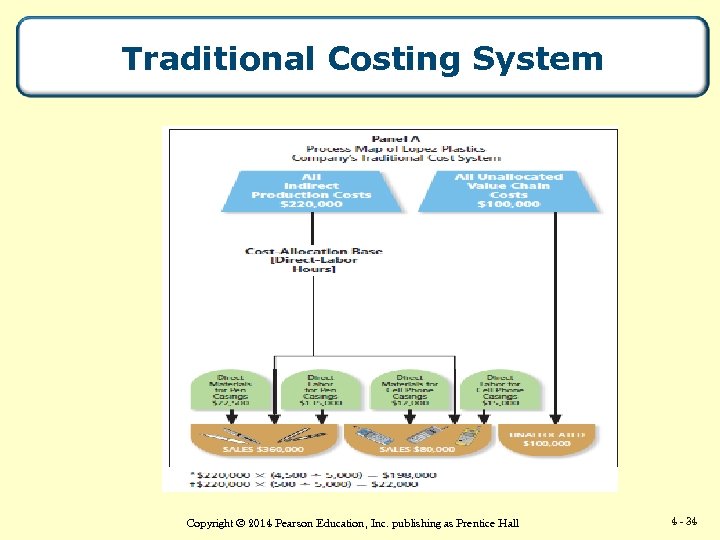

Traditional Costing System Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 34

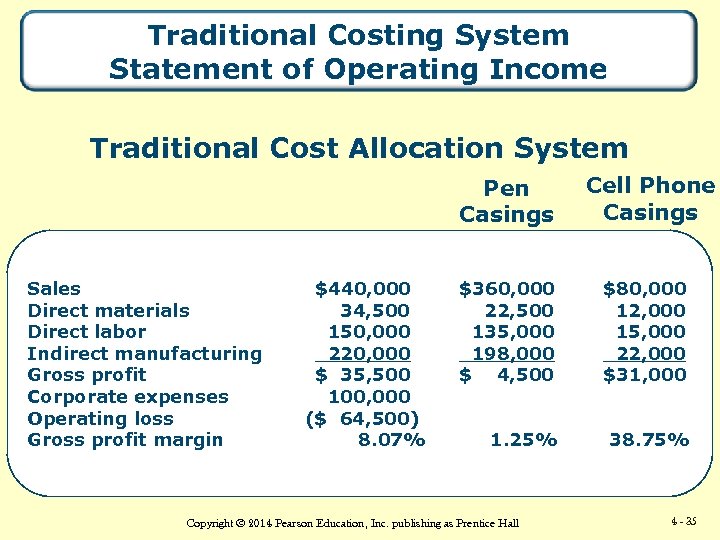

Traditional Costing System Statement of Operating Income Traditional Cost Allocation System Pen Casings Sales Direct materials Direct labor Indirect manufacturing Gross profit Corporate expenses Operating loss Gross profit margin $440, 000 34, 500 150, 000 220, 000 $ 35, 500 100, 000 ($ 64, 500) 8. 07% Cell Phone Casings $360, 000 22, 500 135, 000 198, 000 $ 4, 500 $80, 000 12, 000 15, 000 22, 000 $31, 000 1. 25% 38. 75% Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 35

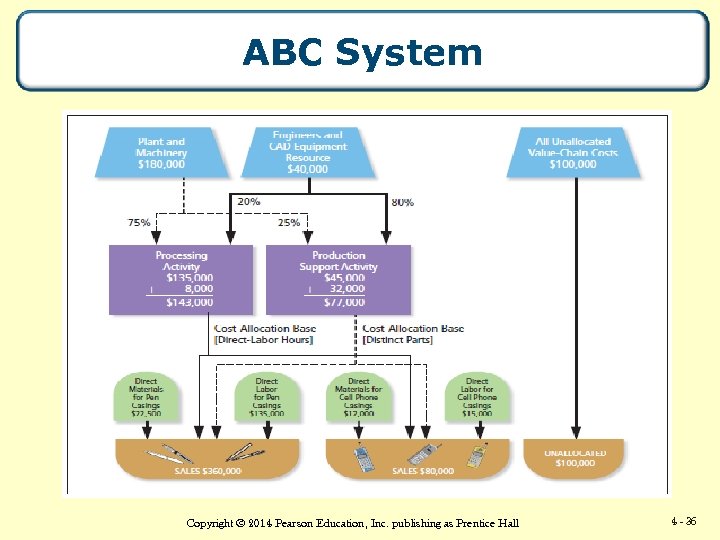

ABC System Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 36

Learning Objective 8 Activity-Based Management ABM is using the output of an activity-based cost accounting system to aid strategic decision making and to improve operational control. A value-added cost is the cost of an activity that cannot be eliminated without affecting a product’s value to the customer. Nonvalue-added costs are costs that can be eliminated without affecting a product’s value to the customer. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 37

Activity-Based Management Benchmarking is the continuous process of comparing products, services, and activities to the best industry standards. Benchmarking is a tool to help an organization measure its competitive posture. Benchmarks can come from within the organization, from competing organizations, or from other organizations having similar processes. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 38

Benefits of Activity-Based Costing and Management Systems Companies adopt ABC systems to: Ø set an optimal product mix Ø estimate profit margins of new products Ø determine consumption of shared resources Ø keep pace with new product techniques Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 39

Benefits of Activity-Based Costing and Management Systems (cont. ) Companies adopt ABC systems to: Ø keep pace with technological changes Ø decrease costs associated with bad decisions Ø Ø take advantage of reduced cost of ABC Systems due to computer technology Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 40

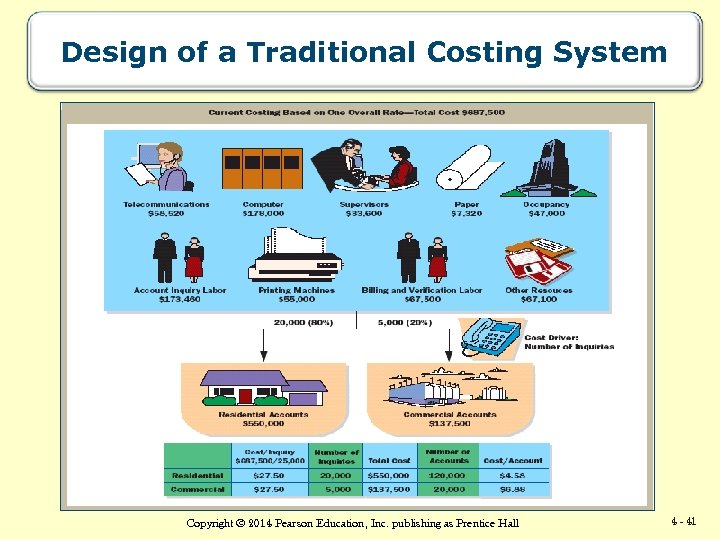

Design of a Traditional Costing System Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 41

Learning Objective 9 Design of an Activity-Based Cost Accounting System Determine the key components of the cost accounting system. ØCost objectives ØKey activities ØResources ØRelated cost drivers Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 42

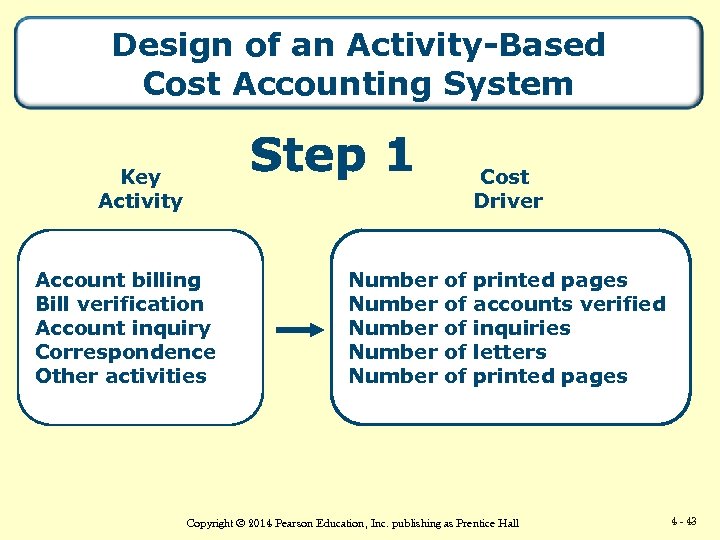

Design of an Activity-Based Cost Accounting System Key Activity Cost Driver Account billing Bill verification Account inquiry Correspondence Other activities Number Number of of of printed pages accounts verified inquiries letters printed pages Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 43

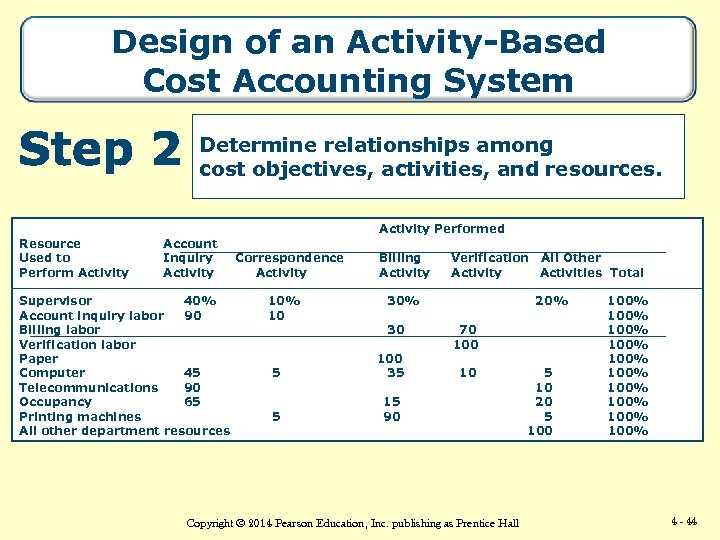

Design of an Activity-Based Cost Accounting System Determine relationships among cost objectives, activities, and resources. Resource Used to Perform Activity Account Inquiry Activity Supervisor 40% Account inquiry labor 90 Billing labor Verification labor Paper Computer 45 Telecommunications 90 Occupancy 65 Printing machines All other department resources Activity Performed Correspondence Activity 10% 10 Billing Activity Verification All Other Activity Activities Total 30% 30 5 100 35 5 20% 70 100 15 90 10 Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 5 10 20 5 100% 100% 100% 4 4 -- 44

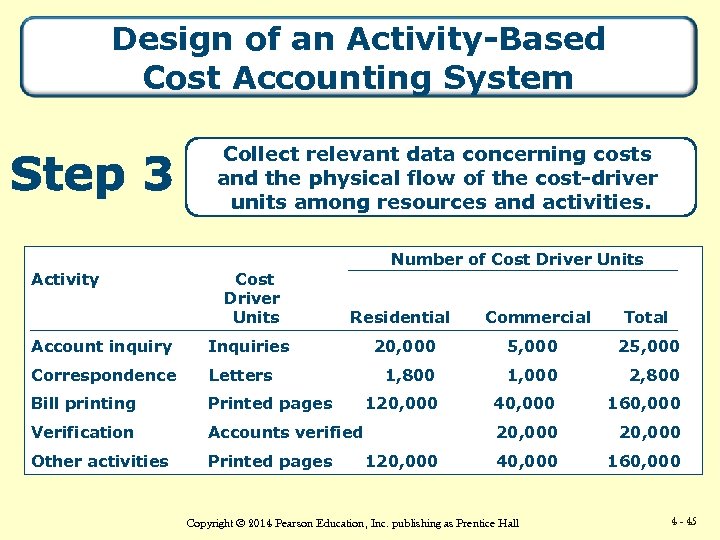

Design of an Activity-Based Cost Accounting System Collect relevant data concerning costs and the physical flow of the cost-driver units among resources and activities. Activity Number of Cost Driver Units Residential Account inquiry Inquiries 20, 000 5, 000 25, 000 Correspondence Letters 1, 800 1, 000 2, 800 Bill printing Printed pages 120, 000 40, 000 160, 000 Verification Accounts verified 20, 000 Other activities Printed pages 40, 000 160, 000 120, 000 Commercial Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall Total 4 4 -- 45

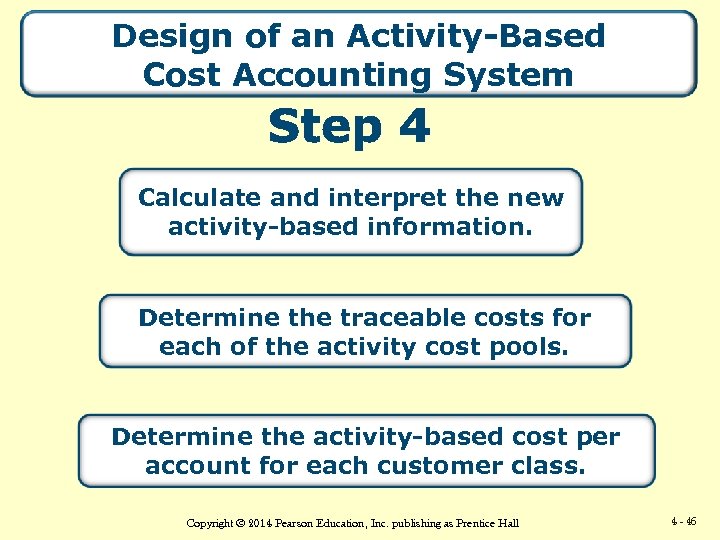

Design of an Activity-Based Cost Accounting System Calculate and interpret the new activity-based information. Determine the traceable costs for each of the activity cost pools. Determine the activity-based cost per account for each customer class. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 46

Strategic Decisions, Operational Cost Control, and ABM Outsourcing Reducing operating costs Identifying nonvalue-added activities Improving both strategic and operational decisions Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 47

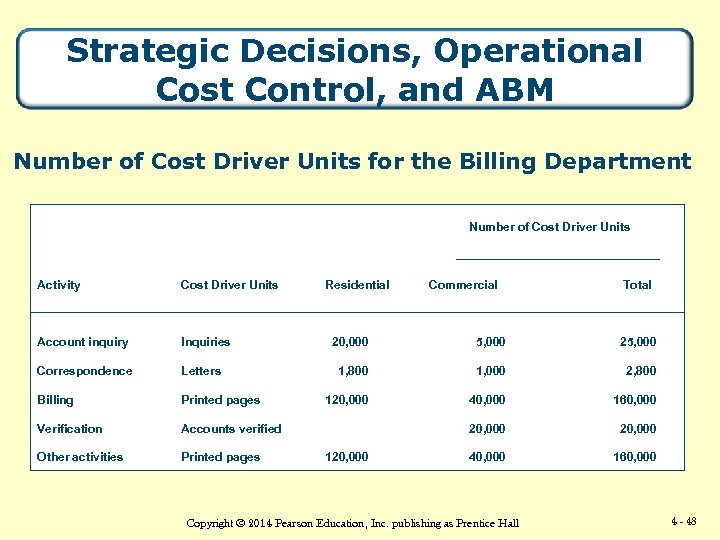

Strategic Decisions, Operational Cost Control, and ABM Number of Cost Driver Units for the Billing Department Number of Cost Driver Units Activity Cost Driver Units Account inquiry Inquiries Correspondence Letters Billing Printed pages Verification Accounts verified Other activities Printed pages Residential Commercial Total 20, 000 5, 000 25, 000 1, 800 1, 000 2, 800 120, 000 40, 000 160, 000 120, 000 Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 48

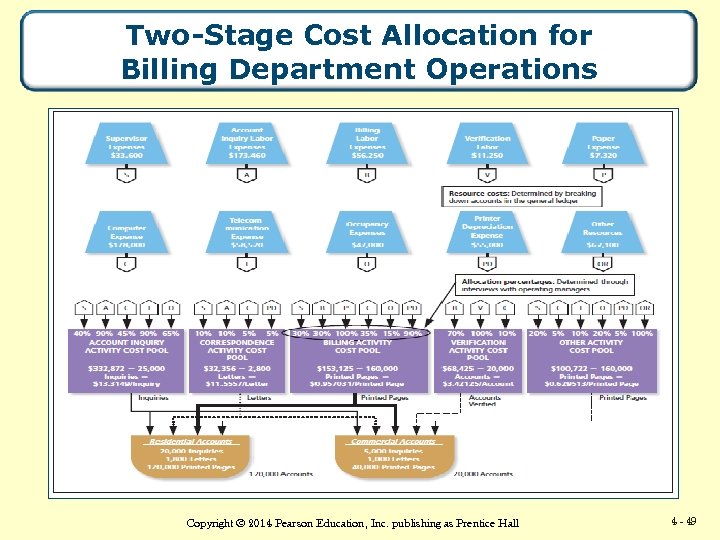

Two-Stage Cost Allocation for Billing Department Operations Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 49

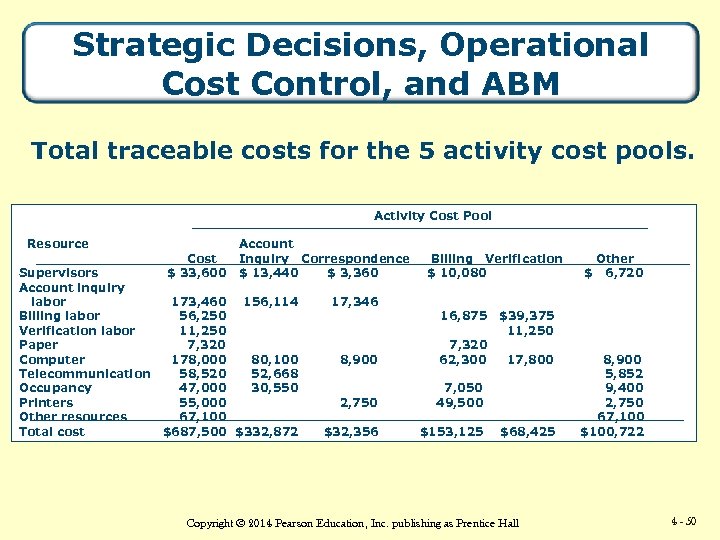

Strategic Decisions, Operational Cost Control, and ABM Total traceable costs for the 5 activity cost pools. Activity Cost Pool Resource Supervisors Account inquiry labor Billing labor Verification labor Paper Computer Telecommunication Occupancy Printers Other resources Total cost Cost $ 33, 600 Account Inquiry Correspondence $ 13, 440 $ 3, 360 173, 460 156, 114 56, 250 11, 250 7, 320 178, 000 80, 100 58, 520 52, 668 47, 000 30, 550 55, 000 67, 100 $687, 500 $332, 872 17, 346 Billing Verification $ 10, 080 16, 875 8, 900 7, 320 62, 300 2, 750 $153, 125 $39, 375 11, 250 7, 050 49, 500 $32, 356 Other $ 6, 720 17, 800 $68, 425 Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 8, 900 5, 852 9, 400 2, 750 67, 100 $100, 722 4 4 -- 50

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher. Printed in the United States of America. Copyright © 2014 Pearson Education, Inc. publishing as Prentice Hall 4 4 -- 51

047c69da806d364855713ab77c603a91.ppt