f3136f3d06297a72bcfcb7e0de089ca9.ppt

- Количество слайдов: 53

Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 1

Internal Control and Cash Chapter 4 Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 2

Learning Objective 1 Describe fraud and its impact Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 3

Fraud • Intentional misrepresentation of facts • Causes injury or damage to another party • Large problem that increases each year Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 4

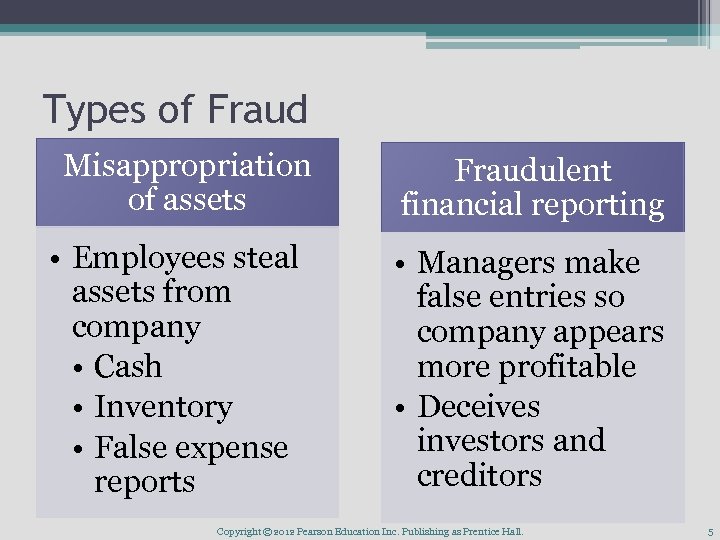

Types of Fraud Misappropriation of assets • Employees steal assets from company • Cash • Inventory • False expense reports Fraudulent financial reporting • Managers make false entries so company appears more profitable • Deceives investors and creditors Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 5

Fraud Triangle Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 6

Learning Objective Two Explain the objectives and components of internal control Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 11

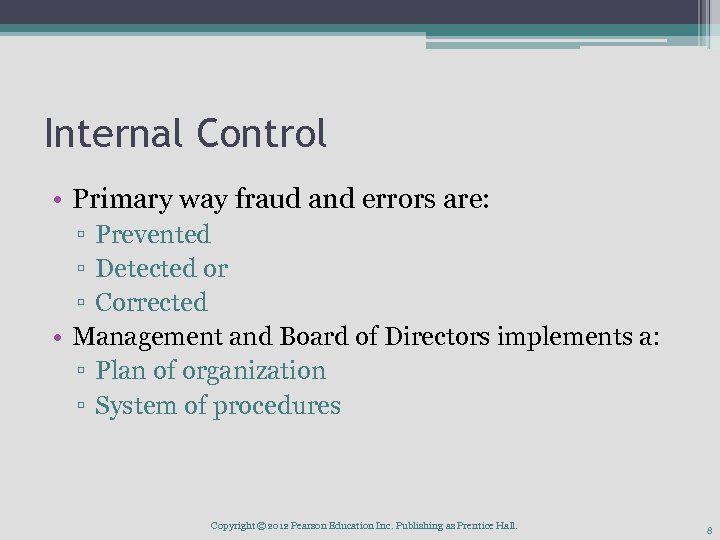

Internal Control • Primary way fraud and errors are: ▫ Prevented ▫ Detected or ▫ Corrected • Management and Board of Directors implements a: ▫ Plan of organization ▫ System of procedures Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 8

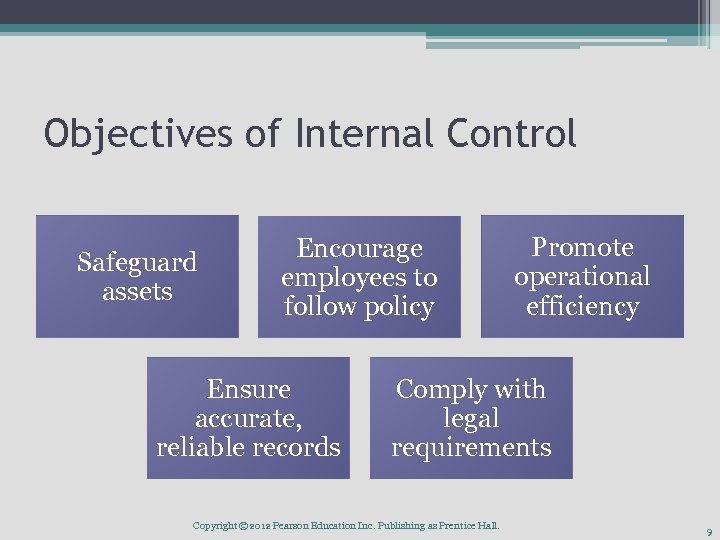

Objectives of Internal Control Safeguard assets Encourage employees to follow policy Ensure accurate, reliable records Promote operational efficiency Comply with legal requirements Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 9

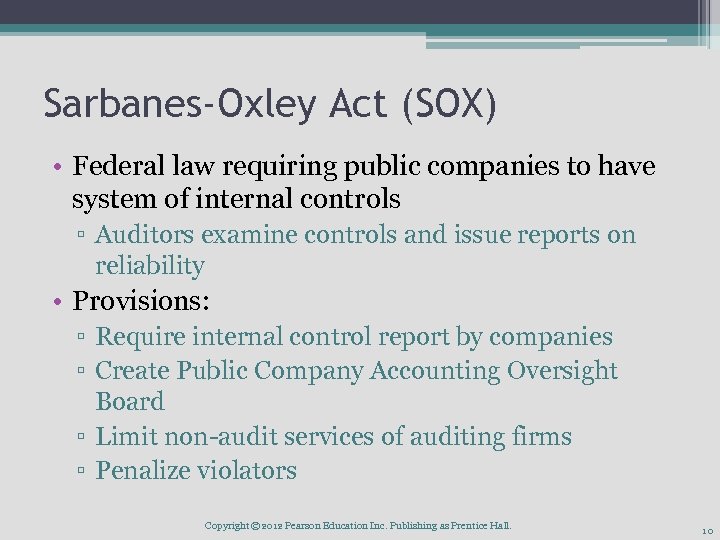

Sarbanes-Oxley Act (SOX) • Federal law requiring public companies to have system of internal controls ▫ Auditors examine controls and issue reports on reliability • Provisions: ▫ Require internal control report by companies ▫ Create Public Company Accounting Oversight Board ▫ Limit non-audit services of auditing firms ▫ Penalize violators Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 10

Shield of Internal Controls Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 11

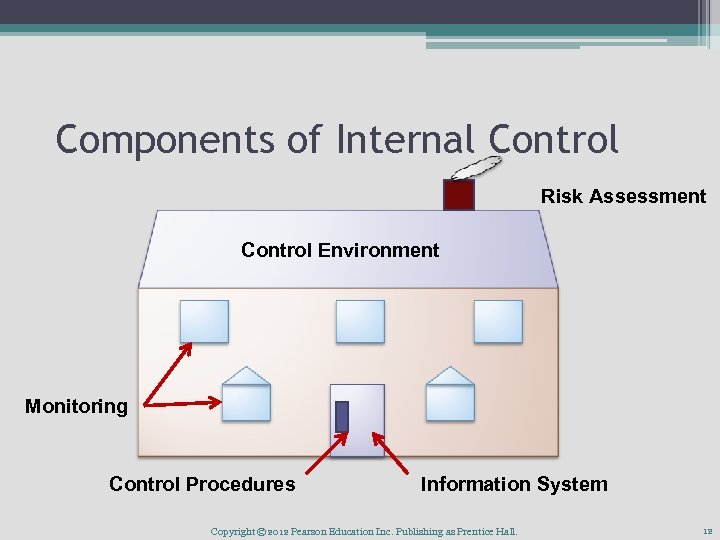

Components of Internal Control Risk Assessment Control Environment Monitoring Control Procedures Information System Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 12

Control Environment • Tone at the top • Key ingredient Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 13

Risk Assessment • Identify business risks • Establish procedures to deal with risks Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 14

Information System and Control Procedures • Information System ▫ How accounting information enters and exits company ▫ System must capture, process and report transactions accurately • Control procedures ▫ Built in control environment and information system ▫ How companies meet five objectives of internal control Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 15

Monitoring Controls • Prohibit one employee from process transaction completely • Program controls into computerized system • Hired auditors to monitor controls ▫ Internal – monitor from the inside to safeguard assets ▫ External – test from the outside to ensure accounting records are accurate Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 16

Internal Control Procedures • Smart Hiring Practices • Separation of Duties ▫ Asset handling ▫ Record keeping ▫ Transaction approval • Comparison and Compliance Monitoring ▫ Operating and cash budgets ▫ Audits ▫ Manual or computer checks Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 17

Internal Control Procedures • Adequate Records ▫ Hard copy or electronic • Limited Access ▫ Assets by custodians ▫ Records by accounting department • Proper Approvals ▫ The larger the transaction, the more specific approval Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 18

SCALP • • • Smart hiring practices and segregation of duties Comparisons and compliance monitoring Adequate records Limited access Proper approvals Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 19

Information Technology (IT) • Accounting systems rely on more than ever before • Examples: ▫ Inventory sensors ▫ Barcode scanning • Basic attributes of internal control do not change ▫ Procedures to implement are different • Use of computers can greatly improve speed and accuracy Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 20

Safeguard Controls Fireproof vaults Security cameras Mandatory vacations Fidelity bonds Loss prevention specialists Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 21

Internal Controls for E-Commerce • Pitfalls of e-commerce ▫ Stolen credit card numbers ▫ Computer viruses and Trojan Horses ▫ Phishing expeditions • Security measures ▫ Encryption ▫ Firewalls Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 22

Costs and Benefits of Internal Control • Ways good internal control can be circumvented ▫ Collusion ▫ Management override ▫ Fatigue & negligence • The stricter the internal control, the more it costs ▫ The benefits should outweigh the costs Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 23

Bank Account as Control Device Signature card Bank statement Bank reconciliation Deposit ticket Check Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 24

Learning Objective Three Design and use a bank reconciliation Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 25

Bank Account Documents • Signature card • Deposit ticket • Check ▫ Maker ▫ Payee ▫ Bank Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 26

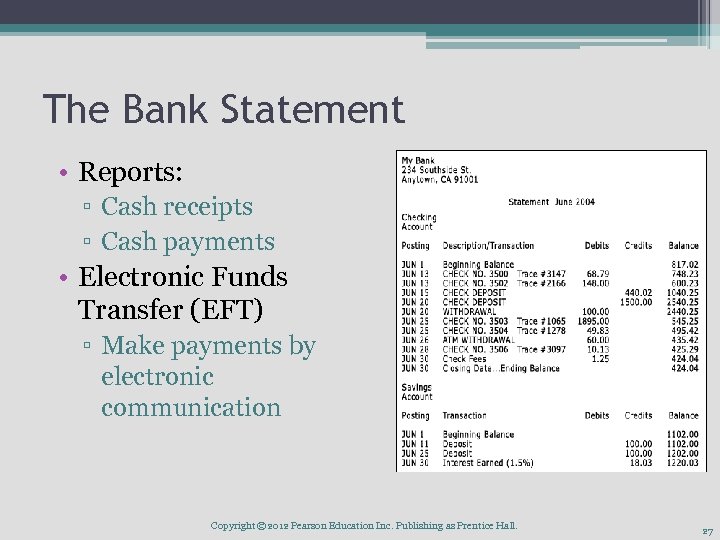

The Bank Statement • Reports: ▫ Cash receipts ▫ Cash payments • Electronic Funds Transfer (EFT) ▫ Make payments by electronic communication Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 27

Bank Reconciliation • Two records of a business’s cash • Amounts are usually different ▫ Time lags in recording transactions • Bank reconciliation explains differences Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 28

Bank Side of the Reconciliation • Deposits in transit • Outstanding checks • Bank errors Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 29

Book Side of the Reconciliation • • Bank collections Electronic Funds Transfers (EFT) Service charges Interest revenue NSF checks Cost of printed checks Book errors Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 30

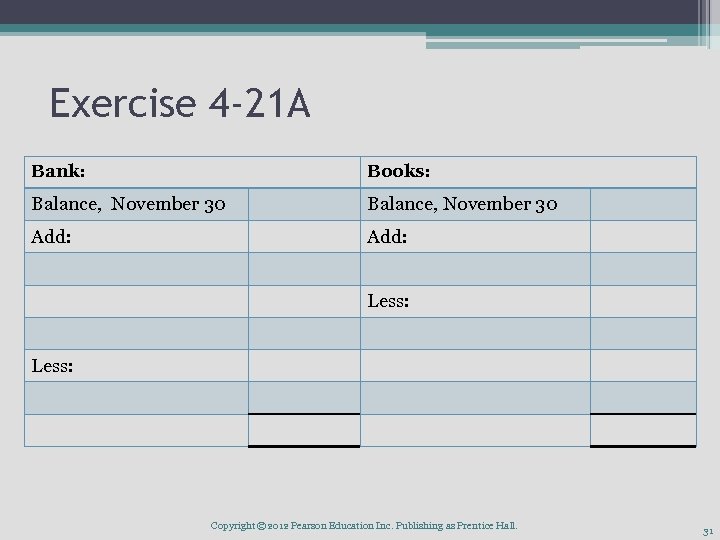

Exercise 4 -21 A Bank: Books: Balance, November 30 Add: Less: Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 31

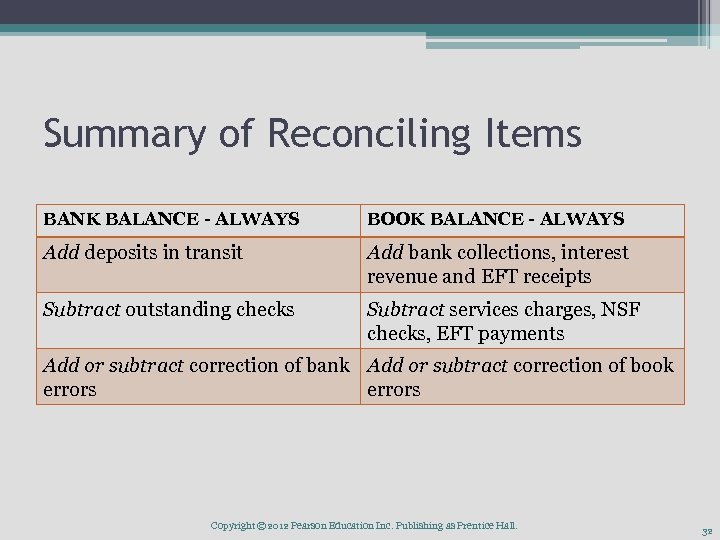

Summary of Reconciling Items BANK BALANCE - ALWAYS BOOK BALANCE - ALWAYS Add deposits in transit Add bank collections, interest revenue and EFT receipts Subtract outstanding checks Subtract services charges, NSF checks, EFT payments Add or subtract correction of bank Add or subtract correction of book errors Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 32

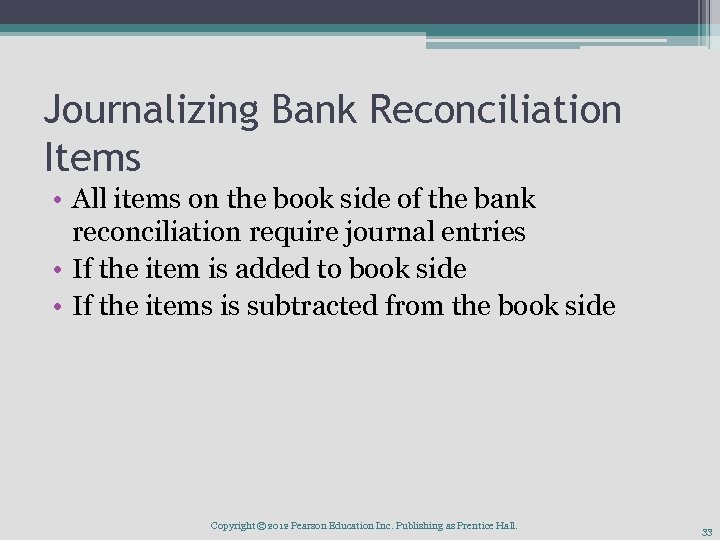

Journalizing Bank Reconciliation Items • All items on the book side of the bank reconciliation require journal entries • If the item is added to book side • If the items is subtracted from the book side Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 33

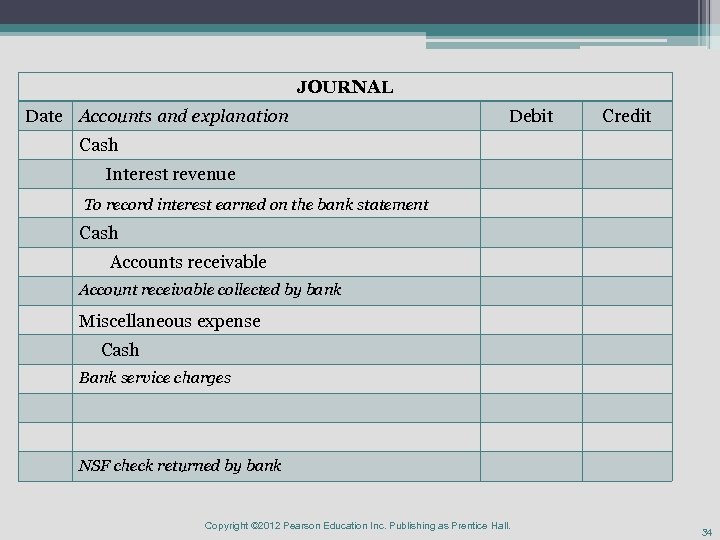

JOURNAL Date Accounts and explanation Debit Credit Cash Interest revenue To record interest earned on the bank statement Cash Accounts receivable Account receivable collected by bank Miscellaneous expense Cash Bank service charges NSF check returned by bank Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 34

Learning Objective Four Evaluate internal controls over cash receipts and cash payments Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 35

Internal Control over Cash Receipts • • Cash is easy to steal All transactions ultimately affect cash Cash receipts should be deposited quickly Companies can receive cash ▫ Over the counter ▫ Through the mail Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 36

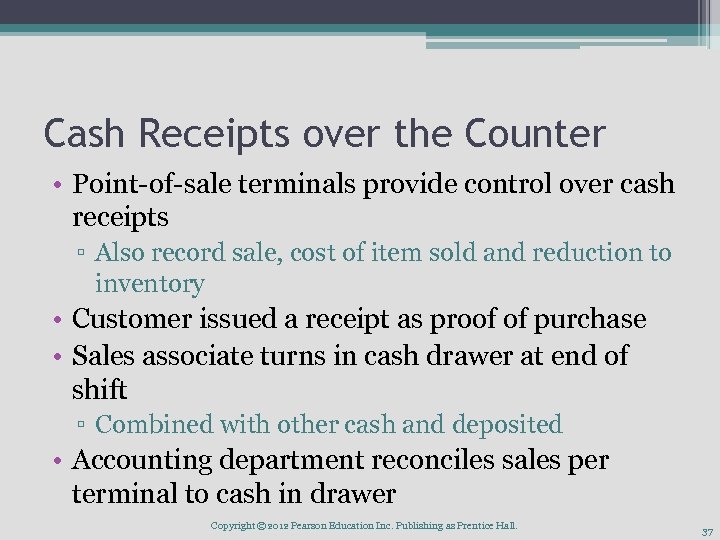

Cash Receipts over the Counter • Point-of-sale terminals provide control over cash receipts ▫ Also record sale, cost of item sold and reduction to inventory • Customer issued a receipt as proof of purchase • Sales associate turns in cash drawer at end of shift ▫ Combined with other cash and deposited • Accounting department reconciles sales per terminal to cash in drawer Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 37

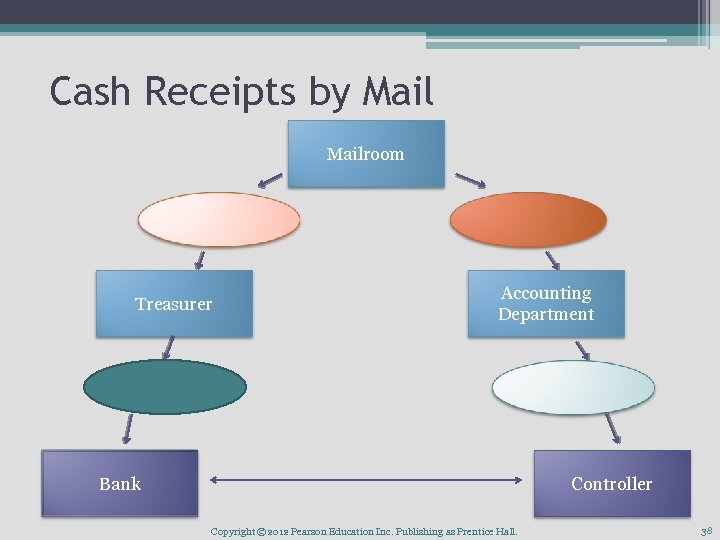

Cash Receipts by Mailroom Treasurer Accounting Department Bank Controller Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 38

Controls Over Payments by Check • Payment by check or EFT payment is an internal control ▫ ▫ Provides record of the payment Check must be signed by an authorized official EFT must be approved by an authorized official Should be supported by evidence payment Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 39

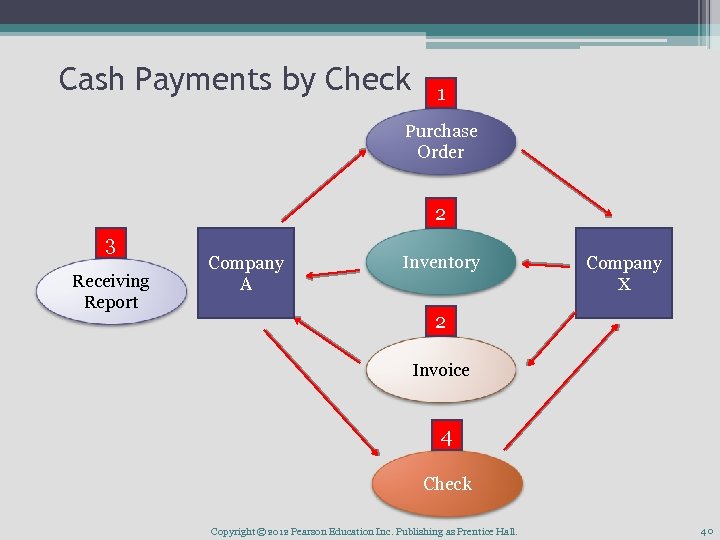

Cash Payments by Check 1 Purchase Order 2 3 Receiving Report Company A Inventory Company X 2 Invoice 4 Check Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 40

Internal Control for Purchasing • Segregate the following duties: Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 41

Payment Packet Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 42

Petty Cash • Small fund to make minor purchases • One employee is responsible for the accounting ▫ Custodian • Set amount of cash • Voucher prepared for each payment • Sum of fund plus paid voucher should equal set amount ▫ Imprest system Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 43

Learning Objective Five Construct and use a cash budget Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 44

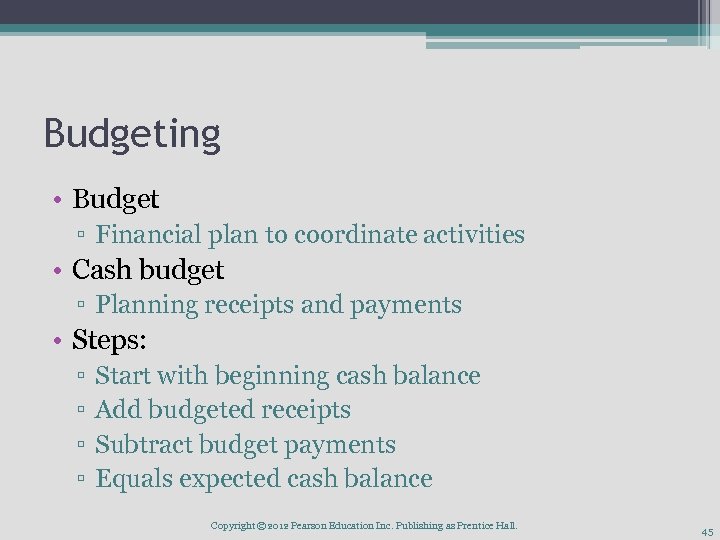

Budgeting • Budget ▫ Financial plan to coordinate activities • Cash budget ▫ Planning receipts and payments • Steps: ▫ ▫ Start with beginning cash balance Add budgeted receipts Subtract budget payments Equals expected cash balance Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 45

Expected Cash Balance If expected cash is greater than minimum needed If expected cash is less than minimum needed Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 46

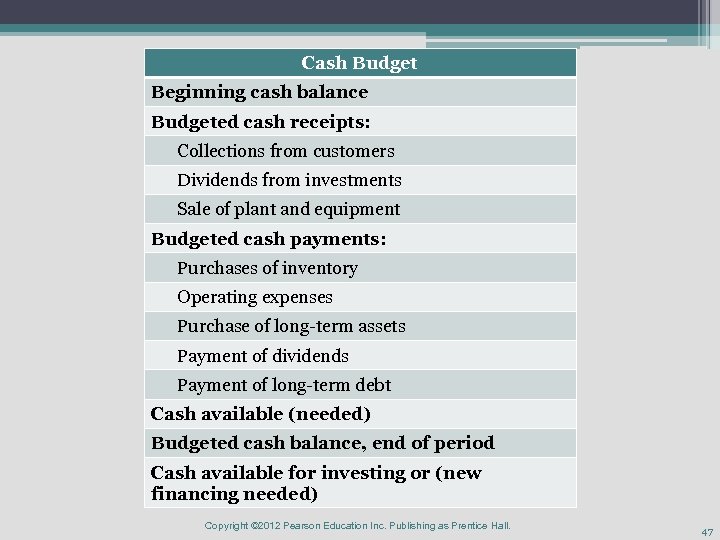

Cash Budget Beginning cash balance Budgeted cash receipts: Collections from customers Dividends from investments Sale of plant and equipment Budgeted cash payments: Purchases of inventory Operating expenses Purchase of long-term assets Payment of dividends Payment of long-term debt Cash available (needed) Budgeted cash balance, end of period Cash available for investing or (new financing needed) Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 47

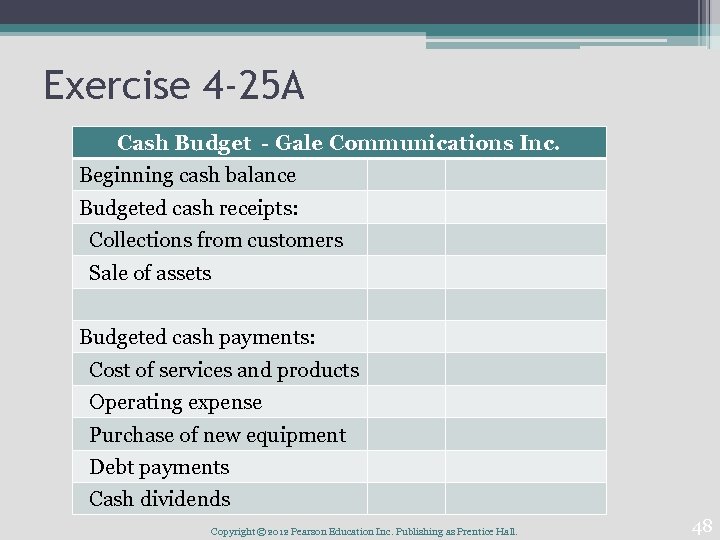

Exercise 4 -25 A Cash Budget - Gale Communications Inc. Beginning cash balance Budgeted cash receipts: Collections from customers Sale of assets Budgeted cash payments: Cost of services and products Operating expense Purchase of new equipment Debt payments Cash dividends Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 48

Exercise 4 -25 A (continued) Cash available Budgeted cash balance, end of period Cash available for investing Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall.

Reporting Cash on the Balance Sheet • All cash accounts combined into a single total ▫ Cash & Cash Equivalents • Cash equivalents include ▫ Time deposits ▫ Certificates of deposit ▫ High grade government securities Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 50

Compensating Balances • Cash balance should not include cash that is restricted in any way • Company that borrows agrees to maintain a minimum cash balance ▫ Compensating balance agreement Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 51

End of Chapter Four Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 52

Copyright © 2012 Pearson Education Inc. Publishing as Prentice Hall. 53

f3136f3d06297a72bcfcb7e0de089ca9.ppt